This

Bearish-Crab PatternGood morning and good weekend to everyone. We now are climbing steady. We since noon yesterday now can see a trend going up successfully. The market has flipped a switch to follow another Flubberbuster. We now have a Bearish-Crab pattern. We all on February 11 are going to a 1.10 mark. Small dip is able to be possible at 1.05 this evening. We on the 10 at 2:30 will enter a dip down to .9103030 or lower. This morning we all can see dip after 1.05. On February 9 we all can see a dip to .92916 or less. Not moneies advice. The gains forward.

Tradingview banned my account & removed previous chart analysisAUDUSD IDEA - USE APPROPRIATE RISK MANAGEMENT WHEN ENTERING

-AUDUSD RECOVERY POST CORONA CRASH

-AUDUSD BULL PRESSURE BROKE KEY LEVEL

-MARKET CORRECTION CURRENTLY IN BEARISH MOMENTUM

-BREAKEVEN ON BEAR MOMENTUM

LONG NOW

If you like what you see please don't forget to like and leave a comment, and let us exchange ideas.

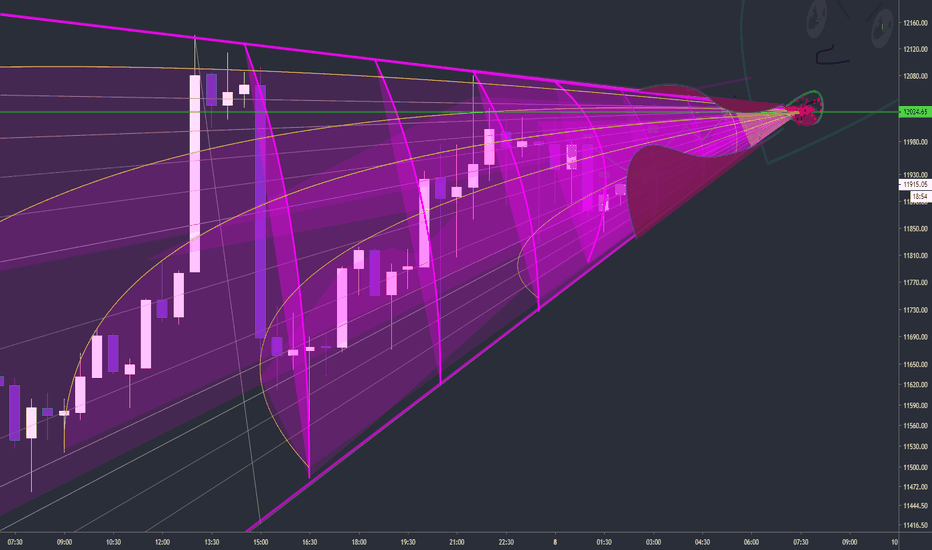

BTC/USD - it's a trap!!Hello, traders!

In last week’s analysis, we ran through BTC’s potential Wyckoff distribution stage. Looking through the basics of Wyckoff market cycles while analyzing the potential cycle which is occurring, as demonstrated below. Showing that BTC could be potentially overbought. During this report it was stated that BTC could see an imminent drop, that BTC was showing signs of weakness – it would only be a matter of time until the BTC price fell from a cliff.

However, Bitcoin has had a surprising rally over the past few days, seeing BTC increase from just over $9000 USD pushing towards $10700 USD. This represented over a 10% gain over a 7 day period. Although is this push an exit plan for the larger players – allowing them to set up a trap? Or is it the start of a new BTC bullish trend?

We should note that the RSI is at an extremely high level, meaning that a small retracement is likely. If BTC can use the 20 MA (centerline) from the BB as support, allowing for the RSI to recover then this would point towards questions of the Wyckoff analysis indicating the LPSY too early. On the other hand, if BTC is not supported by the center line and proceeds to touch the lower band, then this would be a huge bearish indicator – suggesting that a major reversal from the previous uptrend from March is in place. Therefore maintaining the current Wyckoff analysis.

The first bullish target for BTC should have been $10250 USD. Which was broken above, invalidating the recent Wyckoff analysis? This represented a 6.25% gain.

The second bullish target is 10 750. A break above would represent over a 7% gain.

The first bearish target would be a break below $9000 USD. A break below this would represent a 6.25% loss, a drop here would majorly increase the likelihood of a major breakdown in price.

The second bearish target would be $8620 USD. A fall below this level would certify the new bearish price wave, representing a 24% loss from BTCs current position.

What do you think happens with BTC next? Share your thoughts in the comments!

Vedanta - H4 charts - support levelNSE:VEDL on the H4 chart approaching oversold zone on the RSI which is coinciding with the bottom of the sideways channel formation and on the daily charts we can see that is currently in the mid green zone on RSI, price could test 139 levels. Watch out if the price bounces off support , if yes, may go upwards toward the upper channel.

Ideally, don't trade the channel, look for breakouts. These maybe more profitable!

Trying between channels is riskier, know your risk!

If you like what you read, please share a thumbs up and follow for more updates!

Cheers

The BITCOIN gaps become apparent, 3150% increase next cycle!A divisor of 4.101x, decrease in %age between waves 1 and 3.

Watch for a sneaky drop, the price may fill an inefficiency, fast.

BTFD.

Look at the prices on the Y-Axis, a lot of whole numbers where the gaps are, isn't that strange? At least 50% of the lines are whole numbers... :thinking_face:

$WORK Looking for entry$WORK is rising from the ashes here. Look to break the first level and buy in for some long term positions. This is a ticker that should be kept on a tight leash though, set good stops and follow them. $WORK can reject at any of the levels.