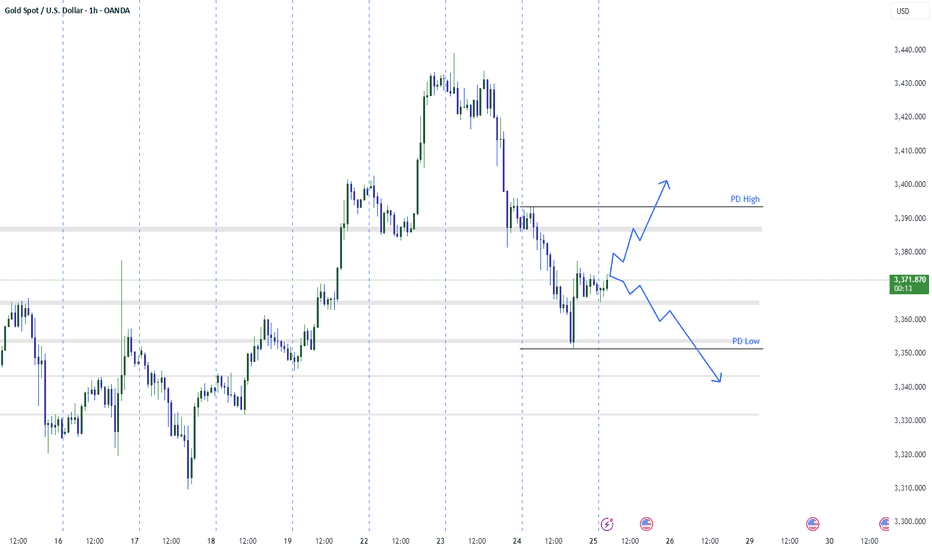

Gold UpdateGold (XAUUSD) is currently trading between PD High and PD Low, showing signs of consolidation after a recent downtrend.

Price reacted from the demand zone near PD Low and is now testing a minor resistance zone.

Key levels to watch: 3375–3385 resistance and 3355–3360 support.

Break above 3385 could open the path toward 3395–3400.

Failure to hold 3355 may trigger further downside toward 3340.

Waiting for clean structure and candlestick confirmation for directional bias.

Tradesetups

Minswap looks like a good entry here.Trading Fam,

I'm seeing great potential on this Minswap entry.

First, we're oversold on all lower indicators.

Secondly, we're back inside of a green liquidity block.

Third, we're on excellent support (aqua trendline).

This trade is a no brainer. I'm setting my target for an easy 25% profit target at which point I'll take half off and let the rest ride a bit longer, trailing my stops as I go.

Stew

USDJPY Forecast for NFP Week | Price at a Critical Turning PointIn this video, I’m diving into the USDJPY setup ahead of a high-impact week filled with major economic news like the NFP, ADP Employment, and speeches from the BoJ Governor.

We’ll walk through the technical zones I’m watching, discuss potential buyer and seller reactions, and outline the key catalysts that could move the market.

🔔 Don’t forget to like the video in support of my work.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#USDJPY #ForexForecast #NFPWeek #ForexMentor #TechnicalAnalysis #ForexTrading #BoJ #TradeSetups #PriceAction #MarketBreakdown

CADJPY - Buy with Target at 108This is a pretty good setup when taking everything into consideration. BOC on Wednesday likely to add additional strength to the Loonie from the tariffs. Earnings also adds more fire power towards this pair gaining in value along with Gold, looks like it wants to top off.

Fil Crypto Signal, we just make trading easier!Traders,

Here is the type of trade we like to give to our followers. Aside from the teaching of the allocation someone would take in this trade and understanding the risk management we teach or you learn about in trading this is how trades should be set up to best explain what to do, when to do it and how to do it so you can have the least risk and most gain as possible.

We will be giving all of our signals our moving forward like this to help our followers to maximize on a trade and minimize losses on the few signals that we post.

If you have any question about this signal or other feel free to shoot us a DM and we would be happy to break it down for you. You can also leave us a comment if it is related to this exact signal.

