DXY Top-Down Analysis: Market Structure & Directional Bias This video demonstrates a top-down analysis of DXY. I'll show you how to identify market structure, value areas, directional bias, and key support and resistance levels. You'll learn to analyze the market from weekly to hourly timeframes using Heikin-Ashi candles and the 200 EMA.

Topdownanalysis

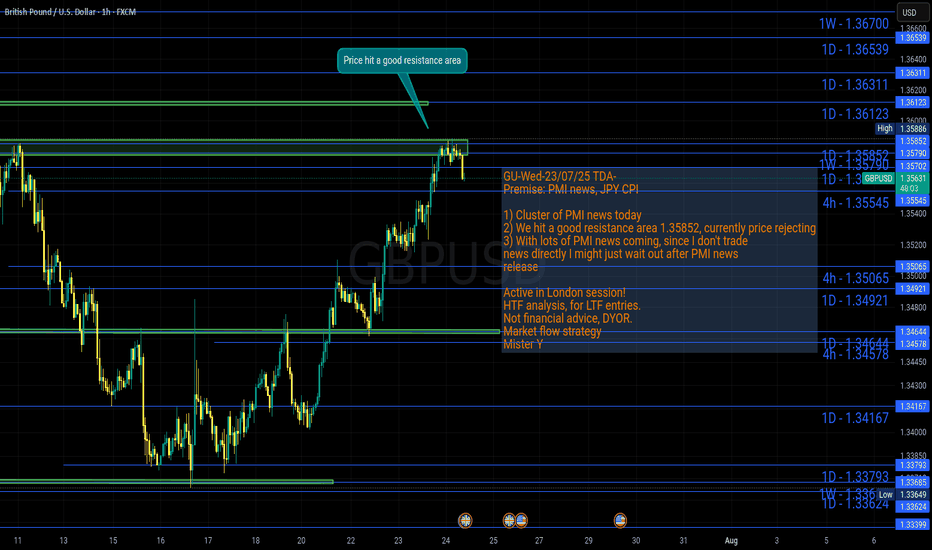

GU-Wed-23/07/25 TDA-Cluster of PMI news now, watch out!Analysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

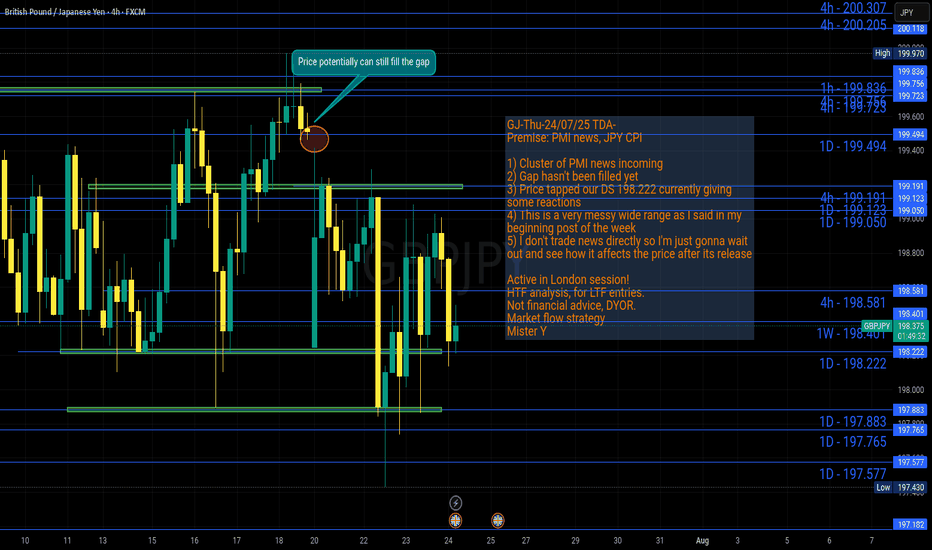

GJ-Thu-24/07/25 TDA-Messy wide range, gap hasn't been filled yetAnalysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

