Terraluna

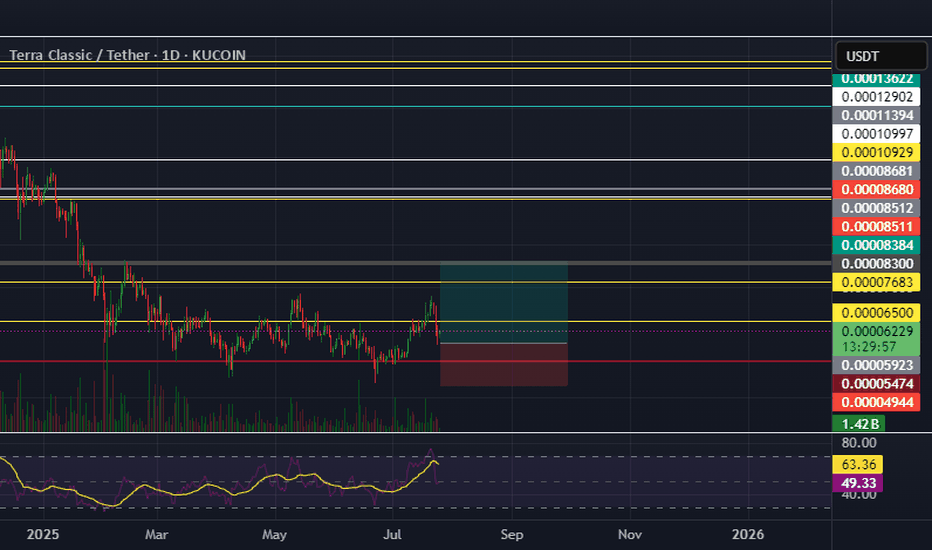

Terra Luna Classic LT Double-Bottom & 771% Potential ProfitsYou can say it is a long-term (LT) triple-bottom when taking into consideration the July-August 2024 support.

Terra Luna Classic (LUNC) has been reacting at the same level for years. Each time this strong support range gets challenged, what follows is a bullish wave.

» August 2023 marked the bottom of the bear market. And this produced a bullish wave.

» July-August 2024 marked the bottom of a correction and this produced a new period of growth.

» February-June 2025 is the present low and this too marks a market bottom, from this point on we will see so much growth. This support level is already confirmed and the action has been turning bullish. Here is what I mean.

A low in February 2025, a higher low in April and now a new higher low in June. LUNC has been growing from its base. This reveals what comes next.

When the market is bearish, these lows become lower and lower, by a significant amount. Instead, there is no bearish momentum, no bearish force, in fact, the bearish wave is over, we are seeing accumulation, four months of accumulation before a new wave of growth.

Hundreds of percentages of points up follow next. The chart shows 771% profits potential but there will be more, likely to be much more. This is the best time to buy, when prices are low. Comeback to this publication and see the results in October or November 2025. You will see the difference in price. Right now LUNCUSDT is trading at 0.00006066. In 4-6 months, prices will be many times higher. Wait and see.

Namaste.

Luna Classic: Burn Tax Proposal Sparks Debate Amid Price DeclineThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community has initiated a heated discussion surrounding Proposal 12149, which aims to increase the on-chain tax rate from 0.5% to 1.5%. While this measure promises to enhance LUNC’s burn rate and bolster funding for the community and Oracle pools, it has not been without controversy. The vote comes in the wake of the successful v.3.3.0 network upgrade, which simplified tax handling and improved the ecosystem for developers and dApps.

The Proposal: A Closer Look

The proposed tax increase would triple the burn tax, allocating 1.2% for burns and 0.3% for community and Oracle pools. Proponents argue this move could significantly reduce the total supply of LUNC, accelerate burns, and increase funds available for staking rewards and ecosystem growth.

However, critics, including Binance co-founder Changpeng “CZ” Zhao, have raised concerns about higher taxes potentially deterring developers and layer-2 projects from building on the Terra Luna Classic network. Validators have also expressed divided opinions, with 43.24% voting "Yes," 16.01% voting "No," and 40.74% voting "No with veto" as of the latest tally.

Current Market Performance

Despite the promising implications of the burn tax proposal, LUNC has struggled in the market, dropping 9% in the last 24 hours to $0.0001135. The token’s trading volume surged by 38% during the same period, indicating heightened market activity. Similarly, USTC has seen a 7% drop, trading at $0.02029, with an 87% increase in trading volume.

