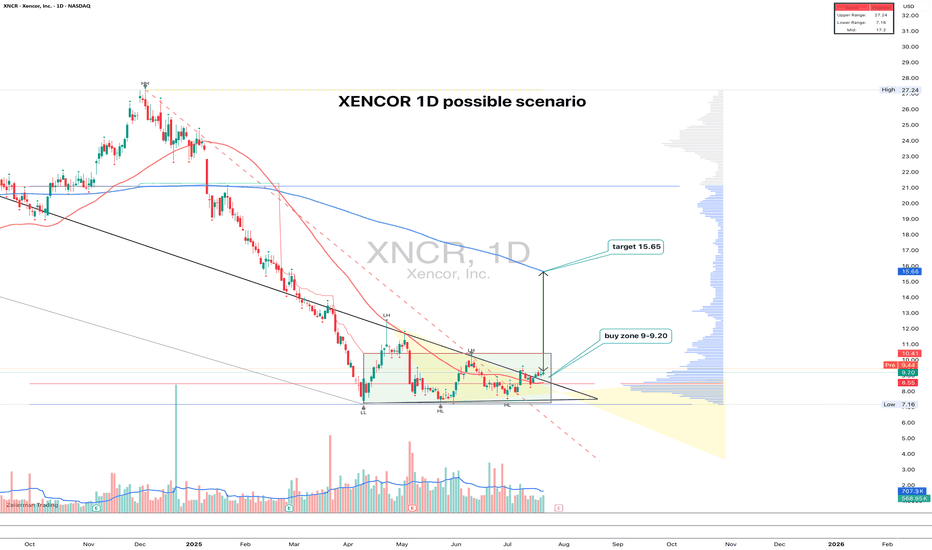

XNCR 1D time to growth?XNCR: the uptrend hasn't started yet - but someone's quietly accumulating

XNCR spent nearly 4 months building a base and finally broke out of consolidation with a clear upward move. The pattern looks like a range with a narrowing triangle at the bottom — the breakout came with rising volume. Entry makes sense in the 9.00–9.20 zone on a retest. Volume profile and Fib levels confirm the importance of this area, plus there’s a clean support shelf at 9.00. The target is 15.65, which aligns with the height of the structure. The 200-day MA is still above price, but a push beyond 11.00 could open the door to acceleration.

Fundamentally, Xencor is a biotech company focused on monoclonal antibodies. After a tough 2023–2024 and cost reductions, the market is beginning to price in signs of recovery. Key partnerships remain intact, the pipeline is alive, and recent data for XmAb7195 was well received at industry events. Valuation remains low, and biotech ETF flows are slowly picking up.

Still a relatively low-volume name, but the structure is clean, the setup is readable, and fundamentals are turning. With a tight stop below 8.50, the risk-reward looks solid.

