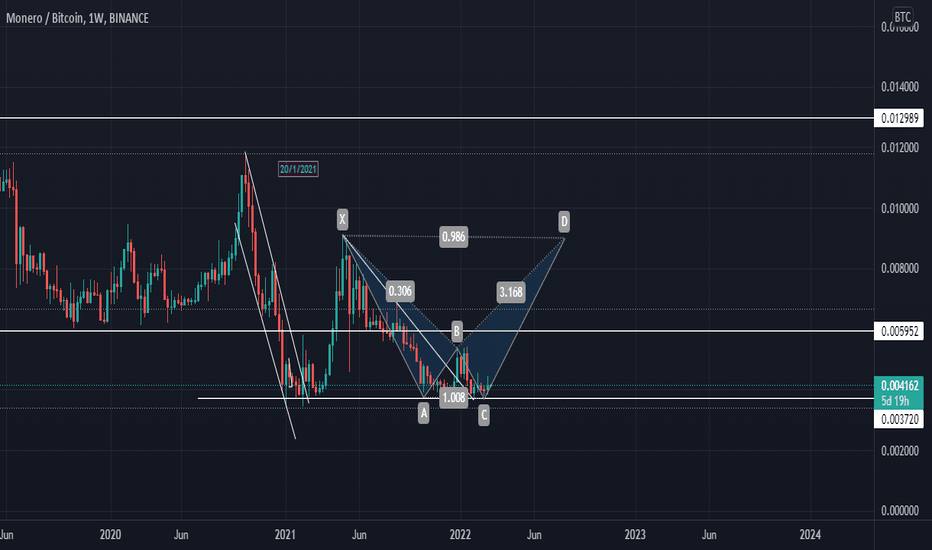

Three Drives

XMRBTC will formed a Harmonic PatternXMRBTC will form a Harmonic Pattern will continue price in the trend

AUDUSD - 3 DRIVE INTO FIB LEVEL!!In the AUDUSD this morning we are in the later stages of a 3 Drive pattern into a 61.8% Fib level.

There hasnt been a decent retracement to sell but now im thinking this could be the start of the first retracement to take us back up to the 0.75 area and if there is a nice ABCD pattern back up then that will be the chance to flip from long to short.

Monday morning thoughts.

Let me know what you think or do you see something else.

Enjoy the day.. 👍👍

CRYPTO- Patterns & patterns. ALGORAND.BINANCE:ALGOUSDT

In this post I take a look at some of the patterns I trade and how often they show up.

This is a30min chart over the last couple of weeks of ALGORAND.

Firstly is a 3 DRIVE into the high. This pattern often occurs at highs or at lows and normally has an ABCD pattern with it.

Next we have the 135 pattern which occurs when leaving a high or a low.

After that we have the AB=CD Pattern.

Now we are completing a Gartley and Butterfly pattern coming in at mulitiple Fibonacci levels.

This is just a look at the patterns I use and how often they occur.

I hope this helps. Enjoy the day. 👍👍

Multi-time frame TRIGGER PRICE ACTION The three driver pattern has been created in daily time and the price has moved towards the level of the first driver.

The level of the first driver is at the location of the weekly support area.

This area is drawn according to the weekly pivot, which is a pristine surface.

Also, by connecting the upper level of the 3 drivers to each other, a channel line is formed, which creates an ascending channel by moving the bottom of the channel to the source of the upward movement.

The price is now at the bottom of the uptrend channel, and since this is the second price encounter to this level, we can expect the uptrend to start at least 50% of the uptrend channel.

Of course, we note that the price can go down to 66% below the weekly support area.

There are knots in the way of rising prices that can cause a reaction

SOL showing signs of weakness later than mostWith Sol coming out of the alt field as a clear leader on many fronts it still has some bugs to work out. I love it as an everyday usage crypto, when I liquidate my positions and have to send them anywhere it's on the solana blockchaing because it takes 10 seconds and costs 10 cents.

XAUUSD - GOLD BUYGOLD had a nice spike low last week and is looking to move higher.

On the close Friday we completed the 3 Drive and also a nice Gartley pattern into the 61.8% area where we a re expecting a bounce especially if this is going to be bullish.

We need to stay above 1920 on the short term for this to be bullish, any drop 1900 would see a possible move a lot lower.

AI has the GOLD trending higher for the day and we have just retraced into the 50-61.8% area from Fridays low and todays high.

I hope this helps.

Enjoy the day!! 👍👍

Risk/Reward trade setups are more important than Win RateIf you told somebody new to trading that markets can only go in one of two directions, it would be natural for them to conclude that even a beginner could be right half the time. That’s not the reality because traders don’t make a binary up/down calls on their outright positions. What traders do is say, “I think it’s going to go up to point x (target) and in the process NOT hit point y (stop).”

