Bullish Bet , UnionBankBanknifty at support.

UnionBank on recent high making sideways moves, which means consolidation.

Once Banknifty Bounce back, UnionBank will break the resistance on weekly and monthly Basis and will start moving higher.

It has higher targets on a short and long term investment.

Good to hold for short term.

TERM

Good Stock for Medium to Long TermClosed at 181.52 (05-06-2025)

Printed HH on Daily tf.

Should retrace towards 177 - 178

& then may be around 165 -166 to print

HL.

188 - 195 is the resistance for now that

needs to be sustained.

Crossing this may move the price towards

235 - 236.

Medium to Long term target can be around

290 - 300 if 260 is crossed with Good Volumes.

Czech Republic: A Dividend HeavenThe Prague Stock Exchange (PSE) PSECZ:PX is characterized by a concentration of mature, dividend-paying companies, particularly in sectors such as energy, banking, and heavy industry. Unlike growth-focused exchanges in the U.S. or Asia, the Czech market offers relatively few stocks with high reinvestment or expansion trajectories.

Preference for Payouts

Over the past two decades, Czech listed companies have consistently distributed a significant share of profits as dividends. This reflects both limited reinvestment opportunities in a relatively saturated domestic market and a shareholder preference for cash returns. For example, CEZ and Komercni banka have maintained payout ratios above 70% in most years.

Structural Support & Tax environment

The Czech Republic provides a structurally supportive environment for dividend-oriented investors. One key advantage is the tax framework. Czech residents are exempt from capital gains tax if they hold an investment for more than three years. This strongly favors long-term investing.

For non-residents, a 15% withholding tax on dividends applies—unless the investor resides in a country outside the EU/EEA that does not have a tax treaty or tax information exchange agreement with the Czech Republic.

Key Dividend-Paying Companies

CEZ (CEZ) PSECZ:CEZ

Industry: Energy (Electricity generation and distribution)

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 34 10.1%

2021: CZK 52 5.8%

2022: CZK 48 18.83%

2023: CZK 145 5.43%

2024: CZK 52 5.9%

Dividend Growth:

2020 to 2021: +52.9%

2021 to 2022: -7.7%

2022 to 2023: +202%

2023 to 2024: -64.1%

Komercni banka (KOMB) PSECZ:KOMB

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 23.9 3.63%

2021: CZK 99.3 10.62%

2022: CZK 60.42 9.22%

2023: CZK 82.7 11.41%

2024: CZK 91.3 10.76%

Dividend Growth:

2020 to 2021: +315.6%

2021 to 2022: -39.2%

2022 to 2023: +36.9%

2023 to 2024: +10.4%

Moneta Money Bank (MONET) PSECZ:MONET

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 0 (dividend suspended)

2021: CZK 3 10.67%

2022: CZK 7 10.53%

2023: CZK 8 12.82%

2024: CZK 9 8.08%

Dividend Growth:

2020 to 2021: N/A

2021 to 2022: +133.3%

2022 to 2023: +14.3%

2023 to 2024: +12.5%

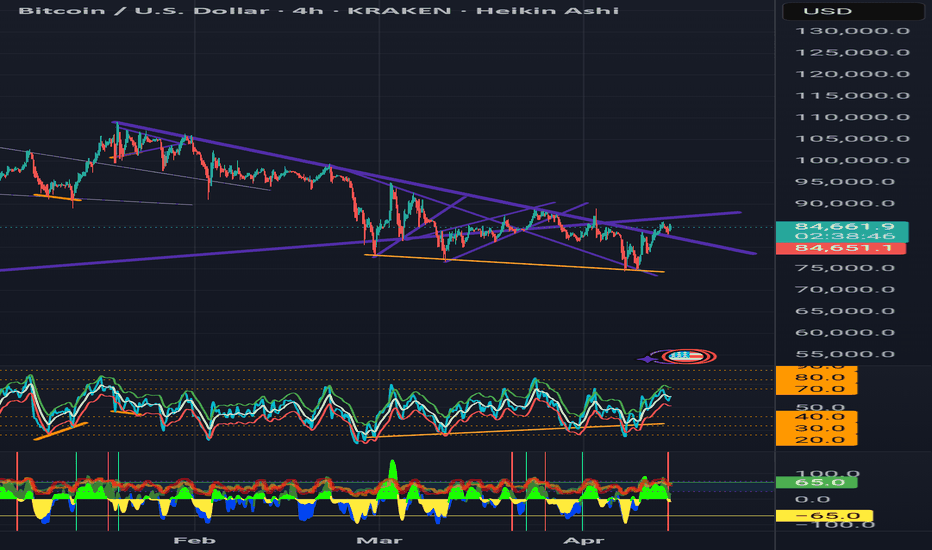

Bitcoin Ascending Broadening Wedge (4H)After a clean breakout above the macro downtrend, BINANCE:BTCUSDT rallied into its supply zone — but price action has since become increasingly volatile, forming a rising broadening wedge (also known as a megaphone pattern).

