Tesla (TSLA) - The Big Short?Can Tesla save itself from the Big Short? With earnings coming up on April 29, the anticipated sales and earnings may be dismal. If hedge funds and retirement managers decide to lighten their exposure, this could lead to abrupt moves in the price of Tesla. Basically, if people want to sell and no one wants to buy at this price, then price has to go down. Also if Tesla hits a certain price on the way down, then all the loans like those used to purchase Twitter may margin call due to risk, more selling. This would not be good for Tesla or the market in general. Also keep in mind that April may be a pullback month for the S&P500 and Nasdaq anyway. So, what does Tesla need to do to combat this? 1. Deliver new products or announce the delivery of new product. 2. Deliver on full self driving along with the Robo Taxi service 3. Deliver on a new cheaper Tesla Model that can be used by individual owners to participate in the Robo Taxi network (Income for the buyer). 4. Deliver on a redesigned Cyber Truck. The current design in getting banned in European countries. Therefore, missing out on sells. 5. Deliver on mass productoin of humanoid robots and AI agents (someone has to be first). This will create excitement but can be tricky since it will unleash AI on the world which can be great but also introduce risk that have not been vetted. Such as, who controls the AI? Who is the AI 'loyal' to? What can people or Tesla ask AI to do? Are there morality rules? Is AI subject to the law? Who's laws based on the Country, State, or county/city it resides or where it was manufactured? 6. Advertise all the positive things about Tesla as a company and the cars as a product. Explain why someone should buy a Tesla over a BYD brand electric car in markets around the world.

These are just a few suggestions for Tesla to avoid The Big Short. What are some of your ideas?

Tesla

TESLA formed the new bottom and is going for $600.Tesla / TSLA is on the 2nd straight green 1week candle, crossing above the 1week MA50.

With the 1week RSI bouncing on the 2 year Rising Support, the Channel Up has technically formed its new bottom.

Both the current and the previous one were formed on the 0.618 Fibonacci retracement level after a -55% decline.

If the bullish wave is also as similar as the bearish waves have been, the price should reach as high as the -0.382 Fib extension.

Buy and target the top of the Channel Up at $600.

Follow us, like the idea and leave a comment below!!

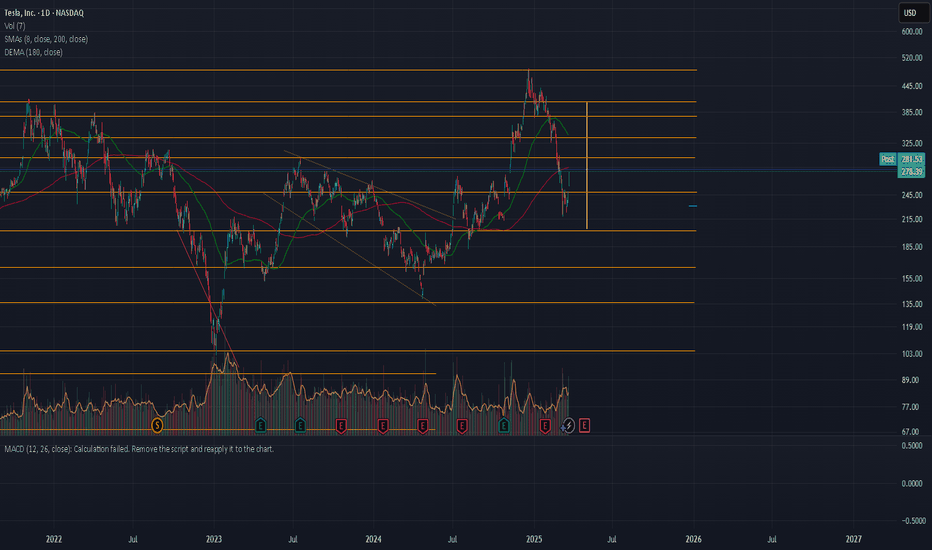

Tesla stock has completed 5 downward waves.Tesla stock has completed 5 downward waves

Currently, market sentiment is highly negative. A correction to the $296-$326 area, which corresponds to 38.20 and 50% Fibonacci levels, seems likely. They have also covered the gap from below.

