Is #THETA Ready For a Major Reversal or Another Fakeout ahead?Yello, Paradisers! Is this breakout the beginning of a bullish reversal for #THETA or just a setup to trap the herd before a sharp dump? Let’s break down the setup of #ThetaNetwork:

💎After weeks of slow bleeding inside a falling wedge, #THETAUSDT has broken out of this pattern. The price is currently hovering around $0.718, and it’s the first time in weeks we’re seeing real bullish momentum starting to build. The volume is slowly picking up, so the probability of a bullish push is higher.

💎A clean breakout above the descending resistance now opens the door toward moderate resistance at $0.999. That’s the next key hurdle where we expect sellers to show up. If bulls are strong enough to clear that zone, we’re targeting the strong supply level at $1.284, where significant distribution will likely begin.

💎Why this setup matters: The support zone between $0.60 and $0.66 has acted as strong demand for multiple weeks now for #THETAUSD. Price wicked into it again recently and got bought up quickly, forming a potential higher low. This kind of accumulation behavior often precedes a strong leg up if volume confirms the move.

💎However, if price loses the key support at $0.60, and more importantly breaks below the setup invalidation level at $0.439, we’ll treat this as a failed breakout and expect a deeper correction. That would bring us back into the lower demand zones, and we’ll sit on our hands until the next proper high-probability entry appears.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

THETAUSD

THETA Holding the Line – A Hidden Gem Before the Next Altseason?

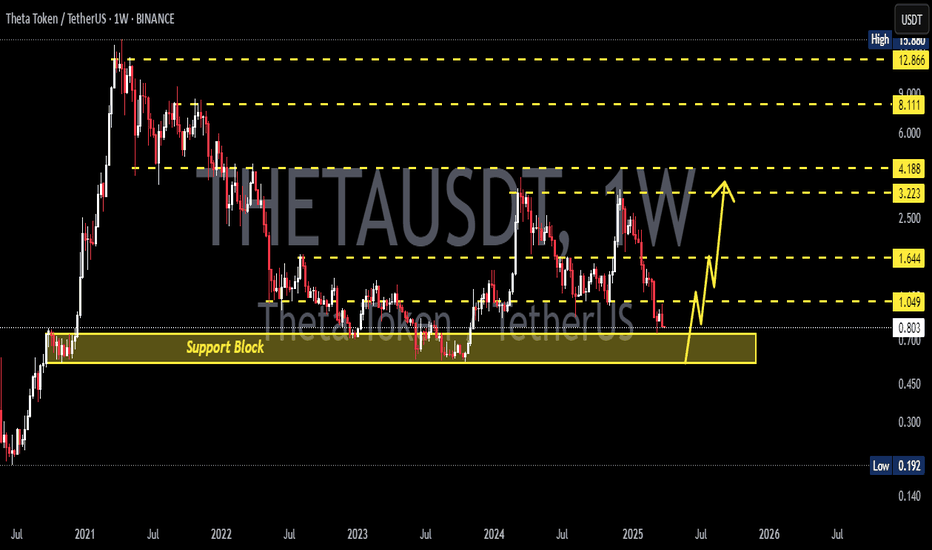

🔍 Chart Structure and Key Zones:

Timeframe: 1W (Weekly)

Major Historical Support: The yellow zone between $0.55 - $0.70 has been tested multiple times since 2021.

The current price is once again retesting this strong support area, showing signs of a potential bullish bounce.

📈 Bullish Scenario:

If the support at $0.696 holds and triggers a reversal:

Potential short-term targets are:

$1.029 as the first minor resistance

Breakout above $1.658 could lead to a rally toward:

$3.047

$3.50

$4.216

If bullish momentum sustains, long-term targets include:

$8.154

$12.742

And possibly a retest of the all-time high at $15.880

> This price action suggests the formation of a potential Double Bottom pattern — a classic bullish reversal signal on higher timeframes.

📉 Bearish Scenario:

If price breaks below the support zone of $0.696 – $0.55:

The bullish setup becomes invalidated.

