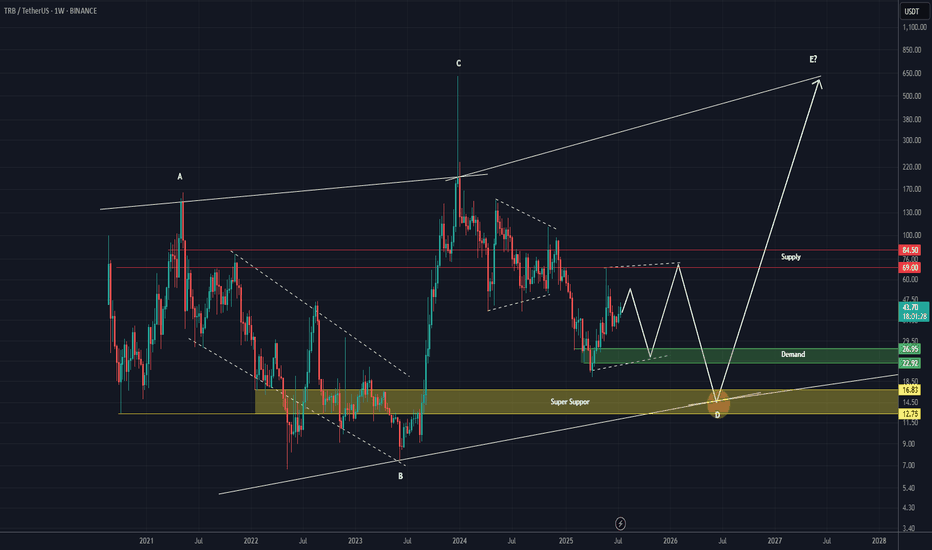

TRB Roadmap (1W)It appears to be within wave D of a larger pattern.

Given the strong rally in wave C, it is expected that this coin will enter a time-consuming correction, so considering a symmetrical pattern for wave D is not illogical.

A short-term upward swing is expected from the green zone.

However, the main buy zone is the yellow box, where wave D could end and wave E may begin.

These moves and this pattern belong to the weekly timeframe and will take time to play out. For a spot buy, it’s best to keep this asset on your watchlist.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Tellor

Tellor Double iH&S —Marketwide Higher High NextYou can never miss a bullish market. Whenever the market stops, goes sideways, some pairs just can't take it and continue growing. They grow bullish and continue bullish and move straight up. Aren't we supposed to crash? Isn't the market going lower?

Hold on, the question: Will Bitcoin continue and hit $120,000 or is it $100,000 next?

When Bitcoin crashes, everything crashes.

Just a few days ago, it was AAVE that was moving straight up. See how Tellor is moving today, some pairs are sideways and there isn't strong bullish momentum marketwide but still, some pairs are moving ahead. This moving ahead is what reveals what comes next marketwide; bullish continuation of course.

Super high volume on this TRBUSDT chart just two days ago.

Notice the double inverted head and shoulders pattern.

Notice the change from a bearish to a bullish trend.

Notice the full green candle...

Cryptocurrency will continue growing; it is already growing and will continue to do so long-term.

Namaste.

Tellor (TRB) a hidden gem, will previous price action repeat?Hello again dear reader for a another analysis.

From August to December 2023 TRB has seen a MASSIVE move of 7000% gains over the course of just 126 days. Since then it has corrected a whopping 96%!

There is now a reason to be bullish on this coin. Looking at the drawn structure we can see multiple important touch zones described with the letters ''A till F'' (NOT ELLIOT). It is quite possible price action might correct further till 19$ where a big support zone lies, but there is no guarantee that ''will'' happen.

Target: 1200$ (M-cap of 3B which is very achievable)

Stoploss: 15$

I aim to keep analysis simple and easy to understand. Any questions of requests for analysis feel free to ask!

Rustle

TRBUSDT:100% Daily Volume Surge – A Bullish Setup in the Making!Extreme Bullish Potential with Smart Entry Points

"TRBUSDT is catching attention with a 100% daily volume increase. Big moves like this don’t happen by accident – the market is speaking, and we’re listening."

Here’s What I See:

Black Line Manipulation: If the price manipulates the black line, I believe the chart will enter an extreme bullish condition. However, patience is key – no trades without confirmation of an upward breakout.

Breakout and Retest: The golden rule – wait for the breakout, then target the retest for a strong and safe entry.

Demand Zones Below: Let’s not forget, there are solid demand zones below that could provide additional opportunities.

Key Observations:

"As always, I rely on the data: CDV, volume profile, and liquidity heatmap must confirm the expected price action before I commit to a trade. No confirmation, no entry!"

This is a chart full of potential. Be patient, act smart, and let the market show its hand. 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

TELLOR $TRB OracleLooking good. Confident bottom/ base has been set. Now comes expansion! Target for 2025 $1000+

Oracle narrative will grow. Now 51st crypto category in terms of Market cap according to CoinGecko, very undervalued, as they prove more essential every day that passes and connectivity (+ security) among blockchains becomes more important. Riding the upcoming LINK wave as well. Other potential gainers and good holds imo, are PYTH and to lesser extent BAND.