After Tesla stock's correction, I expect a global collapse of the SP500, the US stock market, and the cryptocurrency market.

You can review ideas for Bitcoin, Ethereum, Solana, SPY/SP500:

-----

SP500/SPY:

Today:

-----

Bitcoin:

-----

Ethereum:

-----

Solana:

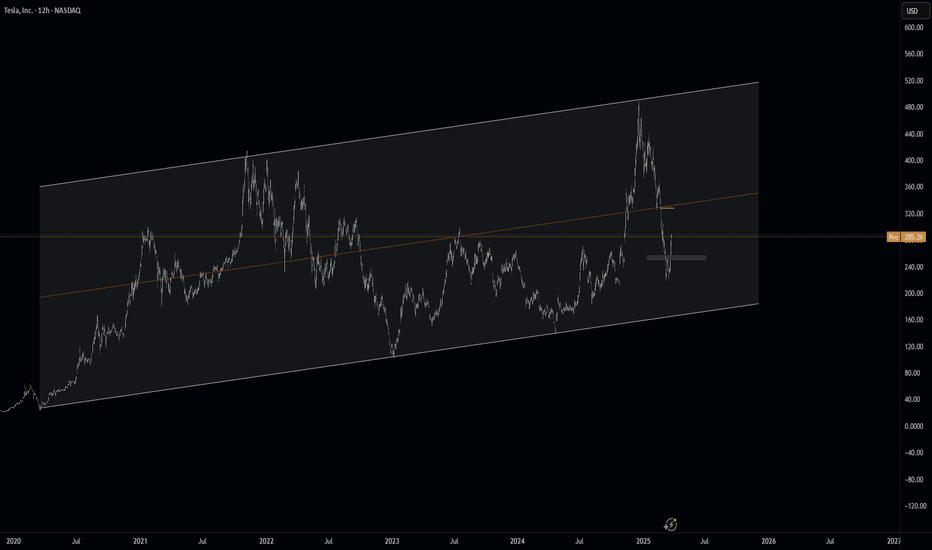

TESLA Market Outlook: Strong Reversal Expected at $200 SupportNASDAQ:TSLA is currently trading within a well-defined ascending channel , a structure that has guided price action since 2020. This channel reflects the broader bullish trend, with higher highs and higher lows consistently forming over the years. The recent sharp decline from the upper boundary of the channel is best interpreted as a temporary retracement rather than a structural shift. Such pullbacks have presented strong buying opportunities before, particularly when price approaches key support levels within the channel. The key area to watch is the $200 demand zone. This level coincides with the lower boundary of the ascending channel and has before drawn significant buying interest.

Given the broader bullish structure, a reversal from this zone could reestablish the uptrend and lead to a retest of higher levels. If a bounce occurs at the $200 demand zone, the immediate target is $263, which aligns with a key resistance level where prior rejection occurred. This area represents a logical point to watch for, but a successful breakout above $263 could lead to further move toward the upper boundary of the channel.

Fundamental Outlook:

From a fundamental perspective, the recent decline could be due to Tesla facing a unique set of challenges stemming from Elon Musk’s increasing involvement in the U.S. government. His role in the Department of Government Efficiency (DOGE) under the Trump administration has triggered mixed reactions across the financial landscape. The DOGE program, aimed at cutting bureaucratic waste and enhancing operational efficiency, has led to concerns about Musk’s ability to maintain focus on Tesla. Some investors do worry that his attention, divided among a few ventures such as Tesla, SpaceX, and also the federal program, might slow the company’s innovation pipeline in addition to running efficiency.

People are quite divided in their opinions. While some view Musk’s governmental involvement as a strategic advantage, believing his influence could drive favorable policy outcomes, others see it as a distraction that threatens Tesla’s future success. Additionally, if the DOGE program prompts budgetary austerity measures, there could be cuts to clean energy incentives, an outcome that would directly impact Tesla’s profits directly.

Despite these concerns, the market’s long-term outlook for Tesla remains bullish. Many investors view any significant retracement as a buying opportunity, particularly near major technical support zones like $200. This area is widely recognized as a strong accumulation zone where institutional buyers are likely to step in. Furthermore, the electric vehicle market continues to expand globally, and Tesla’s brand strength and technological lead remain intact, reinforcing the long-term growth narrative.