P.S. If you would like a specific analysis on any coin shoot us a DM with the ticker as we are giving out free analysis on any crypto or traditional assets for the rest of this week! Its going to be a great year, keep your eyes on the chart, your head out of the clouds and do not let the news outlets alter your knowledge of the charts. It seems like they work for the market maker if you ask me..... Op's!!!!

Stay Profitable,

Savvy

ADA - Next Trade Setups to WatchADA’s been stuck in this sideways grind for a while, and the volume’s basically ghosting us. So, where’s it at, and where’s the next move? Let’s dig in.

ADA’s sitting at $0.6615 right now, trading below the yearly open at $0.8451 and the range’s sweet spot, the POC, at $0.7325. That tells me it’s leaning a bit bearish, but not exactly screaming panic, more like it’s just chilling in this 57 day range. It tapped the monthly open at $0.6328 recently, bounced a little, but without volume showing up, it’s like nobody’s ready to commit yet.

Key Levels

Resistance Zones (Short Opportunities)

1.) Range POC: $0.7325, this is the most traded price within the 57 day range, acting as a magnet for price. A rejection here could signal a short setup.

2.) Yearly Open ($0.8451): a psychological and structural level that could cap upside if momentum remains weak. Trading below this level keeps the yearly bias bearish. A break above with volume would flip the narrative.

Support Zones (Long Opportunities)

1.) Monthly Open: $0.6328, already saw a little bounce here with that swing failure move, perfect setup for a long trade if you were quick on the draw.

2.) Yearly Open 2024 + 21 Monthly EMA: $0.594 - $0.5928, strong confluence with the prior yearly open and a key moving average. This zone aligns closely with the swing low at $0.5801, forming a robust support cluster between $0.5801 - $0.594.

3.) 21 SMA: $0.53, a deeper support level if the above zone fails. This would indicate a more significant breakdown, but it’s a potential accumulation area for longer-term traders.

Market Structure Analysis

Bearish Bias Above Swing Low: Trading below the yearly open and POC suggests sellers are in control unless price reclaims $0.7325 with conviction.

Range-Bound Behaviour: The 57 day range indicates consolidation. Volume is the missing catalyst, watch for a spike to confirm direction.

Swing Low as Key Pivot: The $0.5801 level is critical. A hold here maintains the range; a break below shifts focus to $0.53 and signals capitulation.

High-Probability Trade Setups

Long Setups

1.) Long Setup #1 at Swing Low ($0.5801 - $0.594 Zone)

Entry Trigger: Look for a swing failure pattern (SFP) where price dips below $0.5801, reclaims it, and shows rejection of lower prices (e.g., a bullish candle with a wick below).

Stop Loss (SL): Place just below the swing low

Take Profit (TP): $0.70 (near-term resistance)

Stretch Target: $0.8451 (yearly open), though this requires stronger momentum.

Confirmation: Higher-than-average volume on the reclaim + bullish price action (e.g., engulfing candle).

2.) Long Setup #2: $0.4735 Sniper Entry

Entry Trigger: If ADA takes a bigger tumble, $0.4735 is your sniper’s nest, think of it as catching the knife with style. Could be a wick that snaps back.

This is a deeper, high-reward play. Price has to fall by a lot from here, but if it hits, the R:R is amazing, and it’s below most traders radar. Patience is the name of the game.

Short Setup

At POC ($0.7325) or Yearly Open ($0.8451)

Strategic Outlook

Current Stance: If not in a trade, the $0.5801 level is the highest-probability long setup due to confluence and R:R. The SFP at $0.6328 today was a missed opportunity, but a deeper pullback sets up an even better entry.

Breakout Watch: A decisive close above $0.7325 (POC) with volume shifts focus to $0.8451. Conversely, a break below $0.5801 targets $0.53.

Patience is Key: Low volume suggests waiting for a clear catalyst (e.g., news, BTC move) to drive ADA out of this range.

Wrapping It Up

The $0.5801 swing low long with SL below and TP at $0.7 - $0.8451 is the standout trade right now—low risk, high reward, and backed by confluence. Monitor volume closely, as it’s the linchpin for any breakout or reversal. If ADA holds this support and volume picks up, the retest of $0.8451 becomes plausible.

If you found this helpful, please leave a like and a comment. Happy trading!

