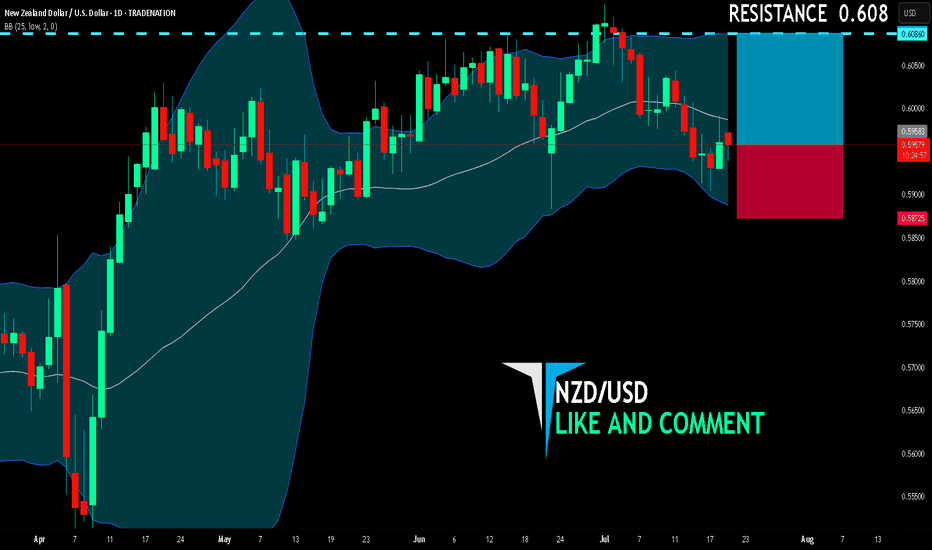

NZD/USD BUYERS WILL DOMINATE THE MARKET|LONG

NZD/USD SIGNAL

Trade Direction: long

Entry Level: 0.595

Target Level: 0.608

Stop Loss: 0.587

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trading

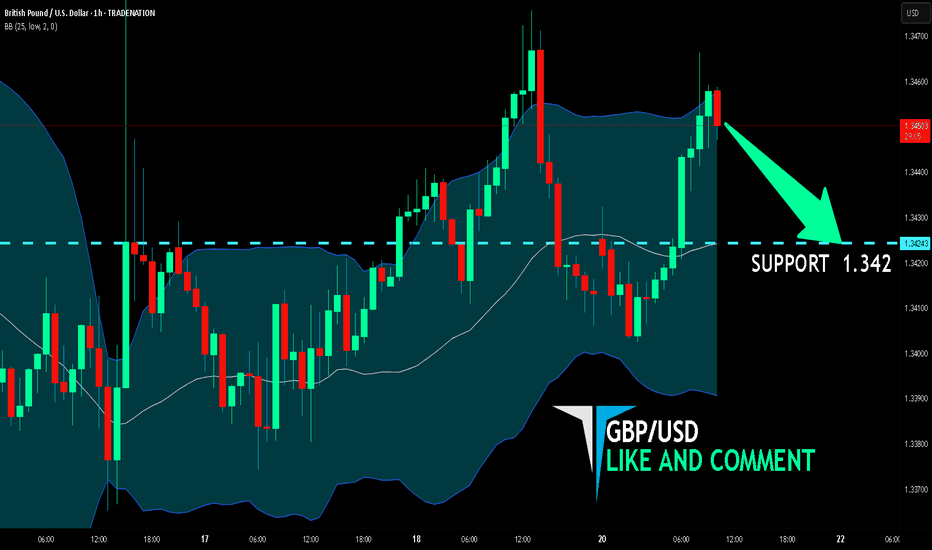

GBP/USD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are targeting the 1.342 level area with our short trade on GBP/USD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