Technical Analysis

From a technical standpoint, SEED_DONKEYDAN_MARKET_CAP:LUNC is in oversold territory, with the Relative Strength Index (RSI) at 28. This low RSI typically signals a potential correction or breakout, presenting two possible scenarios:

1. Upside Potential: The active community and the burn mechanism could drive renewed investor confidence, sparking a rally.

2. Downside Risk: If the broader market correction persists, LUNC may continue its downward trajectory, especially as Bitcoin’s ( CRYPTOCAP:BTC ) price movement exerts influence over the altcoin market.

Immediate support for SEED_DONKEYDAN_MARKET_CAP:LUNC is seen at $0.0001115, with resistance at $0.0001243. A breakout above this resistance could signal a short-term recovery, while a failure to hold support might lead to further declines.

Fundamental Outlook

The burn tax proposal highlights the Terra Luna Classic community's commitment to reducing token supply and strengthening the ecosystem. However, the divided vote underscores the challenge of balancing ecosystem growth with immediate investor sentiment.

Despite the current price volatility, LUNC's long-term potential remains tied to the community's ability to execute on its vision and navigate market challenges. If Proposal 12149 passes, the increased burn rate and enhanced community funding could lay the groundwork for a more robust Terra Luna Classic network.

Conclusion

While LUNC’s recent price action reflects broader market trends and skepticism around the burn tax proposal, its strong community backing and proactive governance measures position it as a token with significant long-term potential. Traders and investors should closely monitor the outcome of Proposal 12149 and key technical levels to gauge the token’s next move.

The Fallout: 3AC Demands $1.3 Bln From Bankrupt Terraform LabsIn the latest development in the crypto world’s legal drama, Three Arrows Capital (3AC), once one of the most prominent hedge funds in the industry, has filed a staggering $1.3 billion claim against the now-bankrupt Terraform Labs. The claim adds a new layer of complexity to the already convoluted legal struggles surrounding Terraform Labs and its founder, Do Kwon, as the repercussions of the TerraUSD and LUNA collapse continue to unfold.

The Rise and Fall of TerraUSD and LUNA ( NASDAQ:LUNA )

Terraform Labs, led by the controversial figure Do Kwon, was once at the forefront of the cryptocurrency boom, with TerraUSD (UST) and LUNA being key players in the market. However, the ecosystem’s catastrophic collapse in May 2022 sent shockwaves through the industry. The implosion resulted in billions of dollars in losses, with LUNA’s value plummeting to near zero and UST losing its peg to the US dollar.

For Three Arrows Capital, this collapse was nothing short of disastrous. The hedge fund had heavily invested in LUNA ( NASDAQ:LUNA ), reportedly holding up to $462 million worth of the token at its peak. However, within weeks, that investment was reduced to a mere $2,700, leading to the eventual downfall of 3AC.

3AC’s Allegations: Market Manipulation and Inflated Valuations

Three Arrows Capital’s $1.3 billion claim centers on allegations of market manipulation and inflated valuations by Terraform Labs. According to the court filing, 3AC accuses Terraform Labs of orchestrating the selloff that led to the devaluation of LUNA and UST, thereby directly contributing to 3AC’s collapse. The hedge fund asserts that Terraform Labs manipulated the market by artificially inflating the value of its assets, leaving investors like 3AC with devastating losses.

This legal move marks a significant escalation in the ongoing fallout from the Terra ecosystem’s collapse. As 3AC seeks to recoup its losses, the claim underscores the broader impact that the Terra meltdown had on the crypto industry, affecting not just retail investors but also institutional giants like Three Arrows Capital.

Legal Battles on Multiple Fronts

The $1.3 billion claim against Terraform Labs ( NASDAQ:LUNA ) is just one of many legal challenges facing the company and its founder, Do Kwon. The crypto world has been closely following Kwon’s legal woes, with his extradition to South Korea still pending. The Supreme Court of Montenegro recently delayed the extradition in response to a request from the State Prosecutor’s Office, further prolonging the legal limbo in which Kwon finds himself.

