EURUSD - Sell Trade SetupTaking a look at the daily chart, EURUSD is resting at a minor pivot point. However, I suspect further weakness based off comments from the Fed last week and with all eyes on this Friday's PCE report.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

Tradeplans

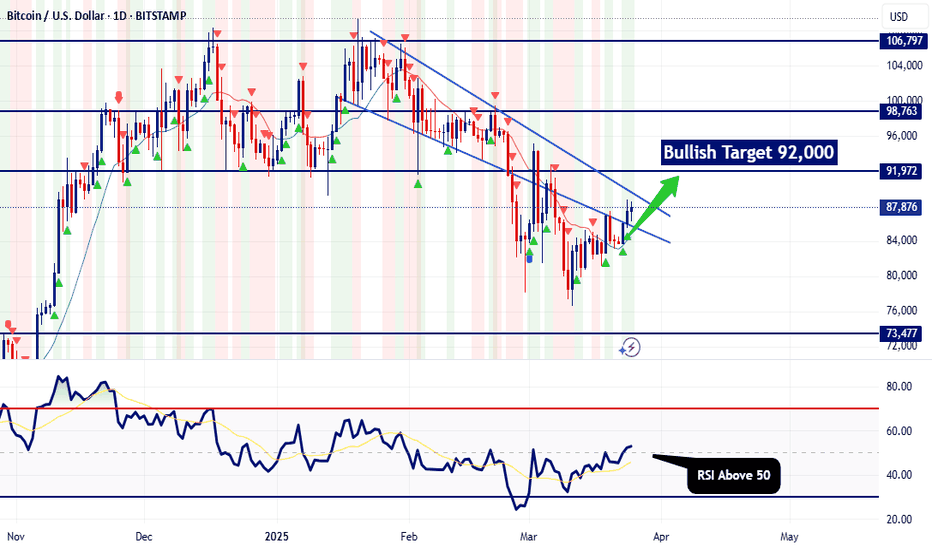

BTCUSD - Buy Trade SetupTaking a look at the daily chart, BTCUSD is now above 88k and I'm expecting further upside towards 92k, This week we have PCE inflation data from the US on Friday. Should inflation come in weaker then analyst forecast, that should weaken the dollar and thus power up Bitcoin.

We will have to wait and see what happens but as of right now, technicals are indicating of a good possibility.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

AUDCHF - Potential Short-Term BottomTaking a look at the daily chart, AUDCHF has began showing indications of a potential bottom. This might be a decent low risk LONG setup as a swing trade.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for account management

Trade Safe - Trade Well

~Michael Harding

EURNZD Maintains Bearish TrendJust a simple TA using conventional wave length projections. This pair wasn't able to hold onto the 78.6% fib pullback level so now I anticipate this pair first retesting around the 1.74 handle. Following the retest I would expect a natural bounce from profit taking and buyers heading into the market, but then I can foresee this pair breaking support heading towards the 1.7170 area in the days ahead.

How to trade this you ask?

First wait for bullish action, then follow the bullish candles on a small timeframe (5 or 15min) then wait for the bullish momentum to stall out for the best entry on the sell side.

That's it - That's all

Trade Safe

EURUSD - Rejected Off Descending ResistanceTaking a look at the daily timeframe, price action did in fact arrive as previous explained but now we look for a possible correct with this pair.

See previous analysis below.

On screen you can see that I'm first waiting for a bullish pullback from yesterday's rejection candle to then enter some shorts to the downside.

This setup is only a 1:1.39 risk to reward but has great chances of becoming a winner.

Trade Safe

Learning Price Action Through ObservationLearning Happens when you're open and curious and making observations from what you see. From there, you must be mentally balanced to take action on your observations.

In this post, I focus on the price action that happens in the pivot portion of a swing cycle. If you make observations of this area you will see a certain kind of repeating behavior that can help you understand and design methods for trading swings. You will notice that the market likes to wash everybody out of their positions before pivoting to continue its swing.

I have a look at two of the ways this shows up in the price action of a pivot. The first is an engulfing bar that expands and swallows at least 3 of the previous bars. The second is a Gap Swap where there will be a WRB Gap making an effort in one direction just to be followed by another WRB GAP that reverses that effort and direction and shows that the balance of power has shifted.

This is just a small part of what makes up a swing but it factors into my overall methods and trade plan. You can make observations yourself on pivots and see what you can learn.

Shane

NZDCHF we back in on a long this time. Trade details for current trade are shown on the chart.

Trade has not long just alerted.

We are working the 15M time frame on this strategy.

We're looking for the green line which is take profit target.

Little blue long arrow is entry point and purple line is stop loss.

Trade history can be seen at the foot of this trade idea too for full transparency.

Previous trade can also be seen on chart covered in an idea this morning and seen below.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

Btc may just sideways and dump with very little upsideso here is the thing. we are right at where our weekly pivot point it coming it. its possible btc plays out down or up before thie daily/weekly close then either way reverts back to that purple line. I think corretions is just some time away. if you wanted to long try to do it on developing camarilla L3 for daily or weekly around close. If you want short do the same for H3. I do not see a lot good risk reward selling at these current prices. I will say be patient. dont front run anything here. most alts even still hve lower to got to meet their new weekly pivots. and btc going either direction now (unless huge direction) will be only a waste of time.