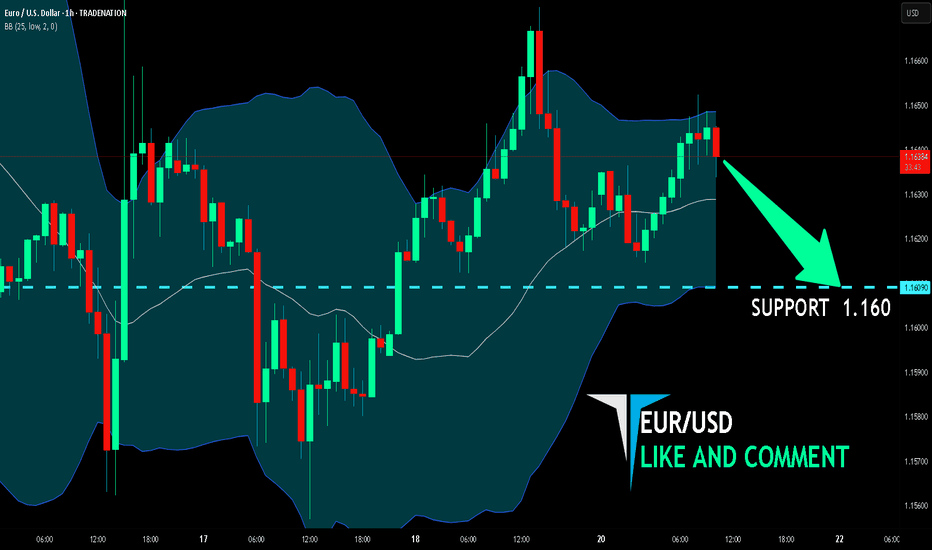

EUR/USD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR/USD is making a bullish rebound on the 1H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 1.160level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SILVER SELLERS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,612.8

Target Level: 3,572.6

Stop Loss: 3,639.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/USD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR/USD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 17H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.160 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1! BEARS ARE GAINING STRENGTH|SHORT

NG1! SIGNAL

Trade Direction: short

Entry Level: 3.737

Target Level: 3.205

Stop Loss: 4.089

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

NZD/CAD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 5H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.817 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/JPY BEARS ARE STRONG HERE|SHORT

Hello, Friends!

NZD/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 4H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 88.126 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD's wide trading range remains intact✏️GBPAUD is trading in a wide range. After the increase on Friday, the pair is retesting the support zone breaking past resistance. And the current reaction point also coincides with the 20 SMA. There is not much momentum for the pair to break out of the wide trading range, so buying the pair to the upper range of 2.097 is a reasonable choice at the moment.

📉 Key Levels

Support: 2.058

Resistance: 2.083-2.096

BUY Trigger: Confirmed bounce from 2.059 (EMA support)

Target 2.09600

BUY DCA Trigger: Break 2.083

Leave your comments on the idea. I am happy to read your views.

ETHUSD heading towards the top of the D1 frame✏️ CRYPTO:ETHUSD is in a strong uptrend towards the resistance zone of the 3800 daily frame. There are not many conditions for the sellers to jump in and reverse the current trend. Wait for the price reaction at the resistance of the D1 frame to consider the SELL strategy. Because currently if BUY is too Fomo.

📉 Key Levels

Sell trigger: Rejection from 3800

Target 3400, potentially 3,380

Leave your comments on the idea. I am happy to read your views.

Find a recovery point to continue buying BTC✏️ CRYPTO:BTCUSD is trading near the all-time high. The trading strategy is to wait for some investors to take profit so that the price can return to the nearest support zones and continue to buy to the new all-time high zones.

📉 Key Levels

BUY Trigger: confirms the recovery from the support trend line 116000

BUY zone 112000 (Strong support zone)

Target 129000

Leave your comments on the idea. I am happy to read your views.

