Traderlifestyle

Panic Selling LINK? Here’s Your Master PlanBuckle up! LINK has been riding a relentless bearish trend for 113 days, ever since it kissed its peak of $30.94 back in December 2024. With economic uncertainty casting a shadow over the markets and fear gripping investors, the big questions loom: Is this the dip to buy while others panic-sell? Or is it wiser to sit on the sidelines? Let’s slice through the noise, dissect LINK’s chart like a seasoned pro, and uncover the setups that could turn this chaos into opportunity. Let’s dive in!

The Big Picture: LINK’s Bearish Blueprint

LINK is currently trading at $13, a far cry from its yearly open of $20. April has kicked off, and LINK has already surrendered the monthly open at $13.5, a critical level now acting as a brick wall overhead. Zooming out, the trend is unmistakably bearish: lower highs and lower lows dominate the chart. Adding fuel to the fire, LINK is languishing below the Point of Control (POC) at $14.32, derived from a 1.5-year trading range. This is a market screaming caution for bulls and whispering opportunity for bears, at least for now.

But charts don’t lie, and they’re packed with clues. Let’s map out the key levels, pinpoint trade setups, and arm ourselves with a plan that’d make even the most seasoned traders nod in approval.

Resistance Zones: Where Bears Sharpen Their Claws

1.) Resistance - The Golden Pocket ($13.6 - $13.7)

Using the Fibonacci retracement tool on the latest downward wave, the golden pocket (0.618 - 0.65 Fib) aligns beautifully with the monthly open at $13.5. Oh wait there’s more, this zone overlaps with a Fair Value Gap (FVG), making it a magnet for price action.

Trade Setup (Short):

Entry: ~$13.5 (if price tests and rejects this zone).

Stop Loss (SL): Above the recent swing high at $14.4.

Take Profit (TP): First target at $11.85 (swing low), with a stretch goal at $11.

Risk-to-Reward (R:R): A solid 2:1.

The Play: If LINK crawls up to this resistance and gets smacked down, bears can pounce. Watch for rejection candles (e.g., shooting star, bearish engulfing) to confirm the move.

2. Key Resistance - Cloud Edge & VWAP ($15.74 - $16.5)

The Cloud edge of my indicator sits at $15.74, while the anchored VWAP (from the $26.4 high) hovers at $16.5. A break above $16.5 would flip the script, snapping the bearish structure and signaling a potential trend reversal.

Bullish Scenario: If bulls reclaim $16.5 as support, it’s a green light for a long trade. Until then, this is a fortress for bears to defend.

The Play: No bullish setups here yet.

Support Zones: Where Bulls Build Their Base

1.) Support - Swing Low ($11.85)

This is the first line in the sand for bulls. A potential Swing Failure Pattern (SFP), where price dips below $11.85, sweeps liquidity, and reverses—could spark a long trade.

The Play: Watch for a bullish reversal candle or volume spike here.

2.) Major Support Cluster - The Golden Zone ($10 - $11.85)

This is where the chart sings a symphony of confluence:

Swing Low: $11.85.

POC: $11.33 (1.5-year trading range).

Monthly Level: $11.02.

Fib Retracement: 0.886 at $10.69 and 0.786 (log scale) at $10.77.

Psychological Level: $10.

Trade Setup (Long):

Entry: Dollar-Cost Average (DCA) between $11.85 and $10.

Stop Loss (SL): Below $10

Take Profit (TP): First target: $13.5 (monthly open), stretch goal: $20 (yearly open).

Risk-to-Reward (R:R): A monstrous 6:1 or better, depending on your average entry. This is the kind of trade we are looking for!

The Play: Patience is key. Wait for confirmation—think bullish engulfing candles, a surge in volume, or positive order-flow momentum. This isn’t a “hope and pray” trade; it’s a calculated ambush on the bears.

Market Structure: Bears Rule, But Bulls Lurk

Right now, LINK’s chart is a bear’s playground—lower highs, lower lows, and no bullish momentum to speak of. The $16.5 VWAP is the line in the sand for a trend shift, but until then, short trades take priority. That said, the $10 - $11.85 support zone is a coiled spring for bulls. If fear drives LINK into this range, it’s time to load the boat with longs—provided confirmation aligns.

