USDT/THB 1D and 1H analysis$USD/THB Analysis on 1H and 1D Timeframes

1H: It appears that we’ve hit a bottom at $32/THB and have seen a solid bounce. The uptrend is likely to continue after a brief correction.

The MACD is resetting lower and needs some time to reach a bottom.

The RSI is very low, which indicates a potential short-term bounce.

Conclusion: We should stabilize above $33/THB in the short term.

1D: The daily chart presents a more mixed outlook. While it seems we’ve bottomed at $32/THB, the MACD still needs to reset, suggesting the current bounce is temporary. Additionally, the RSI is overbought, which points to a likely correction until November, when a downtrend reversal could be confirmed with a lower low.

Invalidation: If THB/USD falls below $32/THB, it means the bottom is not yet in, and the bounce was a bull trap or fakeout.

Thb

Trade Like A Sniper - Episode 51 - JPYTHB - (25th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing JPYTHB, starting from the 2-Month chart.

If you want to learn more, check out my profile.

Thailand vs USA- A good point for Tourism in Thailand, the country could get much more US/EU customers in 2022-23.

- in return it will be much more pain for Thai Peoples to visit USA and EU. (Euro is weak vs USD, but strong vs THB).

- Tourism still remain a big economic factor for Thailand, and much more important right now, after Covid Pandemic.

- The big problem is : Economy not only based on Tourism.

- Importations will be much more expensive for Thailand, and they will get much less profits for exportations.

- Thailand is the biggest exporter of natural rubber in the world ( around 14B annual ).

Scenarios :

- if DXY breakout his bullish trend and reach 120ish, we could expect to have 1$ = 39 to 41 THB

- A panic sell of riches peoples and companies could lead to transform their THB to USD. Then THB could back to 2001 situation, 1$ = 45ish THB.

Happy Tr4Ding !

Thai Baht May Outperform as Tourism Slowly Boosts EconomyThe Thai Baht has been cautiously gaining ground against the US Dollar since December despite recent volatility in stock markets.

In fact, USD/THB recently broke under a key rising trendline from early 2021, confirming the breakout. Key support below appears to be the 200-day Simple Moving Average.

Tourism is a key component of Thailand's economy, which has been hampered due to the global pandemic. But, as countries around the world gradually move forward with vaccinations and natural immunity, a gradual comeback in local tourism may boost the economy, perhaps setting the Thai Baht on course to outperform in the medium to long term.

In the event of a turn higher, critical resistance seems to be the 33.861 - 34.000 resistance zone, where breaking above may open the door to resuming the dominant uptrend. Further Covid-19 variants also risk derailing domestic growth expectations.

Clearing the 200-day SMA exposes the November and August lows. In the long run, key below seems to be the 29.718 - 29.842 range.

Select forex currencies post-covid bounceback - weak frm Dec2020Select foreign currencies, after Covid/coronavirus bounce-back, have been weakening since early December 2020 - ahead of the NASDAQ (IXIC) question of faith in mid February 2021: Russian ruble RUB/USD, Brazilian real BRL/USD, Colombian peso COP/USD, Mexican peso MXN/USD, Korean won KRW/USD, Thai baht THB/USD, Japanese yen JPY/USD, Euro EUR/USD.

Select Asian Currencies vs Inverse DXY, recent trends & past 10yThe inverse of the US Dollar Index DXY versus select Asian currencies of Japanese yen JPY, Korean won KRW, Singapore dollar SGD, Malaysian ringgit MYR, Thai baht THB, Philippine peso PHP - note recent trends against trends over the last decade.

USDTHB: Short signal on the 1D EMA50.The pair is trading on a multi month 1M Channel Down (RSI = 35.185, MACD = -0.898, Highs/Lows = -0.7368). The price is now on the 1D MA50 (blue line) which since May 2019 has always initiated a new bearish leg. Since the 1D RSI is also approaching the usual 65.60 Sell Level, we are expecting a decline. Our Target is 30.000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDTHB hits the support of channel | a good long opportunityThe priceline of USDTHB is moving within an Up channel and hits at the channel's support.

The MACD is turning bullish.

RSI is oversold.

Stochastic is oversold and gave bull cross.

