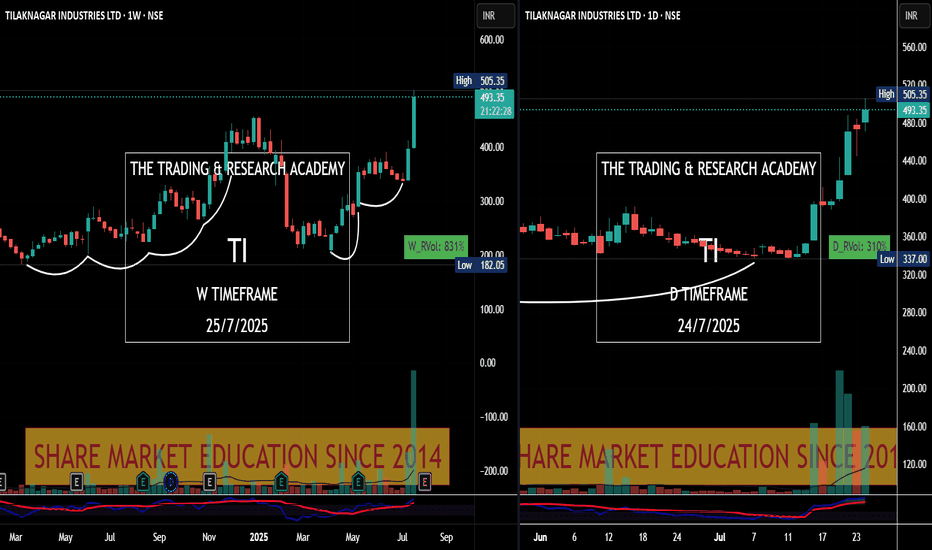

Tilaknagarindustries

TILAK NAGAR INDUSTRY: Possible breakout candidate for 52 wk highTI Industry:

stocks is above 200 dema

stocks is above 50 dema

Volumes are building which indicates big players are adding up.

Level of 260-262 can act as a next level of resistance.

Can test 288-290 above that.

Fresh leg of rally above 292.

Upto 100 % upside in Tilaknagar IndustriesPrice bounced near key support level and RSI is showing strong bullish divergence on daily & weekly TF.

Good to buy at CMP for positional target of 440 (103% ROI) in medium term.

Short term target should be around 300 (38.5% ROI).

FIIs have increased their shareholdings aggressively and TTM sales & operating profit are highest ever in spite of margin pressure.

Do your own due diligence before taking any action.

Peace!!

Upto 40% upside potential in Tilaknagar Industries (Short Term)Upside break out of the triangle pattern will confirm it's final 5th wave move.

Approx. 40% short term target is based on Pole with Flag pattern.

Good to buy around 250 level for a target of 350+ in short term.

Mandatory SL @ 237

A good 7.2:1 R:R setup.

Fundamentals are good.

Do your own due diligence before taking any action.

Peace!!

#TI LONG INTRADAY TRADE SETUPGreetings Folks,

today i have prepared a setup of TI on NSE

the analysis is as follows-

- the price is trading in a very close vicinity to an important static resistance

- either the price will breakout at instant or take some time to gather some orders

- there is also some imbalance which needs to be filled, this will act as confirmation to our setup

don't play with fire, always use a predefined stoploss