Liberation, Altercation & Boom: US China Trade talks CME_MINI:ES1!

Pointing to our previously written blog post (Liberation, Altercation or Doom) on March 31st. A mix of all scenarios played out.

Global universal tariffs with reciprocal tariffs layered on top. It resulted in a huge sell-off on April 2nd.

After months of tit-for-tat tariffs and growing economic friction, the US and China have agreed to hit pause. In a joint statement that’s given markets some breathing room, both countries announced a 90-day suspension on a large portion of their punitive tariffs—an initial step toward dialing back tensions and restarting dialogue.

Key Tariff Measures from US-China Joint Statement (90-Day Pause)

US Tariff Reductions:

Tariffs on Chinese goods were reduced from 145% to 30% for a 90-day period.

24 percentage points suspended, leaving a 10% base tariff in place.

China Tariff Reductions:

Tariffs on US goods reduced from 125% to 10% for the same 90-day period.

China also suspends 24 percentage points of additional ad valorem duties.

Retains a 10% baseline tariff on US imports.

Non-Tariff Measures: China to suspend or remove all non-tariff countermeasures imposed since April 2.

Includes sanctions on certain US companies.

Lifts export controls on some critical minerals.

Timeline & Commitment:

Both parties agree to implement these actions by May 14.

Commitment to continue trade and economic talks through a new bilateral mechanism.

Talks may be held in alternating locations (US/China) or via third-party venues.

No Agreement On:

Currency policy.

E-commerce “de minimis” exemptions.

Sector-specific tariff frameworks.

Future Key Dates and Timeline:

May - Potential US semiconductor tariffs.

May/June - Potential US pharmaceutical tariffs.

July 8th - 90-day tariff lowering for "worst offenders" expires.

July 14th - US tariffs on Mexican agriculture goes into effect.

August 10th - US-China tariff relief expires.

Was this really mutual or just a game of chicken?

There’s an argument to be made that this is more of a tactical pause than a full reconciliation. With China’s GDP in purchasing power parity terms now surpassing that of the US, and its continued technological advancements across sectors like aerospace, semiconductors, and critical minerals, the balance of economic leverage is shifting. For investors, this isn’t just about tariffs—it’s about the evolving structure of global trade.

Geopolitical undercurrents continue to shape the backdrop. China’s strategic influence in regional security, technology supply chains, and commodity access adds another layer to its negotiating position. Recent developments—such as China's reassertion of dominance in strategic corridors and growing control over key mineral exports—suggest its economic posture is becoming more assertive. This, in turn, has implications for US firms dependent on Chinese inputs or facing retaliatory restrictions.

In short, the 90-day window presents a tactical opportunity, but the structural story remains complex. Investors would be wise to monitor not just tariff updates, but broader shifts in trade alliances, export controls, and supply chain vulnerabilities—especially in sectors like tech, energy, and defense-adjacent industries.

ES Futures:

ES Futures and risk on assets are positive across the board following this announcement.

Key Levels:

Key LVN/ Key LIS: 5861-5837.25

200 Day MA: 5872.99

0.786 Fib Retracement level: 5921.75

0.618 Fib Retracement level: 5688.75

pWkHi: 5741

mCVAL 2025: 5639.75

Expectations for the week ahead:

US CPI and Retail Sales data on the docket this week along with slew of FED speakers.

Scenario 1: Risk on

ES Futures get back above 200-day moving average clearing the key LVN resistance zone and our key LIS, head towards 0.786 Fib retracement level before pulling back and consolidating for the remainder of the week.

Example trade:

Entry: 5861

Stop: 5837

Target: 5921.75

Risk: 96 ticks

Reward: 243 ticks

Risk/Reward ratio: 2.5 R

Scenario 2: Further consolidation

Markets consolidate below the key LVN resistance zone and prior weekly high.

Example Trade:

Entry: 5837

Stop: 5861

Target: 5741

Risk: 96 ticks

Reward: 384 ticks

Risk/Reward ratio: 4 R

Glossary:

VA: Value Area

VPOC: Volume Point of Control

VAL: Value Area Low

C: Composite (used as a prefix: VA, VAL, VAH, VPOC, etc.)

mC: micro Composite (used as a prefix: mCVA, mCVAL, etc.)

LNV: Low Volume Node

LIS: Line in Sand

Important Notes:

These are example trade ideas not intended to be a recommendation to trade, and traders are encouraged to do their own analysis and preparation before entering any positions.

Stop losses are not guaranteed to trigger at specified levels, and actual losses may exceed predetermined stop levels.

