TQQQ WEEKLY TRADE IDEA (07/28/2025)

**🚀 TQQQ WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Triple-Leveraged Momentum Play — But Watch the Volume Trap!**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 75.0 ⬆️

* **Weekly RSI:** 70.1 ⬆️

🔥 Bullish across **all timeframes** = strong trend confirmation

📊 **Options Flow:**

* **Call Volume:** 24,492

* **Put Volume:** 18,970

* **C/P Ratio:** **1.29** → Institutional bias = **Bullish**

📉 **Volume Concern:**

* Weekly volume = **0.8x** previous week

⚠️ Weak participation could limit breakout strength

🌪️ **Volatility Environment:**

* **VIX < 20** → ✅ Great for directional plays

---

🔍 **Model Consensus Recap:**

✅ All reports agree on bullish momentum

✅ Favorable volatility = cleaner setups

⚠️ Volume is the only red flag

📌 Final Take: **Bullish, but be tactical**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 75%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$93

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.79

* **Profit Target:** \$1.58 (🟢 2x Gain)

* **Stop Loss:** \$0.39 (🔻 50% Risk)

📆 Entry Timing: Market Open

📏 Position Size: 2–4% of account

---

⚠️ **Key Risks to Watch:**

* 🔍 **Volume Trap**: Weak volume = fragile follow-through

* ⚡ **Gamma Risk** into expiry → price may swing quickly

* 📉 Avoid chasing — stick to setup, use stop-loss

---

📌 **JSON FORMAT TRADE DETAILS (Automation-Ready):**

```json

{

"instrument": "TQQQ",

"direction": "call",

"strike": 93.0,

"expiry": "2025-08-01",

"confidence": 0.75,

"profit_target": 1.58,

"stop_loss": 0.39,

"size": 1,

"entry_price": 0.79,

"entry_timing": "open",

"signal_publish_time": "2025-07-31 09:29:00 UTC-04:00"

}

```

---

**TL;DR:**

✅ RSI momentum = 🔥

📈 Call flow = ✅

⚠️ Volume = 🟡 Caution

🎯 \ NASDAQ:TQQQ breakout play for the bold

💬 Are you riding the 3x bull, or waiting for confirmation?

\#TQQQ #OptionsTrading #MomentumSetup #UnusualOptionsFlow #TradingView #TechStocks #QQQ #LeveragedETF