There is little significant support below $0.55, which could lead to an aggressive selloff.

This would indicate a possible final capitulation phase before a true macro bottom is formed.

📊 Chart Pattern Insight:

Potential Double Bottom forming in a high-confluence support zone

Signs of accumulation structure with long lower wicks (indicating buyers stepping in)

Bullish impulse projection is marked if a breakout confirms

🔖 Conclusion:

The $0.55 - $0.70 zone is a critical turning point for THETA.

If held, this could mark the beginning of a long-term trend reversal.

The current setup offers a favorable risk-reward ratio for swing and long-term traders, though caution is needed if the support fails.

#THETAUSDT #THETA #CryptoAnalysis #TechnicalAnalysis #CryptoBreakout #BullishReversal #AltcoinSeason #SupportAndResistance #DoubleBottom #SwingTrade

THETAUSDT: Weak Buyers & Your Short Opportunity in the Red BoxAlright everyone, with a critical update on THETAUSDT. Here’s the stark truth: buyers, in general, are weak. This isn't a market signaling strong demand, and it's a mistake to think otherwise.

Most traders get trapped by false signals. But you? You need a clear, confirmed path to profit. My strategy for THETAUSDT is precise: I absolutely will not take a short without clear confirmation from the red box. This isn't about guessing; it's about making calculated moves where the market reveals its true intent.

Look at the chart. That red box I've identified? That's your critical zone for potential short entries. When price engages with this area, we're not just watching; we're hunting for specific signals:

Volume Footprint: I'll be meticulously checking the volume footprint within that red box. Are sellers truly overwhelming buyers? Is there genuine distribution happening, not just a momentary pause?

CDV (Cumulative Delta Volume): Watch for CDV to turn definitively negative or show strong bearish divergences. This tells you the sellers are gaining true control, not just a fleeting advantage.

LTF Breakdowns: On the low timeframes (LTF), I need to see clear, decisive breakdowns. We're looking for price to fail, retest the red box as new resistance, and then continue its move lower. This is your confirmation.

Why does this matter? My focus is exclusively on assets showing a sudden and significant increase in volume. While THETAUSDT might not be seeing a bullish volume surge, understanding the volume dynamics within its weakness is how we pinpoint high-probability short setups.

Keep a very close eye on that red box. If the bearish confirmations line up, you'll uncover a clear, strategic short entry. Don't be surprised if THETAUSDT's price action confounds the masses; this is where smart, confirmed decisions are made.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

THETA Token Is In A Larger Flat CorrectionTheta Token with ticker THETAUSD made a deeper retracement in the last year, but it’s actually still above 2023 lows, so it can still be a larger regular 3-3-5 A-B-C flat correction in play. After recent projected five-wave impulse into wave (C) of a three-wave (A)(B)(C) decline in blue wave B, it can be now on the way back to March 2024 highs for blue wave C, which could be a five-wave impulsive cycle. Currently, it can be still unfolding a lower-degree five-wave impulse into wave (1), so more upside is expected for wave (3), especially if breaks above 1.74 bullish level, just be aware of wave (2) pullback.

Theta Token (THETA) is the native cryptocurrency of the Theta Network, a blockchain-powered platform designed for decentralized video streaming and content delivery. It aims to improve the efficiency and cost of streaming by allowing users to share bandwidth and computing resources on a peer-to-peer basis.

#THETA/USDT#THETA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.899, which acts as strong support from which the price can rebound.

Entry price: 0.903

First target: 0.941

Second target: 0.966

Third target: 0.998

THETAUSDT Bounce from Demand ZoneTHETAUSDT has once again respected its long-term support zone, . This area has acted as a reliable demand zone multiple times in the past, leading to strong upward moves. The recent bounce from this level indicates continued buyer interest and potential for a bullish reversal.

If the current momentum sustains, we could see a move toward the $2.00–$2.50 range in the coming months. As long as THETA holds above the support zone, the bias remains bullish.

