Teropongbursa

SHORT / MEDIUM TERM - KPJ POTENTIAL ELLIOTT WAVE 5KPJ a profitable company, has started wave 5 leg after a sharp correction. Potential price might attempt R1. If price break above R1, there is potential to reach R2 with sustained momentum on wave 5 with an optimistic Fibonacci projection 1.618. use trailing stoploss based on personal preference to protect your profits.

If price failed to break R1, possible it will test S1 and potentially trading within ascending triangle, a bullish continuation pattern.

If price break S1, price might be trading sideways.

GOLD - Peluang untuk ShortGold masih dalam aliran menurun ('downtrend') dan dijangkakan atas terus menurun sehingga paras sokongan 1212 (S1, garisan merah) iaitu paras terendah pada Julai 2017. Harga masih berada dibawah mid band Indikator Bollinger Band, menandakan pergerakan harga dalam trend menurun.

Jika harga berjaya melepasi garisan 'downtrend' biru R1 ke atas, bermakna perubahan trend jangka pendek bermula, dengan sokongan 'bearish divergance' pada indicator RSI.

GOLD - Peluang untuk ShortGold masih dalam aliran menurun ('downtrend') dan dijangkakan atas terus menurun sehingga paras sokongan 1212 (S1, garisan merah) iaitu paras terendah pada Julai 2017. Harga masih berada dibawah mid band Indikator Bollinger Band , menandakan pergerakan harga dalam trend menurun.

Jika harga berjaya melepasi garisan 'downtrend' biru R1 ke atas, bermakna perubahan trend jangka pendek bermula, dengan sokongan 'bearish divergance' pada indicator RSI .

ST/MT- MAHSING - BUY on BREAKOUT (BOB)DAGANGAN JANGKA MASA PENDEK (SHORT TERM , ST / MEDIUM TERM, MT)

MAHSING sebuah syarikat pembinaan yang stabil dengan keuntungan yang konsisten.

Harga saham syarikat bergerak melepasi garisan harga tertinggi sebelum (previous high) garisan biru, dengan minat belian yang tinggi, harga mungkin akan menuju R1.

Indicator RSI sekarang telah melepasi tahap Overbought, pergerakan harga mungkin akan turun kerana penjualan oleh short term traders dulu sebelum meneruskan kenaikan.

Cadangan untuk ambil untung pada paras 50% dan 78% dari sasaran, atau mengikut kesesuaian / trading plan anda.

Laporan sukuan tahun dijangka akan dikeluarkan pada hujung bulan Ogos.

Jika harga bergerak melepasi S1, jual dahulu (cutloss) untuk melindungi modal anda dari kerugian yang lebih banyak.

ST/MT- DIALOG - POTENSI BREAKOUTDAGANGAN JANGKA MASA PENDEK (SHORT TERM , ST / MEDIUM TERM, MT)

DIALOG sebuah syarikat O&G dengan keuntungan yang konsisten.

harga saham syarikat bergerak menghampiri garisan downtrend R1. Jika minat belian yang tinggi, harga mungkin akan melepasi R1. Jika ini berlaku, maka pergerakan berkemungkinan akan menuju ke R2 dan R3 (garisan hijau) jika minat belian terus meningkat.

laporan sukuan tahun dijangka akan dikeluarkan pada hujung bulan Ogos.

Jika harga bergerak melepasi S1, jual dahulu (cutloss) untuk melindungi modal anda dari kerugian yang lebih banyak.

DAGANGAN JANGKA PENDEK - MYEG - BUY ON BREAKOUT (BOB)MYEG sebuah syarikat teknologi yang stabil mempunyai keuntungan positif.

harga saham syarikat bergerak melepasi harga tertinggi sebelum ini (previous high) pada 1.04 dan juga telah melepasi uptrend channel (garisan biru sebelah atas), berkemungkinan menuju ke arah R1 (garisan hijau). Kadar belian meningkat berbanding hari sebelumnya dengan kadar belian sebanyak 54% (maklumat dari platform broker). Bollinger band sedang mengembang selepas mengecut (Squeeze) menandakan kekuatan trend tersebut.

Jika harga bergerak melepasi S1, jual dahulu (cutloss) untuk melindungi modal anda dari kerugian yang lebih banyak.

