XAU/USD Weekly Outlook Liquidity Grab Before Next Move📌 XAU/USD Weekly Outlook: Range-Bound Behavior Hints at Potential Liquidity Grab Before Next Move 💰📊

Gold (XAU/USD) is currently consolidating within a broad 30-point price channel between 3,216 and 3,246. Price action shows clear indecision, as bulls and bears wrestle for control without confirmation of a breakout or breakdown.

While the overall trend remains bullish, momentum has softened compared to last week. Technical indicators are signaling overbought conditions, and a deeper liquidity sweep is becoming increasingly probable. Traders should remain patient and watch for clearer signals during the upcoming European session.

🔍 Market Structure Highlights

Upside Barriers: 3,246 (ATH), 3,255, 3,268, 3,285, 3,302

Downside Supports: 3,216, 3,195, 3,172, 3,152, 3,120

📈 Trade Opportunity Zones

Potential Long Setup:

Buy Zone: 3,172 – 3,170

Stop Loss: 3,166

ls: 3,176 | 3,180 | 3,184 | 3,188 | 3,192 | 3,196 | 3,200

Potential Short Setup:

Sell Zone: 3,268 – 3,270

Stop Loss: 3,274

Target Levels: 3,264 | 3,260 | 3,256 | 3,252 | 3,248 | 3,244 | 3,240

🧭 Weekly Strategy Insight

With no significant economic data on the calendar this week, price movements will likely be driven by intraday liquidity and order flow. Focus should be placed on the London and New York sessions, where volume tends to peak and directional bias becomes more evident.

Current market behavior suggests that a fake-out or liquidity trap could develop before the next significant move. Traders are advised to avoid chasing price and instead wait for optimal entries at key zones.

⚠️ Risk Reminder

Even in the absence of major news, volatility remains elevated. Always execute trades with a solid risk plan and predefined TP/SL levels. Protect your capital first — the opportunities will come with patience and discipline. 🛡️

Trading-forex

Trade Analysis for Week 16 (14Apr25 onwards)Hello fellow traders , my regular and new friends!

Over here I will be sharing my analysis for this week.

Mainly On:

EURUSD

EURAUD

EURNZD

BTC

USDSGD

Moving forward I will separate both the Trade review and Coming week trade analysis for easy viewing!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

Trading Week 15 Review 2025Hello fellow traders , my regular and new friends!

How was your trading this week?

Did you get a killing on the SNP, EURUSD etc?

This part will be on the review for this week.

Moving forward I will separate both the Trade review and Coming week trade analysis for easy viewing!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

USD/HUF 4H LONG Investment OpportunityHello, I am Trader Andrea Russo and today I want to share with you an interesting LONG investment opportunity on USD/HUF. We are on a 4-hour chart (4H), and several technical indicators are highlighting an increase in bullish pressure. Oversold signals and the recovery of momentum suggest a potential reversal to the upside, making this configuration particularly promising.

Investment Setup:

Entry Price: 359.7 Signal: BUY with Target Price set at 365.170 (TP: 1.52%). Stop Loss: set at 358 (SL: 0.47%).

Thanks to our SwipeUP INVERSION Radar with Alerts indicator, we were able to identify:

The oversold zone, which suggested the opportunity for a rebound.

The Break Point, which confirmed the start of a potential reversal to the upside.

The entry point, to maximize the risk/reward ratio.

As a Target point, we have chosen the area highlighted in the photo, which is the first important resistance that in our opinion represents a key level where the price could slow down.

👉 This setup takes advantage of the current bullish pressure and offers a favorable risk/reward ratio. I encourage you to monitor this setup and implement solid risk management in your trading plan.

Happy trading everyone! 📈

US-China Trade War: Impacts on Financial Markets

The trade war between the United States and China has reached unprecedented levels, with the imposition of reciprocal tariffs that are upsetting the global economic balance. China has recently increased tariffs on American products up to 50%, while President Trump has temporarily suspended tariffs for three months, trying to negotiate with other nations. This scenario is generating strong volatility in the financial markets and profoundly affecting the Forex market.

Analysis of the Impacts on Financial Markets

Stock Markets: The main world stock exchanges are recording significant fluctuations. Asian and European indices have suffered drastic drops, reflecting investor uncertainty.

Raw Materials: The price of oil and precious metals shows instability, with oscillations that reflect global nervousness. Gold, considered a safe haven, is gaining ground, exceeding the threshold of 3,000 dollars.

