Terraclassic

Terra Luna Classic ($LUNC) Hits Major Burn MilestoneThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) ecosystem has reached a significant milestone, burning over 405 billion LUNC since May 2022. This deflationary move, alongside the burning of 3.5 billion USTC, has fueled optimism for a potential price breakout. As fundamental and technical indicators align, market sentiment suggests an imminent shift in trajectory.

The Impact of LUNC and USTC Burns

The Terra Luna Classic community has remained committed to revitalizing the ecosystem following its 2022 collapse. The burning of tokens serves as a crucial deflationary strategy aimed at reducing supply and, in turn, boosting demand. According to the latest burn tracker update, the total LUNC burned has reached 405,867,335,786, with USTC burns surpassing 3.5 billion tokens.

One of the key contributors to this burn mechanism is Binance, which has reaffirmed its commitment to reducing LUNC’s circulating supply. The exchange recently incinerated 760 million LUNC from trading commission income for February, highlighting the sustained community and partner contributions toward the token’s long-term sustainability.

Despite the aggressive burn, LUNC has struggled to break past major resistance levels. However, the positive market sentiment stemming from these fundamental shifts could be the catalyst needed for a substantial price movement.

Technical Outlook

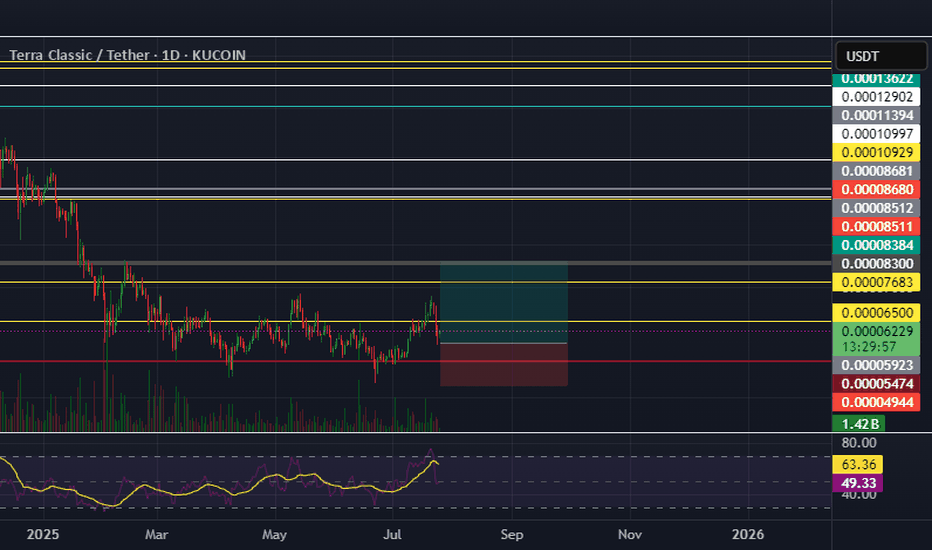

LUNC’s price is currently trading at $0.00006094, marking a 5% increase in the past 24 hours. However, the broader market turbulence has caused LUNC to decline 5.74% over the past week and 46% Year-to-Date (YTD).

Key Technical Indicators:

The RSI is pegged at 41, a neutral zone that signals room for a potential bullish surge while still susceptible to downside risks. SEED_DONKEYDAN_MARKET_CAP:LUNC is currently testing the 38.2% Fibonacci retracement level. A breakout above this key resistance could signal the start of a bullish reversal.

If selling pressure persists, a dip below the 1-month low could be inevitable, potentially dragging LUNC back into bearish territory.

LUNC Ecosystem Updates: What’s Next?

Earlier this year, the Terra Luna Classic development team outlined five major updates aimed at strengthening the ecosystem. These include removing fork modules, enhancing token burns, and refining governance mechanisms. While most of these plans have been successfully implemented, the long-term success of LUNC still hinges on broader market sentiment and further adoption.

Conclusion

The latest burn figures have reignited optimism within the Terra Luna Classic community, setting the stage for a potential bullish turnaround. With key technical indicators aligning with fundamental improvements, LUNC traders are eyeing a breakout above critical resistance levels.