Your Trading Edge

LINK’s 113-day bearish descent is a wild ride, but it’s not random chaos—it’s a roadmap. Bears can feast on rejections at $13.5 - $13.7 with a tidy 2:1 R:R short. Bulls, meanwhile, should stalk the $10 - $11.85 zone for a high-probability long with a 6:1+ R:R payoff. Whether you’re scalping the dips or swinging for the fences, these levels give you the edge to trade with confidence.

So, what’s it gonna be? Short the resistance and ride the wave down? Or stack bids at support and catch the reversal of a lifetime? The chart’s laid bare—now it’s your move. Drop your thoughts below, and let’s conquer this market together!

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know, I’m here to break down the charts you want to see.

Happy trading =)

XAUUSD Update: Bullish or Bearish? Key Levels to Watch! 🚨 Attention Traders! 🚨

XAUUSD is making waves and breaking through key levels! 🔥 The price is currently battling between 2980 and 2989 — will we see a breakout soon?

Bearish Alert: A dip below this range could lead us to targets like 2860 and 2850. ⚠️

Bullish Opportunity: A move above 2989 could trigger buying opportunities, with targets around 3004 and 3027. 🚀

💬 Let’s Talk Strategy! What’s your take on this? Share your insights as we ride this golden wave together and unlock new opportunities! 💰

SPX500 Long at 55301. All timeframes are massively oversold due to the huge sell-off on Friday night

2. It is the start of the week, and it opened at the low, which tends to mean there would be some strength to go up

3. Unfortunately, I cannot check if there is a harmonic pattern due to technical difficulties.

4. This is at excellent support as it is at the year low

5. There is a lot of divergence due to this not being a long consolidation try to exit at M15 overbought

6. Stop loss below 5500

XAUUSD: Battle for New Highs – Bullish or Bearish?🚨 Attention Traders!🚨

🔥 XAUUSD is on FIRE! Price action is 🔥, and we're seeing a major battle at 3004 - 3014! Will it break out?

Bearish Alert 📉: If price dips below this zone, we could see targets around 2988 and 2998. Keep an eye on these support levels!

Bullish Opportunity 📈: A breakout above 2911 could lead to buying opportunities! Watch for moves above 3025 with targets at 3035 and 3050.

💬 Join the convo! Share your thoughts & strategies — let’s ride the gold wave together and catch these opportunities! 🚀✨

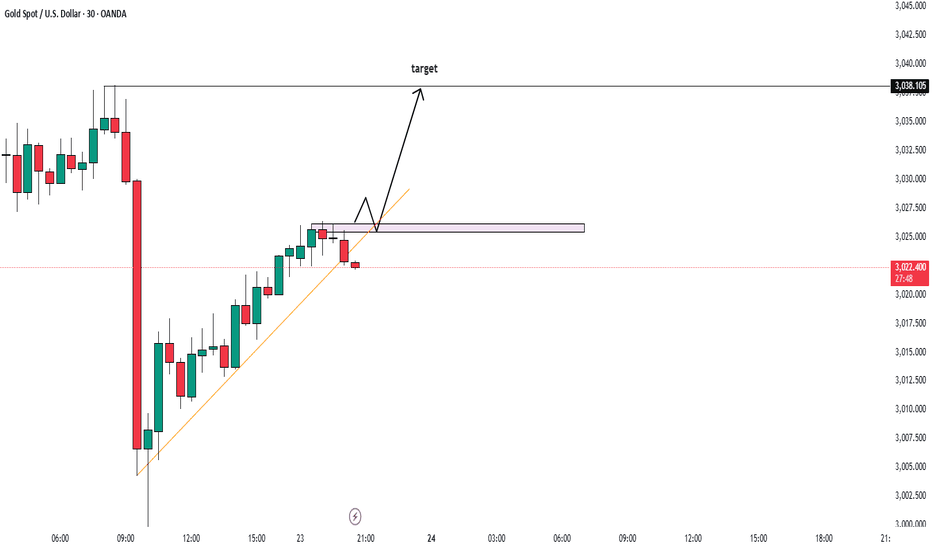

BULLISH MOVEMENT AFTER 3000 LEVEL RETEST ALERT!Hello trader

today market is higher high mark and continue bull pattern and also make a trend line in m30

so we wait to break and test for change the trend wanna gold see 4 Time tap and go for BUY

and trend also bullish so going with bull bias

key level for target 3045 and 3060

EURUSD BUYWe have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#eurusd #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

