Three White Soldiers & Three Black CrowsHello, Traders! 😎

In technical analysis, not all candlestick patterns are created equal. While some merely hint at indecision or short-term corrections, others shout with conviction: "Trend reversal is coming…" Two of the most powerful momentum candlestick formations are the Three White Soldiers and the Three Black Crows. When they appear, traders PAY ATTENTION. In this article, we’ll dive deep into: What do these patterns look like? Why do they form? What do they tell us about market psychology? How to trade them?+ Their limitations 👇🏻

What Are Three White Soldiers and Three Black Crows?

These Are Multi-Candle Reversal Patterns That Suggest A Strong Shift In Market Sentiment:

Three White Soldiers. A 🐂bullish reversal pattern that occurs after a downtrend. It consists of three consecutive long-bodied green (or white) candles, each closing higher than the last, and ideally opening within the previous candle’s real body.

Three Black Crows. A 🐻bearish reversal pattern that shows up after an uptrend. It’s made of three consecutive long-bodied red (or black) candles, each closing lower than the last and opening within the previous candle’s real body. They signal not just a change in price, but a shift in power, from sellers to buyers (or vice versa).

Candles With a Message

Unlike most one-candle signals or minor patterns, these sequences tell a real story. They show that one side has taken clear control over the market — not for an hour, not for a single day, but for multiple sessions. And that kind of shift, especially on higher timeframes like daily or weekly charts, is something seasoned traders pay close attention to.

Let’s get into the psychology for a second. Imagine you’re a trader who just watched BTC drop for two weeks. Then out of nowhere, three strong green candles appear, each more bullish than the last. You’re seeing buyers push through resistance levels like they don’t even exist. That’s not just a bounce, that’s confidence. That’s the kind of thing that makes people FOMO back in, or finally close out their shorts. Same with the Black Crows. If the price has been climbing and suddenly sellers start hammering it for three days straight? That’s not retail panic. That’s big money exiting.

Now, How do Traders Trade Them?

Well, a lot of people jump in right after the third candle closes. If you’re going long on the Three White Soldiers, you’re betting that the breakout has legs. Same for shorting the Black Crows.

But, and here’s the trap, not all of these patterns play out. Sometimes, that third candle is the climax, not the beginning. So confirmation matters. Volume should increase. The move should break a recent key level. Indicators like RSI or MACD should support the shift. Otherwise, you might just be catching the end of a move, not the start of one.

Another mistake? Ignoring context. These patterns mean nothing if they’re forming in the middle of chop or during low-volume holiday trading. They work best when they signal the end of exhaustion.

And let’s be honest. Even if the pattern is clean, you still need a plan. Stops should go below the first green candle (for bullish setups) or above the first red one (for bearish setups). If price moves against you, it means momentum never really shifted. That’s your cue to get out fast.

Final Thoughts

Three White Soldiers and Three Black Crows are powerful tools in the hands of a patient trader. Of course, these patterns aren’t perfect. They don’t account for time, so a 3-day move might seem powerful, but if it happens slowly over 12-hour candles, it’s not as strong as the same pattern on a daily chart with volume.

The takeaway? These are patterns worth knowing, not because they’re magic, but because they reflect a real shift in market behavior. When Three White Soldiers or Three Black Crows show up in the right place, at the right time, with the right confirmation… that’s when charts stop being random and start making sense. But remember. They are indicators, not guarantees. The best traders use them in conjunction with other tools and a clear trading plan.

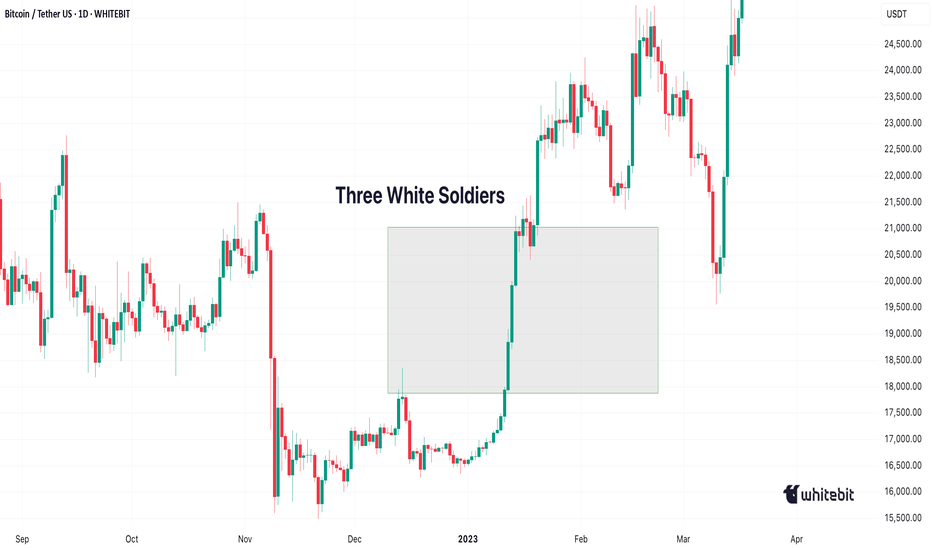

Three White Soldiers

BTC | W-BOTTOM Pattern Continuation - UPDATEA quick continuation on yesterday's BTC update, with regards to the bullish W bottom pattern that likely takes us into the new ATH.

There are a few conditions that need to be met in order to "secure" the W pattern, but we're currently not seeing these conditions met. The good news, is that it's beginning to look more like a cup an handle pattern, also a bullish pattern.

This daily lose and especially the weekly close is going to be a KEY candle close to watch.

___________________

BINANCE:BTCUSDT

Will Three White Soldiers Lead the Way?OANDA:XAUUSD Analysis

4H Chart

Current Price: 2447.215

Analysis Summary

• Three White Soldiers Pattern

• Volume Analysis

• Overbought and Resistance Zone

• Overall Bullish Trend

Three White Soldiers:

The chart shows a clear Three White Soldiers pattern, a strong bullish reversal candlestick formation indicating potential upward momentum. This pattern suggests consistent buying interest, as each candle closes higher than the previous one, signaling sustained demand.

Volume Analysis:

A closer look at volume reveals a weakening trend in the third candle of the Three White Soldiers pattern, suggesting a slight decline in buying strength:

• 1st Candle: 74.889K

• 2nd Candle: 134.962K

• 3rd Candle: 41.235K

This drop in volume in the last candle may indicate limited buying pressure, warranting caution before assuming continued upward movement.

Overbought and Resistance Zone:

The price is approaching a significant Overbought and Resistance Zone, which could act as a barrier to further upward movement in the short term. Combined with the lower volume in the third candle, this zone could lead to a potential consolidation or minor pullback before the next upward move. Despite this, the bullish reversal signaled by the Three White Soldiers suggests that the overall trend remains positive.

Interpretation:

Considering the overall bullish trend, the weakening volume in the last candle of the Three White Soldiers, and the approach to the Overbought and Resistance Zone, we anticipate the following:

1. Retracement to Support: The price may retrace down to 2739.624 before rebounding back to the Resistance Zone.

2. Potential Pullback to Ultimate Support: A further dip may take the price towards Ultimate Support at 2734.375.

3. Continued Bullish Momentum: After testing these support levels, the price is expected to resume its upward trend, with a potential breakout beyond the Resistance Zone, targeting the Extreme Overbought Zone.

Key Levels to Watch:

• Support: 2714.844

• Ultimate Support: 2734.375

• Retracement Level: 2739.624

• Overbought Zone: 2754.116

• Extreme Overbought: 2758.565

• Resistance: 2758.565

Overall Trend:

The overall trend remains bullish, with expectations of continued upward movement following any short-term pullbacks.

This analysis combines technical patterns, volume insights, and trend direction to provide a comprehensive outlook. Happy trading!

LINK - Three White Soldiers Candlestick PatternIn the weekly timeframe, a bullish candlestick pattern has formed on Chainlink.

The Three White Soldiers are characterized by three consecutive green candles. The higher the timeframe, the more powerful the pattern. We've recently observed an instance of the TWS pattern in the weekly, which was a precursor to a 136% increase:

However, the unfilled wick around $8 remains a concern - but also a potential for buying in / accumulating at a lower price.