TQQQ

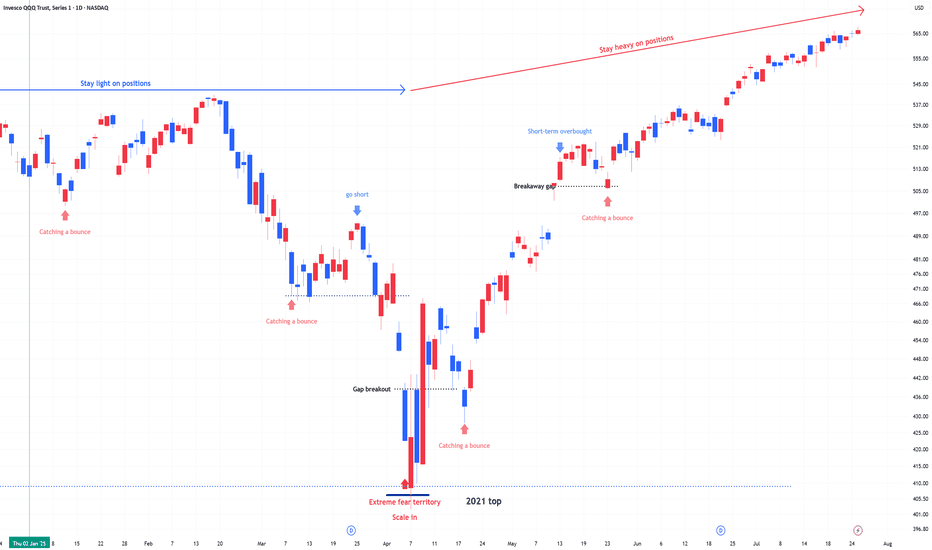

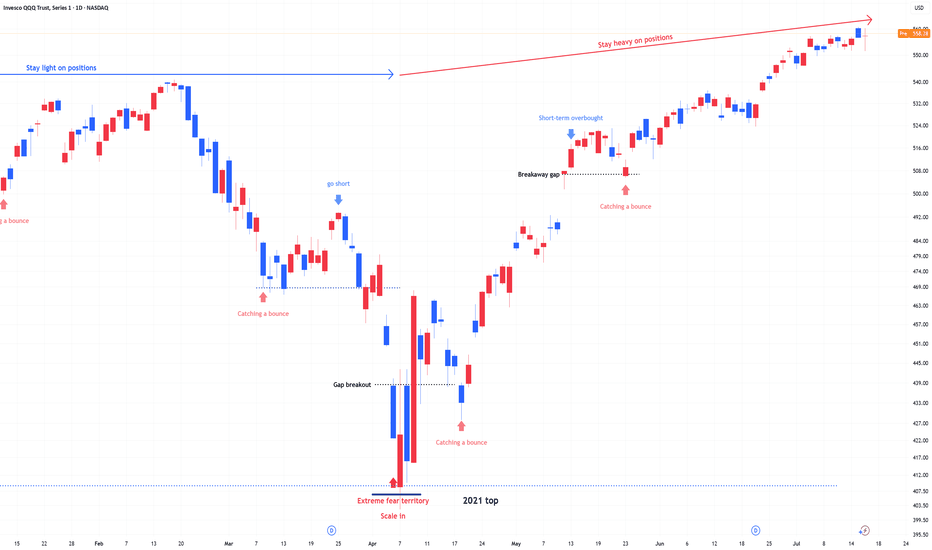

QQQ : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

$Entire Market - MASSIVE MOVE COMING SOONSo to keep things short, i've just seen the most massive move in my data i've ever seen in the history of my data. Moves like this indicate an extreme event in the world being priced in.

NEVER in the history of my data have i seen this kind of move in ANY stock and it's being shown in almost ALL stocks.

I think that at some point in the next 14 days we're going to have a massive 4-6 Sigma event either being rate cuts or war stuff. I don't know what it can be myself but i see the state of the world + the absolutely mind boggling move in the data and can put 1+1 together.

This combined with my AI having sold all stocks on Friday... yeah. Something is being priced in.

I had in fact thought this was like a GME thing cause i first saw it in GME's data but it's in fact a move in data for ALL stocks and happened on Friday. My dumbass bought GME on Friday thinking we were gonna see a move next week.

To keep things short the TLDR is:

-MASSIVE MOVE SOON (Next week - Maybe the week after)

-Likely direction is BIG DOWNS OR BIG UPs. Only huge outsized moves coming.

-How to play it: Straddle for safety. Puts for big risk big return.

I think we're dropping like -$100 bucks on SPY within a month based on this alone. Won't bet on it until my AI says to do so however. Right now it's just sold all stocks, hasn't bought puts yet or bought calls. Also something like -15 bucks on TQQQ and GME to $11. That or the exact opposite with some absolutely batshit insane ripper due to announcing to replace Jpow and doing rate cuts as soon as next week. It's either this or actual war, but anyway something's being priced in HARD and across the ENTIRE market. This kind of move is going to happen soon and quick, with this kind of insane liquidity, something is going to break...

Not gonna share future updates on the data for this event as to keep some secret and for myself to make money without affecting this trade by informing half the internet. Might eventually make it into a subscription thing on my website for those really interested but for now nah.

Rising Geopolitical Tension (Iran Conflict) Signals Market RiskMoving Partially to Cash (VEA, QQQ, TQQQ, SPY, TECL, SOXL)

The global market is entering a high-risk environment. Geopolitical escalation, particularly the growing threat of direct US involvement in a military conflict with Iran, is pushing global uncertainty to new highs. Tensions in the Middle East, rising oil and gold volatility, and increased friction between major world powers all point toward a potential market breakdown. On the chart, VEA ETF is showing signs of topping out within a rising wedge pattern. Meanwhile, institutional funds are starting to reduce exposure to high-risk assets. I'm taking partial profits and shifting to cash across VEA, QQQ, TQQQ, SPY, SOXL, and TECL to preserve gains. Buy-back zones are set around 53.00, 48.00, and 44.00. In an environment of global escalation and rapid risk-off sentiment, active portfolio defense is more important than passive hope.

$TQQQ - $78 ishHey guys, the AI helped me ride the wayve from 68 all the way to 76. With a small pullback the AI says we'll see something around the range of 77.5 ish, closer to 78 quite soon.

Would buy all opporutnites below the 75 range. Anything below 72.5 is a crazy buy and anything below $70 for the moment means one asks their relatives for a small loan of 1 billion dollars for a quick investment.

Will be sharing the AI with the public once it's ready for public consumption.

SPY: Bullish Outlook Based on Market StructureETF Strategy: Still Buying for 2025 Growth

I'm continuing to buy SPY and adding other strong ETFs like VEA, QQQ, and TQQQ. The market structure looks solid after the recent bounce, and I’m positioning for continued growth through the rest of 2025. My goal is to close the year with a strong percentage gain.