TOP

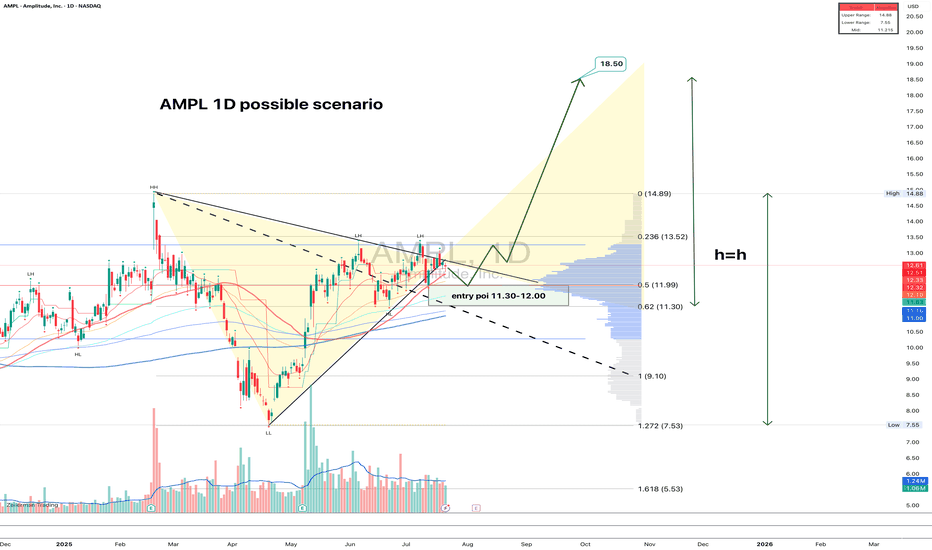

AMPL: structure clean, volume right, fundamentals warming upAMPL just broke out of a symmetrical triangle on the daily chart. The breakout was confirmed with decent volume, and now price is calmly pulling back into the 11.30–12.00 zone — exactly the kind of textbook retest that gets serious traders interested. The 0.618 Fib level sits at 11.30, and 0.5 at 11.99, strengthening this entry area. Volume has tapered off post-breakout, which is typical before a continuation. Moving averages are stacked bullish, confirming the trend shift. First upside target is 13.52, followed by 14.89, and if the full h = h move plays out, price could reach 18.50. A natural stop sits just below 11.00. Clear structure, solid risk control — this is one of those setups that checks all the boxes.

On the fundamental side, Amplitude remains a key player in product analytics and digital optimization. After a slow 2024 marked by cost-cutting and stagnating revenue, the company is showing early signs of recovery this year. The broader SaaS market has stabilized, and AMPL is benefiting from renewed enterprise demand, especially for AI-driven user behavior analytics. Recent earnings came in better than expected, and institutional interest has quietly returned. Valuation is still moderate at these levels, giving it room to re-rate if momentum builds.

A clean breakout with technical alignment and an improving macro picture - when both sides of the story match, it's worth paying attention.

Gaussian will tell the exit signal!Please do not fomo at the current prices , instead be prepared to sell some once Gaussian LMACD signal line and lmacd line come together before crossing to the upside. Might be happening soon in the coming months Unfortunately this signals lags a little bit so you won't be catching the actual peak but we will be in a really good spot to get out before coming back down to the Gaussian Core in late 2026 around 40-50k.

BABA: triangle with tensionOn the weekly chart, BABA has already formed a golden cross - price is above both MA50 and MA200, confirming a bullish trend shift. The stock is now approaching the upper edge of the symmetrical triangle and the key resistance at $122, which also aligns with the 0.5 Fibonacci level.

The numbers inside the triangle represent the contraction phases, not Elliott waves. This is a classical consolidation before a potential breakout. If the $122 level is broken and retested, upside targets are $128 (0.618), $137 (0.786), and eventually $148–181 (1.0–1.618 extension).

Volume is rising, MACD is flipping bullish, and RSI is climbing out of oversold territory — all signs point to growing bullish momentum.

Fundamentally, Alibaba benefits from China's economic rebound, possible regulatory relief, and ongoing share buybacks. With Chinese tech rotating back into favor, BABA could lead the rally.

So if you're still waiting for a signal - it's already here. The golden cross is done, price is flying above moving averages, and all that’s left is a clean breakout. Watch $122 — that’s the launchpad.

USDJPY 1H - market buy with a confirmed structureThe price has bounced from a key support zone and is showing early signs of recovery. A clear base has formed, and the MA50 is starting to turn upward, indicating a shift in short-term momentum. While the MA200 remains above the price, the overall structure suggests a potential continuation of the bullish move.

Trade #1 — entry at market, target: 145.939, stop below recent local low.

Trade #2 — entry after breakout and retest of 145.939, target: 148.000, stop below the retest zone.

Volume has stabilized, and the reaction from support is clear. As long as price holds above the last swing low, buying remains the preferred strategy.

YEXT 1W - breakout confirmed, retest inside bullish channelYext stock just pulled a clean breakout of the weekly downtrend line, retested the buy zone around the 0.5 Fibo level ($7.32), and is now bouncing within a rising channel. The 200MA and 50EMA are both below price, supporting a shift in trend even though the golden cross hasn’t formed yet. The volume increased on breakout, and there's low overhead supply - a classic setup for continuation. The arrow shows the expected move, contingent on confirmation.

Targets: 9.15 - 11.40 - 15.06

Fundamentally, Yext offers enterprise-grade AI-powered search solutions and recently gained attention with new product updates. With AI adoption accelerating, the company may ride the next wave of institutional interest.

When price retests the zone, MA is supportive, and there's no overhead resistance - that’s not noise, that’s a signal.

AUDJPY 1D: breakout toward 100–105AUDJPY has confirmed an inverse head and shoulders breakout on the daily chart, with a strong move above the neckline. All key moving averages, including MA50 and MA200, remain below the current price — confirming bullish momentum. Volume increased on the breakout, and price has held above the 95.6 neckline zone. As long as that level holds, the setup remains valid. Targets are set at 100.36 (1.618 Fibo) and 105.19 (2.0 Fibo).

