Totalmarketcap

TOTAL 2 ANALYSEThe longer BTC dominance continues to decline, the more likely it is that Total 2 will break through key resistance levels.

For now, I’m anticipating a retest of the highlighted area, which would support a logical continuation to the upside, in line with the H4 analysis on BTC dominance.

$TOTAL Crypto Market Cap - Banana Zone or Bull Trap!?Massive day for CRYPTOCAP:TOTAL Crypto Market Cap with 9% move UP, breaking above the 200DMA and last cycle’s ATH.

Got rejected at the .618 Fib ~$3.19T, so work still needs to be done to confirm this region.

Expect a retest at $3T to decide if the market goes to $3.2T or back down to $2.85T

As I've been saying this past month, this is either the biggest bull trap all cycle, or it's the start of the PARABOLA 🍌

The 4 Crypto Dominance charts and 4 x TOTAL charts -ALT ?

There are some charts we should always refer to in times where we feel change may be upon us.

The chart above are

Bitcoin Dominance ( BTC.D ) - Ethereum Dominance ( ETH.D )

Others Dominace ( OTHERS.D) and USDT Dominance ( USDT.D) ( I use USDT as it remains the largest Stablecoin by market cap)

The RED line in these Daily charts is the 50 day SMA

In most of my posts recently, I have been mentioning how Strong BITCOIN is remaining while under a Lot of resistance.

But we really should not forget the rest of the market. THE ALTS

The Fabled ALT Season has been running away from us, making many wonder just what is happening.

To explain, while BTC.D remains high, it shows us that the Money remain invested in Bitcoin.

When this Dominance Drops, in the past, it has signalled the rise of investment into ALTS.

Called ROTATION, the money rotates from one asset to another.

Due to the corporate investment in Bitcoin, this rotation has not happened.

BUT IS IT ABOUT TO ?

Let look at a few things

BTC.D has been rising continuously for Months now, It is way above that 50 day SMA. PA could fall a Long way before the support of that 50 SMA is required and I notice as I type, that is is beginning to drop. It's local support may help

ETH.D has begun to Rise but we need to pay attention to this as it could get rejected once again by the 50 SMA. Ethereum has had a very hard time this cycle and has yet to show any sustained recovery

OTHERS.D - Now OTHERS is the one I watch most. Others is the Top 125 Coins MINUS the Top 10 by market cap. This shows us the Mid to Low cap Alts coins.

This is also rising right now but once again, we need to wait and see if it breaks through the 50 SMA that has rejected it many times.

The USDT.D has been dropping. This shows that USDT has been rotated into other assets. Bullish but I have to say, that as I write this, I have just noticed that this has begun to rise also though only on a 1 hour chart so maybe just Noise but it is worth watching.

So, on these dominance charts, we see a potential start to a rotation but with the likely hood of rejection of the 50 SMA, It could be the First step of a bigger move.....But with potholes in front.

The Next Logical thing to do is to look at the TOTAL market Cap charts, to compare this dominance.

This chart shows us the Daily charts for

TOTAL Crypto market Cap - TOTAL2 ( minus BTC )

TOTAL3 ( Minus BTC & ETH ) - OTHERS ( Top 125 coins Minus top 10 by Dominace )

SMA;s in chart are RED= 50, BLUE = 100, GREEN = 128, YELLOW = 200

The TOTAL is the ONLY one that has PA above all the SMA's, potentially offering Support on many fronts. It has also had the most sustained Rise. Hence the high level of Dominance in the Market.

TOTAL2 is above the 50 SMA that has rejected it previously and is about to hit into the 100. We need to see if this will be rejected or not.

Remember how the ETH.D is also facing rejection off the 50SMA - ETH is under pressure

TOTAL3 is above the 50 and appears to have broken through the 100. This is VERY Bullish for the ALT coins and could show us some potential for a continued rise as sentiment continues to turn positive. But we should watch that 200 as a potential problem

OTHERS has the largest and strongest rise and again, is above the 50 and appears to have broken through the 100. This chart has the largest gap between current PA level and the next SMA that may reject it. This is the same on the Others.D chart

SO, in conclusion, The potential for a Rotation does exist but it is going to be hard fought. There is the possibility of a HIGH volitle state for the next few days, possibly Weeks.

If you are going to rotate out of Bitcoin, Be VERY CAUTIOUS until at least the next SMA have been claimed on both sets of charts.

The nest bets are on the Mid to lower Cap ALT coins.

