DeFi’s Make-or-Break MomentThe spotlight today is on TOTALDEFI, an index that could become one of the most exciting charts in the crypto market.

While many altcoins look heavy under selling pressure, TOTALDEFI is holding firmly at the 61.8% Fibonacci support near 116B. This zone is often a turning point where strong reversals begin. If the level continues to hold, we might see a 20% move to the upside, signaling renewed strength in the DeFi sector.

This price action could be a sign that decentralized finance projects are ready to lead the next market phase.

TOTALDEFI

TOTAL DEFI: HTF Reaccumulation Underway — $200B+ In SightThis is one of the cleanest HTF setups in the market right now — and it’s flying under the radar.

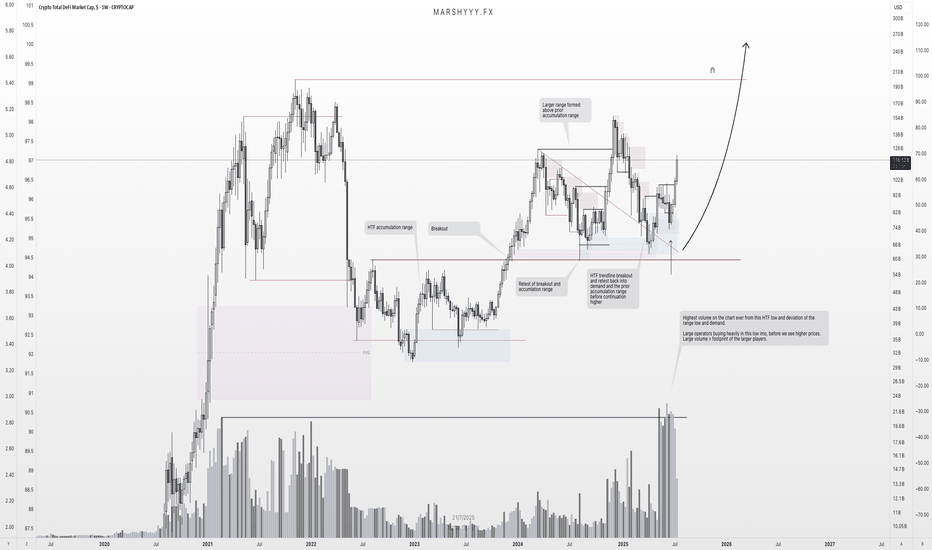

We're looking at TOTAL DEFI market cap, and it’s showing all the signs of strong reaccumulation following a textbook breakout–retest structure off a larger HTF accumulation base.

Price broke out from the 2023–2024 accumulation range, retested that breakout zone and range highs in August 2024, swept liquidity, and tapped into unmitigated demand within the accumulation range — before climbing back to the $155B region, creating a larger range above the prior accumulation range it broke out from.

Since then, price pulled all the way back to range lows and HTF demand at $65B, forming a new bullish reversal from this key region and retesting the trendline breakout before continuing another leg higher — as we’re now seeing unfold.

But here’s the key:

🧠 That recent deviation came with the highest volume ever recorded on this chart — right off the range low and HTF demand.

That’s not retail. That’s large operators loading up, leaving their footprint ahead of the next expansion leg.

We’ve now:

- Broken the descending trendline cleanly

- Flipped key SR levels back into support

- Started pushing higher with strong HTF closes

📈 Expectation:

This is a spring + test setup within a reaccumulation range. I’m targeting continuation toward the range highs, followed by a macro breakout that could take DeFi market cap to $200B+ — especially once the prior distribution zone is reclaimed.

This aligns with the broader cycle narrative — liquidity rotating back into altcoins, particularly DeFi, as stablecoin dominance declines and the market shifts fully risk-on into the final phase of the bull cycle.

Key Structure Summary:

- HTF accumulation base → breakout → retest → demand sweep

- Largest volume spike = operator footprint

- Higher lows forming = market structure flipping

- Expecting expansion to $200B+ as trend continues

One to watch closely.

Don’t fade the volume. Don’t fade the structure.

defi summerthis chart portrays the total market cap of the defi dominance.

it's currently sitting at 3.98% with an inverse h&s on a weekly timeframe.

my projected upside target sits at the ath of about 7.95%

---

the last meaningful defi summer we experienced was in 2020.

☀

let's make this one count.

---

i'm projecting this defi market cap dominance to hit 8% into the presidential election where a soft top will likely be created.

i've shared a lot of plays over the last few months with our members, and we're just chilling into november.

---

tldr; hodl into a 3-4 month long alt season, and tp into the presidential election.

Bull markets start with DeFiLet's look back at the previous bull market. As you can see, with the explosive growth of DeFi, the bull market officially started.

The upcoming bull market can be the same. We expect to see massive adoption of retail and commercial investors this time.

What is your DeFi bet? Will you play it safe or high R:R? Let me know below!

Bullish divergence in ETHBTC 📉📈❓🔍Here we are looking at the price indexed to 100.

🟢We have a descending rising wedge, with a bullish divergence: price falling, with the SMI (Stochastic Momentum Index) of the PVT (Price Volume Trend) rising.

🔴Could price revisit the 0.5 Fibo retracement in the final breather?

It could, but I think it's unlikely.

In any case, I traced this possibility using the white line.

🟢Furthermore, we have other divergences, if we consider the TOTALDEFI index:

$TOTALDEFI Identifying a Rectangle Bottom PatternHello, Traders! Today, I want to share an exciting technical analysis finding on the cryptocurrency Total DeFi ( CRYPTOCAP:TOTALDEFI ). A rectangle bottom pattern has been identified, indicating the potential for a bullish move in the near future. Let's delve into the details!