Economic Sectors: Sectors such as technology and agriculture are particularly hard hit, with export restrictions and rising production costs.

Impact on Forex

The trade war is directly impacting the currency market:

US Dollar (USD): The dollar is coming under pressure due to economic uncertainty and recession fears in the United States. The Federal Reserve may be forced to cut interest rates further.

Chinese Yuan (CNY): The yuan is under pressure, with the risk of lower exports to the US and a slowdown in Chinese economic growth.

Safe Haven Currencies: The Swiss Franc (CHF) and the Japanese Yen (JPY) are gaining ground, as investors seek stability amid global volatility.

Commodity Currencies: The Australian Dollar (AUD) and the Canadian Dollar (CAD) could be negatively impacted by fluctuations in international trade.

Forex Strategies for Traders

In a context of high volatility, traders must adopt targeted strategies:

Constant Monitoring: Follow the developments of the trade war and the decisions of central banks.

Diversification: Invest in safe haven currencies to reduce risk.

Technical Analysis: Use analysis tools to identify trading opportunities based on market movements.

Risk Management: Set stop-loss and take-profit to protect capital.

This situation requires attention and flexibility from traders, who must adapt their strategies to the new market dynamics. If you need further insights or a specific analysis on a currency, I am here to help!

EURJPY Will Go Down! Short!

Here is our detailed technical review for EURJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 161.313.

The above observations make me that the market will inevitably achieve 160.605 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

LONG GBP/CAD 4H Investment Opportunity

Hello, I am Trader Andrea Russo and today I want to share with you an interesting LONG investment opportunity on GBP/CAD. We are on a 4-hour (4H) chart, and several technical indicators are highlighting an increase in bullish pressure. Oversold signals and the recovery of momentum suggest a potential reversal to the upside, making this configuration particularly promising.

Investment Setup:

Entry Price: 1.812

Signal: BUY with Target Price set at 1.835 (TP: 1.27%).

Stop Loss: set at 1.8033 (SL: 0.48%).

Thanks to our SwipeUP Reversal Radar Multi-Timeframe Alerts indicator, we were able to identify:

The oversold zone, which suggested the opportunity for a rebound.

The Break Point, which confirmed the beginning of a potential reversal to the upside.

The entry point, to maximize the risk/reward ratio.

As a Target point, we have chosen the area highlighted in the photo, which is the first important resistance that in our opinion represents a key level where the price could slow down.

👉 This setup takes advantage of the current bullish pressure and offers a favorable risk/reward ratio. I encourage you to monitor this setup and implement solid risk management in your trading plan.

Happy trading everyone! 📈

EUR/PLN SHORT Investment Opportunity 4HHello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently on a 4-hour (4H) chart, and some technical indicators suggest increasing bearish pressure. The overbought signals and the loss of momentum suggest that we could be facing a possible bearish reversal, making this configuration particularly interesting.

Here is the Investment Setup:

The entry price for the trade is set at 4.2854.

There is a SELL signal with a target price set at 4.2066, corresponding to a TP of 1.85%.

The stop loss is set at 4.2593, corresponding to a SL of 0.61%.

This short position offers a favorable risk/reward ratio, taking advantage of the current bearish pressure and the possible confirmation of a bearish trend on EUR/PLN.

As always, I encourage you to monitor this setup carefully and apply strategic and conscious risk management to your trading plan. Happy trading! 📉

XAU/USD Outlook: Gold's Bullish Momentum Strengthens 📌 XAU/USD Analysis: Gold on a Strong Bullish Momentum Amid Economic Optimism 📈💰

✨ Overview:

Gold (XAU/USD) is currently demonstrating significant bullish momentum, driven by improved global economic sentiment. The recent 90-day tariff suspension among major global economies and hints from the recent FOMC meeting about potential rate cuts later this year are fueling investor optimism.

📊 Technical Analysis:

🔹 Key Resistance Levels:

3,146

3,162

3,168

🔸 Key Support Levels:

3,096

3,078

3,066

3,052

📈 Moving Averages Analysis:

MA 13 (Short-term): Clearly supports bullish momentum, offering buy signals as price sustains above this MA.

MA 34 (Medium-term): Supporting bullish sentiment with prices comfortably above.

MA 200 (Long-term): Reinforces the robust long-term bullish outlook with price consistently trading above this level.

