#TOTAL MARKETCAP! Breakout imminent? BULL MARKET NOT OVER YET?Welcome to this extensive analysis on BTC Dominance.

If you are reading my updates for the first time , make sure you follow em if you want the most complex charts

Explained in the most simplified manner.

I also post margin and futures trade setups.

Now, let’s get to the chart.

The index is currently retesting the BLUE MA which is bullish in the short term for both btc and altcoins.

What's really important is a close above that back expanding channel.

Breakout and retest would confirm a new bullish rally throughout the market and possibly a new ATH in BTC. For that to happen it needs to close above the $1.92 trillion mark and retest it successfully.

CONCLUSION:- Mcap must break and close above the red resistance cluster and retest it successfully for a new bullish rally. The expanding channel is a bullish pattern all we need is a breakout and retest.

What do you thunk of this chart?

Do share your views the comment section and so not forget to hit the like button.

Thank you

#PEACE

Totalcryptomarket

TOTAL MARKET CAP 12 HOURS UPDATE Welcome to this quick update, everyone.

If you are reading my updates for the first time do follow me to get more complex charts in a very simplified way.

I also post altcoin setups on Spot, Margin, and Futures.

I have tried my best to bring the best possible outcome in this chart.

As we can see in the chart TOAL has rejected from this big channel upper resistance level now it is lying on the support of this green line.

let's see how the daily candle closes.

What's your thought on this?

Do hit the like button if you like this update and share your views in the comment section.

Thank you

#TOTAL MCAP, LTF Analysis, Buy levels will trigger soon..Welcome to this quick update.

If you are reading my chart for the first time, do follow me for more timely analysis and exclusive trade setups.

I share all my strategies for free which can help you to add some extra value to your trading decisions.

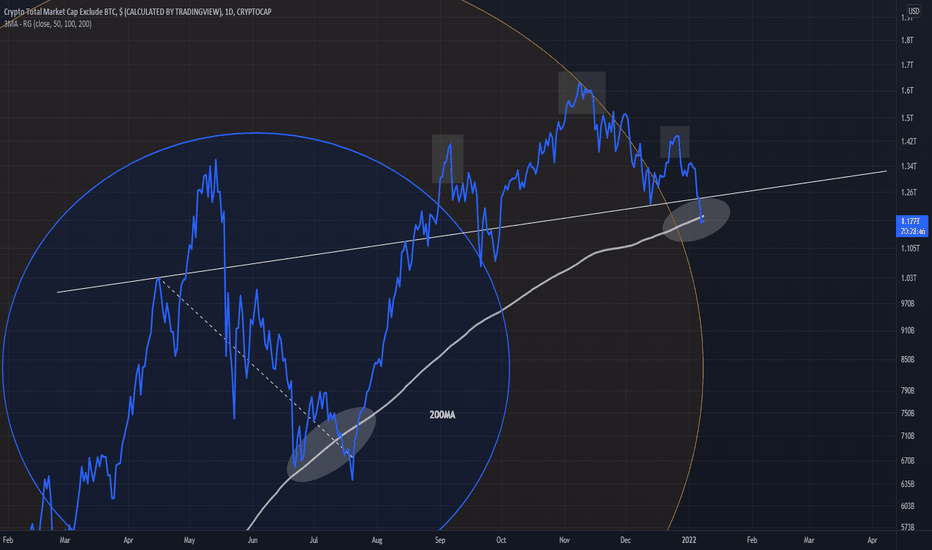

The total chart followed our speculated move as shown in the last chart (leaving the link to the previous chart below this analysis).

The formation of the right shoulder is in play.

Likely to retest the blue MA and bounce from there.

This could be the time to start adding some alt positions and DCA while it touches that MA.

Secondly, at this point, the risk will be lesser than 3 days back when you wanted to FOMO in that green market.

Hope you got my point!

You'll find most of the altcoins forming the same structure as shown in this chart.

The same rules apply to those too.

So trade accordingly,

If you want me to share all of these charts, all you need to do is hit that like button and share your views (If you have any) in the comment section. It supports me to make more of these contents for free.

Thank you

#PEACE

TOTAL MARKET CAP 12 HOURS UPDATE Welcome to this quick update, everyone.

If you are reading my updates for the first time do follow me to get more complex charts in a very simplified way.

I also post altcoin setups on Spot, Margin, and Futures.

I have tried my best to bring the best possible outcome in this chart.

As I mentioned in my previous chart the TOTAL market cap is broken the bullish expanding triangle it will come for a retest and it retests successfully

now time to go to the moon.

let's see how the daily candle closes.

What's your thought on this?

Do hit the like button if you like this update and share your views in the comment section.

Thank you

#TOTAL MARKETCAP! Bitcoins and Altcoins are not done yet!Welcome to this quick update, everyone.

The total mark cap has broken out of the downtrend channel and is currently trying to retest the level.

In my previous chart, I said we need a close above that blue MA line though I expected some early rejections it broke out at once!