BUT I will say this. I cannot See BITCOIN Selling off to invest in ALTS. I also see Bitcoin continuing higher against the USD.

IF we get an ALT season now, It will be Quick, Volatile and possibly with Quick Pump and Dumps on most ALTS.

The larger ALTS will survive this better than the Meme, small caps in my opinion

For me, the ROTATION that creates an ALT Season will occur with the rotation of money from ALT to ALT and NOT BTC to ALT

What ever you do, Remain in Peace and Safety

$TOTAL Crypto Market Cap BULL TRAP AlertBULL TRAP 🚨

New money has been coming into the market as shown on the Crypto CRYPTOCAP:TOTAL Market Cap, hence why you haven’t seen “rotations” in coins, but it appears to be drying up.

There’s been major resistance at the 200DMA, which is just below the previous ATH at $3T, and PA is being squeezed between the 9DMA.

Combine this with a heated RSI, it appears to be a bear flag in the making.

The trendline from Oct. ’23 gives confluence with the 50DMA as support.

*The only savior I see at this point is price smashing through the 200DMA and flipping support into the green accumulation box.

Regardless, this move is coming to an end later this week to test support or breakout.

Again, I’ll reconfirm my stance that this is the most obvious bull trap I’ve seen all cycle. Although I hope to be wrong 🥲

Having said that, after support is confirmed on the move, we are going to VALHALLA 🚀

Bookmark this 🤓

Total Market Cap: Testing the 200 MA as Resistance (Daily Chart)28.04.2025

Price is currently testing the 200 MA as resistance.

Last time we saw a similar test, price rejected and soon after, the infamous **death cross** occurred (50 MA crossing below the 200 MA).

Today, the internal structure looks better:

✅ MLR > SMA > BB Center > PSAR – positive alignment, signalling early momentum shift.

However, for a real bullish confirmation, price must flip the 200 MA from resistance into support.

Until then:

⚠️ Watch for rejection at this level.

⚠️ Patience — wait for the structure to fully align before considering heavy positioning.

Discipline first, excitement second.

Crypto Euphoria Is Back, But Should It Be?📈 Bitcoin is back above 90k and the crowd is cheering again: moons, 150k by summer, non-stop hopium.

But is the overall picture that bullish? Not even close.

📊 Looking at the Total Market Cap chart :

- After that long November to late February consolidation, Total finally broke below the 3T support

- We retested the break and new local lows followed

- The recent bounce? Looks corrective, not impulsive

- And we’re still trading below 3T and with good percentages

❗ Conclusion:

I’m not buying into the hype.

In fact, I’m expecting a new leg lower – possibly all the way to 2T

📌 Trading Focus:

Shorting Solana and ETH

This Chart Screams Strength — Are You Positioned?The total crypto market cap is currently showing a very strong technical setup. It’s holding firm at a major long-term rising trendline, which has historically acted as a launchpad for massive bullish moves across the market. Additionally, the 100 EMA is providing solid support, further reinforcing this zone as a key demand area.

We’re also seeing a bottomed-out Stochastic RSI, now starting to curl upward — a classic early signal of momentum shifting back to the bulls. Although the market is still sitting just below the long-term resistance line, this type of structure often leads to strong breakouts once confidence returns.

If this trendline support continues to hold and the market cap begins pushing back toward the $3 trillion mark, we could see a major surge in altcoin strength. Historically, this is when altcoin capital rotation picks up and narratives gain momentum. Overall, the crypto market is flashing strength — and this might just be the calm before a powerful altcoin rally.

Thanks for reading! Please do like and follow us for more updates.

The 4 Crypto Market Cap charts and SMA's comparedTop Left TOTAL CRYPTO MARKET CAP

Top Right TOTAL 2 CRYPTO MARKET CAP ( Minus Bitcoin )

Bottom Left TOTAL 3 CRYPTO MARKET CAP ( Minus BTC and ETH )

Bottom Right OTHERS CRYPTO MARKET CAP ( Top 125 coins Minus Top 10 by dominance )

50 SMA RED

100 SMA BLUE

128 SMA GREEN

TOTAL Cap is the ONLY one that has broken above the 2021 ATH and has subsequently dropped back under but is still "touching the line" with a Wick up from the current candle.

It can also be seen how it is only the TOTAL chart that has remained easily above the 50 SMA since late 2023. The toer charts can be seen to have needed to bounce of it in 2024

The TOTAL 2 & 3 charts have very similar Candle moves and 50 SMA use.