Tradetalks

$META long or short?Indecisive on this ticker. I like what Zuck is trying to do. This chart looks pretty nice. I’m seeing upside into the earnings and maybe this earnings NASDAQ:META will go up $50+ (hopeium). Let me know what you guys think. I want to see 700’s and honestly it could be insane, yet not so insane in this current market, to try and hit 800. Look at other tickers, NASDAQ:CRWD lost $200 in what a month? Then regained $200 or so in 2-3 months? NASDAQ:NVDA speaks for itself, NASDAQ:MSTR , these large MC names can do wild things.

Wallstreet

The real reason you aren't profitable, YETHumble yourself and come to realize that:

1. Nothing is on YOUR time

2. You don't know everything

3. You cannot win every single trade

Most traders struggle in 1 or all of these areas and thus it stops them from actually progressing forward.

Pride cometh before the fall.....

A Chat With Traders: Traders And Psychology With EnochEnoch Baz, the 19-year-old, who literally pays his mama’s bills with: forex trading. Baz is a penultimate student of Architecture in Nigeria. He started forex because according to him, “it’s the only way I can work minor and earn major from home”.

Enoch is an indices fan as he says, “that’s where the money is for me (lol). Work less, earn more.”—US30 and S&P500 do the trick. Chatting with Baz made me realize his undeviating and unswerving approach to trading these pairs. “I trade against Supply and Demand zones looking to be Liquidated and Mitigated”, he utters.

The trader also advances to explain this strategy. To Enoch, It’s more of combining Zone to zone with smart money trading (institutional trading)”.

In addition, he got introduced to Forex in October 2018, after he graduated High-school—by his cousin who’s not a trader currently. Albeit, he took it seriously in 2019. Enoch started off making researches and reading multiple PDFs in his genesis.

Enoch And His Trade Management

Hello Baz, so, how do you manage a trade when in it?

Yeah, before I hop into any trade, I have 3 goals: Firstly, I close with big profits, secondly, small profits, and lastly small loss. Either way, I let my trade run. After I’m in—I go ahead with my day. I always have my risk in mind. Once I’m fine with it, It’s a good day then.

Love the simplicity I must add. However, social media has allowed us as traders to have a wider footprint outside of the forex industry, what do you think your impact is in the industry?

Well, I started my forex-focus-Instagram-account in October 2020, I’ve gotten a lot of messages regarding me leveling up individuals-forex game involuntarily from contents I post. It has been a good impact—helped people over the world know what this grind could bring.

Love the term “over the world” What is your trading plan? And what is your go-to asset class (what pair(s) would you consider are your favorites) and why do you prefer these pairs?

As for trading plan, It’s definitely the: Zone to zone ( risking just 4% of my account maximum), cos of its simplicity & direct approach to the market. I started trading XAUUSD, but currently, I trade indices like US30 & SPX500. Reason—that’s where the money is for me lol. Work less, earn more.

Enoch On Trading Techniques

Work less; Earn more. Yeah—the fun of trading the indices. Do you have a special way you trade this particular pair? If yes, can you share a tip for that pair?

Trade against Supply and Demand zones looking to be: Liquidated or Mitigated. It’s more of combining Zone to zone and smart money trading (institutional trading).

Woah. That’s a lot to take in. However, Fast one Technical, Fundamental or Sentiments? Why?

Technical. Although, fundamentals fuels the market, but only runs for a certain period. After that, we are left with the naked chart. So, Technical is king to me.

A personal question, How much money do you handle now?

Well, I handle two accounts: a $30,000 and a four figure on synthetic indexes.

That’s huge and inspiring, What are your forex weaknesses? How do you plan on going about them? Have you succeeded in doing that?

Forex weakness? Hmm. I’m thinking about that. I basically just trade my thing and what I have an edge in.

Totally threw me of with that one. The confidence. I admire that no doubt. Who is one person/academy you think Neophyte or everyone should follow and why?

Definitely—Cue banks. Following him on Instagram would give you valid reason not to quit.

Enoch In Trade environment and Work history

“Take a cue from cue”—I’ll do anything to interview him. He’s indeed a great trader. How would you describe your ideal work environment?

Love trading alone. So just me and my screens with—UK Drills music playing in the back ground.

The lone wolf. Tell me about a time you disagreed with a decision. A time you didn’t follow your trading plan. What did you do?

Took out my SL, I didn’t want to get stopped out because, it was a fundamental market on BTCUSD, short story, lost over 85% when I got back.

Ouch! What was your salary in your last job before forex? Was leaving it for forex worth it and why?

