TOTAL 3 Analysis (1D)The TOTAL3 chart is currently retesting a key diagonal trendline that was broken previously. This is a classic bullish retest scenario.

If the current daily candle closes green, and is followed by a strong impulsive candle without invalidation, it could signal the start of a new leg upward, right from this zone.

The $900B market cap level remains the key support.

As long as TOTAL3 holds above this threshold, the bullish bias remains intact.

This structure could lead to momentum across the altcoin market.

Total3marketcap

Has Bitcoin become a "SAFE" asset ? These charts show that......

After we heard the US Federal Reserve hold rates yesterday, Markets Fell some.

And Bitcoin joined them for a couple of hours but Look now.

While the $ falls, the S&P Falls, GOLD is the traditional haven of safety and we can see how it Rose in Value over the last 12 hours

The $ has Fallen over the last 8 hours

S&P Stalled for the last 24 hours

And the STRONGEST positive moves over the last 12 hours were from BITCOIN rising, though it is taking a breather for the moment.

SO, has it become a SAFE HAVEN ?

Put it like this. Bitcoin has NOT lost value like it used to when under pressure.

We have yet to see what would happen once it reaches its cycle Top. Will it retreat as it has historicaly...

But for now, it does seem to be a strong store of Value and remains with potential and likelihood of further rises.

The TOTAL CRYPTO MARKET CAP chart below

This shows us that the investor market seems Very confident in the Crypto Market,,Just going from strength to strength.

The TOTAL 2 Market Cap chart shows us something very interesting.

The TOTAL2 chart is the Total Market Cap MINUS BITCOIN

Compare the 2 charts and you will see how the TOTAL chart has risen way over its previous cycle ATH but the TOTAL2 is currently being rejected off its previous ATH line.

This clearly shows us that BITCOIN is the strength in the Crypto Market.

It is the same story on the TOTAL3 chart ( TOTAL minus BTC & ETH )

It is the same on the OTHERS chart ( Top 125 coins minus top 10 by market Cap )

BITCOIN CARRIES THE MARKET

These are early days but the Future of Bitcoin does seem VERY good

So far this cycle, the largest retrace was -31%

This drop was NOT a sharp Drop over a short period of time. It was an expected and controlled drop over 112 days.

But the zoomed out version of that chart tells us something VERY GOOD

PA has risen above and Tested and held that line of resistance that had rejected PA at Cycle Top ATH in 2017 and 2021.

That is a HUGE move and we wait to see if we Hold and move higher away from this line.

SO, Is Bitcoin a Safe Haven ?

It is certainly looking more and more like it.

PA is secure, has held position well and is in Price discovery...slowly and with caution...but always moving forward.

The traditional 4 yeat Cycle would end in late Q4 this year and so we have to wait and see what happens then.

But Bitcoin PA has moved into New ground on so many fronts now.

The traditinal BEAR market may not appear, in which case, YES, Bitcoin could become a New SAFE HAVEN

Buy Bitcoin

Hold Bitcoin

TOTAL 3 New Update (12H)This analysis is an update of the analysis you see in the "Related publications" section

This index has broken below the red zone; if a pullback to this area occurs, it may act as support again and the index could move upward

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TOTAL 3 New Update (12H)This analysis is an update of the analysis you see in the "Related publications" section

TOTAL3 refers to the total crypto market cap excluding Bitcoin and Ethereum.

It pumped from the lower demand zone to the marked red box and has surged by 21%.

We now need a retracement to make the price more attractive.

If the invalidation level and the green zone hold, we could witness another bullish wave.

In this analysis, the invalidation level has been updated. A daily candle closing below this level will invalidate the setup.