Luna Classic: Burn Tax Proposal Sparks Debate Amid Price DeclineThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community has initiated a heated discussion surrounding Proposal 12149, which aims to increase the on-chain tax rate from 0.5% to 1.5%. While this measure promises to enhance LUNC’s burn rate and bolster funding for the community and Oracle pools, it has not been without controversy. The vote comes in the wake of the successful v.3.3.0 network upgrade, which simplified tax handling and improved the ecosystem for developers and dApps.

The Proposal: A Closer Look

The proposed tax increase would triple the burn tax, allocating 1.2% for burns and 0.3% for community and Oracle pools. Proponents argue this move could significantly reduce the total supply of LUNC, accelerate burns, and increase funds available for staking rewards and ecosystem growth.

However, critics, including Binance co-founder Changpeng “CZ” Zhao, have raised concerns about higher taxes potentially deterring developers and layer-2 projects from building on the Terra Luna Classic network. Validators have also expressed divided opinions, with 43.24% voting "Yes," 16.01% voting "No," and 40.74% voting "No with veto" as of the latest tally.

Current Market Performance

Despite the promising implications of the burn tax proposal, LUNC has struggled in the market, dropping 9% in the last 24 hours to $0.0001135. The token’s trading volume surged by 38% during the same period, indicating heightened market activity. Similarly, USTC has seen a 7% drop, trading at $0.02029, with an 87% increase in trading volume.

Technical Analysis

From a technical standpoint, SEED_DONKEYDAN_MARKET_CAP:LUNC is in oversold territory, with the Relative Strength Index (RSI) at 28. This low RSI typically signals a potential correction or breakout, presenting two possible scenarios:

1. Upside Potential: The active community and the burn mechanism could drive renewed investor confidence, sparking a rally.

2. Downside Risk: If the broader market correction persists, LUNC may continue its downward trajectory, especially as Bitcoin’s ( CRYPTOCAP:BTC ) price movement exerts influence over the altcoin market.

Immediate support for SEED_DONKEYDAN_MARKET_CAP:LUNC is seen at $0.0001115, with resistance at $0.0001243. A breakout above this resistance could signal a short-term recovery, while a failure to hold support might lead to further declines.

Fundamental Outlook

The burn tax proposal highlights the Terra Luna Classic community's commitment to reducing token supply and strengthening the ecosystem. However, the divided vote underscores the challenge of balancing ecosystem growth with immediate investor sentiment.

Despite the current price volatility, LUNC's long-term potential remains tied to the community's ability to execute on its vision and navigate market challenges. If Proposal 12149 passes, the increased burn rate and enhanced community funding could lay the groundwork for a more robust Terra Luna Classic network.

Conclusion

While LUNC’s recent price action reflects broader market trends and skepticism around the burn tax proposal, its strong community backing and proactive governance measures position it as a token with significant long-term potential. Traders and investors should closely monitor the outcome of Proposal 12149 and key technical levels to gauge the token’s next move.

Terra Classic (LUNC)So far, LUNC's movement behavior is analyzable by technical analysis and Elliot waves. That is, the corrective 2 and 4 waves both ended at 0.5 and 0.618 Fibonacci retracement; And the impulse wave 3 have been extended to 1.618. So, if the impulse wave 5 grow bigger than wave 3 it can extend past the 1.618 about 0.0041. Otherwise, it probably going to be smaller than wave 3 and extend up to 1 Fibonacci extension; that is about 0.00125.

There is another possibility and that is the corrective wave 4 is not finished yet and going to unfold in complex waves. Lets wait and see which happens.

The Fallout: 3AC Demands $1.3 Bln From Bankrupt Terraform LabsIn the latest development in the crypto world’s legal drama, Three Arrows Capital (3AC), once one of the most prominent hedge funds in the industry, has filed a staggering $1.3 billion claim against the now-bankrupt Terraform Labs. The claim adds a new layer of complexity to the already convoluted legal struggles surrounding Terraform Labs and its founder, Do Kwon, as the repercussions of the TerraUSD and LUNA collapse continue to unfold.

