Nonfarm Pay Attention Zone✏️ OANDA:XAUUSD is recovering and increasing towards the resistance zone of yesterday's US session. The 3315 zone is considered a strategic zone for Nonfarm today. A sweep up and then collapse to the liquidity zone of 3250 will be scenario 1 for Nonfarm today. If this important price zone is broken, we will not implement SELL strategies but wait for retests to BUY. It is very possible that when breaking 3315, it will create a DOW wave with the continuation of wave 3 when breaking the peak of wave 1.

📉 Key Levels

SELL trigger: Reject resistance 3315.

Target 3250

BUY Trigger: Break out and retest resistance 3315

Leave your comments on the idea. I am happy to read your views.

Trade Management

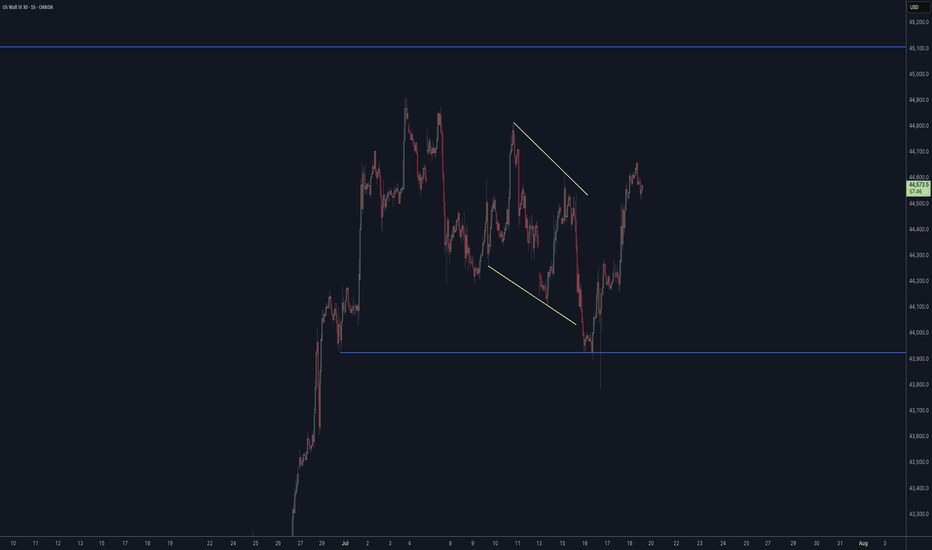

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

My Ideal Elliott Wave Entry ModelThe IMSETT 3/C Entry Model.

Every trader wants to catch the big moves the ones that pay quickly and decisively. In Elliott Wave, those moves often come during Wave 3. It's the strongest part of the trend, and when you're positioned early, the risk-to-reward is unmatched.

But not every opportunity hands you a clean Wave 3 on a silver platter. Sometimes you’re looking at a Wave C instead. That’s where the 3/C Entry Model comes in. It’s designed to get you aligned with high-conviction moves—whether the market is in a trend or a zig zag.

Here’s the edge: both Wave 3 and Wave C often start the same way—a strong, motive push off an AOI (area of interest), followed by a retracement. That shared structure gives us an anchor. Whether we’re labeling it a 3 or a C doesn’t change the fact that the initial impulse gives us clarity, direction, and a place to manage risk.

That’s what the IMSETT Model is built around:

Identify

Motive

Scout

Entry Plan

Track

Trade

Each step is focused, actionable, and repeatable. You're not trying to outguess the market—you’re reacting to structure, preparing for common behavior, and executing with intent.

I do have a video with a walk through.

This just the way I look for clarity in setups. As with everything in trading, nothing will work every time so do your own research this is not financial advice.

Cheers!

Trade Safe, Trade Clarity.

Gold Trading Strategy June 19Yesterday's D1 candle confirmed the Sell side after the FOMC announcement. Today's Asian session had a push but the European and American sessions are likely to sell again.

3366 will be an important breakout zone today, if broken through, the Sell side will continue to be strong and push the price deeper and limit buying when breaking this 3366 zone. 3344 is the first target, it is difficult for gold to break this zone but if it breaks right away, wait below 3296 to BUY for safety. Before that, pay attention to another support zone 3322.