VTI 1D: breakout on the daily within a long-term weekly uptrend On the daily chart, VTI (Vanguard Total Stock Market ETF) has broken through the key $303.5 resistance level with strong volume. This breakout occurs within a larger weekly uptrend channel, highlighting a continuation of the long-term bullish structure.

Volume profile shows a clear path ahead: $321.7 (1.272 Fibo) and $345 (1.618 Fibo). The golden cross (MA50 crossing MA200 from below) further supports the bullish case.

Fundamentally, VTI represents the entire U.S. equity market - large to small caps - and benefits from economic resilience, declining inflation, and passive inflows. It’s a logical macro play for trend continuation.

Tactical plan:

— Entry by market or after retest $303.5

— TP1: $321.7

— TP2: $345

— Invalidation below $300

The whole market breaking out? That’s not noise — it’s the signal.

AMAZON TROUBLENASDAQ:AMZN Is currently trading Just 11% below its all time high and currently Facing exhaustion.

Amazon is currently trading 217$ range which was previous support now turned resistance (Daily Timeframe) , making a double top pattern and a negative divergence on the RSI.

The best Trades are the ones with multiple confirmations

- Trading at a resistance (1D chart)✅

- Negative Price Action at the resistance (Double Top Pattern)✅

- RSI negative divergence✅

- Market Structure ✅

Entry Criteria

- A Red candle at the entry Line Marked

- Stoploss Above the Entry Candle

Target 1- 211$

Target 2- 208$

Keep Your Risk Reward Intact! Not An investment Advice

$TSLA | Robotaxi Launch Incoming? - Plan Rock Solid w/ 3 TradesNASDAQ:TSLA

Launch could be as soon as Sunday, June 22. However, Musk has emphasized safety as priority. There is the potential to undercut traditional taxi services at less than $0.20 per mile. Tesla’s government and military contracts are key growth drivers but further clash between Musk and President Trump could cause further volatility in price action. Long-term $271 is a critical price point. There are several ways to play Tesla:

* Range between $270 and $350

* $330 to $400 into price discovery

* Breakdown under $270 targeting $212 and $204

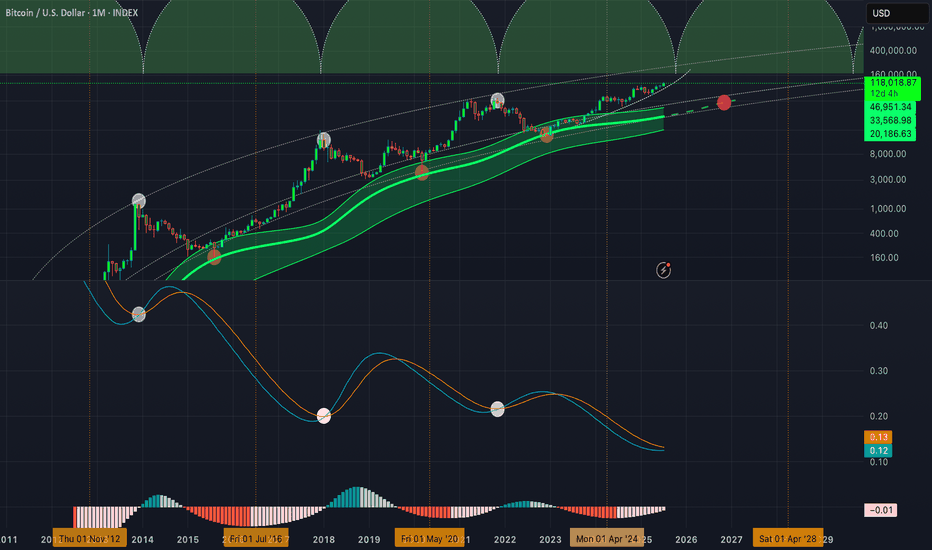

BTC Macro Cycle Outlook (Log Chart)Bitcoin continues to respect its logarithmic ascending channel that has defined every major bull and bear cycle since 2015. Each cycle top has historically aligned with the upper blue trendline, marked by sharp rejections (red arrows 🔴).

Currently, BTC is pushing within a steep short-term channel, mirroring previous parabolic phases. If the structure holds, we could see a final push toward the $300,000 zone, which aligns with the channel resistance — potentially marking the next cycle top.

📈 This chart captures the bigger picture — filtering out short-term noise and focusing on the rhythm of Bitcoin’s long-term cycles.

Do you think this cycle will end like the last two? Or are we in for something different?