Market View & Predictions

While short-term volatility is expected due to ongoing uncertainties surrounding Musk’s government involvement, the broader technical structure suggests that the uptrend is still intact.

The recent pullback from the upper channel boundary appears to be a healthy correction rather than a trend reversal. If the price tests the $200 support zone, it could trigger a new wave of buying pressure, potentially driving the stock back toward the $263 resistance and beyond. As long as the price remains within the ascending channel, the bullish case for Tesla remains valid, with the potential for further upside as market confidence stabilizes.

SeekingPips sees TSLS Tesla GAIN $60 ! What's Next?It's hard for many traders to do. 🤔

⭐️ I still see it today with traders and investors alike. Even with some who have been at it for many years...

BUT some of the BEST ENTRIES & EXITS for me have been when the OPEN CANDLE IS COMPLETELY AGAINST ME.

The LAST WEEKLY TESLA chart that I shared is another prime example of this.

🟢SeekingPips🟢 shared a BULLISH BIAS when the WEEKLY CHART was looking as BEARISH as hell. 🔥

ℹ️ Now it really is not a method that works for everyone.

Trading against momentum always looks SCARY BUT the SECRET is MULTI TIMEFRAME ANALYSIS and also being able to...

VISUALISE DIFFERENT OBSCURE TIMEFRAMES IN REAL-TIME USING THE CURRENT OPEN CHART.

⚠️I plan on going DEEPER INTO this rabbit hole with some information and examples in the TUTORIAL SECTIONS soon.⚠️

🚥 In it's simplest terms an example would be beaing able to note where price is on a 20 or 10 min chart just only by having a 5 minute chart in front of you.

By being able to do so in REAL-TIME KEY LEVELS POP OUT that you may not have noticed from the 5 minute chart perspective only.💡💡💡

Now 🟢SeekingPips🟢 has to wait for a TRIGGER for a NEW ENTRY & SO SHOULD YOU.👍👌👍

Tesla on the Path to New Highs: Correction Before a Major high?hello guys.

let's have a comprehensive analysis of Tesla

__________________________

Technical Analysis

Price Structure & Trend:

The monthly chart indicates a long-term uptrend within a broad ascending channel.

Tesla has recently faced resistance around $300 and is now in a corrective phase.

The expected correction may bring the price down to around $220-$250, where it could find strong support before continuing its bullish move. or it is possible to start an upward movement and form an ATH!

RSI & Divergence:

The RSI indicator previously showed a fake bearish divergence, meaning the price action remains strong despite earlier weakness signals.

Potential Higher Levels

If Tesla successfully follows the projected movement, a break above $575 could open the door to $700-$750, based on the channel extension and historical breakout patterns.

__________________________

Fundamental Analysis

Earnings & Growth:

Tesla's revenue growth remains strong despite market headwinds.

New factory expansions (Giga Texas, Giga Berlin) and production efficiency improvements contribute to long-term profitability.

The Cybertruck ramp-up and expansion in AI-driven automation could drive future stock value.

EV Market Outlook:

Tesla maintains a dominant position, but increasing competition from Chinese EV manufacturers and legacy automakers remains a challenge.

Recent price cuts have impacted margins but helped sustain high sales volume.

Macroeconomic Factors:

Interest rate decisions by the Federal Reserve could impact growth stocks like Tesla.

If rates stabilize or decrease in 2025, Tesla could see renewed investor interest, pushing the stock to new highs.

_________________________

Conclusion

The mid-term bearish retracement toward $250 aligns with healthy correction levels.

If Tesla holds above support and breaks $350, your $575 target is highly probable.

A break above $575 could lead to $700+ in the longer term, assuming positive earnings growth and stable macroeconomic conditions.

OH NO GUESS WHAT I FOUND $TSLA HEAD AND SHOULDERThe head and shoulders pattern is a chart formation in technical analysis that signals possible trend reversals, often suggesting a change from a bullish to a bearish trend. It features three peaks: a central "head" that is the highest, flanked by two "shoulders," with a neckline connecting the troughs between these peaks.