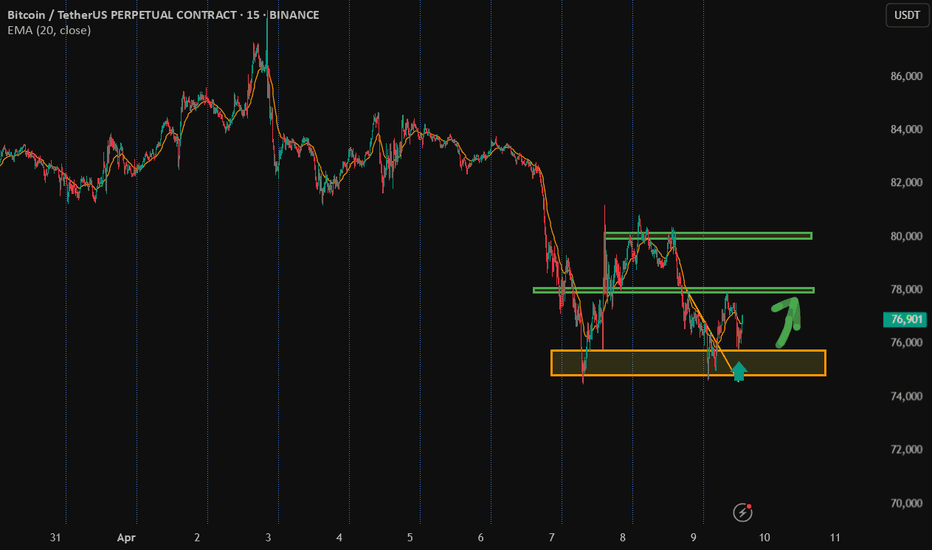

BTC/USDT updateBefore the correction, we had already shared the most probable scenario for #BTC in Spot Club and, with a slight delay, in this channel. As expected, the price dropped around 11% in spot within wave C, leading to significant liquidity being absorbed in the market.

However, we had already warned tarde-ai.bot members about this potential move in advance.

We still consider our previous outlook as the most probable scenario for Bitcoin's next move. If our perspective changes, we will update the analysis accordingly.

How To Manage Your Risk In Trading?Beginner!

Chasing profits is not the only purpose of smart trading. It is also about managing risk correctly. Every trade comes with uncertainty, and without a solid strategy, even the best opportunities can turn into costly mistakes. That’s where the 3-5-7 Rule comes in.

Think of it as a built-in safety net for your trades, a simple yet powerful guideline that helps you balance risk and reward. By setting clear limits on your exposure per trade, per market, and across your portfolio, the 3-5-7 Rule keeps you in control, protecting your investments from unexpected losses.

In this guide, we’ll break it all down: how the rule works, why it’s effective, and how you can apply it to your own trading strategy. Plus, we’ll walk through real examples to make it practical and easy to follow. By the end, you’ll be trading with more confidence, better discipline, and a clear plan to keep risk in check.

What is the 3 5 7 Rule?

The 3 5 7 rule works on a simple principle: never risk more than 3% of your trading capital on any single trade; limit your overall exposure to 5% of your capital on all open trades combined; and ensure your winning trades are at least 7% more profitable than your losing trades. It’s simple in theory, but success depends on discipline and consistency.

GOLD M30 DETAILED OVERVIEWGold (XAUUSD) is currently trading within a range-bound structure, forming key supply and demand zones.

🔹 Key Levels & Zones:

Strong Demand Zone (2H): Price recently tested a significant demand zone near $2,900 - $2,905, showing signs of potential bullish reaction.