I’ve never worked a job. I was barely 16 when I started Forex.

Right. Makes sense—What are your trading aspirations? I know many trade for “financial freedom” but what happens when that’s achieved? What do you plan on doing with trading?

Plan on putting young boy and girls on this grind. I know what it feels like earning above average.

Enoch Talks Trading Psychology

Great plan. What keeps you sane? Cos’ I won’t lie trading can stress you out and some even get depressed. So how do you overcome this.

You know, I feel people risk money which they basically can afford to lose. Like I say, everyone needs to have a passive source of income to fund their trading accounts. That way, you stress-less after losses because it’s OPM (other people’s money). I leverage on OPM a lot, that way I don’t have to beat myself up after losses.

Other people’s cash. Hmm, That requires trust though. However, this may sound “cliché” but why forex? What is your major reason for choosing forex?

Personally, I got caught up with the lifestyle, but as a kid, I loved exploring. I had always wanted to test out everything, new gadget and stuffs I see. That way, I knew I could afford this when I make literally free money, that’s why I’m still trading; love giving major portions of my withdrawals.

Who doesn’t love a giver? Do you trade for any proprietary firm? If yes, which one and how is it going?

No, But FTMO is looking nice haha.

What would you consider to be your biggest forex achievement? Tell me about a forex accomplishment you are most proud of.

Being able to pay my mom weekly. Paying her more than her salary is a flex for me at 18. I’m also proud of being able to afford my trading gadgets without anyone’s assistance, fully funded by me and the markets. Good flex too. Also surprising my cousins with quite expensive gifts on their birthdays.

Aww. That’s really nice. Indeed a big flex for a trader your age. Okay Baz, Let’s visualize now. So what would you want your forex dream to be like (in details).

Inner circle for billionaire traders with the dope garages and cribs. That’s enough.

Enoch In The Business Of trading

Do you keep a journal? If yes, what does it consist of?

No journals. Just Notepads with Risk calculations.

Oh, okay. When you’re not trading, what are you doing?

On YouTube watching pranks and skits. I don’t watch movies longer than 15mins or I’m working on my “Social Media Management” site (SMM).

That interesting an weird. What would say is your “win-rate” and what really drives results in your trading?

Haven’t really had time to know my win-rate. But 78%- 82% is reasonable, because I rarely over trade. Haha! My Risk management is key, that’s my major sauce in trading. With my style of risk management, 38% win rate is still Profitable. I love hopping on high-rewarding trades.

Well, you ain’t lying. Listen, I think psychology is one of the most important if not the most important part of trading. So, that’s why I’m laying emphasis on it. What are your trading rituals and how has it helped your trading?

Pray, plan my trades and trade my plan. That way, I worry less because I’ve literally done the easiest things which are the most important things too.

Trading inspiration

Who or what inspired you to start trading? If you have a mentor, what’s their name and what about that individual inspired you?

I got inspired by Inyang Jude “Forex bae”. My cousin showed me his picture back in 2018. He was literally the first trader I saw from Nigeria. I’m grateful for the inspiration! Another mentor I have is MomoForex. His lifestyle is simple and that’s me.

Yeah. I actually love Nick Shawn. I believe he was a mentor to Momo—drop a forex secret you feel should be shared and no-one talks about.

How much are you risking on this trade? if you can’t answer that before taking the trade, don’t trade. Because I feel most people get surprised by how much they lose on a trade. They lack the background idea of how much they should be risking.

Interesting. How long do you plan on trading forex and Where do you see yourself in five years with forex?

Till forever. Let’s wait

Enoch and trading strengths

What are you biggest strengths in forex and What’s one thing you think you are very good at in forex?

That will be, determining market directions in the long run.

Nice. We have the Neophytes trooping in the industry. What’s your advice to them and what would you recommend they start with?

Knowledge first. You’re here for a long run. “Do what is right and cash will flow”

You hear that, it’s always the knowledge first. How do you handle pressure, impatience, fear, doubt and greed in forex?

I only experience doubt. If you’re doubting a trade, it’s best not to take that trade. And if you’re in a trade already and you doubting, it’s safer to close or move your Stop-loss very tight to curb losses.

Tell me about the toughest decision you had to make in the last six months. Was it a trading decision? If yes, tell me how you handled the situation.

Leaving a MLM company (best decision). I left this company that offered to help my trading journey. But it was clear BS! Full of fake traders and lifestyle. I was earning 3 figures for two months. My journey skyrocketed after I took the bold step to leave that company and start trading Full-time. Grateful for the growth now.

