TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

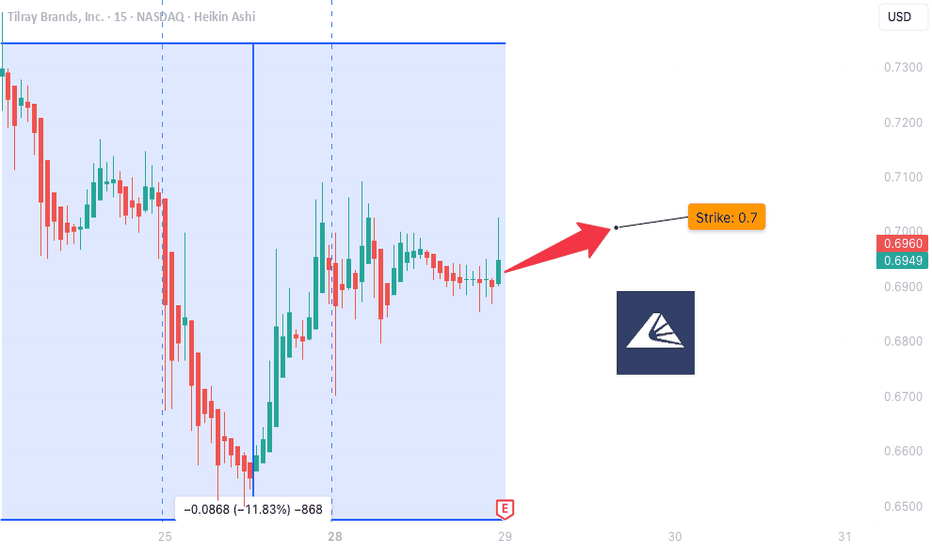

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

Tlrypump

Tilray Brands Reports Weak Q3 Fiscal 2024 Financial ResultsTilray Brands, Inc., ( NASDAQ:TLRY ) a leading global cannabis-lifestyle and consumer packaged goods company, recently released its financial results for the third quarter of fiscal year 2024. Despite facing a challenging market environment, the company showcased resilience and growth across various segments, demonstrating its strategic positioning in the evolving cannabis industry.

Steady Revenue Growth Amidst Market Volatility:

Despite market volatility, Tilray Brands ( NASDAQ:TLRY ) reported a remarkable 30% increase in net revenue compared to the prior year quarter, reaching $188 million. This growth was primarily driven by a robust performance in beverage-alcohol and global cannabis segments, reflecting the company's agility in capitalizing on emerging market trends.

Diversification Strategy Pays Off:

Tilray's strategic expansion into complementary markets such as beverages and wellness foods has proven fruitful. The company's beverage-alcohol net revenue surged by an impressive 165%, cementing its position as the 5th largest craft beer brewer in the U.S. Furthermore, its wellness segment witnessed a notable 12% increase in net revenue, highlighting the success of targeted advertising campaigns and continuous innovation efforts.

Global Cannabis Leadership and Market Penetration:

In the global cannabis arena, Tilray Brands ( NASDAQ:TLRY ) solidified its leadership position with a 33% increase in net revenue, driven by significant growth in international markets such as Canada and Germany. With the #1 market share in both countries, Tilray ( NASDAQ:TLRY ) is well-positioned to capitalize on the expanding medicinal and adult-use cannabis markets, showcasing its prowess in navigating complex regulatory landscapes.

Strategic Focus on Financial Stability and Debt Reduction:

The company's focus on financial stability was evident, with a strong liquidity position of approximately $226 million, comprising cash and marketable securities. Notably, Tilray ( NASDAQ:TLRY ) reduced its outstanding convertible debt by $50.7 million compared to the previous quarter, demonstrating prudent financial management amidst economic uncertainties.