🚀 Trading Strategy & Recommendations:

BUY Strategy (Preferred Scenario):

Entry Zone: 3,094 – 3,096

Stop Loss: 3,090

Take Profit Levels: 3,100 | 3,104 | 3,108 | 3,112 | 3,116 | 3,120

SELL Strategy (Cautious Approach):

Entry Zone: 3,164 – 3,166

Stop Loss: 3,170

Take Profit Levels: 3,160 | 3,156 | 3,152 | 3,148 | 3,144 | 3,140

🌍 Fundamental Context:

Positive Market Sentiment: The global economic outlook has turned favorable due to tariff suspensions and strong performance in equity markets.

Interest Rate Outlook: Recent signals from the FOMC regarding possible interest rate cuts are providing further support for gold’s upward trajectory.

⚠️ Risk Management:

Emphasize caution when engaging in short positions, given the prevailing bullish conditions.

Always implement strict stop-loss measures and maintain risk-to-reward ratios of at least 1:2.

Avoid over-leverage and ensure trades are sized appropriately.

💡 Conclusion & Final Thoughts:

Gold remains strongly bullish, backed by both technical indicators and a positive fundamental backdrop. Traders are encouraged to focus primarily on buy opportunities near significant support levels and remain alert to potential trend reversals at key resistance zones.

🗨️ Engage with Us:

What are your current strategies for gold? Share your insights and views in the comments section below! 💬👇

CAD/NOK SHORT Investment Opportunity 4H

Hello everyone, I am Trader Andrea Russo, and today I want to present you a SHORT investment opportunity on CAD/NOK. With the help of the SwipeUP Reversal Radar Multi-Timeframe Alerts indicator, we have identified a setup that stands out for its bearish potential.

Investment Setup:

Entry Price: 7.67

Target Price (TP): 7,418, corresponding to an estimated profit of 3.28%

Stop Loss (SL): 7,803, corresponding to a risk of 1.74%

Technical Analysis and Motivation:

This setup is based on bearish pressure signals, with technical confirmations that suggest a potential downside reversal. The break of the Dynamic Support on the 4-hour (4H) chart reinforces the idea of a possible bearish movement, offering an interesting trading opportunity.

Final Recommendations:

Always check the chart to verify that the conditions remain favorable.

Apply adequate risk management to optimize the outcome of the trade.

Create a strategic plan before acting to best capitalize on this setup.

Happy trading everyone! 📉

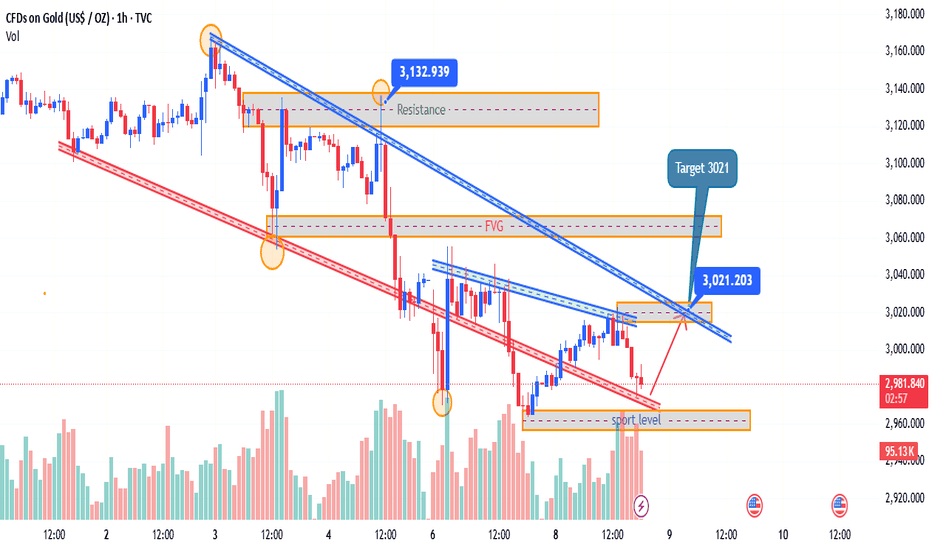

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

LONG Investment Opportunity on GBP/DKK 4H

Hello everyone, I am Trader Andrea Russo, and today I want to share with you a LONG investment opportunity on GBP/DKK. With the help of the SwipeUP Reversal Radar Multi-Timeframe Alerts indicator, we have managed to identify a setup that deserves attention for its bullish potential.

