SNEK/USDT - Weekly TSMOM Model SNEK/USDT - Weekly TSMOM Model

Weekly Model, looks much more promosing having printed a long/bull regime and remaining bullish running into this current weeks closing price.

As you will notice, since June our weekly bear regime prints have been far more dominant and remained in trend for much longer.

Let's spice up this chart with some additional analysis shall we. Levels of interest identified leveraging both Dealing Range Theory (DRT) and PDarrays (Premium/Discount.

You can see where both buyside and sellside were swept, leading to a reaction and reversal before chasing opposing liquidity, for example Turtle Soup

We are right back to trading within extreme discount of this monthly range right now.

Timeseriesanalysis

Pick up that COIN when it hits da floorWhen a coin drops it is merely instinctual to pick it right up, thats money we're talking about, can't leave it on the floor...

Using a term I coined, harmonic wolfekraft, I have obtained the following scenario for COIN.

Summary

- Look for a bounce around 135 this week (4/18-4/20 range most likely). The bounce zone is 130-140. If it drops below that we might have a bigger problem on our hands and it could drop as low as 92. More likely to bounce in zone though.

- Initial target of 166 by around 4/25 (before the Apr 29 expiry)

- Intermediate target of 227 -240 by mid-June (the 227 is actually possible by 6/2 )

- Max Target by 6/24 is 350s - this is theoretically possible, but not statistically plausible... the time-series adj. target by 6/24 is 288.

Explaination :

- The bigger picture is that COIN is working toward completing a larger bearish harmonic, with the X at its ATH right after its IPO, the C is TBD but I used logic from the nested smaller harmonics within, levels from wolfe waves, proprietary control charts, and MMM by how options are currently priced to determine a bounce zone/bottom likely in the 130-140 range (worth watching closely this week).

- Within the AB of the larger developing harmonic, COIN completed a nested bearish Crab within a bearish deep crab back on 5/12/'21 - 11/9/'21. From there it started downside to the larger C.

- There is a new nested bearish harmonic development that aligns with a bottoming around 135. A bounce from around 135 would setup for a potential completion of a nested Bearish A Butterfly within a slightly larger Bearish A Butterfly, and interestingly, their D would form right at the intermediate targets I am getting using wolfe-wave EPA-ETA off the 1-4 resistance. These same levels are also showing up as critical levels in a stability monitoring algo I created using control charts and robust rando cut forest. Essentially, below 135 in a weeks time would make COINs level a statistical outlier with over 90% probability of explosive bounce.

- looking at the MMM for Apr 22 the range is 135 -160 which aligns with bounce zone and point bounce level. The MMM for Apr 29 is priced for 130-165 - the initial target/time to target I am getting from using the minor wolfe wave (blue) in chart is 166. I do love this setup. Note the relatively huge wolfe wave buy signal that just occured (bottom panel (wws)); at smaller time frames (5-15 min), there are trace buy signals starting to show up which indicates bounce is near.

- finally, the intermediate targets using the major wolfe wave 1-4 projection (grey in chart) are, indeed, statistically plausible: fitting a time series model to COIN, an optimal selection is ARIMA(2,1,2) w/ p = 0.42. The upper 80-95% Prediction Interval on 6/2 (223-263) spans the intermediate target range of 227-240. The adjusted target by 6/24 of 288 is the 95% PI.. although such a move would be kinda crazy, it could occur in a scenario where BTC explodes and COIN follows and runs to meet its 1-4 projection prior to ETA (not impossible, but not expected TBH).

I am expecting a bounce to initial target and then a continuation on that momentum to the intermediate target range and am considering the following play (FOR THE CURIOUS, OBVIOUSLY NOT FINANCIAL ADVICE):

COIN May 13 160 calls IF it bounces at or before 135 this week

COIN June 17 185 calls IF it bounces at or before 135 this week

Bless you all,

The Alpinist

BTCUSD Time serise . daily timeframeIn the daily timeframe after the start of the uptrend in March 2020, the downtrends that formed after the uptrend all corrected about 50% of their previous wave time, so according to the previous cycles, I expect on January 7-8, the bitcoin phase Start your ascent again. You can see in the chart

time series BTC in weekly timeframeWell, in the weekly timeframe time series from about 2010 onwards, each ascending and descending wave consists of four cycles, of which three are ascending and one is descending, as I have shown in the chart. According to these cycles, we are now in the third wave of the third cycle, and in the previous cycles before the end of the third wave, a strong sound wave formed and then began to fall, which I expect this cycle to repeat again.

