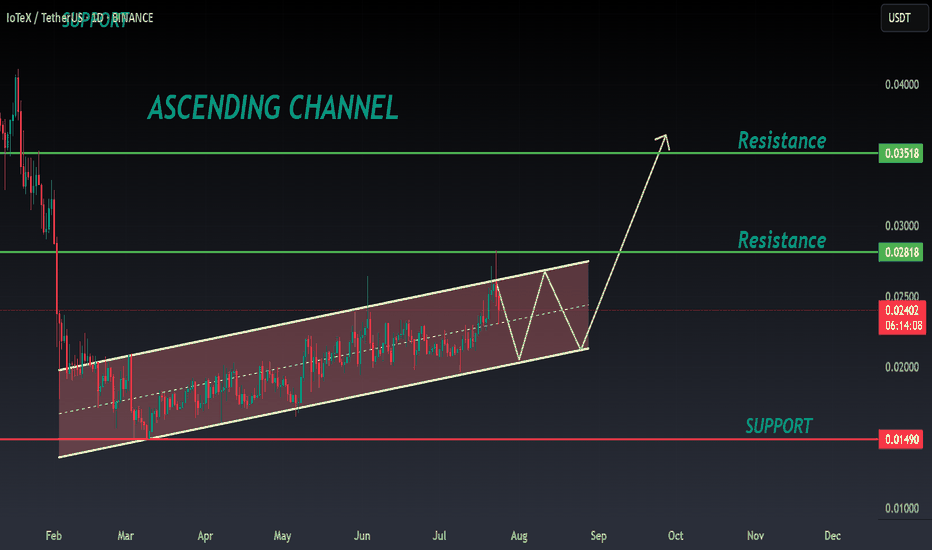

IOTX ANALYSIS🔆#IOTX Analysis : Channel Following ⛔️⛔️

As we can see that #IOTX is following ascending channel on daily time frame. We can see a bullish formation here. And if it trade with good volume then we can see a proper bullish move in #IOTX 📈📈

🔖 Current Price: $0.02400

⏳ Target Price: $0.03500

⁉️ What to do?

- Keep your eyes on the chart, observe trading volume and stay accustom to market moves.🚀💸

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#IOTX #Cryptocurrency #ChartPattern #DYOR

Technicalindicators

XAUUSD Weekly Trade Setup(14-18th July 2025) - Bullish StrategyIn the ever-volatile world of commodities, Gold (XAUUSD) has yet again presented a promising technical setup. For traders looking to capitalize on price action and structure-based strategies, the upcoming week (14th to 18th July 2025) offers a clean breakout and retest opportunity backed by a strong risk/reward ratio.

Let’s break down the trade plan in detail.

1. Overview of the Current Market Structure

As shown in the 4-hour chart, XAUUSD is approaching a key horizontal resistance zone around 3360–3370. Historically, this area has acted as a rejection point for buyers. However, the recent bullish momentum, supported by price trading above the 200 EMA, suggests a potential breakout.

This forms the basis of a Breakout-Retest-Continuation strategy – one of the most reliable setups in price action trading.

2. The Trade Plan

Here’s the structured plan for this setup:

🔵 Step 1: Wait for the Breakout

Price must break above the resistance zone (3360–3370) with a strong bullish candle.

Avoid chasing the breakout; instead, let the market confirm its direction.

🟠 Step 2: Look for the Retest

After the breakout, wait for the price to pull back to the broken resistance, now acting as support.

Confirm this retest with a reversal candlestick pattern (e.g., bullish engulfing or hammer) on the 1H or 4H timeframe.

🔴 Step 3: Entry and Stop Loss

Enter the trade after the confirmation candle closes.

Place a stop loss below the swing low of the retest zone.

This protects the trade in case of a false breakout.

🟢 Step 4: Set Your Target

The profit booking zone lies around the 3440–3450 region.

This setup offers a Risk/Reward Ratio of 1:4, targeting 1:2, 1:3, and potentially 1:4 if momentum continues.

3. Why This Setup Makes Sense

EMA Confirmation: Price is trading above the 200 EMA, showing bullish bias.

Clean Price Action: Well-defined structure makes it easy to identify breakout/retest levels.

Strong Risk Management: The stop is tight and logical, while the upside potential is considerable.

Psychological Support Zone: 3360–3370 has repeatedly acted as a key decision level.

4. Trade Management Tips

Trail your stop loss once 1:2 R:R is achieved.

