THOMASCOOK

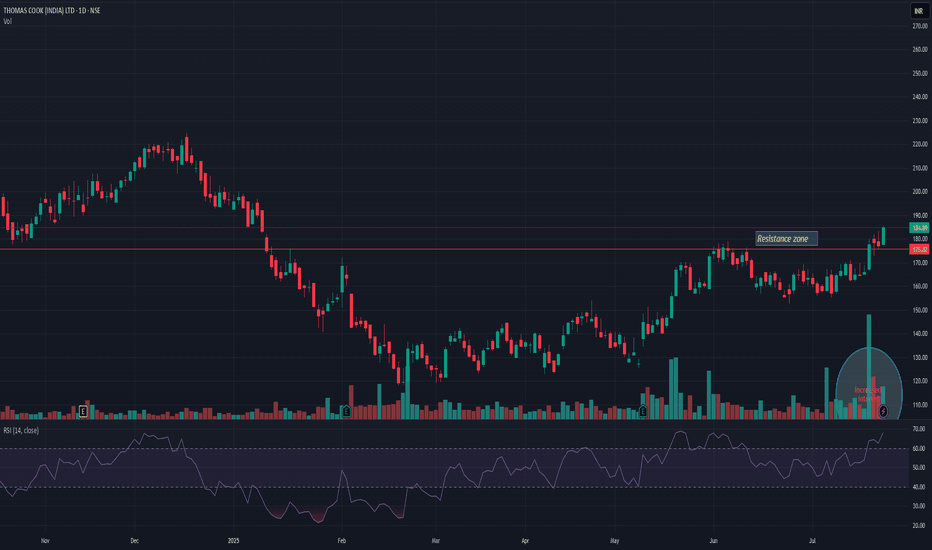

Thomas Cook India Ltd - Double Digit + MACD Crossover 📊 Script: THOMASCOOK (THOMAS COOK (INDIA) LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: NIFTY 500

📊 Sector: Consumer Services

📊 Industry: Tour Travel Related Services

Key highlights: 💡⚡

📈 Script is trading at upper band of Bollinger Bands (BB) and giving breakout of it.

📈 MACD is giving crossover.

📈 Double Moving Averages may give crossover in next trading session.

📈 Volume is increasing along with price which is volume breakout.

📈 Current RSI is around 67.

📈 One can go for Swing Trade.

⏱️ C.M.P 📑💰- 81

🟢 Target 🎯🏆 - 91

⚠️ Stoploss ☠️🚫 - 75

⚠️ Important: Always maintain your Risk & Reward Ratio.

⚠️ Purely technical based pick.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy learning with trading. Cheers!🥂

Finnair's support zone holding - BullishHello everyone! Time for free analysis! :)

Finnair has been downtrending for months now and by now we are able to trade the uptrend. In December Finnair was priced at 5.5€ and since then it has been uptrending. Support trendline has been strong and it has not been broken. When touched, it will go back up.

Today Finnair has been declining for 3.5%. Good opportunity to long.

Earlier in the chart I have analyzed Finnair's profit levels. (Unfortunately not in the picture).

The most common price channel on Finnair has been 6.87 to 7.515.

Here is what I suggest:

-Long Finnair.

First profit takeout: 0.236 fibo (6.410)

Second profit takeout: 6.820€

Third profit takeout: 7.15€

At best there is 18% upside.

Dark blue lines = low-point trendlines

Light blue = top-point trendlines

Feel free to leave comment! What do you think about Finnair's future?

Which company profits most from insolvency of Thomas Cook? The total turnover of the 5 largest German tour operators in 2017/18 was over 36 billion euros, twice as high as 15 years ago. At the top is a well-known company, which should profit most from the insolvency of the Thomas Cook Group.

You can find an overview of the profiteers of the insolvency here:

5. ALLTOURS

(1.44 billion euros + 1.73 million travelers)

In the 2017/2018 financial year, Alltours sent 1.73 million customers on holiday. The Group generated sales of 1.44 billion euros in 2017/18, with a profit before taxes of 42 million euros. This puts Alltours in fifth place among the largest travel companies in Germany.

4. FTI GROUP

(3.6 billion euros + 7 million traverlers)

The Munich-based FTI Group is the fourth largest travel company in Germany and has almost doubled its business volume in the past 5 years. The tourism group is represented in the D-A-CH region and employs over 10,000 people worldwide. The company has earned 3.6 billion euros with package and modular tours, language travel (LAL), luxury travel (Windrose) and cruises.

3. DER TOURISTIK GROUP

(6.7 billion euros + 9.9 million travelers)

In 2018, DER Touristik, which belongs to REWE Group, generated turnover of approx. 6.7 billion euros. The Group's head office is in Frankfurt am Main. The company employs more than 10,500 people and has 25 travel specialists, including Apollo, Dertour, Exim Tours, ITS, Meiers Weltreisen and Kuoni, who represent the Northern/Western & Eastern European tour operator segment. Proximity to the customer is demonstrated by 2,400 travel agencies in Germany, Switzerland, Eastern Europe and Great Britain.

2. THOMAS COOK GROUP

(10.65 billion euros + 19 million travelers)

The listed Thomas Cook Group (WKN: A0MR3W) is headquartered in London, but is also represented in Germany through its subsidiary Thomas Cook AG. By 2018, it was the second largest travel company in Germany and has around 21,300 employees worldwide, who now, from 23 September 2019, have to fear for their career prospects.

Well-known brands include MyTravel, Neckermann Reisen, Condor Flugdienst, Bucher Reisen and Öger Tours. The remaining 4 travel companies will certainly compete for these in the coming weeks and months, as everyone wants to win over the one or the other traveller of the yearly approx. 19 million holidaymakers for his own company.

1ST TUI AG

(19.6 billion euros + 27 million travelers)

Touristik Union International AG (WKN: TUAG00), better known as TUI AG, generated total turnover of 19.6 billion euros in 2018. The world's largest tourism group employs around 71,850 people and over 27 million holidaymakers book their holidays annually via the group and its subsidiaries. The tour operator is divided worldwide into the brands TUI, Robinson Club, RIU, Hapag-Lloyd Cruises and Marella Cruises. TUI AG's market share on the German market in 2018 was approx. 18 per cent and was thus in charge of 7.3 billion euros of total turnover.

As the "top dog", TUI AG could profit most from the insolvency of its competitor Thomas Cook and absorb the largest share of the newly distributed travel business.

The economic failure of the world's No. 2 enables the tourism industry to consolidate and improve margins, as many holidaymakers will certainly pay more attention to the solidity of the travel companies in the coming years. The worldwide No. 1, which is comparatively well positioned in the market with an equity ratio of over 19.8%, should benefit most from this.

Thomas Cook Declares Bankruptcy Longterm trend would suggest as much, but with more than 600,000 tourists stranded globally, who will be picking up the pieces?