Tesla's stock is often viewed as a risky investment for several reasons:

High Valuation: NASDAQ:TSLA stock price is considered very high compared to traditional car manufacturers, with a much higher price-to-earnings ratio.

Market Volatility: The NASDAQ:TLSA price is highly volatile, influenced by factors like CEO Elon Musk's public comments, regulatory changes, and overall market sentiment.

Intense Competition: The electric vehicle market is becoming more competitive, with many established and new companies investing heavily in EV technology.

Production Issues: Tesla has experienced production and supply chain challenges, which can affect its ability to meet demand and maintain profitability.

Regulatory Risks: Changes in government policies and regulations, especially those related to environmental standards and EV incentives, can significantly impact Tesla's business.

While these points highlight potential risks, Tesla also has strengths such as strong brand recognition, technological innovation, and leadership in the EV market. It's important to consider both the risks and potential rewards when evaluating Tesla as an investment.

SELLL NOW!!!!!

$TSLA The rollercoaster ride The ride continues.... It can go up or it can go down 400 - 200 is the current range, while I think and hope that next quarters numbers are going to come in low. It's all going to come down to what happens when FSD launches middle of this year. Will this be a world changing moment? Or a somewhat disappointing take rate with crappy numbers...

TSLA at Key Resistance—Breakout or Rejection?Hi Traders! 🚀 TSLA is approaching a key resistance zone—will it break out or face rejection?

🔹 Scenarios:

📈 Buy if it breaks above $284, with a stop loss at $275 and targets at $290 and $320.

📉 Sell if it rejects $284 and falls below $270, with a stop loss at $280 and targets at $260 and $230.

📊 RSI is recovering from oversold territory—momentum could push prices higher! Keep an eye on the price action.

📢 Watch out for earnings reports and macro news! These could add volatility.

🔥 Smash that like button and show some energy! Let’s trade like pros! 🚀

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

Tesla entering key $275 area.Tesla's stock price is currently at a critical juncture, entering the significant resistance zone around $270. The chart highlights this level as a pivotal threshold separating bearish and bullish market sentiments. Tesla's behavior around this region will likely determine its next major trend.

### Analysis of the Scenarios:

1. **Below $270: Bearish Outlook**

If Tesla's stock fails to effectively break above the $270 resistance zone and instead gets rejected, the bears will remain in control. Previous price actions indicate this level as a significant area of selling pressure, with multiple failed breakout attempts in the past. A rejection here could set the stage for a continuation of the downtrend, with potential declines back to lower support levels.

2. **Above $270: Bullish Resurgence**

A clear breakout above $270, confirmed by successive daily or weekly closes, would signal a bullish shift in Tesla's technical structure. This would suggest that buying momentum has overcome prior resistance, paving the way for further upward price movements. Breaking through this level could reignite investor enthusiasm and potentially initiate a new rally.

### Key Observations from the Chart:

- The $270 level has acted as both support and resistance in the past, underscoring its importance as a psychological and technical barrier.

- Tesla has recently bounced back after a sharp decline, suggesting a potential recovery attempt. However, the current price action faces a stiff challenge at this resistance level.

- A failure or success at $270 could trigger broader directional movement, with implications for both short-term traders and long-term investors.

### Conclusion:

Tesla's stock is at a decisive crossroads as it entered the $270 resistance zone. A rejection would signify continued bearish dominance, while a sustained breakout would indicate a bullish reversal. Investors will be closely watching the price action around this critical level to gauge the next directional move. As the market exhibits uncertainty, patience and prudent risk management will be key for traders looking to navigate Tesla's current trajectory.

$TSLL – Major Reversal in Play? Is tesla finally back???

TSLL has been in a prolonged downtrend but is now showing signs of a potential bottoming pattern. Price recently tested a key support zone between $6.26 and $7.18, holding firmly after multiple attempts to break lower.

Current price action is forming a strong base, and the first green candle breaking out of this range suggests momentum may be shifting.

The upside target is set near $20, which lines up with a previous consolidation zone and psychological resistance. A break and hold above current levels could trigger a strong move higher.