Consider partial profit booking at 1:2 or 1:3 to lock in gains and reduce risk.

Be patient – the key to this strategy is waiting for the retest confirmation.

5. Final Thoughts

Trading XAUUSD can be both rewarding and risky. This weekly setup gives you a disciplined approach to enter the market at a high-probability point with excellent reward potential. Whether you’re a swing trader or an intraday scalper on lower timeframes, this strategy adapts well with proper confirmation.

Stay tuned for live updates, and as always – plan your trade, and trade your plan.

Happy Trading!

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

APPLE Set To Fall! SELL!

My dear friends,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 211.08 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 206.69

Recommended Stop Loss - 213.91

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Understanding Elliott Wave Theory with BTC/USDIntroduction to Elliott Wave Theory:

Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

1. Impulse Waves (The Trend)

2. These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

* Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

* Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

* Wave 3: The longest and most powerful wave in the trend.

* Wave 4: A smaller correction in the direction of the trend.

* Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

3. Corrective Waves (The Pullbacks)

4. After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B, C:

* Wave A: The initial correction, typically smaller than Wave 3.

* Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

* Wave C: The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

1. Identify the Trend

2. Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

3. Locate the Waves

4. Look for the five-wave structure in the trend direction. Once you identify a potential impulse move, label the waves accordingly:

* Wave 1: A new uptrend starts.

* Wave 2: A small pullback (usually less than the size of Wave 1).

* Wave 3: A significant surge in price, often the most volatile.

* Wave 4: A smaller pullback or consolidation.

* Wave 5: The final push higher, which might show signs of exhaustion.

5. Corrective Phase

6. After completing the 5-wave impulse, expect a corrective 3-wave pattern (A, B, C). These corrections typically last longer than expected and can often confuse traders.

* Wave A: Price starts to reverse.

* Wave B: A retracement that may confuse traders into thinking the trend is resuming.

* Wave C: A strong pullback that brings the price even lower.

7. Use Fibonacci Levels as confluence

8. One of the most powerful tools in Elliott Wave analysis is Fibonacci retracement levels. You can use these to predict potential levels where Wave 2 and Wave 4 could end, or where Wave C might complete the correction. Common retracement levels are 38.2%-50% for Wave 4, and 50-61.8% For Waves 2 and B but keep in mind, these wave can retrace up to 100% before the wave analysis becomes invalid. But ideally these points are where you look to make an entry.

Wave 2 Example:

This one hit the golden spot (0.5-0.618) perfectly and continued to push upward.

Wave B and C Example:

This example hit closer to the 0.786 level which is also a key level for retracement.

Wave 4 Example:

This one hit the golden spot (0.382-0.5) for Wave 4 perfectly before continue the bullish momentum.

I try to use the RED levels below (1.1 and 1.2) as my invalidation (Stop Loss) levels and the GREEN levels (-0.27 and -0.618) as my Take Profit levels. Depending on your goals you can also use Fib Levels 0.236 and 0 as partial Take Profit levels.

9. Confirm with Indicators

10. To validate your Elliott Wave counts, use other indicators like the RSI (Relative Strength Index), MACD, or Moving Averages. For example, a Wave 3 might occur when the RSI is above 50, indicating strength in the trend.

In this example you can see the RSI cross the 50 threshold and the 3rd Wave form.

Continuation after the Wave is complete:

Tips for Trading with Elliott Wave Theory:

* Stay Flexible: Elliott Wave Theory is not set in stone. If the market doesn’t follow the expected pattern, adjust your wave counts accordingly.

* Don’t Rely on One Timeframe: A 5-wave structure on one timeframe may be part of a larger wave pattern on a higher timeframe. Always analyze multiple timeframes.

* Wave Personality: Waves don’t always look the same as stated earlier. Wave 2 can retrace up to 100% of Wave 1 and Wave 4 should generally not overlap Wave 1 or this may invalidate the Wave structure.

* Risk Management: Always use proper risk management techniques. No theory is perfect, so make sure you have a stop-loss in place to manage your risk.

Conclusion: Using Elliott Wave Theory on BTC/USD:

The Elliott Wave Theory can be a powerful tool for analyzing and forecasting price movements. By identifying the 5-wave impulse and 3-wave corrective patterns, you can gain insights into potential market direction. Just remember to use it alongside other tools and indicators for confirmation, and don’t forget to manage your risk.

As you apply it to BTC/USD or any other asset, remember that the market doesn’t always follow the "ideal" patterns, and flexibility is key. Practice on different timeframes, refine your skills, and use the theory as a part of your overall trading strategy.