Some altcoins are currently bullish, and each chart must be analyzed individually| so be cautious with your short positions.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

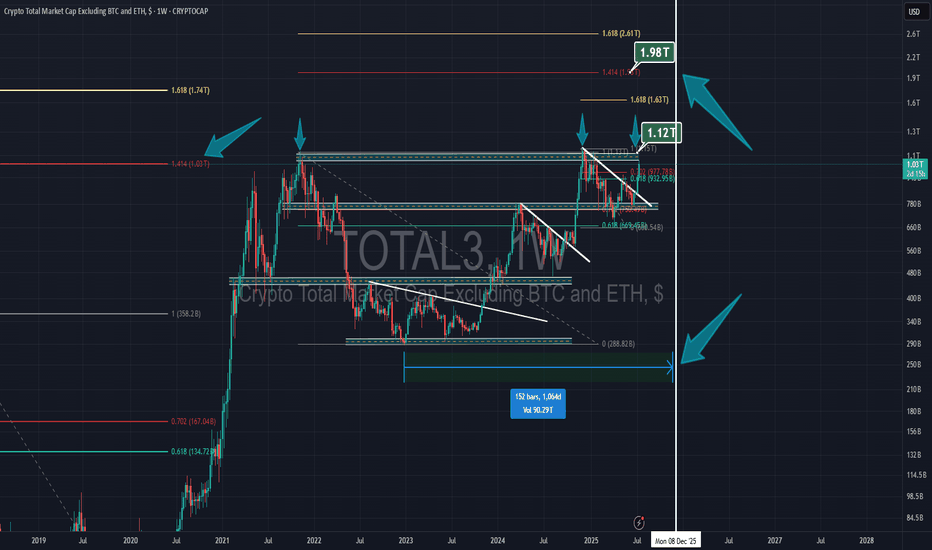

TOTAL3 – Altcoin Market Cap (Excluding BTC & ETH) Weekly TF 2025Summary

TOTAL3 is currently in a macro bullish cycle and undergoing a mid-cycle correction. The chart presents a Fibonacci-based structural roadmap with 3 Take Profit zones, identifying both correction supports and breakout targets. There is a high probability of short-term downside before a significant altcoin rally.

🌈 Chart Context

Fibonacci Retracement (Primary Leg):

100% = 285.3B

0% = 1.16T

Trend-Based Fibonacci Extension

A = 285.3B

B = 775B

C = 464.11B

Price as of analysis: ~845.62B

Key Technical Observations

Support Levels:

61.8% Fib Retracement = 618.5B

Strong Confluence Zone: Fib Retracement 48% + Fib Extension 50–61.8% (highlighted on chart)

38.2% Fib Retracement = 824.38B

Resistance Levels:

951.73B: 23.6% Retracement + 100% Extension – strong resistance zone before $1T psychological level

Take Profit Zones:

1 TP (1.1T) = 127% Fib Extension (Upper leg of parallel extension)

2 TP (1.28T) = 161.8% Fib Extension

3 TP (1.7T) = -61.8% Fib Retracement and 261.8% Extension confluence zone

Pattern & Projection:

The structure suggests a possible correction phase to lower support before continuation.

Bullish continuation expected after corrective phase, shown by the projected dotted path.

Structure: Bullish structure with healthy correction in mid-phase of the macro uptrend.

Fundamental Context

Altcoin Lag: TOTAL3 remains ~40% below its ATH, while BTC and ETH have already hit new highs.

Liquidity Shift Expected: Altcoin capital rotation tends to follow after BTC dominance stabilizes or drops.

Macro Backdrop:

Fed expected to cut rates later in 2025

Stablecoin legislation and ETF narratives building altcoin trust

Institutional inflows are slowly diversifying from BTC to ETH and large-cap alts

These suggest a possible shakeout or deeper correction before altseason breakout gains strength.

Bias & Strategy Implication:

Bias: Bullish Mid-Term – Correction Before Continuation

Expected Scenario: Pullback to strong support zones (824B–733B–618B), followed by a sustained breakout toward 1.1T–1.7T.

Invalidation: Weekly close below 618B may delay bullish structure and extend correction.

Strategy:

Long entries at support zones with tight invalidation

Scaling out near TP1, TP2, TP3 based on market momentum

Philosophical View

Patience is the virtue of the second leg in a macro trend. The correction serves to eject the impatient, reprice risk, and strengthen conviction. When TOTAL3 rises from deep support, it will be not just price but confidence that rallies.

