Bitcoin - Quick updateOver the weekend, the price of Bitcoin slumped below 16 000$ before erasing some of its early losses. Currently, the price of one coin trades near 16 600$. So far, we have not changed our bearish view and remain committed to the price target of 15 000$.

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD and support/resistance levels.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are bearish. Overall, the daily time frame is bearish.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic are bearish. DM+ and DM- are also bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Tokens

Bitcoin - The market is poised to go SouthTwo days ago, we projected the downward sloping channel on the daily chart of BTCUSD. Since then, the price broke to the upside and retraced back to the channel, increasing the upper bound's significance (and again validating the pattern). Meanwhile, the market sentiment started to turn bearish, with many market participants giving up on hopes of the FED's pivot. As we also do not believe the FED will backtrack on its monetary policy in 2022, we think the mood is set to turn very grim in the month of September.

Because of that, we will pay close attention to the FED's decision on the 21st September 2022. We expect the FED to raise interest rates from 50bps to 75bps, which will negatively affect the economy. As a result, we think the risk-on appetite will deteriorate and lead to high selling pressure. However, we will update our thoughts on that before the meeting.

In terms of other fundamental factors, we see mounting evidence that the world has entered a global recession, with many real economies starting to feel it. Moreover, with central banks around the globe pursuing the destruction of demand, we think the evidence over the coming months will be even more apparent.

Meanwhile, technical factors also point to the downside across various sectors; and across daily, weekly, and monthly time frames. That bolsters our bearish conviction and makes us stick to our price targets at 17 500 USD and 15 000 USD. However, we think the cyclical low might lie far below our price targets. Again, though, we will reassess our thoughts as the trend unravels.

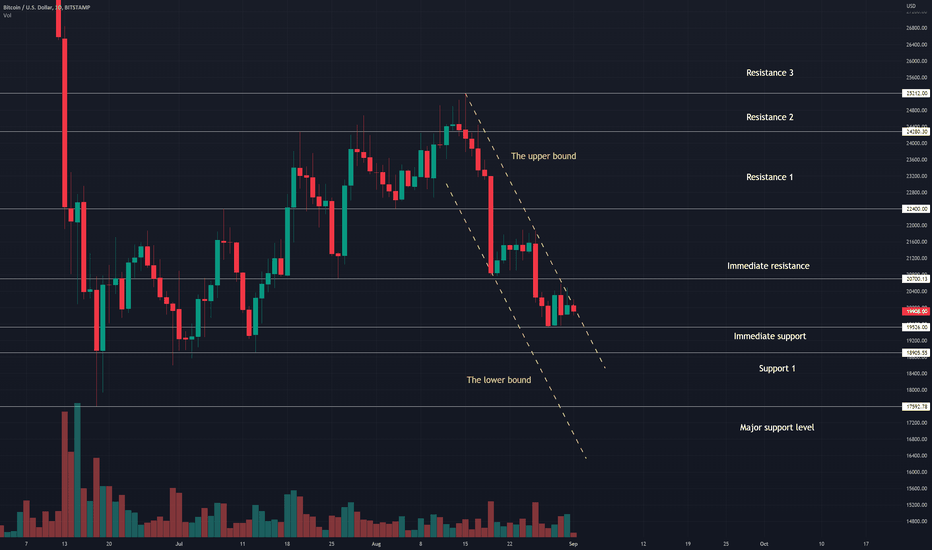

Illustration 1.01

Illustration 1.01 shows the most recent technical developments on the daily chart of BTCUSDT. Yellow arrows indicate two bearish breakouts below prior support levels, a bearish crossover between 20-day SMA and 50-day SMA, and a bullish breakout above the channel followed by the retracement. Additionally, the green arrow indicates increasing volume, which is ideal for confirming our bearish thesis. Now, we will pay close attention to the price action; ideally, we would like to see it take out its recent low at 19 510 USD.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 shows the daily chart of BTCUSD. Additionally, several bearish developments are indicated by yellow arrows. Declining and increasing volume is shown by red and green arrows. We would like to see a breakout below the immediate support to confirm our bearish thesis.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Illustration 1.03

The chart above shows simple support and resistance levels for BTCUSD; for this pair, the low needed to be taken out is 19 526 USD.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Is FTX the Lehman Brothers of crypto?For weeks, we have warned investors about the unsustainable rally in the cryptocurrency market, and now, our price target of 17 500$ was finally hit. That comes to us as no surprise since we reiterated several times that no double bottom occurred and no primary trend reversal was on the horizon; already, in February 2022, we stated that no all-time high would happen this year. Instead, we made a compelling case for the bear market and have continued to do so while hitting one price target after another.

