TLT

$TLT Target Remains 157-158I'm not convinced that $TLT has given up the ghost. Looking at weekly close only TLT remains in rising channel from June '18. Support still holding.

I still think this goes to 157-158. Bull case fails below 134 imo. (FYI - Using secondary highs/lows for Fib extension)

Thoughts?

SHY-1 to 3 year Treasury ETF-Trendline breakdown Forming H&S TopTreasury yields have been rising over the past two months, with 2-10 treasury yield spread reaching 29 bps on 12/20/2019, highest level since June 2019.

The 1 to 3 year Treasury ETF - SHY broke below the June-November 2019 trendline last week, forming a head-and-shoulder top. Based on the project, the treasury bond ETF prices could target 83.95 area, retracing 50% of the 82.85 (November 2018 low) and 85.12 (August 2019 peak) swing in the next few months.

Happy Trading!

SHY-1 to 3 year Treasury ETF forming H&S top Treasury yields have been rising over the past two months, with 2-10 treasury yield spread reaching 29 bps on 12/20/2019, highest level since June 2019.

The 1 to 3 year Treasury ETF - SHY broke below the June-November 2019 trendline last week, forming a head-and-shoulder top. Based on the project, the treasury bond ETF prices could target 83.95 area, retracing 50% of the 82.85 (November 2018 low) and 85.12 (August 2019 peak) swing in the next few months.

Happy Trading!

S&P Next Week Expected Move ($27.5)Melting up. Next week shaping up to be a fairly boring neutral holiday week.

Goodluck Next Week

- RH

Recent Charts Worth Watching:

Unemployment Rate:

Bitcoin:

EM relative strength:

Value > Growth:

SKEW:

Bonds:

REPO:

VIX + VVIX:

VIX vs. VIX3M:

Industrial Production:

www.tradingview.com

Homebuilders:

Regional Banks:

China:

Emerging Markets:

EXCELLENT Risk to Reward TLT TradeAs described within the chart, there is an excellent opportunity here with going long TLT (20 year bond etf)... Oil took a small turn down today (still expecting sub $50) and could be seen as an indicator of further downwards price action for risk on assets... Equities continue to grind higher with little news propelling it forward... Gold is also looking towards completing a 5th wave higher with TLT... Stop loss is indicated in red and target is indicated in green...

Thanks for checking out my idea!

Please leave a LIKE and FOLLOW!

I encourage comments and constructive criticisms!

TNX 10-Year Yield + Repo Problems + Bonds Extreme LeverageWhen plumbing works well, you don’t need to think about it. That’s usually the case with a vital but obscure part of the financial system known as the repo market.

Bank of International Settlements has been reporting some very interesting documents connecting overleverage by MULTIPLE hedge funds (potentially even my hero Ray at Bridgewater) in the overnight repo market (making a percentage by loaning it out) which is having ripple effects in the TNX, and Bond market - Forcing the Fed to supply liquidity directly from its balance sheet. But the plumbing (Repo=Liquidity) got blown out, and the Fed is plugging the hole with QE.

The about-face interest rate policy from the Fed put significant stress on the overleveraged market.

The Bank of International Settlements is just doing routine reports, I think they don't want to be caught up in it.

Feels crazy, but I think the TNX might fall further.

Stocks and Bonds correlations appear to be absent.

SPX500 future for coming weeks Long story short. New highs incoming.

I went long today before VIX loses its mind from the good ole "EVERYTHINGS GANA CRASH" people and premiums on calls/puts go wild.

---Indicators:

RSI is trending up. not over bought yet.

Gold sold off hard today. Still down trending off a massive weekly resistance

TLT had money go into it and its rise got smacked back down to almost even with its weekly open

emerging markets had a great week - always good

vix is vix - My assumption is we see volatility go crazy as we swing around the monthly resistance. Then it will die down until election time.

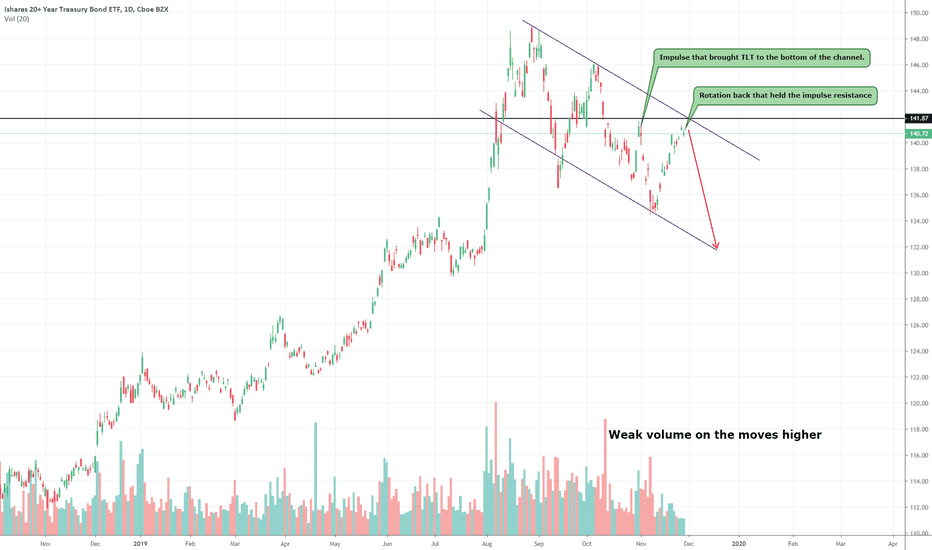

TLT weakness & bond weakness, TLT down to $132TLT is a 20+ year bond ETF that made strong highs throughout the rate-cutting cycle and rightfully so. The inversion of bonds vs the equity market has caused bond yields to drop and because of that since the price of bonds is directly inversely correlated to their yields, prices in TLT and other bonds have been increasing. The low rates have come to a halt as the rate-cutting cycle has stopped, or so we think it has. TLT has since then entered a downtrend in a channel and looks to be continuing in that respect. Bond yields are so low, that the convergence with the SPX is imminent, we've seen a slow increase in yields which will further push the price of TLT down. Another factor is that the equity market is continuously showing strength and looks to be on the rise for the next few months based on FED policy to pump more money into the economy. The volume on TLTto the upside has decreased as well and every swing lower is accompanied by strong volume.

Disclaimer: This idea is for educational purposes only, this does not constitute investment advice. TRADEPRO Academy is not liable for any market activity based on this idea.

Treasuries are about to see a great rally hereThe squeeze in Treasuries is coming soon. Right now, it's just getting started and testing the break. The narrative of deflation has picked up steam strongly in the past 2 months with oil now clobbered, Powell going dovish (today), stocks down, and many many other reasons.

TLT LongTLT has pulled back to a very key trend line with additonal supports coming in below. On the hourly chart, we have positive divergence on TLT meaning we should see upside soon in the short term. Given the postures of the markets and how treasuries act as a flight to safety asset, it is reasonable to assume they will go up in price as stocks fall.

For this trade, I advise picking up TMF (x3 leverage) with a stop anywhere from 28.00 to 26.60. I also recommend scaling into the position with 2 or 3 batches comprising your total allocation that you are willing to invest.