Related Reference Charts

TOTAL Market Cap Structural Breakout:

TOTAL2 Altcoin Chart with Fibonacci Path:

✅ Tags

#TOTAL3 #AltcoinMarket #Fibonacci #Altseason #CryptoCorrection #CryptoMacro #TechnicalAnalysis #BullishOutlook #MidCycleCorrection #Crypto2025

⚠️ Notes & Disclaimers

This analysis is educational and not financial advice. Markets are inherently risky. Do your own research and manage risk accordingly.

USDT dominance chart!The chart shows USDT.D (Tether dominance) moving within a descending channel.

Currently, USDT.D is testing the upper resistance of the channel, around 4.65%.

If the dominance gets rejected at this level, the next potential target is the lower channel support around 3.9-4.0%.

This could indicate a risk-off environment where traders move capital from stablecoins (USDT) to more volatile assets like Bitcoin or altcoins.

The 50 and 200 moving averages provide dynamic resistance levels that support this potential downside move.

Thanks for your support!

DYOR. NFA

TOTAL3 Update: Potential Recovery on the Daily ChartLooking at TOTAL3 on the daily:

Yesterday, we saw a wick below the 200MA, but the price managed to close above it by the end of the day—a good sign for recovery. 🔄

Although the MLR < SMA < BB Center isn't ideal, we continue to monitor price action in relation to the 200MA. If we close above it again today, things might start to turn positive. 🌱

⚠️ Keep an eye on macro news and hope for no more downgrades from agencies like Moody’s.

Thanks for reading! Stay safe and manage your risk. 📊

TOTAL 3 ROADMAP (3D)This analysis is an update of the analysis you see in the "Related publications" section

TOTAL3 refers to the total crypto market cap excluding Bitcoin and Ethereum.

If we zoom out and observe what altcoins are doing, we might gain better control over the market.

We know that in the past few days, there have been heavy pump-and-dump moves that have hunted liquidity.

From the point where we placed the red arrow, it appears that a correction in TOTAL3 has begun. This correction seems to be forming a flat pattern, and we are currently in wave B of that flat. Wave B itself appears to be a diagonal (diametric), and we are now in wave F of it.

The triangle from the previous analysis is actually the triangle of wave F, and altcoins have turned red as they are likely in wave e of this triangle.

Wave g of B is expected to start soon (from the green zone), and a bullish rally could follow.

After this rally, price may enter a deeper correction equal in size to wave A, forming a large wave C | a move that could take over 423 days to complete.

This seems to be the roadmap for TOTAL3.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Altcoin Market Holding Strong – Breakout on the Horizon!📈🚀 Altcoin Market Holding Strong – Breakout on the Horizon! 🌈📊

Hey Traders!

The altcoin market is gearing up for a powerful breakout! TOTAL3 (the altcoin market cap excluding BTC and ETH) is holding perfectly above the critical $893B support zone. This is exactly the kind of price action we expect before major upside explosions!

📊 Key Levels to Watch:

📍 Support Holding Strong: $893B – Bulls are defending this level with conviction.

🚀 Breakout Zone: A clear move above $900B sets the stage for a rapid surge toward $1.13 Trillion, a potential +25% rally!

✅ The structure is bullish, momentum is building, and the charts don’t lie—this market wants higher!

📚 Why This Time Feels Different:

BTC dominance is struggling at resistance—this is the perfect environment for altcoins to shine! 🌟

Real crypto projects are finally starting to show strength amid all the meme coin noise.

We’ve seen this setup before… and it led to explosive alt rallies. History may not repeat perfectly, but it sure loves to rhyme! 🎯

💬 Your Next Move:

Are you already positioned for this altseason breakout, or planning your entries now?

Which altcoins are you most bullish on for this run to $1.13T and beyond?

