Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

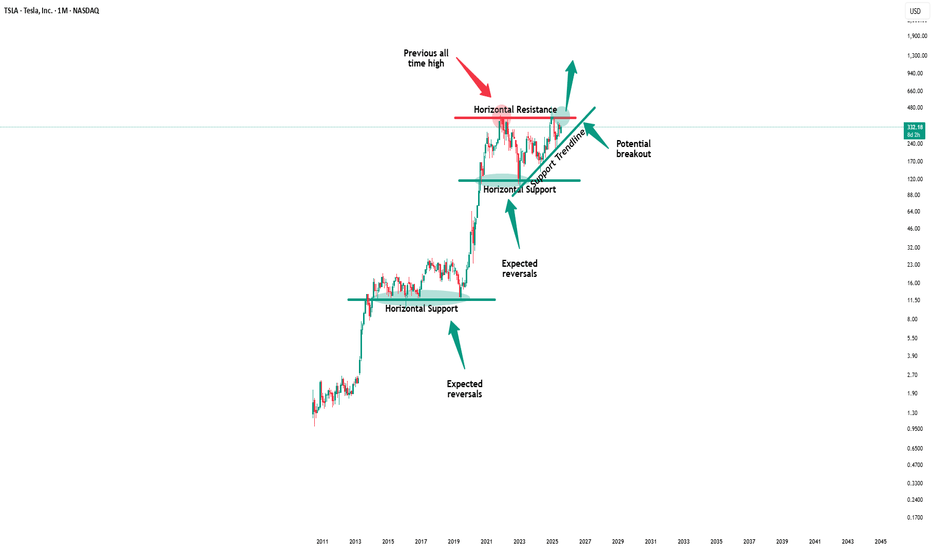

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon break above the previous all time highs.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

SwingTraderPhil

Teslalong

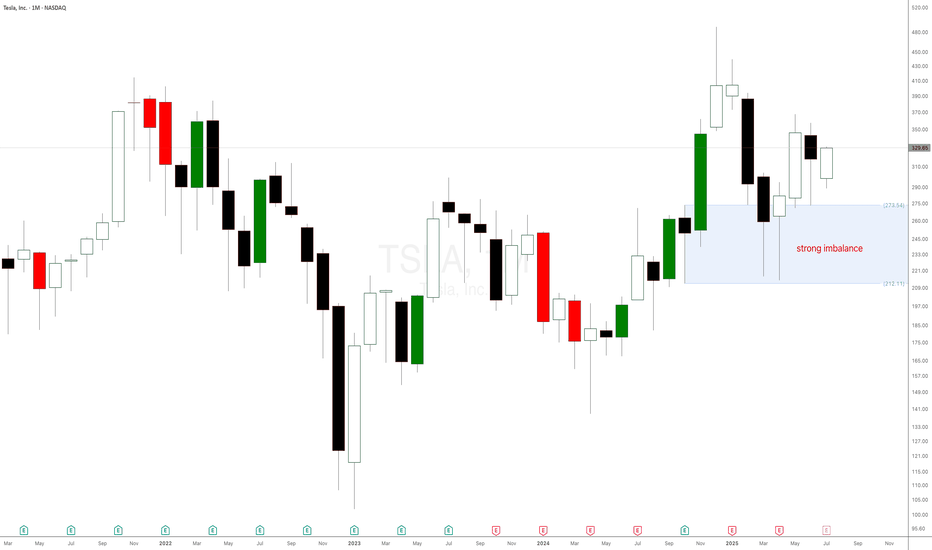

Don’t Listen to Elon Musk – Tesla Stock Chart Tells the REAL StoTesla Stock Set to Break Records: The Power of Monthly and Weekly Demand Imbalances at $273 and $298. Welcome back, traders! In today’s supply and demand breakdown, we’re diving deep into Tesla Inc. (NASDAQ: TSLA) — not from the noisy headlines or what Elon Musk just tweeted, but strictly from raw price action, demand imbalances, and the truth on the charts. Forget the fundamentals, forget the hype, because that’s already been priced in.

This is all about supply and demand, price action, and the power of patience.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

Tesla -> The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) prepares a major breakout:

🔎Analysis summary:

Not long ago Tesla perfectly retested the major support trendline of the ascending triangle pattern. So far we witnessed a nice rejection of about +50%, following the overall uptrend. There is actually a quite high chance that Tesla will eventually create a new all time high breakout.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Tesla - This bullish break and retest!Tesla - NASDAQ:TSLA - confirmed the bullish reversal:

(click chart above to see the in depth analysis👆🏻)

Tesla recently created a very bullish break and retest. Therefore together with the monthly bullish price action, the recent rally was totally expected. But despite the short term volatility, Tesla remains bullish, is heading higher and will soon create new highs.

Levels to watch: $400

Keep your long term vision!

Philip (BasicTrading)

Adam & Eve on the Chart:Will They Bless Us with a $1,500 MiracleI don’t have much to say — it’s pretty straightforward.

We’ve got two potential structures on the chart:

✅ First, the symmetrical triangle that already broke out, aiming for a target around $958 to $1,000.

✅ Then we’ve got the “Adam & Eve” structure (gotta flex sometimes 😎), see it as a cup & handle pattern, aiming for a crazy $1,500 target. This one hasn’t broken out yet — but if the first triangle breakout plays out fully, it basically sets the stage for this one to break out too.

Some quick facts:

The bounce zone around ~$245 is a huge multi-timeframe confluence level.

Volume profile support is literally chilling right at $245.

Multiple moving averages are backing this move, even on lower timeframes than the "1M"

Triangle retest? Check.

0.786 fib support? Check.

(And to name a few)

Overall, the chart looks Fine to me.

Negative news might affect the short term, but the trend should stay intact.

Unless the macro changes.

That's it, that's the idea" - Good night !

Tesla: bounce expected at $200 Support?NASDAQ:TSLA is currently approaching an important support zone, an area where the price has previously shown bullish reactions. This level aligns closely with the psychological $200 mark, which tends to carry added weight in the market .

The recent momentum suggests that buyers could step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If I'm right and buyers regain control, the price could move toward the 260.00 level.

However, a breakout below this support would invalidate the bullish outlook, potentially leading to more downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Tsla Lesson Tesla Stock Always Pay YOURSELFI say this time and time again and this is a PRIME EXAMPLE SO FAR.

🌍Now I suggested THAT IF YOU WERE A TESLA BULL that you might want to start to PAY ATTENTION TO THE STOCK TWO WEEKS AGO.

❓️"OK SO WHAT'S THE LESSON"❓️

I emphasise ALWAYS that TIME TRUMPS PRICE...

TESLA has been rather docile since its initial POP.

But take a look at the HIGHER TIMEFRAME WEEKLY CHART❗️

Whats clear to see is that although the PRICE RANGE hasn't been MASSIVE there has been plenty OF ⏳️TIME TO CAPITALISE AND PAY YOURSELF. £$€¥ 💰

Two 📈HIGHER CLOSES ON THE WEEKLY and the call made whilst the weekly looked EXTREMELY BEARISH📉

EVEN RIGHT NOW we are currently UP ON THE WEEK UNTIL NOW.

ℹ️ If you WERE UNABLE to STRUCTURE A TRADE TO TAKE advantage of this PRICE RANGE whilst DAY TRADING you may need to LOOK BACK and STUDY WHY NOT.

⚠️You could have paid yourself several times over already and even if TESLA was to seek lower prices from here you SHOULD HAVE BACKED SOMETHING ALREADY.

✅️AS ALWAYS TRADE YOUR PLAN & WAIT FOR YOU SIGNAL✅️

TESLA Market Outlook: Strong Reversal Expected at $200 SupportNASDAQ:TSLA is currently trading within a well-defined ascending channel , a structure that has guided price action since 2020. This channel reflects the broader bullish trend, with higher highs and higher lows consistently forming over the years. The recent sharp decline from the upper boundary of the channel is best interpreted as a temporary retracement rather than a structural shift. Such pullbacks have presented strong buying opportunities before, particularly when price approaches key support levels within the channel. The key area to watch is the $200 demand zone. This level coincides with the lower boundary of the ascending channel and has before drawn significant buying interest.

Given the broader bullish structure, a reversal from this zone could reestablish the uptrend and lead to a retest of higher levels. If a bounce occurs at the $200 demand zone, the immediate target is $263, which aligns with a key resistance level where prior rejection occurred. This area represents a logical point to watch for, but a successful breakout above $263 could lead to further move toward the upper boundary of the channel.

Fundamental Outlook:

From a fundamental perspective, the recent decline could be due to Tesla facing a unique set of challenges stemming from Elon Musk’s increasing involvement in the U.S. government. His role in the Department of Government Efficiency (DOGE) under the Trump administration has triggered mixed reactions across the financial landscape. The DOGE program, aimed at cutting bureaucratic waste and enhancing operational efficiency, has led to concerns about Musk’s ability to maintain focus on Tesla. Some investors do worry that his attention, divided among a few ventures such as Tesla, SpaceX, and also the federal program, might slow the company’s innovation pipeline in addition to running efficiency.

People are quite divided in their opinions. While some view Musk’s governmental involvement as a strategic advantage, believing his influence could drive favorable policy outcomes, others see it as a distraction that threatens Tesla’s future success. Additionally, if the DOGE program prompts budgetary austerity measures, there could be cuts to clean energy incentives, an outcome that would directly impact Tesla’s profits directly.

