TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

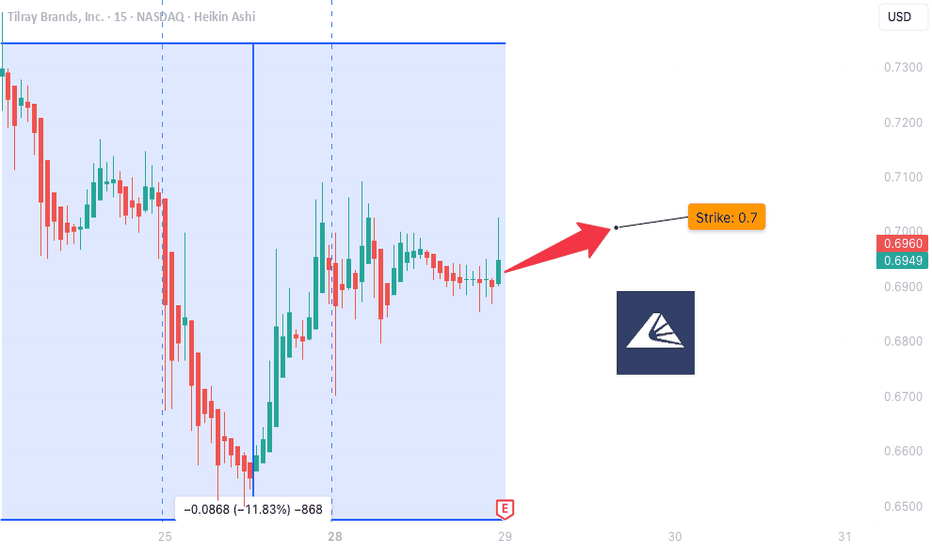

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

Tlrysetup

No rest for Tilray?Tilray

Short Term - We look to Sell at 5.33 (stop at 5.87)

Our outlook is bullish. A mild correction has been posted from yesterdays high, this is seen as a retest of the breakout level. The hourly chart technicals suggests further upside before the downtrend returns. The bias is still for lower levels and we look for any gains to be limited.

Our profit targets will be 3.92 and 3.18

Resistance: 5.50 / 8.50 / 15.00

Support: 4.00 / 3.00 / 2.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Tilray HUGE VolumeTilray - Short Term - We look to Buy at 7.44 (stop at 6.71)

We look to buy dips. Trading volume is increasing. Previous resistance at 7.20 now becomes support. Last week Marabuzo is located at 8.56. Traded to the highest level in 70 weeks.

Our profit targets will be 9.82 and 10.30

Resistance: 10.00 / 13.50 / 22.00

Support: 7.20 / 5.00 / 2.50

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

$TLRY is looking for a Pump!$TLRY is looking like it is getting ready for another pump once it breaks out of current trend.

My points being....

1. Strong Bullish RSI Divergence

2. The Old Supply area is acting as a New Demand level as seen with the red arrows

3. TLRY is creating a Falling Wedge Pattern which is known for being a bullish continuation pattern

4. The ATR is in an uptrend which means TLRY is gaining volatility. This is very important for breaking this wedge pattern.

My key resistance levels are listed.

Trade at your own risk and always buy/sell after a clear breakout and/or retest of the old trend!

Trade safe!

Tilray (TLRY) - Weekly chart - Long scenario Looking to buy some Tilray if following should happen:

1. Price goes above the Resistance (orange line)

2. Price should create a higher close than last swing (blue line)

Would buy then on a retest of the yellow trendline.

Target: A weekly supply level also close to 50% Fib level.

Taking out that High (red line) would be interesting from a liquidity aspect.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further accelerated its price incline with a momentous gain of +50.91%, closing at $63.91. The total gain achieved by $TLRY for 2021 stands at +684.04%, marking it as one of the biggest winner in NASDAQ for 2021 till date.