3400 is the Breakout border zone from yesterday to today but gold has not broken it yet. To SELL this zone, you must also wait for the confirmation of the candle, but if you want to wait for a better SELL, you must wait for 3415 or wait at the ATH peak 3443. However, if it breaks 3400, waiting for a Buy test will be quite nice.

Support: 3343-3322-3296

Resistance: 3415-3443

Break out zone: 3366-3400

Gold Price Analysis June 16There is not much surprise when the price gap up appeared on Monday morning

there is no barrier that can stop the price of gold from increasing towards ATH.

Gold has a slight correction in Tokyo session after the price gap up touched the round resistance zone 3450.

The correction may extend to 3413 in European session. This is a BUY zone with the expectation that Gold will regain the ATH hook. If broken, there will be some Scalping buy zones but the risk is quite high so to be safe, wait for 3398.

3463 acts as temporary resistance for a reaction period before Gold returns to the all-time high. Maybe before 3490 there will be another price reaction before reaching the top.

I am waiting for SELL here with wave 5 catching strategy In the Kitco survey, Wall Street analysts were divided on the direction of gold prices this week. Fifty percent of experts expect prices to rise, 43 percent expect prices to fall, and 7 percent believe gold will move sideways. This reflects a generally cautious sentiment as there is no clear factor to promote a new trend.

Some experts still lean towards the uptrend as gold holds important support levels and remains a safe haven amid geopolitical uncertainty. Others predict a correction in gold prices due to positive signals from the White House about the possibility of reaching trade agreements and the recovery of US stocks.

In addition, there are also neutral opinions that gold is unlikely to continue to rise sharply without further momentum, especially when stock indexes are more attractive to investors.

James Stanley, senior strategist at Forex.com, remains optimistic, saying that gold is making a technical correction to continue the larger trend. He believes that the $3,300 and $3,280 zones will be important boundaries to watch.

What do you think about this strategy?

Best regards, StarrOne !!!

Gold Price Analysis May 6D1 Frame

It is not surprising that the price has increased again. If this momentum continues, the 3408 level can be reached today.

H1 Frame

The uptrend is clear, heading towards the area above 3400.

3363 is a good support zone, suitable for BUY orders in the Asia - Europe session.

3344 is an important level. If broken, the short-term uptrend will be broken and we need to wait for a new wave.

Resistance to watch

3382 is the nearest resistance zone in today's session.

3397 is an area prone to false breaks (old peaks). The price may react slightly here before reaching the 3408 level.

MNQ Buy Idea 5.29.25 (Part 2)Continuation of the first video entry of this trade.

We were aiming for $200 in profits today but failed to get that, ending with $61 in profits. I don't think we will be entering another trade due to the time and also that I want to focus on reading my book "The Trading Game" by Ryan Jones.

If you guys found this insightful give it a 🚀, it helps me see that you guys learned something from watching this and motivates me to post more.

Drop your comments down below, do you think MNQ is bullish or bearish? What prices do you see MNQ reaching?

Gold Price Analysis May 26After a correction, the D candle on the following day confirmed a strong price increase towards ATH in the near future

The barrier to reach the all-time peak is not much and it is difficult to have a downtrend at the present time

The gold price increase in the early Asian session met with a price reaction at the Gap opening zone around 3356. With the candle's force, it is completely possible to push the price up to 3364 in the late Asian session or early European session. The nearest lower border is noted around the Asian session resistance zone this morning at 3335-3336. If 3364 does not break in the European session, it can give a pretty good SELL signal with a target of 333x and deeper at 321x. If it breaks 3264, it confirms a strong uptrend and only BUYs and does not look for a SELL point. The resistance until the target of 3405. 3191-3292 still plays a daily support role for any prolonged price decline of Gold

ZYDUSLIFE Weekly UpdateZYDUSLIFE seems to be stable on the current 985-990 levels.

Things to watch carefully for Long trades.

Long Trade entry :

Entry Trigger : 1011

Stop Loss for target 1 : 977

First Target : 1044

Second target : 1068

Third target: 1130

Last target: 1211

Note: Consider each target for exit of the hold position and re- enter after 3%(Approx.) drop. this will maximize the re-entry position and the profits.