Markets do only go up and down, but the trades we place aren’t a binary call. Our target is “where we think the market will go” and our stop should be “I’m wrong if it hits this point.” It's not a binary decision, it is a decision on the direction and the amount of 'wiggle room' it needs on the way.

Don’t Be Fooled by Trading Strategy Win Rate

When novice traders come to the markets for the first time, they are bombarded with ads for magical trading systems offering extremely high win rates. It plays on the logical (but false) assumption that a higher win rate is always better. It ignores the cost of the higher win rate, what did we do to achieve it?

For example, it's unlikely the S&P 500 Futures will ever hit 0.00, so you could go long S&P 500 over and over and have a 100%-win rate. In the process, you will no doubt sit in trades for extended periods with massive drawdowns. In the event of a market correction, you could quickly draw down $40-$50k per futures contract and sit in for years waiting for a recovery.

A high win rate alone is not a measure of success. Should it be a goal? Not in absolute terms. Instead, a trader should chase a decent win rate relative to the break-even point of any specific opportunity.

How Traders Think About Risk Reward

Let's say you have an opportunity where you believe a price in the market is a key trading level. You think the market will rally higher from current prices 40 ticks. You enter the trade with a 10-tick stop. You risk 10 to make 40.

Can you do this and be right every single time? Probably not but you could be right 50% of the time and make great money. This is where confusion creeps in. People associate a 50%-win rate with no edge, with a coin toss. In this example, our win rate is way above the break-even rate for this setup, and so 50% is excellent. It represents an edge.

If you combine this with more active trade management, such as scaling into positions that go your way, you change the equation again. Your losers might be 2 lots but your winners 8 lots.

This is of course what a lot of 'outright' proprietary day traders are doing — looking for an opportunity with a low break-even point, where they can beat the odds.

They don’t care if the actual win rate is 40,50 or 60%. It doesn’t matter.

Trading Strategy Win Rate and Run of Losing Trades

One other important consideration is the ability to survive the inevitable run of losing trades. Let's say you use an artificially large stop to help achieve a 90%-win rate - an 8 tick stop and a 2-tick target. The moment your win rate dips below 80%, you will start to lose. Take 5 or 6 losers in a row, and you are looking at a drawn down account and the NEED to maintain a high win rate to stop the bleeding. Keep on down that road and the next thing you know they'll be calling you "the new Nick Leeson".

Trader Takeaway

The ability to exceed the break-even rate is where profits lie. Focusing on trading strategies with a low break-even rate will help you thrive and survive as a trader.

BINANCE:BTCUSD

👍

ETHUSDT : Bear WeekHi guys .

#eth #ethusdt

Let's stand on Banks and Institution and Market Makers shoulders :)

our context for next week is bearish and we gonna use green dudes for Sell Short !

I'm learning some huge datas and informations that you can't find on Youtube jerks or bullcrap instagram show off dudes... :) let's think special

Throw out jerky Oscillators and Trends and blah blah blah

Shopify entered bearish marketShopify entered bearish market.. i will be waiting to buy it at between 585 and 335$

#btc Bitcoin Strategy TMPOC ( The Mighty Points Of Controls v1)Hi guys I'm back with more information and knowledge than before (learning Smart money , ICT , Institutional , ... stuff)

this is my Strategy for #bitcoin #btc that I 'm following and I believe it . I will update it if something special happened but the base and main Idea will be same !

so let 's dig into the deeper datas of chart .

we got some SPECIAL NPOC (Naked Point Of Control) that market must reach and fill them.

all of the datas are applied in the chart so I don't thing any description here will be helpful .

I really want to know your ideas and datas about this strategy . hope you enjoy :)

ref of nPOC levels : Exocharts

#btc #btcusdt #bitcoin

Buy on dips for 40% returnHi All,

Please refer chart for detailed explanation on technical analysis .

Falling wedge is one the most accurate pattern. One can use buy on dips strategy.

If you think my analysis is helpful than please do like my idea. For future reference do follow me so that you do not miss any of my analyses.

You can also check my Axis Bank trade for 20% return. Link is shared below or else you can visit my profile and check all the Ideas which I have shared.

Feel free to leave any questions you have in the comments! I will gladly respond to them.

Hopefully, this helps you out a little bit. Please make your own research before investing.

P.S: This is not an investment advice. This chart is meant for learning purposes only. This is my personal viewpoint so please Invest your capital at your own risk

CBG | Possible upcoming powerful 3-Drive Reversal PatternCBG | Thailand SET Index | F&B Sector | Chart Pattern Trading

Price Action | Entry Position - Buy @ Breakout after pullback above Volume Profile Point of Control (POC) or EMA200

Chart Pattern | Possible upcoming powerful 3-Drive Harmonic Reversal Pattern

Indicators:

>RSI - Bullish Divergent

>MACD - Bullish Divergent

Speculative buy for bullish divergent along the way is also possible.

Always respect your stop-loss

Good Luck