With that being said, we continue to be bearish on Bitcoin and dismiss new calls about the market bottom. In fact, we want to remind our audience of articles we published over the summer about Celsius Network's insolvency and its contingency spreading over to other cryptocurrency institutions in the coming months. Now it seems FTX joined the list of troubling companies, with Binance announcing the buyout of its distressed assets.

In our opinion, that is a particularly bearish development, further drawing a parallel between insolvencies in the banking sector in 2008 and now (but in the cryptocurrency sector). Unfortunately, though, we do not expect any improvement in the market with the FED pursuing tighter economic conditions and potential regulatory fallout (as so many cryptocurrency exchanges are going bust). Contrarily, we believe the bear market is far from over, and Bitcoin will mark new lows over time. Accordingly, we stick to our price target of 15 000$.

*In the latter part of this article, we would like to introduce a part of Bitwise Asset Management's presentation to the SEC in March 2019. (about fake volume)*

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD, and yellow arrows indicate the latest technical developments.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are bearish. Overall, the daily time frame is bearish.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic all show signs of faltering. DM+ and DM- is bearish. Overall, the weekly time frame is bearish.

Bitwise Asset Management presentation to the SEC in March 2019

In March 2019, Bitwise Asset Management (which created the world's first crypto index fund) made a presentation to the SEC about fake volumes on major cryptocurrency exchanges. In its research, the company analyzed volume and trade orders across 81 exchanges listed on Coinmarketcap. Additionally, it argued that the data reported by the website were wrong (despite Coinmarketcap being widely referenced in media - The Wall Street Journal, The New York Times, etc.).

Bitwise Asset Management demonstrated the difference between real and suspicious exchanges (ones that were likely to engage in trade washing with the purpose of inflating trading volumes) by highlighting differences in the order book and showing discrepancies within the information available in the trading interface. For example, some exchanges showed buy and sell orders with roughly the same trade sizes, the absence of round numbers in the order book (despite the natural tendency of humans to pick rounded numbers), the lack of small transactions, perfect even distribution of buy and sell orders, and so on.

However, researchers went beyond these technicalities and looked at these exchanges' footprints in the real world. Subsequently, by comparing publicly available data, they found a substantial difference between the real companies and suspicious ones (lacking media exposure, followers, number of employees, etc.). Furthermore, they analyzed trade histograms and applied several alternative data assessment methods. The 227-page presentation also touched slightly on the subject of Tether, market regulation, market surveillance tools, and market manipulation.

In its findings, the company stated that at the time, only 10 out of 81 exchanges showed the presence of real volume, including Coinbase, Bitfinex, Kraken, Bitstamp, BitFlyer, Gemini, itBit, Bittrex. In addition to that, researchers concluded that the total volume was merely 4.5% of the reported volume (by exchanges) between 4th and 8th March 2019. As if it was not enough, the study stated that nearly 30% of spot bitcoin volume was on U.S.-domiciled exchanges, compared to just 1% of reported volume.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Do not get fooled by "double bottom" forecasts Bitcoin is up more than 5% after an overnight move. Despite that, we remain unshaken by the rising volatility and stick to a bearish outlook for the rest of 2022. At the moment, however, we will pay close attention to volume, price, and sloping resistance. If the price breaks above the sloping resistance, it will further bolster a bullish case for Bitcoin in the short term. In addition to that, we speculate that many people will try to forecast double bottom and buy here, dragging price higher.

Although we do not expect relief to last and turn into recovery. Instead, we think a bounce will be very short-lived, and more downward pressure will follow. Additionally, we expect Bitcoin to mark new lows over time and reaffirm our bearish thesis.

