#AUDNZD: Keep an eye on the basing pattern here...The weekly down trend signal in $AUDNZD expires next week, this means a potential reversal can be setting up. At the same time, the daily chart is basing and can flash a bullish signal in a day or more. I'll be watching this pair closely in the coming days, after today's close in particular. The recent bout of #NZD strength courtesy of RNBZ's hawkishness has droven the cross pair too far in my opinion and is bound to mean revert substantially, as we recover from peak pessimism when it comes to Australia and China...

Cheers,

Ivan Labrie.

Timeatmode

$WKHS: interesting junctureI will list a series of facts, which make me think we can gamble a small amount of money on a long shot trade entry in $WKHS:

The new climate spending bill includes items that could benefit EV names, and there could be renewed interest in names that could end up landing the deal with the United States Postal Service to provide them with vans. www.bloomberg.com

cathiesark.com Cathie Woods sold. Bullish.

Long term mode retested, after the prior long term bullish trend signal peaked at the target as per my forecast published here ages ago, it has come all the way down and it's basing, could be a bottom in the making, as we had 13 months elapse since the expiration of the last monthly trend, which was at the end of June, weekly trend turned up since and monthly put on a strong candle, with a range expansion move signaling strength.

I'm long, small 1% position as a 'long shot' trade. Potential reward to risk is interesting, but worst I can lose is 1% if it goes to $0. (that's what I call a 'long shot')

Let's see how it goes, my other positions here are $TSLA, $F and a small bet in $RIVN as well.

Cheers,

Ivan Labrie.