The sell targets are as below:

Short between: 30.912 to 30.966

Regards,

Atif Akbar (moon333)

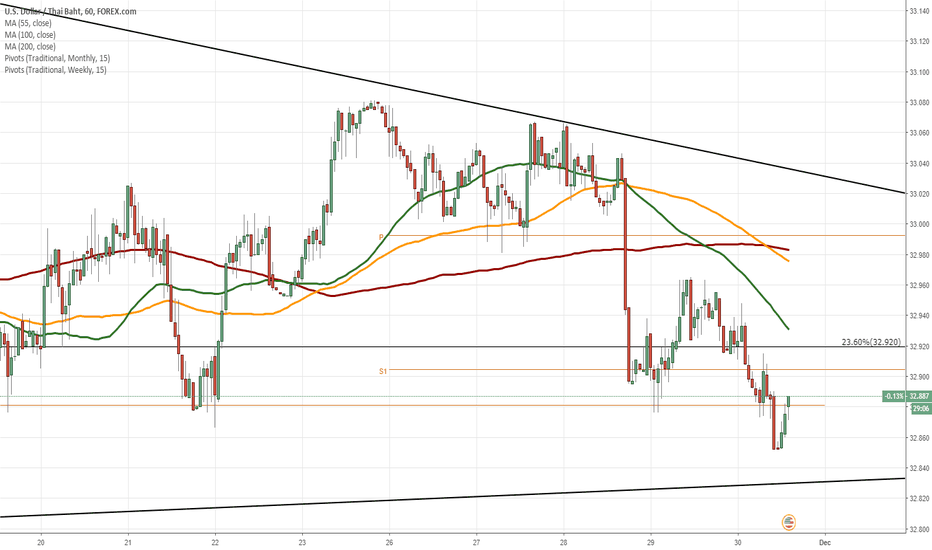

USD/THB 1H Chart: Descending triangle in sightThe USD/THB currency pair has been trading in a descending triangle since the end of October.

From a theoretical point of view, a breakout north from the pattern occurs in the nearest future. A potential upside target is the upper boundary of the medium-term descending channel located circa 3.24. Technical indicators for the 1W time frame support bullish scenario.

However, important resistance level to surpass is a combination of the 55-, 100– and 200-hour SMAs in the 32.96 area. If given level holds, it is likely that the pair goes downside to the Fibonacci 38.20% retracement at 32.58.

USD/THB 1H Chart: Bearish momentumThe US Dollar has been depreciating against the Thai Baht in a short-term descending channel after the exchange rate reversed from the upper boundary of a long-term descending channel at 33.05.

As apparent on the chart, the currency pair has breached the support level formed by a combination of the 100– and 200-period SMAs (4H). Given this fact, it is likely that the downside momentum still prevails in the nearest time. The most probable downside target during the following trading sessions is the Fibonacci 50.00% retracement at 32.31.

In the unlikely event that some bullish pressure still prevails in the market, the US Dollar should not exceed the Fibonacci 23.60% retracement at 32.94.

Target hit. Now reversing on a Channel Down. Short.TP = 33.600 hit as the previous 1D Channel Up aggressively broke to the upside (as indicated by the 4H consolidation mentioned on the previous post) and peaked at 34.650. Now a new 1D Channel Down has emerged (RSI = 30.614, MACD = -0.139, Highs/Lows = -0.2244, B/BP = -0.4740) aiming at a Lower Low near the 31.850 support. We are short with TP = 32.000.

USD/THB 1H Chart: Potential reversalThe Thai Baht has been appreciating against the US Dollar since the end of August. This movement is bounded by a descending channel.

Currently, the currency pair is trading near the lower channel line at 32.43. From the theoretical point of view, the pair could reverse from the lower boundary of given channel and aim for the resistance cluster formed by a combination of the 55-, 100– and 200-hour SMAs in the 32.60/32.73 range. An important resistance level to look out for is the Fibonacci 38.20% retracement at 32.59.

Technical indicators for the 1W time-frame also support bullish scenario.

Consolidation before Channel Up continuation. Long.USDTHB should enter a consolidation phase on 4H (as seen on the Rectangle with high volatility, ATR = 0.0861) in order to bring down the overbought values on the most recent bullish run on the 1D Channel Up (RSI = 72.893, Williams = -12.000). The suggested course of action is to buy on every dip within the Rectangle, TP = 33.600.

USDTHB. Triangular consolidation is possible.This pair broke above the long term resistance (yellow) last month.

EM currencies suffer a lot these days amid strong dollar and rising yields.

USDTHB could finish triangular consolidation soon.

The target for the further rise of USDTHB is set within the orange box at the 0.382-0.618 Fibonacci.

Wait if price could break above the triangle's upside.

USD/THB 1H Chart: Bears expected to prevailThe US Dollar has been trading in an ascending channel against the Thai Baht for the last two months. This has guided the pair from its 2014/2018 low of 31.10 towards the 61.80% Fibonacci retracement at 32.20.

From theoretical point of view, the pair has failed to form a new high this week which might be an early indication of a new wave down. In case the senior channel and the 200-hour SMA are breached at 31.97, the Greenback is likely to depreciate even further down to the 38.20% Fibo.

Given that these retracement lines have worked effectively at reversing the pair during the last week, it is likely that the pair continues respecting this junior channel and therefore reverses back to the upside. The general direction should nevertheless remain south.

Meanwhile, there is still some upside potential in the market that could result in a test of the monthly R3 at 32.30 within the remaining part of this week.