In a related development, the crypto lending platform Celsius Network is also entangled in its own legal battle, seeking to claw back $2.4 billion from Tether over allegations of Bitcoin transaction fraud. The legal entanglements of Celsius and Terraform Labs highlight the broader struggles of the crypto industry as it grapples with the consequences of the market’s volatility and the collapse of key players.

The Road Ahead: What’s Next for Terraform Labs and 3AC?

As the legal battle between 3AC and Terraform Labs heats up, the crypto community will be watching closely to see how the case unfolds. The outcome could set a significant precedent for other cases involving market manipulation and the responsibilities of crypto companies toward their investors.

For Terraform Labs, the $1.3 billion claim is yet another hurdle in its fight for survival amidst ongoing lawsuits and regulatory scrutiny. Meanwhile, Three Arrows Capital, once a titan in the crypto hedge fund space, is seeking to salvage what it can from the wreckage of its investments.

The case serves as a stark reminder of the high stakes and risks involved in the cryptocurrency market, where fortunes can be made and lost in an instant. As the industry continues to evolve, the legal and regulatory frameworks surrounding it will likely undergo significant changes, driven in part by cases like this one.

Technical Outlook

As of the time of writing, Terra Luna ( NASDAQ:LUNA ) demonstrates a 3.32% increase on Monday, accompanied by a Relative Strength Index (RSI) of 43, indicative of an unhealthy scenario in light of the developments pertaining to Terraform Labs, where 3AC is demanding $1.3 billion from the bankrupt entity. The daily price chart displays a bearish hanging man pattern, recognized as a bearish reversal candlestick pattern following a price advance, characterized by a small real body and a long lower shadow measuring at least twice the size of the real body. This bears ominous implications for NASDAQ:LUNA in conjunction with the ongoing matter involving 3AC.

Conclusion: A Turning Point for the Crypto Industry?

The $1.3 billion claim filed by Three Arrows Capital against Terraform Labs represents a significant moment in the ongoing legal saga of the crypto industry. As both companies navigate their respective challenges, the outcome of this case could have far-reaching implications for the future of cryptocurrency regulation and the responsibilities of crypto firms to their investors.

For now, all eyes are on the courts as the battle between 3AC and Terraform Labs plays out. The stakes are high, and the consequences could shape the future of the crypto industry for years to come.

Despite Binance Burn 1.35 Bln LUNC Chart shows a Bearish PatternBinance has burned 1.35 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens in its 22nd batch of its SEED_DONKEYDAN_MARKET_CAP:LUNC burn mechanism, marking a bearish pattern in the crypto exchange's net burn. The total SEED_DONKEYDAN_MARKET_CAP:LUNC burn by Binance has now surpassed 60 billion, accounting for more than 52% of the total SEED_DONKEYDAN_MARKET_CAP:LUNC burned by the Terra Luna Classic community. The 22nd batch of the SEED_DONKEYDAN_MARKET_CAP:LUNC burn mechanism burned a significant amount of trading fees for the period between April 30 and May 29. Binance has now burned nearly 60.42 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens from trading fees on SEED_DONKEYDAN_MARKET_CAP:LUNC spot and margin trading pairs.

Last month, Binance burned 1.4 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens. The exchange burned 1.40 billion in trading fees on LUNC spot and margin trading pairs worth $156,362 as trading volumes fell significantly in April. However, trading volumes reversed higher in the last few weeks of May, with prices mostly trading sideways near $0.00012.

SEED_DONKEYDAN_MARKET_CAP:LUNC and OTC:USTC prices continue to trade under pressure even after the Binance SEED_DONKEYDAN_MARKET_CAP:LUNC burn due to a recent crypto market selloff, causing Terra Luna Classic ecosystem tokens to pare recent gains. The community narrative has switched to development activity and SEED_DONKEYDAN_MARKET_CAP:LUNC burns in May, bringing back speculation of SEED_DONKEYDAN_MARKET_CAP:LUNC price hitting $0.0002. SEED_DONKEYDAN_MARKET_CAP:LUNC price has rallied over 17% in a month amid buying from spot and derivatives traders, currently trading at $0.000117.

Despite the burning streak by Binance, the token seems to trade in respite to the burn campaign. The memecoin is down by 2.76% technically, SEED_DONKEYDAN_MARKET_CAP:LUNC 's daily price chart depicts a bearish symmetrical triangle pattern in the long term. But the Relative Strength Index (RSI) which is at 56.59 gives hope of a trend reversal for long and short term investors alike.