The Rise and Fall of TerraUSD and LUNA ( NASDAQ:LUNA )

Terraform Labs, led by the controversial figure Do Kwon, was once at the forefront of the cryptocurrency boom, with TerraUSD (UST) and LUNA being key players in the market. However, the ecosystem’s catastrophic collapse in May 2022 sent shockwaves through the industry. The implosion resulted in billions of dollars in losses, with LUNA’s value plummeting to near zero and UST losing its peg to the US dollar.

For Three Arrows Capital, this collapse was nothing short of disastrous. The hedge fund had heavily invested in LUNA ( NASDAQ:LUNA ), reportedly holding up to $462 million worth of the token at its peak. However, within weeks, that investment was reduced to a mere $2,700, leading to the eventual downfall of 3AC.

3AC’s Allegations: Market Manipulation and Inflated Valuations

Three Arrows Capital’s $1.3 billion claim centers on allegations of market manipulation and inflated valuations by Terraform Labs. According to the court filing, 3AC accuses Terraform Labs of orchestrating the selloff that led to the devaluation of LUNA and UST, thereby directly contributing to 3AC’s collapse. The hedge fund asserts that Terraform Labs manipulated the market by artificially inflating the value of its assets, leaving investors like 3AC with devastating losses.

This legal move marks a significant escalation in the ongoing fallout from the Terra ecosystem’s collapse. As 3AC seeks to recoup its losses, the claim underscores the broader impact that the Terra meltdown had on the crypto industry, affecting not just retail investors but also institutional giants like Three Arrows Capital.

Legal Battles on Multiple Fronts

The $1.3 billion claim against Terraform Labs ( NASDAQ:LUNA ) is just one of many legal challenges facing the company and its founder, Do Kwon. The crypto world has been closely following Kwon’s legal woes, with his extradition to South Korea still pending. The Supreme Court of Montenegro recently delayed the extradition in response to a request from the State Prosecutor’s Office, further prolonging the legal limbo in which Kwon finds himself.

In a related development, the crypto lending platform Celsius Network is also entangled in its own legal battle, seeking to claw back $2.4 billion from Tether over allegations of Bitcoin transaction fraud. The legal entanglements of Celsius and Terraform Labs highlight the broader struggles of the crypto industry as it grapples with the consequences of the market’s volatility and the collapse of key players.

The Road Ahead: What’s Next for Terraform Labs and 3AC?

As the legal battle between 3AC and Terraform Labs heats up, the crypto community will be watching closely to see how the case unfolds. The outcome could set a significant precedent for other cases involving market manipulation and the responsibilities of crypto companies toward their investors.

For Terraform Labs, the $1.3 billion claim is yet another hurdle in its fight for survival amidst ongoing lawsuits and regulatory scrutiny. Meanwhile, Three Arrows Capital, once a titan in the crypto hedge fund space, is seeking to salvage what it can from the wreckage of its investments.

The case serves as a stark reminder of the high stakes and risks involved in the cryptocurrency market, where fortunes can be made and lost in an instant. As the industry continues to evolve, the legal and regulatory frameworks surrounding it will likely undergo significant changes, driven in part by cases like this one.

Technical Outlook

As of the time of writing, Terra Luna ( NASDAQ:LUNA ) demonstrates a 3.32% increase on Monday, accompanied by a Relative Strength Index (RSI) of 43, indicative of an unhealthy scenario in light of the developments pertaining to Terraform Labs, where 3AC is demanding $1.3 billion from the bankrupt entity. The daily price chart displays a bearish hanging man pattern, recognized as a bearish reversal candlestick pattern following a price advance, characterized by a small real body and a long lower shadow measuring at least twice the size of the real body. This bears ominous implications for NASDAQ:LUNA in conjunction with the ongoing matter involving 3AC.

Conclusion: A Turning Point for the Crypto Industry?

The $1.3 billion claim filed by Three Arrows Capital against Terraform Labs represents a significant moment in the ongoing legal saga of the crypto industry. As both companies navigate their respective challenges, the outcome of this case could have far-reaching implications for the future of cryptocurrency regulation and the responsibilities of crypto firms to their investors.

For now, all eyes are on the courts as the battle between 3AC and Terraform Labs plays out. The stakes are high, and the consequences could shape the future of the crypto industry for years to come.