Here is the Investment Setup:

Entry Price: 8,714

Target Price (TP): 8,818, corresponding to an estimated profit of 1.20%.

Stop Loss (SL): 8,679, corresponding to a risk of 0.40%.

This setup is based on bullish pressure signals, with technical confirmations that show a potential reversal to the upside. The break of the Dynamic Resistance on the 4-hour (4H) chart supports the idea of a possible bullish movement.

As always, I encourage you to check the chart and apply proper risk management to ensure informed trading. Don't forget to use a strategic plan to capitalize on this setup. Happy trading everyone! 📈

Wall Street's Difficulties: How It Impacts the Forex Market

Hello, I am Andrea Russo, Forex Trader, and today I want to discuss how the recent difficulties on Wall Street are influencing the global forex market.

The Storm on Wall Street

In recent days, Wall Street has experienced significant turbulence, with major indices sharply declining. This scenario has been driven by several factors, including:

Rising Interest Rates in the U.S.: The Federal Reserve, concerned about persistent inflation, has hinted at potential monetary tightening.

Geopolitical Tensions: Global uncertainties are unsettling investors and reducing risk appetite.

Signs of Economic Slowdown: Recent macroeconomic data have fueled fears of an imminent recession.

These elements have resulted in a decline in investor confidence, leading to heavy sell-offs in equity markets.

Effects on the Forex Market

The repercussions of this turbulence are already manifesting in the forex market. Here are the key implications:

Strengthening of the U.S. Dollar: The dollar has gained momentum as a safe-haven currency, particularly against emerging market currencies like the Brazilian real and Turkish lira.

Japanese Yen and Swiss Franc Rising: These haven currencies have seen increased demand, drawing monetary flows.

Pressure on Emerging Market Currencies: Reduced risk appetite has triggered sell-offs in the major currencies of emerging markets.

What Should Forex Traders Do Now?

In such a volatile environment, it's crucial for traders to:

Analyze the Data: Keep a close watch on U.S. economic indicators and Federal Reserve announcements.

Diversify Risk: Consider hedging strategies to reduce exposure to volatility.

Observe Safe Havens: Explore trading opportunities involving the yen and Swiss franc, which remain stable during uncertainty.

LONG AUD/TRY 4H Investment Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a LONG investment opportunity on AUD/TRY. We are currently on a 4-hour chart (4H), and the "WaveTrend + Multi-Timeframe Alerts" indicator signals an oversold situation both at 4H and 8H. Furthermore, we are observing signs of a possible bullish recovery, which makes this configuration particularly intriguing.

Here is the Investment Setup:

The current price is around 22,814.

There is a BUY signal with a target price set at 23,435, corresponding to a TP of 2.72%.

The stop loss is set at 22,625, corresponding to a SL of 0.83%.

The suggested long position offers a highly favorable risk/reward ratio.

These combined signals indicate a potential reversal of the uptrend, making this an interesting setup for investors looking for buying opportunities on AUD/TRY.

As always, I encourage you to monitor this setup closely and apply conscious and strategic risk management to your trading plan. Happy trading! 📈

EUR/PLN 4H SHORT Selling Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently in a 4-hour chart (4H) and my indicator "WaveTrend + Multi-Timeframe Alerts", published in the SCRIPT section of my TradingView profile, signals an overbought situation both at 4H and 8H. In addition, we are also in a downtrend phase, so we have more signals that support this opportunity.

In the attached chart we can observe the following details:

The current price is around 4.62400.

There is a SELL signal with a target price set at 4.61400, corresponding to a TP of 1.06%.

The stop loss is set at 4.63400, corresponding to a SL of 0.32%.

The suggested short position has a favorable risk/reward ratio.

These combined signals indicate a potential downtrend reversal, making this setup particularly interesting for investors looking for short selling opportunities on EUR/PLN.

I encourage you to monitor this setup closely and act prudently, always considering risk management in your trading plan. Happy trading!

GBP/USD BULLS ARE STRONG HERE|LONG

Hello, Friends!

We are now examining the GBP/USD pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 1.302 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

China: 34% Tariffs Against US, Impact on Forex Market

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about China's response to US Tariffs. China's recent decision to impose 34% counter-tariffs on US products represents a significant development in trade tensions between the world's two largest economies. This move, which will take effect on April 10, is a direct response to the 10% tariffs imposed by the United States. The announcement has already had repercussions on global markets, with stocks recording sharp declines. In this article, we will analyze the motivations behind this decision, its economic implications and the impact on the Forex market.