To me, this is telling us about the Higher Cap ALT coins.

The fact that both TOTAL 2 ( Minus BTC ) and TOTAL 3 ( Minus BTC and ETH ) are similar shows me the little impact of ETH on price rise. These Charts are held up by the Higher ALT coins like SOL, INJ, SUI, XCN, HBAR to name a few. Most of these are still less than 100% gains over the last 12 months.

But what the slight Difference there is between the two charts does show us that ETH is a burden. It is dragging the TOTAL 2 chart down lwoer than the TOTAL 3 and that difference, though small on a monthly chart, is VERY SIGNIFICANT

OTHERS tells a huge story of how the Mid to Lower Caps are paying the price of Bitcoins adoption by Corporations and the fact that, as a result of these Corporations HOLDING, Bitcoin Dominance remaining High. The money that has once been used to Feed the ALT Market is static.

OTHERS is also the only chart that has fallen below its own 50SMA

That is not Bullish and very clearly shows how the Crypto Market has now matured and the absolute Tidal wave of New, worthless, useless ALT coins are failing.

This does not mean that will continue but I am inclined to believe that while we have such uncertainty in the world, the utter risk of investing in something with no use or history and security does not appeal to many.

To many extents, this could be seen as the beginning of the " Dot Com" Bubble burst for Crypto, where the best Coins / Projects are adopted and the rest, well, fall aside......

We shall see

TOTAL Crypto Market Cap Monthly Candle Close numbers & sequence

This is the TOTAL version of the Bitcoin chart I post every month

It is not always the same but, on average, it has the same Candle colour but not always the same Size, due to influences of ALT coins.

But what I want to draw your attention to is where that arrow is pointing.

We have just had a RED Febuary and March candle close.

This has only ever happened ONCE before.

Late 2019 - Early 2020

Infact, in 2019 we had Dec RED, Jan GREEN, Feb RED, March RED

And currently we have Dec RED, Jan GREEN, Feb RED, March RED,

The 2020 March RED was the Covid dive, that was swiftly recovered

Currently we have the "Trump Tariff Dive"

In so many ways, we are repeating the early 2020 Sequence in the TOTAL Cap

The Bitcoin Chart however, seems to be repeating the 2017 Sequence.

In 2020, TOTAL market Ca [pApril and May both closed GREEN. while en-route to a New ATH in March 2021.

A New cycle ATH in early 2026 is entirely possible though it would be Very Much out of sequence.

Things are different in many way with Crypto now...We are under new Regimes..

Discount Nothing

Interesting days indeed

TOTAL Bearish PennantThe Parameter known as TOTAL has a currently working bearish pennant formation.

Market is bearish and every green candle on Total means another Short opportuinty.

If Total breaks 2.58T (which is a montly pivot value), we can expect more dumps. 2.36 would be the main target.

When Total reachs 2.36, look for a long wick. If the daily candle close isn't happening, it's a Long opportuinty.

Crypto Market at Critical Crossroads: Is History Repeating?Maybe an altcoin season seems too luxurious for us investors right now.

The TOTAL market cap is currently at a critical point, showing price action similar to past cycles.

Previously, we had COVID as our black swan event - could today's equivalent be a trade war?

We're probably approaching the final wave before the market truly enters a downtrend. It's crucial now to stay alert and prepare carefully.

Everything the US is currently doing—including tariffs—serves one goal: shrinking their huge federal debt load, absorbing wealth from other global economies, and keeping gold prices in check. This gives the FED more room to reduce interest rates and reignite growth.

Eventually, global markets always rebalance. Governments typically respond by printing more money to ease the pain, and historically, that's positive news for BINANCE:BTCUSD

Cheap money policies always return; it's just a matter of when.

Your job now is straightforward:

- Be patient

- Stay flexible

- Maintain solid cash reserves

Remain calm, stay sharp, and be ready for opportunities.

#BTC #FED #TotalMarketCap #CryptoTrading #TechnicalAnalysis #CryptoVeteran #TheCryptoFire

Bitcoin Analysis: Potential Path to $150K and Market TrendsCurrent Price & Key Levels

- BTC/USDT Price: BINANCE:BTCUSDT (as per chart).

- Critical Support: Bottom of the ascending channel .

- Key Resistance: Upper trendline of the channel (to be confirmed).

Technical Signals

1. Ascending Channel:

- Price is at the bottom of the channel, historically a bounce zone.

