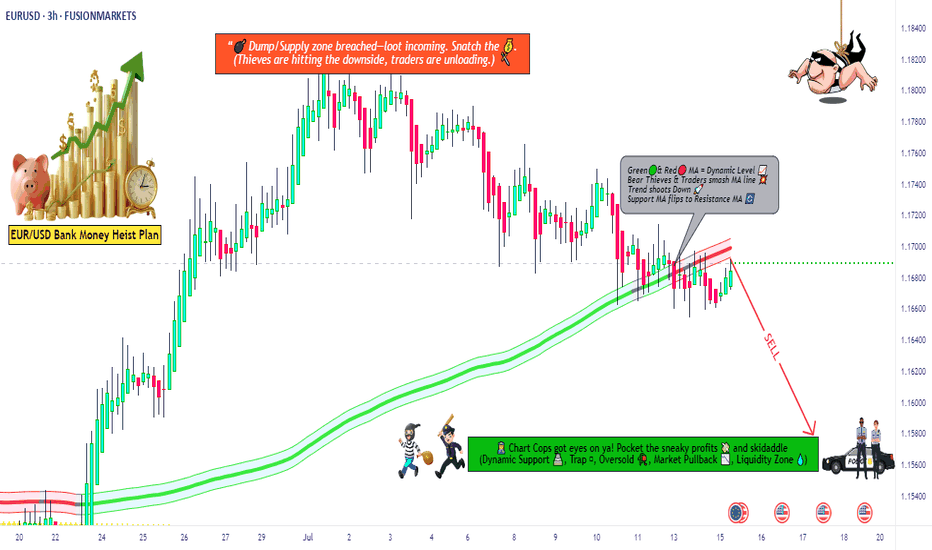

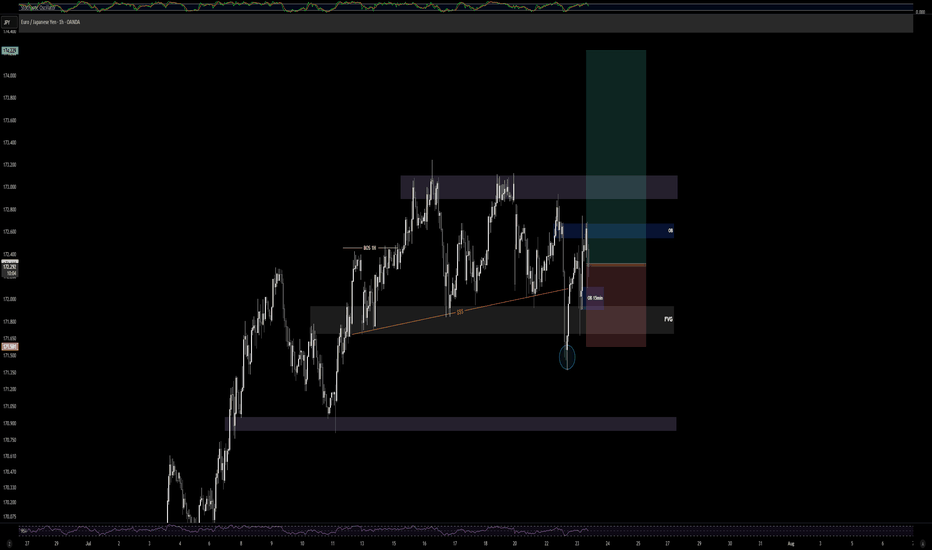

EUR/USD Robbery Blueprint Bear Strike Activated!💣🎯Operation Fiber Down: EUR/USD Robbery Blueprint (Day Trade Edition) 💰🔫

🚨 Thieves, Hustlers & Chart Bandits Assemble! 🚨

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome back to another Thief Trading Operation, where the money never sleeps—and neither do we. Let’s break into the vault of EUR/USD “The Fiber” with surgical precision. 🧠💼🕶️

🧨 THE MASTER ROBBERY PLAN: EUR/USD SHORT STRIKE 🔍💸

💀 Market Bias: Bearish – Trend Reversal + Supply Trap Setup

🎯 Target: 1.15800

🛑 Stop-Loss: Near Swing High (around 1.17400 – 3H chart view)

🕓 Timeframe Focus: 15m / 30m / 3H

🧭 ENTRY ZONE:

👣 Plan your entry from recent high retests—that’s where the big money bulls get trapped.