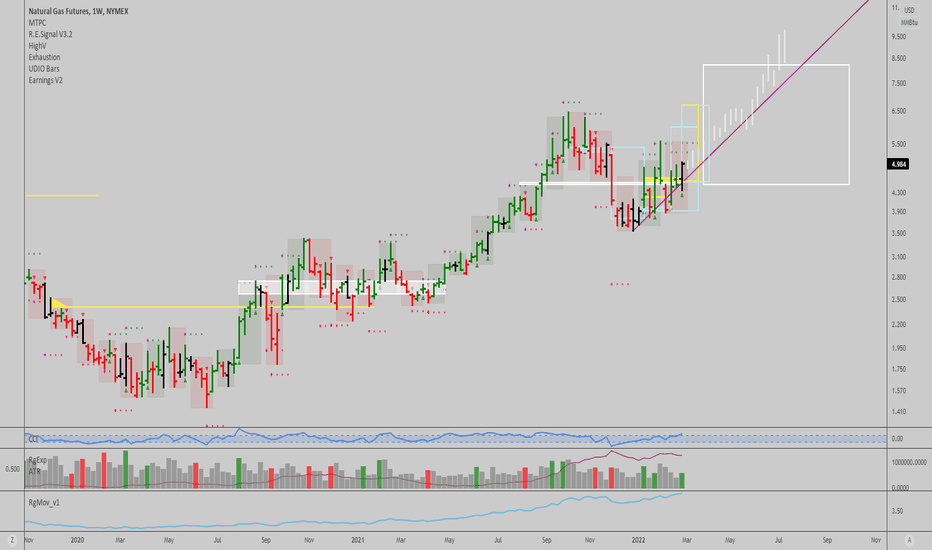

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

$TSLA: Held the S&P500 inclusion level$TSLA has a bottom signal in the daily here, I'm long as of yesterday, time and price target is shown in yellow. Until the next earnings report, price might glide higher. Considering the $TWTR merger, risk of Elon needing to sell more shares is a scary but not impossible bearish catalyst that could rain in the bull's parade soon. Partnering with a PE firm would be a safer bet for $TSLA shareholder's cardiac health, but it's not yet clear what route Elon will go with yet. Earnings might not look too great this quarter, considering Elon's recent sayings about new factories still being a source of losses for the company (clearly gonna be a negative factor until they produce at full capacity, not a demand problem yet). Also have to factor in risk from recent down time in Shanghai due to lock downs and potential impact of the economy on sales with rising inflation and fuel prices affecting consumers. This last point might be what Elon talked about when referring to the economy being at risk of entering a recession soon. I'm sure that if a recession occurs, $TSLA might stay sideways or go lower over time until the market bottoms. To be safe, I'll only trade the stock in the short term. I don't see a huge reward to risk trade in long term exposure to the stock here, all things considered. Long term technical targets are all reached, and price has formed a bearish trend signal in the weekly/biweekly/monthly timeframes, with only the daily trend reversing now.

Best of luck,

Ivan Labrie.

$AMZN: Down trend slowing down...There's a possibility of further downside for $AMZN over time, but currently, price action and the drop in commodities suggest that $AMZN is likely to go higher for a while.

Until the next FOMC meeting, market participants might bet on a Fed pivot taking place sooner rather than later, given the drop in commodities suggesting inflation might be under control already.

I personally think what comes after it is a recession, particularly if the Fed stays in the same hawkish course for longer...For now I'm out of bearish positions and went long using options in a few select names, as well as stock positions in names like $TWTR and $TSLA, etc.

Upside here is good, see the yellow boxes for time and price targets in the immediate short term. What comes after this relief rally until mid to late July is to be seen. Will know more when we get there.

Best of luck!

Cheers,

Ivan Labrie.

$TWTR: Board approved the merger...Now that the board unanimously approved the merger, and the broad market is staging a relief rally or even a bottom, as inflation being under control potentially sets the stage for the Fed to pivot and stop hiking (at least this is what the market might be pricing in), $TWTR offers a good reward to risk entry to go long and pull off a merger arb trade here. Upside capped at $54.2 or lower if Elon bids less for the company after reviewing the real time data he obtained recently. Technicals and broad market risk improved substantially to revisit this idea and go long.

Good luck,

Cheers.

Ivan Labrie.

#Bitcoin: Trend is down in the daily chartSoon the weekly and monthly can flash a signal, aligning with the 2 month timeframe forecast, for the end of a trend by the end of April 2022, which I had anticipated back in July 2020. The last time we had this pattern was in December 2017, right before a fall from 20k to 3k over the course of 1 year. The monthly trend could turn down, and if so, predicts a move down until September 2022, with targets @ 23k and 13k. We also need to factor the support level @ the start of the 2-Month trend around 9k. It's clear markets topped, and $BTCUSD acts like one more risk asset, whenever liquidity suffers, it goes down. Valuations across the board had reached astronomical levels, and essentially, liquidity and money supply weren't enough to support them were investors to take profits in their unrealized gains...

I suggest hedging or buying long dated OTM puts against crypto holdings if you're long, or just going to cash, this is going to hurt.

Best of luck,

Ivan Labrie.

$SOYB / $ZS_F: Weekly and monthly trends are upSoybeans have been consolidating and shorts have been hitting the same level near the invasion day highs for 3 months give or take, today price broke out and confirmed a weekly trend signal. The monthly timeframe indicates beans can rally until October 2022, so, getting lower timeframes to turn bullish again presents us with a massive reward to risk long opportunity here. I bot July futures / $SOYB calls today, aiming to capture the move shown in the continuous chart here. If you want you can join the trade when beans futures open tonight, keep in mind you will need to roll the position to the next contract month 8 calendar days before the expiration date give or take (you'll see volume is high on that day), or, to make it simpler, buy the Nov 18 $31 strike $SOYB calls. If you buy futures, calculate risking a drop under last week's low, if you buy options, calculate risking 1-5% of your capital in call premium. Over time we might be able to bet on higher strikes as well, or trade around the position in shorter term timeframes (often good to delta hedge calls with 15m setups on the short side if you're good at scalping, then use proceeds to add to the call position for increased exposure without increasing risk).

Best of luck!