This left 53136 BTC in Terra's reserves (+313 BTC)

Between January and May (2022), 80394 bitcoins were purchased by the LFG (Do Kwon)

There are two different sets of LFG Bitcoins (Bitcoin reserves (Terra's reserves)):

First, from 80394 BTC, 42530 BTC was sent to LFG wallet (wallet = bc1q.... s50tv4q).

Luna-LFG balance chart: (Max = 42530 BTC)

from 42530 BTC, 15272 BTC was sent to this address (wallet = bc1qm3....3ewf0j77s3h)

a- This left 15272 BTC in Terra's reserves (Do Kwon)

Second, (From 80394 BTC) Do Kwon did not send 37864 BTC to LFG wallet!

b- This left 37864 BTC in Terra's reserves ((9 - 10 May 2022))

As a result: (a and b) ---> 15272 BTC + 37864 BTC = 53136 BTC

This left 53136 BTC in Terra's reserves

the remaining 53136 remain unspent and are likely still sitting with the LFG (Terra's reserves or Do Kwon).

a, b, c

Money laundering:

LUNA = a scheme to disguise the money as legal ($ 411 M)

and ...

Transactions:

Despite Binance Burn 1.35 Bln LUNC Chart shows a Bearish PatternBinance has burned 1.35 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens in its 22nd batch of its SEED_DONKEYDAN_MARKET_CAP:LUNC burn mechanism, marking a bearish pattern in the crypto exchange's net burn. The total SEED_DONKEYDAN_MARKET_CAP:LUNC burn by Binance has now surpassed 60 billion, accounting for more than 52% of the total SEED_DONKEYDAN_MARKET_CAP:LUNC burned by the Terra Luna Classic community. The 22nd batch of the SEED_DONKEYDAN_MARKET_CAP:LUNC burn mechanism burned a significant amount of trading fees for the period between April 30 and May 29. Binance has now burned nearly 60.42 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens from trading fees on SEED_DONKEYDAN_MARKET_CAP:LUNC spot and margin trading pairs.

Last month, Binance burned 1.4 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens. The exchange burned 1.40 billion in trading fees on LUNC spot and margin trading pairs worth $156,362 as trading volumes fell significantly in April. However, trading volumes reversed higher in the last few weeks of May, with prices mostly trading sideways near $0.00012.

SEED_DONKEYDAN_MARKET_CAP:LUNC and OTC:USTC prices continue to trade under pressure even after the Binance SEED_DONKEYDAN_MARKET_CAP:LUNC burn due to a recent crypto market selloff, causing Terra Luna Classic ecosystem tokens to pare recent gains. The community narrative has switched to development activity and SEED_DONKEYDAN_MARKET_CAP:LUNC burns in May, bringing back speculation of SEED_DONKEYDAN_MARKET_CAP:LUNC price hitting $0.0002. SEED_DONKEYDAN_MARKET_CAP:LUNC price has rallied over 17% in a month amid buying from spot and derivatives traders, currently trading at $0.000117.

Despite the burning streak by Binance, the token seems to trade in respite to the burn campaign. The memecoin is down by 2.76% technically, SEED_DONKEYDAN_MARKET_CAP:LUNC 's daily price chart depicts a bearish symmetrical triangle pattern in the long term. But the Relative Strength Index (RSI) which is at 56.59 gives hope of a trend reversal for long and short term investors alike.