Despite these concerns, the market’s long-term outlook for Tesla remains bullish. Many investors view any significant retracement as a buying opportunity, particularly near major technical support zones like $200. This area is widely recognized as a strong accumulation zone where institutional buyers are likely to step in. Furthermore, the electric vehicle market continues to expand globally, and Tesla’s brand strength and technological lead remain intact, reinforcing the long-term growth narrative.

Market View & Predictions

While short-term volatility is expected due to ongoing uncertainties surrounding Musk’s government involvement, the broader technical structure suggests that the uptrend is still intact.

The recent pullback from the upper channel boundary appears to be a healthy correction rather than a trend reversal. If the price tests the $200 support zone, it could trigger a new wave of buying pressure, potentially driving the stock back toward the $263 resistance and beyond. As long as the price remains within the ascending channel, the bullish case for Tesla remains valid, with the potential for further upside as market confidence stabilizes.

SeekingPips sees TSLS Tesla GAIN $60 ! What's Next?It's hard for many traders to do. 🤔

⭐️ I still see it today with traders and investors alike. Even with some who have been at it for many years...

BUT some of the BEST ENTRIES & EXITS for me have been when the OPEN CANDLE IS COMPLETELY AGAINST ME.

The LAST WEEKLY TESLA chart that I shared is another prime example of this.

🟢SeekingPips🟢 shared a BULLISH BIAS when the WEEKLY CHART was looking as BEARISH as hell. 🔥

ℹ️ Now it really is not a method that works for everyone.

Trading against momentum always looks SCARY BUT the SECRET is MULTI TIMEFRAME ANALYSIS and also being able to...

VISUALISE DIFFERENT OBSCURE TIMEFRAMES IN REAL-TIME USING THE CURRENT OPEN CHART.

⚠️I plan on going DEEPER INTO this rabbit hole with some information and examples in the TUTORIAL SECTIONS soon.⚠️

🚥 In it's simplest terms an example would be beaing able to note where price is on a 20 or 10 min chart just only by having a 5 minute chart in front of you.

By being able to do so in REAL-TIME KEY LEVELS POP OUT that you may not have noticed from the 5 minute chart perspective only.💡💡💡

Now 🟢SeekingPips🟢 has to wait for a TRIGGER for a NEW ENTRY & SO SHOULD YOU.👍👌👍

Tesla LongTesla Long Analysis

Tesla (TSLA) currently presents potential long opportunities near key support zones at $194 and $186. These levels align with historical demand zones and provide a favorable risk-to-reward setup for bullish trades.

Key Analysis:

Support Levels:

$194: A critical zone where buying activity has previously increased, indicating strong institutional interest.

$186: A lower support level that historically acts as a buffer against further downside.

Technical Indicators:

A confluence of moving averages and trendline support near these zones bolsters their significance.

Catalysts:

Upcoming earnings or positive developments in Tesla’s production or delivery numbers could act as bullish triggers.

General market sentiment and Nasdaq trends will also play a role in TSLA's price action.

Strategy:

Entry: Long positions near $194 and $186 with stop-losses below respective levels.

Target: First target around $240 and extended target near $350, depending on momentum.

This setup provides an opportunity for scalpers and swing traders to capitalize on Tesla’s volatility with managed risk.

Tesla Stock $TSLA monthly imbalance. Bullish price action to buyTesla Stock NASDAQ:TSLA monthly imbalance at $273 has taken control. Bullish price action to buy shares of Tesla stock. Expecting a decent reaction for this stock in the following days. You can use smaller timeframe stock strategies, bullish option strategies and intraday stock strategies to trade this imbalance.

Tesla Stock Goes 'Interesting', Ahead of Earnings CallTesla is preparing to release its fourth-quarter earnings report on January 29, 2025, and analysts are closely watching the stock as it approaches this key event.

Here are some important points regarding Tesla's current stock situation and what to expect:

Current Stock Performance

Tesla shares have seen a 10% increase in 2025, but recently experienced a more than 5% decline, trading at Monday's pre-marker below $400, approximately $395.

The stock's valuation is considered high, with some analysts stating it is "priced for perfection," indicating that any earnings miss could lead to a significant pullback.

Earnings Expectations

Analysts forecast earnings per share (EPS) of 72 cents and revenue of $27.23 billion for the fourth quarter.

Gross profit margins are expected to widen slightly to 18.85%.

Key Factors Influencing Stock Valuation

👉 Delivery Performance. Tesla's deliveries were slightly below expectations in 2024, with 1.79 million units delivered, compared to 1.81 million in 20231. Investors will be keenly interested in guidance for 2025, especially with increasing competition from Chinese manufacturers like BYD and NIO.