$TQQQ Weirdly mildly bullishDon't understand why, don't care. My AI gave of a partial bullishness signal for tomorrow onwards for TQQQ. It believes this a buy the dip moment (Unless it changes it's mind for whatever reason).

This is a signal on 3 out of 16 of my 3.6 sharpe models which is fairly bullish. I also had a UVXY call buy suggestion for today which i acted on which weirdly worked out intraday.

Expected move is around ~$4-7 dollars up, more likely on the lower end of that but i can't be sure. All i know is that the AI says up so i'm in.

I've dipped my feet a bit at these levels and waiting for more of my models to say BUY before i fully dip in. Several other tickers like CVNA and MARA flashed BUY today as well which is a nice extra confirmation, but not as good as if all 16 of my TQQQ models flash BUY which they haven't yet.

$TQQQ - Small moonThe AI has been triggered on TQQQ and UVXY. Calls on TQQQ and puts on UVXY.

The models i have on these have a sharpe of around 3.4-3.6 which means these are almost guaranteed money making trades as long as your entry point is good.

I'm waiting for confirmation before i go in but i'm likely to enter this trade really hard. The AI suggests ITM Calls at around 57.5 and 60 a month out. You can trade QQQ for this as well for similar equivalent strikes and expiries.

TQQQ Day Trade Plan for 04/29/2025TQQQ Day Trade Plan for 04/29/2025

📈 55.10 55.60

📉 52.10 51.60

Thanks to all my followers! Truly appreciate the support!

Please like and share for more ES/NQ levels Tues & Thurs 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

Opening (IRA): TQQQ April 4th 70 Covered Call... for a 68.05 debit.

Comments: Starter position in the first weekly in April ... .

Metrics:

Buying Power Effect/Break Even: 68.05

Max Profit: 1.95

ROC at Max: 2.87%

50% Max: .98

ROC at 50% Max: 1.44%

Will generally look to take profit at 50% max, add at intervals assuming I can get in at strikes better than what I currently have on, and/or roll out short call if my take profit is not hit.

Opening (IRA): TQQQ April 17th 60 Covered Call... for a 57.91 debit.

Comments: Adding at strikes better than what I currently have on ... . Here, going lower net delta by selling the -84 call against shares to emulate the delta metrics of a 2 x expected move 16 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 57.91/share

Max Profit: 2.09

ROC at Max: 3.61%

50% Max: 1.05

ROC at 50% Max: 1.82%

Will generally look to take profit at 50% max, add at intervals if I can get in at strikes better than what I currently have on, and/or roll out short call if my take profit is not hit.

Short-Term Gamble on a NASDAQ Bounce Using TQQQIn this quick update, I’m taking a speculative short-term trade on a possible NASDAQ recovery after a steep sell-off. Was the market oversold—at least for a day? Maybe. Do I think the pain is over for the longer term? Probably not.

I’m using NASDAQ:TQQQ , a 3x leveraged ETF that tracks the NASDAQ-100 (the top 100 non-financial stocks in the NASDAQ). This means if the index moves up 2%, TQQQ should theoretically gain roughly 6%, and vice versa on the downside. Leveraged ETFs like this are high-risk, time-sensitive instruments—they’re designed for short-term trades, not buy-and-hold investing.

The idea here is that after a sharp drop, institutions might step in to scoop up oversold tech stocks, creating a brief rebound. If that happens, TQQQ could give me amplified upside. But this is purely a gamble—I’m under no illusion that the market has bottomed. In fact, I expect more downside ahead.

I entered in the after-hours session once some of the heavy bearish volume faded, and I’ve set a tight 5% stop-loss to manage risk. Yes, I could get shaken out by an early dip before any rebound, but the stop is there to protect me if the sell-off continues.

This is a high-risk, short-term trade—buyer beware. If you’re considering TQQQ, understand the risks: decay from daily resetting leverage, extreme volatility, and the potential for rapid losses.

I’ll update on how this plays out. Wish me luck in the comments below 😁

Real question is where to take profit...

Opening (IRA): TQQQ May 16th 51 Covered Call... for a 48.05 credit.

Comments: Adding at a strike better than what I currently have on, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 48.05

Max Profit: 2.95

ROC at Max: 6.14%

50% Max: 1.48%

ROC at 50% Max: 3.07%

Will generally look to take profit at 50% max, add at intervals if I can get in at strikes better than what I currently have on, and/or roll out short call at 50% max.

Opening (IRA): TQQQ April 17th 45 Covered Call... for a 43.24 debit.