CEO Perspective:

Irwin D. Simon, Tilray Brands' Chairman and CEO, emphasized the company's dynamic and diversified portfolio, spanning cannabis, beverages, and wellness products. He underscored Tilray's strategic achievements during the quarter, including revenue growth, debt reduction, and operational synergies. Simon's vision for Tilray as a global leader in the cannabis-lifestyle and consumer products industry highlights the company's commitment to innovation and market leadership.

Conclusion:

Tilray Brands, Inc.'s ( NASDAQ:TLRY ) robust performance in the third quarter of fiscal year 2024 underscores its resilience and strategic foresight amidst market challenges. With steady revenue growth, a diversified product portfolio, and a strong focus on financial stability, Tilray remains poised to capitalize on emerging growth opportunities in the evolving cannabis industry. As the company continues to innovate and expand its market presence, investors can look forward to sustained value creation and long-term growth potential.

Technical Outlook

Tilray Brand ( NASDAQ:TLRY ) stock is down by 20% trading at $2.07 Tuesday Trading session. NASDAQ:TLRY has a weak Relative Strength Index (RSI) of 46.78. The Yearly price chart shows a bearish Harami despite Robust Q3 Fiscal 2024 Financial Results.

Tilray at support? Tilray

Short Term

We look to Buy at 3.18 (stop at 2.94)

We look to buy dips. There is scope for mild selling at the open but losses should be limited. A higher correction is expected. Expect trading to remain mixed and volatile. Previous support located at 3.120.

Our profit targets will be 3.74 and 3.99

Resistance: 3.75 / 4.00 / 5.15

Support: 3.20 / 3.00 / 2.50

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Tilray fighting back? Tilray

Short Term

We look to Buy at 3.09 (stop at 2.91)

We look to buy dips. Trading volume is increasing. There is scope for mild selling at the open but losses should be limited. Expect trading to remain mixed and volatile. Previous support located at 3.10.

Our profit targets will be 3.72 and 3.99

Resistance: 3.72 / 4.00 / 5.15

Support: 3.10 / 3.00 / 2.50

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Tilray HUGE VolumeTilray - Short Term - We look to Buy at 7.44 (stop at 6.71)

We look to buy dips. Trading volume is increasing. Previous resistance at 7.20 now becomes support. Last week Marabuzo is located at 8.56. Traded to the highest level in 70 weeks.

Our profit targets will be 9.82 and 10.30

Resistance: 10.00 / 13.50 / 22.00

Support: 7.20 / 5.00 / 2.50

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Weed stocksTLRY, CGC, SNDL, ACB

So far this year looks like the weed stocks have found a temporary bottom. Most are curling off the bottom. TLRY has lots of resistance above but last few days has been pushing with increasing volume. Just keep an eye on them if they really start squeezing. Most likely will be looking at some calls this week to see if we can get some follow through. Of course it has been in a nice downtrend overall for over a year but I do like what I have seen last few days.

$TLRY is looking for a Pump!$TLRY is looking like it is getting ready for another pump once it breaks out of current trend.

My points being....

1. Strong Bullish RSI Divergence

2. The Old Supply area is acting as a New Demand level as seen with the red arrows

3. TLRY is creating a Falling Wedge Pattern which is known for being a bullish continuation pattern

4. The ATR is in an uptrend which means TLRY is gaining volatility. This is very important for breaking this wedge pattern.

My key resistance levels are listed.

Trade at your own risk and always buy/sell after a clear breakout and/or retest of the old trend!

Trade safe!

$TLRY : Yes, I stepped over a rattlesnake buying it @$44-32.7 :(This is my approach after today´s $TLRY sell off or should I say, tsunami?

I projected a possible long term trendline from before the "pump" and it took me to... about current price.

I also see a possible channel following "more or less" such trend, and it takes me to exactly the current place, in a $31-37 "ish" zone.

Presently clueless as to where it is headed, just describing the present situation.

Comments welcome and encouraged.

And yes, I bought several times today, under the wrong idea that 20,30% falling was enough. No, it was NOT enough.

I made several purchases between $44 and 32.75, ending up with a $39.54 average cost per share.