This is the moment serious traders wait for—don’t let it slip by! The market is loading the rocket… will you be on it when it takes off? 🚀

One Love,

The FXPROFESSOR 💙

TOTAL3 Set to Explode: Altcoin Season Incoming? (12H)TOTAL3 refers to the total crypto market cap excluding Bitcoin and Ethereum.

The correction of TOTAL3 started from the point where we placed the red arrow on the chart.

It seems to have formed a triangle, and wave C now appears to be complete.

As long as the demand zone holds, it can move up toward the supply box and complete wave D.

After hitting the red box, a drop is expected for wave E — followed by the main bullish move.

Altcoins seem ready for a strong move; let’s see how it plays out.

A weekly candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

The 4 Crypto Market Cap charts and SMA's comparedTop Left TOTAL CRYPTO MARKET CAP

Top Right TOTAL 2 CRYPTO MARKET CAP ( Minus Bitcoin )

Bottom Left TOTAL 3 CRYPTO MARKET CAP ( Minus BTC and ETH )

Bottom Right OTHERS CRYPTO MARKET CAP ( Top 125 coins Minus Top 10 by dominance )

50 SMA RED

100 SMA BLUE

128 SMA GREEN

TOTAL Cap is the ONLY one that has broken above the 2021 ATH and has subsequently dropped back under but is still "touching the line" with a Wick up from the current candle.

It can also be seen how it is only the TOTAL chart that has remained easily above the 50 SMA since late 2023. The toer charts can be seen to have needed to bounce of it in 2024

The TOTAL 2 & 3 charts have very similar Candle moves and 50 SMA use.

To me, this is telling us about the Higher Cap ALT coins.

The fact that both TOTAL 2 ( Minus BTC ) and TOTAL 3 ( Minus BTC and ETH ) are similar shows me the little impact of ETH on price rise. These Charts are held up by the Higher ALT coins like SOL, INJ, SUI, XCN, HBAR to name a few. Most of these are still less than 100% gains over the last 12 months.

But what the slight Difference there is between the two charts does show us that ETH is a burden. It is dragging the TOTAL 2 chart down lwoer than the TOTAL 3 and that difference, though small on a monthly chart, is VERY SIGNIFICANT

OTHERS tells a huge story of how the Mid to Lower Caps are paying the price of Bitcoins adoption by Corporations and the fact that, as a result of these Corporations HOLDING, Bitcoin Dominance remaining High. The money that has once been used to Feed the ALT Market is static.

OTHERS is also the only chart that has fallen below its own 50SMA

That is not Bullish and very clearly shows how the Crypto Market has now matured and the absolute Tidal wave of New, worthless, useless ALT coins are failing.

This does not mean that will continue but I am inclined to believe that while we have such uncertainty in the world, the utter risk of investing in something with no use or history and security does not appeal to many.

To many extents, this could be seen as the beginning of the " Dot Com" Bubble burst for Crypto, where the best Coins / Projects are adopted and the rest, well, fall aside......

We shall see

#TOTAL3 #Analysis #Eddy#TOTAL3 #Analysis #Eddy

Crypto Total Market Cap Excluding BTC and ETH

Everything is clearly drawn and labeled.

For buy Long & Spot investment on altcoins, wait for the Total 3 index to reach its demand zone.

This is just my opinion and you should make your decision based on your style and strategy and get the necessary confirmations.

Be sure to take a look at this indicator on the monthly time frame.

TOTAL MARKET CHART UPDATE !!The chart shows the total cryptocurrency market capitalization trend. It shows a range-bound movement within parallel lines, indicating potential resistance and support levels.

Here are some key points you may find useful:

Current market capitalization: approximately $3.13 trillion.

Resistance and support: The upper and lower lines indicate levels where the price has historically reversed.

Trend analysis: The price seems to be consolidating, which could lead to a breakout or breakdown.

Keep an eye on the market to see if it breaks out of this range!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

TOTAL3🔴 Total 3 Index

Currently, the weekly support box and the key level of $800 billion have been maintained after a fake breakout.