🎯 Use Sell Limit Orders (DCA style / Layered Limit Orders) like a true thief setting up tripwires.

💼 RISK STRATEGY:

💡 SL should match your lot size and order count—not one-size-fits-all!

📌 Place above key structure or swing level (e.g. 1.17400) based on timeframe.

🔍 BEHIND THE SCENES – THE WHY:

The EUR/USD "Fiber" pair is showing all the classic signs of a trend shift and bear raid setup, including:

📰 Fundamentals weakening the Euro

💣 COT Report reveals institutional exits

🍂 Seasonal Bias points to downward trend

📉 Intermarket Pressure from bond yields & USD strength

📊 Sentiment turning overly bullish = trap zone

⛽ Storage & Inventory imbalances adding fuel

📌 Reminder: Before any robbery, study the layout—Macro, Fundamentals, Sentiment, and Intermarket are your blueprint.

🚨 HEIST ALERT – PROTECT THE LOOT:

🕰️ High-Impact News Events? Tighten up!

💼 Don’t take fresh entries during releases.

🔐 Use Trailing SLs to lock in profits.

🎯 Exit with grace before the sirens start.

⚡🔥JOIN THE CREW, BOOST THE LOOT🔥⚡

💥 Smash the Boost Button 💥 if you're vibing with the Thief Trading Movement.

We ain’t just trading—we’re executing strategic robberies on the market’s weaknesses.

🧠💪 Every like = more power to the crew. Every comment = a new map to a vault.

We rob, retreat, and repeat. Let’s make money with skill, not luck. 🕶️💰🚁

⚠️ LEGAL COVER (For the Lawyers 😏):

This plan is not investment advice, just an organized heist blueprint by chart robbers.

Always manage your own risk and update your plan as the market evolves.

🕶️ Stay ready for the next master plan... Until then, keep your charts clean and your stops tight. 🕶️💣📉

– Thief Trader Out 🐱👤🚀

Trade

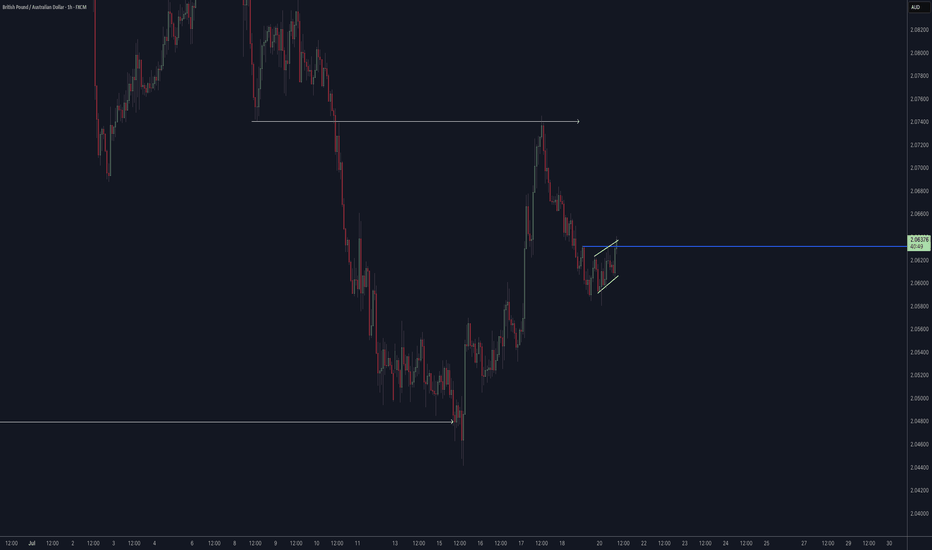

USD/CAD Institutional Buy Zone – Thief Trading Alert!🔥 USD/CAD "LOONIE BANK HEIST" 🔥 – THIEF TRADING STYLE (BULLISH SNIPER PLAN)

💸 ATTENTION: Market Robbers & Profit Pirates!