Not proud about it.

Go ahead. Tell me.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further accelerated its price incline with a momentous gain of +50.91%, closing at $63.91. The total gain achieved by $TLRY for 2021 stands at +684.04%, marking it as one of the biggest winner in NASDAQ for 2021 till date.

The current price volatility of $TLRY has spiked to a level that was last seen in 2019, but remains a far cry from last 36 months peak average volatility which is 86% away. Substantial purchase order was observed at intraday support at $47.83 – $51.92 at 23.43pm till 23.59pm (GMT+8). Further institutional accumulation is also observed at $58.50 – $60.22 at 03.25am – 03.33am (GM+8).

This implied volatility contraction will not be witnessed until a break of price short term price support at $46.50.

US Stock In Play: $TLRY (Tilray Inc)$TLRY broke out of its Bullish Flag pattern with a remarkable day gain of +40.74%, closing at $42.35. $TLRY extended volatility was earlier highlighted 4 hours before the US pre-market opening session yesterday. The total gain achieved by $TLRY for 2021 stands at +298.45%.

At the current junction, substantial buying pressure remains in force with no signs of price exhaustion. Average price volatility of $TLRY have further inched to a range of $3.50/day with continuous volatility expected on TLRY in this month of February. The first major resistance to watch for a test on $TLRY is at $46, last traded in August 2019.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further extended its astounding rally with a day gain of +16.99%, closing at $30.09. The total gain achieved by $TLRY for 2021 stands at +247.56%, a further upward trajectory of +70% since it was last highlighted 6 days ago.

At the current junction, substantial buying pressure remains in force with no signs of price exhaustion. Average price volatility of $TLRY have further inched to a range of 8.8%/day with continuous volatility expected on TLRY in this month of February.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further extends its 2021 vast rally with a day gain of +22.98%, closing at $23.49. $TLRY engages in the research, cultivation, processing, and distribution of medical cannabis. The total gain achieved by $TLRY for 2021 stands at +179.64%.

The first accumulation signal of $TLRY coincides with a higher opening at premarket which broken out of its 5-weeks Symmetrical Triangle chart pattern on 16th December 2020. It was noted that substantial buying pressure kicked off the run up on 6th January 2021.

At the current junction, average price volatility of $TLRY ranged within 8%/day with continuous volatility expected on TLRY bi-directionally.

$tlry updated chart Great setup here on $tlry with a beautiful inverse head and shoulders with my .618 retracement level acting as the neckline. We also have a sneaky pitchfork drawn in here with price reacting to the median which is known to have major price action confluence.

A close below 18.05 would invalidate this setup

Other notes:

-The blue trend line is drawn from the same point as the pitchfork

-Watch MACD for a bounce or cross on the hourly time frame

TLRY Tilray Fibonacci Retracement completedTILRAY is also following the cannabis rally, even though the fundamentals aren`t there:

891.954M MARKET CAP and Net Income (FY) -321.169M. :)

So be careful with this one. It`s not life VFF (by the way, a great stock).

Tilray engages in the research, cultivation, production, and distribution of medical cannabis and cannabinoids.

If you are interested to test some amazing BUY and SELL INDICATORS, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

And we have BLASTOFF on $TLRY!!!! Where to add...Following our pattern to a T! With the results of the Presidential Election eyes to turn cannabis stocks as potential moves in the Federal guidelines for schedule 1 drugs might change. A buy the rumor type event IMO. Welllllllllll, if you bought the pullback like we suggested you got your money's worth. Pattern called for a nice dip between 5.17 and 5.71 (actual lowest level was 5.29) and then it really took off. High Friday was 12.04 and the a pullback. We think this finished it's wave 3, now in wave 4 and a wave 5 to follow (shown on chart). Wave 4 target ideally is at 8.01, invalidates at red line 7.24. If very bullish can continue extending up or have a shallower retrace. Wave I of 3 should end between 13.79 to 16.56, again typical targets but can extend.