Tfuelusd

#TFUEL (SPOT) IN ( 0.04900- 0.06800) T. (0.16600) SL(0.04771)BINANCE:TFUELUSDT

#TFUEL / USDT

Entry ( 0.04900- 0.06800)

SL 1D close below 0.04771

T1 0.08900

T2 0.11000

T3 0.20000

T4 0.28600

2 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL

#TFUEL/USDT Ready to go up#TFUEL

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.06320

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.06900

First target 0.07350

Second target 0.07794

Third target 0.08200

Can #TFUEL Bulls Really Keep Up With Current Bullish Momentum? Yello, Paradisers! Can #TFUEL bulls really keep up with the current bullish momentum or not? Let's discuss the latest analysis of #ThetaFuel:

💎After breaking through its descending channel resistance, #TFUELUSDT is showing promising signs of bullish momentum. However, its rally has been stalled at a crucial resistance level of $0.0794. This minor resistance is a key hurdle; if breached, it could mark a significant shift in market structure and open the door for #ThetaFuel to target higher price levels. A clean break above this zone would likely validate the bullish outlook, signaling market confidence and a potential trend reversal.

💎On the flip side, the downside risks cannot be ignored. If #TFUEL fails to push above $0.0794, the price may slip further to test the major support range between $0.0478 and $0.0518. This zone, aligned with a previous significant low, serves as a critical safety net for buyers. A failure to hold this level would likely lead to a retest of the $0.0413 demand area, a last line of defense for the bulls.

💎Should #TFUEL close below $0.0413 on the daily chart, the bullish case would be invalidated entirely. Such a move would shift the narrative to a bearish outlook, increasing the likelihood of forming a new lower low and potentially triggering deeper declines as market sentiment deteriorates further.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#TFUEL/USDT#TFUEL

The price has broken the descending channel on the 1-day frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have an upward trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0 0.05200

Entry price 0.6000

First target 0.07940

Second target 0.1000

Third target 0.1300

Can #TFUELUSDT Ignite a Bullish Run from the Demand Zone?Yello! Is #ThetaFuel (#TFUELUSDT) poised for a breakout? Let's look at the latest analysis and see what's going to happen next:

💎Currently, #TFUEL is trading within a crucial demand zone, indicating a high probability of a bullish move. The token has been navigating a descending resistance trend for some time, but recent price action shows strong momentum within the $0.066-$0.071 range.

💎This zone is crucial for sustaining momentum. If SEED_DONKEYDAN_MARKET_CAP:TFUEL can maintain its current trajectory, the next target is the key resistance level at $0.115.

💎But what happens if the price fails to hold at the major support between $0.066 and $0.071? In this case, we'll be looking for a retest of the lower support around $0.056. A successful retest here could confirm a robust bullish reversal, setting the stage for a potential breakout above the major support area.

💎However, caution is warranted. If #TFUEL loses momentum and falls below the previous low, this would invalidate the bullish outlook and could lead to a significant price decline.

Keep an eye on these critical levels and be ready for whatever comes next.

MyCryptoParadise

iFeel the success🌴

TFUELUSD: Attempting to finally close over the 1W MA200.TFUEL has been consolidating under the 1W MA200 since the 1W candle of March 4th. This week and two weeks ago, it even crossed it but failed to close the candle over it, keeping the 1W timeframe overbought (RSI = 78.657) but 1D rather neutral (MACD = 0.005, ADX = 31.357). This means that the market is waiting for that 1W candle validation above the 1W MA200. We will turn bullish if that happens and target the 2.0 Fibonacci extension (TP = 0.50000), which is identical to what took place in the previous Cycle.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

TFUEL/USDT ascending trendline bullish horizon?👀🚀TFUEL💎 Paradisers! Get ready for an exciting trading opportunity with #TFUELUSDT! The price action is beautifully following an ascending trendline consecutively, and our optimism is high. We anticipate that the price will tap this trendline for the third time, setting the stage for a bullish trajectory.

💎 Reflecting on the past, SEED_DONKEYDAN_MARKET_CAP:TFUEL encountered challenges in surpassing the resistance at $0.10454, leading to a bearish sentiment. However, the tides seem to be turning. The price is steadily approaching the trendline, and there’s a significant probability of a bullish continuation if it successfully regains momentum at this level.

💎 As savvy traders, we always have a Plan B. Should #TFUEL dip below the ascending trendline, we’re strategically positioned to capitalize on a bullish rebound from a lower support level around $0.07678. But exercise caution—breaching this additional support could signal a deeper decline.

💎 Stay adaptable in your strategies and keep a close eye on the charts, fellow Paradisers. Your ParadiseTeam is here to guide you through these market waves with expert insight. Happy trading!