This view is supported by economic tightening on a global scale, rising volatility, and the market progressing into the second stage of the downtrend. Because of that, we remain committed to our price targets of 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD. The recent decline in volume suggests temporary relief in selling pressure. Ideally, to further confirm our bearish thesis, we would like to see declining volume as the price rises toward the sloping resistance.

Technical analysis - daily time frame

RSI is bullish. Stochastic points to the upside but stays in the bearish area; the same applies to MACD. DM+ and DM- are bearish, striving for the bullish crossover. Overall, the daily time frame is neutral/slightly bullish.

Illustration 1.02

Illustration 1.02 displays the daily chart of BTCUSD and simple support/resistance levels.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Will the FED crush dreams and hopes today? Today, we await a much anticipated FED meeting, with central bankers expected to raise interest rates in the range between 75 bps to 100 bps. Over the past few weeks, we said that more rate hikes would put additional pressure on the U.S. economy and drag it into a deeper recession. As a result, we expect such a period to be accompanied by risk aversion, leading to a selloff in the general stock market and cryptocurrency sector.

Although we do not rule out the initial bounce up in the price of Bitcoin after the FED decision (though we expect it to be short-lived if it occurs). Our reasoning is that many investors will be (again) on the lookout for the FED pivot. However, we do not think the FED will backtrack its monetary policy in 2022; quite contrarily, we believe the FED will pursue the path of tightening throughout 2023, further deteriorating economic conditions.

The same grim story is told by volume hovering around monthly lows and by many technical indicators flashing warning signs across the board. Daily, weekly, and monthly time frames are all bearish, which is ideal for the continuation of the downtrend. Therefore, we have no reason to change our view on Bitcoin. Accordingly, we remain bearish, and our price targets stay at 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows the setup with two alternative trades and the yellow arrow pointing to volume at weekly lows.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

The picture above shows the daily chart of BTCUSD. To further confirm our bearish thesis, we would like to see Bitcoin fall below the Support 1.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - The downtrend is confirmed by several developmentsRight after Jerome Powell's speech, the stock market dropped sharply, dragging cryptocurrencies with it. As a result, Bitcoin fell approximately 6%, dropping below 21 000 USD and subsequently below the immediate support. That is particularly bearish as this development constitutes a new low for BTCUSD, further confirming the downtrend. As if it was not enough, volume continues to grow while the price declines, suggesting a strengthening selling pressure.

As for the fundamental factors, it is clear now that the FED's pivot is dead, and there is no reversal in the central bank's monetary policy. As we previously noted, this will inadvertently drag the global economy into a deeper recession, leading to even a higher risk aversion. Consequently, we expect this to pull Bitcoin below its 2022 lows.

Concerning technical factors, these are flashing warning signs across the board. We expect a heavy selloff in the short-term future. Indeed, we would not be surprised to see Bitcoin break below 20 000 USD over the weekend. Accordingly, we stick to our price target of 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows the daily chart of Bitcoin and simple support/resistance levels. Yellow arrows indicate bearish breakouts. The green arrow indicates growing volume, which supports our bearish thesis; indeed, in our previous post, we stated that this would be an ideal picture to confirm our hypothesis.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

The picture above shows the monthly chart of BTCUSD. Again, extremely shallow volumes hint at brewing troubles for Bitcoin.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - No longer bullish, top in for the rally During the last week, we gave market participants an ultimate warning about the impending reversal in the market. Soon after we argued the top of the bear market rally might be in, Bitcoin fell more than 15%.

A change in our short-term view is mainly influenced by technical factors, which point to the return of intense selling pressure. Indeed, we believe the current selloff will soon escalate into panic mode in the cryptocurrency sector. As a result, we expect highly elevated volatility and Bitcoin to drop to a new low.

Our medium-term and long-term views remain unchanged as we expect bearish fundamental factors to stay persistent throughout 2022 and 2023. Additionally, we believe that the recession will bring risk-off sentiment, wreaking chaos in the stock market as well as the cryptocurrency market.