Final Thoughts:

If you're just starting, don't get discouraged if you miss a wave or two. Trading is a journey, and with patience and practice, you'll begin to spot these patterns more naturally. Whether you’re analyzing Bitcoin's price action or any other asset, Elliott Wave Theory can give you a deeper understanding of market psychology.

Good Luck and Happy Trading!

GOLD: Bearish Continuation & Short Signal

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 3335.9

Stop - 3338.8

Take - 3330.1

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

ALLCARGO LOGISTICS at Best Support !!This is the 4 hour Chart of ALLCARGO LOGISTICS.

ALLCARGO is having good law of polarity at 33 range .

Price action confirms a retest of the support zone at 33 range.

Price action indicates a bullish HH-HL formation.

If the support level sustains, the stock has the potential to make a new high.

Thank You !!

BTC/USDT Drop to 101k?🧠 High Time Frame Context

Trend: Consolidation within a broad range (support and resistance clearly defined).

Key Psychological Levels:

105,000 USDT – minor level, acting as a magnet in short-term PA.

110,000 USDT – major supply confluence and liquidity target.

🟪 Supply & Resistance Zone

Zone: Marked in purple (108.5k-112k).

Key Observation:

Swing high formed inside this zone, indicating liquidity trap.

Potential fake-out or strong rejection from this area.

Strong confluence with a descending resistance trendline, adding to the selling pressure.

🔵 Fair Value Gap (FVG) & Retracement Targets

FVG identified just below the current price (~103.5k-104.5k).

Price is projected to:

Reject from the current high.

Drop to fill the FVG zone.

Possibly bounce between FVG and Fibonacci retracement levels:

0.5

0.618

0.786

🔴 Volume & RSI Divergence

Volume breakout is noted on the last push down (bottom red annotation), followed by a retrace.

OBV shows bullish divergence with price:

🔻 Support Structure

Lower red trendline is a key long-term support.

Previous swing low aligns with this trendline – buyers showed strong interest here.

If FVG fails to hold, expect a retest of this trendline near 97,000–98,000.

📈 Likely Scenarios

Base Case (Neutral-Bearish):

Price rejects current zone (~107,000).

Pullback into FVG (101–104K).

Bounce to 105K (minor resistance), then decide next direction.

Bullish Breakout:

If price breaks and closes above 110K, it invalidates supply zone.

Opens door to 115–118K range.

Bearish Breakdown:

Fails FVG zone.

Tests previous swing low and support (~97K).

Below that, structure becomes macro bearish.

🧩 Summary

Short-Term: Retracement into FVG likely. Monitor reaction.

Medium-Term: Bearish bias while price is below 110K.

Invalidation for bears: Clean break and hold above 110K.

GBP/AUD Triple-Top Resistance Test – Watch for Reversal or BreakThe GBP/AUD pair is currently testing a strong horizontal resistance zone near 2.1000, which has been rejected multiple times in the past. The chart clearly highlights a triple-top formation (marked by red arrows), signaling repeated failures to break above this supply area. Meanwhile, the price action has been respecting an upward trendline support, forming a broad ascending channel or rising wedge-like structure.

This setup is now at a critical juncture — with the potential for either a strong bullish breakout or a bearish reversal.

📉 Bearish Rejection Scenario

If the resistance holds once again, we may see a pullback toward the rising support line around 2.0700. This would maintain the overall sideways-to-bullish bias within the structure. A firm rejection pattern (e.g., bearish engulfing or long upper wick) near 2.1000 could provide confirmation for short entries targeting that support.

📈 Bullish Breakout Scenario

On the other hand, a decisive breakout above 2.1000 — especially with strong volume and candle close — could trigger a breakout rally. If confirmed, the next leg up may drive GBP/AUD toward 2.1250–2.1300, based on the previous swing expansion zones.

🧭 Strategic Outlook

Sell near resistance: Target 2.0750–2.0700 with SL above 2.1020.

Buy on breakout: Enter above 2.1010–2.1025 with targets near 2.1250.

Confirmation required: Wait for candle confirmation (break or rejection) before acting.

This setup offers a clear risk-managed opportunity in either direction, ideal for breakout traders or reversal players.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

EUR/CHF Parallel Channel Breakout WatchThe EUR/CHF pair has been trading within a well-defined parallel channel on the 1-hour timeframe. The price action is contained between a strong resistance zone near 0.9420–0.9425 (marked in red) and a support zone near 0.9365–0.9370 (marked in green). Multiple rejections from both the top and bottom of the range indicate solid market structure and participation from both buyers and sellers.

