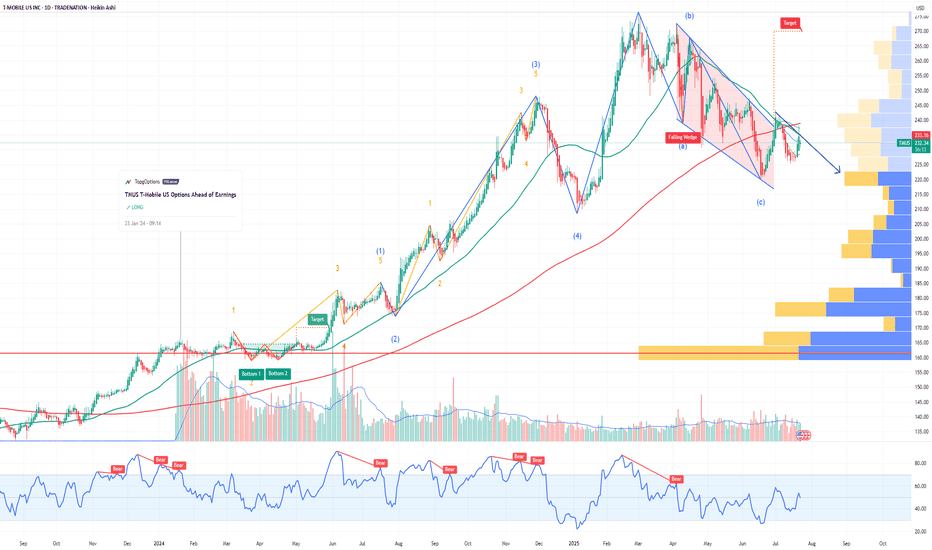

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the rally:

Now analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 227.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TMUS

T-Mobile US (TMUS) Long Daily 14/10/24Asset Class: Stocks

Income Type: Daily

Symbol: TMUS

Trade Type: Long

Trends:

Short Term: Up

Long Term: UP

Set-Up Parameters:

Entry: 211.71

Stop: 210.78

TP1 211.71 (1:1)

TP2 213.58 (2:1)

TP3 214.5 (3:1)

TP4 215.45 (4:1)

Trade idea:

1H fresh demand zone formed by a drop-base-rally at the breakout level, with a Fair Value Gap above and a 1:4 risk-reward ratio. The stock has been in an uptrend channel since September 23.

!!Be aware of pending Economic Reports. If price is within 20 pips of proximal value at time of major impact report, then Confirmation entry.

Trade management:

**When price hits 1:1 or T1, consider moving stop to entry in case of pullback.

**Disclaimer**:

The trading strategies, ideas, and information shared are for educational and informational purposes only. They do not constitute financial advice or a recommendation to buy or sell any securities, currencies, or financial instruments. You should do your own research or consult with a licensed financial advisor before making any trading decisions. The author assumes no responsibility for any losses incurred from following these trading ideas.

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the previous earnings:

Then analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 155usd strike price Puts with

an expiration date of 2024-11-15,

for a premium of approximately $4.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

T-Mobile US: Downhill ⛷️TMUS was able to pull out of its green Target Zone ($168.80 - $161.69) on the downside. As we consider the high of the green wave (B) to be already established, we now expect a pronounced sell-off to below the support at $154.38. Our 37% probable alternative scenario, on the other hand, calls for a slightly different development. If the Zone is overshot, it will lead to a higher high of the green wave alt.(B).

T-Mobile US: Almost done 👀T-Mobile US in our dark green Target Zone, which extends between $161.69 and $168.80 on the chart. We assume that a bearish trend reversal will soon set in here and that the stock will then initially fall below the support level of $154.38. Primarily, we give the current wave (B) some room to make a new high in our Zone. The probability of our alternative scenario, which envisages an already deposited high with the wave alt(B), is 35%.

Controlled Large Lot Selling Pattern: TMUSTelecom Industry stocks hit the wall of Market Saturation some time ago. NASDAQ:TMUS has a pattern that indicates a controlled selling mode of larger lots before the earnings report. There has been more volume to the downside and money is flowing out of the stock while the price action develops a narrow sideways range. Risk for a breakout to the downside is high.

T-Mobile US: Destination reached 📍✅In line with our expectations, the TMUS share has since risen further and in the process also reached our dark green Target Zone (coordinates: $161.69 - $168.80). Basically, we now expect a bearish trend reversal in that price range after the top of wave (B) in dark green. This top could already be imminent, but we have to concede that the price can rise even higher in our Zone to this end and utilise the entire price range accordingly. Once the high is in, however, it should go lower again.

T-Mobile's Strategic Moves Breed New Opportunities for Investors

In the fast-paced world of telecommunications, T-Mobile ( NASDAQ:TMUS ) stands out as a company making strategic moves that position it for significant growth in 2024 and beyond. Recent developments, including the acquisition of midband spectrum and a stock buyback from SoftBank, have removed overhangs on the stock, making it an appealing choice for investors seeking long-term opportunities in the evolving 5G landscape.