The current price volatility of $TLRY has spiked to a level that was last seen in 2019, but remains a far cry from last 36 months peak average volatility which is 86% away. Substantial purchase order was observed at intraday support at $47.83 – $51.92 at 23.43pm till 23.59pm (GMT+8). Further institutional accumulation is also observed at $58.50 – $60.22 at 03.25am – 03.33am (GM+8).

This implied volatility contraction will not be witnessed until a break of price short term price support at $46.50.

US Stock In Play: $TLRY (Tilray Inc)$TLRY broke out of its Bullish Flag pattern with a remarkable day gain of +40.74%, closing at $42.35. $TLRY extended volatility was earlier highlighted 4 hours before the US pre-market opening session yesterday. The total gain achieved by $TLRY for 2021 stands at +298.45%.

At the current junction, substantial buying pressure remains in force with no signs of price exhaustion. Average price volatility of $TLRY have further inched to a range of $3.50/day with continuous volatility expected on TLRY in this month of February. The first major resistance to watch for a test on $TLRY is at $46, last traded in August 2019.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further extended its astounding rally with a day gain of +16.99%, closing at $30.09. The total gain achieved by $TLRY for 2021 stands at +247.56%, a further upward trajectory of +70% since it was last highlighted 6 days ago.

At the current junction, substantial buying pressure remains in force with no signs of price exhaustion. Average price volatility of $TLRY have further inched to a range of 8.8%/day with continuous volatility expected on TLRY in this month of February.

US Stock In Play: $TLRY (Tilray Inc)$TLRY further extends its 2021 vast rally with a day gain of +22.98%, closing at $23.49. $TLRY engages in the research, cultivation, processing, and distribution of medical cannabis. The total gain achieved by $TLRY for 2021 stands at +179.64%.

The first accumulation signal of $TLRY coincides with a higher opening at premarket which broken out of its 5-weeks Symmetrical Triangle chart pattern on 16th December 2020. It was noted that substantial buying pressure kicked off the run up on 6th January 2021.

At the current junction, average price volatility of $TLRY ranged within 8%/day with continuous volatility expected on TLRY bi-directionally.

TLRY Tilray Fibonacci Retracement completedTILRAY is also following the cannabis rally, even though the fundamentals aren`t there:

891.954M MARKET CAP and Net Income (FY) -321.169M. :)

So be careful with this one. It`s not life VFF (by the way, a great stock).

Tilray engages in the research, cultivation, production, and distribution of medical cannabis and cannabinoids.

If you are interested to test some amazing BUY and SELL INDICATORS, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

TLRY coming down, buying opportunityTLRY shoots up on election results, then gets a positive earnings report (they made money instead of losing!). As per our pattern, it is holding. Our wave 3 extended to 12.14 and now looks like it's in its wave 4, opportunity to add. 7.11 invalidates the pattern, so eyes on that level. Also looking for RSI to curl up and respect our line.

TLRY WEEKLYStanding at a breaking point which is also a heavy supply zone from the March lows. Volumes are accumulating since Thursday. Expect stock trading at 10-10.5 level for couple days next week. Let the volumes accumulate, successful in doing so TLRY is easily getting to 16 within next week. Breaking 10.5 resistance is a must!

[TLRY] Boxed in w/ Nowhere to Go but Down, Load Up Pre EarningsBest case scenario TLRY bounces between $7 and $10 until earnings. I think it'll crack below the support there along with overall market weakness and tumble back down, who knows how low, really doubt it'll retest lows ($2.5 is a crazy steal) but anything under $7 really is a great value buy here especially after what ACB just demonstrated but if you're stingy like me you're probably aiming to buy in the $4-$5 range.

The industry gravity seems to be having an especially depressing effect on TLRY (aside from the overall climbing support line). Even as ACB soared and CGC, OGI, APHA and hell even the black sheep of the industry, SNDL and HEXO, made double digit gains, TLRY stayed mostly put.

Everything now reverting to mean because industry gravity is too high, that's only going to pull TLRY lower.

Eventually that gravity will dissipate and all these companies will soar, just a matter if that happens this earnings or next, but will happen.