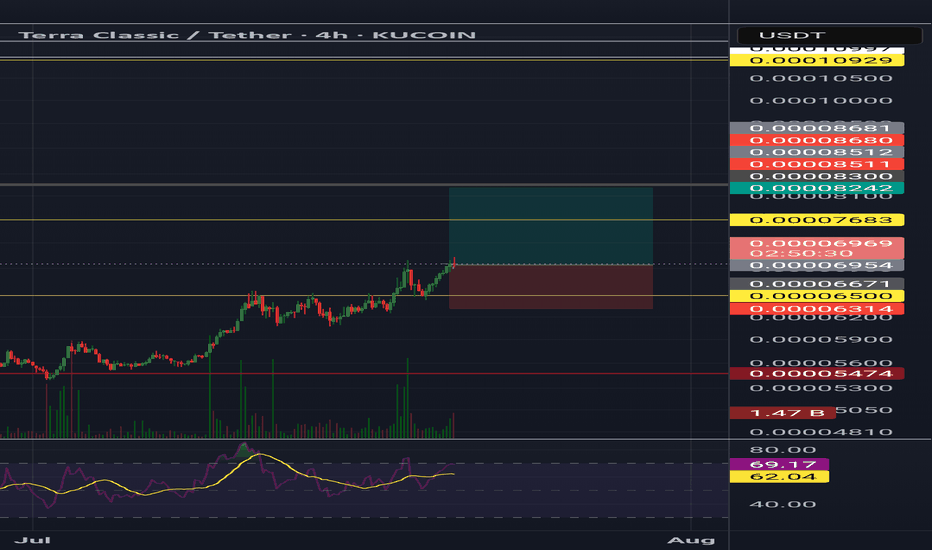

Terra Classic (LUNC) 4H TF AnalysisOn the 4H TF LUNC is currently exhibiting important technical patterns. The volume profile shows the highest trading activity around $0.0001077 to $0.0001047, indicating strong support levels. Recently, the price action has been sideways, suggesting a balance between buying and selling pressures, with low trend strength and volatility, indicating consolidation.

Key resistance levels are at $0.0001253, $0.0001324, and $0.0001425. Key support levels are at $0.00011, $0.0001015, and $0.00009220. The price is just above a crucial support level at $0.00011; a break below this could lead to a retest of lower support levels.

Two patterns are visible: a falling wedge and a bearish pennant. The falling wedge, a bullish pattern, has completed, with the price breaking the upper boundary and entering consolidation, suggesting a potential breakout to $0.00017.

Conversely, the bearish pennant indicates potential declines. If the price breaks the pennant's lower boundary, it could test the lower boundaries of the sideways trend. If support fails, the price may fall to $0.00009220 - $0.00008662.

Summary:

◼️ Strengths: Strong support around $0.00009220 and a completed falling wedge pattern suggesting a potential end of the downtrend.

◼️ Weaknesses: The bearish pennant suggests further downside risk, with a crucial support level at $0.00011; a break below could lead to significant drops.

History and Background of Terra Classic (LUNC).

Terra Classic (LUNC) is the rebranded version of the original Terra (LUNA) token, which experienced a dramatic collapse in value in May 2022. Here's an overview of what happened and the current state of Terra Classic, highlighting its strengths and weaknesses:

Background of Terra (LUNA) Collapse:

Collapse Details: Terra (LUNA) and its associated stablecoin TerraUSD (UST) were part of the Terra blockchain ecosystem. UST was designed to maintain a 1:1 peg with the US dollar through an algorithmic mechanism involving LUNA. In May 2022, UST lost its peg, leading to a massive sell-off of both UST and LUNA, causing LUNA's value to plummet from over $80 to less than a cent within days.

◻️ Impact: The collapse wiped out billions of dollars in market value, significantly impacting investors and the broader cryptocurrency market.

Transition to Terra Classic (LUNC):

Rebranding: Following the collapse, the Terra community and its founder, Do Kwon, proposed a recovery plan. This plan involved rebranding the original chain as Terra Classic, with its native token renamed to Terra Classic (LUNC).

◻️ New Chain: A new Terra chain was launched without the algorithmic stablecoin, maintaining the name Terra (LUNA) but as a distinct entity separate from Terra Classic.

Current State of Terra Classic (LUNC):

Community and Governance: Terra Classic is now community-driven, with governance decisions being made through proposals and voting by LUNC holders.

◻️ Development: The community is working on various initiatives to revive and develop the Terra Classic ecosystem, including potential integrations, dApps, and improvements to the blockchain's infrastructure.

◻️ Market Performance: LUNC has seen fluctuating interest and trading volumes. Its value remains highly volatile, influenced by broader market trends and specific developments within the Terra Classic community.

Key Points for Investors and Traders.

➖ Strengths:

◼️ Active Community Involvement: The dedicated community is actively involved in governance and development, which could drive future growth.