The THETA chart sure has a story to tell!*"Here is a copy of my latest THETA chart, which I recently covered. There is a lot of information to be discovered simply by looking at it and drawing the proper conclusions. This will be one to watch as we move forward into the 'April flash crash' thesis I have been widely discussing.

Even if it doesn't materialize as I've theorized, there are still some interesting developments that could be coming regarding the future of this asset.

Good luck, and always use a stop loss!

theta midterm buy "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

THETA long term analysis updatei made an analysis on this coin weeks ago the main pattern is not changed these is a selling pressure on this coin when it touches the VWAP indicator but it made a perfect pattern for rising we have to wait for the last drop and after that the market will insanely rise !

THETAUSDT at a Crossroads: Breakout or Breakdown Ahead?Yello, Paradisers! Is THETAUSDT gearing up for a massive breakout or bracing for a sharp breakdown? Here's what you need to know right now.

💎#THETAUSD is currently sitting at a critical support level of $1.863 an area that has previously ignited significant bullish momentum. However, the price continues to struggle to break above the descending trendline, which has acted as a stubborn resistance for weeks. This makes the next move pivotal in determining whether we’re heading for a continuation of the downward trend or a reversal into a bullish rally.

💎If the bulls defend the $1.863 support zone and successfully break above the descending trendline, we could see an upside move toward the resistance zone at $2.60–$2.80. Beyond that, the next target sits at the resistance area of $3.48, which could trigger a substantial rally if supported by strong volume and momentum.

💎However, if the $1.863 support fails to hold, #THETANETWORK could slide toward the $1.570 demand zone, where there is a pool of liquidity that may prompt a bullish rebound. That said, a clean break below this demand zone would invalidate bullish scenarios, opening the door for further bearish pressure that could drive the price even lower.

Paradisers, stay sharp and disciplined! The market is brimming with both opportunities and risks, but only those who wait patiently for high-probability setups will thrive. Whether you’re leaning bullish or bearish, tight stop-losses and proper risk management are non-negotiable.

MyCryptoParadise

iFeel the success🌴

Massive Volume Spike This Blue Box Could Be the Game Changer!THETAUSDT: Massive Volume Spike—This Blue Box Could Be the Game Changer! 🚀

Ladies and gentlemen, we’re looking at a 229% daily volume spike . That’s big, really big. When you see numbers like this, you know there’s something brewing under the surface. The question is, are you ready to act?

Here’s the plan for THETAUSDT:

Blue Box Buy Zone: This is where the magic happens. It’s carefully identified as the area where buyers could step in aggressively.

Volume Surge Means Opportunity: A volume increase of this size doesn’t happen by accident. It’s a sign that the big players are getting involved, and we’re here to ride their wave.

Lower Timeframe Confirmation: I’ll wait for bullish market structure breaks on the 1H chart before entering. Tools like CDV, volume profile, and liquidity heatmaps will guide the final decision.

This is not just a trade—it’s a statement. The market doesn’t hand out opportunities like this every day. Take action, be decisive, and don’t let this slip by. Boost, comment, follow—and let’s crush it! 💥

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

theta usdt Update"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

THETA - A Nice Pattern for a quick tradeBINANCE:THETAUSDT (1D CHART) Technical Analysis Update

THETA is currently trading at $2.33 and showing overall bearish sentiment

Price got rejected from the resistance within the channel and expected to crash further. There is a good short trade opportunity here.

Entry level: $ 2.33

Stop Loss Level: $ 2.58

TakeProfit 1: $ 2.1

TakeProfit 2: $ 2.0

TakeProfit 3: $ 1.9

TakeProfit 4: $ 1.78

Max Leverage: 5x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

THETA is on its way to being a Tier-2 projectTheta is a rather large project in terms of capitalization and it is quite difficult to move its price. From the chart point of view everything looks bullish and is about to shoot. You could also draw a cup with a pen here, but I didn't want to clutter the chart. Fairly good buyback reaction this week, the RSI is in the overbought zone and I think the asset's potential is not as high as a number of altcoins. This is not a bad option for investors who take a conservative approach to the market and for traders who like to trade with high leverage.

Horban Brothers.