This type of formation often leads to explosive moves when the price eventually breaks out of the consolidation range. The current chart shows price testing the upper boundary of the channel once again, and now attempting a bullish breakout.

📈 Bullish Breakout Scenario

If the price sustains above the resistance zone (confirmed breakout), we could see a continuation of bullish momentum toward the projected breakout target near 0.9475. This target is calculated using the height of the channel added to the breakout level, a classic price projection method. A strong candle close above the resistance with volume would validate this move. Traders may look for long entries on breakout confirmation or on a successful retest of the resistance zone as new support.

📉 Bearish Reversal Scenario

However, if the breakout fails and price gets rejected again from the red zone, a sharp reversal back toward the support zone around 0.9370 may occur. This would keep the channel intact and suggest continued range-bound movement. A breakdown below support would then be required for further bearish confirmation, leading toward deeper downside targets.

This setup provides a high-probability opportunity in either direction with clearly defined levels and structure. Wait for breakout confirmation before entering to avoid false moves.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

EUR/GBP 4H Bullish Breakout Trade Setup – Demand Zone to 0.85250📉 Trendline Break

🔵 A key trendline was broken 🔽 (bearish ➡️ bullish shift).

✂️ This break signals potential upside movement as sellers lose control.

🟦 Demand Zone (BUY Area)

📍 Zone: 0.83967 – 0.84249

🛒 Buyers expected here!

🟢 Price may pull back here before heading up.

🟡 This is marked as the ENTRY POINT zone.

🔴 Stop Loss Zone

📍 Level: 0.83977

❌ Place stop loss just below the demand zone.

🛡️ Protects against downside breakout risk.

🟧 Resistance Zone

📍 Around: 0.84500 – 0.84600

⚠️ Price may face resistance temporarily before continuing the upward move.

📏 Testing this area confirms strength.

🟩 Target Zone

🎯 Target Point: 0.85250

💸 If the trade plays out, this is where profit is expected.

🚀 Bullish target above the resistance zone.

✅ Trade Setup Summary

🧩 Details

🟦 Entry 0.84240 (inside demand zone)

🔴 Stop Loss 0.83977 (below demand zone)

🟩 Target 0.85250 (above resistance)

📈 R/R Ratio ~1:4 (great risk/reward!)

🔍 Final Outlook:

🟠 Watch for: Pullback to entry zone

🟢 Then look for: Bullish candlestick confirmation

🚀 Goal: Ride it up to 0.85250 with strong momentum

GOLD (XAU/USD) 4H CHART – BULLISH BREAKOUT TRADE SETUP🔵 Trendline Breakout 📈

📏 Price broke above a descending trendline, signaling a potential bullish reversal.

🔼 This breakout is often seen as a buy signal by traders.

🧱 Resistance Area 🛑

🔹 Price has entered and broken through a horizontal resistance zone.

🔄 This zone may now flip into support, adding confidence to the long setup.

🟧 Demand Zone 📦

📍 Marked between 3,267 – 3,298.

🛡️ Strong buying interest historically observed in this area.

📉 EMA (70) at 3,298.065 acts as dynamic support.

🟦 Entry Point 🚪

🎯 Entry Level: 3,322.930

🔄 Enter after retest confirmation or bullish candle above resistance.

🔴 Stop Loss ⛔

⚠️ SL Level: 3,267.993

💣 Below the demand zone and EMA — protecting against false breakouts.

🟩 Target Point 🎯

🚀 TP Level: 3,490.000

📌 Prior high zone — strong historical resistance expected here.

💰 Trade Setup Summary

✅ Buy Above: 3,322.930

❌ Stop Loss: 3,267.993

🎯 Target: 3,490.000

📊 Risk/Reward Ratio: Favorable (approx. 1:3)

🔎 Technical Confidence Levels

🔵 EMA Support ✅

🔵 Trendline Breakout ✅

🔵 Resistance Flip ✅

🔴 False Breakout Risk

U.S. Dollar Index (DXY) Bearish Setup – Supply Zone Rejection & 🔹 Trend Overview

📊 Overall Trend: Bearish (Downtrend)

📉 Price is forming lower highs and lower lows within a descending channel.

🔻 Recently bounced off a support zone, now heading toward a potential pullback.

🔵 Supply Zone (Resistance Area)

📍 Zone Range: 100.049 – 100.601

🧱 Acts as a resistance block where sellers might step in.