Motivations Behind the Counter-Tariffs

China's decision to impose counter-tariffs is a strategic response to the aggressive trade policies of the United States. The 10% tariffs imposed by the US are aimed at correcting what is perceived as an unfair trade deficit and protecting domestic industries. However, China sees these tariffs as a threat to its economic growth and the stability of its exports. The 34% counter-tariffs are therefore an attempt to rebalance the trade balance and put pressure on the United States to review its policies.

Global Economic Implications

The imposition of counter-tariffs has economic implications that go far beyond the two nations involved. Trade tensions can trigger a series of chain reactions that affect the global economy in various ways:

Increased Production Costs: Companies that rely on imports of raw materials and components from the United States will see an increase in production costs, which could be passed on to consumers in the form of higher prices.

Slower Economic Growth: Trade tensions can lead to a slowdown in global economic growth, as companies may reduce investment due to economic uncertainty.

Inflation: Rising prices of imported goods can contribute to inflation, reducing the purchasing power of consumers and increasing costs for businesses.

Forex Market Impact

The Forex market, known for its sensitivity to geopolitical and economic events, is not immune to the effects of the trade tensions between China and the United States. Here are some of the main impacts:

US Dollar Volatility: The increase in tariffs could weaken the US dollar, as trade tensions tend to reduce investor confidence. Demand for US goods could decrease, negatively impacting the value of the dollar.

Strengthening of the Chinese Yuan: China could see a strengthening of the yuan, as its economy could be perceived as more stable than that of the United States in this context of trade tensions.

Federal Reserve Monetary Policy: The Federal Reserve could be forced to review its monetary policy, with possible interest rate cuts to mitigate the economic impact of the tariffs. This could further impact the Forex market, increasing volatility.

Conclusion

China's decision to impose counter-tariffs of 34% on US products represents a significant development in the trade tensions between the world's two largest economies. The economic implications of this move are vast and complex, affecting not only national economies but also the global Forex market. Investors and analysts will need to monitor these developments closely to fully understand their implications and adjust their strategies accordingly.

US Tariffs Global Stock Market Crash and International Reactions

Hello, I am Forex Trader Andrea Russo and today I am talking to you about what happened yesterday, Liberation Day. Yesterday, US President Donald Trump announced new "reciprocal" customs duties against several countries, including the European Union, China, the United Kingdom and many others. This announcement, called "Liberation Day" by the White House, has triggered a series of chain reactions on global markets.

The new tariffs, ranging from 10% to 46%, have been justified as a measure to rebalance international trade practices and protect the American economy. However, the immediate impact has been a significant collapse of global stock markets. Investors, worried about possible retaliation and the escalation of trade tensions, have reacted by massively selling their shares.

In Europe, European Commission President Ursula von der Leyen said the EU was ready to respond with appropriate measures, while Italian President Sergio Mattarella called the new tariffs a "profound mistake." The oil market also took a hit, with the price of WTI falling to $69.87 a barrel.

The impact on financial markets was devastating. On Wall Street, the Dow Jones closed down 3.5%, while the Nasdaq lost 4.2%. European stocks were not far behind, with London's FTSE 100 losing 3.8% and Frankfurt's DAX falling 4.1%. Asian stocks also suffered sharp declines, with Japan's Nikkei closing down 3.7%.

For forex traders, these dynamics represent both a challenge and an opportunity. Market volatility can offer opportunities for profit, but it also requires careful risk management. It is essential to closely monitor geopolitical news and market reactions to make informed decisions.

In conclusion, the global economic landscape is in a phase of great uncertainty. As a trader, it is essential to stay updated and ready to react quickly to changes. Keep following my updates for more analysis and trading tips.

Happy trading everyone!

ADP in Focus: Will Strong Jobs Data Trigger Gold Pullback?🟡 GOLD MARKET BRIEF – Early Asian Surge Meets Resistance Ahead of Key US Jobs Data

Gold kicked off the day with a sharp rally during the Asian session, driven by consistent demand from Asian and Middle Eastern investors — a pattern we’ve seen forming repeatedly during early sessions lately.

