TLT - 20+Year Treasury Bond ETF s/r zonesHello traders,

Description of the analysis:

Strong s/r zones. If the first support will be broken, it should mean support for shares. The VIX index, as the main indicator of panic in the markets, is also slowly beginning to gradually return to its normal values. Market ties that were valid yesterday may not be valid tomorrow, so invest and trade wisely and carefully.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

Tltshort

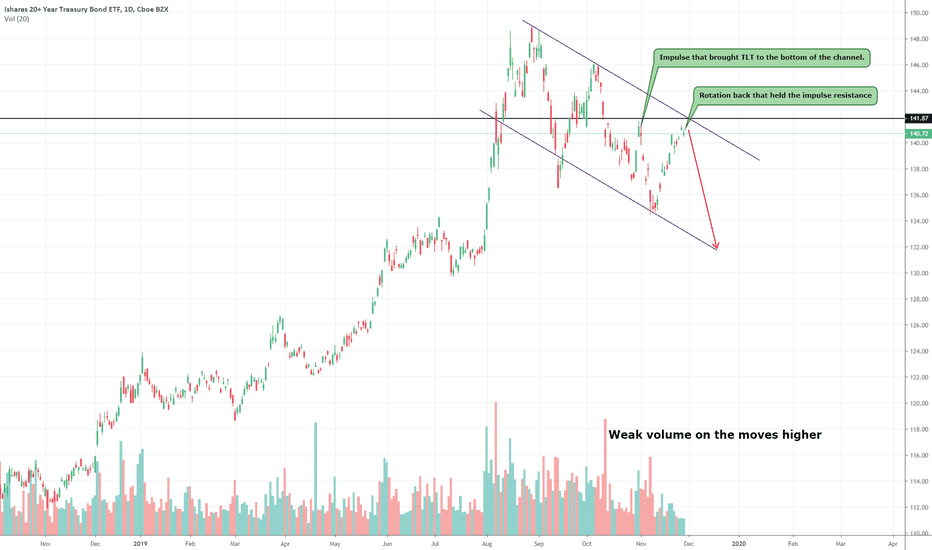

TLT weakness & bond weakness, TLT down to $132TLT is a 20+ year bond ETF that made strong highs throughout the rate-cutting cycle and rightfully so. The inversion of bonds vs the equity market has caused bond yields to drop and because of that since the price of bonds is directly inversely correlated to their yields, prices in TLT and other bonds have been increasing. The low rates have come to a halt as the rate-cutting cycle has stopped, or so we think it has. TLT has since then entered a downtrend in a channel and looks to be continuing in that respect. Bond yields are so low, that the convergence with the SPX is imminent, we've seen a slow increase in yields which will further push the price of TLT down. Another factor is that the equity market is continuously showing strength and looks to be on the rise for the next few months based on FED policy to pump more money into the economy. The volume on TLTto the upside has decreased as well and every swing lower is accompanied by strong volume.

Disclaimer: This idea is for educational purposes only, this does not constitute investment advice. TRADEPRO Academy is not liable for any market activity based on this idea.

TLT - 9.43 R:R ShortEvening traders, been a while since I shared my thoughts.

I'm looking to enter short on TLT, as it's approaching historic over-extension.

Let's dive in at the key points:

1) It's gapped up and will likely close outside the BB, should lead to down movement next week.

2) Short term squeeze has begun to trigger, this week is likely the top.

3) RSI is overbought and approaching historic levels.

4) Stoch is overbought

5) Percentage volume oscillator shows trend strength is reducing.

6) We have bearish divergence on money flow.

A re-trace towards mid bb band / .5 is likely in order, if the weekly 5 EMA is supported I will exit the trade as there would be another leg up in store. This should coincide with one more up for the markets.

From a fundamental point, after inversion I believe market continues for 7 months upward, yes, I know, this time is different. Rates are low, fed doesn't have much ammo, corporate debt is outta control, I know, I know. The chart doesn't lie though, I think we will have one more up in the markets before the big collapse, and it just so happens I believe bonds are topping temporarily now as well.

As always, hit that like and follow button and let me know your opinion!

Short TLT - Attractive OpportunityWith US rates rising significantly in the past couple of months - how should a trader play this

Being structurally short $TLT offers significant upside with a Put Butterfly Spread

We have outlined trade which can be accessed on profile however a summary is provided

2 Month Put Skew is 3.62 standard Deviations above its 1 year mean

2 Month Volatility is 1.58 standard deviations above its 1 year mean

TLT (Long US Treasury Bonds) is very vulnerable due to above trend growth, increasing budget deficits, the potential for a return of inflation and Fed Tapering

Interested in all thoughts & analysis on our idea.

SHORTING US GOVT BONDSLet me warn you now, this is not a fundamental or technical analysis based trade. This is a speculation on my behalf based on a simple theory.

As the US Federal Reserve continues to rise interest rates up to 3x this year, is it time that a true bear market in fixed income has come to fruition? Are the "safe" government bonds becoming one of the worst asset classes to be in? I would say it is up there, with the exception of tech and anything blockchain.

It takes some basic algebra to figure out if bond prices will go up or down based on interest rate increases or decreases the PRESENT VALUE (Price) of the bond. In short, interest rates rise and prices fall, interest rates decrease prices increases. For most bonds, depending on default risk, upon maturity you are paid the face value. You have security in your principle if you can afford to wait. Another interesting component is that the longer the yield to maturity of the bond, the more sensitive to rises and falls in interest rates.

So with some Bonds 101 behind us, let me give you the trade. I propose that based on the projection that if interest rates rise three times this year as forecasted by the market, long term bond prices will decline in the short term (1-2 years), so I propose that, given the sentiment in the expectation of further increases in interest rates we short #TLT, a 20+ Year Govt Bond ETF sponsored by iShares.

Some things to be wary of:

If equity markets continue to fall, say to 20% down from highs, this could cause the federal reserve to STOP increasing rates. (speculation on my behalf)

As well, if the markets do fall and firms start to go under (smaller scale 2008), don't be suprised if they start to bail firms out, look at how rich it made the government after 2008...

Dodd Frank requires banks to be able to withstand up to 10% unemployment, $383 Billion in loan losses, as well as " heightened stress in corporate loan markets and commercial real estate." A fianancial collapse is probably not out of the question, but I'm saying that if any of the above scenarios start to play out, this trade would be out the window.

So yeah, bold bet for sure, but might be something to think about. Please, tell me where you think I could be wrong.