Midband Spectrum Acquisition:

T-Mobile's recent legislative win, securing additional midband spectrum through the 5G Spectrum Authority Licensing Enforcement (SALE) Act, has set the stage for the company to enhance its 5G network across rural areas, covering approximately 81 million people. The ability to deploy this spectrum quickly and efficiently gives T-Mobile a competitive edge, and CEO Mike Sievert's statement about activating the spectrum for 50 million people within two days underscores the company's readiness to capitalize on this strategic move.

Stock Buyback and SoftBank Resolution:

A significant development for T-Mobile occurred on December 22, 2023, as its stock registered a weighted volume average above $150 per share for 45 days, triggering a stock transfer worth around $7.6 billion to SoftBank. This transaction not only boosted SoftBank's internal rate of return on its Sprint investment but also removed a longstanding overhang on T-Mobile's stock. As a result, the share price surged, signaling positive momentum and renewed investor confidence.

Financial Strength and Market Performance:

T-Mobile's financial resilience and market performance further contribute to its attractiveness as an investment option. The company reported third-quarter earnings that exceeded analyst estimates, with wireless subscriber additions surpassing expectations. In 2023, T-Mobile outperformed the S&P 500, gaining nearly 21%, showcasing its ability to weather market fluctuations and deliver value to shareholders.

Strategic Initiatives and 5G Spectrum Edge:

T-Mobile's commitment to maintaining its 5G spectrum edge is evident in its proactive approach to securing additional spectrum. The company's purchase of 5G airwaves from Comcast further solidifies its position in the evolving 5G landscape, opening up new avenues for growth.

Positive Outlook and Future Prospects:

The positive outlook for T-Mobile revolves around factors such as Sprint merger synergies, robust free cash flow growth, and expectations for a substantial share buyback. With the removal of the SoftBank-related overhang, T-Mobile's stock is poised for further appreciation, offering investors an opportunity to participate in the company's continued success.

Conclusion:

T-Mobile's recent strategic moves, including the acquisition of midband spectrum and the resolution of the SoftBank-related stock transfer, have positioned the company for a promising future.

T-Mobile: Already reached the summit? ⛰️The share price of T-Mobile has come very close to our dark green Target Zone (coordinates: $161.69 - $168.80) in the past weeks, but has turned around underneath it. In the context of an alternative count, it is now 35% likely that we have already seen the top with the wave alt.(B) in dark green, which would mean that we are now already seeing a sell-off to below the support at $142.84. Primarily, however, we assume that the course of the regular wave (B) in dark green will prevail and thus lead to the scheduled top in our Target Zone, which, by the way, potentially offers itself as a short opportunity.

Looking Bearish on TMUS.

As you can see here we are sitting on a support line I drew on the 1 hour chart. We have formed a double top on the daily chart. I am looking to either gap below this level or breakthrough, retest and buy puts on the 15-minute chart with high volume. The bottom green demand zone would be my profit target.

20% ROI potential on TMUST-Mobile US Inc. (TMUS) presently breaking through key resistance.

A weekly settlement above this resistance would place (TMUS) into a buy-signal with potential gains of 5% - 10% over the next 1 - 2 months for short-term traders, and gains of 20% expected over the next 6 - 8 months for long-term investors.

Inversely, failing to close above this resistance level on a weekly basis keeps (TMUS) susceptible to falling back to key support.

T-MOBILE 1st Bullish Break-out signalT-Mobile US (TMUS) broke today above the Lower Highs trend-line of April, the long-term Resistance and will most likely close the first 1D candle above the 1D MA50 (blue trend-line) since August 16. This is the first bullish break-out signal of this pattern. The second will be if the price breaks above the 1D MA200 (orange trend-line) / 1W MA50 (red trend-line) which are trading on the exact same spot.

If we get a 1D candle close above them, we will buy the first break of Resistance 1 (142.85) and target 150.00, which will be a +14.33% rise from the bottom, same as the July 25 peak.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Can VZ reverse with earnings coming up?VZ on the 2H chart has been in a trend down since July 5 and the fall is accelerating

in the past three trading days. Earnings are a week away. The dual time frame RSI

indicator shows the weakness with RS in the oversold and undervalued zone while

the zero-lag MACD shows hard bearish momentum. Relative selling volumes are

about 3X the mean. Overall considering that price is now three standard deviations

below the mean anchored VWAPs set in March and April I believe that price is now

at or near the bottom. Accordingly I will watch for signs of a reversal on a 30-60

minute time frame from which to consider a long entry. the upcoming earnings

could increase volatility and potential profits if VZW can rally some trader interest.