Because of these reasons, and the ones described in our previous ideas, we stick to our price targets at 17 500 USD and 15 000 USD.

Illustration 1.01

The picture above shows two bearish breakouts below prior support levels. Additionally, a build-up in volume accompanying a price drop is indicated on the bottom; this development is the ideal picture we wanted to see in order to confirm our bearish thesis.

Technical analysis - daily time frame

RSI is very bearish. MACD and Stochastic are bearish. DM+ and DM- performed bearish crossover. Overall, the daily time frame is very bearish.

Illustration 1.02

Illustration 1.02 shows another bearish breakout below the sloping support, further bolstering the bearish case for BTCUSD.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Illustration 1.03

Above is the setup we introduced recently.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Professional selling to retail investors?Prior to the FED meeting, we speculated that the rally could falter with another rate hike. However, after the 2.04% decline following the FED decision, Bitcoin erased its early losses and made a new high at 21 473$. That is a bullish development, although we still remain bearish for the medium and the long term. Indeed, after a brief period of bullishness, we are slowly but surely turning bearish on BTC in the short term as well. Accordingly, we stay committed to our price targets of 17 500$ and 15 000$.

Despite that, we can not ignore the prospect of rally continuation. Therefore, we will pay close attention to the price action and volume. Ideally, we would like to see a pick-up in volume and subsequent selling pressure to confirm our bearish bias. Contrarily, to support the opposite bullish view, we would like to see the price attempt to test resistance at 22 781$.

We would like to point out different relationships between the price and volume across various exchanges displayed in the illustrations below.

Illustration 1.01

Illustration 1.01 shows the relationship between the price and volume on the exchange FTX.

Illustration 1.02

Illustration 1.02 shows the relationship between the price and volume on the exchange Binance.

Illustration 1.03

Illustration 1.03 shows the relationship between the price and volume on the exchange Kraken.

Illustration 1.04

Illustration 1.04 shows the relationship between the price and volume on the exchange Bitstamp.

Illustration 1.05

Illustration 1.05 shows the relationship between the price and volume in the futures market.

Technical analysis - daily time frame

MACD flattens. RSI trends sideways, and Stochastic performed a bearish crossover. DM+ and DM- are bullish. Overall, the daily time frame is bullish but shows signs of exhaustion.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic point to the upside, although they still remain within bearish zones. DM+ and DM- are bearish. Overall, the weekly time frame is neutral.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

LUNA - Still Extremely BearishLUNA has fallen massively since my last analysis on it. Price was at around 0.00028 when I mentioned it will tank from there. An ASYMMETRIC TRIANGLE was broken to the downside, a clear BEARISH SIGNAL. Then a massive spike took place to lure more BUYERS into the market. Price is currently testing the 0.00018961 zone - a zone which will be broken to the downside very soon.

This token's price is in a clear free-fall.

PATIENCE PAYS IN THE MARKETS!

Ethereum - Short term relief drags onEthereum is approaching the sloping resistance after the period of sideways-moving price action. The breakout above the resistance will be bullish for the short term. However, we do remain bearish beyond that and maintain our price targets of 1 000 USD and 900 USD.

Our reasoning is based on the fact that the FED will continue to pursue economic tightening, predestining the current rally to fall. In addition to that, our view is also supported by the ongoing global recession and geopolitical turmoil leading to problems on all economic fronts.

Therefore, we voice a word of caution to market participants as we do not believe the market has bottomed out and the primary trend has reversed. With that being said, we will pay close attention to the FED meeting next week.

Illustration 1.01

Illustration 1.01 shows the daily chart of ETHUSD and the downward-sloping channel. The price is approaching the upper bound of the channel, the sloping resistance. If the breakout above it occurs, we will pay close attention to the volume and if it will be sufficient to propel the price higher.

Technical analysis - daily time frame

RSI and Stochastic are bullish. MACD is also bullish; if it breaks above 0 points, it will further bolster the bullish case in the short term. DM+ and DM- are bearish. Overall, the daily time frame is slightly bullish, while the breakout below the short-term support will be bearish.

