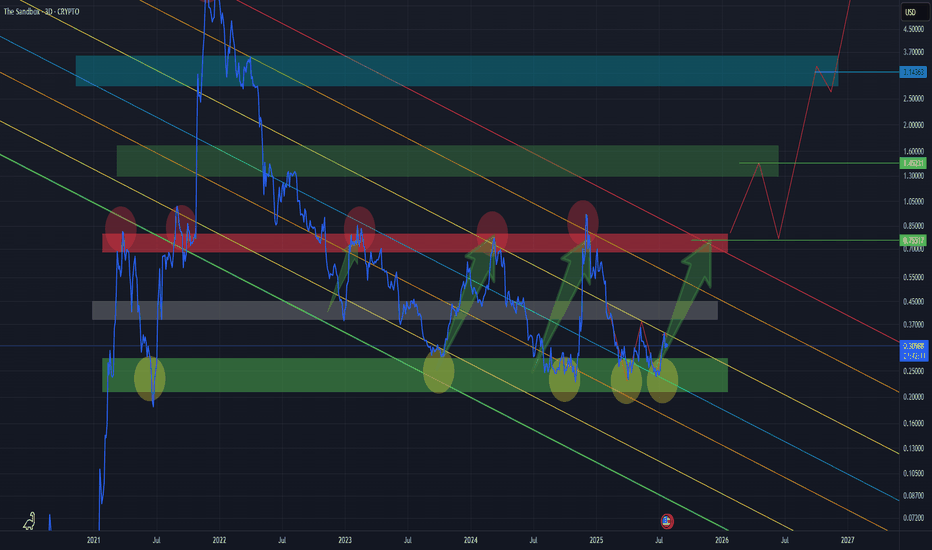

THE SANDBOX mid - to long - termThis might seem obvious to some, but it’s worth emphasizing —

📌 When analyzing charts like this, switch to a Line Chart instead of Candlesticks.

Why?

It filters out market noise and shake-outs

You can clearly see how price respects key zones and levels

Candles often distort the picture with wicks — line charts show the real body movement

Bullish Setup:

Market has printed a clean W-bottom, confirming bullish intent.

We are currently retesting the neckline of the pattern — a common and healthy move before continuation.

A successful retest could lead to an impulsive move upward toward target zones.

🎯 Target Zones:

Green zone (top) — this is the maximum target in the current structure.

Anything above the red line already carries increased risk, and should be approached with caution.

Above green zone = extreme risk / high-probability rejection unless backed by strong fundamentals.

The

Thena: Hold Until The End (1,337% Profits Potential)Which one will you take? Endless opportunities the Cryptocurrency market has to offer; which one will you take?

Doesn't need to be just one can be many. You can choose many pairs to trade.

Countless opportunities are available now and these will be generating huge profits in the coming days.

The first burst forward will produce 100%, in 1-3 days. And this will be followed by sustained long-term growth. It will grow so much and for so long, that you will become bored. It won't be exciting anymore... Until the correction of course.

Thena here has more than 1,000% potential for growth. Right now this pair, THEUSDT, is sitting on a higher low or double-bottom, in this case it is the same.

This is the same pattern produced by Ravencoin, remember?

That project that grew more than 150% in a single day. "Altcoins Market Bull Market Confirmed, Ravencoin." And it is true, watch everything grow.

This same pattern is present on so many altcoins, not all of them but many and we know exactly what will happen next because what one does, the rest follows.

THEUSDT is about to go bullish, can take a few weeks or less, a few days.

When the bullish wave starts it will go for months, months of sustained growth. You simply hold until the end.

Thank you for reading.

Namaste.

Thena Ready To Move Now! Strong Short- & Long-Term (1,155% PP)I don't like to post the same charts because there are just too many options and we cannot even get close to looking at all those, specially with a limit of only ten post per day. But, with that said, here we have Thena again, THEUSDT, why? Because it is ready to move and a great time-based opportunity only comes around so often.

When it comes to Cryptocurrencies opportunities are endless is true, but some tend to move faster than others and this one looks good. It looks good short-term and has huge potential also long-term. So good on all sides. Risk is very low. We have a classic local higher low and the stage is set, the world is ready; watch it grow.

Nothing is pointing down. Everything is pointing up.

No plan, no strategy, no complexities... Just buy and hold.

Namaste.

NO.1 MEME COIN ON KASPA IS NACHO THE KAT - DYORThe chart shows a symmetrical triangle pattern forming after a falling wedge. A falling wedge is typically seen as a bullish reversal pattern, indicating that the price may break out to the upside after the convergence of the trendlines. The symmetrical triangle, which is forming after the falling wedge, suggests consolidation before the breakout, likely pointing towards higher price action.