LUNA/USDT Looking Good For a Bounce Back to Supply Zone 🚀 💎The recent market activities for #LUNAUSDT have caught our attention. Currently, LUNA is finding footing at a support area, highlighted by a bullish rejection candle, signaling possible upward movement.

💎This setup suggests a bounce could be imminent, propelling #TerraLuna towards higher resistance targets. The presence of this bullish candle at support hints at a strengthening of momentum, potentially steering the price toward notable resistance levels.

💎Conversely, if NASDAQ:LUNA struggles to sustain this support or the bounce falters, it may point to a weakening of bullish forces. A drop below the support level could usher in a bearish phase, emphasizing the need for vigilance.

💎Monitoring #LUNA's response to this support zone is crucial. We need to watch closely for either a confirmation of the bullish trajectory or signs of a reversal to bearish trends. Stay alert, Paradisers, as these market shifts unfold.

MyCryptoParadise

i Feel the success 🌴

Do Kwon and Terraform Labs Found Guilty of Misleading Investors The recent civil fraud trial in the United States has found Do Kwon and Terraform Labs liable for misleading investors prior to the UST stablecoin collapse in 2022. The US Securities and Exchange Commission (SEC) had charged Kwon and Terraform Labs of falsely leading investors about the stability of TerraUSD, the network's stablecoin also known as UST. The UST stablecoin was designed to maintain a value of 1:1 against the dollar. The SEC also accused the defendants of falsely claiming that Terraform's blockchain was used in a popular Korean mobile payment app. The jury, after a two-week trial, agreed with the SEC's allegations and found the defendants guilty of civil fraud charges on Friday.

The TerraUSD and Luna collapse caused a cryptocurrency market crash in 2022, which resulted in several companies going bankrupt. The collapse was severe enough that it sent shockwaves throughout the industry, leading to the arrest of Terraform Labs founder, Do Kwon, in Montenegro in March 2023.

Following the verdict, a spokesperson for Terraform expressed disappointment and stated that the company would weigh its options. However, the SEC, through its Division of Enforcement Director Gurbir Grewal, emphasized the importance of compliance and registration in the crypto markets. According to Grewal, the lack of compliance and registration has real consequences for investors.

US District Judge Jed Rakoff is expected to determine the penalties in the coming weeks after hearing from the SEC and the defendants. Terraform will be able to challenge the ruling on appeal after the final judgment in the case.

Terra ($LUNA) Soars as Founder's Legal Saga Takes a New TurnTerra ( NASDAQ:LUNA ) Skyrockets Over 26% After Do Kwon’s Release

The imminent release of Terra ( NASDAQ:LUNA ) founder Do Kwon from Montenegro's prison stirs a 26% price surge for Terra (LUNA).

Market Analysis and Performance of Terra ( NASDAQ:LUNA )

The announcement of Do Kwon’s impending release has coincided with a notable surge in the price of Terra ( NASDAQ:LUNA ). Investors have responded positively to this development, leading to a significant 26% increase in Terra’s price. Currently valued at $1.105, with a circulating supply of $630,798,184.69 and a market cap of 690,802,291 LUNA.

Terra’s recent performance has been impressive, with a 22.4% increase in price over the past 7 days and a remarkable 72.7% surge over the last month. These figures indicate a strong upward trend, suggesting favorable conditions for potential investors. The market sentiment surrounding Terra ( NASDAQ:LUNA ) is optimistic, with many recognizing its growth potential amidst recent developments.

Background and Context of Do Kwon’s Legal Situation

The legal saga surrounding Do Kwon traces back to a forgery case involving a fake passport, which ultimately led to his imprisonment in Montenegro. Following his arrest, Kwon was convicted by the court in Podgorica and subsequently served a prison sentence. However, the situation has been further complicated by conflicting extradition requests from the United States and South Korea, each presenting different charges against Kwon.

The ongoing legal battle has underscored the importance of the Montenegrin Supreme Court’s review in determining Kwon’s extradition fate. This review process will be crucial in assessing the legality of the extradition requests and addressing the concerns raised by Kwon’s legal team. Furthermore, the announcement of Kwon’s release holds significant implications not only for his personal circumstances but also for the trajectory of Terra ( NASDAQ:LUNA ) and the broader crypto market.