📈 Ticker: CRYPTOCAP:TOTALDEFI

📅 Timeframe: Daily Chart

📊 Pattern: Rectangle Bottom

📉 Understanding the Rectangle Bottom Pattern:

A rectangle bottom is a bullish chart pattern characterized by a horizontal price consolidation range. It signifies a period of consolidation before a potential bullish breakout. This pattern indicates the possibility of an upward price movement.

🔍 Identifying the Rectangle Bottom on CRYPTOCAP:TOTALDEFI :

Upon analyzing the daily chart of CRYPTOCAP:TOTALDEFI , the following observations come to light:

1️⃣ Price consolidation range: CRYPTOCAP:TOTALDEFI has been trading within a horizontal range, with relatively equal highs and lows.

2️⃣ Multiple touches: The price has tested the upper and lower boundaries of the range multiple times, confirming the validity of the pattern.

3️⃣ Volume analysis: Observe increasing trading volume during the breakout phase to confirm the pattern's reliability.

📈 Price Targets and Trading Strategy:

If the rectangle bottom pattern on CRYPTOCAP:TOTALDEFI plays out as anticipated, a potential bullish breakout above the upper boundary may occur, indicating a potential price appreciation. Consider the following price targets:

1️⃣ Target 1: Resistance level near $60 billion

2️⃣ Target 2: Psychological resistance near $80 billion

🛡️ Risk Management:

Managing risk is crucial for successful trading. Implement the following risk management techniques:

1️⃣ Set a stop-loss order below the lower boundary to protect against unexpected price reversals.

2️⃣ Adjust position size based on your risk tolerance and overall portfolio management strategy.

🔔 Conclusion:

Keep a close eye on Total DeFi ( CRYPTOCAP:TOTALDEFI ) as it continues to develop this rectangle bottom pattern. The pattern suggests the potential for a bullish breakout and subsequent price increase. However, please remember that technical analysis is not foolproof, and market conditions can change. Consider incorporating additional analysis and fundamental factors before making any trading decisions.

Disclaimer: This post is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Happy Trading! 📈💰

#tradingview #technicalanalysis #rectanglebottom #bullishpotential #TOTALDEFI #cryptocurrency #chartpatterns #tradingstrategies #investing #finance #marketanalysis

10 TradingView Crypto Indices You Should Know!📉📌 10 @TradingView Crypto Indices You Should Know!

Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst. And I want to start by thanking @TradingView for putting these indices together - making our life easier.

A couple of days ago, TradingView posted a tweet (attached on the chart) highlighting these 10 Crypto Indices. So I thought it would be a good idea to go over it and post its analysis as per my trading style.

So grab a cup of coffee or tea, and let's enjoy it together 😁

📌 BTC.D - Market Cap BTC Dominance

🗒 BTC.D is rejecting a strong support zone in green. For the bulls to take over short-term, we need a break above the last minor high in orange.

And for the bulls to remain in control from a medium-term perspective, we need a break above the main high in gray.

If we break below 40% level, then we will be expecting BTC.D to dive inside the green zone.

📌 ETH.D - Market Cap ETH Dominance

🗒 ETH.D has been stuck inside a range. For the bears to take over, we need a break below the orange zone and lower red trendline. In this case, a movement till the 13% green zone would be expected.

In parallel, for the bulls to take over, we need a break above the upper gray high. In this case, further bullish movement till around the upper red trendline would be expected.

📌 USDT.D - Market Cap USDT Dominance

🗒 USDT.D rejected our blue support zone last week and traded higher. We are currently sitting around a supply zone. If we trade higher, then we will be approaching a strong resistance zone in green.

For the bears to take over, thus for the bull run to start for Crypto, we need a break below the blue support AND lower blue trendline.

📌 USDC.D - Market Cap USDC Dominance

🗒 USDC.D is overall bullish trading inside our two red trendlines. For the bulls to remain in control, we need a break above the last major high in green.

Meanwhile, USDC.D is sitting around the upper red trendline acting as a non-horizontal resistance that might push price lower inside the range again.

For the bears to take over from a medium-term perspective, which would be healthy for the crypto market, we need a break below the lower red trendline. In this case, a movement till the 4% support zone would be expected.

📌 TOTAL - Total Crypto Market Capitalization

🗒 TOTAL has been overall bearish for a while, and lately we have been trading inside the red channel.

The next support that might hold TOTAL up is the 500B - 600B demand zone.

For the bulls to take over from a long-term perspective, we need a break above the 1 Trillion round number in blue.

Meanwhile, every bullish movement would be a short-term correction.

🗒 TOTAL2, TOTAL3, OTHERS and TOTALDEFI charts are very similar to TOTAL

📌 TOTAL2 - Total Market Capitalization (Excluding BTC)

📌 TOTAL3 - Crypto Total Market Cap (Excluding BTC and ETH)

📌 OTHERS - Crypto Total Market Cap Others

📌 TOTALDEFI - Total DeFi Market Capitalization

📌 DEFIETH - DeFi/Ethereum ratio

🗒 DEFIETH is stuck inside a range.

For the bulls to take over, we need a break above the upper gray zone AND upper red trendline.

For the bears to take over, we need a break below the lower gray zone. In this case a movement till around the 15% demand zone would be expected.

Hope you find this article useful. Feel free to share your thoughts or request any chart analysis.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

DeFi (TOTALDEFI)• Break of trend signs of weakness Posting chart idea following the video I made on this.

It is expected to see several DeFi projects to let go some of the 2021 gains and possible 2020. But we are not there... just yet.

This chart is one of major reason I could see Bitcoin also get a huge cut like piercing bellow 30k.