Key Points

Price Action and Trend:

NACHO has been in a downtrend, creating a falling wedge. The falling wedge has converging trendlines, which is a common setup for a bullish breakout.

Currently, the price is consolidating within a symmetrical triangle pattern, with lower highs and higher lows, indicating indecision in the market. The breakout from this triangle is likely to be significant, either continuing the previous downtrend or initiating a bullish reversal.

Volume Analysis:

The volume profile at the bottom shows an increase in volume as the price approaches the apex of the symmetrical triangle, suggesting potential strength behind the breakout.

It's important to monitor if volume increases further upon breakout to confirm the strength of the move.

Key Indicators:

RSI (Relative Strength Index): The RSI is currently around 50.39, suggesting a neutral market sentiment. The RSI has been ranging between oversold and overbought territories, which indicates that NACHO has not yet entered a strong trend but may be preparing for one.

Stochastic RSI: The Stochastic RSI is hovering around 37.57, showing a neutral stance, but it is closer to the oversold region, which could indicate that NACHO is near a potential reversal.

Money Flow Index (MFI): The MFI is at 35, indicating that the market is not yet in a strong buying or selling pressure zone. This shows that there is room for price movement based on volume.

VMC Cipher B Divergences: Positive divergence could suggest bullish momentum emerging, even if the price remains in consolidation.

Target and Resistance Levels:

If NACHO breaks out to the upside from the symmetrical triangle, the target is likely near the upper trendline of the wedge, which aligns with previous highs, possibly reaching the 0.00004500-0.00005000 USDT range.

Immediate resistance is near the 0.00004300 price level.

Support levels to watch are 0.00003000 and 0.00002000, which are key levels from previous price action.

Trading Plan

Entry Strategy:

Breakout Strategy: A strong breakout above the upper trendline of the symmetrical triangle would be a potential buy signal. If the price breaks and closes above 0.00004200, consider entering a long position with a target at 0.00004500-0.00005000.

Volume Confirmation: Ensure that the breakout is accompanied by an increase in volume. A low-volume breakout could be a false signal.

Stop-Loss Strategy:

Initial Stop-Loss: Place a stop-loss just below the symmetrical triangle's lower trendline or 0.00003000. This provides a reasonable distance to avoid being stopped out on small fluctuations.

Trailing Stop: As the price moves up towards your target, consider adjusting your stop-loss to lock in profits, especially if the price exceeds the 0.00004300 resistance level.

Take-Profit Strategy:

First Profit Target: Set a take-profit order around 0.00004500, the first resistance level. This is a key point based on the historical price action and previous swing highs.

Secondary Target: If the price breaks past 0.00004500, adjust the target to 0.00005000, which is the next logical resistance zone.

Risk Management:

Position Sizing: Risk no more than 1-2% of your total capital on this trade. For example, if your trading account is $5,000, you should risk no more than $100-$150 per trade.

Risk-Reward Ratio: Aim for a minimum 2:1 risk-to-reward ratio. For example, if you risk $150 on a trade, aim for a potential reward of $300 or more.

Additional Considerations:

Market Sentiment: As NACHO is a meme coin, market sentiment plays a huge role. Watch for social media trends and any news related to meme coins or Kaspa-based coins that could drive the price action.

Macro Conditions: Stay updated on the general market conditions for cryptocurrencies, as a broader downtrend in the market could limit the upside potential, even if technicals suggest a breakout.

NACHO THE KAT presents a technical setup with the potential for an upward move following a breakout from the symmetrical triangle. A close watch on volume and key price levels will be critical for confirming the breakout and determining the right moment for entry.

bASED ON THE SCIENTIFICALLY PROVEN NUMBER KNOWN AS FIVE (5) Now, don't blame me if this financial advice works. It is highly scientific and has a record of generating a staggering amount of wealth to the most undeserving of individuals leaving them in a drunken stuppor and awash in a really indecent amount cash. I want no part of this.

You would be far better off getting yourself a nice girlfriend who owns sensible shoes and has an interest in sheep farming rather then leading the crypto life.

See you in 5 months and bring cash.

wmw

Thena: Simply Bullish (555% Potential)It is no longer necessary to proof that the bottom is in for the Altcoins market, this is clearly confirmed as it happened a while ago, more than three weeks ago.

Here, on the THEUSDT (Thena) chart, it can be seen as a low hit 3-February. With a higher low hit Tuesday (25-Feb), this pair is turning green.

This is easy, simple but bullish.

