Tradeidea

USDCHF to find sellers at market price?USDCHF - 24h expiry

There is no clear indication that the downward move is coming to an end.

20 4hour EMA is at 0.8816.

Bespoke resistance is located at 0.8800.

Our outlook is bearish.

The weaker US dollar has boosted performance.

We look to Sell at 0.8803 (stop at 0.8843)

Our profit targets will be 0.8703 and 0.8683

Resistance: 0.8811 / 0.8830 / 0.8845

Support: 0.8765 / 0.8740 / 0.8720

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

$LMND lagger in fintech, upside potential, EMA SMA crossingNYSE:LMND I'm a fan of financials, NYSE:MA , NYSE:V , NYSE:DFS , NASDAQ:PYPL , NASDAQ:AFRM , etc, even look at $SEZL. I think this name is a laggard in the sector and actually provides a good idea of business, something oversaturated but a different approach and ideas. With momentum and volume this name can trigger great upside potential in the next 3-6 months. Earnings are there and I look the setup here inside the triangle/flag. Long.

Also the 200ema and 200sma are riding nicely and the 50ema and 50sma are crossing over one another.

WSL

$GOOGL Rising bearish wedge with declining volume; $165 belowNASDAQ:GOOGL here looks weak to me trying to reclaim it's support of $175-$180. This is on my watchlist for a short term short, if this name tanks back into the $150's I will load everything I got for the long side. I see this name in a downside trend currently in a rising wedge with declining volume, buyers can't hold it up much longer. It's retested that support on 3 or more daily candles and hasn't busted through. I expect this name to drop into a support zone of $160-$165. I will look to enter puts off a retest of $176-$178 area keeping the stops tight.

WSL.

$AFRM $70-$80 target, cup and handle WEEKLY, pt. 2 chartYes, I used the brush and drew that juicy cup and handle. I don't know, friends, this one looks really good for setup to long. Part 1 was posted just before this give it a glance. The EMA and SMA used here was the 50 and in the previous chart was 200.

WSL

$AFRM $70 target into retest $80, pt. 1 chartI wish you could post multiple charts in the same size so you can see and I don't have to post twice. I looked at the D and W. This name should see it's IPO highs at some point this year, with the volatility it could be sooner than later as well. Resistance, in my opinion, looks to be $80 zone, a psyche area as well -- dating back to 3/2021, 1/2022, 2/2022, and 2/2025. Looks like $45-$50 which was once resistance now flipped to support. It touched the 200sma and riding the 200ema. & There almost seems like a huge cup and handle formed on the weekly as well... interesting. Also, look at the earnings on NASDAQ:AFRM ... lmao. Monstrous.

WSL

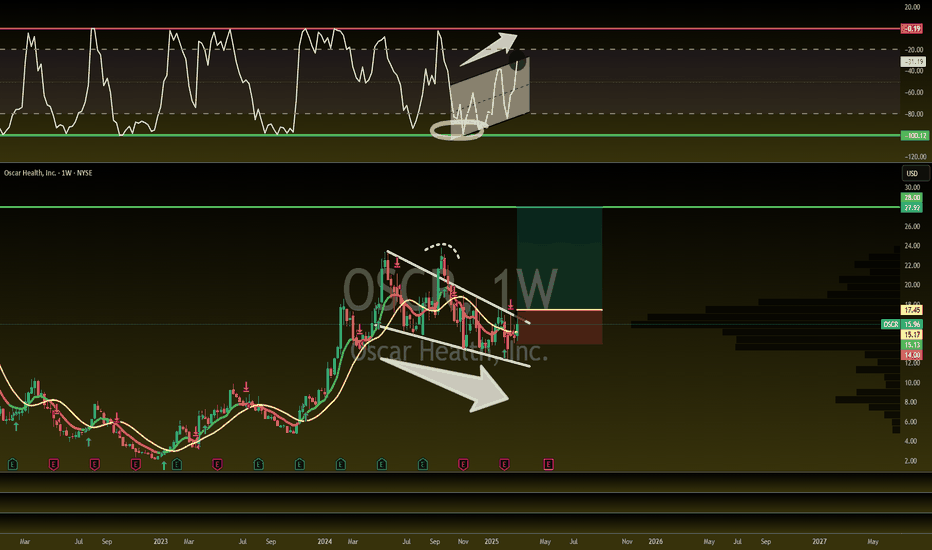

60% Upside - H5 Trade of the Week!H5 Trade of the Week!

In this video, we are talking about a phenomenal potential trade that allows us to take action if we get some key items.

Everything is lining up for this one. We just need a few more items, and it will be time to enter!

NYSE:OSCR Breakout = $24/ $28

Not financial advice

CN50 to find buyers at previous support?CHN50 - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Short term RSI has turned positive.

Risk/Reward would be poor to call a buy from current levels.

A move through 13150 will confirm the bullish momentum.

The measured move target is 13450.

We look to Buy at 13225 (stop at 13125)

Our profit targets will be 13425 and 13450

Resistance: 13350 / 13425 / 13450

Support: 13250 / 13225 / 13150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

200pts secured from IFVG's 50% > SSL Targeted Caught a 200-point move on MNQ from the 50% level of a Fair Value Gap (FVG) that previously acted as an Inverted FVG (IFVG). My target was sell-side liquidity, and the setup played out perfectly. Watch the breakdown of the trade and my thought process in real-time!

💯 100 likes and I'll post the entire trading session with all trades taken!

Disclaimer:

This video is for educational and entertainment purposes only. Trading futures involves significant risk and is not suitable for all investors. Past performance is not indicative of future results. Always conduct your own research and trade responsibly.