If the index can establish a base at this level, we can remain hopeful for the formation of the final bullish leg (W5) with the goal of reaching a new ATH . This would allow some top-market altcoins to move in line with their pattern completion and recover.

TOTAL 3Everything is clear; just look at the past chart. There are two scenarios. In any case, we should see a sharp move in altcoins soon.

My personal opinion is that the blue box scenario will play out within the next 2 to 6 months. If Ethereum rises above $3,000, altcoins will begin their growth.

TOTAL3 - ALT SEASON - Bull Swing CRYPTOCAP:TOTAL3 is ready for the Alt Season.

#Altcoins will be rockin' the boat in '25.

CRYPTOCAP:BTC.D is running out of steam, thus opening the door for #AltSeason to start.

The correction on MARKETSCOM:BITCOIN Dominance is the key to #Alts to shine.

1.13T MC has been touched, previous #ATH.

Now CRYPTOCAP:TOTAL3 is in a Wave 4 (#ElliottWave Triangle), with Wave 5 of the Larger Degree C Wave about to shoot.

Targets between the #Fibonacci Extensions 200-261.8%.

That's the 1.5T to 1.8T range.

TOTAL3 Chart Analysis.

The TOTAL3 chart, representing the entire Altcoin market except for Ethereum, has successfully broken its downtrend resistance, indicating a significant shift in market sentiment. With the RSI remaining comfortably above 60, bullish momentum is gaining momentum, indicating growing confidence among market participants.

Historically, this pattern precedes a macro bullish phase, where small-cap Altcoins begin to surge, led by Bitcoin and Ethereum. A break above the $1.1T level could act as a catalyst, potentially igniting a broader Altcoin season as capital flows into the Altcoin market.

Let me know if you’d like further assistance or adjustments!

DYOR. NFA

I foresee a retracement for TOTAL 3 extending into April.Since December 24, we have observed a retracement for TOTAL 3, and I anticipate this trend will persist until April. Based on wave analysis, the final wave is expected to be the longest, consisting of five waves and potentially dropping TOTAL 3 to around $740B. If this scenario unfolds, it could result in several challenging months, marked by significant "crypto bleeding."

It’s worth mentioning that some cryptocurrencies may still experience great individual waves, as usual. However, I believe the overall market trend suggests a delay in the broader bull run.

My advice, if this prediction holds true, is to exit the market while this outlook remains valid. Once the charts show a positive shift, you can re-enter the market and fully enjoy the journey of the bull run.

Total 3 Crypto Market Cap and US10YIn our ‘Daily dose of Chart’ today we are looking into Crypto and US10Y rates. We are plotting Total 3 Crypto market Cap vs US 10 Y. Total 3 Crypto Market Cap which is the sum of all the total Crypto market cap except BTC and ETH. The Total 3 was in a bearish pattern throughout 2022 and 2024 when the US10Y was making a head and shoulder pattern. After completing the head and shoulder pattern, the yields fell which gave Total 3 to break out of a 2 year base. But with the recent breakout in US10Y rates, the Total 3 is suffering a short term bearish market. We see a cup and handle forming on the weekly chart for the Total 3. But my assessment is that the handle formation will not complete until the beginning of Q2 2025 on the weekly chart. We will revisit the chart in April 2025.

Alt Coins - one more correction likelyThis is the chart of TOTAL3 market cap - all coins excluding BTC and ETH (essentially market cap of all alt coins).

As we can see, price action is within a larger bull flag (yellow parallel channel) but within it, there is a bear flag (red parallel channel).

Market cap is currently at 950 bn. We are likely to see one more correction where market cap is likely to touch 800 bn market cap. This is because if market cap breaks down from the bear flag, on the basis of measured move, market cap is likely to touch 800 bn. This is also a fib retracement level of 50% and a strong support zone on Weekly timeframe.

Once market cap hits 800 bn zone, there is likely to be a bounce which could pierce the yellow parallel channel as it will be the 3rd hit on the upper trendline of the yellow parallel channel.

Remember technicals are all probabilities, market cap could negate bear flag to hit upper trendline of the yellow parallel channel.