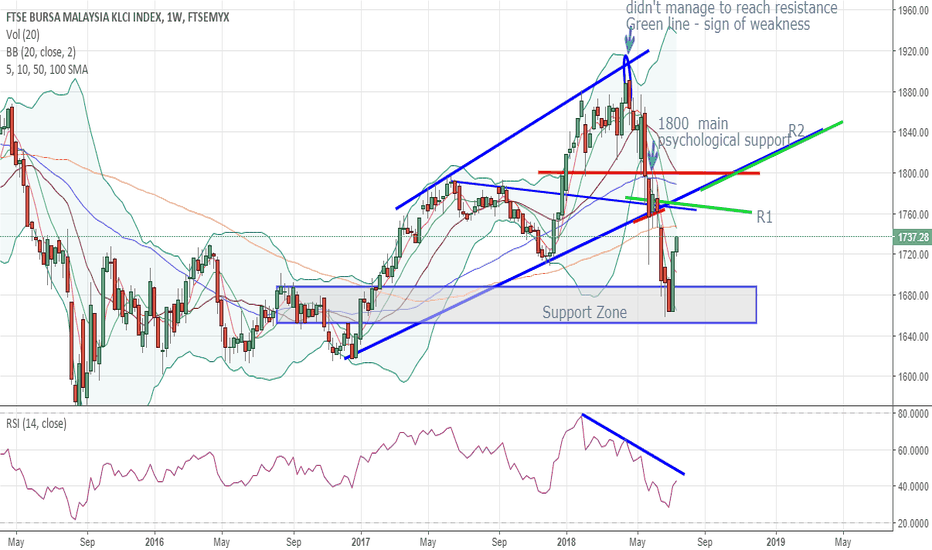

FBM KLCI weekly chart - short term reboundKLCI staged a breather from a sharp drop since early May after failed attempt to break and close above 1900 level. Short term uptrend with Resistance set at R1 and R2, if momentum continues, might signal a comeback. But for now, bearish trend still in effect.

SHORT/MEDIUM TERM TRADE - LEESK- POTENTIAL BREAKOUTLEESK is a profitable company, attempting the Resistance zone with strong volume signalling potential breakout might be inevitible.

If price manage too break resistance zone, price might be heading to R1 fibo projection of 1.628. Take profits regularly to avoid dissappointment.

Cut losses short if price went below S1.

SHORT/MEDIUM TERM TRADE - SYSTECH - POTENTIAL BREAKOUTSYSTECH is a profitable company, heading to Resistance zone with stepper uptrendline, signalling potential reversal might be developing.

If price manage too break resistance zone, price might be heading to R1 and R2 if the momentum continues.

Cut losses short if price went below S1.

SHORT / MEDIUM TERM - PIE BREAKOUT-PULLBACK-CONTINUEPIE a profitable company, has broken out descending triangle chart pattern while RSI is bullish. potential price will attempt R1. If price break above R1, there is potential to reach R2 with sustained momentum. take regular profits, preferably at 50% and 78% from target.

If price failed to break R1, possible it will test S1 and potentially trading sideways.

SHORT / MEDIUM TERM - YEE LEE BUY NEAR SUPPORTYEELEE a profitable company, has been trading within descending triangle chart pattern while RSI is heading into the bullish region 50%. Recent buying interest emerged, and there is a potential that price will attempt R1 while RSI is above 50%. If price break above R1, there is potential to reach R2 with sustained momentum. take regular profits, preferably at 50% and 78% from target.

If price failed to break R1, possible it will test S1 and potentially trading sideways.

SHORT / MEDIUM TERM - TAANN - BUY ON BREAKOUTTAANN, profitable company, has broken short term downtrendline, while RSI is heading into the bullish region 50%. potential price will attempt R1 while RSI is above 50%. If price break above R1, there is potential to reach R2 with sustained momentum. take regular profits, preferably at 50% and 78% from target.

If price failed to break R1, possible it will test S1 and potentially trading sideways.If S1 failed to hold, next support will be S2.

SHORT TERM TRADE - REACH - BUY ON BREAKOUTREACH has been rallying for the past few days and has reached critical junction Resistance 1 (R1) with a Doji, while RSI is in the early bullish region >50%. If price break above R1, there is potential to reach R2 with sustained momentum. take regular profits, preferably at 50% and 78% from target.

If price failed to break R1, possible it will test S1 and potentially forming descending triangle chart pattern. If S1 failed to hold, next support will be S2.

SHORT/MEDIUM TERM TRADE - AEMULUS - TRADE THE BREAKOUTAEMULUS closed above previous resistance from a ascending triangle pattern.If buying increase in the following days, price is poised to test T1. Staggered profit taking is suggested at 50% and 78% of the target. Support is at S1 (along red line).