USOIL. P-Modeling PT V2. Inverted Springs of Cajun OilWelcome Hyperspace Agents,

This is the second part of US OIL. Part V2.

In order to understand this chart. You must do the following:

- View the ENTIRE Time-Series Analysis.

- View Pt. 1 of the US OIL idea.

-Try and Grasp the understanding of Harmonics and Inverted C&H formations.

-Be open minded.

Please see the snapshots in order. They represent a snapshot progression of the dynamic model being executed. This is called a Time-Series Analysis.

Time-Series Start:

Baseline Snapshot: 1 Week TF.

Inverted cup and handle formation not yet executed.

Dec 6th, 2019

Price $58.25

Next Snapshot: 1 Week TF.

Inverted Cup and Handle formation has been partially executed up to the C & D conjunction of the HANDLE harmonic of the formation. Formation Validated.

March 26th, 2020

Price $23.79

Next Snapshot: 1 Week TF.

Inverted Cup and Handle formation EXECUTED. Past lowest linear conjunction of Handle.

April 20th,2020

Price $14.85

Next TWO snapshot: 1 Week TF.

Inverted Cup and Handle formation Executed. Full cup pour to $0.00 and oil goes (-) on some exchanges.

April 20th, 2020

Price $13.61

& Oil goes to 0.

Now let us fast forward to the rebound dead-cat.

We create a harmonic exit pattern, leading into new bull-run for oil.

Sept 1st, 2020

Price $43.06

I thought, why not a nice double bottom inverted spring to set us off the cajun way.

We begin 2nd crash of oil.

Sept 8th, 2020 (posted date).

Price: $36.46

________________________________________________________________

You can find all the original snapshots here:

Please view PT 1.

Snapshot Time-Series Analyses are very hard to refute. Because the proof is in front of you. No numbers. No guessing. Simply View the evidence in picture format.

Area of Interest was confirmed in PT 1.

Target for this drop is $11 stable on US OIL.<---

WTI OIL will also drop to a TP of 0.11 cents.

Idea here :

Covid-19 Wave Two.

Dropped demand.

Complex Supply availability due to weather.

May even see a flash crash to 0$ again..

Who knows..

Not I said the sheep.

Thanks for Pondering the Unknown with Me,

Glitch420

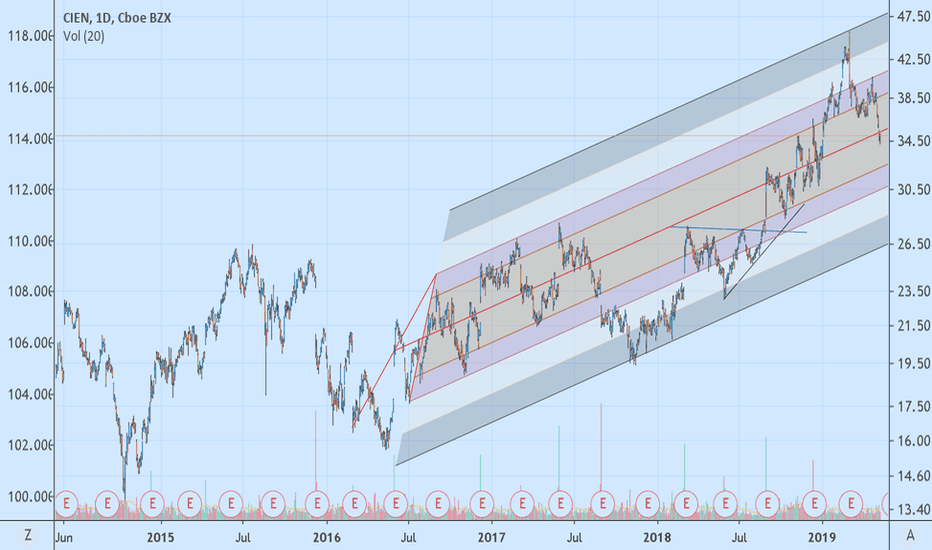

CIEN Trend Analysis with Modified Pitch ForkAlthough the short term signal is SHORT, look for a reversal to LONG around $31.