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTC Educational Idea by 1PercentFundedBTC Update : These are the possible scenarios for BTC based on 2021

Scenario A. BTC rejects 108/109k (Purple Arrow) & retest 98k (High Probability)

Scenario B. BTC retest 110/111k (Black Arrow) & creates a double top before dumping to 88/98k

Our team will be building shorts at 108k onwards & will add if 111k is given. 117.5k invalidation.

2007 Top /2025 day 38td t-minus 2.5 days Major TOP The chart in focus is the 2007 chart we are now day 38 in the pattern and in 2007 we took 40td to make a new high And I have posted my models .I see the next rally to reach anywhere from 6035/on the low end to 6177 on the high end focus 6147 where Ax 1.618 = wave C or 3 Best of trades WAVETIMER

Dow Jonas - Elliot wave📉 DJI — Elliott Wave Top in Sight?

🔍 A long-term analysis with serious implications...

I've been diving deep into the Dow Jones Industrial Average (DJI), using Elliott Wave principles — and what I see may signal the end of one of the longest bull markets in history.

Elliott was right — the massive bull cycle did arrive and extended well into the 2000s. But now, that journey looks to be nearing its final destination.

Currently, I believe we're witnessing the development of an Ending Diagonal pattern — a structure often seen at the end of a major impulse. This formation appears to be completing a set of blue sub-waves, which in turn cap off the larger green primary impulse wave.

📍 The box marks my anticipated top for the DJI. From this point, I expect a strong reversal and the beginning of a major correction.

Now here's the shocking part:

If this correction plays out in time and reaches the Fibonacci 0.382 level, that would suggest a retracement spanning up to 86 years — yes, 86 years.

This isn’t just about markets anymore — such a scenario could carry massive consequences for the global economy and society as a whole.

If, however, we see a strong breakout above the box, then the ending diagonal thesis would be invalidated, and we might instead be witnessing an extended wave 5 — complete with five internal sub-waves.

But either way — the top is coming. It’s just a matter of when, and how hard we fall.

💬 What are your thoughts? Could we really be on the edge of a generational peak?

Is Bitcoin Topping Out? Critical Levels to WatchSince the low of $15,476 on November 21, 2022, Bitcoin has surged to an all-time high of $109,588 on January 20, 2025. That’s an incredible +608% increase over 791 days. We also hit the long-anticipated $100K mark. But for almost three months now, Bitcoin has been stuck in a range between $90K and the all-time high, showing some indecision in the market.

Looking Back: Market Structure & Trends

Bitcoin spent over 250 days consolidating between $50K and $70K before finally breaking out in November 2024, right around the U.S. election. That breakout triggered a massive rally, pushing Bitcoin to 100K in just one month. Since then, bulls and bears have been battling it out, trying to establish control over this crucial psychological level.

A look at the pitchfork tool shows that Bitcoin has been rejected at the 0.618, 0.666, and 0.786 levels multiple times while trying to push higher. Recently, we lost the median line of the pitchfork and dropped below 100K, suggesting bullish momentum is fading. The 233 SMA/EMA on the 4-hour TF as well as the 21 EMA/MA on the daily TF has also flipped into resistance, adding to the bearish pressure.

Is February Shaping Up to Be a Bearish Month?

If we compare the current cycle to the 2020 bull market, the price action looks similar, forming a top where Bitcoin struggles to break higher. February could bring a healthy correction before any new leg up.

Key Support Zones & Confluences

Here’s where we could see solid support:

Unfilled CME Gap at $77,930 – Historically, Bitcoin tends to fill these gaps over time

Pitchfork Lower Support Line (~$80K) – If Bitcoin drops, this level aligns with multiple confluences by late February or early March

Fib Speed Fan (0.618 from $50K to ATH) – Perfectly lines up with the pitchfork lower support around $80K

Trend-Based Fibonacci Extension (1.618) – Another confluence at the $79K mark

Fib Retracement (0.5 from $50K to ATH) – Adds more support at $79.3K

Negative Fibonacci Retracement (-0.618) – Lands right at the open gap, reinforcing this zone

Daily 233 EMA/MA – Sitting at $81.3K and $76.4K, further supporting this region

Key Support Zone: $80K - $78K – With all these confluences, this is a strong area for a potential long setup

Additional Support Zone: FWB:88K - $86K – Another important region to watch for a bounce

Resistance Levels & Confluences

Psychological Resistance at 100K – A major battle zone between bulls and bears

Daily 21 EMA/MA (~$99.5K - 101K) – A key resistance level that could cap any upward movement

233 SMA/EMA on the 4H Timeframe – Now acting as resistance, adding pressure to the downside

Potential Trade Setups

Long Setup #1: A potential entry from FWB:88K - $86K

Long Setup #2: $80K - $78K support zone with confirmation could present a high-probability trade

Final Thoughts

Bitcoin is facing strong resistance at 100K, with multiple technical indicators suggesting a possible pullback. While the bigger trend remains bullish, February might bring a correction, providing great long opportunities around the FWB:88K - $86K and $80K - $78K region. Keep an eye on key support zones and look for confirmation signals before jumping into trades.