Exit for sure On last target as 2-3 Month or retracement would possibly come after this point.

Trade Updates would be shared on this on every Friday

Trade Reflection & Overview – Final Thoughts on the Day’s SetupIn this final video, I’m reflecting on the trade and the key lessons learned throughout the session. Looking back, I realize I should have taken profits when price tested the 9:33 AM fair value gap, which would have given us a nice profit. Although I expected lower prices, considering we had a bearish daily bias, I underestimated the strength of the daily fair value gap, which had already been tapped multiple times. Price held above the 50% level, and that was a strong signal for higher prices.

Additionally, the double top formation near Monday’s buy-side liquidity could have been a target for price, which adds to the case for a reversal higher. Despite missing some potential profit, we ended the day with a total of $50,723.16 in profit.

Looking ahead, the focus is on consistent trades, avoiding FOMO, and maintaining solid setups that make sense. I’m committed to sticking with MNQ for now, refining my confidence in the setups and building a steady rhythm. Once we’re fully confident and have more capital, I’ll look to take on more risk, but for now, the goal is simple — keep it consistent and avoid repeating past mistakes.

This is the year of building profitability and consistency, and I’m ready for the journey ahead.

Trade Overview:

Profit: $200

Account Balance: $50,723.16 for the day

Reflections: Missed opportunity to take profits at key levels

Next Steps: Focus on solid setups, consistency, and avoiding FOMO

Trading Plan: Sticking with MNQ for now, working on building confidence and rhythm.

Position Management – Consolidation and Missed Exit OpportunityPosition Management – Consolidation, Inverse Head & Shoulders, and Missed Exit Opportunity

In this video, we continue managing the position, which remains in consolidation. Price taps the 50% level where we took our first partial, retraces higher, and taps the inverse fair value gap that previously held support for the sell-off. From there, we rush lower to the 9:33 AM fair value gap, finding instant support and bouncing just shy of the 50% mark of that gap.

This is also coinciding with the 25% level of the daily fair value gap. As price trades up to the 7.05 area, we create a triple top before moving lower again, but it’s been choppy and ugly. At around 11:00 AM, I reflect on how taking profits at the first test of the 9:33 AM fair value gap would've been the ideal move, putting us up around $380.

We’re now observing a potential inverse head and shoulders forming, with the 9:33 AM fair value gap as the head and the 50% area as the higher right shoulder, suggesting a reversal for higher prices.

Trade Overview:

Price Action: Choppy movement, with multiple taps of key levels

Key Levels: 9:33 AM fair value gap, 50% of fair value gap, 25% daily fair value gap

Pattern: Observing an inverse head and shoulders setup forming

Exit Reflection: Considering missed opportunity to take profits at 11:00 AM.

Position Management – Price Consolidation & FVG SupportIn this video, we continue managing the position after taking our first partial. Price consolidates around the 50% retracement level before pushing lower to the 21,188.75 level, which aligns with the 9:33 AM fair value gap we identified earlier. We find support here, and at this point, we’re still hoping to see a continuation lower.

However, the inverse fair value gap only holds for a few more points before the price reverses against us. This ultimately takes us out of the position, but we still lock in a profit of $65 from the trade.

Trade Overview:

Price Action: Consolidation near 50%, then lower to 21,188.75 (9:33 AM fair value gap)

Support: Price found support at the fair value gap level before reversing

Exit: Stopped out with $65 profit as the inverse fair value gap failed to hold.

Trade Management – First Partial at 50% of the TrendIn this video, we’re already inside the 10 AM trade from the previous setup. At this point, we’re up 290 ticks, and we’re managing the position carefully. To mitigate risk, we decided to take our first partial near the 50% retracement of the trend, just in case the price reversed and went against us.

This step allowed us to lock in some profit while still leaving room for the trade to continue in our favor.

Trade Overview:

Profit: +290 ticks

Partial: First partial taken at 50% retracement of the trend

Risk Management: Protecting against potential reversal while staying in the trade.

Pre-9:45 PMI Trade – Executing the Sell and Managing In this trade, we executed a sell before the Flash PMI at 9:45 AM, following our setup and market analysis. We were in the trade and managed it until we were stopped out, at which point we stayed out of the market until after the PMI release.