When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. It's important to note CIEN had been in a flat range since 2002, however, it's a very wide range from $10 to $40, with two outliers that extend the range to $50 (1/03-1/04) on the high-end of the range and $5 on the low-end of the range (11/08-02/09).

Once a leader in networking hardware, Ciena lost tremendous market share to Motorola Solutions (MSI) , Arista ANET and Cisco CSCO by not recognizing the importance of 4G early enough. That mistake led them to invest heavily in 5G and the company is benefiting from this as it emerges as a potential leader in the crucial migration to 5G. With US sanctions pressuring their lead international competitor, Huwei, Ciena is poised for a massive repricing of its market cap, which at $5.5B ranks it amongst the smallest amongst its peer group: MSI: $25B, ANET: $20B, CSCO: $232B. CIEN's market cap is roughly equal to Lumentum LITE ($4.9B) but the latter trades at a PE of 130 compared to CIEN's PE of 23. If CIEN was priced at the same earnings multiple as LITE, the stock would be trading around $200/sh.

For a long position, look for a convergence of technical zones. Looking at a monthly chart, you'll see that the high end of 2010-2018 range is $30. The 50p EMA is crossing above the 100p EMA and the 24p EMA crossed above both slower EMA's last October.

On the weekly scale, the 100p EMA is at $30 with the 200p EMA just below around $27.

On the daily scale, a Fibonacci fan of the May 2018 to March 2019 move projects the 3rd fan line around $32, with prices presently hugging the 2nd fan line at $35, which also coincides with the 200p EMA. RSI is close to penetrating the lower band, confirming the stock is getting oversold, but there is still downside left before CIEN finds a floor. When it does, load the boat.

I also use a proprietary short term price predictor overlaid against a linear regression slope. When the predicted price forecast moves above the linear regression slope, it's generally a good time to step in. To create a similar 'indicator', you can use a Time Series Forecast (similar to a MA) with a periodicity of 9 overlaid against a Linear Regression Indicator with a periodicity of 18. When the TSF crosses above or below the LRI, it's a powerful buy/sell signal, but use the slope itself as a filter to avoid chop in sideways markets and this technique will help you capture very large moves. As of this writing, this method is in a sell signal with the linear regression slope pointing down. Look for when the slope levels off, and the TSF crosses above/below the LRI, as happened in early February just before the move from $38 to $46 for a buy signal, and in late February for a sell signal as the slope leveled off and the crossover occurred near $45 for a short trade that remains open. Using the linear regression slope as a filter for the TSF/LRI crossover would have avoided the chop from March to late April, and then the current short trade would have been validated at the end of April at $40.

BCH/USD forecast trend idea for January–February 2018I foresee BCH breaking out to 4000–5000 USD by January 20th. This is all based on what you can see in my chart above. I used the consolidating wedge that many other users have posted thus far, overlaid with a set of time-series curves to show the possible periodic nature of this crypto. Note that I am not an expert at this, but I have understanding of the crypto market and I am good at numerical analysis and pattern recognition. This all of course depends on news, adoption, potential volume, and any huge bearish moves would invalidate all of this.

I'll likely be taking profits at the end of January somewhere in the 4000-5000 range...

Let me know your thoughts!

Personal disclaimer:

Don't take any of my published ideas as reality. Always make educated decisions before doing anything with your investments. Use my charts for making rational

Analysis by Fourier Series from S&P 500 IndexI am test the analysis of Fourier Series in S&P 500 Index some times I have very good results in forecast. The prediction at future is short in time and It´s bad predictor when there ispolitic effect on markets. I fixed two model, exponencial with tend to up and damped: