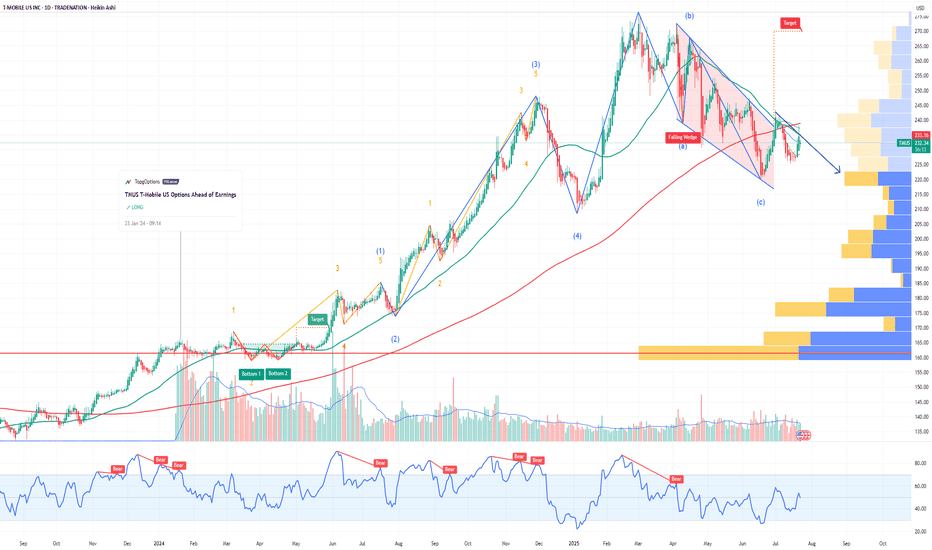

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the rally:

Now analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 227.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Tmobile

T-MOBILE No signs of stopping this rally before $350.T-Mobile (TMUS) has been trading within a 12-year Channel Up since the October 2012 High. Since the weekly break-out on the May 20 2013 1W candle, the 1W MA200 (orange trend-line) has been the absolute Support of this pattern, never broken, offering the most optimal buy opportunities as close to is as possible every time the price broke below the 1W MA50 (blue trend-line).

The 1W RSI indicates that we are in a similar stage of the uptrend as the two mega Bullish Legs the preceded it. The Sine Waves accurately catch the tops (Higher Highs) of this Channel Up pattern, and the next one should be around $350 by the end of 2025. A really good opportunity to buy even on the current levels.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Possible qhale loading zone??Added a fat stack.

Watched some good volume come in and was part of it.

Also watched a video on FB showing that for $60 currently you can buy what took them months to mine.

If this thing is ready to POP we will know soon.

Mining rewards are diminishing and the price is a normal Alt coin bear market low. I think we see new highsand not too long away.

These type of plays are my favorite. Has more utility than DOGE(whales are dumping currently IMO) ever has had.

NOTHING I EVER SAY IS FINANCIAL ADVICE!!!

Verizon ($VZ) Earns $100M Contract With The State of MichiganT-Mobile and Verizon Communications ( NYSE:VZ ) are in talks to buy parts of United States Cellular for over $2 billion, according to the Wall Street Journal. Shares of the regional wireless carrier jumped 8.6% to $39.08. T-Mobile is close on a deal to buy a chunk of U.S. Cellular for more than $2 billion, taking over some operations and wireless spectrum licenses. Verizon's talks with the regional carrier are expected to take longer and might not result in an agreement.

In another significant development, Verizon ( NYSE:VZ ) Public Sector has been awarded a $100 million contract by the State of Michigan. This agreement allows state agencies and affiliated entities access to Verizon's award-winning network and a suite of communications solutions designed to help serve the state's more than 10 million residents. The contract also allows eligible Michigan cities, townships, villages, counties, school districts, universities, colleges, and nonprofit hospitals to take advantage of available Verizon services through MiDeal, the State of Michigan’s extended purchasing program.

The new contract, effective through August 11, 2028, is renewable for up to five additional option years and includes access to devices and services including Fixed Wireless Access (FWA), 5G Ultra Wideband (UW) connectivity, special plan pricing, and Verizon Frontline, the advanced network and technology built for first responders. Verizon Communications Inc., one of the world's leading providers of technology and communications services, generated revenues of $134.0 billion in 2023.

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the previous earnings:

Then analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 155usd strike price Puts with

an expiration date of 2024-11-15,

for a premium of approximately $4.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

T-Mobile US: Almost done 👀T-Mobile US in our dark green Target Zone, which extends between $161.69 and $168.80 on the chart. We assume that a bearish trend reversal will soon set in here and that the stock will then initially fall below the support level of $154.38. Primarily, we give the current wave (B) some room to make a new high in our Zone. The probability of our alternative scenario, which envisages an already deposited high with the wave alt(B), is 35%.

Tech-Media Stocks: Macro Fib SchematicsThese Tech Media/Entertainment companies are among the biggest and most influential. Their Fib Schematics are somewhat similar but a few are unique. Twitter is newer than the rest so it takes up less room. We may see Twitter keep this support and continue onto its new schematics.

As for every single chart, we can see the monthly candles respecting these s/r lines. One must not need me to tell them which way we are suppose to go, rather they must look deep inside the chart and understand weather it is on support, on resistance, or pushing away from one of them. We can see this in ever single one.

Unfortunately, this is a 2 month chart but it still definitely works! 100 percent will still work no matter the timeframe. Its just that the structure gets more defined the lower the timeframe.

Front runs, rejections, and clear supports can be spotted here.

For me, AT&T looks like a buy because of multiple frontuns above. T-Mobile looks like a buy to resistance and then short sell. The others are too complex to put into mere words.

T-Mobile: Already reached the summit? ⛰️The share price of T-Mobile has come very close to our dark green Target Zone (coordinates: $161.69 - $168.80) in the past weeks, but has turned around underneath it. In the context of an alternative count, it is now 35% likely that we have already seen the top with the wave alt.(B) in dark green, which would mean that we are now already seeing a sell-off to below the support at $142.84. Primarily, however, we assume that the course of the regular wave (B) in dark green will prevail and thus lead to the scheduled top in our Target Zone, which, by the way, potentially offers itself as a short opportunity.

T-MOBILE 1st Bullish Break-out signalT-Mobile US (TMUS) broke today above the Lower Highs trend-line of April, the long-term Resistance and will most likely close the first 1D candle above the 1D MA50 (blue trend-line) since August 16. This is the first bullish break-out signal of this pattern. The second will be if the price breaks above the 1D MA200 (orange trend-line) / 1W MA50 (red trend-line) which are trading on the exact same spot.

If we get a 1D candle close above them, we will buy the first break of Resistance 1 (142.85) and target 150.00, which will be a +14.33% rise from the bottom, same as the July 25 peak.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Alright !!! do you want to hit 13 now?Yes I do want to. Why not? I formed a nice u shaped. As long as I dont go down below 6, i am good with my goal. Don be jealous of my ride !!!

T-Mobile US: Answer the Call! 📞Slowly but surely, T-Mobile US is answering the call of our dark green target zone between $161.69 and $168.80, heading further upwards. To finally pick up the receiver and complete wave B in dark green, the share should develop a three part upwards movement consisting of waves a, b and c in magenta, which should carry it above the resistance at $154.38. However, there is a 33% chance that T-Mobile US could have already hung up wave alt.B in dark green and thus drop below the support at $124.92.

T-MOBILE hit the 1W MA100 after 7 months. Buy. T-Mobile (TMUS) has been trading within a long-term Channel Down pattern and yesterday started rebounding after hitting the 1W MA100 (red trend-line) for the first time since October 13 2022. That fractal is very similar with the current sequence. This is a buy call and with it we are targeting the 1D MA50 (blue trend-line) at 143.50.

Attention is needed as we are about to see the first 1D Death Cross since October 11 2021. As a result we will only turn bullish on T-Mobile again on the long-term if the price breaks above Resistance 1 (152.25).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trade Idea: TMUS (T-mobile) TMUS is looking very topping heavy on the larger term time frame.

This would align with our thesis that we believe communication and aspects of the tech market are going to see some capital rotation.

If this weekly topping formation is triggered in this chart we will have a high probability trade setup.

Knowing the trend to trade is key.

VPLM Bullish AF- STOCKTWITS STRONG BUY!!! TODASO!I have anchored the FIB from the breakout earlier his year and then included the wick at the top. I have Vwap anchored to weekly and it's nice how all these level have similar confluence. We have a pennant which is neutral but it's also a bull flag as well. The flag pole gives us the extrapolation for a target above. Fib levels, vwap and 200ema etc for lower targets. Not financial advice, DYOR.

From Stocktwits

History101

Yesterday 7:09 PM

$VPLM for all the new visitors to the VPLM board, welcome. I thought I'd re-post some info to get you up to speed (several posts below). Summary: VPLM has been defending its patents against multiple HUGE tech company infringers for 10+ years. Google, Samsung, Tmobile, Meta, Amazon, etc. VPLM has been winning over & over again, in court and at the patent board. It is the 9th inning now, with court dates set for this summer IN WACO TEXAS, a court (and jury) that supports patent property rights. The big boys are in a big bind, and we investors might have a decent shot at some real $$. Not investment advice, GLTA

From

investorshub.advfn.com

GreenBackClub

Re: None

Tuesday, January 24, 2023 7:01:49 PM

Post#

112387

of 113349

FOR ANYONE CLAIMING THAT VPLM HAS NOT DONE ANYTHING MEANINGFUL FOR THE COMPANY AND SHAREHOLDERS I OFFER THIS LIST OF ACCOMPLISHMENTS BY VPLM THUS FAR:

* Up-listed from OTC-PINK to OTCQB

* Removed the DTC Chill

* Conducted an annual financial audit to be in full SEC compliance and fully reporting.

* Conducted an initial damages analysis for RBR parent patent.

* Initiated 4 federal infringement lawsuits to enforce VPLM's IP rights against Verizon, Apple, AT&T, Twitter.

* Initiated 1 federal infringement lawsuit to enforce VPLM's IP rights against Amazon.

* Agreed to having all 5 cases venue transferred to Northern California and consolidated for pre-trial purposes.

* Defended and defeated 8 IPR petitions brought before the PTAB by Unified Patents, Apple and Verizon/ATT.

* Successfully defeated a motion, in part, for sanctions by Apple at the PTAB.

* Successfully defeated an Alice motion brought by Verizon & ATT.

* 27 total patents granted and issued as of February 2019 (21 U.S. Patents).

* Granted RBR patent in Europe without any opposition challenge within 9 month challenge period.

* successful efforts to recoup most of the 100 million shares from Richard Kipping et al

* Upgraded the Board of Directors to include new members with extensive experience in M&A.

* Brought on board new boutique NYC law firm (Kevin Malek) to go to battle against the big silicon defendants.

* Brought on board terrific superstar lawyer in luis Hudnell

- ceo malak returned many hundreds of millions of shares back to the treasury to reduce the outstanding share count (to the benefit of shareholders)

And more recently…….

***Patents have been validated***

***Initial damages analysis done***

***Defeated 12 more IPRS (20 total)**

***IPRs have been appealed and upheld unanimously***

***No patents have been invalidated***

*** Current with all requisite filings***

***current with prosecuting patents and keeping both parent and child patents current***

***Reduction in OS count (thanks Emil!)***

***Some claims (@20) invalidated for RBR but could be overturned with a decision on Axle at the Supreme Court***

***NDCA is a very difficult court to win as it is defendant friendly. Waco is fair and plaintiff friendly***

***Foot in the door in WACO and now some defendants must remain in Waco (Amazon’s writ of mandamus denied!) and face a trial. Other defendants currently stayed in NDCA are tied to Waco results***

***Albright is a judge that is perceived as fair, by the books and fast which means vplm will be given a fair chance to argue / defend patents on the merits (all we could ask for)***

***99% of Albright's cases settle before trial. Albright encourages settlement ALL THE TIME. If defendants get to trial they have been given multiple chances to settle so they can’t expect Leniency from judge Albright***

***Defendants are NOT working together as a formal consolidated group. There is a disconnect - which plays into VPLM’s favor***

***Most big defendants will settle before providing source code when discovery is requested and required. Vplm is well into discovery phase so it is only a matter of when and not if source code will be demanded***

***Apple's own expert admitted in court in virnetx case - on the record - that they use relays to route their calls (imessage, facetime, etc.). This admission will come to bite the apple in the butt***

***Apple tried to file a patent when VPLM was updating their RBR child patent but they failed to do so before VPLM did. We were first to file at USPTO. Now why did they do this? --> because they wanted to get around infringing. Sorry apple, you lose again***

***60+ companies have received letters that notified them of possible infringement AND offered them the chance to take a license. This was years ago. Willful infringement equals treble damages!***

***Apple and others can be brought back into litigation as they were dismissed WITHOUT PREJUDICE***

T-Mobile about to drop some bars. TMUSWe are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

T Mobile Stock Analysis | Long term sell-off startedT Mobile Stock Analysis | Long-term sell-off started. T Mobile offers voice, messaging, and data services to 108.7 million customers in the postpaid, prepaid, and wholesale markets. The long-term sell-off started after reaching the strong supply imbalance located at $141. We could see T mobile stock price dropping to $63 and even more. Stock prices do not move in straight lines. We will probably see a few pullbacks in T Mobile stock price that will allow us to use bearish stock and stock options strategies to take advantage of this huge potential sell-off happening on T Mobile stock. The sell-off started at the beginning of September 2022.

$TMUS ER Breakout and bullish flowTMUS since FEB's gap up on earnings has been grinding higher, with a nice pop today after ER on good volume

Option flow is pretty bullish, especially leaps on the 160C JAN 24 and JUN 23.

Personally I'm hoping for a retest of the breakout zone where I will go long i.e. BRB - breakout retest bounce - with 145 and 151 zone upside targets.

Post ER and Post Fed meeting so less risk IMO but I'd give this idea some time to work targeting SEP opex or later.

Buy the dip

Cheers

TMUS: Looking to go higher?TMUS

Short Term - We look to Buy a break of 138.19 (stop at 133.78)

Trend line resistance is located at 137.50. A break of resistance at 137.50 should lead to a more aggressive move higher towards 150.00. Daily signals are bullish. Our bias remains bullish and further upside is expected to target resistance at 150.00.

Our profit targets will be 149.90 and 160.00

Resistance: 150.00 / 160.00 / 180.00

Support: 137.00 / 132.00 / 124.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

$TMUS now shortClosed TMUS calls up about 40% and flipped to the short side.

I heard Cramer was pumping this week, that alone should have been my signal,

but technically on the weekly it seems to have been rejected at 135 resistance and a volume uptick this week

Momo is also turning and seeing Bearish confluence in the MACD

First PT $123 with a possible move down to the 30MA (orange line) similar to FEB's price action