"Steal Like a Pro – Escape Before the Cops Arrive!"

🎯 MASTER TRADE PLAN (Based on Thief Trading Tactics):

Entry Zone (Pullback Heist):

📌 Pullback-1: Market Maker Trap Zone (1.35400+) – Wait for retest!

📌 Pullback-2: Institutional Buy Zone (1.33500+) – Confirm bullish momentum!

"Patience = Perfect Heist Timing. Don’t rush—ambush the trend!"

🎯 Profit Target: 1.38100 (or escape earlier if momentum fades).

🛑 Stop Loss (Escape Route): Nearest 4H Swing Low (wick/close) – Adjust based on risk & lot size!

🚨 SCALPERS’ WARNING:

"Only snipe LONG! Big pockets? Strike now. Small stack? Join swing robbers & trail your SL!"

📉 WHY THIS HEIST? (Bullish Triggers):

Technical + Fundamental alignment (COT, Macro, Sentiment).

Overbought but institutional demand holding strong.

"Bears are trapped—time to rob their stops!"

⚠️ CRITICAL ALERT:

News = Volatility = Police Ambush!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before reversals.

💥 BOOST THIS HEIST!

"Hit 👍, 🔔 Follow, and 🚀 Boost to fuel our next robbery! Let’s drain the banks together!"

🔮 NEXT HEIST COMING SOON… Stay tuned, partner! 🎭💰

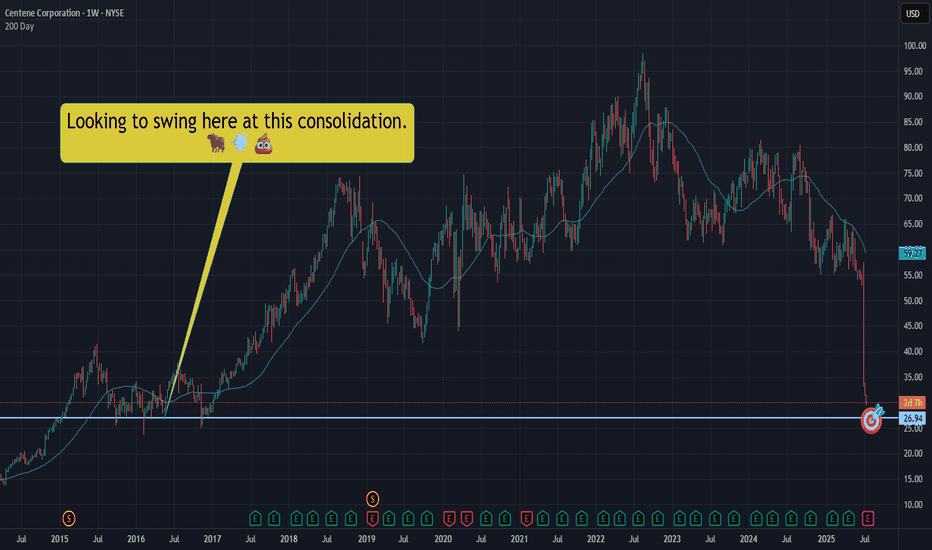

CNC|Let's take a swing at a falling dagger! NYSE:CNC slicing through the void, well.... like a falling dagger through a void.

Not trying to catch this bad boi, but we should expect a bounce at some point. Let's swing for a bounce in that $26.90ish area.

This is NOT a YOLO and I hope it's not an "oh no!" Let's keep our wits about us - starter position only. We can add if we need to, but let's just hope we sell and make some quick Christmas money.