Pattern Insights

• The structure is defined by diverging trendlines, with each swing becoming larger and more erratic.

• This pattern often signals instability or exhaustion, especially near key resistance.

• While it can break either way, broadening wedges in an uptrend frequently resolve to the downside, especially when supply is overhead.

Key Levels

• Resistance: ~$ 98K-$99.5k supply zone — the upper boundary of the pattern.

• Support: ~$93.5k area — prior S/R, potential flip zone.

• Reversal: A breakdown below ~$93k could confirm a short-term bearish resolution and open the door to ~$88.5k.

• Continuation: A breakout above the upper boundary with volume could trap shorts and ignite a squeeze toward new highs.

Until then, BTC remains in a high-volatility structure, best approached with caution or as a range-trading opportunity.

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

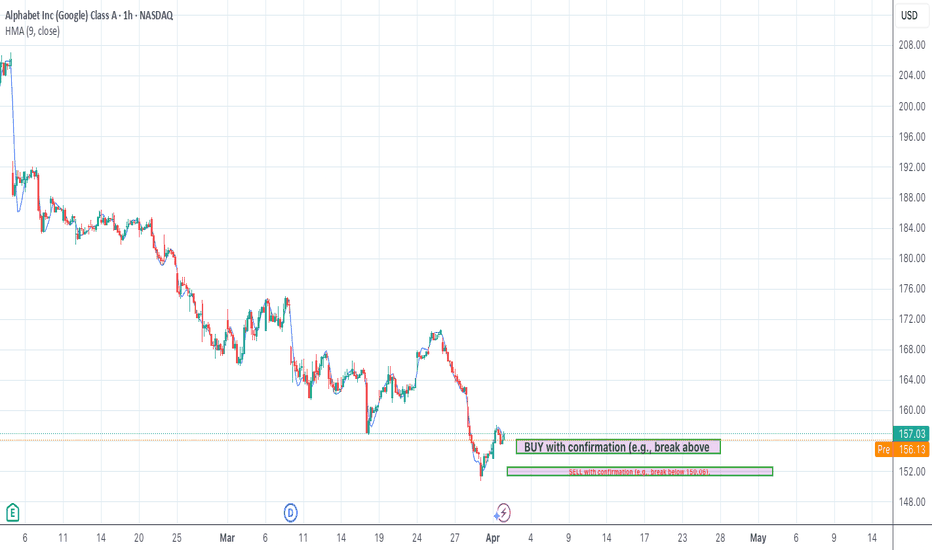

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

$NYSE:WOLF - analysis of annual cot levelsPlease remember that this idea does not constitute investment advice.

NYSE:WOLF

After a personal analysis of the institutional value of the COT, buy and sell program levels are outlined. Since the asset is at its minimum, the idea is to wait for the price to head inside the buy program, wait for a swing to form in the direction of the target level (the first sell program) and open the trade at the break of this. The position is medium-term (from 1-2 weeks to 1-2 months); without financial leverage and the maximum profit area is that outlined by the sell program. Personally I do not use stop loss as the trade does not involve the use of financial leverage, however if a level for the stop loss were to be identified, this would be below the buy program.

For any clearly ask me.

EURUSD - the upcoming US PCE & the ECB rate decisionAt the moment, we are seeing that the bulls are fighting hard to keep MARKETSCOM:EURUSD elevated. But they are struggling to overcome some key resistance barriers. But the upside doesn't look very promising, due to the upcoming US PCE numbers and the ECB rate decision. Let's dig into the possible near-term outcome scenarios for the $FX_IDC:EURUSD.

What are your thoughts on this?