◼️ Ongoing Development Efforts: Continuous work on ecosystem development, including dApps and infrastructure improvements, adds potential value.

➖ Weaknesses:

◼️ High Volatility: LUNC's value remains highly volatile, making it a speculative and high-risk investment.

◼️ Historical Context: The collapse of the original LUNA casts a long shadow, contributing to skepticism and caution among investors.

Market Sentiment: The sentiment around LUNC is heavily impacted by news, updates from the Terra Classic community, and overall market conditions.

Conclusion:

Terra Classic (LUNC) represents an attempt to salvage and rebrand the remnants of the original Terra (LUNA) project after its catastrophic failure. While it has a dedicated community striving to rebuild, it remains a speculative and volatile asset. Investors and traders should approach LUNC with caution, keeping in mind its historical context and the inherent risks associated with it.

Always remember the golden rule of investing: never risk more than you can afford to lose. Trade carefully and wisely, and may each of your transactions be successful!

$LUNC Soars with Unanimous Approval of v2.4.2 Upgrade Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) embarks on a transformative journey with the unanimous passage of its v2.4.2 upgrade proposal. Bolstered by overwhelming validation from validators and stakeholders, the Terra Luna Classic community sets the stage for a significant evolution in its blockchain ecosystem.

The v2.4.2 upgrade, aptly dubbed Terra Classic v7, introduces a slew of groundbreaking features, chief among them being the implementation of IBC-Hooks. This pivotal upgrade paves the way for seamless integration of decentralized applications (dApps) onto the Terra Luna Classic platform, notably including the highly anticipated Enterprise DAO.

The unanimous endorsement of the proposal underscores its paramount importance within the Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community. Notably, key validators such as Allnodes, Orion, Interstellar Lounge, Stakely, and HappCattyCrypto have rallied behind the upgrade, affirming its significance and potential impact on the platform's future trajectory.

The comprehensive upgrade encompasses various enhancements, including the removal of package-forward-middleware (PFM) from the mainnet release and the addition of a minimum initial deposit requirement. These refinements, borne out of community discussions and deliberations, signify a collective commitment to advancing the Terra Luna Classic ecosystem.

Moreover, Genuine Labs' proposal for a major security upgrade, incorporating key components such as Cosmos SDK 0.47.10 and IBC go v7, further fortifies Terra Luna Classic's resilience against potential threats and vulnerabilities.

In tandem with these developments, the Singapore-based crypto futures trading platform WEEX announces the listing of LUNC spot and futures pairs. This strategic move not only expands LUNC's market accessibility but also augurs well for its liquidity and trading volume.

Despite recent market fluctuations, SEED_DONKEYDAN_MARKET_CAP:LUNC demonstrates resilience, with a 1% price increase over the past 24 hours and a 4% uptick in the last week. Trading activity remains robust, underpinning investor confidence in Terra Luna Classic's long-term viability and growth potential.

As Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) charts a course towards greater innovation and inclusivity, the unanimous approval of the v2.4.2 upgrade heralds a new era of possibility and progress. With a firm foundation in community consensus and technological advancement, Terra Luna Classic emerges as a beacon of resilience and evolution in the ever-expanding landscape of blockchain ecosystems.

LUNC Community Approves Genuine Labs' Upgrade ProposalIn a significant development for the Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) ecosystem, the community has rallied behind Genuine Labs' proposal for major core upgrades aimed at enhancing security, functionality, and interoperability. With the proposal officially passing, the stage is set for a transformative journey that could propel SEED_DONKEYDAN_MARKET_CAP:LUNC to new heights.

The Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community's overwhelming support, with a staggering 99.95% "Yes" votes, underscores the collective belief in the potential of Genuine Labs' upgrade package. This package, encompassing crucial improvements to Wasmd, IBC Go, and Cosmos SDK, promises to fortify the foundation of the Terra Luna Classic network, paving the way for enhanced performance and expanded capabilities.

Genuine Labs' roadmap includes upgrading to Cosmos SDK 0.47 and subsequently to Cosmos SDK 0.50.1, marking a pivotal step towards aligning Terra Luna Classic with the latest advancements in blockchain technology. The proposed upgrades bring forth a host of benefits, including heightened security measures, improved interoperability, and developer-friendly enhancements, all of which are essential for fostering innovation and growth within the ecosystem.