THANK YOU FOR YOUR ATTENTION ON THIS MATTER

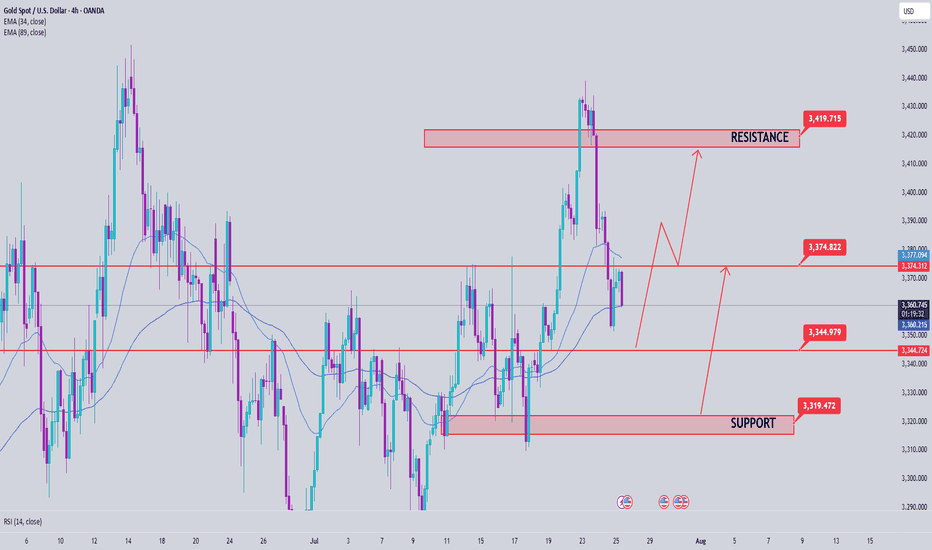

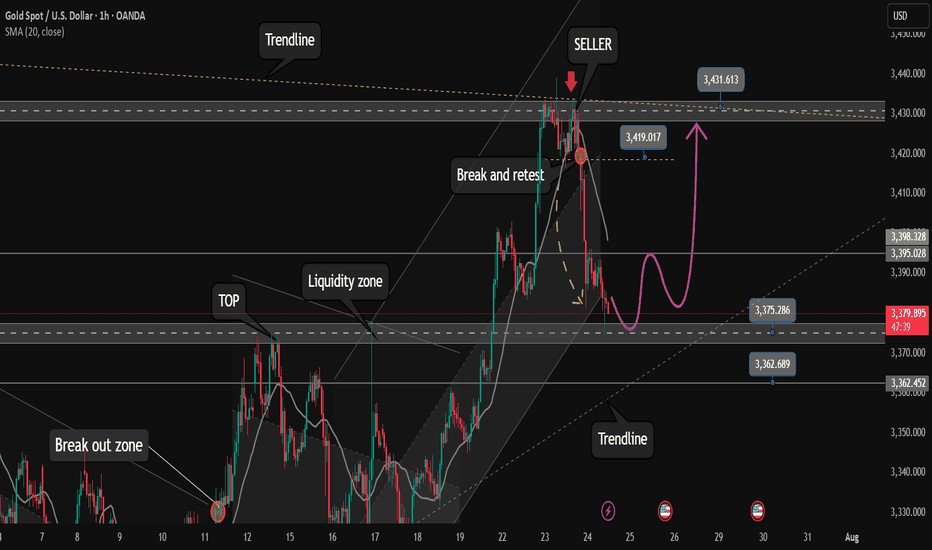

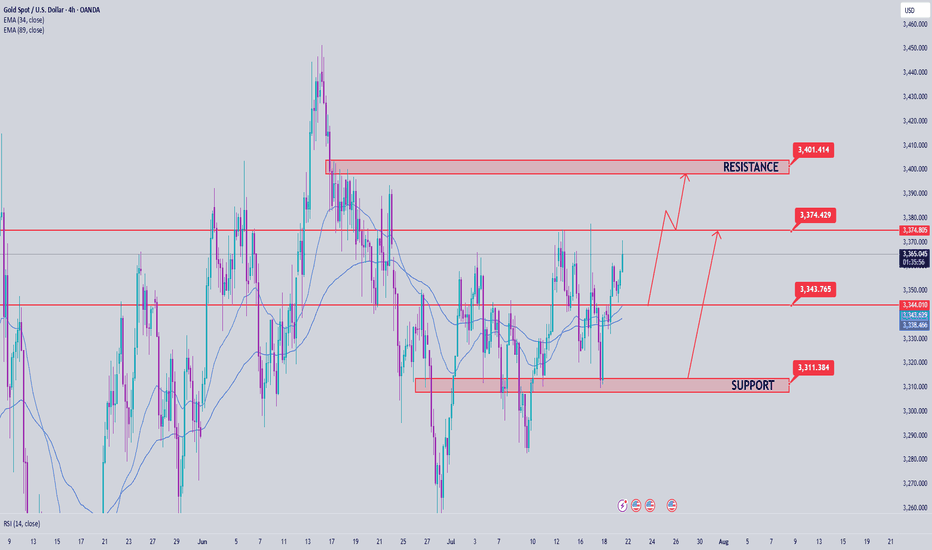

Gold price analysis July 25Gold Analysis – D1 Uptrend Still Maintains, But Needs New Momentum

Yesterday’s trading session recorded a D1 candle closing above the Breakout 3363 zone, indicating that buying power in the US session is still dominant. This implies that the uptrend is still being maintained, although the market may need a short-term technical correction.

In today’s Tokyo and London sessions, there is a possibility of liquidity sweeps to the support zone below before Gold recovers and increases again in the New York session.

Important to note:

The uptrend will only be broken if Gold closes below the 3345 zone on the D1 chart.

In this case, the 3320 level will be the next support zone to observe the price reaction and consider buying points.

For the bullish wave to continue expanding towards the historical peak (ATH) at 3500, the market needs stronger supporting factors, which can come from economic data or geopolitical developments.

📌 Support zone: 3345 – 3320

📌 Resistance zone: 3373 – 3418

🎯 Potential buy zone:

3345 (prioritize price reaction in this zone)

3320 (in case of breaking through 3345)

🎯 Target: 3417

Some investors take profits. Opportunity to buy gold to 3500?✏️ OANDA:XAUUSD price correction of 50 appeared yesterday. This is obvious to happen in a sustainable uptrend. Today's strategy will look for liquidity sweeps to support to BUY to ATH 3500. Gold's current border zone is limited by the upper and lower trendlines. Be careful not to trade against the trend when breaking the trend zone.

📉 Key Levels

Support: 3375 -3363

Resistance: 3418-3431-3490

Buy trigger: Buyers react at 3375

Buy zone: 3363

Target: 3430; level higher at 3490

Leave your comments on the idea. I am happy to read your views.