📏 Confluent with EMA 70 at 100.178, strengthening its validity.

🔸 Trade Setup – Short Position

🟠 ENTRY POINT: 100.088

❌ STOP LOSS: 100.587 – 100.595 (Just above supply zone)

🎯 TARGET: 98.000 (With intermediate support levels)

📌 Support Levels

🔹 98.112 – First minor support

🔹 98.106 – Close-range confirmation

🔹 97.885 – Additional support zone

🟦 Main Target: 98.000

⚖️ Risk/Reward Ratio

🟧 Small risk above supply zone

🟩 Large reward to downside = Favorable R:R

📌 Summary

📈 Expecting a pullback into supply zone.

🧨 Look for bearish confirmation around 100.088.

🎯 Target the downside at 98.000 for profit.

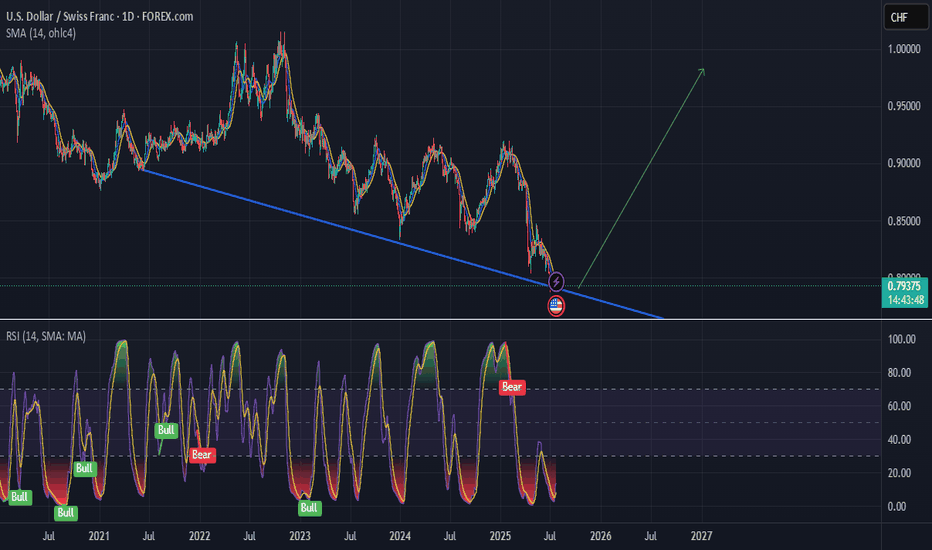

USD/CHF 4H Bearish Setup: FVG Rejection & EMA Resistance Strateg🔵 Chart Structure

🔻 Downtrend Identified

* Lower highs & lower lows forming.

* Resistance line sloping down 📉.

🧲 EMA 70 (0.82387)

* Acting as dynamic resistance 🔴.

* Price currently sitting just below it ⬇️.

💠 FVG (Fair Value Gap) — 0.82441 to 0.83097

* Price expected to fill the imbalance here.

* Confluence with resistance = 🔥 ideal sell zone.

🎯 Trade Plan (Short Setup)

🟦 Entry Point:

* 💥 0.82415

* Just under EMA + inside FVG zone.

🛑 Stop Loss:

* ❌ 0.83110

* Above FVG + above previous high = protected stop.

🎯 Take Profit:

* ✅ 0.80150

* Near prior demand zone + horizontal support.

* Target zone clearly marked in light blue 🧊.

⚖️ Risk-Reward Ratio

🎲 Estimated around 2.5:1 or better.

✅ High reward potential if resistance holds.

⚠️ Caution / Notes

🔎 Watch for bearish confirmation candles 🕯️ at entry zone.

📆 Be aware of economic news that could impact USD or CHF.

🧪 If price closes above 0.83110, setup becomes invalid ❌.