EURAUD to see a turnaround?EURAUD - 24h expiry

We are trading at overbought extremes.

Bearish divergence is expected to cap gains.

The rally is close to a correction count on the daily chart.

We look to Sell a break of 1.6950.

A lower correction is expected.

We look to Sell a break of 1.6950 (stop at 1.7010)

Our profit targets will be 1.6740 and 1.6710

Resistance: 1.7070 / 1.7100 / 1.7250

Support: 1.6950 / 1.6850 / 1.6730

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Trade Idea: XAUUSD Long ( BUY LIMIT )Technical Analysis:

1. Trend Analysis:

• H1: Uptrend resuming after a pullback. MACD histogram turning positive, indicating bullish momentum. RSI at 59.21, showing strength but not overbought.

• M15: Price recently broke above resistance and is holding above it. MACD near zero but turning positive, supporting bullish continuation. RSI is neutral at 50.36, leaving room for further upside.

• M3: Strong breakout and consolidation. MACD is positive, and RSI at 52.73 shows bullish strength.

2. Support & Resistance:

• Key support: 2900

• Key resistance: 2945

3. Moving Average Confirmation:

• On all timeframes, the price is holding above the moving average, signaling bullish continuation.

Fundamental Analysis:

• Gold is benefiting from safe-haven demand amid global uncertainties.

• US Dollar Index (DXY) has been weakening, which supports gold’s upside.

• Upcoming economic data (if dovish) may further push gold higher.

Trade Execution:

• Entry: 2915 (Current price)

• Stop-Loss (SL): 2900 (Below key support)

• Take-Profit (TP): 2945 (Key resistance level)

FUSIONMARKETS:XAUUSD

Nikkei to continue in the downward move?JP225USD - 24h expiry

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

A higher correction is expected.

The primary trend remains bearish.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Further downside is expected although we prefer to sell into rallies close to the 37650 level.

We look to Sell at 37650 (stop at 38290)

Our profit targets will be 36000 and 34390

Resistance: 36790 / 38275 / 40675

Support: 35590 / 34390 / 32680

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

$SPOT the overvalued stock..Be real.. I’m an Apple Music/ Apple applications guy. This stock just seems a little too bloated for me. I’d like to see a retrace to that gap up, this market is volatile and this thing can move hardbody either direction. I’d take my chances with a short for about 50 days out, $560 is the target. I got a bearish rising wedge forming possibly here and some FIB retrace and Elliot Waves. Very expensive premiums as well. Have fun.

WsL

ASX to find buyers at market price?AU200AUD - 24H expiry

Price action has continued to trend strongly lower and has stalled at the previous support near 8150.

Price action looks to be forming a bottom.

Risk/Reward would be poor to call a buy from current levels.

A move through 8250 will confirm the bullish momentum.

The measured move target is 8300.

We look to Buy at 8175 (stop at 8125)

Our profit targets will be 8275 and 8300

Resistance: 8250 / 8275 / 8300

Support: 8200 / 8175 / 8150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GOLD to continue in the downward move?Gold - 24h expiry

Our short term bias remains negative.

The trend of higher intraday lows has also been broken.

Offers ample risk/reward to sell at the market.

50 1hour EMA is at 2871.

The overnight rally has been sold into and there is scope for further bearish pressure going into this morning.

We look to Sell at 2874.5 (stop at 2895.1)

Our profit targets will be 2820.8 and 2809.8

Resistance: 2876.6 / 2890.0 / 2910.0

Support: 2855.0 / 2832.4 / 2815.0

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CN50 dips continue to attract buyers.CHN50 - 24h expiry

Price action has continued to trend strongly lower and has stalled at the previous support near 13200.

Further upside is expected.

Risk/Reward would be poor to call a buy from current levels.

A move through 13400 will confirm the bullish momentum.

The measured move target is 13550.

We look to Buy at 13300 (stop at 13200)

Our profit targets will be 13500 and 13550

Resistance: 13400 / 13500 / 13550

Support: 13300 / 13250 / 13200

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

$MSFT $SNOW sympathy play, $390-$400 SupportNASDAQ:MSFT NYSE:SNOW — Microsoft is like a snail in this AI/ Tech race but I suppose that shows strength because no major drops and holding zones well. Bottoms after bottoms. I’m looking for short term calls here. As of today, ending week 2/28, I may try $405c. But can see this retest the $420s weeks to come.

WallStreetLoser

USDCHF to continue in the downward move?USDCHF - 24h expiry

Broken out of the channel formation to the downside.

Our short term bias remains negative.

Previous support level of 0.8965 broken.

Preferred trade is to sell into rallies.

50 4hour EMA is at 0.8987.

We look to Sell at 0.8987 (stop at 0.9012)

Our profit targets will be 0.8915 and 0.8905

Resistance: 0.8974 / 0.9004 / 0.9020

Support: 0.8950 / 0.8930 / 0.8912

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei forming a bottom?NIK225 - 24h expiry

Daily signals for sentiment are at oversold extremes.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Preferred trade is to buy on dips.

The hourly chart technicals suggests further downside before the uptrend returns.

We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

We look to Buy at 38080 (stop at 37643)

Our profit targets will be 39330 and 39660

Resistance: 39660 / 40720 / 42155

Support: 37705 / 36330 / 34955

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD in a sequence of higher lows and highs.NZDUSD - 24h expiry

Trend line support is located at 0.5725.

RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending.

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5775 will confirm the bullish momentum.

We look to Buy at 0.5725 (stop at 0.5695)

Our profit targets will be 0.5800 and 0.5825

Resistance: 0.5775 / 0.5800 / 0.5825

Support: 0.5725 / 0.5700 / 0.5675

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.