As the Terra Luna Classic community looks forward to the completion of these developments within the next 8 weeks, anticipation runs high for the positive impact they will have on the network. With an estimated budget of $30K allocated for the upgrades, Genuine Labs is poised to deliver on its promise of ushering in a new era of progress and prosperity for SEED_DONKEYDAN_MARKET_CAP:LUNC holders and stakeholders.

One of the most notable outcomes of the proposed upgrades is the significant increase in the burn rate of LUNC tokens. With an average daily burn of 200 million tokens and a whopping 1.3 billion tokens burned this week alone, the decline in token supply has already begun to exert upward pressure on LUNC's price. This surge in demand, coupled with the anticipation of future developments, has led to a 1% jump in LUNC's price over the past 24 hours and a remarkable 12% increase over the week.

Meanwhile, the price of USTC, another token within the Terra Luna Classic ecosystem, continues to trade sideways near $0.03600. Although trading volume has decreased slightly, the overall sentiment remains positive, with stakeholders eagerly awaiting the ripple effects of Genuine Labs' upgrades across the entire ecosystem.

In conclusion, the approval of Genuine Labs' upgrade proposal marks a significant milestone in the evolution of Terra Luna Classic. With the community's unwavering support and Genuine Labs' commitment to excellence, the future looks bright for LUNC as it embarks on a journey towards greater security, functionality, and value creation.

LUNC/USDT Poised for Exponential Bull Run? 👀🚀LUNC Analysis💎Paradisers, let's take a closer look at #LUNCUSDT, as the current formation suggests a possibility for a significant bullish recovery from its pivotal support zone.

💎Reviewing #TerraClassic's recent market trends, we've observed a substantial 70% decrease after it met resistance at a crucial supply level. However, a certain resilience is noticeable around the support level of $0.000091, indicating a potential upward trajectory.

💎Despite the recent challenges in establishing new highs or exceeding past peaks, resulting in a short-term bearish view, the $0.000091 mark is essential for #LUNC. This level may well be the key to triggering a substantial bullish movement upon retesting.

💎As strategic traders, we're always prepared with an alternative plan. If #LUNC drops below the $0.000091 support, we're ready to target a bullish comeback starting from the next support at $0.000059. However, be aware that a descent below this secondary level might point to more extensive downtrends.

💎Maintain flexibility in your strategies and stay vigilant with the market trends, Paradisers. Your ParadiseTeam is continually monitoring, prepared to steer you through these market changes.

Luna Classic Embracing EVM for a Resurgence in ProgrammabilityTerra Luna Classic ($LUNC) is set to undergo a transformative revival as it embraces Ethereum Virtual Machine (EVM) support. The proposal, aptly named "Investigate EVM Functionality" (Proposal 11978), has garnered significant community support, signaling a strategic move towards enhanced programmability, composability, and interoperability. This bold initiative positions Terra Luna Classic to join the ranks of blockchain projects adopting widely-used standards, potentially attracting major players like Curve DAO, Uniswap, ChainLink, Hedera, and others.

The EVM Support Proposition:

Terra Luna Classic's proposal to introduce EVM support is more than just a technical upgrade; it's a visionary step towards adapting to new and emerging technologies. By integrating the Ethereum Virtual Machine, Terra Luna Classic aims to leverage the programming capabilities offered by the Solidity language, a hallmark of EVM chains. This move aligns the community-led Terra Classic chain with cutting-edge developments in the blockchain space.

Advantages and Functionality:

The advantages of EVM support on Terra Luna Classic are manifold. The proposal emphasizes the potential for the chain to seamlessly integrate with Optimistic transactions and Rollups, promising increased efficiency and scalability. Optimistic transactions, in particular, offer a novel approach where Terra Classic can execute transactions without revealing direct security information, enhancing privacy and security.

As ClanMudhorn of Terrarium validator points out, "Terra Classic will have the potential to become compliant with new and emerging technologies like Optimistic transactions, where Terra Classic does not need to send direct security information on each transaction, and Rollups, which allow significantly more transactions to be processed at once, dramatically increasing the processing power of Terra Classic."