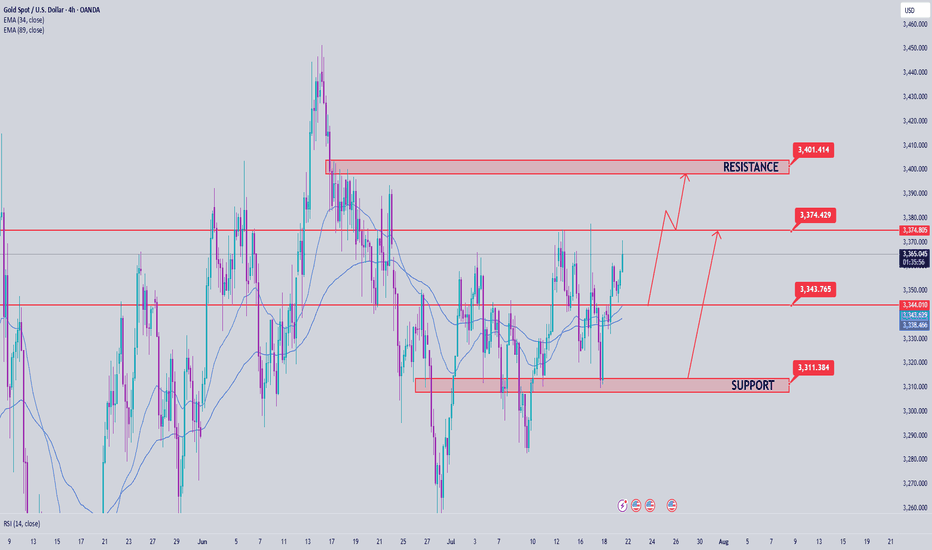

Gold returns to its original nature. Price increase towards 3400✏️ OANDA:XAUUSD is back to its inherent uptrend. Currently trading in a wide range. Shaped by CPI news last week. Trendline is still supporting Gold price towards 3400 next week. Pay attention to the important zone 3373 to DCA BUY and do not SELL when breaking this important zone 3373. Effective trading strategy is to wait for Gold to correct and buy.

📉 Key Levels

Support: 3343 - 3322

Resistance: 3373-3400

Buy Trigger: Rejects the support zone 3343 and reacts to the upside

Buy Trigger: Rebound from 3322

Target 3400

Leave your comments on the idea. I am happy to read your views.

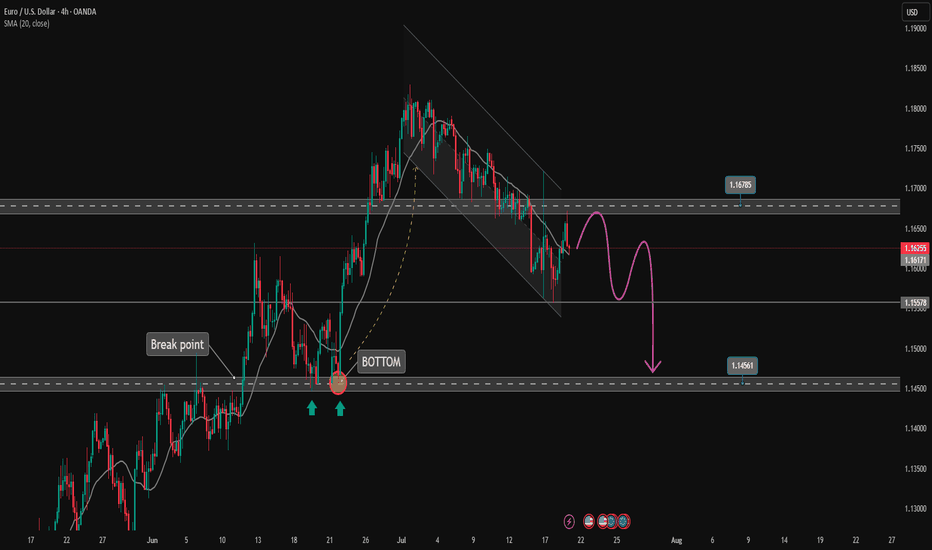

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

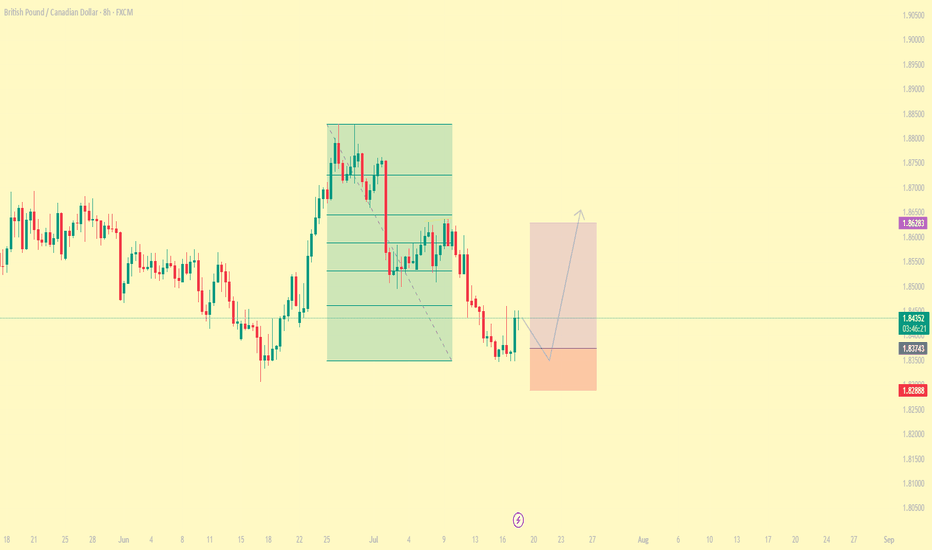

#011: Long Investment Opportunity on GBP/CAD

After weeks of compression, GBP/CAD is showing clear signs of institutional accumulation. The price recently released a false bearish breakout below 1.8400, followed by a reabsorption and spike with decreasing volumes: a typical "retail flush" structure.