Comments: Adding to my position at break evens better than what I currently have on, but going a little bit less aggressive net delta-wise, selling the -84 delta call against shares to emulate the delta metrics of a 2 x expected move short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 43.24

Max Profit: 1.76

ROC at Max: 4.07%

50% Max: .88

ROC at 50% Max: 2.04%

Will generally look to take profit at 50% max, add at intervals if I can get in at break evens better than what I currently have on, and/or roll out short call if my take profit is not hit.

$QQQ Getting Over Sold?NASDAQ:QQQ I am stalking a bounce on the Q’s. From an intraday high (all time high) to an intraday low on this chart is about 6.2%. I would expect at least a dead cat bounce in the short term, but the market may not deliver for me. Having said that, I have an alert set on this 30-minute chart on the Downtrend line. “If” that triggers, I will go to a 5- or 10-minute chart to see if there is a good risk reward entry. And if I take the trade, it will be meant to be a day trade (of which I am not a fan) but it could turn to a swing trade “if” it gives me at least a 2% cushion.

I know I have a lot of "ifs" on this one, but isn't that the way it is?

I had posted another chart on the NASDAQ:QQQ index with a link below. I had said in that one that a pullback to the 510 “area” would not negate the longer-term uptrend. But one must be open to all outcomes.

$QQQ Support and Resistance Areas?QQQ had a big bearish candle on Friday. If you look left on the chart there were 2 comparable recent days. On Dec 18, 2024, and Jan 7, 2025, both lead to further downside. On Dec 18, the decline before a rally was about 5.3% and the Jan 7 decline was around 4.9%. Friday’s decline was about 2.4%. “If” those declines are any guide, we could expect another 2.5% to 3% additional deterioration. Which portends a pullback to around 512 to 510. Think of those as areas of concern, not a prediction. I have also drawn in horizontal lines that “may” become areas of support or resistance. In addition, we are touching an area of upward sloping line (area) that has defined a series of higher lows over the last 4 weeks.

In summary, it is a good idea to have an open mind about any outcome over the next few days to weeks and simply look at these areas to see if they do indeed end up being turning points.

One more point, this is an index fund and as such looks at heavily weighted stocks. We are likely in a period of picking individual stocks that are leading and using this index simply as a guide to overall market health.

I hope that helps.

Opening (IRA): TQQQ March 21st 69 Covered Call... for a 67.07 debit

Comments: Not finished with March yet ... . Taking less risk here than I would ordinarily do to give me more room to be wrong, selling the -84 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 67.07 debit

Max Profit: 1.93

ROC at Max: 2.88%

50% Max: .97

ROC at 50% Max: 1.44%

Will generally look to take profit at 50% max, add at intervals if I can get in at break evens better than what I currently have on, and/or roll out my short call if my take profit is not hit.

Opening (IRA): TQQQ March 21st 72 Covered Call... for a 68.95 debit.

Comments: Starter position on weakness. Selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 68.95

Max Profit: 3.05

ROC at Max: 4.42%

50% Max: 1.53

ROC at 50% Max: 2.21%

Will generally look to take profit at 50% max, add at intervals, assuming I can get in at strikes/break evens that what I have on at the time, and/or roll out short call if my take profit is not hit.

Opening (IRA): TQQQ March 21st 68 Covered Call... for a 64.63 debit.

Comments: Starter position on weakness, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with built-in short call defense.

Metrics:

Buying Power Effect/Break Even: 64.63

Max Profit: 3.37

ROC at Max: 5.21%

50% Max: 1.69

ROC at 50% Max: 2.61%

Will generally look to take profit at 50% max, add at intervals assuming I can get in at strikes better than what I currently have on, and/or roll out short call if my TP is not hit.

Opening (IRA): TQQQ March 21st 71 Covered Call... for a 67.75 debit.

Comments: Starter position, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 67.75/share

Max Profit: 3.25

ROC at Max: 4.80%

50% Max: 1.63

ROC at 50% Max: 2.40%

Will generally look to take profit at 50% max, add at intervals (assuming I can get in at break evens/strikes better than what I currently have on), and/or roll out short call if my take profit is not hit.

Opening (IRA): TQQQ March 21st 69 Covered Call... for a 65.42 debit.

Comments: High IV + weakness. Selling the -75 call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 65.42

Max Profit: 3.58

ROC at Max: 5.47%

50% Max: 1.79

ROC at 50% Max: 2.74%

Will generally look to take profit at 50% max, add at intervals (assuming I can get in at a break even better than what I currently have on), and/or roll out the short call in the event take profit is not hit.