Heavy on these 3, LINK PYTH TRB.

Hodl!

Tellor | Data Oracle or Price Miracle? The TRB Mystery UnfoldsTellor is a decentralized oracle network designed to support DeFi. It primarily provides high quality, reliable price data by allowing parties to request off chain data, which miners then compete to add to the blockchain. The main Tellor smart contract tracks requested data over time, aiming to serve as a trusted data source for decentralized applications.

TRB token has experienced a substantial price increase recently, with factors linked to its role as a decentralized oracle network driving the demand

The main reasons behind TRB's recent pump are:

Increased Demand for Decentralized Oracles: As TRB serves as the native token for the Tellor network, it allows users to access off-chain data within blockchain ecosystems, especially for DeFi (Decentralized Finance) projects. The growing demand for reliable data oracles in decentralized applications may be boosting TRB's value.

Market Liquidity and Limited Supply: Tellor’s circulating supply remains low, contributing to price sensitivity and making it more susceptible to large price swings. High trading volumes combined with increased buying pressure can lead to rapid price escalations.

Network Utility and Staking: TRB is used within the Tellor network for staking, rewards, and governance. Increased interest in staking TRB for governance rights may also be affecting its market price. Additionally, miners and data providers require TRB to participate and earn rewards, increasing the token's intrinsic demand.

Speculative Investment and Market Sentiment: General market sentiment around TRB has been positive, with investors potentially betting on the project's growth and long-term utility in blockchain ecosystems. Strong market performance in broader crypto and a wave of renewed interest in decentralized projects could be contributing to this surge

Major resistance: breaking 77$ resistance which was a huge warzone for trb bulls

This combination of demand for oracle services, limited supply, utility based staking, and positive market sentiment explains the recent surge in TRB's value

Dont miss this crypto bull market

Tellor (TRB)Tellor is a decentralized, transparent and permissionless oracle protocol that supplies data that can be requested, validated and put on-chain permissionlessly with data reporters competing for incentives of TRB. Data reporters bring valuable information on-chain for a wide range of DeFi applications. Anyway, TRB analysis is straightforward; after TRB made a 5 waves upward impulse wave, it went into correction which unfolded in a complex pattern. Then, TRB broke the major downtrend line and went up strongly. This kind of momentum signals bright future; also, waves count confirm such potential too. Let's see what happens.

TRB, journey to more rise is inevitable..TRB recent series of surges caught everyone by suprise. It has risen an impressive 500% in just 3 months.

It has undergone muted correction from its peak at 67 before trimming back to 40 levels.

Now it's ascend journey has reset so-to-speak with 4h metrics suggesting higher lows and net buying activity at the current range conveying preparation to retest previous resistance range.

Expect more upside valuation of this coin in the coming weeks. The uninflated market cap of TRB will aid on reaching that goal. The incoming crypto market big shift will favor the small market cap ones, and TRB will be in line.

Spotted at 48.0

TAYOR.

Safeguard funds always.

Potential inverse h&s on TRBUSD to keep an eye onThe right shoulder hasn’t completed yet so there’s always a chance this doesn’t play out. Especially if any unforeseen black swans are looming in the near future. However, considering Q4 should likely be bullish at this phase of the market cycle, there’s also a good probability of this pattern playing out so I’m posting a chart of it here so I can easily keep tabs on it later. *not financial advice*

Tellor Trade Successfully Closed — Signal Indicates More DownsidJust yesterday, I posted a trade setup to short on the 4H chart. With today's market dip we reached the profit target easily.

However, the dip flashed another bearish signal for Tellor, indicating even more downside potential. Here are the details 👇

1️⃣ Trade Signal

Tellor flashed a bearish Parabolic Trader signal on the 4H chart. The signal combines indicators such as the EMA200, PSAR, ADX, and MACD.

2️⃣ Reliability

Based on backtests, the signal shows solid reliability on the 4H chart. In terms of TRB and based on 13 signals, it has a 77% probability of achieving 5% gains.

3️⃣ Profit Potential

The profit target is calculated at 8% and aligns with the TRB's resistance at $82. However, based on the backtest data, it might be reasonable to use two profit targets.

4️⃣ What about the chart?

Tellor's 4H chart looks mostly bearish and, therefore, supports the signal. The token fell below the reversal trendline, which has served as a support area for several days.

Tellor — Ichimoku Signal Indicates 5% Dip!Our algorithms identified a bearish Ichimoku signal for LSE:TRB on the 4H chart. The signal indicates a 4%-5% setback.

Here are the details 👇

TRB printed an Ichimoku signal on the 4H chart. The signal combines various Ichimoku indicators and validates the direction on higher timeframes. As a result, it is considered highly reliable.

Backtest Details 🧐

The signal has solid backtest results. Based on 7 historical signals, TRB dipped over 5% after signals flashed in 72% of their occurrence.