However, price reacted swiftly at the 3130–3135 resistance zone, exactly as mapped out in yesterday’s trading plan. With sellers stepping in again, my outlook remains:

🔻 Look for reaction-based SELL opportunities in the Asian and London sessions, especially if price pulls back into key resistance.

📉 Technical Outlook:

Gold is approaching the apex of a symmetrical triangle pattern, suggesting a breakout is imminent.

✅ As always: Wait for the breakout — then trade the retest in the confirmed direction.

📰 Fundamental Focus:

All eyes today will be on the US ADP Non-Farm Employment report, which tends to offer early clues ahead of Friday’s NFP.

Should the data come in stronger than expected, USD could gain traction — likely applying downward pressure on Gold, in line with our target zone around 308x–307x.

🧭 Key Technical Levels:

🔺 Resistance: 3128 – 3135 – 3142 – 3148

🔻 Support: 3110 – 3100 – 3080 – 3070

🎯 Trade Plan:

🟢 BUY ZONE: 3102 – 3100

SL: 3096

TP: 3106 – 3110 – 3114 – 3118 – 3122 – 3126 – 3130

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

📌 Caution: With ADP on deck during the US session, expect a spike in volatility.

Stick to clear levels, protect capital, and trade with discipline — not emotion.

Let the market come to you.

— AD | Money Market Flow

2 April Liberation Day: USA-Europe War Impact on ForexHi, I'm Forex Trader Andrea Russo and today I want to talk to you about an event that is shaking global markets: the tariff war between the United States and Europe.

Sunday, April 2, we started in force and new American news, celebrating "Liberation Day" by President Donald Trump. These data, which include 25% tariffs on your steel, aluminum and automobiles, look to rebalance the trade deficit of the United States. However, Europe is not ready to be saved. Ursula von der Leyen, president of the European Commission, has said that Europe has not started this matter, but is ready to defend its interests with a strong plan for control2.

The tension between the economic power has caused a significant impact on the market. The European stock exchange has not recorded consistent losses, with Milan having lost 16.4 million euros. Europe has responded with tariffs to its strategic American products, such as whiskey, motorcycles and legumes, and is evaluating further measures to protect its own industry4.

Forex Impact

This commercial war will bring about repercussions directly on the Forex market. Here's what to expect:

Removal of the American Dollar (USD): Protectionist tariffs tend to reforce the dollar, as they reduce the command of foreign currencies for imports. In addition, the increase in the price could lead the Federal Reserve to modify its own monetary policy, increasing interest rates.

Volatility of European Currencies: The euro (EUR) may rise in pressures due to economic uncertainties and European constraints. Also the value of the Swedish crown (SEK) may be negatively influenced.

Opportunity for the Trader: The volatility generated by these tensions offers opportunities for the Forex trader. Significant movements and exchange rates can be completed with trading strategies soon, but fundamentally adopt rigorous risk management.

Conclusion

The tariff war between the United States and Europe represents a significant loss for the global economy and the Forex market. Tomorrow will be a crucial day, and the trader will not carefully monitor the resources to adapt their own strategy. Always advise me to do my own analysis and operate with prudence.

Happy trading everyone!

SEK/MXN 8H SHORT Selling Opportunity

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about a SHORT selling opportunity on SEKMXN.

After careful technical and fundamental analysis, I decided to enter a SHORT position on the SEKMXN cross at the level of 2.0465. My strategy includes a profit target (Take Profit) set at 1.75%, while the protection level (Stop Loss) is set at 0.59% to manage the risk effectively.

Technical Analysis

The chart shows a clear bearish trend, supported by overbought signals on the RSI and MACD indicators. In addition, the price has recently tested a key resistance, suggesting a possible reversal.

Fundamental Analysis

From a macroeconomic perspective, the Swedish krona (SEK) is facing pressure from weak economic data, while the Mexican peso (MXN) benefits from a more stable economic environment and competitive interest rates.

Trading Strategy

Entry: 2.0465

Take Profit (TP): 1.75%

Stop Loss (SL): 0.59%

This setup offers an interesting risk/reward ratio, ideal for those looking for short-term opportunities with a calculated risk.

Conclusion

Forex trading requires discipline and rigorous risk management. This trade on SEKMXN represents an interesting opportunity, but as always, I recommend doing your own analysis before entering the position.

Happy trading everyone!

NZDCAD Will Fall! Sell!

Please, check our technical outlook for NZDCAD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.813 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!