_________________________

BINANCE:LINKUSDT

Bitcoin PATTERN - BTC Roadmap to NEW ATHBINANCE:BTCUSDT

👉 Trendline Analysis: BTC has been consolidating directly underneath the resistance zone - BULLISH

👉 Candlestick Analysis: Three white soldiers in the 2W timeframe - BULLISH

👉 Technical Indicator Analysis : Price has cooled down after being "Extremely Overbought", moving averages holds - BULLISH

Technical Indicator Monthly Timeframe:

Technical Indicator Weekly Timeframe:

There is really only one concerning matter, and that is from a potential near term scenario:

❗ Pattern Analysis: Potential for M-Pattern to form, medium risk: BEARISH

The candle closes of the next two weeks are crucial in determining how this pattern will play out.

For further reading, here's the initial Elliot Wave analysis on BTC:

___________________________

Three White SoldiersGreetings, traders! Today, let’s dive into a powerful candlestick pattern: the Three White Soldiers. This pattern, often regarded as a bullish signal, can provide valuable insights.

Understanding the Three White Soldiers Pattern:

The Three White Soldiers pattern is identified by three consecutive bullish candles, symbolizing a robust influx of buying pressure. When these candles appear in a sequence, it suggests a shift in market sentiment from bearish to bullish.

Key Characteristics:

Bullish Momentum: The pattern signifies a strong uptrend, indicating a potential continuation of the existing market trend.

Candlestick Size: Pay attention to the size of the candles. In this pattern, large-bodied candles with minimal wicks reflect substantial buying activity. This emphasizes the dominance of buyers in the market.

Volume Confirmation: Volume indicators on charting platforms can validate the pattern. An uptick in volume during the formation of the Three White Soldiers further strengthens its significance.

Trading Strategies with the Three White Soldiers Pattern:

Confirmation with Volume: Ensure the pattern is supported by increased trading volume, affirming the authenticity of the bullish move.

Combine with Other Indicators: Enhance your trading strategy by integrating the Three White Soldiers pattern with trend lines, Fibonacci retracement levels, or other technical indicators. This synergy can provide a more comprehensive view of the market.

Wait for Confirmation: Patience is key. Wait for the bullish candles to close before considering the pattern confirmed. This approach reduces the risk of false signals.

Consider Timeframes: Analyze the pattern across multiple timeframes. A Three White Soldiers formation on higher timeframes (such as daily or weekly charts) often indicates stronger bullish potential.

Risk Management and Trade Execution:

Set Stop-Loss: Establish stop-loss below first candlestick of the Three White Soldiers.

Diversify Your Trades: Avoid over-concentration in a single asset. Diversifying your trades across different instruments can mitigate risks associated with individual market volatility.

By combining this pattern with meticulous analysis, strategic planning, and risk management, traders can enhance their overall trading prowess.

Happy trading, and may the markets be ever in your favour!

NATURALGAS: 3 White Soldiers at Bullish Shark PCZAt the start of the year Natural Gas had a potential Bullish Shark setup at the minimum .886 PCZ and it ultimately failed to pivot from there but now we are significantly lower at the 1.13/1.618 Confluence zone of this Shark and are showing Bullish Divergence on the MACD as well as a 3 White Soldiers pattern on the daily. The bullish Target for Natural Gas remains to be $4.5 but it could go as high as $9.00. As for stops i'd put it below the second candle of the 3 White Soldiers Pattern which should be below the PCZ.

The Three Black Crows PatternThe Three Black Crows or as otherwise known Three Soldiers are a formation of price continuation showing how the bears are taking control over the bulls to reverse the trend as we can see here.

Price comes down buyers try to push it back up only to be reversed by sellers overpowering them so it falls back down the buyers try again but realise the bear is the almighty and with that last attempt they withdraw from the market causing a big sell off with a strong downward movement when just the bears remain

key points:

- last attempt of the bulls

- price goes up and bears push price down every time

- bears in control after a long uptrend shows prelude to sell

FTM/USDT BINANCE W Three White Soldiers (propsect)FTM/USDT BINANCE W Three White Soldiers (prospect)

Here is a three white soldier candlestick pattern

wait for Price and breakout confirmation

when bullish breakout watch target with the green horizontal ray

BTCUSD - WEEKLY - THREE WHITE SOLDIERS !Good morning to all of you.