$LUNC Soars with Unanimous Approval of v2.4.2 Upgrade Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) embarks on a transformative journey with the unanimous passage of its v2.4.2 upgrade proposal. Bolstered by overwhelming validation from validators and stakeholders, the Terra Luna Classic community sets the stage for a significant evolution in its blockchain ecosystem.

The v2.4.2 upgrade, aptly dubbed Terra Classic v7, introduces a slew of groundbreaking features, chief among them being the implementation of IBC-Hooks. This pivotal upgrade paves the way for seamless integration of decentralized applications (dApps) onto the Terra Luna Classic platform, notably including the highly anticipated Enterprise DAO.

The unanimous endorsement of the proposal underscores its paramount importance within the Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community. Notably, key validators such as Allnodes, Orion, Interstellar Lounge, Stakely, and HappCattyCrypto have rallied behind the upgrade, affirming its significance and potential impact on the platform's future trajectory.

The comprehensive upgrade encompasses various enhancements, including the removal of package-forward-middleware (PFM) from the mainnet release and the addition of a minimum initial deposit requirement. These refinements, borne out of community discussions and deliberations, signify a collective commitment to advancing the Terra Luna Classic ecosystem.

Moreover, Genuine Labs' proposal for a major security upgrade, incorporating key components such as Cosmos SDK 0.47.10 and IBC go v7, further fortifies Terra Luna Classic's resilience against potential threats and vulnerabilities.

In tandem with these developments, the Singapore-based crypto futures trading platform WEEX announces the listing of LUNC spot and futures pairs. This strategic move not only expands LUNC's market accessibility but also augurs well for its liquidity and trading volume.

Despite recent market fluctuations, SEED_DONKEYDAN_MARKET_CAP:LUNC demonstrates resilience, with a 1% price increase over the past 24 hours and a 4% uptick in the last week. Trading activity remains robust, underpinning investor confidence in Terra Luna Classic's long-term viability and growth potential.

As Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) charts a course towards greater innovation and inclusivity, the unanimous approval of the v2.4.2 upgrade heralds a new era of possibility and progress. With a firm foundation in community consensus and technological advancement, Terra Luna Classic emerges as a beacon of resilience and evolution in the ever-expanding landscape of blockchain ecosystems.

LUNC Community Approves Genuine Labs' Upgrade ProposalIn a significant development for the Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) ecosystem, the community has rallied behind Genuine Labs' proposal for major core upgrades aimed at enhancing security, functionality, and interoperability. With the proposal officially passing, the stage is set for a transformative journey that could propel SEED_DONKEYDAN_MARKET_CAP:LUNC to new heights.

The Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community's overwhelming support, with a staggering 99.95% "Yes" votes, underscores the collective belief in the potential of Genuine Labs' upgrade package. This package, encompassing crucial improvements to Wasmd, IBC Go, and Cosmos SDK, promises to fortify the foundation of the Terra Luna Classic network, paving the way for enhanced performance and expanded capabilities.

Genuine Labs' roadmap includes upgrading to Cosmos SDK 0.47 and subsequently to Cosmos SDK 0.50.1, marking a pivotal step towards aligning Terra Luna Classic with the latest advancements in blockchain technology. The proposed upgrades bring forth a host of benefits, including heightened security measures, improved interoperability, and developer-friendly enhancements, all of which are essential for fostering innovation and growth within the ecosystem.

As the Terra Luna Classic community looks forward to the completion of these developments within the next 8 weeks, anticipation runs high for the positive impact they will have on the network. With an estimated budget of $30K allocated for the upgrades, Genuine Labs is poised to deliver on its promise of ushering in a new era of progress and prosperity for SEED_DONKEYDAN_MARKET_CAP:LUNC holders and stakeholders.

One of the most notable outcomes of the proposed upgrades is the significant increase in the burn rate of LUNC tokens. With an average daily burn of 200 million tokens and a whopping 1.3 billion tokens burned this week alone, the decline in token supply has already begun to exert upward pressure on LUNC's price. This surge in demand, coupled with the anticipation of future developments, has led to a 1% jump in LUNC's price over the past 24 hours and a remarkable 12% increase over the week.

Meanwhile, the price of USTC, another token within the Terra Luna Classic ecosystem, continues to trade sideways near $0.03600. Although trading volume has decreased slightly, the overall sentiment remains positive, with stakeholders eagerly awaiting the ripple effects of Genuine Labs' upgrades across the entire ecosystem.