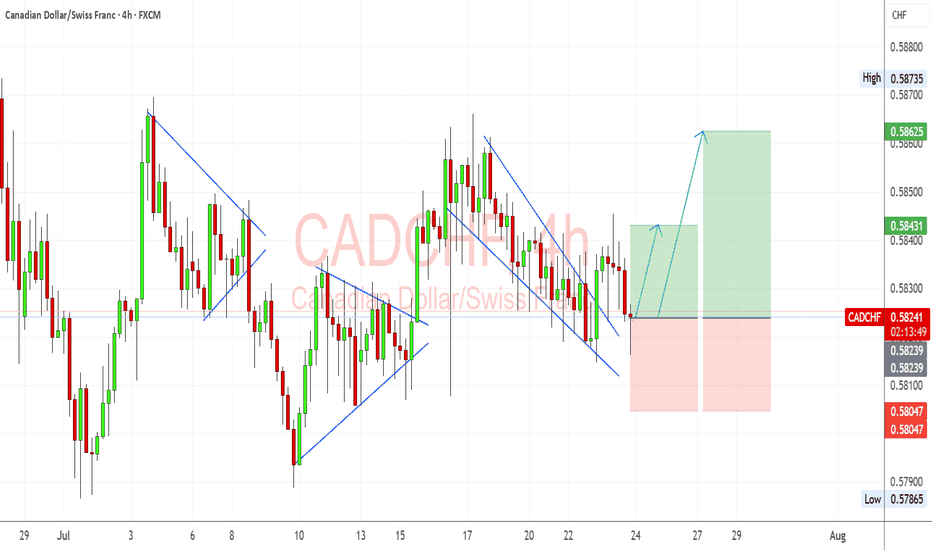

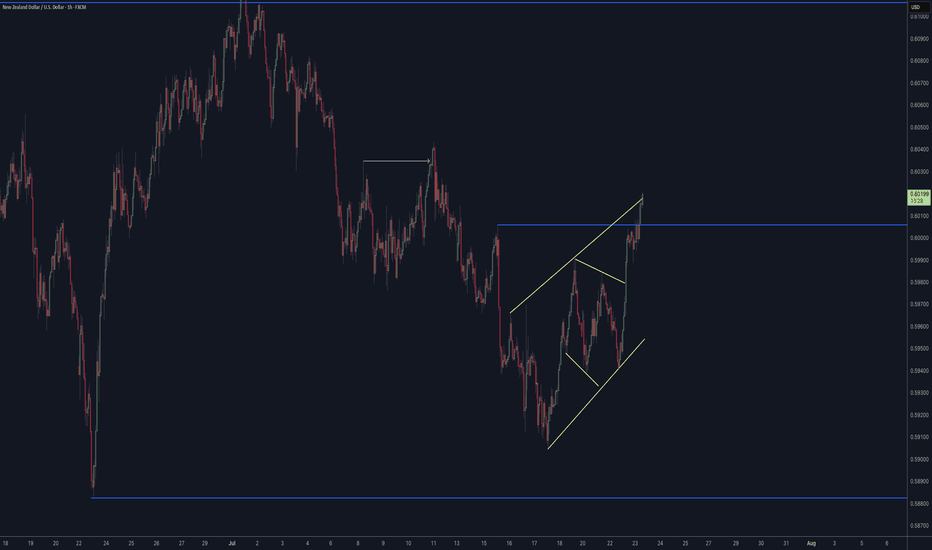

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

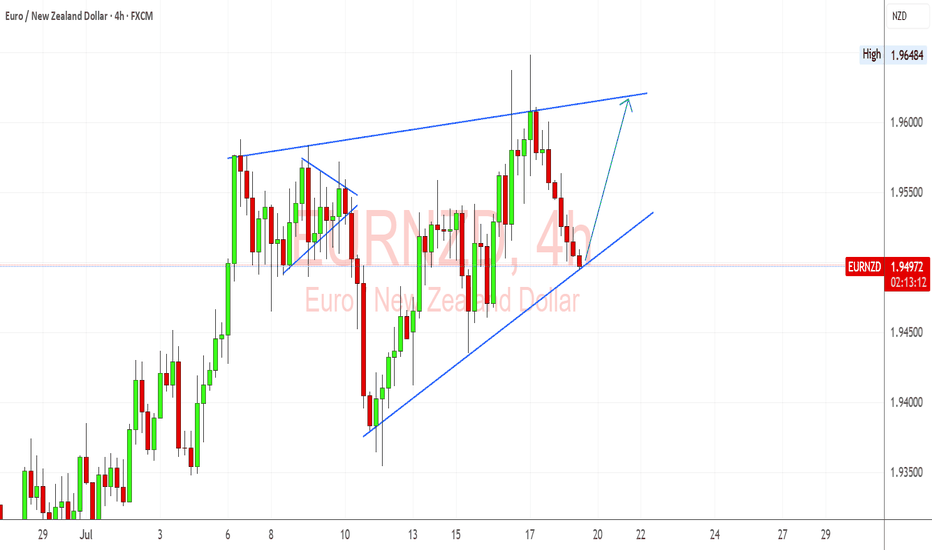

EURNZD Trendline & Hawkish ECB Bias Support Bullish ContinuationEURNZD is holding beautifully above the ascending trendline on the 4H, and I’m watching this level closely for a bounce continuation setup. Fundamentally, the euro remains supported by sticky inflation and hawkish ECB commentary, while the kiwi is showing softness after dovish signals from the RBNZ and mixed jobs data. If this trendline holds, I’ll be targeting a retest of the upper wedge resistance near 1.9640.