Cheers,

Ivan Labrie.

$XAUUSD: Huge reward to risk bottom signal...$I'm long PMs as of today, Silver and Gold acting strong after a weekly down trend expired recently. As per my long term yearly chart data, both $XAUUSD and $XAGUSD show long term uptrend signals active and are attractive to rejoin that potential scenario being oversold into support, while short term charts progressively turn bullish from daily upwards. Weekly had a signal which will expire next week and implies a potential mean reversion move towards $1927+ within the span of 6 weeks or less. The daily timeframe turned bullish today, reversing the recent weakness seen since March 8th when metals peaked. Select gold and silver mining stocks look very appealing with low valuations once again ($GFI, $SBSW, $PAAS, $AU, as well as $SCCO and $FCX to name a few).

Decent opportunity to go long with low risk vs potential upside in the case of a stagflationary scenario or a scenario where real rates stop going up or come down over time. which seems likely given demographics and fundamentals. For instance, the adoption of renewable energy and electric vehicles to resolve climate change and potentially address the energy crisis at hand could serve as a tailwind for precious and base metals and mining stocks in general. Long term investments can be done with funds that we can afford to lose or see cut in half to hold for long as necessary to let this trend play out, the trend in $XAUUSD is also a great short term trade, from where we can hold long exposure with big size, while risking small given the tight stop that is possible here at the signal invalidation. Long term positions are better done with physical gold and silver ETFs and/or mining stocks to buy metals in the ground, rather than dealing with futures or CFDs and their carry.

Best of luck!

Cheers,

Ivan Labrie.

$DEFI is toast: nice short...I think we are likely to see a massive move down in DeFi names, the contract issued by FTX is a nice way of riding the eventual move down, which can be magnified if we get some large protocol issue, or some unexpected black swan event causing a cascading decline of epic size as a gigantic levered bubble bursts. It is likely the best short in crypto, to profit from the bear market we are in.

Best of luck if going short.

Cheers,

Ivan Labrie.

$BTCUSD: Daily uptrend signal...Potentially a relief rally in a long term bear market...Weekly trend hit target, monthly trend is still down and equities could top after a relief rally. I'm long $BTCUSD here, aiming for a move back to the range of the Ukraine invasion day, give or take. Time@Mode trend in the daily turned up, so if the base here holds up, we will go higher. A lot of pessimism got me optimistic lately, everyone on Crypto Twitter was going on about the decoupling of $Bitcoin vs $SPX, citing the last couple days relative performance as a really bearish cue. In my opinion, it was short sighted to look at it and discard historical data since Bitcoin topped. I compared it vs $ARKK and $SPY and $QQQ, and it's clear to me that overall, the correlation remains. I figured out it would catch up to where equities were, and go higher with them for a couple weeks here.

The market seems to be pricing in a potential Fed pivot by Sept, and until we get to the next FOMC meeting, nothing can easily stop the bulls here...If sellers stop selling, we can easily glide higher due to short covering, since everyone was so negative. As a cherry on top, we had Jim Chanos going public about his short thesis for $COIN, which came after the stock formed a bullish base and Time@Mode signal. Considering his awful timing with $TSLA, and the various bearish CT influencers (like the infamous Maren, who made a bearish call based on the horoscope or some insane bs) I find the long trade an easy low risk bet here. Set stops sligthly below the yellow box (daily uptrend mode, where most of the trading took place since basing after the bottom).

I've covered shorts across the board, and bot back Soybeans, and some stocks, since last week, and now am long $Bitcoin again, let's see how this goes, we may have some time to rally here. Soybeans and oil can go higher for longer than risk assets and Bitcoin, and might end up affecting equities negatively due to inflation data getting worse, specially if we hear about the Fed's resolve to hike, and get people to give up on the Fed pivot hopium theory.

Best of luck,

Ivan Labrie.