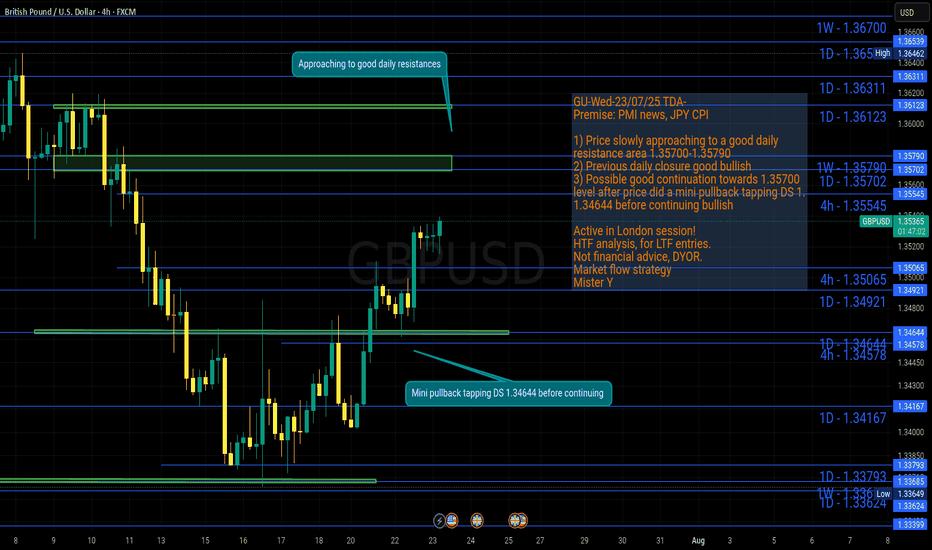

GU-Wed-23/07/25 TDA-GU approaching to a good resistance zoneAnalysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

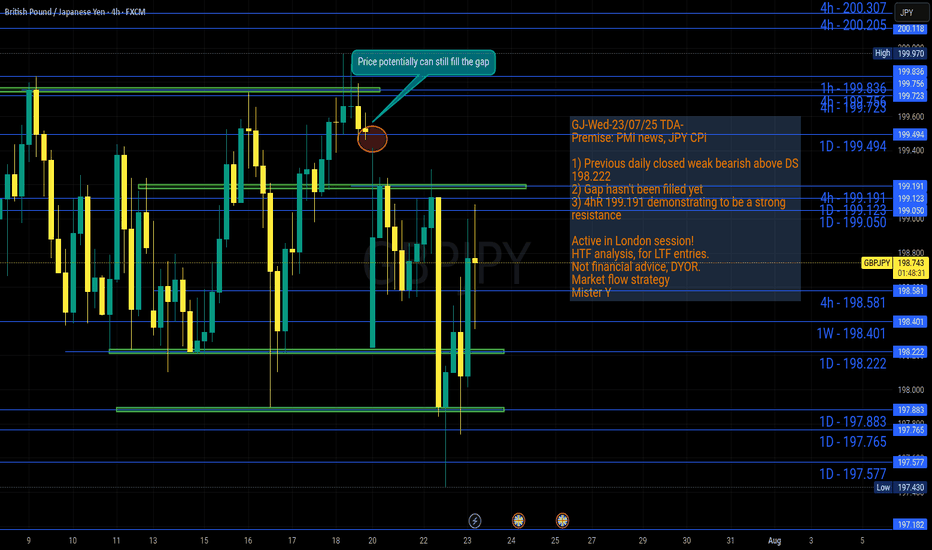

GJ-Wed-23/07/25 TDA-Gap hasn't been filled yet!Analysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