T-Mobile US: Answer the Call! 📞Slowly but surely, T-Mobile US is answering the call of our dark green target zone between $161.69 and $168.80, heading further upwards. To finally pick up the receiver and complete wave B in dark green, the share should develop a three part upwards movement consisting of waves a, b and c in magenta, which should carry it above the resistance at $154.38. However, there is a 33% chance that T-Mobile US could have already hung up wave alt.B in dark green and thus drop below the support at $124.92.

T-MOBILE hit the 1W MA100 after 7 months. Buy. T-Mobile (TMUS) has been trading within a long-term Channel Down pattern and yesterday started rebounding after hitting the 1W MA100 (red trend-line) for the first time since October 13 2022. That fractal is very similar with the current sequence. This is a buy call and with it we are targeting the 1D MA50 (blue trend-line) at 143.50.

Attention is needed as we are about to see the first 1D Death Cross since October 11 2021. As a result we will only turn bullish on T-Mobile again on the long-term if the price breaks above Resistance 1 (152.25).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trade Idea: TMUS (T-mobile) TMUS is looking very topping heavy on the larger term time frame.

This would align with our thesis that we believe communication and aspects of the tech market are going to see some capital rotation.

If this weekly topping formation is triggered in this chart we will have a high probability trade setup.

Knowing the trend to trade is key.

TMUS Earnings WeekOn Wednesday, TMUS reports its quarterly earnings. The last earnings report saw a gap on the surprise earnings, but overall the price did not do much. TMUS's price has remained rangebound between the high and low of the previous earnings week. Looking at the earnings estimate, analysts are predicting an increase in earnings from the prior quarter and the same quarter last year, which could provide the catalyst needed to break out of this range.

TMUS managed to post steady gains over 2022 when the SP500 and the Communications Sector (XLC), the sector in which TMUS is a member, declined. This upward progress shows underlying fundamental strength. The price action leveling off this last quarter could mean a few different things. The response to this earnings report could show it was just price action taking a breath.

Stepping back from the TMUS chart, the SPY marked a significant milestone last week by closing above its resistance line that formed during 2022. We also see that XLC is one of the top-performing sectors YTD.

A surprise on earnings coupled with a break of the previous earnings week high could mark the beginning of a new strong uptrend for TMUS.

Apple Breaking to Resistance?This is a weekly chart of Apple (AAPL) as measured relative to the S&P 500 ETF (SPY).

The chart has been arbitrarily adjusted in magnitude (x1000) to improve visibility of price movement.

One should always analyze an asset's performance relative to the performance of the broader index before choosing to invest. If an asset is underperforming the broader index, one would be better off just investing in the broader index than investing in the underperforming asset.

Few people may have known that, under the surface, Apple has been resisted downward since August 2020 in its chart relative to SPY. In other words, this means that since August 2020, even though the price of Apple has gone up it has generally not outperformed the SPY.

This weekly relative chart between Apple and SPY shows that Apple may be attempting a breakout relative to SPY. Even though Apple's charts look somewhat weak on the higher timeframes (3M, 6M, 12M), this chart may suggest that Apple will at least attempt a breakout in its performance relative to the SPY. The weekly candle closed above the resistance line, and the Stochastic RSI oscillator is showing strong upward momentum on the weekly timeframe. Additionally, the weekly exponential moving average (EMA) is creating an ascending triangle pattern with the resistance line (not shown on chart). In 75% of cases, an ascending triangle is a continuation pattern, which in the context of Apple would mean a bullish breakout.

It's important to realize that relative price charts like this do not necessarily predict price action. In other words, since this is a relative chart, Apple may break out in this chart, and yet its price actually falls. This can happen if the SPY is falling faster than Apple. The best time to use this kind of chart, therefore, is when you think the SPY has made a significant bottom and will rise. Rather than investing in the SPY as its price rebounds, why not amplify your returns by investing in an asset that is likely to outperform the SPY?

Some consider this a "seeking Alpha" approach. Alpha is a term used in investing to describe an investment strategy's ability to beat the market. Strategies that are able to generate greater alpha (or return relative to the market), without introducing greater risk to your portfolio will increase your Sharpe Ratio. In this case, Apple is slightly more volatile than SPY and therefore introduces slightly more risk than owning SPY. One can mitigate this by analyzing all of one's portfolio holdings relative to SPY and selling an underperforming asset that is also more volatile than SPY and then purchasing an asset, (like Apple), that is likely to outperform SPY and which is equally or less volatile than the sold asset.

For example, compare the below charts of T-Mobile US (TMUS) and Verizon (VZ). Both charts are quarterly charts (3-month charts) and are relative to SPY. Relative price action for the past 10 years is shown. (Neither chart is adjusted for dividends). Although TMUS is slightly more volatile, it is generally in line with VZ. If given the choice between the two, which would you rather add to your portfolio?

T-Mobile US (TMUS) trending toward infinity relative to SPY:

Verizon (VZ) trending toward zero relative to SPY:

Not investment advice.