Illustration 1.02

The picture above shows the daily chart of ETHUSD and simple support/resistance levels. The breakout above the short-term resistance will be bullish.

Technical analysis - weekly time frame

RSI is neutral. Stochastic is bearish. MACD points to the upside but stays in the bearish zone. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Ripple - Major updateOn 8th September 2022, when the XRPUSD was trending sideways, we introduced a setup with two alternative scenarios. Since then, the price broke to the upside from a trading range and rose by more than 40%. Meanwhile, right at the beginning of the rally, we stated that it was predestined to fail over time and that no reversal of the primary trend was taking place.

We repeated this same statement several times over the past month and a half while we continued to outline multiple bearish developments on the chart of XRPUSD. Furthermore, we kept our medium-term price target at 0.30 USD and long-term one at 0.28 USD. We reasoned that the FED's pursuit of tighter economic conditions would let the reality sink in over time.

Now, it is finally time for us to update our price targets on the timeline. In accordance with that, we would like to set a medium-term price target to a short-term price target. Additionally, we would like to change our long-term price target to a medium-term price target.

Illustration 1.01

Illustration 1.01 shows several technical developments on the daily chart of XRPUSD. The declining volume supports our bearish thesis, and the same applies to today's pick-up in volume. Furthermore, we expect the crossover between the 20-day SMA and 50-day SMA to occur, further confirming our thesis.

Technical analysis - daily time frame

RSI and Stochastic are bearish. MACD is due to break below 0 points which will be bearish for the short term if it succeeds. DM+ and DM- are bearish. Overall, the daily time frame is bearish.

Illustration 1.02

We will closely watch support levels at 0.44312 USD and 0.42542 USD. A breakout below each of these levels will confirm our bearish thesis for the short term. Contrarily, a breakout above the short-term resistance will be bullish.

Technical analysis - weekly time frame

RSI is slightly bearish. Stochastic also turned bearish. MACD shows signs of exhaustion. DM+ and DM- are bullish. Overall, the weekly time frame is neutral.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Risk appettite is not picking up muchTwo days ago, Bitcoin broke above the sloping resistance, which is bullish in the short term. However, then it quickly erased gains, and the breakout became invalidated. So far, despite the ongoing rally in the stock market, the price action in Bitcoin has remained muted. We believe that reflects a lack of risk appetite among market participants.

Indeed, at the current stock market value, we would expect BTCUSD to trade much higher from the current level; yet, it merely continues the choppy price action near the 19 300 USD price tag. That tells us something is not exactly right. Therefore, we are very cautious. As for the price targets, they remain unchanged at 17 500 USD and 15 000 USD due to the persistence of macroeconomic factors.

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD and simple support/resistance levels. The yellow arrow points to the bullish breakout above the sloping resistance; volume is declining throughout the rise, which is not particularly bullish.

Technical analysis - daily time frame

Stochastic is bullish. MACD is rising but still below the 0 points; if it breaks above, it will be a bullish sign. RSI is neutral. DM+ and DM- are causing whipsaws, with the ADX hinting at the neutral trend. Overall, the daily time frame is neutral.

Illustration 1.02

Simple moving averages on the daily chart of BTCUSD reflect the neutral nature of the prevailing short-term trend that is currently in place.

Technical analysis - weekly time frame

RSI and Stochastic are trending sideways in the lower bound of the bearish zone. MACD points to the upside but stays in the bearish zone as well. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Ripple - The recap of latest developmentsFour days ago, we warned that the Ripple cryptocurrency would attempt to test its low from 13th October 2022. Shortly after, the XRPUSD fell approximately 7.5% toward the mentioned low. However, it did not manage to break below it. Instead, it paused its decline slightly above it and reversed back up. Therefore, we will continue to pay close attention to this level and price action; ideally, to support our bearish thesis, we would like to see another attempt of the price to break below the short-term support.

With that being said, we remain bearish in the medium and long term. Indeed, we are on the brink of changing our medium-term price target of 0.30 USD to a short-term price target (and long-term price target of 0.28 USD to a medium-term price target). Similarly, like in previous instances, we draw our conclusion from a combination of bearish fundamental and technical factors.