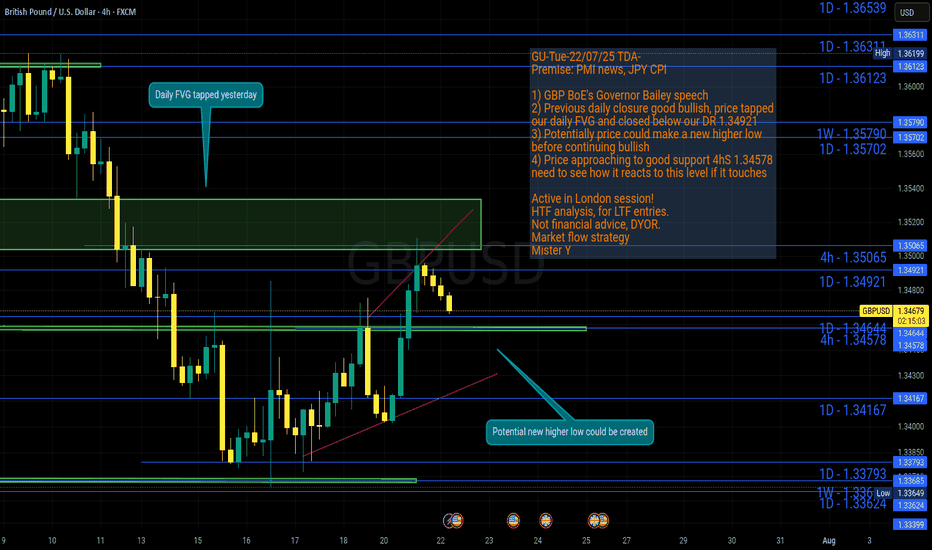

GU-Tue-22/07/25 TDA-Potential new higher low before continue?Analysis done directly on the chart!

Price gave a good bullish closure on daily candle yesterday,

if bullish trend continues, there's a good probability for price

to create a new higher low before continuing up.

Monitor and react to how price move from level to level.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

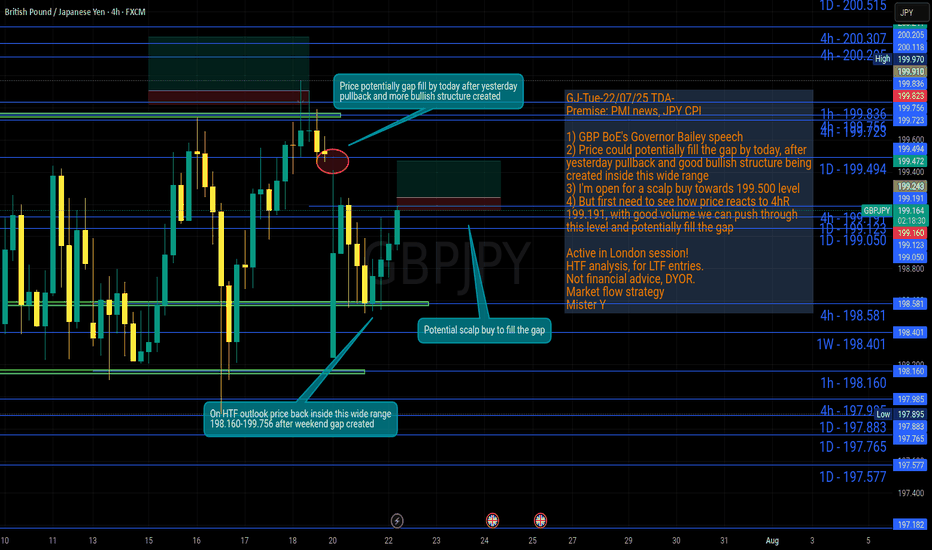

GJ-Tue-22/07/25 TDA-Potential scalp buy to fill the gap!Analysis done directly on the chart!