In conclusion, the approval of Genuine Labs' upgrade proposal marks a significant milestone in the evolution of Terra Luna Classic. With the community's unwavering support and Genuine Labs' commitment to excellence, the future looks bright for LUNC as it embarks on a journey towards greater security, functionality, and value creation.

Binance Burns 2.1 Billion Terra Luna Classic (LUNC) TokensBinance, the world's largest cryptocurrency exchange, recently burned a staggering 2.1 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens. This move marks the 18th batch of the SEED_DONKEYDAN_MARKET_CAP:LUNC burn mechanism, bringing the total number of tokens burned by Binance to over 50 billion. With the broader community effort, the SEED_DONKEYDAN_MARKET_CAP:LUNC burn is on the cusp of reaching a monumental 100 billion milestone.

Binance's Role in the SEED_DONKEYDAN_MARKET_CAP:LUNC Burn:

The recent burn, executed on January 1, saw 2.1 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens sent to the burn address terra1sk06e3dyexuq4shw77y3dsv480xv42mq73anxu. This action further solidifies Binance's commitment to reducing the circulating supply of SEED_DONKEYDAN_MARKET_CAP:LUNC tokens. The exchange's contribution now stands at an impressive 52.4% of the total tokens burned by the Terra Luna Classic community.

Increasing Burn Rates and Trading Volume:

January witnessed a substantial increase in the burn rate, with 5.57 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens incinerated by Binance. This surge in burning activity can be attributed to a significant uptick in SEED_DONKEYDAN_MARKET_CAP:LUNC trading volume on the exchange. Binance, along with other crypto platforms, introduced a USTC perpetual contract and new OTC:USTC and SEED_DONKEYDAN_MARKET_CAP:LUNC trading pairs, fostering a conducive environment for increased token trading.

Community Collaboration and Milestones:

The Terra Luna Classic burn campaign, a collaborative effort involving crypto exchanges, validators, projects, and community members, has propelled the total burn close to the 100 billion SEED_DONKEYDAN_MARKET_CAP:LUNC landmark. On average, the community burns an impressive 600 million SEED_DONKEYDAN_MARKET_CAP:LUNC per week, showcasing the collective dedication to reducing the token's circulating supply.

Market Performance and Challenges:

While the SEED_DONKEYDAN_MARKET_CAP:LUNC community remains bullish about the token hitting local highs, recent market trends have presented some challenges. SEED_DONKEYDAN_MARKET_CAP:LUNC prices experienced a 7% decline this week, currently trading at $0.00009444.

Conclusion:

The recent burn of 2.1 billion SEED_DONKEYDAN_MARKET_CAP:LUNC tokens by Binance marks a crucial step towards the community's ambitious goal of reaching the 100 billion milestone. As the Terra Luna Classic ecosystem continues to evolve, collaborations between crypto exchanges, validators, and community members remain integral to the success of the burn campaign. Despite short-term market fluctuations, the collective efforts underline a resilient commitment to shaping the future of the Terra Luna Classic token. Investors and enthusiasts alike await further developments as the community inches closer to achieving this monumental milestone.

Terra Classic's Bold Move: EVM Integration and the LUNC SurgeThe Terra Classic community has recently made waves in the crypto sphere with its groundbreaking proposal to integrate the Ethereum Virtual Machine (EVM) into its platform. This strategic move has captured the attention of the global crypto market, positioning Terra Classic as a player to watch in the evolving landscape of blockchain technology.

EVM Integration Unveiled:

In a significant development, the Terra Classic community unveiled its successful EVM proposal, signaling a new era for the platform. By embracing the Ethereum Virtual Machine, Terra Classic aims to enhance its flexibility and align with the latest advancements in the crypto space. This move positions Terra Classic to become compliant with emerging technologies globally, opening the door to exciting possibilities for its native token, $LUNC.

EVM's Dominance and Terra Classic's Vision:

The decision to integrate EVM comes as no surprise, given its status as the gold standard for blockchain development since 2013. EVM boasts a massive network, encompassing over 910 separate chains. Terra Classic's strategic alignment with EVM reflects a vision to leverage the dominant standard in the crypto realm, facilitating interoperability and adoption of widely-used blockchain development standards.