Illustration 1.01

Illustration 1.01 recapitulates our statements in the past few weeks for the audience.

Technical analysis - daily time frame

RSI, MACD, and Stochastic are bearish. DM+ and DM- performed a bearish crossover. The daily time frame is bearish, although the trend is very weak.

Illustration 1.02

The image above is a reminder that Ripple is still deep in the bear market territory, down approximately 86% from its all-time-high value.

Technical analysis - weekly time frame

RSI is turning neutral. Stochastic shows signs of exhaustion. MACD remains bullish. DM+ and DM- are also bullish. Overall, the weekly time frame is losing bullish momentum.

Illustration 1.03

While many people point out the rising volume on the monthly chart, Illustration 1.03 takes a closer look at what is going on in the weekly time frame; the volume continues to decline since the recent high in price, which does not support the bullish narrative for this cryptocurrency.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

BCH - 1st and 2nd TPs Have been Reached!!I have been short BCH from 138.50. This was a short-term trade just to pocket a few bucks. My targets were 111.00 (1st TP) and 107.00 (2nd TP) zone respectively. These two zones were successfully reached.

Check out my previous analysis in the RELATED IDEAS section below.

PRICE ACTION AND PATIENCE ARE KINGS!!!

Bitcoin - Correlation with the stock market represents a hurdleWith the market, Bitcoin saw a sharp reversal yesterday and retraced back into the proximity of the 20 000 USD pricetag. In our opinion, this price action, once again, represents merely a short-lived bounce predestined to falter later. However, we can not ignore the odds of this price action continuing a little bit further.

Therefore, for more clues about the continuation, we will watch the price's ability to break above the sloping and short-term resistance. These developments will bolster the bullish case in the short term. However, in the face of another rate hike, worsening economic data, and progressing recession, we have difficulty believing that this recent move represents any significant change in the primary trend.

In fact, we believe that the current bounce in cryptocurrencies provides a great opportunity for repositioning on the short side. Therefore, we have no reason to change our bearish stance and stay committed to our price targets of 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows support and resistance levels for BTCUSD.

Technical analysis - daily time frame

MACD points to the upside; if it breaks above 0 points, it will be very bullish. Stochastic and RSI are rising. DM+ and DM- are bearish. Overall, the daily time frame is neutral/slightly bullish.

Illustration 1.02

Illustration 1.02 portrays the daily chart of BTCUSD. The yellow arrow hints at the retracement from yesterday. The high correlation between the stock market and cryptocurrencies suggests that no primary trend reversal will happen.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic are rising slightly. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Do not get ahead of the marketWith Bitcoin jumping above 20 000 USD, we again see a rise in bullish ideas all over the place, claiming bottoms, new all-time highs, and even trend reversal in spite of bearish macroeconomic factors. Despite that, however, elevated volatility and wild swings in the price do not concern us. Quite the contrary, they give us confidence as the market sentiment reflects what it should be in the bear market - constant swings in the mood of market participants, people trying to get ahead of the market, and tremendous moves in single stock/cryptocurrency titles.

As grim as it sounds, we believe these signs will grow more apparent in the coming weeks as the volatility is set to continue higher, sparking more risk-aversion and another leg down in the market. Our thesis comes from the premise that the FED will increase interest rates in November 2022, further crashing the market in order to beat high inflation.

In our opinion, these macroeconomic factors, combined with technical ones, foreshadow a new low for Bitcoin in 2022 and a continuation lower in 2023. Additionally, the lack of liquidity reflected in low monthly volumes suggests Bitcoin is not gaining any interest among new investors, which is an obstacle for the trend to reverse; meanwhile, this lack of liquidity has been responsible for wild moves up and down in the past months.

At the moment, we pay close attention to the resistance level at 20 381 USD, which is the 27th September 2022 high. For the short-term, it would be bullish if the price managed to break above this level and stay there. However, a failure of the price to hold above the resistance will suggest a return to the lower end of the range, in which Bitcoin has been trading for the past few weeks.