Once the 10 AM candle opened, we observed price action closely, waiting for manipulation. Our focus was on potential higher wick manipulation before the actual distribution of the 10 AM candle. This setup provided us with the opportunity to get into the market once the manipulation played out.

Trade Overview:

Entry: Pre-9:45 PMI sell

Exit: Stopped out, then waited for the 10 AM candle manipulation

Bias: Watching for higher wick manipulation and potential distribution after PMI release.

BTCUSD UPDATE - 22- 05- 2025This chart illustrates a potential rising wedge pattern in the Bitcoin/USDT (BTC/USDT) 45-minute timeframe on Binance. Here's a breakdown of the key elements:

Chart Analysis:

Rising Wedge Pattern (Bearish):

The price is moving within converging trend lines (marked in blue), forming a rising wedge — typically a bearish reversal pattern.

The projected breakdown (blue arrow) suggests a move downward out of the wedge.

Support Zone (Yellow Box):

A strong historical support zone is highlighted, around the $103,000–$104,500 range.

This is the likely target if the price breaks down from the wedge.

Bearish Target:

If the breakdown occurs, the price may fall to the yellow support zone.

Volume spikes on recent candles suggest increasing interest or volatility.

Stop Loss Zone (Red Area):

The red shaded area at the top of the wedge likely represents a stop-loss for a short trade setup.

Current Price: Around $110,708.20 at the time of the snapshot.

Summary:

The chart implies a potential short opportunity based on the rising wedge breakdown, targeting the yellow support zone. Confirmation would be needed from a strong bearish candle closing below the lower wedge boundary with increased volume.

Would you like help identifying entry/exit points or risk management strategies for this trade setup?

MNQ 5.20.25 Trade Idea (2)Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys.

I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting.

Closing the day out with $110 in profits, Which you will see on Video #3

MNQ Trade Idea Continuation (3)Continuation into the trade idea we were sharing, we traded through the Daily high level we were targetting of 21,404.75 then rushed lower under the Trendline Phantom line and under the IFVG that was used as support for price to reach 21,419.75.

Will this be another manipulation below 21,362.00 lows before continuation higher, or should I have set a TP at the 21,404.75 highs and called it a day?

European Stocks Rise Amid Positive NewsEuropean stock markets are experiencing a steady rise, buoyed by a series of encouraging developments that have boosted investor confidence and driven share prices higher. This wave of optimism is being fueled by both internal economic signals and an improving global environment, including stabilized interest rates and signs of a business rebound.

What's Driving the Growth?

One of the primary catalysts behind the rally is recent economic data showing a slowdown in inflation across the eurozone, alongside a revival in consumer demand. These indicators have strengthened expectations that the European Central Bank may soon pivot from a tight monetary stance to a more accommodative approach. Investors have welcomed these signals as evidence that the regional economy is adjusting well to challenging conditions and avoiding a deeper downturn.

Additionally, stronger-than-expected quarterly earnings reports have played a key role in lifting stock prices, particularly in the banking, technology, and industrial sectors. Major players such as Siemens, BNP Paribas, and SAP have posted solid gains, reflecting broader confidence in corporate resilience.

Renewed Investor Interest in Europe

Improving macroeconomic indicators are drawing renewed attention to European assets. With risks appearing more contained and equity yields remaining attractive, many investors are beginning to view the region as a compelling opportunity. Stock exchanges in Germany, France, and the Netherlands have stood out, showing consistent growth and high trading volumes.

Geopolitical factors are also contributing to the market’s upbeat tone. Gradual normalization of trade relations with key partners and the strengthening of the euro on foreign exchange markets are adding to investor enthusiasm.

What’s Next?

Analysts suggest that if current trends continue, European indices could reach new yearly highs. Key factors to watch in the near term include upcoming central bank decisions and fresh data on GDP growth and employment. Nevertheless, the present sentiment points toward confidence in the ongoing recovery.

Conclusion

The European stock market is entering a phase of stable growth, driven by favorable economic indicators, manageable inflation, and an improving business climate. Positive news continues to give investors reasons for optimism, and if momentum holds, Europe could emerge as one of the top-performing investment regions in the coming months.