👉 New Vehicle Launches/ The anticipated launch of the smaller SUV, referred to as the Model Q, is expected later this year, which could impact Tesla's growth trajectory.

👉 Technological Developments. Progress in autonomous driving software and energy generation will also be focal points during the earnings call.

👉 The company aims to launch its Level 3 Full Self-Driving software in specific U.S. states and expand its energy storage business.

Analyst Sentiment

There is a mix of opinions among analysts; while some maintain a cautious stance due to potential delivery shortfalls and market competition, others see Tesla as a strong buy-and-hold investment for the long term.

The average price target among analysts is around $345.11, suggesting a potential downside from current levels.

Technical Sentiment

Technical graph indicates on epic upside channel breakthrough, as a result of China DeepSeek AI model influence.

Ahead of Tesla Earnings Call our "super-duper" Team is Bearishly calling to $300 per Tesla share, that is correspond to major current support of 125-day SMA.

Conclusion

As Tesla approaches its earnings report, investors should remain vigilant about delivery numbers and guidance for the upcoming year. The stock's high valuation combined with competitive pressures makes it susceptible to volatility based on the forthcoming financial results.

Are you a TESLA bull? If so check this out!NASDAQ:TSLA

and just like that Tesla has most likely bottomed...

- Bull Flag

- Volume shelf with GAP

- Wr% downtrend breakout

A bullish cross and green H5 indicator means we will more than likely breakout and head higher!

Short term we retest $400 🎯

Breakout = 🎯$488 🎯 $581

Not financial advice

TESLA - Buy the news - Fundamentals will carry us to 600$p/shareHi guys , we are looking into TESLA probably one of the hottest companies on the Stock Market.

Currently with the inauguration of US President Donald Trump, who will focus his whole mandate of 4 years onto the local economy.When he was elected at the end of last year, he came up and made a serious statement how in his last presidential campaign he was focusing on international relations and stabilizing that, but in his eyes it was taken for granted and made an extremely serious statement that he would focus on the local prospect of the U.S. Economy.

He has made it clear that he wants to give a great focus to Electric Vehicle production and increase the output. Additionally with the tariffs which are opposed to concurrent companies of TESLA , brings even more eyes to the famous U.S. based EA company. So this is why my obeserverience is that TESLA will increase quite a lot in the next couple of months.

My entry perspective:

Entry: 427

TP1: 500

TP2: 545

TP3: 604

Please do share with me what is your opinion on the current situation with TESLA and what are your analysis based on where the price is going to go!

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

$TSLA will reach an all time time?NASDAQ:TSLA has broken above the downtrend line and starts to go bullish.

But it just reached to the resistance level of the key candlestick with high volume where many chips were bought.

Personally speaking, I think it will be pulled up after a short-term pullback, since it may be rejected by the resistance level recently.

Tesla has a Cup&Handle target of 500 dollarsHello Tradingview people!

Before i explain my idea... I just want to make it clear this is an idea and nothing more! if NASDAQ:TSLA doesn't do this specific pattern I'm showcasing, then don't come crying to me (Do your own research before investing)

Alright it's fairly simple as you can see.. Tesla is atm making a classic "Cup and handle" pattern that's famous in the TA world! This certain pattern (on my chart at least) has a target of 450-550 dollars.

Could this fail? Of course.. Some say a "cup and handle" pattern has a success rate of 95% but some other sources shows around the 70% mark (so I guess 70-95% chance)

I will update this post in the near future to see if its still "working" or if Tesla has completely dumped to hell and destroyed our "cup" - we shall see.

Please leave a friendly comment and share your opinion down below! (ty)

NFA DYOR <<<----

TESLA TSLA SeekingPips on FIRE AGAIN TODAY Did You Get Involved?TESLA TSLA SeekingPips on FIRE AGAIN TODAY Did You Get Involved?

Participate or Spectate the choice if your by when 🌎SeekingPips🌍 Is in THE ZONE you know the team had a GREAT TRADING DAY.

🟢SeekingPips🟢 Shared the last TSLA STOCK CHART 17 hours ago and to be honest there was only upside from that TIME ONWARDS UNTIL NOW.

✅️Our calls this MORING on the CRYPTOS ADA CARDANO & HBAR HEDERA were on the MONEY TOO.

ℹ️ CHECK IT OUT FOR YOURSELF...

✅️ IF YOU LIKE WHAT YOU SEE AND WANT TO STAY IN THE LOOP FOR OUR NEXT MOVE LIKE, BOOST & SHARE THIS POST NOW❗️❕️❗️❕️❗️

⚠️ DON'T FORGET TO FOLLOW 🟢SeekingPips🟢 NOW TOO