You calling MLM out like that, makes me want to ask further but, I WON’T PRY. Tell me how you think other people would describe you. What do you want to be remembered for in the industry?

Don’t really care of how anyone would describe me, Everyone has various opinions. I want to be remembered for the impact.

Trading traits

Straight-forward. Like that… What are traits do you have that keeps you successful?

Fearless. I take calculated risk always I involve myself in profitable relationships.

I know this particular question may sound weird. The reason asked is because as humans we have the whole “act now, think later” thingy going on even when it’s not the right thing to do. So, do you have a trading “guilty pleasure”? If “yes” what is it and how do you handle it when it happens?

Heh, FOMO “Fear Of Missing Out” from cryptos, If you don’t ignore the internet noise these days, you tend to hop on trends due to the hype and find yourself getting screwed up after.

I can hugely relate. We all talk about trading psychology, what can you say about that? Good question Baz. What is your go-to strategy? I would also love that you explain why that is your go-to. Do you have a major reason why you chose that strategy and how it has helped sharpen your trading.

Why beat yourself up when you were not comfortable risking such amount of money? That’s the major thing I can say. Always going to be: zone to zone. I spend two minutes analyzing a trade that would be take a regular trader hours. Yeah, it helped me create more time to do other important thongs.

Final words from Enoch

What’s your take on Neophytes that want to learn forex? Do you prefer they paid for the knowledge or stick with YouTube videos and free materials?

This question. First of all, there are two ways to acquire knowledge. By Discovering or Duplicating. These two approaches require different sacrifices. Time or money. When Discovering, You spend time in search of knowledge, absorbing but important & less important stuff. As time goes on when trading, you’ll find out you have a lot of things to unlearn cos they’re literally useless. That way, you spend another precious time trying to focus on the main sauce. For Duplication, you meet a “Guru” Mentor, who’s been in the game for a while, this way you don’t have to pass through the process of sourcing for a scheme. This guru puts you on what’s needed in the market and that way, you’re starting the major aspect of the market with enough time to execute Knowledge gained (while someone discovering is still trying to unlearn some things) either way, experience is important.

EURGBP H4 - Short SetupEURGBP H4

Off the back of the resumed GBP strength, I feel we could see a break and close below our current support zone of 0.88300. Waiting for this closure is important, a clear break and close below followed by a subsequent retest and resisted price at 0.88400 could set us up for potential shorts.

GBPCHF H4 - Long Trade SetupGBPCHF H4 - Broken resistance price of 1.19, quite a big price to break, currently looking to retest as support to confirm a change in s/r, this would effectively act as our buy zone pending PA confirmation, slower moving pair, we can hold out for candle closure for that extra bit of certainty.

GBPCHF H4 - Long SetupGBPCHF H4 - Same reasoning for EG shorts, fundamentals spiking GBP and market volume comes into play and EUR/LON markets react to weekend headlines. Still best practice to let the dust settle after such an opening. Personally like to let London morning do it's thing before looking to scout any trades out around NA/LON overlap time.

RidetheMacro| EURUSD Market Commentery 2020.09.23

🎈 Given the absence of important fundamental statistics today, the pressure on the euro was also limited in the first half of the day. After an unsuccessful attempt to break below the monthly lows, the pair returned back to the opening level.

🔑 From a technical point of view, nothing has changed. Bears will continue to focus on breaking through and fixing below the low of 1.1635. If the pair easily reaches the level, it may drop to new support levels of 1.1600-1.1550 and 1.1535. If the price returns to 1.1770, the buyers will become more active. However, if the quote goes above 1.1770, it may jump to 1.1820.⚠

🌡 Thus economists upwardly revised the situation in the German economy. It is expected that further growth will be no less active than in the summer period. as the GDP drop in the second quarter was less than expected.

📍 However, the worsening epidemiological situation will shape the control measures and social distancing that could be imposed later. Moreover, if the EU and the UK fail to sign an agreement 🔴, a new trade war may break out.

📍 As far as the labor market is concerned, the number of unemployed people in Germany in 2020 is expected to rise to 2.7 million compared to 2.3 million last year. In 2021, the indicator could fall to 2.6 million.

📌 German consumers currently show two directions. There is the direction of a high willingness to spend, while at the same time the willingness to save is still much higher than prior to the crisis. since the end of 2019, the savings ratio of German households has more than doubled, to 20% in the second quarter. according to ECB study, the increase in the savings ratio in the entire eurozone is mainly driven by so-called forced, ie involuntary, savings. While this would imply that there is lots of pent-up demand once the economic situation stabilizes, the fact that wages dropped significantly in the second quarter suggests that the role of precautionary savings could be more important than suggested by the ECB study. In Germany, nominal wages dropped by 4% YoY in the second quarter on the back of short-term work schemes and the lockdown measures.