The blue line on the chart marks the downtrend. A descending trendline. As soon as the action moves above this line the downtrend is confirmed broken. The market bias changes from bearish to bullish. THEUSDT is now in the bullish zone with bullish potential. The higher low reinforces this notion/signal.

Notice how after the 12-February bullish breakout there are three reactions on the same down-trendline that was once a strong resistance. Resistance turned support. This trendline was tested and it holds. Now that it holds prices can easily move up. It is still early though.

Another signal comes from the 0.148 Fib. extension level. The action is moving above this level today. A close above this level further strengthens a bullish case.

Finally, we have EMA13, the orange line on the chart. Once the day closes above it bullish tendencies are confirmed. Simple, yet bullish.

We have two targets mainly based on the short- and mid-term. One target goes for 325% and the next one goes for 555%.

Patience is key.

Buy and hold.

The Altcoins market is bullish now.

Thank you for reading.

Namaste.

New Thena project from Binance!Thena reminds me of Lista, which was also made for pumping Binance bags. So far it's only 130 million capitalization, but knowing Binance, it will easily grow into 1 billion! I expect a Thena partnership with one of the market makers soon. So far, I haven't detected any MM presence... TVL is also good, I would expect a price around 7$ per coin, this just correlates with the thought of 1 billion, and also technically fits well with the chart technicals.

Horban Brothers.

Thena ($THE): A Rising Star in BNB Chain's DeFi EcosystemIn the dynamic world of decentralized finance (DeFi), Thena ( TSX:THE ) has emerged as a notable player on the BNB Chain, showcasing remarkable growth and innovation. With a recent surge that has seen its value increase by approximately 1774% over the past week, Thena is not just a token to watch but a case study in the power of well-executed DeFi strategies and market dynamics.

Innovative Liquidity Model

Thena introduces the ve(3,3) model, a novel approach within its Liquidity Marketplace, allowing DeFi protocols to influence liquidity through voting on reward distributions. This system incentivizes liquidity providers by enabling them to earn TSX:THE tokens, thereby fostering a healthier liquidity environment. This strategic use of tokenomics has been pivotal in attracting significant Total Value Locked (TVL) to the platform. (www.dai.com)

Strategic Positioning

Positioned as the native liquidity layer for the BNB Chain, Thena is not just a DEX but a fundamental infrastructure provider. Its integration with major DeFi activities and its offerings of both spot and perpetual trading options have made it an essential part of the ecosystem. This broad scope enhances its utility and relevance in the market, potentially leading to sustained growth if the BNB Chain continues to expand.

Market Sentiment and Airdrop Impact

Recent listings on major exchanges like Binance have significantly boosted TSX:THE 's visibility and market cap. The enthusiasm was further amplified by an airdrop event for BNB holders, which not only increased its circulation but also community engagement. The market's reaction was immediate, with a price surge reflecting strong investor interest and speculative buying driven by these developments.

Technical Analysis

Thena's price has experienced an unprecedented rise, with a 24-hour increase of 37.68% and a weekly surge of 1774%. This makes TSX:THE the standout performer in the crypto landscape over this period. The coin's current market cap stands at $275,197,639 USD, with a circulating supply of 78,124,682 THE coins, indicating robust market participation.

With an RSI (Relative Strength Index) of 77 it suggests that Thena might be in overbought territory, hinting at a possible near-term correction. Investors should be cautious as this indicator often precedes a price retreat, providing a potential entry point for those who missed the initial surge.

Volume and Market Dynamics

With a 24-hour trading volume of over $2 billion, Thena's liquidity and market interest are undeniable. Such volume supports the price action and indicates strong trader engagement, which is critical for maintaining price levels and reducing volatility spikes

Investment Considerations

The innovative liquidity management strategies and its integral role in the BNB Chain ecosystem provide Thena with a strong foundation for growth. For investors looking at long-term potential, these fundamentals suggest a platform with significant utility and staying power.

The current hype and price momentum could lead to further partnerships and integrations, enhancing Thena's offerings and increasing its adoption rate.

Risks:

The high RSI indicates immediate risk of a correction, which could be sharp given the recent rapid ascent. also, the crypto market's volatility means that even fundamentally strong projects can experience significant price drops due to broader market sentiment or regulatory news.

The competition within the DeFi space on BNB Chain is fierce, and sustaining growth amidst new entrants will require continuous innovation and community engagement.

Conclusion

With all cryptocurrencies, potential investors should approach with caution, considering both the technical indicators suggesting a potential correction and the fundamental strengths that could lead to long-term value creation. As the market evolves, keeping an eye on how Thena adapts to changing conditions will be key for those looking to leverage its current momentum.