Despite the short-term bullish potential in Bitcoin, we have no reason to backtrack on our bearish views. Accordingly, we stick to our price targets at 17 500 USD and 15 000 USD. We will update our thoughts as time progresses.

Illustration 1.01

Yesterday, we showed several signs of exhaustion accompanying the price rise and subsequent breakout above the resistance level. We said that the breakout would be bullish; however, it became quickly invalidated when the price fell back below the resistance level. That is yet another sign of exhaustion. Despite that, the short-term trend is neutral/slightly bullish; therefore, we will remain very cautious today and closely monitor the price action and volume levels.

Technical analysis - daily time frame

RSI is slightly bullish; however, it is showing signs of exhaustion already. MACD is neutral; if it breaks above the mid-point, it will be bullish. Stochastic is bullish. DM+ and DM- are bullish. The daily time frame is slightly bullish, with a very weak trend.

Illustration 1.02

Illustration 1.02 displays the daily chart of BTCUSD and particular levels of interest.

Technical analysis - weekly time frame

RSI is neutral. Stochastic is also neutral. MACD points to the upside but stays in the bearish zone. DM+ and DM- are bearish. Overall, the weekly time frame is bearish; but the trend grew substantially weaker over the past few weeks.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Committed to the bearish narrative Over the past few days, Bitcoin has continued to be choppy, oscillating mainly between 19 000 USD and 20 000 USD. Currently, it trades near the 19 200 USD price tag. We believe the recent volatile movements reflect rising anxiety among market participants. Additionally, lower troughs and lower peaks, constituted since 15th August 2022, suggest the downtrend continuation.

Furthermore, fundamental factors weighing on risk appetite will continue to persist throughout 2022 and 2023, putting aside the bullish potential of the cryptocurrency market. In addition to fundamental factors, technical factors also support the bearish case for BTCUSD.

Therefore, we have no reason to change our bearish bias and stick to our price targets at 17 500 USD and 15 000 USD. We expect our price targets to be reached within Q4 2022.

Illustration 1.01

The picture above shows the daily chart of BTCUSD. Again, we pay close attention to the sloping resistance; the breakout above it will be bullish, while the failure of the price to break above it will be bearish.

Technical analysis - daily time frame

MACD and RSI are neutral. Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 displays the daily chart of BTCUSD and simple support/resistance levels.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

ETH - Short-Term Bullish SentimentIt looks like BTC and ETH are showing pretty much the same movements. These two are highly correlated. I expect ETH to bounce back to the 4 800 zone (a zone it failed to break) before experiencing a huge crash back to around 100. We are going to see crazy BEARISH moves in the crypto space after the current BULL move that's taking place.

I will keep track of the movements. It's going to be interesting the crypto market!!

BUY LOW. SELL HIGH!!

Crypto Market Cap - BEAR SENTIMENTThe total crypto market cap still looks extremely BEARISH. I expect the market to fall to around:

1. $400B

2. $120B

before a climb ensues. We will go back to the $3T zone and break it. Cryptocurrencies will SKY-ROCKET. However, for now we are still headed downwards.

PATIENCE IS EVERYTHING IN THIS BUSINESS!

Bitcoin - BTCUSD to mark new lows by the end of Q4 2022Just hours after our last post, in which we warned about the unsustainability of the up move, Bitcoin erased all of its early gains and retraced below 19 000 USD. This development aligns with what we highlighted as a bear market behavior, characteristic of wild swings from one side to another and market participants trying to fish for a bottom.

That and a looming decrease in corporate earnings and a slowdown in the global economy will further reinforce our narrative about the progression into the second stage of the bear market. As a result, we think the risk aversion will rise, causing more weakness in the stock and cryptocurrency markets over time.

Indeed, we think what market participants have seen up until now, regarding erratic moves and elevated volatility, is just a pretext for what will unravel over the coming months. We believe we will see a dramatic increase in volatility, which will cause even more people to jump back and forth between bullish and bearish narratives.

However, as we did for the past year, we plan to stay unshaken by the high volatility and focus on the market's primary trend. Therefore, we remain bearish and committed to our price targets at 17 500 USD and 15 000 USD. Technical and fundamental factors support our view.