New Indicator Release

The 4H, Daily, and Weekly support zones seen on the charts are from my new indicator, which I released for free a few days ago. Feel free to check it out and incorporate it into your analysis.

GBP/USD Resistance Rejection and Bearish OutlookGBP/USD is a forex pair representing the British Pound against the US Dollar. The current price is 1.24150, and the target price is 1.21000, indicating an expected decline. This suggests a bearish outlook, with a potential gain of 300+ pips if the price moves as anticipated. The analysis is based on support and resistance levels, key technical indicators in forex trading. The price is currently facing strong resistance, leading to a rejection at this level. A rejection from resistance often signals selling pressure, pushing prices downward. Traders expect the price to drop toward the next support level at 1.21000. The setup aligns with technical analysis, where resistance acts as a ceiling for price movements. If the resistance holds, further bearish momentum could drive the price lower. Risk management is essential, as price movements can be unpredictable.

Possible Double Top? What to expect?So BINANCE:BTCUSDT hit and checked 105k-108k area twice in last month. That means it is Double Top pattern in either 4H and 1D timeframe. And there is another thing concerning me and it might lead to 75k. As you can see it is also possible that BINANCE:BTCUSDT made triple top too and MACD is making huge divergence, so we might see new low in next few weeks or months.

Bollinger Bands — Enhanced Classic Tool for Technical AnalysisBollinger Bands — Enhanced Classic Tool for Technical Analysis

Bollinger Bands are a classic technical analysis tool designed to identify short-term trends and gauge market volatility. We’ve upgraded their functionality to make them even more intuitive and precise for trading decisions.

What’s New in Our Bollinger Bands:

Color-Coded Trend Identification

The band color automatically shifts with short-term trend reversals. This allows traders to quickly spot trend direction and decide when to enter trades.

Band Width

Reflects current volatility levels and price momentum. Narrow bands signal consolidation (accumulation/distribution), while wide bands indicate high volatility and potential trend initiation.

Dynamic Support & Resistance Levels

The outer bands, calculated as standard deviations from the moving average, act as dynamic reference points for entry and exit levels.

Gradient Zones

The bands are divided into four gradient zones, highlighting optimal areas for position sizing. Buy near the lower zones, sell near the upper zones—simple yet effective.

How to Use Bollinger Bands in Trading:

1. Identify Short-Term Trends

Bullish Trend: Green bands signal a bullish market.

Bearish Trend: Red bands indicate bearish sentiment.

2. Assess Volatility & Choose Strategies

Wide Bands: High volatility, strong trend initiation. Consider breakout strategies.

Medium Bands: Range-bound markets. Trade bounces from band boundaries.

Narrow Bands: Consolidation (accumulation/distribution), often preceding strong price impulses.

Pro Tip: A sharp band contraction often precedes explosive price movements.

Volatility Assessment Examples

High Volatility + Trend:

Wide band expansion signals a strong bullish trend (green bands).

Medium Volatility + Range:

Moderate band width and frequent color shifts suggest choppy markets—ideal for boundary bounce trades.

Low Volatility + Breakouts:

A narrow band breakout (green bands) confirms a strong bullish impulse.

Trading Bounces from Band Boundaries

Prices tend to revert to the moving average (midline). This makes Bollinger Bands a powerful tool for swing traders:

Lower Band (Support): Oversold zone—consider long positions.

Upper Band (Resistance): Overbought zone—consider short positions.

Bounce trades work best in sideways markets or unclear trends. Avoid bounce strategies during band expansion (new trend formation).

Example Trades

Short on Upper Band Rejection:

Price stalls at the upper band in a bearish macro trend, offering a high-probability short entry.

Long on Lower Band Rebound:

Price bounces from the lower band in a bullish macro trend, confirming a long opportunity.

Additional Confirmation Tips

Combine Bollinger Bounce signals with:

Midas Multi-Indicator: Whale activity detection, trend ribbon reversals.

Oscillator Overextension: RSI, Stochastic, or MACD divergence.