Weekend gaps in the majority of times (if not all the time) at some point

will be filled.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

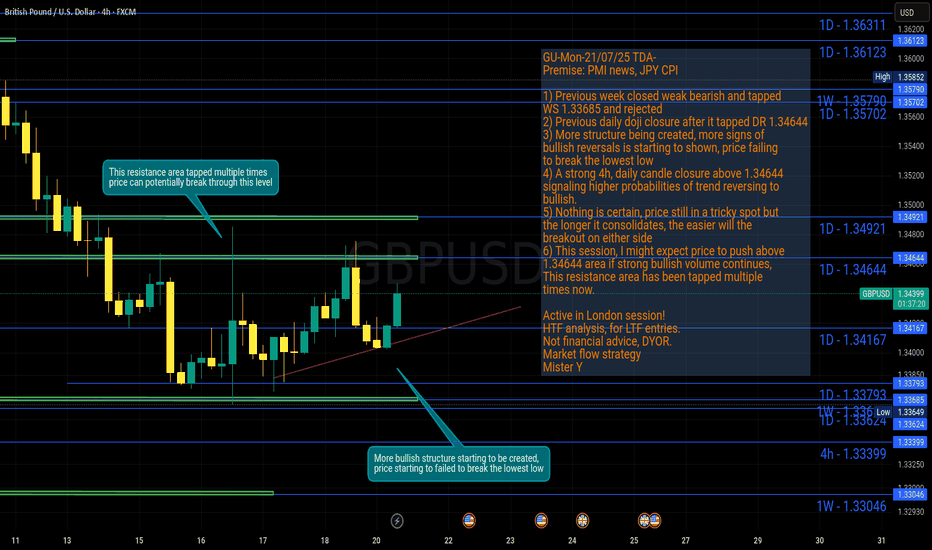

GU-Mon-21/07/25 TDA-More consolidation,are we about to breakout?Analysis done directly on the chart!

Nothing lasts forever, the longer it consolidates

the easier the breakout will be.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

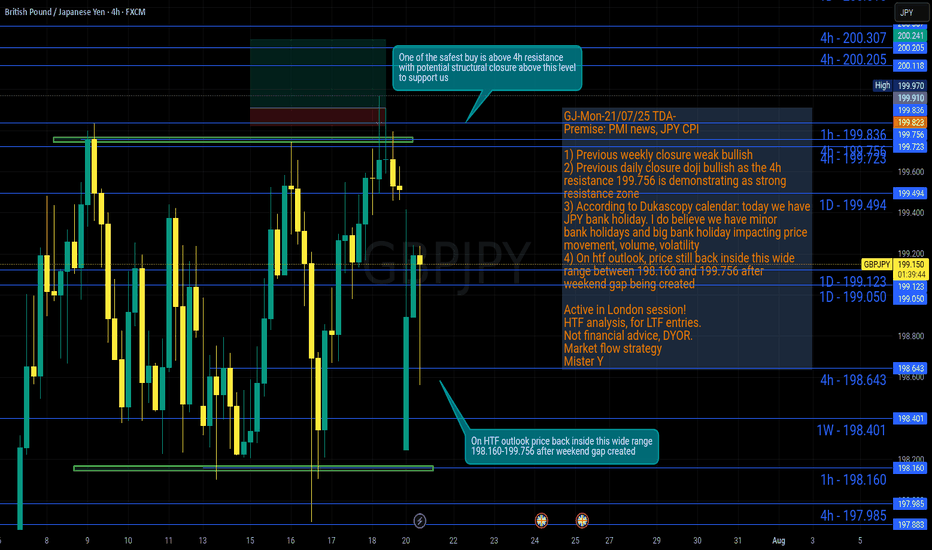

GJ-Mon-21/07/25 TDA-Wide range GJ, weekend gap at open!Analysis done directly on the chart!

We have big bank holidays and minor bank holidays.

Surely minor bank holidays impact less the price

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Thu-10/07/25 TDA-GJ pull back,good support created.Now what? Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Houses aren't built over night, it takes brick by brick, one step at a time.

Same for trading, one step at a time. You make mistakes, you learn, you improve.

You make more mistakes, you learn more, you should improve more.