We also got a breakout above the downtrend channel after exactly 90 days of consolidation.

I expected a little more sideways action and consolidation previously but the breakout on 4th Feb changed everything.

What are the possible scenarios right now?

Well, keeping in mind this is not a fakeout, we are likely to continue the rally to retest $46k and $53k in BTC but before that, the red zone is needed to be retested for a healthy and sustainable rally throughout the market. This retest could result in some pullbacks in altcoins and BTC ($38.8k to $41k) followed by a 15% rally in BTC.

That will be the best time to enter the market.

ALTCOINS will follow BTC.

This is not financial advice, these are all my own views as per the chart.

What's your thought on this?

Do hit the like button and share your views in the comment section.

Thank you

#PEACE

TOTAL MARKET CAP 12 HOURS UPDATE Welcome to this quick update, everyone.

If you are reading my updates for the first time do follow me to get more complex charts in a very simplified way.

I also post altcoin setups on Spot, Margin, and Futures.

I have tried my best to bring the best possible outcome in this chart.

As we can see in the chart TOAL is trending around this big channel resistance if it breaks and closes upside this blu line then we can expect a bounce up to 2.12T and if it gets rejected from his level then we have one more support of this green line but for confirmation, we should wait for a daily candle close.

let's see how the daily candle closes.

What's your thought on this?

Do hit the like button if you like this update and share your views in the comment section.

Thank you

TOTAL 1D UPDATE Welcome to this quick update, everyone.

If you are reading my updates for the first time do follow me to get more complex charts in a very simplified way.

I also post altcoin setups on Spot, Margin, and Futures .

I have tried my best to bring the best possible outcome in this chart.

As we can see in the chart TOAL is trending around this channel and from the same downer support line now we are expecting a bounce from the support level

let's see how the daily candle closes.

What's your thought on this?

Do hit the like button if you like this update and share your views in the comment section.

Thank you

#Total Mcap, Not everyone is watching this!!I'll keep it short unless we see a break and close in daily above this red resistance which happens to be around $1.87 trillion. I don't think we will start rallying.

Also if you look into the grey box, the index got rejected multiple times from the blue line.

It needs to get above it.

If you are too excited with that $3000 candle on BTC, Don't!

Be smart and think twice before FOMO buying anything.

It's better to buy higher with confirmation rather than buying exactly at the resistance!

What's your thought on this?

Do hit the like button and share your views in the comment section!

#PEACE

Total Crypto Market Cap 1W Chart UpdateHello friends, today you can review the technical analysis idea on a 1W linear scale chart for the Total Crypto Market Cap.

The chart is self-explanatory. The total crypto market cap is making an attempt to get back into the Ascending Channel. If it does not get back into the channel, it has the potential to fall down significantly. RSI is approaching the S/R Line and will need to go back above it to continue the move up. Lastly, this is a weekly chart, so please have patience.

Included in the chart: Trend line, Ascending Channel, Support and Resistance Lines, RSI .

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #cryptopickk

Total Crypto Market Cap: 1W ReviewHello friends, today you can review the technical analysis idea on a 1W linear scale chart for the Total Crypto Market Cap.

The chart is self-explanatory. The total crypto market cap failed the Ascending Channel support re-test and has been falling. If it does not get back into the channel, it has the potential to fall down significantly. RSI is in a descending wedge pattern so there may be a chance of upside, however economics and traditional markets do not look strong so this may be a short lived upside. Lastly, this is a weekly chart, so please have patience.

Included in the chart: Trend line, Ascending Channel, Support and Resistance Lines, Descending Wedge Pattern, RSI.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #cryptopickk

BTC: mean transaction fee (USD) vs. priceLet's look at an on chain metric: the mean transaction fee in USD for Bitcoin since inception.

We can see there's a clear correlation between the mean fees and price. When transaction fees go up, so does the price and vice versa. What we can conclude from Bitcoin's all time history is that fees peak out at all time high, this could be because of big players cashing out, thus having high volume transactions creating relative high fees. Just based off this metric we could argue Bitcoin topped out in April, which it didn't.

Another interesting point is the May - July accumulation where fees were still relative high, this could represent the high institutional buying interest at that time. Fun fact is that - from that point - we have seen price going towards a new ATH but fees have still kept dropping. Overall you could argue this is bullish, because institutions seem to have held onto their Bitcoin bags. However, I regard it as bearish. Institutions (or whales) - whatever you want to call them - moving into Bitcoin in 2021 means to me(!) they have no clue about this space. Simply said, they are late adopters and they definitely have missed the parabolic price action action on Bitcoin especially in terms of percentage returns.

This also explain the large amount of Bitcoin that has left exchanges over the last (half a) year or so. It means a pivotal shift of the Bitcoin supply from smart money (early adopters) to dumb institutional money (laggards). I know they teach you institutions are always "smart money", but believe me they aren't: the financial crisis of 2008 should teach you a lot about this - and wasn't that event referred to by Bitcoin's creator?