Price Momentum: Volume spikes or candlestick patterns.

Refine entries by aligning band signals with broader market context and multi-timeframe analysis.

AI GEMS 💎AI

The ubiquitous integration of artificial intelligence into our daily lives is steadily increasing, and the technology is impacting many industries and activities. One of the drivers of the AI field has been OpenAI, which has a variety of products such as GPT, ChatGPT, Sora, and DALL-E. AI is used in many industries, from personal assistants such as Siri and Alexa to AI algorithms in social media - AI's presence is ubiquitous and continues to expand.

In the field of cryptocurrencies, AI has been no exception. The convergence of AI and blockchain technology has led to a surge in the development of AI-based cryptocurrencies and applications. These projects utilize AI and machine learning to empower blockchain networks, improve security, and create new use cases. AI is used in cryptocurrency for various purposes, such as automating trading strategies, improving market analysis, and making blockchain networks more efficient. Even some AI-enabled cryptocurrencies have emerged, looking to capitalize on the growing interest in both AI and cryptocurrencies. However, the use of AI in cryptocurrencies should be approached with caution. While AI can potentially empower blockchain networks and improve user experience, it poses new risks and challenges. For example, AI algorithms can be susceptible to manipulation or exploitation, and the security of AI-based cryptocurrency systems can be jeopardized.

AI has become an essential part of our lives, and its integration into the cryptocurrency world is no exception. As AI evolves and improves, its role in cryptocurrency will likely expand, offering new opportunities and challenges for developers and users alike.

AI Market today

The AI sector of the cryptocurrency market is currently experiencing a period of significant growth and development. According to the latest data, the total market capitalization of AI-related cryptocurrencies is $32.8 billion. AI-related crypto assets have performed well after major developments in OpenAI:

The sector has seen significant growth over the past year, with high-profile projects such as CSEMA:AKT , NYSE:FET , and SET:PRIME significantly increasing their market value. The artificial intelligence sector in the cryptocurrency space is seen as a strong contender for becoming the following big narrative, and the continuous development of AI technologies is expected to drive further growth. Projects such as The Graph (GRT), Fetch.ai (FET), and SingularityNET (AGIX) are among the most successful in the AI cryptocurrency space, offering unique value propositions that utilize AI to enhance the functionality of blockchain and cryptocurrencies.

The convergence of AI and cryptocurrencies is seen as a significant trend: AI is used to analyze the vast amounts of data generated by cryptocurrency markets. Such analysis helps to understand market trends, predict price movements, and improve the security of digital transactions. The use of AI in crypto trading and market forecasting is a crucial area, with projects such as Ocean Protocol (OCEAN) and Numeraire (NMR) leading the way. However, it is essential to note that the artificial intelligence cryptocurrency sector is still at an early stage of development, and while it offers excellent opportunities, it also carries risks. The speculative and volatile nature of the cryptocurrency market means that it is difficult to predict which particular AI cryptocurrency will show significant growth.

The AI sector of the cryptocurrency market is a dynamic and rapidly evolving space. A wide range of projects utilize AI technologies to enhance the functionality of blockchain and cryptocurrencies. As AI evolves and integrates into the cryptocurrency market, we can expect to see more sophisticated and efficient solutions for trading, security, and compliance.

Example of AI in DAO

AI at the edge of DAO - autonomous agents act as token holders. Decision-making in the DAO is democratic and decentralized. This means that every member of the DAO has the right to vote. In theory, the democratic nature of the DAO has several advantages. However, in practice, the requirement to vote on every single proposal can be overwhelming for members. Many DAO members do not have the time to vote or even the ability to understand each proposal. The lack of voter participation in the DAO limits the efficiency of decision-making within the DAO and could be a potential risk of centralization if only a tiny fraction of DAO members participate in the voting process. If autonomous agents act as delegates for token holders, voter participation in the DAO could increase, the speed of decision-making would accelerate, and decentralization could become feasible.

Promising projects

Attention! Make your DYOR! If you want to see my portfolio, please see its description below the chart.

MASA

The MASA project is a decentralized AI data and LLM (Large Language Model) network that aims to enable users to own, share, and earn from their data and computations, thereby facilitating the development of AI applications. The MASA token serves as a utility and management token for the Masa network and operates as a standard ERC20 token on Ethereum Mainnet.

The MASA token has several options for use in the Masa network:

Users can submit their data to the Masa network and receive MASA tokens as rewards. This incentivizes data sharing and helps build a robust AI data ecosystem.