If it's easy, everyone will do it realistically.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Thu-10/07/25 TDA-GU resuming bullish trend?Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

For every trade I take, no matter if it's a loss or win, I always

do post trade analysis. It really helps to understand and

improve. You get to know or try to figure out why price

at this time specifically moved this way or that way.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Wed-09/07/25 TDA-Daily support (DS) 1.35702 is holding strongAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

One of the basic concept of trading: Parts of candlestick

-The body

-The bottom wick

-The upper wick

Generally speaking, waiting for body closure above or below

certain levels gives higher probability of a certain move to

continue.

But it depends also on the timeframe you are considering:

-The 5m-15m body closure optimal for lower timeframe

-The 1h-4h body closure optimal for higher timeframe

-Etc...

These are all general considerations, in fact as a trader you

should evaluate each case based on market conditions and more.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Wed-09/07/25 TDA-Asian push, price hit our 4hR 199.723Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

When you have a specific trading time during the day,

it's can be frustrating when moves happen outside of

your trading time. But remember this is part of the game,

we will never catch every single move on the chart.

Don't force the entries, learn to get used to it.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Tue-08/07/25 TDA-GU stagnant ahead of tomorrow's FOMC minutesAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Green flags, Red flags when you follow someone in trading:

Red flags:

-Always and only share winning trades

-No track records

-A lot of marketing campaign, offering paid courses and more but

with no proof of real trading skills

(I'm not against paid course etc... Just to keep in mind)

-Just sharing buy or sell but without explaining the confluences,

the setups, the reasons, the lot size, how risk manage the trade...

-Simply don't even know where to put sl and tp in advance

Green flags:

-Do live streaming in real time

-Keeping transparent about trade setups, ideas,

about wins and losses

-Share live track record of an account

These are just some signs (could be more green and red flag signs),

and should not be used as effective methods.

If you have more of green flags or red flags ideas, comment down below!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Tue-08/07/25 TDA-Trump's new tariff 25% on Japan, YEN weakAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Trump's new tariff 25% on Japan and South Korea has Yen weakening

further more significantly. Historically JXY is at minimum levels, where

BoJ can possibly intervene and buy back YEN and strengthening it.

Possibly causing massive dump on GJ like 100-200-300 pips move

within minutes. Always be careful and stay up to date to recent global

events and more.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Mon-07/07/25 TDA-Good support zone,but possible sell continueAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Mon-07/07/25 TDA-Both sides possible, more structure->clarityAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

I often repeat in my analysis, more structure, more clarity,

easier trend identification. I won't and I will never catch

every single move but with more structure and more clarity

you'll likely to increase the probability that a move will

happen in either direction.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Thu-03/07/25 TDA-UK political turmoil triggers market selloffAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Thu-03/07/25 TDA-UK political turmoil triggers market selloffAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Wed-02/07/25 TDA-Daily support 196.371 tapped and rejectedAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Patience.

There are periods where price move smoothly

and some others less smoothly. The trader's

job is to adapting to market changing conditions.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Wed-02/07/25 TDA-Market positioning not the best atmAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Another factor that plays huge your trade setups, ideas is

market positioning. Your ideas might be good, but with

bad market positioning there's high chance price might

stop you out before going to your direction.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GU-Tue-01/07/25 TDA-Strong resistance area approaching 1.37500Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Timing!

You might ask yourself why sometimes your

trade idea was good but still ended up hitting your sl before it moves to your direction.

The reason is simple: Timing.

price is just not ready to push at that time

and needed extra liquidity and structure before it finally has the force to push.

Understanding when the market is ready is one of the most difficult thing for a trader to do but with experience you start to understand better and improve.

If you like the way I present and analyze, make sure to boost,

share and follow me for more future posts, ideas and useful informations.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GJ-Tue-01/07/25 TDA-Lots of speeches in NY, including BoJ Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Being consistently profitable is not equal to be simply profitable.

Many but many claims that they are consistently profitable but

they need years of track record to be able to say that and not

months of track record.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y