Other Technical Indicators 💹

Trend indicators are mainly bearish, whereas momentum indicators show a mixed picture.

What about the chart 📊

TRB is currently showing an uptrend after forming a bottom in early/mid-June. Therefore, based on the chart, a further price increase is likely. However, the Ichimoku price target perfectly fits the U-shape.

As a result, a possible scenario could be another retest of the U-shape before TRB continues going higher.

$Tellor 10X Ahead? Back to $300?The COINBASE:TRBUSD chart looks like one of the best charts out there at the moment, but I still think there's a bit more downside ahead before a big run.

I think Tellor has one last leg down to $28.60 or $35 supports, then I think we'll see a big surge higher in the coming weeks back up to retest the highs in the $300 range (which would be a 10x move).

I think the move down is likely to happen before that May 31 pivot and I think we're likely to see the highs hit before August.

Let's see how it plays out over the coming weeks.

TRB Price Eyes Key Resistance LevelsSupport and Resistance Levels:

Resistance : Notable resistance levels are marked at approximately $111.81 and $146.37 . These levels have historically acted as ceilings where the price struggles to break above.

Support : Strong support levels are evident at around $82.11 and $46.07 . These levels have provided a floor, preventing the price from declining further.

Trendlines:

The chart exhibits upward-sloping trendlines, indicating a bullish trend over the longer term. These trendlines act as dynamic support and resistance, guiding the price movement within an ascending channel.

Stochastic RSI:

The Stochastic RSI indicator shows a value of 74.36 , suggesting the market is in the overbought territory but could still have room to rise before a potential pullback.

Cumulative Volume Delta (CVD):

The CVD value is positive at 51.295K, indicating a higher buying volume compared to the selling volume, which aligns with the bullish sentiment in the market.

Technical Analysis:

Current Price Action : The price is currently at $104.31, just below a key resistance level of $111.81. This indicates potential consolidation or a minor pullback before attempting to break through this resistance.

Bullish Outlook : Given the ascending trendlines and the positive CVD, there is optimism for further upside. A successful breach above $111.81 could open the path toward the next resistance level at $146.37.

Support Levels : In the event of a pullback, strong support around $82.11 should provide a cushion, maintaining the bullish structure. A break below this level would target the next support at $46.07.

Tellor (TRB) completed a setup for upto 9.50% pumpHi dear members, hope you are well and welcome to the new trade setup of Tellor (TRB) token with US Dollar pair.

Previously we caught almost 113% pump of TRB as below:

Now on 1-hr time frame, TRB has formed a bullish AB=CD move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

$TRB 2h Bybit: What's Next Tellor?Hi! Tellor consolidating, new impulse possible to both directions. Price has already declined over 80% since top, the logaritmic 0.5 of total $9-$644 move is around $75-$80. That corresponds to demand zone lower yellow box. Price is above 100,200,400 sma daily, 50d around 130 trending up still.

- Main trigger is $102-$110 to enter positions either direction.

- Strong bull above $140, strong bear below $75.

- no/low lev

Tellor (TRB) complete a setup for upto 34.50% pumpHi dear friends, hope you are well and welcome to the new trade setup of Tellor (TRB) token with US Dollar pair.

Previously we caught almost 113% pump of TRB as below:

Now on a daily time frame, TRB has formed a bullish Cypher move for the next pump.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

TRB/USDT bullish horizons? what next💎 Paradisers, turn your attention to #TRBUSDT for an exciting trading prospect. This asset is charting its course within an ascending channel, signaling a strong potential for a bullish leap from a key demand level.

💎 Throughout the last month, #TELLOR has consistently adhered to its ascending channel pattern. As it approaches the support of the channel, we anticipate a bullish reversal from the demand level of $107.3, contingent on the asset maintaining momentum at this juncture, setting the stage for a promising bullish expedition.

💎 However, should there be a dip below the critical demand level of $107.3, it would signal the need for a thorough review of our trading approach. Such a development might indicate difficulties in upholding the bullish momentum, prompting a necessary pivot in strategy to align with evolving market conditions.🌴💰

TRB/USDT Gearing Up for a Bull Run? 👀🚀TRB Analysis💎TRBUSDT has shown remarkable market movements and has successfully exited the descending channel pattern.

💎At the moment, #Tellor is engaging in lateral consolidation after retesting the demand zone, which was once a supply area. There's a notable chance for the price to rebound from this zone and propel upwards, aiming for the bearish OB area as its forthcoming target.

💎If TRB does not manage to rebound and instead falls below the demand zone, it might withdraw to the Bullish OB area, situated around the $118.40 mark, in pursuit of a renewed drive for an ascent.

💎The Bullish OB area has historically been a pivotal point, invariably leading to significant recoveries upon its examination. Yet, a failure of this zone, substantiating a bearish trend, could direct the price to seek bullish prospects from an even lower stance.

💎In the event TRB doesn't leverage upward momentum from this additional level, it would likely maintain its descent. Rest assured, we're here to assist you in navigating through these market shifts.