🔍 Technical Setup (4H):

Structure: Ascending triangle forming – price is pressing into dynamic support.

Support Zone: Around 1.9480 trendline area – price rejected this level several times in July.

Resistance Target: 1.9640 highs – double top and triangle resistance.

Bullish Confirmation: Rebound with bullish engulfing or strong 4H close above 1.9525 could trigger long setup.

Invalidation: Clean break below trendline and 1.9440 invalidates bullish scenario short-term.

💡 Fundamental Insight:

EUR Drivers:

ECB members remain cautious about declaring victory on inflation.

German and Eurozone CPI data remain above target, supporting higher-for-longer ECB stance.

Speculation that ECB won't cut aggressively compared to RBNZ.

NZD Weakness:

RBNZ minutes show concern over downside inflation risks.

Labor market cooling, and migration pressures remain high.

Commodity and China-linked sentiment weakening NZD.

⚠️ Key Risks:

If Eurozone inflation or PMI data surprises to the downside, EUR may weaken.

RBNZ hawkish pivot or surprise tightening would flip sentiment toward NZD.

Global risk-on could favor NZD as a high-beta currency.

🧭 Summary:

I’m bullish on EURNZD as long as price holds above the trendline near 1.9480. The technical structure shows a clean ascending pattern, and the fundamentals currently favor EUR strength over NZD. My eyes are on a potential move toward 1.9640, especially if upcoming ECB rhetoric stays hawkish. EURNZD tends to lead NZD-crosses like NZDJPY or NZDCHF in risk-off regimes and could signal euro strength if it breaks out. Watching closely for price action confirmation.