Community Support and Governance-Driven Decision Making:

The proposal has already surpassed the pass threshold, with over 62% of the community voting in favor. A total of 29 validators have thrown their support behind the initiative, showcasing the widespread enthusiasm for the integration of EVM functionality. The voting deadline is set for January 17, and if all goes as planned, Terra Luna Classic will mark a significant milestone in its evolution.

Strategic Interoperability and Industry Adoption:

By incorporating EVM support, Terra Luna Classic positions itself strategically in the blockchain ecosystem. The move towards interoperability and adherence to widely-used blockchain development standards open the door to collaborations with major projects in the space. The proposal specifically mentions the potential integration with Curve DAO, Uniswap, ChainLink, Hedera, and others, which could bring a new wave of innovation and utility to Terra Luna Classic.

Conclusion:

Terra Luna Classic's pursuit of EVM support is a compelling narrative of adaptation and evolution in the fast-paced world of blockchain technology. The community's endorsement of the proposal underscores the collective vision for Terra Luna Classic's future. As the voting deadline approaches, the crypto community eagerly anticipates the resurgence of Terra Luna Classic as it ventures into a new era of programmability, composability, and interoperability, setting the stage for a dynamic and inclusive blockchain ecosystem.

Terra Luna Classic ($LUNC) Community Rejects Key Burn ProposalTerra Luna Classic community rejected a proposal to burn 800 million USTC, with LUNC and USTC price falling over 10%.

The Terra Luna Classic community rejected a proposal to burn 800 million TerraClassicUSD (USTC) as they look for better ways to burn these. The community believes there are easy ways to burn funds from the Risk Harbor (formerly Ozone Protocol) multisig wallet without an update and any legal consequences.

The Terra Luna Classic community was recently notified that Risk Harbor lost the keys and has agreed to blacklist the wallet.

LUNC price fell 13% in the past 24 hours, with the price currently trading at $0.000149. The 24-hour low and high are $0.000142 and $0.000168, respectively. However, trading volume has increased 20% in the last 24 hours.

LUNCUSD Excellent short-term buy signalTerra Classic (LUNCUSD) just hit the 1D MA50 (blue trend-line) for the first time since July 22. The pattern is a Channel Down going back to early March and every time the price broke above the 1D MA50, it went all the way for the 1D MA100 (green trend-line) to form a new Lower High at the top of the Channel Down.

As a result, we will buy the moment the 1D MA50 breaks and target the 1D MA100 at 0.00007550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

😱Luna 2.0 will lose another ➖30%😱After the arrest of Do Kwon in Montenegro by the 👮♂️Interpol police👮♂️, there is a possibility that Luna will drop more than before, and at least it will drop to the Price Reversal Zone (PRZ) and Support line(➖30%).

Terra Analyze ( LUNAUSDT ), Daily time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

LUNC Terra Classic $605 Million valuation problemThe valuation of LUNC Terra Classic at a market cap of $605 million raises concerns, particularly considering the project's current state of inactivity. As a community-led project that has become stagnant or defunct, such a high valuation appears to be disproportionate.

In my opinion, the valuation for a purely speculative token like LUNC should be re-evaluated to align with a more realistic assessment. A market cap of around $50 million seems more reasonable, considering the absence of recent development or active engagement.

So add another $0.

Looking forward to read your opinion about it.

LUNCUSD Bearish under the 1day MA50, bullish over it.Terra Classic/ LUNCUSD is inside a Channel Down, which has the 1day MA50 as its Resistance since March 2nd.

As long as it trades under it, target 0.000075.

If it closes over it, target the 1day MA200 at 0.00014.

Follow us, like the idea and leave a comment below!!

Luna Classic Bullish ScenarioLuna Classic has already experienced a lot of depression and sideways movement. I think the door is open for the big players…

TP: 0.0012-0.0013

That is all.

Big Tuna LUNA this is it right here folks, the moneymaker, the generation shaker, when they talk about life changing money this is what they mean. if anyone wants to compete with elon on the global stage, theyll have to yolo a punt like this and pray it turns around. massive opportunity folks dont sleep!