Businesses and developers can pay for MASA tokens to access and utilize the data, products, and services available on the Masa network.

Users pay for MASA gas on the Masa Avalanche subnet to mine and manage their zkSBT (zero-knowledge Soulbound Token), an encrypted repository of personal data. Some of these gas payments are burned, contributing to the token's deflation.

Masa Oracle node operators use MASA tokens to manage Masa zk-oracle nodes. This helps secure the network and maintain its integrity.

Through community management, MASA token holders can participate in the Masa network's decision-making process. This ensures that the network develops in a decentralized and democratic manner.

Overall, the MASA project is a promising initiative in the field of decentralized AI data and LLM. It offers users the opportunity to contribute to the development of AI applications while being rewarded for their data. The MASA token is vital in encouraging data sharing, securing the network, and facilitating community management in the Masa ecosystem.

Parsiq

Parsiq is a comprehensive data network that powers the dApps backend and Web3 protocols. Its APIs provide real-time and historical data querying for blockchain protocols and clients, facilitating the creation of various Web3 data products.

The platform is designed to connect blockchain to various ecosystems or off-chain devices and applications, allowing users to control and secure DeFi applications, create custom event triggers, and automate real-time operations. Parsiq has made significant strides in its growth, including more than 50 strategic partnerships in 2021. These include well-known projects and service providers such as AAVE, OKEx, Solana, Chainlink, Polkadot, UnoRe, Mysterium Network, PancakeSwap, and deBridge. The project's technology is linked to many famous projects and protocols in the cryptocurrency space, allowing it to be used in increasing use cases, including AML and KYT processes, DeFi, and TradFi. In 2023, Parsiq introduced its Reactive Network, designed to bring the concepts of ReactEVM (rEVM), reactive smart contracts (RSC), and Relayer Network to the blockchain world. The Relayer Network extends the functionality and capabilities of RSCs by bringing their abilities to the entire blockchain and allowing the whole network of blockchain ecosystems to be tracked, analyzed, and responded to through a single, smart contract. The REACT token plays a vital role in the Reactive Network, paying for gas and post-blockchain RSC transactions and rewarding participants who maintain consensus in the event log.

Parsiq's evolution of rEVM leverages all aspects of its past and accumulated experience to bring its most revolutionary and industry-impacting solutions to the future to date. The VM reactive brilliant contract standard, combined with the cross-chaining capabilities provided by the Relayer Network, will enable current and future developers to build the next generation of Web3 applications.

Parsiq is a promising Web3 data networking project that offers innovative solutions for connecting blockchain to off-chain applications and facilitates the development of advanced Web3 applications. Introducing the Reactive Network and the REACT token further expands the platform's capabilities, making it a significant player in the blockchain ecosystem.

EMC

EMC ( Edge Matrix Computing ) is a cryptocurrency project that aims to create a decentralized network of AI computing power applications. It focuses on efficiently connecting and collaborating tens of thousands of idle or clustered GPU computing power nodes through Proof of Work (POW). The unique value of the EMC project is that it is the only project in the Web3 space that directly links GPU computing power to AI applications, delivering them to everyday developers and users at low cost and convenience.

The project was launched with the first RWA (Real World Assets) product based on GPU hardware computing power for AI on December 6, 2023. This product is based on GPUs, the most valuable manufacturing tools of the AI era, and represents standardization, high value, and high technical added value. The release of RWA increases asset liquidity for nodes and the network and ensures the continued growth of EMC's network value within the RWA product. EMC is actively under construction and has attracted the crypto community's attention, as evidenced by its strong social media presence and ongoing discussions about its airdrop. The project is considered large-scale and has the potential for significant growth in the future.

Forta

Forta is a project aimed at improving the security of smart contracts on the blockchain. It has a token called FORT, which incentivizes network security. The project was launched with a $23 million fundraising led by Andreessen Horowitz (a16z) and has gained attention for its efforts to secure smart contracts on various blockchain networks.

The project aims to detect and mitigate cybersecurity, financial, operational, and governance threats through a community of developers who build and run bots to monitor these risks. Forta's decentralized approach to security is seen as a critical step in securing smart contracts and the entire blockchain ecosystem. FORT owners can vote on governance proposals, contributing to the decision-making process that guides the network. This democratic approach ensures that the community can influence the direction and development of the Forta network.

This way, the FORT token is central to the Forta project's Web3 security mission, incentivizing the developer community to build the tools needed to secure their projects. The token's value is tied to the success and growth of the Forta Network, making it an essential component in the ecosystem's efforts to improve blockchain security.