- A break above the upper trendline could signal a bullish continuation.

2. Moving Averages:

- SMA 200 (4H) and SMA 20 (1D) are critical for trend confirmation.

- A bullish crossover (e.g., SMA 20 > SMA 200) would strengthen the buy signal.

3. Dominance (BTC.D):

- If Bitcoin dominance turns bearish, expect capital rotation into altcoins (altseason potential).

- Monitor dominance alongside price action for market shifts.

$150K Target: When and How?

- Scenario 1:

- A strong breakout from the ascending channel + rising volume → Acceleration toward $150K.

- Timeline:Mid-2025/Late-2025 (historically aligns with post-halving cycles).

- Scenario 2:

- Slow grind upward with corrections → $150K likely by 2026, pending macroeconomic stability (e.g., ETF inflows, regulatory clarity).

Altcoin Season Watch

- Trigger:

- If Bitcoin’s dominance drops below 57%, altcoins may surge.

- Focus on high-cap alts (ETH, SOL) and narratives like AI, DePIN, or RWA.

Trade Strategy

- Entry:

- Buy on confirmed breakout above the channel + SMA crossover.

- Stop Loss:

- Below the channel’s lower trendline (e.g., $80,000).

- Take Profit:

- targets: $100,000.120,000

- Final target: $150,000 (scale out profits).

Risks to Monitor

- Macro Factors: Fed rate decisions, geopolitical tensions.

- Bitcoin ETF Flows: Sustained inflows/outflows impact momentum.

- Regulation: Crackdowns or approvals (e.g., ETH ETF).

---

Conclusion

- Bullish Outlook: $150K is achievable if Bitcoin holds the ascending channel and dominance remains stable.

- Altseason Hedge: Prepare a basket of altcoins if BTC.D trends downward.

Like, comment, and follow for updates! 🚀

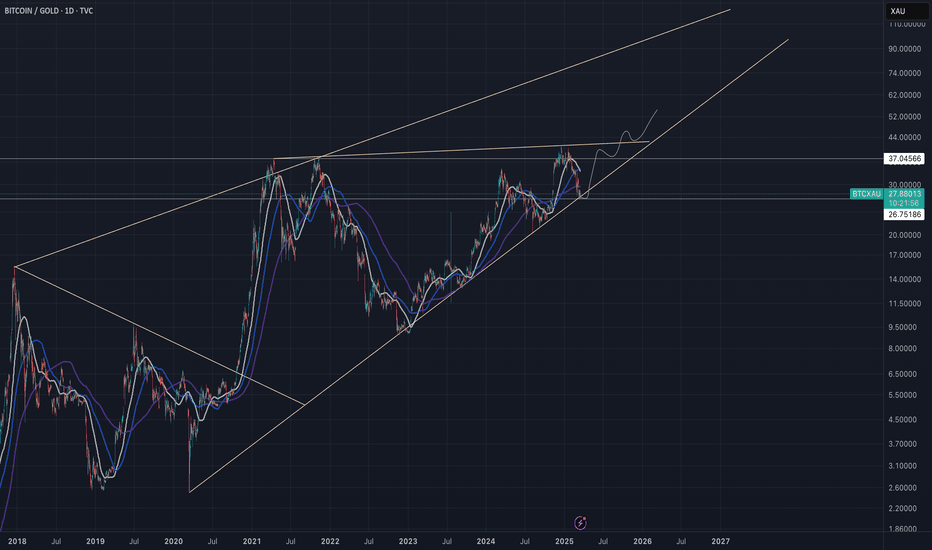

Long BTC, Long MSTR, Neutral to XAUExpecting BTC to consolidate relative to Gold for a few more days and then breaking out and outperform Gold. The ratios make it a more attractive trade with more upside potenial. Im buying NASDAQ:MSTR because of it´s leveraged bet in Bitcoin. I believe Microstrategy will outperform BTC in this scenario breaking out to new all time highs.

CME:BTC1!

COINBASE:BTCUSD

BINANCE:BTCUSD

BITSTAMP:BTCUSD

FX_IDC:XAUUSD

OANDA:XAUUSD

NASDAQ:MSTR

Is the Total Crypto Marketcap gearing up for a major move?A few months ago, the total crypto market cap surged past its previous highs, reaching a new all-time high of $3.7 trillion.

The current pullback appears to be a bullish retest of the breakout level, potentially setting the stage for the next upward leg.