Fair Value Gap (FVG) Fill: There is an imbalance in price action, suggesting a temporary push upward to fill the gap before further moves.

Strong Supply Zone: A major resistance area is identified around $2,945 - $2,950, making it a potential take-profit zone for buyers and an ideal level for fresh sell entries.

🔹 Trade Plan & Expectations:

Short-Term Bullish Move: Price may attempt to retrace higher towards the FVG fill area & supply zone, aiming for $2,940 - $2,945 before facing rejection.

Bearish Continuation: Once the price reaches resistance, a potential sell-off could drive XAUUSD back towards the demand zone and possibly lower towards $2,880 - $2,885.

EMA Confluence: The moving averages suggest an overall bearish trend, with price struggling to hold above key resistance levels.

📉 Bearish Bias: If rejection occurs at resistance, watch for confirmation before entering short positions targeting the demand zone and lower support.

📈 Bullish Scenario: If price breaks above $2,950, it could signal further upside momentum, invalidating the bearish setup.

XAUUSD NEW SIGNAL ALERT (WILL IT FALL OR NOT?)Gold market is now stuck in no trade zone

2919-2912 we mark our support and resistance zone over here and wait for any candle to break and close above or below our rage

if it break through our support then we target previous supports as our Tps

so Tp1= 2906

And if breaks through our resistance zone which is also new ATH then we can mark our new ATH by follow trend line

Tp1= 2942

BEST OF LUCK

XAUUSDwhat a greay weekend...gold is still pushing higher high finally made it to nearly 2900 , as weekly candle close strong bullish that seems like it might hit the cluster edge as predicted on the chart, i hope you all guys understand clean and clear, if not let me know in the comment.

looking for short from the edge of the cluster.

happy weekend.

15M GOLD FURTHER CHART ANALYSISHi Traders,

We are very happy we provided you accurate analysis earlier. We hit successfully all TP1, TP2 and TP3 in 15M and 1H time frame.

Here you go, I will share another 15M chart analysis, you can take the benefit. If you want to see how accurate our signals are, please visit our page and see for yourself.

Lets not waste time, please read this carefully. Lets keep it very simple so you can understand.

To streamline your trades, we’ve outlined ENTRY LEVELS and TAKE PROFIT (TP) targets (TP1, TP2, TP3) based on the EMA5. The EMA5 crossing and sustaining above these weighted levels will determine subsequent targets.

Key Update:

ENTRY LEVEL: 2761

If a candle closes above this level and the EMA5 cross and lock above 2761, we will enter the trade to TP1, we will consider bullish entries.

First Target (TP1): 2768

EMA cross and lock above TP1: 2768, will determine to achieve TP2: 2774

EMA cross and lock above TP2: 2774, will determine to achieve TP3: 2781

Rejection Scenario:

Your target should be 10 - 15 pip moves above each weighted level, which are effective in these conditions while minimizing the risks associated with longer-term positions.

Dip-Buying Strategy:

Continue buying dips at support levels, aiming for 10 - 15 pips per trade.

Each level structure typically provides 10 - 15 pip bounces, making it ideal for accurate entries and exits.

Keep an eye on the EMA5 crossing and locking above or below the ENTRY LEVEL to confirm the next directional range.

BULLISH TARGET: 2781

BEARISH TARGET: 2762

Stay sharp and trade smart!

TheQuantumTradingMastery

Technical Analysis: SOL/USDT (1D Chart)

Technical Analysis: SOL/USDT (1D Chart)

Analysis Overview:

The chart depicts a potential bullish scenario for SOL/USDT, highlighting key entry zones and price action structure. Here's the breakdown:

Entry Zones:

Entry 1 (Immediate Support Zone):

Zone: Around the $210-$220 range.

This area marks the first potential buying opportunity, where price has shown prior support and could bounce if retested.

Ideal for aggressive buyers seeking to capitalize on the current bullish momentum.

Entry 2 (Deeper Retracement Zone):

Zone: Around the $180-$190 range.

This zone represents a stronger support level, aligning with historical price action. It's suitable for conservative buyers awaiting deeper corrections.

Price Action and Path Projection:

A bullish continuation is expected if the price holds above the support zones.