Alethea AI

Alethea AI is a cutting-edge project combining generative AI and blockchain to democratize AI ownership and governance. It is at the forefront of the cryptocurrency revolution to decentralize the ownership and management of AI by leveraging the combined capabilities of these technologies.

The project attracted significant attention and support, with a total funding of $30.4 million, and the ALI token was an integral part of the project. The project introduced the concept of intelligent non-fungible tokens (iNFTs), which are NFTs capable of learning, evolving, and interacting with the environment. These icons can be created using the AI Protocol, which offers developers tools for creating AI-enabled DApps. The native ALI token plays a fundamental role in the decentralized operations of the iNFT protocol and the DApps built on top of it.

The primary mission of Alethea AI is to provide decentralized ownership and democratic governance of artificial intelligence, which is achieved through the use of blockchain technology. The project also introduced CharacterGPT V2, which allows the creation of realistic characters with unique voices and personalities through text input.

Openfabric AI

Openfabric AI is a Tier 1 protocol that aims to revolutionize artificial intelligence (AI) by creating an ecosystem where innovation is highly valued. It provides a platform for people with different backgrounds to contribute and utilize AI solutions to solve complex problems. Open fabric has been developed through extensive research and testing, ensuring it is built on a solid and reliable foundation.

Openfabric architecture encourages communities to unite, monetize their intellectual property, and compete or collaborate to pave the way for the Internet of Artificial Intelligence. It abstracts the technical complexity of artificial intelligence systems, enabling improved user experience and business integration. By utilizing a trusted execution environment and advanced cryptography techniques, the underlying framework ensures scalability, data privacy, and intellectual property protection. Critical features of Open Fabric include decentralization to avoid centralized control, usability to simplify interaction with AI, security to protect privacy and intellectual property, smart economics to ensure fair transactions, interoperability for collaboration between AI agents, and scalability by leveraging the computing power of network participants.

The Openfabric platform offers several tools and resources for developers and users, such as the Openfabric Store, Openfabric Toolkit, Openfabric SDK, and Openfabric Daemon. It also supports creating new AI applications and aims to stimulate fair market competition.

It is a promising projims to create an inclusive and cohesive community and marketplace for AI resources, developers, and companies, making AI and blockchain technology more accessible and efficient for users.

Conclusion

The artificial intelligence sector is experiencing rapid growth and is expected to continue expanding significantly in the coming years. According to Precedence Research, the global artificial intelligence (AI) market was valued at $454.12 billion in 2022 and is projected to reach around $2,575.16 billion by 2032, growing at a compound annual growth rate (CAGR) of 19.7% from 2023 to 2032.

This growth is driven by the increasing demand for AI in various fields, including medical, banking and finance, manufacturing, and others.

One of the key factors driving the growth of the AI sector is the development of new technologies and the widespread adoption of AI across various industries. For instance, the healthcare AI market is expected to grow at a CAGR of 37.5% from 2023 to 2032, driven by the use of AI for drug discovery, medical imaging, and patient care. Similarly, the AI market in the automotive industry is expected to grow at a CAGR of 35.5% from 2023 to 2032, driven by the development of autonomous vehicles and advanced driver assistance systems. Apart from these industry trends, the AI sector also benefits from the increasing availability of data and the development of new algorithms and computing platforms. As available data increases and computing power grows, AI systems become more functional and versatile, enabling them to address an ever-wider range of tasks and applications.

Overall, the future of the AI sector looks bright, with significant growth and innovation expected in the coming years. As AI technologies continue to evolve and become more widespread, they have the potential to change many aspects of our lives and drive economic growth and development. In the future, adopting AI will lead to innovation and success, while resistance to it could lead to stagnation and obsolescence.

Best regards EXCAVO

Why is BTC down today?Stocks and crypto both down the last couple of days. BTC often levers the remainder of the cryptosphere up and down based on it's own direction. Very much like a teacher and a group of students. Most will do what they're told, but there will also sometimes be a couple of rogues that don't follow the pack. With regards to BTC, we could be looking at a head and shoulders top. We've seen a piercing of the neckline today, only to rebound back above it. I'd say that if we see a decisive open and close below the neckline on a 4HR timeframe (minimum) H&S will be confirmed and we'll be down to the long purple box where there lies good resistance. Fear not! This is normal, natural and if you're an investor don't go chopping and changing. Just enjoy your weel and look out for the next few posts where we could leverage a great buy back with some extra cash. So, if you're going to do anything - raise some capital to add in! Follow and share for more.