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

SAFEMOON - Not so safe for the medium termIt looks as though there could be a fractal for SAFEMOON. Historiclally, we've seen rises like this but only to be dissapointed and for the trend to be reversed again. I've drawn out a blue line of what the most likely trajectory will occur. The only other alternative is that the upward trend will continue, buying action will surge and we will see a bursting through of the upper trend line and escape the channel. If it comes back within the channel momentarily, that's fine - but not if the volume dies down and we stay within. So, it doesn't look great for an investment and I wont be putting anyting into it. Follow for more.

47% GROWTH》GODREJPROP SHOWING A GOOD REVERSAL SIGN FROM BOTTOMRecently NSE:GODREJPROP almost drawdown 19% from recent high and we plan for almost 47% upward potentially reward.

🔔 NOTE:

➡️ ENTRY ONLY IF the weekly candle CLOSES ABOVE 2550 INR.

📊 Godrej Properties (GODREJPROP) is exhibiting a positive reversal from its bottom levels. However, ⚠️ signs of weakness remain visible.

✅ Suggestion:

Wait for a strong confirmation with the weekly close above 2550 INR to enter.

Once confirmed, bullish momentum could target long-term profits at the 3802 INR level.

🎯 TARGET LEVELS

TP-1 🟡: 2836.25 INR

TP-2 🟠: 3026.00 INR

TP-3 🟢: 3405.90 INR (50% Profit Booking Recommended Due to Resistance ⚒️)

TP-4 🟩: 3802.00 INR (Long-Term Target – 9 to 12 Months 🚀)

📉 STRICT STOP LOSS (SL):

2240.90 INR 🚫 (Ensure proper risk management here!)

⚡ Action Plan:

If entry conditions are met, follow the targets and risk levels carefully. This stock offers an excellent reward-to-risk ratio, but confirmation is key! 🕒

🔴DISCLAIMER:

I AM NOT A SEBI-REGISTERED ANALYST. SECURITIES AND INVESTMENTS ARE SUBJECT TO MARKET RISKS. PLEASE READ AND UNDERSTAND THE TRADING IDEA CAREFULLY BEFORE MAKING ANY INVESTMENT DECISIONS. INVEST WISELY AND AT YOUR OWN RISK. 📉📈

If you find this really helpful

Like,share,subscribe @Alpha_strike_trader

HBAR/USDT: A Potential Super Long-Term Impulse Wave Take a look at this super long-term potential impulse wave for HBAR. This chart captures a massive Elliott Wave structure that could define the next big move in the crypto market.

We’re seeing the foundation of Wave 3, with the potential for a trend-defining breakout as HBAR progresses through its impulsive phases. The critical zone? A breach of the upper trend line would validate this structure and could signal higher highs on the horizon.

This isn’t just a week-to-week setup—it’s a multi-year roadmap. If the Hurst cycles align, we’re looking at one of the most promising long-term plays.

What’s your take? Do we see confirmation, or does this remain a dream scenario? Share your thoughts and follow for more long-term crypto insights! 🚀

BTC Turned Bullish. MID-TERM 6-12 monthsHi everyone.

I think BTC is turned Bullish after the last fall. Sorry that the explanations on the chart are in Turkish. If someone wanted I'll translate them into English. Otherwise, just by a little knowledge of TA, you can understand what I mean on the chart.

Give my your opinion.

Regards!

Tata power, good buy for long term and short term Tata power one of the best best fundamental stock now available at good demand zone one can add in portfolio if not added yet

Can add at levels of 380-405

Sl mclbs 365

Tgt atleast:1:2 & 25% to 100% expecting a blast before a Indian budget

Ask your financial advisor and broker before buying

Only for educational purposes

GBPJPY - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast: (Daily Time-frame)

While the price is below the resistance 199.79, resumption of downtrend is expected.

Technical analysis:

The descending flag taking shape suggests we will soon see another leg lower.

Trading suggestion:

Price rejected from Trend Hunter Sell Zone (198.42 to 199.79). We are going to open 8 sell trade based on these Take Profits:

Take Profits:

196.00

193.51

191.88

189.47

186.23

182.78

178.41

Short Term forecast: (H4 Time-frame)

The Uptrend is broken, and the price is in an impulse wave.

Correction wave toward the Sell Zone.

Another Downward Impulse wave toward Lower TPs.