Risk is defined below support, making this a favorable risk-to-reward setup. Watching closely for follow-through confirmation.

My Technical Analysis for $TSLA (Tesla)📊 Technical Analysis: NASDAQ:TSLA (Tesla)

🗓️ Updated: March 24, 2025

🚨 Critical Zone Being Tested

After breaking out of a multi-year symmetrical triangle, NASDAQ:TSLA is now retesting the upper boundary of the pattern — perfectly aligned with the key ACTION ZONE (liquidity zone + long-term MAs).

🔵 ACTION ZONE ($245–265):

High-probability decision area. Holding this level could trigger a fresh bullish leg.

🟣 SWING BOX ($180–210):

If support fails, this is the next logical area for a potential bullish reaction.

🟡 FVG Daily ($75–115):

Unmitigated Fair Value Gap. Only relevant in case of a major breakdown.

📉 SMI (Stochastic Momentum Index):

Currently in negative territory, but nearing oversold — watch for a potential reversal.

🎯 Scenarios:

Bullish: Strong rejection from the Action Zone → potential move to $350–400 ✅

Bearish: Breakdown below the blue zone → eyes on Swing Box or FVG for reentry ⚠️

📌 Reminder: This is not financial advice. Always manage risk and wait for confirmation before entering a trade.

💬 What do you think? Is Tesla preparing for a bounce or heading lower?

👇 Share your thoughts in the comments!

Tesla Is Retail Traders' Choice, JPMorgan Says. Are You Buying?Tesla NASDAQ:TSLA has endured a soul-crushing experience over the past three months or so. The stock is down 50% from the record high of $480 hit in December (more than $700 billion in market cap washed out). Even insiders have sold a big chunk of their holdings.

But over the past three weeks (12 trading days to be precise), investment bank JPMorgan NYSE:JPM says, retail traders just couldn't get enough of it.

Retail net buying activity in TSLA stock. Source: JPMorgan

They’ve consistently been buying the dip, and then the dip of the dip and then… you get it. Every new dip is seen as a buying opportunity to the daredevils among us who try to catch a falling knife.

In the latest issue of “Retail Radar” — JPMorgan’s weekly report revealing where the retail money is flowing — the banking giant traced a net $12.5 billion of retail cash poured into stocks or stock-related investments last week.

As much as $4.2 billion went into ETFs (diversification, nice), where a cocktail of ETFs with a broad selection of stocks took the lion’s share along with some gold ETFs . Still, the big chunk of the pie went into individual equities — $8.3 billion of cold hard cash was injected into the retail-trading darlings Tesla NASDAQ:TSLA , Nvidia NASDAQ:NVDA and other Mag 7 members.

🤿 Buying the Dip

Here’s what the bank said:

“Single stocks accounted for +$8.3B of the inflow. TSLA (+$3.2B, +3.5z) and NVDA (+$1.9B, +1.1z) collectively contributed more than half, and the rest of Mag 7 contributed another $1B. Notably, they have been buying TSLA for 12 consecutive days, adding $7.3B in total.”

The 3.5z and the 1.1z describe the standard deviation of the retail traders’ net flows compared to the 12-month average. (Keep reading, it gets even better.)

Did you hear that? Tesla dominated the charts. Day trading bros have kicked in a total of $7.3 billion into Elon Musk’s EV maker over the past 12 cash sessions. It even won some praise from JPMorgan analysts who said this endeavor represents “the highest magnitude among all past ‘buying streaks’ in over a decade.”

Here’s the best part:

“Retail investors returned as aggressive buyers on Wednesday, breaking the $2 billion threshold in the first half of the day (the 2nd time this year), and ending the day at $3.7 billion inflows (+7z),” JPMorgan noted (Wow, 7 standard deviations above the mean). “We observed their allocation into ETFs/single names are at 30/70% during a typical heavy buying day. Among single names, NVDA and TSLA led the inflows.”

JPMorgan also estimated that retail traders’ efforts to snatch the W this year are just bad.

“We estimate retail investors’ performance is down by 7% year to date (vs. -3.3% loss in S&P). Most of the drawdown came from March as they increased their holdings in Tech.”