MyCryptoParadise

iFeel the success🌴

#TFUEL/USDT#TFUEL

The price has been moving in a bear flag since July 2022

It adheres to its limits to a large extent,

and we are now on the verge of breaking it higher

With upward momentum supporting this

And strong support areas

Current price 0.04870

First target 0.05664

Second goal 0.06698

Third goal 0.07939

#TFUEL/USDT#TFUEL

The price is moving in a bearish flag on the 12-hour frame

And we have a breakthrough in that science already

We are oversold on the RSI indicator

We also had a strong uptrend as well as our Moving Average 100

We have a major support from which the price rebounded more than once: 0.04000

Entry price is 0.044291

The first target is 0.04469

The second goal is 0.04709

The third goal is 0.04961

TFUEL ANALYSISThis symbol appears to be inside a diametric that is currently forming the F wave of this diametric. After completing the F wave, we will enter the G wave, which is the green area for buying.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Theta fuel (TFUEL) formed bullish Gartley for upto 15.50% pumpHi dear friends, hope you are well and welcome to the new trade setup of Theta fuel (TFUEL) with US Dollar pair.

Our last successful trade of TFUEL was the below one:

Now on a 2-hr time frame, TFUEL has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

Theta fuel (TFUEL) formed bullish Cypher for upto 15.50% pumpHi dear friends, hope you are well and welcome to the new trade setup of Theta fuel (TFUEL) with US Dollar pair.

Previously we caught almost 29% pump of TFUEL as below

On a daily time frame, TFUEL has formed a bullish Gartley for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

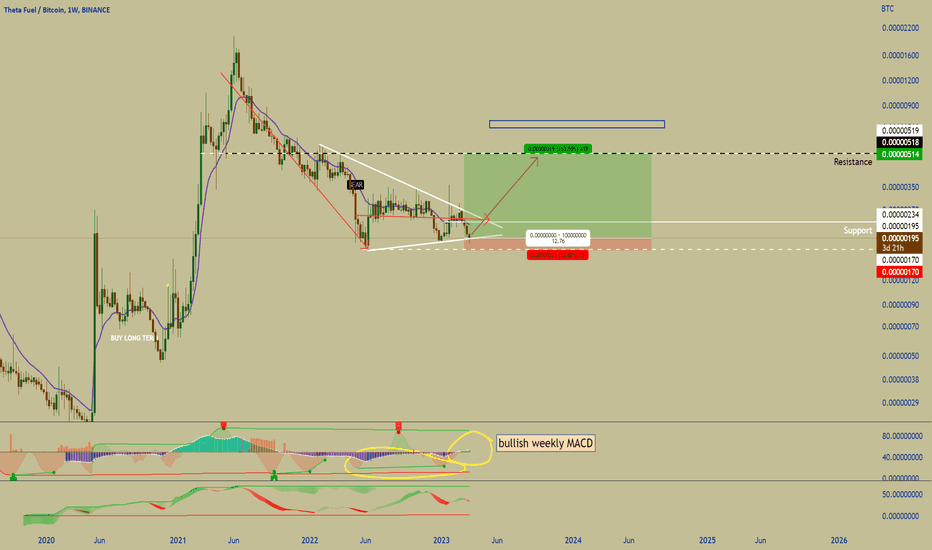

TFUELBTC APEX moment of truthcryptocurrencies that have gained popularity in the cryptocurrency market in recent years. Theta Network is a decentralized video streaming platform that aims to revolutionize the online video industry, while Theta Fuel is the native cryptocurrency of the Theta Network that is used for transaction fees and governance on the network. Here are some reasons why Theta Fuel may be a good investment for the long term:

Growing Adoption: Theta Network has partnerships with major players in the video streaming industry, including Samsung and Google, which demonstrates the growing adoption of the platform. As more users and content creators adopt Theta Network, the demand for TFUEL may increase, potentially driving up its price.

Unique Value Proposition: Theta Network is a unique blockchain project that aims to solve real-world problems in the video streaming industry. The platform offers faster and more cost-effective video streaming services by leveraging a decentralized network of nodes. This unique value proposition could make Theta Network and TFUEL more attractive to investors in the long term.

Mainnet 4.0: new projects (subchains) joining the Theta ecosystem and adding volume.

Experienced Team: The Theta Network team includes experienced professionals from the technology and video streaming industries, which could give investors confidence in the long-term prospects of the project.

TFUELBUSD Another perspectiveNote this is a TFUELBUSD and chart/prices will vary and look distinct.

This is another perspective TA to view TFUEL.

As long as support holds, we are due to break resistance into the 0.10+ level

Theta fuel (TFUEL) formed bullish Cypher for upto 35% pumpHi dear friends, hope you are well and welcome to the new trade setup of Theta fuel (TFUEL) with US Dollar pair.

Our last successful trade of TFUEL was as below:

Now on a daily time frame, TFUEL has formed another bullish Cypher move for another price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

TFUEL Descending Triangle target met $TFUEL Descending Triangle price target of $0.0631 met in the 4H chart. We can also observe the exit position triggered.