AUDCAD - Sell Trade SetupWaiting for AUDCAD to reach the level I plotted on the chart to sell it.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

Favorite Trade Setups for Next WeekSummary of positions I'm looking to take next week with my Copy Trading program include the following:

AUDCAD - LONG ⬆️ 🟢

AUDNZD - SHORT ⬇️ 🔴

NZDCAD - LONG ⬆️ 🟢

US30 - SHORT ⬇️ 🔴

USDCHF - SHORT ⬇️ 🔴

For optimal risk management, it's best to always scale with small volume relative to your equity. Leave lots of available margin on your account. Diversifying with multiple pairs is recommended to mitigate risk.

If you like my setup and would like to copy my trades, send me a DM for further information.

Let's Grow Together 👍 LIKE - FOLLOW - SHARE

~ Michael Harding

USDJPY - Analysis and Potential Setups (Intraday- 10.02.25) Overall Trend & Context:

The OANDA:USDJPY pair is in an overall downtrend on the higher time frames and has reached highly significant support/demand levels. Lower time frame has given bullish indications, we can try to capitalize on this.

Technical Findings:

Price broke above the 200 EMA - this can act as dynamic support so watch current levels.

Demand zone was formed after sweeping internal liquidity (which resulted in an impulsive bullish break).

RSI shows overbought conditions - resulting in a pullback which is what we want to see to confirm price action (currently trading below the 50% level of the RSI)

Potential Scenarios:

Since we have seen a reaction off HTF supply zones we should wait for proper confirmations prior to entry.

If the demand fails, short positions should be considered - analysis will need to be adjusted to adapt to changing supply levels.

BTC to 34,200 - But that’s not the bottom I anticipate Bitcoin to drop a correction sequence - 34,500 level as a first low

From here, we should watch for a major resistance to hold around 43,000 - this indicates a further drop to the 10,000 level

If Bitcoin drops at speed we know why - DXY is seeing a major breakdown and bearish retest. This indicates an extended 1-2 year bull market - prior to which to market has interest in recollecting liquidity at these ultra lows

This is my take on the market and has been for months. I expect this to happen in the short term timespan

Bollinger Bands, Moving Averages, and Stochastic Oscillator* LIVE TRADING *

This is not a get rich quick scheme, if you have the time to study and practice this video it will give great insight on how price moves. Add the indicators to your chart and see if the 3 main signals create entry points for trades

3 Main Signals:

- Stochastic (settings) 14,3,3 with %K marked as RED and %D marked as GREEN (inversed from default)

- CM_Williams_Vix _Fix

- Bollinger Bands (default settings)

Extremely insightful example of how specific indicators correlate to create a trade setup. What the trade setup looks like and how you can practice it in real time. Time Frame Reference and how they mix. Calling out candlesticks as they populate.

Indicators (all indicators from Trading View indicator library):

- Stochastic (settings) 14,3,3 with %K marked as RED and %D marked as GREEN (inversed from default)

- CM_Williams_Vix _Fix

- Volume

- Bollinger Bands (default settings)

- TEMA - settings 9 EMA purple, 50 EMA yellow, 200 EMA black

- Divergence for many V3

BTC - Short Trade DetailsI suspect a massive short on bitcoin to take place. This is because DXY is showing a bearish breakdown on the monthly - with only a small upwards movement left before anticipated rejection from this bearish retest. This means an extended bull market - and this weekend period utilized to wipe long positions prior to this occurring.

There are two major short entry points I can decipher on the chart. The first is 69,250 - which seems to be keeping price below at the moment.

The second possibility is an initial move up to 69,900 to 71,000 and rejection from this location.

My short targets in white are quite drastic. However again, DXY is showing signs of supporting a very lengthy bull market spanning the next 1-2 years. This to me serves as a justification for these extreme lows to be hit, otherwise I would not be suggesting something so drastic.

This HTF bearish trend line supports targets as low as 8,000 - and it’s entirely possible that we don’t see a low that severe, however it is supported by a chart trend line and as such I will be taking it seriously until proven invalid.

Happy trading.

BONK2 a path to 8200% gains!Please see chart for details. These are the trades we generally share to the group privately.