EURUSD Another

Ridethemacro

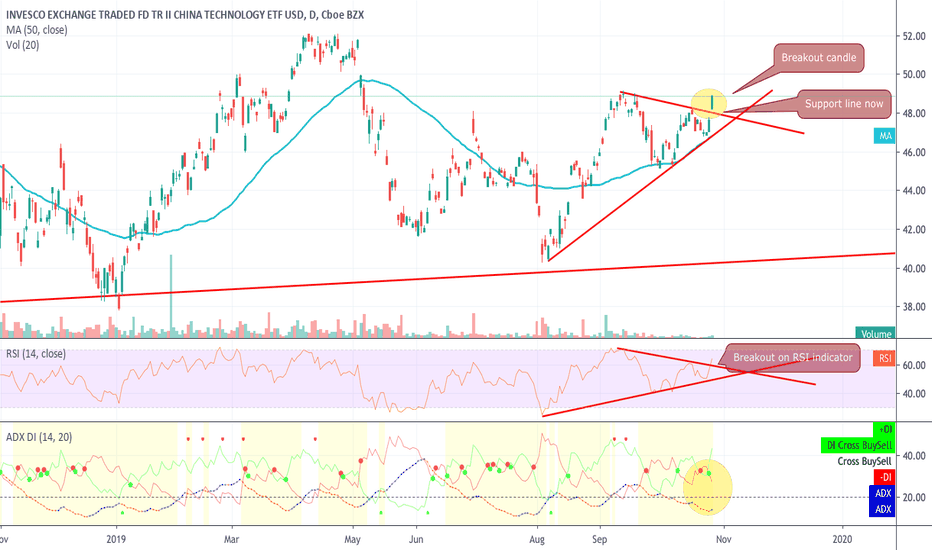

CQQQ - breakout - long with close Stop lossHi Friends , breakout on daily time frame on AMEX:CQQQ .

Look at the breakout with the Green candle peeping out of the triangle formation. RSI and ADX both showing strength (DM crossover the DM- but ADX still weak, but looks like gaining strength.

Watch out for possible retest of the newly found support line ( earlier resistance line) for a possible throwback down to the trend line and then momentum pulling to upwards if the news flow from the trade talks with China remain positive.

If the price renters the triangle then expect the lower support levels of the triangle to be tested fairly soon.

Please note, wait for candle formation (for daily timeframe, wait for close levels to confirm breakouts and also retest levels for finalizing any trade

One could look at entry at this level and place stop loss at 47.50 levels.

SPY Ascending TriangleMy chart from a few days ago on the 4 hour is still in play. I'm sticking to my positions. Please, if you are unsure, do not take my word for it. Do your own research before making ANY investment decision.

YouTube: Dumb Money Trader

twitter.com/dumbmoneytrader

facebook.com/dumbmoneytrader (I don't boot people for opinions or satire... political or otherwise)

www.dumbmoneytrader.com

Nothing has changed! All eyes on trade meetings.Let me clear some things up: I am not a day trader. So, my charts are what I see from a swing trading perspective. I look for opportunities that might not play out today, tomorrow, or even next week. Rather, I look for opportunities that I think might play out anywhere from today to a month (or a little more) from now. Not long term, but short to mid-term... I'm a swing trader. Please keep that in mind when you view my charts.

As always, I appreciate each and every comment and follower! Good luck to all, and may we ALL profit!!

YouTube: Dumb Money Trader

www.dumbmoneytrader.com

www.twitter.com

www.facebook.com

Trading the range on SOXLHere's how I'm trading SOXL right now. I buy when it gets below the red channel and sell when it gets above the red channel. A breach of either of the blue trend lines would indicate a breakout from the current trading range. So I'm keeping a stop loss just below the lower blue trend line.

Today I exited at 170, and my next buy order is at 152.50. I hope to see that Monday, although with trade talks coming up in mid-October, we could easily see the uptrend continue.

In my opinion, semiconductors are overvalued right now. Given the weakness of their earnings, they haven't fallen as far as they should. But if we successfully sign a trade deal, they will explode to new highs regardless of their earnings. So keep an eye out for China news.

XAUUSD - WAIT FOR NEXT MOVEContinuing on from my last analysis - we have now seen the break and re-test after we made a gap in the market, so next we wait to see what price action does.

We have US GDP news this week along with continued trade talks.

I would expect to see more consolidation until Thursday.