META: Short From Resistance! SELL!

META

- Classic bearish resistance pullback

- Our team expects a move down

SUGGESTED TRADE:

Swing Trade

Sell META

Entry Level - 708.68

Sl - 742.00

Tp - 667.90

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Tp

USOIL: Bullish Correction Ahead! Buy!

USOIL

- Classic bullish correction formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry Level - 65.16

Sl - 62.68

Tp - 68.86

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Instructions on how to potentially use the SIG[TP/SL (1H-4H-1D)]It's a HF algorithm for the 1H,4H,1D Time-Frames. Which means whenever the instrument reaches the open price, the algo might give a lot of signals and sometimes it might give plenty of reverse signals. In order to use the specific algo in the best possible way, here's a helpful guide on how to potentially use it:

1)Wait for the instrument to reach the open price.

2) ALWAYS, Follow the signals, e.g: We are at the open price. If it indicates buy signal, then open a long position. If for example 5 seconds later (again at the open price) it indicates a sell signal, then reverse the long position into a short position, and keep doing it until it gives a signal, that will be followed by a good sized candle.

3) The safest way is to close the trade when the price reaches the potential TP1.

4) Happy Trading!

*The text above is not an investment advice, and it does not guarantee any profit.

Looking to take profits on Microsoft that's severely overboughtThis summer most stocks will lose their momentum making it a great time to take profits. We got into NASDAQ:MSFT at an average of $$350-375, it's time to sell at least half to 75% of the stack then buy back around the 0.618 golden fibonacci at $400 after the gap is filled.

NZD_CAD LONG SIGNAL|

✅NZD_CAD is going down to

Retest a horizontal support of 0.8160

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

So we can go long wit the

TP of 0.8206 and the SL of 0.8152

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM: Will Go Up! Long!

My dear friends,

Today we will analyse ETHEREUM together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1801$ Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1810$ Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

GBP_NZD LONG SIGNAL|

✅GBP_NZD is going down

To retest a horizontal support

Level of 2.2200 so after the

Retest we can enter a long

Trade with the TP of 2.2459

And the SL of 2.2132

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CAD Free Signal! Sell!

Hello,Traders!

USD-CAD is trading in a

Downtrend and the pair is

Consolidating below the

Horizontal resistance

Around 1.3880 so we are

Bearish biased and we can

Enter a short trade on Monday

With the Take Profit of 1.3725

And the Stop Loss of 1.3908

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD hit Take Profit within just 15 minutes.As always, EURUSD knows how to surprise us :) Yes, the trade reached our TP precisely at a 1:1.50 RRR, then immediately spiked upward. That’s the FX market — the faster you exit with profits, the better!

🔔 I post detailed trade ideas and daily market analysis like this every day on my TradingView profile.

👉 Follow me to get notified and read the full breakdowns.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD made a retest

Of the horizontal resistance

Of 0.8880 then established

A beautiful double top pattern

And then broke the local neckline

Around 0.8832 so its a great

Setup for a short trade

With the TP of 0.8778 and

The SL of 0.8887 above the

Resistance upper bound

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT SIGNAL|

✅NZD_JPY went up and

Retested the horizontal

Resistance above around 85.023

So we are locally bearish biased

And we can now take a short

Trade with the TP of 83.645

And the SL of 85.405

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_USD LONG SIGNAL|

✅GBP_USD made some crazy

Moves last week and was eventually pushed

Back down to the horizontal support of 1.2874

From where we will be expecting a local

Rebound, therefore we can go long on

The pair with the TP of 1.2946

And the SL of 1.2849

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CAD SHORT SIGNAL|

✅USD_CAD is going up now

But a strong resistance level is ahead

Thus I am expecting a pullback

And a move down so we can

Enter a short trade with the

TP of 1.4171 and the SL of 1.4280

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF SHORT SIGNAL|

✅USD_CHF is going up now

But a strong resistance level is ahead at 0.8860

Thus I am expecting a pullback

Which means we can enter a

Short trade with the TP of 0.8835

And the SL of 0.8866 but its is a

Risky setup so we recommend to use

A small lot size

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CHF LONG SIGNAL|

✅EUR_CHF made a retest

Of the horizontal support level

Of 0.9500 and we are already

Seeing a bullish rebound so

We can enter a long trade

With the TP of 0.9567

And the SL of 0.9488

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_AUD SHORT SIGNAL|

✅GBP_AUD keeps growing

In a strong uptrend but

The pair will soon hit a

Horizontal resistance

Of 2.0620 from where

We can enter a counter-trend

(and therefore a riskier) short

Trade with the TP of 2.0532

And the SL of 2.0653

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

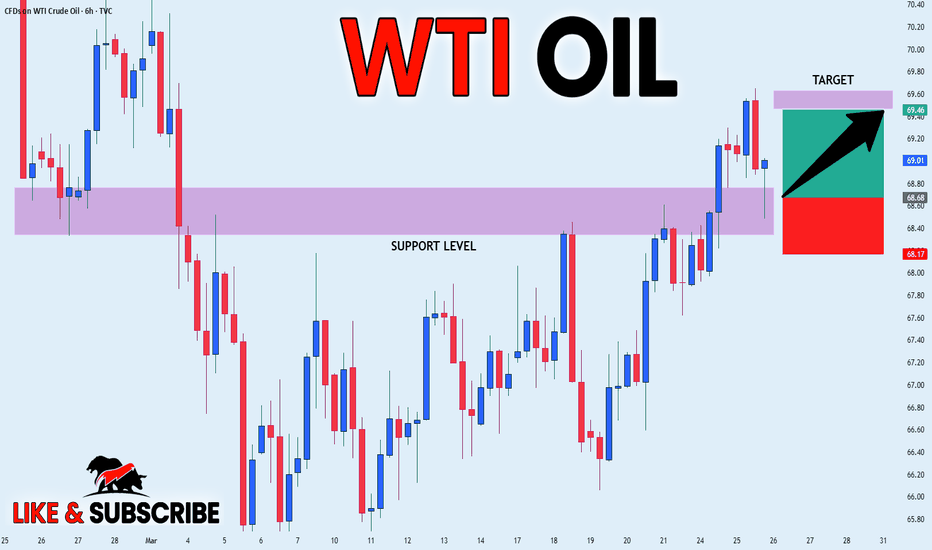

CRUDE OIL LONG SIGNAL|

✅USOIL made a retest

Of the horizontal support

Of 68.60$ so we are bullish

Biased so we can enter a

Long trade with the TP of 69.46$

And the SL of 68.17$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD LONG SIGNAL|

✅GOLD made a retest of the

Horizontal support of 3000$

And we are seeing a bullish

Reaction so we are bullish

Biased and we can enter

A long trade with the TP

Of 3023$ and the SL of 2997$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD is going down

And the pair made a bearish

Breakout of the key horizontal

Level of 0.9007 which is now

A resistance so we are bearish

Biased and we will be able

To enter a short trade on Monday

With the TP of 0.8970 and

The SL of 0.9030

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CAD SHORT SIGNAL|

✅EUR_CAD is going down

Now and the pair made a

Bearish breakout of the local

Key level of 1.5580 which is now

A resistance so we are locally

Bearish biased and we will be

Expecting a further move down

So a short trade can be entered

With the TP of 1.5480 and

The SL of 1.5600

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Free Signal! Buy!

Hello,Traders!

USD-CHF keeps falling down

But the pair will soon hit

A horizontal support

Of 0.8754 from where

We can enter a long trade

With the TP of 0.8795

And the SL of 0.8730

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.