$SPX500: Top of relief rally?I'm short here, hedging my long book. Got a few long term positions that should do well regardless of whether this is part of a larger relief rally in a bear market, or a new leg up with new highs coming...but also have some growth positions I bot to capture the oversold names turning up that I need to manage risk for. I will be closing the ones that fail, but this signal helps control risk as individual charts pan out. Daily $SPX500 trend expires today, might see some rotation from stocks to bonds, as the quarter ends. Interesting at least, recession risk is substantial and bonds might react as well. Weekly charts for bonds show targets have been hit, so a rebound could occur.

Stay safe out there, I'm short 230% vs my stocks portfolio, since some names I hold have higher beta, and I have some leverage going as well. (long term positions are low beta, but got high beta names long still)

Cheers,

Ivan Labrie.

#TSLA: Likely bottomed and is about to rally over 1kI'm long $TSLA for a few days already, and it is coiling for a massive move up in my opinion, as many fundamental catalysts are lining up in the coming weeks and months. I can see a resumption of the big uptrend that kicked in after basing during late 2019. Sentiment has turned pretty grim as the stock corrected and lagged $Nasdaq, and investors seemed pessimistic regarding Elon's foray into crypto, as well as prospects for China sales, and Model Y sales in Europe, as new competition arrives in the market in droves. The thing is, competition is actually far behind in range and specs, and $TSLA has a solid lead for the most part despite the bears' insistence on pointing out the risks in the bull case. Things will start falling into place going into the next quarterly report, and after we hear the deliveries number soon.

It has been a long time since I could recommend buying into $TSLA with this level of conviction, but I think the time to be positioned is now, specially considering the pivot away from value stocks and inflation bets that is causing tidal waves in the macro picture now, since FOMC last week. I'm looking forward to $TSLA announcing having sold their $BTC position in the next report, as well as keen on seeing what the up coming AI day event has in store for the stock.

Best of luck,

Cheers.

Ivan Labrie.

$SPX: 2000 top overlaid on price...I really think we likely saw a long term top in equities and a major turning point in the various trends that we had since 2009 until recently. I copied the pattern from the high in the year 2000, to give us an idea of what to expect, since that was the last time a yearly timeframe Time@Mode pattern concluded, I think it can serve as a guide from here onwards. Publishing this one for posterity, it's interesting that we already have a Dot Com bubble like chart in $ARKK monthly, definitely very critical to figure out if we already topped, as per the yearly, or if we get a different bear market pattern next. In my opinion, the massive excess we saw since 2020 post COVID, with increased retail participation is akin to the frenzy that started in the year 1998, and topped by 2000, which would fit today being equivalent to that period.

I will try to navigate this period profitably, my strategy is to have a long/short portfolio, buying interesting bullish setups in stocks with lower valuations, commodities related positions, and defensive names, all that have historically fared well during yearly trend expirations when bear markets and long term sideways consolidations started, like between 2000 and 2013, or before, during the 70s. I also short overvalued names where I perceive that the story driving them is exhausted, and are rolling over, with insane valuations and market participants complacent and buying option premium on the way down...while shorting options against my short positions. I manage risk carefully, and have split my portfolio in two: one trading account with 25% of my firepower, and 75% in a long term account where I have only long term long positions, no leverage, and try to sell calls to generate income while holding my long term bets.

Best of luck, let's hope we get further clarity over time. Fitting this scenario would result in a tricky period unfolding for months, but eventually we will get a really steady decline to trade more aggressively on the short side. Patience will reward us here, can't take big risks and expect to make money as a bear simply holding random bearish entries.

Cheers,

Ivan.

$PYPL: Buy here...Risk is small.Paypal has finally acted like it is forming a bottom, after a long and bloody decline that drove it down 70% from the top. I think the market is going to produce a substantially big relief rally, similar to the move that took place in the year 2000, from May to September back then. Equities then proceeded to roll over steadily, after triggering a monthly timeframe Time@Mode down trend signal. Sentiment is extreme and people have finally panicked enough with rising oil and the war in Ukraine situation, to the point that I think a rally will catch everyone offside here.

Best of luck,

Ivan Labrie.

$CW: Defense stocks look primedQuarterly charts look extremely appealing in various defense names, $CW is one example of a good valuation and technical setup being present in tandem, together with the right macro backdrop for long term appreciation in this stock. Price to sales is at reasonable levels vs margins here, and free cash flow yield is around 5.95%, with a 4.35% earnings yield (TTM). The stock can reach between $263.08 and $558.90 by Q2 2025, according to the Time@Mode trend signal present here. Long term, the invalidation for said trend sits below $123.84, but I would use a tighter stop for sizing at least, best bet is to not let yourself be stopped out and rather assign a determined % of your long term account to the sector, and rather monitor the long term invalidation and also the evolution of fundamentals on each quarterly report and main corporate event every year to determine if the long term bullish thesis remains viable.

Best of luck,

Ivan Labrie.

$PFE: Big weekly trend setting up...I think $PFE offers a tremendous opportunity here, good setup to enter a position with low risk vs reward potential. Could be a long term position as well, depending on how it evolves.

I'm long 12.07% here, risking a 3 times the daily ATR move against me for a 1% loss if it drops that much. Valuation is attractive and long term charts have a huge setup in $PFE, the big correction as of late seems to be over, and it's ready to go steadily up again.

Best of luck,

Ivan Labrie.

$SONO: Short setup spotted$SONO has a great short signal here, paired with a longer term down trend active, coming down from overbought readings in the daily timeframe, and below the most recent 'Key Earnings Level' from the 'Key Hidden Levels' suite of indicators developed by my mentor @timwest . A great setup considering possible implications and the state of affairs in the market these days. You can enter shorts on slight retrace if possible, or try to enter asap when pre market opens, stop loss here should be sufficiently wide (in general a basic 3 times the daily 11 period Average True Range distance from entry works, but you can risk 0.5 average ranges above the yellow box here for a tighter stop). The company was unprofitable until 2020 essentially, and has reached bubble valuations, with growth needing to continue at this pace by 2024 for current valuation to be sustainable. As other growth stocks, it's not where I'd park my money, unless there's a technical short setup forming...

LUNAUSDT: Huge upside vs modest riskI've been thinking about it and the setup here is probably the best trade to take in crypto markets going into the end of the long term trend signals I had forecasted in $BTCUSD and $ETHUSD as far back as July 2020.

Weekly and daily charts, and also ratios vs $BTC and $ETH show $LUNA can perform incredibly going forward. We all are aware of Do Kwon's stunt, to accumulate a massive $Bitcoin stash to back his $UST stablecoin, and thus reinforce the self reinforced trend present in $LUNA from the start. The last big self reinforced trend we observed in crypto was $Solana and also $Bitcoin and the $GBTC arb play that was absorbing a lot of supply and fueling speculation until the Canadian ETF launched. These trends form tremendous bubbles that George Soros describes as the ideal opportunity to build wealth when identified. The key will be identifying what breaks the self reinforced mechanism, and reverses the trend bursting the bubble that is being inflated here.

The mechanism in question makes each transaction made using Terra’s stablecoin incur a fee which is goes to reward holders of $Luna, the ecosystem's 2nd native token. The Treasury and miners hold these tokens, so higher transaction volumes create more miner demand (which should increase the cost of attacking the network in theory) while giving the Treasury more funds to protect the stablecoin and fund discounts for Terra users who make purchases with the stablecoin (similar to cashbacks). As such, transaction growth will impact $LUNAUSD's price via this mechanism...Can be a double edged blade, and will be interesting to see how this bubble unwinds. For now, it's a good thing to hold considering downside risk and timing of the T@M signals present in the weekly chart.

Cheers,

Ivan Labrie.