📌 Summary

Element Level Emoji

🔵 Entry 0.82415 💥

🛑 Stop Loss 0.83110 ❌

✅ Take Profit 0.80150 🎯

🔻 Trend Bias Bearish 📉

📐 Tools Used EMA, FVG, Resistance 📊

BTC/USD 4H Trade Setup – Demand Zone Reversal Play🔵 1. Demand Zone 🧲💎

📍 Range: 100,418.83 – 102,253.51

🟦 Strong support zone

💡 This is where buyers are expected to step in

📉 Price is currently testing this zone — potential reversal area

🚀 2. Entry Point 🎯

📍 Zone: 102,232.52 – 102,264.33

✅ Just above demand zone for safe entry

🧘♂️ Wait for bullish confirmation (wick rejections, engulfing candles)

🛑 3. Stop Loss 🔻

📍 Zone: 100,498.77 – 100,538.74

🔒 Below demand zone — protects you from false breakouts

⛔ Invalidates setup if price breaks below this level

🎯 4. Target Point 💰

📍 Target: 108,800.00

🧱 Major resistance zone

📈 Offers a solid Risk/Reward setup (approx. 1:4)

🪜 Possible take-profit scaling around 108,656.78 – 109,256.50

🔁 5. CHoCH – Change of Character 🔄

📍 Confirmed structural break above a lower high

🕵️♂️ Indicates shift from bearish to bullish

🔁 Needs confirmation with higher low near demand zone

📏 6. EMA 70 (Exponential Moving Average) 📉

📍 Level: 106,849.30

🔴 Price is currently below EMA = short-term bearish

🧗♂️ Reclaiming the EMA will strengthen the bullish bias

✅ Quick Summary with Emojis

📌 Plan:

🔵 Buy near: 102,250

🛑 Stop Loss: 100,500

🎯 Take Profit: 108,800

📊 Trend:

🔻 Bearish short-term (below EMA)

🔁 Potential reversal from demand zone

⚠️ Watch For:

🔍 Bullish confirmation at demand zone

🔄 Reclaim of EMA (106.8k)

🧱 Resistance near 108.8k

WTI Crude Oil 4H Chart – Bullish Setup from Demand Zone📈 Current Price: $61.74

🔵 Key Zones & Levels

🔹 Demand Zone (Buy Area):

🟦 $59.48 – $61.39

→ Price expected to bounce here

→ 🔄 Potential reversal zone

🔹 Entry Point:

🎯 $61.39

→ Ideal level to enter LONG

→ Just above demand zone

🔹 Stop Loss:

🛑 Below $59.48

→ Exit if price drops here

→ Protects capital

🔹 Target Point:

🚀 $67.00

→ Profit-taking zone

→ Strong resistance zone nearby:

* 66.63

* 66.75

* 67.60

📊 Indicators

📍 EMA (70): 🔴 61.40

→ Price trading above = bullish signal

→ EMA acting as support

📏 Trendline Channel:

🔼 Higher highs & higher lows

→ Supports uptrend continuation

📌 Trade Plan Summary

* Bias: 📈 Bullish

* Buy: At 61.39

* Stop: Below 59.48 🛑

* Target: 67.00 🎯

* Risk-Reward: ✔️ Favorable (~1:3)

🔍 What to Watch

* ✅ Bullish candles in demand zone

* 🔁 Retest of EMA or lower channel

* ❌ Avoid if it breaks below $59.48

$PNUT in Freefall – Can $0.20 Hold as Support?$PNUT is dropping like a falling knife!🚨

Technically, we have support around $0.22 and $0.20.

According to the Fibonacci levels, the 0.786 level may

act as strong support near $0.20, making that area a key zone to watch.

So unless this support range is reached, the price may continue to drop toward that zone.

If you're currently stuck in this coin, you could consider adding funds and setting your liquidation point below $0.18 for safety.

If you're looking to enter or accumulate, the range between $0.22 and $0.20 is ideal for accumulation.

However, even with these support levels, we still need to wait for clear reversal patterns before expecting a trend reversal in the shorter time frame.

Thank you so much for reading, I hope my updates help you in your trading journey.

DYOR, NFA

VEDANTA LTD KEY ZONE..This is the 1 hour chart of VEDL.

VEDL is currently trading near its pattern (Broadening) resistance zone in the 462–465 range.

The stock is trading with in a channel, with its support zone in the 440–445 and resistance zone 485-495 range on the hourly chart.

If this level is sustain,we may see higher prices in VEDL

If VEDL breaks below its support zone, we may see lower levels around 415-405 range .

THANK YOU !!

SHREE DIGVIJAY CEMENET AT LONG TERM SUPPORT ZONEThis is the Weekly chart of SHREDIGCEM.

SHREDIGCEM is trading near it's long term support zone at 60-70 range.

stock has been moving within a long-term parallel channel, with a well-established support zone in the range of ₹65–₹70.

Currently, the stock is forming a broadening pattern near its support zone, with the pattern support range between ₹70–₹75.

If this level is sustain then,we may see higher prices in SHREDIGCEM.