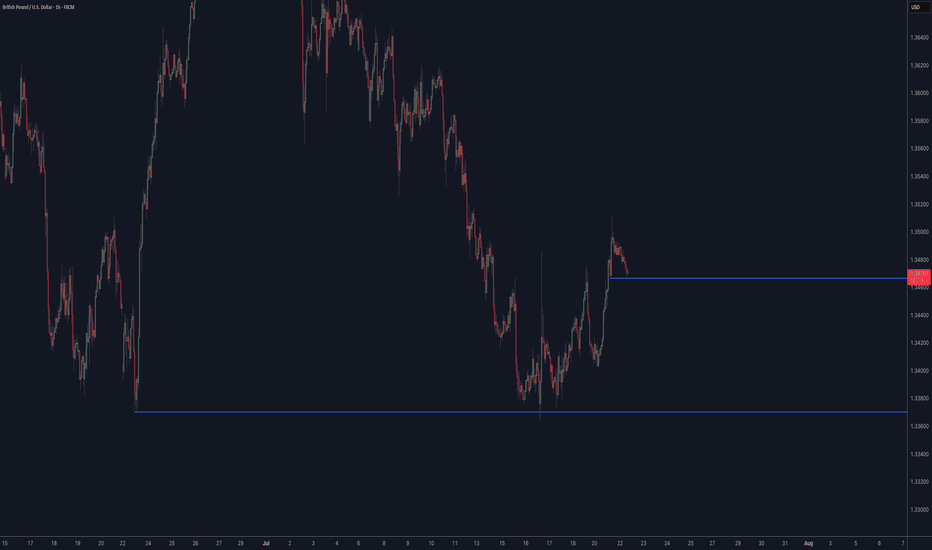

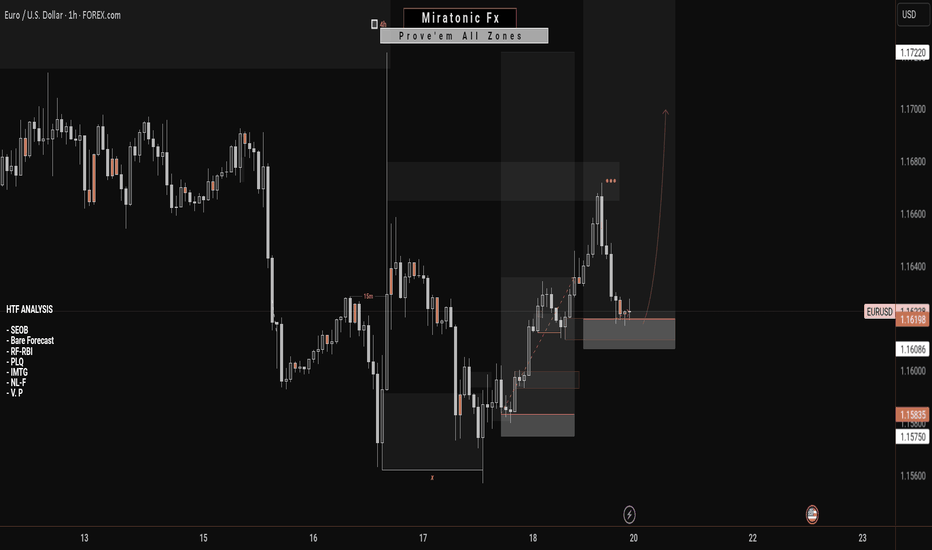

EURUSD Bullish ProjectionIt’s been a while since my last update here.

Here’s my projection and actual entry/entries on EURUSD, based on a sweep of the previous 1H swing low and mitigation of a Daily imbalance (Fair Value Gap).

We're anticipating a full Change of Character to mark the end of the ongoing Daily pullback.

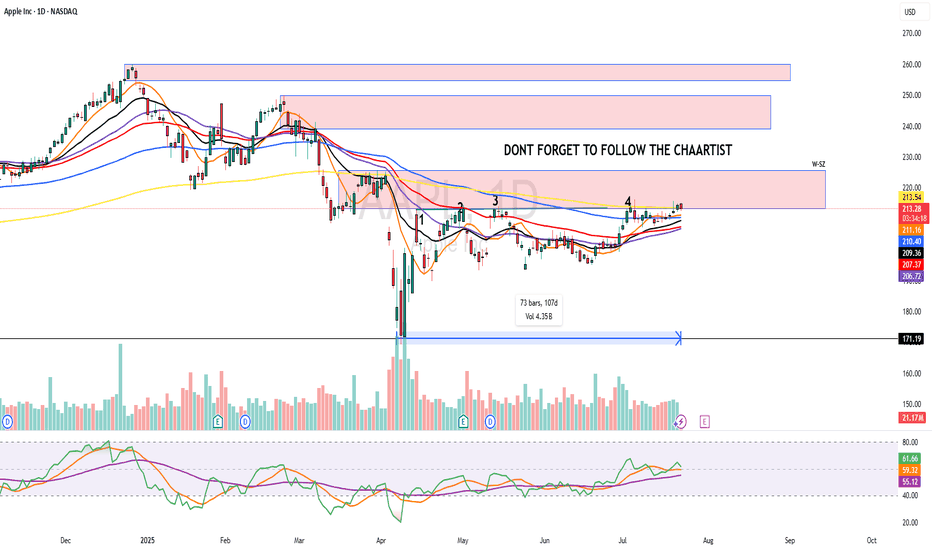

Gold Price Analysis July 21After being reinforced by CPI data last week, gold prices have regained their bullish momentum and are currently trading in a wide range. The technical structure still shows a dominant uptrend, with the trendline continuing to act as reliable support, targeting the important resistance zone of 3400 next week.

📌 Preferred trading strategy:

Watch the price reaction around the support zone of 3343. If there is a rejection signal of this zone accompanied by buying pressure, that will be the ideal entry point.

If the price continues to correct deeper, the strong support zone of 3322 will be a reasonable DCA point.

It is not recommended to SELL if the price breaks the confluence zone of 3373, as this is a signal confirming the strong bullish momentum continues.

📍 Important price zones:

Support: 3343 – 3322

Resistance: 3373 – 3400

🚀 Buy Trigger:

Price rejects 3343 zone with clear bullish signal

Strong bounce from 3322 zone