Today we are going to look closely at the weekly picture in drawing several trading zones :

I : BREAKOUT TRADING ZONES

II : BULLISH ZONE

III : SUPPORT ZONE

BREAKING ZONES :

In looking at the last three weeks price action, a " Three white soldiers" pattern has been identified and each weekly closing level confirmed an upside breakout

BULLISH ZONE :

Current weekly closing will give an important indication about further development. Indeed, a weekly closing above 59'600/60'000 would be the first signal of an upside continuation move ,

calling for 62'250 ahead of the 65'000 area, former ATH

SUPPORT ZONE :

A failure to hold, on a weekly closing, above 59'600/60'000 would trigger a renewal selling pressure and would open the door for the 55'000 area as an intermediate first support target (former congestion zone) ahead of the 52'000 area (September former tops)

Below the Tenkan-Sen (conversion line) is currently @ 51'260

CONCLUSION :

While a " Three white soldiers" should be seen and considered as a strong reversal signal, it is usually followed by a consolidation phase and this should be closely monitored in watching upcoming price action on shorter time frames (Daily and intraday !!)

In acting accordingly you will be able to detect early warning and early signal (s) of a potential trend reversal.

Watch also technical indicators, such as RSI to also detect divergence (s)

3 White Soldiers ABCD ContinuationWe have a 3 white soldiers pattern that has been retraced 50 percent of the way, if we see a reversal here then i expect another big wave up.

This is a continuation trade that can lead to a much bigger move up later on, checkout the related idea for the bigger bullish target.

Let's talk about Candlestick Chart PatternsThe candlestick chart patterns are used by traders to set up their trades, and predicting the future direction of the price movements. There are many candlestick chart patterns. I will be discussing a few of those.

✅ Morning Star is formed after a downtrend indicating a bullish reversal. Generally made of 3 candlesticks, first being a bearish candle, second a Doji, and third being a bullish candle. The first candle shows the continuation of the downtrend, the second being a Doji shows indecision in the market and the third bullish candle shows that bulls are back in action.

✅ Bullish Hammer is a single candlestick pattern, which is formed at the end of the downtrend and shows bullish reversal. The real body of this candle is small with a long lower wick which should be more than twice the real body. This candle is formed when the seller pushes the price downwards but at the same time buyers arrive and push the prices up.

✅ Bullish Engulfing is formed after a downtrend, indicating a bullish reversal. It is formed when a bearish candle is fully engulfed by a bullish candle which shows that the bulls are back in the market.

✅ Three White Soldiers is a multiple candlestick pattern that is formed after a downtrend indicating a bullish reversal. It is formed when three consecutive bullish candles appear one after the other. These three candles show a strong bullish trend.

✅ Hanging Man is generally formed at the end of an uptrend and signals bearish reversal. The real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. This candlestick pattern has no or little upper shadow.

✅ Dark Cloud Cover is formed by two candles, the first candle being a bullish candle which indicates the continuation of the uptrend. The second candle is a bearish candle that opens the gap up but closes more than 50% of the real body of the previous candle which shows that the bears are back in the market and a bearish reversal is going to take place.

✅ Bearish Engulfing is formed by two candles, after an uptrend indicating a bearish reversal. It is formed by two candles, the second candlestick engulfing the first candlestick. The first candle being a bullish candle indicates the continuation of the uptrend. The second candlestick chart is a long bearish candle that completely engulfs the first candle and shows that the bears are back in the market.

✅ Evening Star is made of 3 candlesticks, first being a bullish candle, second a Doji, and third being a bearish candle. The first candle shows the continuation of the uptrend, the second candle being a doji indicates indecision in the market, and the third bearish candle shows that the bears are back in the market and reversal is going to take place.

Thanks for reading and hope you like it.

Please comment and let us know your thoughts on it.

Happy Trading

should continue rising up It's a very clean three white soldiers pattern formed last week; although triggered by the US news, it was validated by the market. Retracement seems not that much yet, so it may potentially drop a bit more to 0.91372 area, but I prefer to consider the uprise start earlier given the facts of Swiss's money policy versus recent US dollar strengh. SL is just slightly below the 100MA which I don't think it can easily break. It's a large setup so I'll only put a small lot size but I may close the trade any time because I don't normally swing. The chart however should stand.