The Voting Landscape:

The proposal faced a divided community, with 44% in favor, 42% against, 12.06% abstaining, and a minimal 0.20% voting with a veto. Despite the divided sentiments, the proposal is gaining traction, inching closer to the 50% pass threshold. This democratic process showcases the Terra Classic community's commitment to inclusive decision-making and reflects the importance of the EVM integration to the platform's future.

Impact on Transactions and Processing Power:

With EVM support, Terra Classic anticipates a significant boost in transaction processing capabilities. The integration aims to enable the platform to handle a higher volume of transactions efficiently. This enhancement in processing power is poised to elevate Terra Classic's standing in the crypto space, attracting attention from developers and projects seeking a robust and scalable blockchain infrastructure.

$LUNC Price Movement:

In response to the EVM integration proposal, the price of $LUNC experienced a minor surge of 0.70%, currently trading at $0.00012579. However, the weekly chart paints a more optimistic picture, showcasing a notable 5.80% surge. As the market digests the implications of the EVM integration, crypto enthusiasts are eagerly anticipating a potential surge in $LUNC prices in the near future.

Conclusion:

Terra Classic's strategic move to integrate EVM reflects a commitment to innovation and adaptability in the ever-evolving crypto landscape. The community's decision to embrace EVM positions Terra Classic as a platform ready to harness the power of widely-accepted blockchain standards. As the proposal gains momentum, the future looks promising for both Terra Classic and its native token, $LUNC, with the potential for increased adoption, interoperability, and a surge in market value.

Luna Classic Embracing EVM for a Resurgence in ProgrammabilityTerra Luna Classic ($LUNC) is set to undergo a transformative revival as it embraces Ethereum Virtual Machine (EVM) support. The proposal, aptly named "Investigate EVM Functionality" (Proposal 11978), has garnered significant community support, signaling a strategic move towards enhanced programmability, composability, and interoperability. This bold initiative positions Terra Luna Classic to join the ranks of blockchain projects adopting widely-used standards, potentially attracting major players like Curve DAO, Uniswap, ChainLink, Hedera, and others.

The EVM Support Proposition:

Terra Luna Classic's proposal to introduce EVM support is more than just a technical upgrade; it's a visionary step towards adapting to new and emerging technologies. By integrating the Ethereum Virtual Machine, Terra Luna Classic aims to leverage the programming capabilities offered by the Solidity language, a hallmark of EVM chains. This move aligns the community-led Terra Classic chain with cutting-edge developments in the blockchain space.

Advantages and Functionality:

The advantages of EVM support on Terra Luna Classic are manifold. The proposal emphasizes the potential for the chain to seamlessly integrate with Optimistic transactions and Rollups, promising increased efficiency and scalability. Optimistic transactions, in particular, offer a novel approach where Terra Classic can execute transactions without revealing direct security information, enhancing privacy and security.

As ClanMudhorn of Terrarium validator points out, "Terra Classic will have the potential to become compliant with new and emerging technologies like Optimistic transactions, where Terra Classic does not need to send direct security information on each transaction, and Rollups, which allow significantly more transactions to be processed at once, dramatically increasing the processing power of Terra Classic."

Community Support and Governance-Driven Decision Making:

The proposal has already surpassed the pass threshold, with over 62% of the community voting in favor. A total of 29 validators have thrown their support behind the initiative, showcasing the widespread enthusiasm for the integration of EVM functionality. The voting deadline is set for January 17, and if all goes as planned, Terra Luna Classic will mark a significant milestone in its evolution.

Strategic Interoperability and Industry Adoption:

By incorporating EVM support, Terra Luna Classic positions itself strategically in the blockchain ecosystem. The move towards interoperability and adherence to widely-used blockchain development standards open the door to collaborations with major projects in the space. The proposal specifically mentions the potential integration with Curve DAO, Uniswap, ChainLink, Hedera, and others, which could bring a new wave of innovation and utility to Terra Luna Classic.

Conclusion:

Terra Luna Classic's pursuit of EVM support is a compelling narrative of adaptation and evolution in the fast-paced world of blockchain technology. The community's endorsement of the proposal underscores the collective vision for Terra Luna Classic's future. As the voting deadline approaches, the crypto community eagerly anticipates the resurgence of Terra Luna Classic as it ventures into a new era of programmability, composability, and interoperability, setting the stage for a dynamic and inclusive blockchain ecosystem.