01/04/24 Weekly outlook (Q2)Last weeks high: $71771.20

Last weeks low: $69088.87

Midpoint: $66406.55

Q2 BEGINS!

BTC saw a 91.35% increase from yearly open and closed out Q1 at ~71K . A very strong first quarter on the lead up to The Halving now less than 20 days away we have only a few more weeks to get set for the event which historically brings new highs after.

Now that we have ended the month of March and begun Q2 , we can see that the bulls really pushed for a strong monthly close above the '21 ATH level of 69K, a very important S/R level and now we have closed above on the monthly it's confirmed as new support.

Almost instantly after the monthly close price did drop back down to the previous weeks Midpoint of the range and the important support level. I do think we range for a while and build a base in the lead up to the Halving, any dip is probably a good entry point for long a long term hold as historically new highs come soon after the halving.

For now I think we'll see a continuation of select alts having double digit days with BTC & ETH staying relatively flat . In my opinion we're at the low cap/memecoin stage of the cycle and just waiting for the next big BTC rally to start the whole cycle again and have money flow back into BTC. Next rally should target 86K (1.272 FIB extension) and with supply halving and ETF backing I do believe it's achievable this year perhaps even this quarter.

PLS,The Bull of Lithium Target $5PLS has been very strong keep going up after big drops, 5/10/20/60 MAs are Lining up below.

The trend is very strong like a Rocket. There are many investors who seeing the future of Lithium industry.

if you want to make good money, Come and join this ride on this amazing rocket!

Happy trading.^.^

GRTUSDT upwards targets in fib extension+resistance fan putting fib extension levels over a larger fib speed resistance fan. daily TF log.

Next few days GRT will break out of current channel even just laying still sideways. Pressure is on the bears to keep it to the lower half of the current channel. If sellers can't produce strong enough dumps, GRT shoots out the channel to the ceiling of the channel above which is above $0.30 for the next 2 months. fib extension level 1 = $0.285. So about 200% gain from the current price. That's the most conservative estimation.

It could happen much faster too. Then we would be looking at sub $0,60 price range. That's 400% gain.

Analyzing GOLD: Market Dynamics and Trading strategyThe XAU/USD currency pair, a dynamic interplay between gold and the US dollar, is currently navigating through pronounced market fluctuations. In this comprehensive analysis, we will delve into the intricate interplay of fundamental factors steering the value of XAU/USD. Our focus extends to the looming potential of The Federal Reserve's interest rate adjustments, the consequential shifts in the 10-year US Treasury Yield, and the intricate repercussions woven into the fabric of the Russia-Ukraine and Israel-Palestine conflicts.

Moreover, we will embark on a journey through the undulating terrain of gold price fluctuations, deciphering their nuanced implications for the volatility inherent in this currency pair. As we scrutinize both the fundamental and technical dimensions, our aim is to provide traders with a nuanced understanding of the multifaceted forces currently at play, guiding them toward informed and strategic trading decisions. Join us as we unravel the layers of complexity inherent in the XAU/USD market, offering insights that transcend the surface, into the heart of this captivating financial landscape.

Fundamental Analysis

Potential Rise in The Fed's Interest Rates

The Federal Reserve, the central bank of the United States, stands at the forefront of XAU/USD trader considerations. Despite maintaining interest rates in the latest meeting, speculation about future rate hikes has introduced uncertainty. A hike in interest rates could diminish gold's allure as a risk-free investment alternative. Gold investors tend to favor assets offering higher yields when interest rates rise.

Increasing 10-Year US Treasury Yield

The recent upswing in the 10-year US Treasury Yield over the past few months has adversely impacted XAU/USD. Gold, often considered a safe-haven asset, typically experiences decreased demand as bond yields rise. Investors seeking protection tend to shift towards bonds offering higher returns than gold, resulting in a decrease in the value of XAU/USD.

Impact of Russia-Ukraine and Israel-Palestine Conflicts

Geopolitical uncertainty stemming from the Russia-Ukraine and Israel-Palestine conflicts plays a pivotal role in the dynamics of XAU/USD. As a traditional safe-haven asset, gold tends to attract attention during periods of uncertainty. Elevated geopolitical tensions increase the demand for gold, contributing to an upsurge in the value of XAU/USD.

Gold Price Fluctuations: Implications for XAU/USD

The notable fluctuation in gold prices, reaching $1,750 per ounce on September 21, 2023, and subsequently declining to approximately $1,700 per ounce on October 20, 2023, reflects significant market volatility. The dip in gold prices could be attributed to a combination of factors, including expectations of interest rate hikes and a shift in investor preferences towards higher-yielding assets.