SL: Above 199.79

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

PEPE, long term super cycle awaits!This is how PEPE could play out in the long-term assuming that we're putting in wave 1, which looks like a leading diaganol. In the medium term we're likely to see some lows as the minor wave 1 corrects for the clearly visible ABC. But, then hold on to your hats as we put in wave 3 which is always the most violent. If you're not out of your shorts by then, this pattern could ripe your face clean off. In any case, keep an eye and plan for early retirement. Follow for more.

Long term fot ETH could look insaneLooking at the long-term for ETH and assuming that we're putting 5 waves of i, of the highest degree of trend, we could be on an orgasmic wave 5 that IF equal to 1, which is often the case, could reach highs which go past the moon, on to Jupiter and beyond. Keep an eye on it, and let's see if the minor degree of trend of subsequent waves gives us confirmation. Follow for more.

easy play on ASMLI’ve been closely monitoring the monthly chart of ASML Holding (Euronext) and have identified a compelling setup that aligns with my long-term strategy. Previously, I shared an idea on TradingView with an ambitious $1200 price target, based on the stock’s strong long-term uptrend and solid fundamentals. However, upon further analysis, I’ve identified an internal trendline, which provides additional clarity and reinforces my bullish outlook. Interestingly, a similar internal trendline has been observed in other stocks like Super Micro Computer, further validating this structure.

Technical Analysis:

Primary Uptrend:

ASML is in a well-established long-term uptrend, confirmed by the primary ascending trendline connecting historical lows since 2012. This line showcases the structural strength of the stock and consistent investor confidence.

Internal Trendline Confirmation:

The recently identified internal trendline connects intermediate lows formed during price retracements, indicating a temporary slowdown in growth while maintaining an overall bullish structure.

This internal trendline has previously acted as dynamic support, suggesting it may serve as a critical reference point for future price action.

Key Price Levels:

The current price (631.5 EUR) sits near a confluence zone between horizontal support and the internal trendline. This presents a strong entry point for a long position with an attractive risk/reward ratio.

Significant support has been identified around the 600 EUR level, reinforcing my confidence in a potential price rebound.

Long-Term Price Target:

My long-term price target remains at $1200, which I believe is achievable as the stock continues to respect its bullish trend. This target aligns with ASML’s historical growth trajectory and the robust potential of the tech sector.

Entry Timing:

The recent bounce off the internal trendline and the +1.66% daily gain signal positive accumulation and increased buying interest. I plan to go long now, taking advantage of the dynamic support, with a stop loss set just below 590 EUR to manage risk effectively.

ASML Holding offers a compelling investment opportunity, supported by a solid technical structure and clear bullish potential. The internal trendline, combined with horizontal support and the broader long-term uptrend, strengthens my confidence in entering a long position. With a $1200 target and a well-defined risk management plan, I believe this is the right time to position for the next leg up in this stock.

EPL Ltd Breakout Alert: 52-Week High + Bullish Momentum! Ready f📈 EPL Ltd (EPL) is showing explosive bullish momentum and has recently achieved a 52-week breakout, positioning it for potential short-term gains. Here’s why EPL should be on your radar:

🔑 Key Technical Highlights:

Bullish Marubozu Candle: Strong buyer dominance, signaling a solid uptrend.

RSI Breakout (63): Momentum is building; watch for continued upward pressure.

Volume Breakout: Price surge supported by heavy volume—confirming buyer interest.

Donchian Bands: New highs suggest further breakout potential ahead.

Bollinger Bands: Positive breakout confirms the strength of the current trend.

Stochastic (94) & CCI (195): Strong overbought levels indicate market strength.

MACD Bullish Crossover: A confirmed bullish signal, pointing to sustained upward movement.

200 EMA: Price above the EMA, and both price and moving averages are trending up, showing a strong uptrend.

Bullish Candlestick Patterns:

🔥 Long White Candles across the Daily, Weekly, and Monthly timeframes indicate consistent bullish pressure and potential for further upward movement.

Why This Could Be a Great Trade:

Possible Swing Trade: Targeting short-term profits with strong bullish indicators.

Possible BTST (Buy Today, Sell Tomorrow): Perfect setup for quick gains.

📢 Don’t miss out on this breakout opportunity – EPL is trending upward, and the momentum is strong! 💥

🚀 Are you ready to take action?

💬 Share your thoughts, predictions, or trade setups in the comments below!

🔔 Follow for daily stock analysis and stay ahead of the market.

Possible levels to watch out : 324-360-396-432