Scenario 1: Price could bounce from Entry 1, consolidate slightly, and break higher, targeting levels beyond $280.

Scenario 2: If Entry 1 fails, the price might retest Entry 2 before forming a double-bottom pattern and resuming its upward trend.

Key Technical Indicators:

Moving Average (MA): The price is trading above a key moving average, reinforcing the bullish bias.

Buy and Sell Signals: Recent buy signals indicate renewed bullish pressure.

Volume: (Add volume analysis if relevant, e.g., increasing volume during breakouts.)

Targets:

Target 1: $300 – Based on the previous high.

Target 2: $350 – Major resistance from historical levels.

Risk Management:

Place stop-losses just below the support zones:

Entry 1: Stop-loss at $200.

Entry 2: Stop-loss at $170.

Use position sizing appropriate to your risk tolerance.

NZD/JPY Buy AnalysisThe pair is bouncing off strong channel support at 88.15, setting up a potential bullish move toward 93.07 (upper channel resistance).

🔥 Why This Setup Stands Out:

Strong support zone at 88.15.

Excellent risk/reward ratio for buyers.

🎯 Key Levels to Watch:

Entry: Above 88.15

Target 1: 91.68

Target 2: 93.07

Stop-Loss: Below 86.43

Stay sharp and wait for confirmation! Let’s catch the wave. 🌊📈

Dent/UsdtBINANCE:DENTUSDT

So, right now **Dent (DENT)** is sitting at a price of **0.01362** 💰. If the price **holds steady** at this level, it suggests that **buyers** are still in control and there's potential for the price to keep rising. If this momentum continues, **Dent** might face some resistance at **0.001503**, **0.001754**, and **0.001875** 🚫. These are key levels where the price could slow down or struggle to break through. At these points, some traders might choose to sell, which could cause the price to temporarily pull back. So, it's important to watch those levels closely to see if Dent can push past them.

But here's the flip side: if the price **fails to hold** at **0.01362** and starts to drop below, it could hit a **support level** at **0.001223** 🔑. This is where the price could **stabilize** for a bit, as some buyers may step in and try to **prevent further decline**. If it doesn’t hold at 0.001223, however, things could get more **volatile**, and the price might continue to fall until it finds another point of support.

This is where the market can get **tricky**, because **sentiment** (what traders are feeling) can shift quickly. You’ll need to keep an eye on the **market trends**, **news**, and **volume** (how much the coin is being traded), as these can give you hints on whether the price is likely to **break through resistance** or **bounce off support**.

---

### Bottom Line:

- **Dent’s price** is currently at **0.01362**.

- If it holds, it may face **resistance** at 0.001503, 0.001754, and 0.001875.

- If it drops, **support** at **0.001223** could be the next level to watch.

Just remember, this isn’t **financial advice**—it’s more about keeping an eye on the **overall trends** and **market behavior**. Always do your own research, and stay informed! 📚💡

GBPUSD Bullish trade Idea after see some sold breakout confirmatGBPUSD bullish trade idea after seeing some sold breakout confirmations on H1.

Buy Price LEVEL: 1. 2597

SL: 1.2550

TP: 1.27141

After the FOMC meeting yesterday night, the price dropped to 1.25627 with high volume when the Fed rate of 4.50 will boost the USD.

The GBP index is bullish; just find the trade with a tight stop loss.

*Note: The market is highly volitile in December; just place a smaller number of trades.

NVDA out of gas?H&S on the daily with 132.67 as the neckline. We also have another H&S that has played out and was followed by a double top, now failing once again under support. I'm in puts now with a stop-loss at 133. This is also where i would flip bias for potential squeeze at 133 after a backtest of 132.67

Japan Nikkei index- just a quick post to show u something.

- As always everything is in the graphic.

- Now look at Japan Index closely.

- So a quick crash happened but look where Nikkei Bounced.

- i always speak in my posts that :

- " Supports are always turning to resistances ".

- " Resistances are always turning as supports ".

- Here you have a perfect exemple with Nikkei225.

- if u can trade Cryptos, u can trade anything else!

Happy Tr4Ding !