Technical Analysis

Indicator Analysis

XAU/USD exhibits overbought signals on the STOCHRSI(14) and MACD(12,26) indicators. However, the elevated volatility serves as a warning for potential market direction changes. The 200-day Exponential Moving Average (EMA) confirms a bullish trend, instilling confidence in traders.

Support and Resistance Levels

According to Barchart, current support and resistance levels are as follows: 1st Resistance Point at 1,986.06, Last Price at 1,994.86, 1st Support Level at 1,954.30, 2nd Support Level at 1,934.11, and 3rd Support Level at 1,914.30. These levels serve as crucial guides in planning trading strategies.

Trading Strategy

The employed trading strategy involves entering positions after the price breaks and retests the breached support and resistance (S&R) levels. The target price is set before the next resistance level or prior to the Fed speech on October 25, 2023, considering potential unforeseen events.

Trade Parameters

Based on the above analysis, several trade parameters are identified:

Entry Point: When the gold price rises and re-test the previous resistance level.

Stop Loss: Placed below the nearest support level to safeguard against sharp declines.

Target Profit: Before the next resistance level or prior to the Fed speech on October 25, 2023, considering potential unforeseen events

Conclusion:

This analysis illuminates the intricacies of XAU/USD, emphasizing the intertwined nature of complex fundamental and technical factors. As investors grapple with potential Fed rate hikes, changes in the 10-year US Treasury Yield, and geopolitical conflicts, a comprehensive understanding of risks is essential. The fluctuation in gold prices serves as a vital indicator, highlighting the need for vigilant monitoring of news and Federal Reserve policies. In navigating these volatile market conditions, prudent trading strategies and effective risk management become indispensable for success in trading XAU/USD.

USDT.D (Full Chart Analysis-Long-Term)Hello Friends.

How are you? Hope you always be happy and successful

Today I want to talk about USDT.D

in another words, I want to talk about the dominance of Tether.

the situation is complicated.

I want to check this item based on Ichimoku, channel line, and classic pattern. so, let's go into details.

based on Ichimoku, the future cloud is getting green(positive)

Tenkensen is above Kijunsen and it's a sign to prove us the chart is bullish.

based on the Classic pattern, we have an Ascending Triangle. As you know it's a continuation pattern. and I expect this trend to continue.

if dominance succeeds in breaking 8.21% and then 8.51%, the next target will be 9.45%.

that's a border of a huge dropping in altcoins.

if dominance is able to stabilize above 9.45%, everything will be changed and the main target of this movement will be 15%

it means that you will see a lower low in all markets.

And you should expect it to drop more than you think.

it's my favorite theory. I think it will happen soon.

let me check based on the channel line in the weekly time frame.

As you can see, we are moving in an ascending channel.

we had three hits at the top of the channel and four hits at the bottom of the channel.

it means that this channel is validated.

at this time we are moving around the midline. This move to the top of the channel is expected to be around 15%.

If these three conditions occur, everything will be changed. and you can buy for example Bitcoin for around 9800-11500 USD for the first level. and maybe cheaper.

sounds great.

who doesn't like it?

🙏🙏 Please don’t forget to like 👍, follow ✌️, and share 👌 this analysis with your friends. Thank you so much for your attention and participation 🙏🙏

Sincerely Yours

Ho3ein.mnD

THE LAST RALLY in The BEAR MARKET RALLY WAVE B TOPThe chart posted tonight is the DIA tracking share we have declined in a three wave decline and from the cycle peak due on july 26/27 into the panic cycle 55 to 62 days down from sept 23 to oct 4 focus on the 25 th of sept we should enjoy a major short squeeze event in the spy dia qqq and smh . I am working on the time spirals as well as the fib time relationships I have labeled the DIA as a diagonal and it should the old record high within or above by 2 % before the WAVE C CRASH see 1998 /1999 fractals to form from the cycle low of oct 13 1998 and oct 13th 2022 a mirror image . The 5 th of the 5 was the top into my dec8th 2021 report .

When do we sell a symbol? Expiry went fine the 2nd June, it has various bullish remarks at the end, the volume spikes spoke for themselves. Now there is new danger ahead, economy is hanging onto verges of a single man, and typically now the popular opinion is that he shall be left with no other option than greening the signal light and another rally is expected. Many weeks have gone by when Hawkish behaviour hysterically chose the opposite stand than what was popularly spread or wrongly articulated by the media houses. Fund managers are having a gala time because on one switch the retailer accumulate huge lots and their low cost investment earns a fortune and at another switch they sell what is a cheap calculated risk investment for future. TSLA is going to sink yet again and AAPL shall make history.