Illustration 1.01

Illustration 1.01 shows simple support and resistance levels. To confirm our bearish thesis, we want to see the price break below the Support 1.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 displays the weekly chart of BTCUSD and two SMAs in a bearish constellation.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

LUNA - Extreme Bear SentimentThe triangle was broken at around 0.00029. Now market-makers are enticing BUYERS into jumping in before they drive the price downward. The rally that took place off the 0.00019 zone is a CORRECTION of the TRIANGLE BREAK. Many are currently buying due to FOMO. We sit back and watch the craziness. See y'all at the 0.000019 zone.

Bitcoin - BTCUSD eyes 2022 lowsDuring the weekend, the price of Bitcoin traded mainly flat. For that matter, we have no reason to change our bearish bias. Just like over the past months, fundamental factors will continue to slow down the global economy, resulting in the declining economic performance of the stock market and companies slashing their economic projections.

In accordance with the Dow Theory, that will reflect the market transitioning from the 1st stage of the bear market into the 2nd stage. In our opinion, the cryptocurrency market will continue to drift to new lows, with many speculative coins going bust and never returning to the market.

We believe the persistence of bullish sentiment does not signal a market capitulation. Quite the contrary, we think it perfectly illustrates the vicious nature of the bear market, with retail investors addicted to buying dips and subsequently causing volatile movements up and down.

Because of that, we will continue to filter these movements and focus on the primary trend to the downside (as we do since November 2021). More details are described below in the text and the attached articles.

Illustration 1.01

Illustration 1.01 displays the hourly chart of BTCUSD. Two yellow arrows indicate bearish breakouts, which constitute new lows for Bitcoin since the end of the bear market rally.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 shows the simple support and resistance levels for BTCUSD. If the price breaks below the immediate support level and stays there, it will further bolster the bearish case for Bitcoin.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Ripple - "Buy the rumor, sell the fact"In our previous idea on Ripple, we stated that it was one of a few cryptocurrencies that failed to reach a new all-time high during the latest bull cycle. Additionally, we expressed our bearish views on it over the coming months, set price targets at 0.30 USD (medium-term) and 0.28 USD (long-term), and presented a conservative setup with two possible scenarios.

Since then, the price of XRPUSD has shot to the upside through the short-term resistance, which is a bullish development we previously outlined. Typically, such price action would invalidate our price targets on the downside for the short-term price target. However, fundamental factors (increasing interest rates and economic tightening) driving the primary trend have not changed, which allows us to stick to our price targets.

Indeed, the abrupt move accompanied news that came out regarding the legal case between RippleLab and the SEC. It took merely a few hours, and we are already noticing a wall of bullish posts forecasting the reversal of the primary trend and the beginning of a new bullish era. However, we have little faith in this thesis because of the slowing global economy and growing geopolitical problems coupled with risk aversion.

We acknowledge that thin volume can lead to a higher price in the short term. However, we think the rally will not sustain in the medium and long term. Furthermore, we believe the recent price action is just a short-lived hype like in the case of other cryptocurrencies that already underwent breakouts to the upside (which were dampened in XRP) from a wide range (in July and August).

As for the short-term, we do not know how much higher XRPUSD can go. However, we are already seeing several warning signs. Because of that, we will pay close attention to volume and price action. Other details are described below.

Illustration 1.01

Illustration 1.01 shows the conservative setup we showed on 8th September 2022. Since its introduction, the breakout to the upside took place, hitting a bullish trigger. Subsequently, the price ripped up more than 40%.

Technical analysis - daily time frame

RSI is overbought. MACD and Stochastic are bullish. DM+ and DM- are bullish. Overall, the daily time frame is bullish.

Illustration 1.02

The picture above shows the price action that followed since the introduction of our setup. Declining volume after the breakout serves as a warning sign, hinting at the evaporation of buyers after the steep climb in price.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic are also bullish. DM+ and DM- are bullish. Overall, the weekly time frame is bullish.

Illustration 1.03

Illustration 1.03 shows a similar decline in volume on the hourly chart of XRPUSD (this time on Binance instead of Bitstamp).

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.