The question remains what these institutions will do with their bags, especially if price goes against them. Price levels of sub 30K will drop them into substantial loss territory and could be used by market makers to induce capitulation.

Looking at the chart we see a clear downtrend on mean transaction fees deviating a lot from it's all time trendline (white dashed), also printing a bearish divergence on the RSI and a negative momentum on the MACD. When we see transaction fees spike again, it could mean one or two things: they are selling or they are buying.

All will come in confluence with the price action on the stock market and the new policies of the federal reserve announced this Wednesday. The Fed is split between record inflation and a looming depression if rate hikes are too fierce. However, I do think they will want to cool off the market and especially the crypto market would become a high liability if institutions behave as laggards in the space. Both the stock and crypto markets are at all time high valuations if you zoom out a year or two, cooling these markets off is nothing more than healthy. A shift back to active income; do something useful for society instead of passive income; watch numbers - would be preferred. This also applies to myself and I have no problem admitting that trading is both a dumb and brilliant way to make money.

Have a life next to these markets and if you don't have one, get one.

IMPORTANT: this is not financial advice, trade or invest based on your own risk and research.

Total Market cap possible scenarioTotal Crypto Market cap already lost its uptrend and pulled back to the trend line. Currently, we are in the defending channel button and it seems its hold the BTC price. If and if this static support works properly we can go up about 1,8 T USD if we do not see any revers from the market we should cash out and let's see possible scenarios depending on the market sentiment and structure.

📌DISCLAIMER: I am NOT a financial adviser. None of what I have communicated verbally or in writing here should be considered as financial advice; it is NOT. Do your own research(DYOR) before investing in any digital asset, and understand that investing in any cryptocurrency is risky. If you do, you need to be prepared to lose your entire investment. I’m only recording my personal Technical Analysis (TA) for educational purposes.

📌I’m researching on crypto-economy and sharing my understanding with others, therefore these are results of my research NOT financial advice.

📌In case you find it interesting please feel free to share with others.

TOTAL CRYTOCAP: Wyckoff schematic #1 & #2Among most indexes across the globe I have spotted a variation of both wyckoff distribution schemes on the total cryptocap. As I said in my previous analysis; the markets have run hot and in no way market makers, early investors and whales would consider a scenario of WAGMI.

Market makers in crypto have learned a tough lesson during 2018 when bear markets could run hot - even for them. Another 3 years of bots, algorithms and machine learning have made them the perfect liquidity (or better said: liquidation) hunters amongst any market in the globe. This is not only because of their "brilliance and analytics" but more so; because they have one of the few retail dominated markets. Every dip should either be bought or diamond handed and every pump even more so. In fact, it is the mentality of the counterpart that made market makers record profits during 2020 and 2021. The expectations nothing less than a record breaking year for more profit.

The machine learning machines that act as intelligent liquidity miners at the fraction of the cost of a Bitcoin mining farm printed new results; the slow bleed. The slow bleed has ever showed to be the best returning strategy to contain the crypto enthousiast. Downtrends come with a few phases:

Phase 1: flash corrections retracting "the floor" that upholds the price of a coin

Phase 2: a quick absorption of liquidity through a cascade of liquidations and stops

Phase 3: a fast vectorized return to a higher floor downplaying the actual floor by a huge wick

Phase 5: the local uptrend creating new hope; "the bottom is in"

Phase 6: the vectorized liquidity chop absorbing the liquidity up and down in the new zone

Phase 7: the short squeeze; "WAGMI"

Rinse and repeat.

The downfall of the bull market itself are in fact the bulls themselves with overleveraged longs or calls, overplaying their hand without a hedge towards the opposite direction, the direction of the market maker.

IMPORTANT: this is not financial advice, trade or invest based on your own risk and research.

TOTAL2 4HOUR UPDATEWelcome to this quick update, everyone.

If you are reading my updates for the first time do follow me to get more complex charts in a very simplified way.

I also post altcoin setups on Spot, Margin, and Futures.

I have tried my best to bring the best possible outcome in this chart.

As we can see in the chart that TOAL 2 is trending around this blue channel and from the same downer support line now we are expecting a bounce from the support level

let's see how the daily candle closes.

What's your thought on this?

Do hit the like button if you like this update and share your views in the comment section.

Thank you

Total Crypto Market Cap: Chart Update Hello friends, today you can review the technical analysis idea on a 1D linear scale chart for the Total Crypto Market Cap.

The chart is showing a possible Head and Shoulders Pattern forming with the right shoulder currently forming. This may be invalidated if the crypto prices start to rise and increases the Total Crypto Market Cap. If the H&S pattern does complete the formation, it could potentially lead into a crypto bear market. Since this is a weekly chart, we will need to wait and watch.

In the related ideas below I discuss the recent BTC price with trend lines, EMA Ribbons and 200 SMA. Please review those as well.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis . Don't trade based on my advice. Do your own research! #cryptopickk