Terra Classic Votes On 800 Million Burn For Another LUNC RallyThe Terra Luna Classic community votes on another proposal related to burning 800 million TerraClassicUSD (USTC). The proposal aims to burn funds from the Risk Harbor (formerly Ozone Protocol) multisig wallet through an update to Terrad client. It is similar to previous proposals on burning 800 million in the wallet, which was later blacklisted via a governance voting.

Terra Luna Classic Community Eyes 800 Million USTC Burn

Proposal 11913 “RH MultiSig Wallet – Burn 800m via Update to Terrad Client” is up for governance voting on the Station wallet. The new proposal aims to burn the 800 million USTC still in the Risk Harbor multisig wallet. The proposal deadline is December 19.

The community passed proposal 11832 to blacklist the wallet citing that “blacklisting allows for a reversible action, enabling fund recovery through governance if valid reasons are provided by the wallet owners.” However, the new proposal argues that no fund recovery via the wallet owners is possible and blacklisting serves no purpose anymore.

LUNC price is moving mostly sideways after a 22% fall in a week, with the price currently trading at $0.000175. The 24-hour low and high are $0.000170 and $0.000185, respectively. Moreover, trading volume has decreased by 57% in the last 24 hours.

Why Is Luna Classic (LUNC) Price Skyrocketing Today?Luna Classic (LUNC) price has skyrocketed by 60% in response to strategic investment and USTC perpetual contract launch by Binance.

The sudden upsurge witnessed in Terra Classic tokens in the last 48 hours is not the first time for the Terra ecosystem. The community-led Terra Luna Classic chain witnessed multiple revival efforts from introducing burning to inter-blockchain communication (IBC). LUNC price has skyrocketed by 60% in response to strategic investment and perpetual contract launch by Binance.

Terra Luna Classic (LUNC) Gains 60%

With multiple key proposals passed by the community and positive sentiment amid broader crypto market recovery, Luna Classic Labs purchased 25.6 million USTC worth about $500,000 as part of its treasury reserve policy at an average purchase price of $0.021 per USTC. Trader QT, a partner of Luna Classic Labs, stated this is an initial investment.

It resulted in a 100% jump in USTC price, with the community noting a breakout above resistance. USTC witnessed a further pump as investors also poured money into USTC. It triggered an upside move in the Terra Classic (LUNC), with traders noting a massive increase in liquidity and trading volumes.

Binance Futures launching the USD-M USTC Perpetual Contract with up to 50x leverage sparked further rally. USTC price climbed nearly 400% in two days. The announcement further raised community sentiment, while also speculating whether it was already known to some investors as the Terra ecosystem tokens witnessed sudden rallies.

LUNC price also jumped and made a 60% gain amid the events. The price is currently trading at $0.000119. The 24-hour low and high are $0.0000787 and $0.0001256, respectively. Furthermore, the trading volume has increased by 1120% in the last 24 hours, indicating interest among traders.

USTC price trades at $0.055, paring earlier gains to 191% in the past 24 hours. The 24-hour low and high are $0.015 and $0.068, respectively. The trading volume has also slid briefly after Binance’s USTC perpetual trading announcement.

LUNAUSDT Is it coming back from extinction?The story of Terra's (LUNAUSD) crash back in May 2022 is well known to everyone in the cryptospace. Shortly after its collapse and following the last dead-cat-bounce on September 09 2022, the price entered a Channel Down pattern in the last 14 months.

In recent price action we see the possibility for a technical comeback though as not only has it reached today the top of the Channel Down but also is about to form the first Golden Cross on the 1D time-frame since August 17 2021!.

As a result, we will turn bullish if a 1D candle closes above the Channel Down, targeting 2.500 (near Resistance 1). An early bullish break-out signal can be seen on the 1D MACD where it just formed a Bullish Cross on a Higher Lows trend-line. The same pattern during the last bullish leg within the Channel Down, after forming the Bearish Cross didn't invalidate it so quickly.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Terra (LUNA) formed a bullish BAT for upto 47% pumpHi friends, hope you are well and welcome to the new trade setup of Terra (LUNA) with US Dollar pair.

Previously we caught more than 28% pump of LUNA as below:

Now on a daily time frame, LUNA has formed a bullish BAT move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.