Difficulty Ahead, Not All Parabolas$JJT is the main instrument on the stock market for trading tin prices; which are based on LME tin contracts; which in turn are based on Shanghai Metals Exchange contracts. Tin prices will continuously increase as Chinese electronics manufacturing ramp up-- $JJT is a China reopening play. Technical indicators are instructing caution as we enter a key supply zone. Knocking right on the 150 EMA and the upper Bollinger Band, plus we are overbought. I don't see a topping pattern and I'm not calling for a reversal, but we are due for a pullback. Good luck

TIN

TINS breakout falling wedge patternPT Timah TBK (TINS) is currently in a breakout condition from the chart pattern, namely the falling wedge. This chart pattern is a correction/retest condition of a trendline resistance line that was formed from 2008 so that it becomes a very strong area or line to reflect the price. On February 25, I observed on the weekly chart, the price broke with a strong candle and strong volume as well.

#RiskDisclaimer

Just breaking out of the baseHere is a 6 million silver ounce producer with tin on the side that is valued as 250 million market cap.

Peers with similar production are valued over a billion.

This is an easy 4x stock from here to match peers, then add the appreciation with all boats rising with the tide.

My biggest position, and I've been pounding the table on it since IPO. Average cost $1.30.

My top silver pickMy postion size is so big here, that I could by 10 normal sized positions. That's how good the risk/reward is on this 6M oz silver producer that's priced like an exploration company.

$TMZ the slaughter! The screams! The horror! The blood!Big bullflag, running down now. Getset to jetset.

Biug bullflag with multipele gradietns. RSI30 up there on the W./Hasn't tapped. But on the D it is. WIll it tap teh W FInal capitulation ?? ? WHo knows! Prob not. :Little tap [py tap to 6.6 possible though

$JDRI camped out watching this for months then when it pumped i hadn't allocated the $$..

ANyways.. loks like an entry imho maybe. DYOR!

AVZ (LONG) Catalysts galore & breaking out off BaseAVZ (LONG) Catalysts galore & breaking out off Base

Catalysts:

- Chart is now set up with strong bullish indicators = Bullish trend gaining momentum

- Off take agreements in the pipeline

- Funding to mine coming up

- Final Investment Decision coming up

- Tin reports still due

- Further final drilling to infill the Measured & Indicated resource

- Special Economic Zone (SEZ) to be announced (reduced tax)

- AVZ to seek further % interest in the resource from the government. (already went from 60% - 75%, so far management are true to their word)

- AVZ to refurbish the Hydro power plant (4 x cheaper than non-renewable energy)

- Looking to build offtake & funding ties with Europe, Saudi Arabia and China (management do not want to put their eggs in 1 basket = A+ decision as China is bottlenecking and destroying Australian Lithium mines so they can buy them from Administration)

- AVZ to build a green Lithium Mine

Lots of news which is all pointing up

AIMO / DYOR

TNT Mines: TIN.AXWatch 20c level

Trading above 21ema

Wait to see if volume will pickup upon the break of 20c

Tin Foil Hat Time BabyWhats up Traders -

If you're waking up today and starting to get worried about the near term United States Economy .... welcome to the party.

Oil Prices are in Shambles and we're heading into a recession which will command significantly reduced Oil Demand

Gold is falling from the sky (no not literally)

The FED has lowered interest rates to zero

The FED has recently fired hundreds and hundreds of Billions at the Economy to keep it liquid - and more will be needed

Equities have fallen 30%

Monetary Policy across the globe is failing (DYOR)

What I think We should Reasonably Expect:

Unemployment to increase in the ensuing months.

Inflation was beginning to show itself naturally. Reduced Rates (post / virus panic) will only exacerbate this.

A quick and healthy Economic Recession as (likely) our best outcome.

People will begin to default on debt. Extent to be determined. Students will begin to default on student debt at increased rates.

Universities that have popped up across the country will begin to bankrupt as students run screaming away from the overpriced education system.

Corporations will begin to default on debt as we enter recession

If you dont think massive increases in Personal and Corporate Debt (relative to GDP) was a cause for the Roaring 10's .... yes the Roaring 10's .. not to be confused with the Roaring 20's bull market....Do you at least agree that it was a cause for the 1920's?

The Preferred Platitude, often for me, ' History Doesn't Repeat Itself, but it often rhymes' - Twain

I fear and plan for the worst...which the picture Im painting certainly is... I'm not predicting a depression, or WW3. . . . Im just saying, the ground on which we stand is familiar, it is shaky . . .. and we must proceed with extreme caution.

The 1930's gave birth to Extremist / Nationalist Politics.

Do you think that may be a condition of our 2020's?

Are we already seeing that with Donald Trump, the Death of the 'Establishment' and the rise in popularity of candidates like Bernie Sanders?

Do Millennials Trust in a 'Free' Market that has capsized 3 x in 20 years?

If they do, how quickly and readily does that happen?

-Nixxx

Sources:

houseofdebt.org

www.quora.com

seekingalpha.com

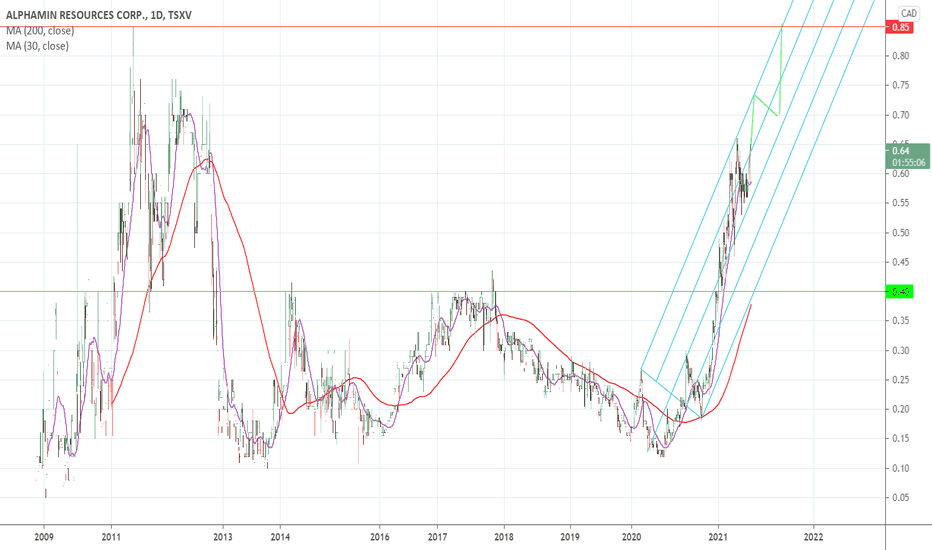

Tinka Resources finally waking up Tinka Resources a Canadian Company that is a South American Based Zinc and Tin explorer in South America is coming out of a 8 month Descending Triangle with increasing volume. This stock likes to Fill Gaps...I already have a position, but if you're looking for an entry, I'd place a bid in around the .65 mark in the event it attempts to fill the gap it made during the break out. First major resistance point is .78 cents which offers a pretty good Risk/Reward.