GM and Palladium: Interesting chartWe have a sizeable spread in $GM vs $XPDUSD currently, and price is trending up strongly in daily and weekly $XPDUSD.

If price breaks into new highs here it could be flashing a strong signal for auto stocks, so I wouldn't be shocked to see $GM gain steam from there onwards.

I'm currently long $GM with 10% allocation and no stop loss, but also no leverage. Looking forward to see the outcome of earnings.

Cheers,

Ivan Labrie.

Timeatmode

GBPAUD: Time at mode and RgMov signal a buyWe have a pretty tight stop loss entry in this pair if we break a previous day high (PDH) soon. Stop loss should sit below the last daily low here.

If we move straight up from this juncture chances are the daily timeframe signals the market is accumulated and ready to march higher once enough time passes, most likely trading sideways at a higher price zone.

Current daily trend expired, a 12 day advance, so we can expect a 12 day consolidation or retracement, but if price breaks up, since the largest timeframe is trending up, buying into strength would be a low risk, big reward entry, which might evolve into a larger move over time.

See the monthly chart below for reference.

Best of luck,

Ivan Labrie.

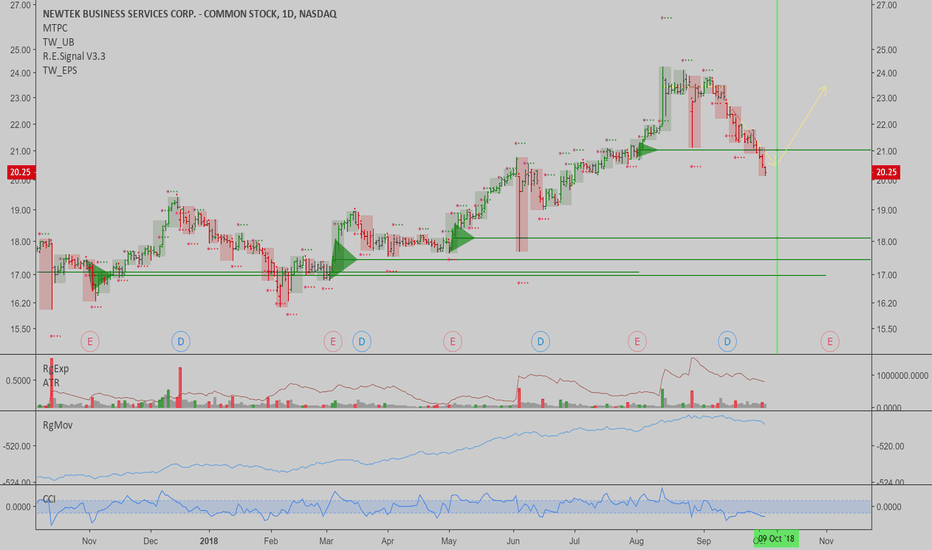

NEWT: Downtrend target hit, time expires soon...$NEWT is one of the stocks we monitor in our income stock watchlist. I like how it's setting up for a buy here, normally it falls after going ex-dividend, since investors leg into it ahead of the dividend being paid, and exit after receiving it. This is a reliable pattern in this stock.

Technicals show price met a downtrend target slightly ahead of time, and as soon as it turns up over a previous day high, it will be safe to be long this stock. Additionally, we could wait for time to expire, by the date shown with the green vertical bar on chart.

I estimate price will act as per the yellow arrow on chart, if it follows 'Time @ Mode' rules by the book (which is likely overall).

Best of luck,

Ivan Labrie.

Weekly commentaryI'd like to discuss some very interesting market signals that I've spotted, as a result of tracking the US equities, FX, Commodities and Cryptocurrency markets on a daily basis.

Many times people ask me about specific markets, or, decide to focus on one market they like. This is not the optimal way to approach trading in my opinion, since a market can be in a rout for a long time, with prices stuck in a sideways range, or, simply in a bear market, without

too much liquidity or interest from investors. The latter is the worst kind of market action, as far as efficiency of trading signals goes, and I will explain why in video publication I will share the link for soon.

We're looking at the #SPX chart here, I find it very interesting when there are big declines in this market,

since more often than not, we can catch very interesting opportunities on the long side in US equities. But we also need to be prepared to anticipate tops, and extended declines or sideways action, which normally come after sentiment turns around. Most of the time, since the last financial crisis the world endured, sentiment tends to be bearish among the public and specialists, normally turning less bearish or bullish near local market tops, which can be followed by corrections or consolidation patterns of different duration.

I'll publish a link to a video publication in related ideas very soon, stay tuned.

Hope you all have a great weekend,

Cheers.

Ivan Labrie.

XAGUSD: Silver has bottomed...It's clear Gold and Silver, and gold and silver miners have reached a long term bottom at the recent lows. It's smart to enter long positions on dips if you're not yet long.

Inflation numbers have been the highest in a long time, election fears cause instability in equities, SKEW has been falling as asset prices tank, and investors have been buying call options, judging by rising VIX numbers since the market toppped. This indicates sentiment has turned bullish, at the top. Weekly time at mode signals indicated $SPY had a 13 week decline ahead of it, and long term charts indicate the market may remain sideways/down until the 2nd half of 2019.

Add to this the data from the Commitment of traders report, where silver commercial hedgers turned net long for the first time in ages, after gold bottomed, and commercials also covered shorts and went net long previously in the yellow metal too...

Best of luck,

Ivan Labrie.

Disclaimer: I hold long positions in Gold, GDXJ, TLT, EURUSD and looking to enter longs in Silver as well.

EURUSD: Daily buy opportunity, could evolve into a larger moveThe Euro is set to rally from here, given the bottom in gold and in the Yen, together with bearish fundamentals for equities odds of this trade increase significantly.

Invalidation would be a move under this week's low, for the daily signal at least.

Cheers,

Ivan Labrie.

BTCUSD: Weekly downtrend?I'm not too convinced of the decline setting up here, but it's a valid trade. If prices do slump over the course of the next 16 weeks, we may end up bottoming around the $3220 mark by then. I'd look into flipping long, long term, once this zone is reached, IF prices don't rally back over this week's high soon.

Cheers,

Ivan Labrie.

GDXJ: Jr. miners have bottomed - upside to shy of $70 possible$GDXJ is an exchange traded fund which lets investors gain exposure to a basket of gold and silver mining companies, which can be a very interesting vehicle to benefit from major moves in precious metals. In this case, we see that the daily chart is likely to start trending sharply up from here, with a chance of breaking above the long term resistance zone above, in which case, prices could surge close to $70 over time. We're long from today, entered a 9.5% position at $28.15, shortly after the market opened.

We may add to it on dips, if prices retrace back into today's range next week.

Best of luck if following me here.

Cheers,

Ivan Labrie.

XAUUSD: Gold is trending from here...I think we may be in the presence of a 3-day timeframe uptrend signal in Gold. Similarly to the pattern that emerged after bottoming in late 2015, Gold prices are set to soar from here onwards, if this signal pans out. Monthly and higher timeframes are bullish as well, so we might be in for a ride, with prices rallying over 1400 if we break over the long term uptrend mode you see in white above (white box on chart).

As I was describing in my Silver publication, fundamentals, sentiment and technicals align, so we can expect a sizeable long term move off this juncture. One interesting sidenote is that cash levels in brokerage accounts are at really low levels, which also favors the bullish gold case, together with the evidence presented in the other chart.

You may go long here or on dips, preferrably buy on dips if not already in. We hold long positions since I published my macro analysis chart when gold was roughly 1179, and looking to add to it on dips here.

Best of luck,

Ivan Labrie.

EURTRY/USDTRY: Bottom of the rangeEURTRY (and $USDTRY) look to be at the bottom of the range here, and might end up evolving into a trend opportunity over time.

I'm long risking small but with very good risk/reward since the invalidation for this trade is small (a drop under 6.87).

$USDTRY offers the same setup pretty much but I like the crosspair more, slightly better r/r.

Good luck,

Ivan Labrie.

BTCUSD: Market is sideways...I think cryptocurrencies are likely to remain range bound, which means short term traders are mainly in control, while long term players await for fundamentals to evolve favorably to position themselves. Overall bullish bias, with weekly sellers exhausted and very few reasons to get momentum in any direction.

I'd stay away from this market for now, my interest will gravitate back towards it by the time MtGox creditors receive their $BTC, or after ETFs or cryptocurrency trading hit proper exchanges like Nasdaq, etc.

Fundamentals are bullish, but lacking to provide the backbone needed for a long term advance, and catalysts aren't there yet, for a move to the downside so the market will remain sideways, hurting the most people possible in every swing...

With BTC being designated a commodity by the SEC, over time, we might see it be treated like gold is in the US. I think over time, as people are shaken out by the potential shake out decline that hordes of MtGox hodlers rushing to sell at exchanges might bring, would cause enough of a negative sentiment extreme to form a long term bottom we could buy, eventually. Patience, time at mode analysis points to a long sideways downwards drift until May-June 2019, which aligns with these developments panning out.

Good luck navigating these murky waters, if you try and do so.

Ivan Labrie.

MIC: Good entry, potential for a big weekly uptrend...$MIC offers an ideal risk/reward here, to go long here, risking 3 average ranges down, to aim for the earnings resistance level above, or maybe even a larger rally as per the cyan weekly arrow.

Check out @timwest's Key Hidden Levels chatroom for more ideas like this one.

Good luck,

Ivan Labrie.

JBLU: Swing trade opportunityBuy here, risk 1-3 Average True Ranges down, to ride it back up to the recent top or into resistance. Watch the 'key earnings levels' for a support/resistance map in price. You can get this indicator in @timwest's indicator pack. Really useful to navigate through the chop.

With oil so extended, airlines oversold into support, we have a nice low risk setup. I'm loading up here.

Cheers,

Ivan Labrie.

WDC: Interesting bottom signal, cheap valuation hereThe trend in $WDC might be turning around here. Valuation is really low here, and the chart seems to indicate the weekly decline is over. I like my odds here, risking $4-$5 to the downside, for huge upside potential if the trend in flash memory turns up again.

Cheers,

Ivan Labrie.

$USDJPY: Looks toppy here...I think we have a clear top signal here in $USDJPY, which aligns with the price action in Gold and $DXY.

I'd reccomend a short position with a wide stop, and a lot of patience. You may enter averaging in during the next 3 days, or over the course of a week to a month, depending on the timeframe you're trading from. Daily, I'd use a stop over 113.85, and average in.

The weekly signal failed to hit its bullish target for this pair, which implies weakness once we break below a weekly low next.

Best of luck,

Ivan Labrie.

Broad market update: DeleveragingI think we might be about to see deleveraging in the market, judging by the action in the yen, together with Gold rising on falling $VIX, while $SPX peaks, but fails to advance further after $VIX fell slightly. I suspect mid term election woes plus all the barrage of bad news related to trade wars and other topics might push investors into cash. Personally I've sold all my holdings except for my positions in gold and $TSLA, and will look into rebuying once a bottom is clearly spotted in the broad market.

For now, I will focus on determining if this thesis is correct, and if so, look into maximizing my gains in the gold rally that might emerge from here.

Gold hit a monthly support level, got oversold, whilst being in a monthly uptrend and flashed a huge buy signal from the Commitment of traders report data, whilst the daily trend ended, forming a potential reversal setup. Risk/reward is optimal on the long side now. I will scale into the trend as we get more and more confirmation and other trend continuation signals later on. Targets for it are as high as 1550, if we confirm a monthly T@M signal eventually.

Cheers,

Ivan Labrie.

BTCUSD: Weekly trend is down...As per my previous analysis, we had a good chance to rally from the last local bottom, back to 8500+- to top there and resume the bear market decline.

We were long, rode a move from 6360 to 8200-8300, and flipped short but we were shaken out of the short sadly. Now the signal is very clear and the weekly confirms the downtrend with full force. Being the main timeframe in control here, this scenario is of very high probability, since it goes against mainstream sentiment and aligns with the longest term pattern which is currently implying a bearish/sideways phase until we reach the vertical green line in my chart -which nicely aligns with the timing for MtGox coins to be distributed and likely sold at market via exchanges by desperate hodlers who were stuck since Gox went to hell-.

We can look to enter shorts at market, gradually, or wait for a retracement entry after the weekly close, which would give us a far greater reward to risk ratio.

Cheers,

Ivan Labrie.

PS: Don't be a stubborn hodler, please go to cash...unless you really enjoy losing money for no good reason.

USDARS: Fellow Argentinians, sadly the dollar rally continues...The target here is big, but it could go even higher depending on how it acts. I'd reccomend to divest positions in local equities and bonds, and get exposure to US equities and the dollar, or pairs like the dollar/yen.

After this next top, we could see a bigger correction in the dollar accross the board though, so I want to be ready to capture the reversal, in particular by going long gold once we have full confirmation, which may come by September.

Best of luck to us all,

Ivan Labrie.

SOHO: Potential quarterly uptrend...$SOHO is a very interesting income play @timwest reccomended over at his chatroom many times. The chart has been setting up for an explosive rally, and we've been accumulating positions for a while, while also playing some shorter term swings in between and collecting the dividend each quarter.

Yield is very good and the company has been really solid, so it is easy to reccomend this one as a potential long term hodl trade.

Best of luck if you consider investing in this company.

Cheers,

Ivan Labrie.

AUDCAD: Good chance to go long given the spread in oil vs copperI think we've reached a point where the huge spread between oil and copper will close, this type of scenario favors an $AUDCAD long position. The chart is constructive already, so, it could end up flashing a nice trend signal from here. I'll be looking to enter longs at market open, and exit once the spread is closed once more.

You could also trade the pair, long copper, short oil, either weighted based on volatility, or equal dollar weights on each leg.

Best of luck,

Ivan Labrie.

USDCAD: Low risk long entry...I like the $USDCAD pair here for a swing trade opportunity, given the trend in the $DXY chart, and in the $EURUSD and $USDJPY pairs, as well as movement in oil and gold, I reckon the trade has very good odds. Market participants have been pricing in the fact that the Fed won't hike rates again this year, but it isn't clear if that will be the case or not. Either way, the technical picture is clear, and given the economic growth in the US, this trade has decent odds of panning out favorably.

Best of luck,

Ivan Labrie.

TSLA: Updated weekly viewAfter a great earnings conference call, $TSLA started jumping higher, and apparently shorts are being squeezed. The weekly Time @ Mode signal implies price can hit 449.36 within 9 more weeks or less. I'm holding longs since we hit $250 roughly, and added a few times on the way up recently, and on dips.

Elon Musk claims $TSLA will be cash flow positive and profitable in very short order, and the production and sales growth certainly is very positive, as well as updates regarding their AI chips and software for self driving. I think we can see a very sharp rally from here, it will be challenging to not sell too soon.

Hodl!

Ivan Labrie.