Retail traders' performance, year to date. Source: JPMorgan

🤙 The YOLO Moment

Buying Tesla shares right now is the ultimate YOLO play. We’re only a week away before Tesla announces what’s shaping up to be the worst delivery figure in years. After a few cuts to delivery targets, considering Europe’s sales took a huge L earlier this year, analysts now predict first-quarter deliveries to land at an average of 418,000 vehicles.

Goldman Sachs NYSE:GS , for one, is bigly bearish on the number. It trimmed its target by 50,000 to 375,000 cars. If true, it would mean that Tesla’s business is shrinking by 3% compared with Q1 of 2024 when deliveries hit 387,000 units.

For the year, analysts expect sales to land anywhere between 1.9 million and 2.1 million. With looming competition in the global auto space , Tesla will need to work extra hard to meet these numbers. In 2024, Tesla rolled 1.8 million vehicles off the assembly line and into customers’ hands (down 1% from 2023).

👀 Are Retail Traders Buying the Dip?

What better place to gauge retail traders’ sentiment than the absolute best trading community out there? Let’s hear it from you — share your thoughts on Tesla! Have you been buying the dipping dip that just keeps carving out new lows? Or you’re a freshly minted Tesla bear after all the havoc and drama around Elon Musk? Off to you!

TESLA Trading Opportunity! SELL!

My dear followers,

I analysed this chart on TESLA and concluded the following:

The market is trading on 249.11 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 240.93

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Bullish TESLA prediction and bullish theoriesBullish triggers for this event to potenially happen. (I think)

1.If the macro landscape will calm down. (QE/ Lower interest rates / Tariff peace talks)

2.Musk returns to focus on TSLA.

3.Improvements or any new news regarding the optimus robots development.

4.Bitcoin breaking out (to the upside).

5.Retirement funds coming back as investors in TSLA. (Danish funds have left the stock).

6.Peace talks between Russia and Ukraine.

NASDAQ:TSLA

Why I think JP Morgan Predicts a $120 price for Tesla1) The price channel (white) reveals that we’re only halfway to the next major bounce on the daily chart. With boycotts gaining traction and sales projections looking bleak, the stage is set for more downward pressure.

2) Looking back at the last significant downward swing ( purple ) within this channel, history could repeat itself with a drop of similar magnitude. The pattern is hard to ignore.

3) A critical support zone ( green ) lies beneath an unresolved price imbalance, still waiting to be tested. It’s like a magnet pulling the price lower.

4) When you weave these factors together—channel dynamics, past swings, and untouched support—they converge ominously around the $120 mark. Coincidence? I think not...

Let me know what you guys think.

TESLA pricing its long-term bottom. $450 rebound highly likely.Nine months ago (June 26 2024, see chart below), we signaled the start of an enormous rally on Tesla (TSLA), which eventually hit our minimum Target ($400), based on a fractal from 2014 - 2016:

Since the upper 1.382 Fib Target wasn't achieved, the model is readjusted and this count makes better sense. Based on the 1W RSI we are on a bottom similar to October 30 2017 around the 4.0 Time Fib extension. That past sequence initiated a rebound towards the market Resistance before the next decline headed to the 5.0 Fib extension.

As a result, we believe Tesla will find a bottom here and target $450 just below the Resistance level.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TSLA bound to return to its GLORY. SEED now at 230 !TSLA'S 2024 year has been a glorious one after surging 2x its valuation from 200 area on Q3 of 2024 to reach a parabolic ATH high of 485.

From there on, the stock has spiraled down -- since TRUMP inauguration.

Slashing half of its market cap from a 1.5T+ company to just 700B. Price suffered most on the market bloodbath from its ATH of 480 back to tappin its pre-surge base zone at 200 levels.

Now, things has become more or less calm. And red days has become saturated hinting of possible reversal play to the upside.

Significant net longs has been registered this past few days conveying heavy accumulation at the current price range of 200.

A double bottom has been spotted on our diagram showing a strong support of the price line.

Current price range is an ideal seeding zone for trade entries.

A rare bargain opportunity for that growth prospect -- and a retap of its glory days back at peak levels.

Spotted at 230.

Target ATH levels at 480.

TAYOR. Trade safely.