We're not selling before a pullback The decline on ERURUSD continues but we still don't have any selling opportunities.

In order to get involved in this downside move, we want to see a pullback to our sell zone.

This way, we will get a better risk to reward ratio and also an extra confirmation once we see a rejection.

Price is currently trading near support which means it's very likely that we can actually see a pullback soon.

The end of the week is also a suitable time for that.

#SPX: Potential forecast if we hold support here$SPX confirmed a bullish signal today, after it was evident selling had been absorbed systematically by long term investors since September 4th until today. This buying puts a floor on the market here, and potentially offers a solid support level if retested once prices move higher, if they do hold here for a couple weeks.

A new weekly signal can trigger by the week starting Sep 28th, and we have many short term charts in certain tech stocks showing bearish signals, while a lot of other stocks -energy, travel, hotels, to name a few- have bullish signals, so a sideways index here would not be too crazy.

Once we confirm a new bullish signal we could project a rally over 3684, at least, provided we get bullish confirmation next.

I'm holding both bullish and bearish positions in individual stocks, as well as some insurance using derivatives as well, but should we get a bullish swing once again, the bullish signals will far outweigh any potential loss I might have to deal with from bearish setups. That's the beauty of stock picking, many times you can find good trades that might not correlate the index at all times, or even afford the luxury of trading both long and short positions in different stocks.

Stimulus talks need to progress for the rally to continue, so I will be keeping an eye on those developments going forward.

Best of luck!

Ivan Labrie.

BTCUSD: Relief rally setting upI suspect we are seeing a broad market relief rally in risk assets, including crypto. I bot my max allocation in $BTCUSD and $ETHUSD today, before US equities closed, with an 80/20% allocation to each respectively. I'm allocating 25% of my capital into it, whenever I want full exposure in crypto assets.

Daily technical charts show a trend signal kicked off here, this signal formed in the $BITO chart today, and was present 2 days ago in spot charts. CME was slower to confirm and is now onboard together with the latest spot signal I'm showing you in this chart.

Weekly charts can easily confirm an advance for 5 weeks here, interestingly this would take Bitcoin close to the current mid term down trend resistance at the 25% speed line (measure 25% of the speed of the decline from top to bottom, and project it as a trendline, you can try this with the Fib Speed Resistance Fan tool here on Tradingview, really useful way to gauge trends' persistence on pullbacks after a sizeable move in one direction).

The long term trend I had predicted back in July/August 2020 will expire by the end of April this year, so it is fitting to get a rally into the end of the trend, time wise...I don't yet know how far this will go, but the same timing is found in various stock market trend signals in long term charts, and almost all risk assets exhibit the same behavior: a massive top since late 2021, and now a potential relief rally setting up. It's unclear if it's a retracement in a down trend, or a reversal of the decline leading to new highs, but I think it's more probable that it is merely a relief rally indeed, and all risk assets likely head lower over time, likely acting similarly to the 2000/2013 period or the move after the late 60s into the early 80s. We will know more over time.

Where will Bitcoin go in this potential new paradigm scenario? It's yet to experience a long term bear market in risk assets, since it was born after the bottom in 2009, following the top of the long term bull market that started in 1982, and culminated in the year 2000. We now are seeing the end of the trend that kicked off from 2009 lows, and peaked in late 2021 probably.

My guess is Bitcoin either decouples from risk assets and performs like Gold and Silver , or other commodities , which outperform during bear markets historically, or it moves like growth stocks, as it has been moving.

Next move here is telegraphed: we go higher, as long as not breaching the 37200 mark give or take, within the next 16 days to 5 weeks. What comes after that is not yet clear, but it could be that it is rejected from the 25% speed resistance line. Let's stay vigilant and nimble. The Federal Reserve can exacerbate volatility this week, so I'll keep an eye on that as well...Crossing fingers gentlemen.

Best of luck!

Cheers,

Ivan Labrie.