Added to this are clear macro elements:

The pound is supported by a still-tight monetary policy, with the BoE maintaining a hawkish tone.

The Canadian dollar is suffering from declining oil expectations and the risk of a more rapid rate cut by the BoE.

📉 What happened?

The market attempted to "clear" the 1.838–1.840 zone with a rapid, unfollow-through bearish move. This behavior, combined with the Open Interest reading and retail positioning, suggests an institutional entry intention in the area between 1.8375 and 1.8365.

📈 Positioning

A Buy Limit was placed at 1.83740, with a wide Stop Loss at 1.82890, outside any visible hunting zone, and a Take Profit at 1.86280, where profit-taking has historically occurred on similar patterns.

🎯 Main motivations for long

Accumulation visible with stop-hunt below support at 1.8400

Net long GBP futures position

Retail short above 70%, a typical reversal signal

No significant volume obstacles until 1.8620

Psychological resistance already tested (1.846, 1.850)

⏳ Estimated timeframe

The setup could develop over several days, with the first movement as early as today (Friday) and completion by mid-next week. The intention is to follow the banking flow, without anticipating or reacting to emotional price movements.

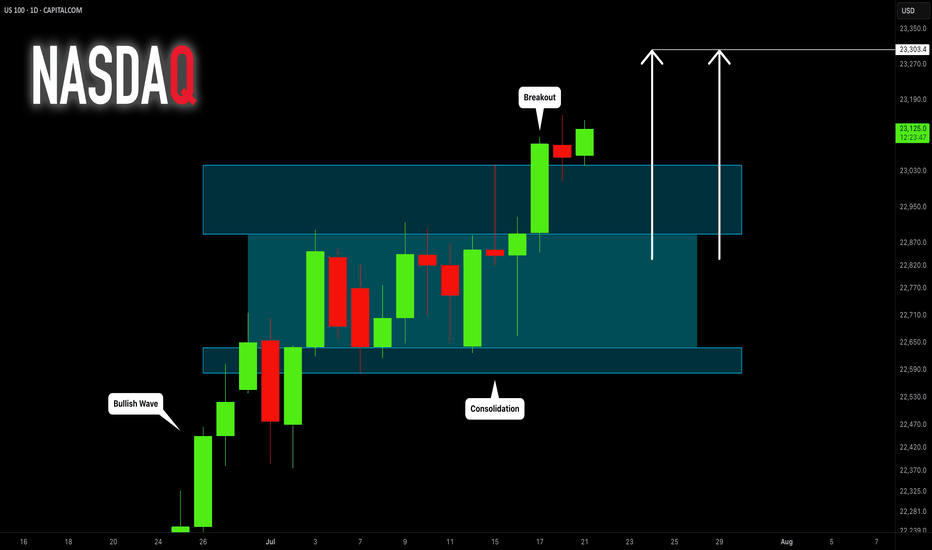

NASDAQ INDEX (US100): Bullish Continuation Confirmed

NASDAQ Index broke and closed above a resistance of a horizontal

parallel channel on a daily.

It confirms a bullish trend continuation and a highly probable growth

to the next strong resistance.

Goal - 23300

❤️Please, support my work with like, thank you!❤️

Gold Price Analysis July 21After being reinforced by CPI data last week, gold prices have regained their bullish momentum and are currently trading in a wide range. The technical structure still shows a dominant uptrend, with the trendline continuing to act as reliable support, targeting the important resistance zone of 3400 next week.

📌 Preferred trading strategy:

Watch the price reaction around the support zone of 3343. If there is a rejection signal of this zone accompanied by buying pressure, that will be the ideal entry point.

If the price continues to correct deeper, the strong support zone of 3322 will be a reasonable DCA point.

It is not recommended to SELL if the price breaks the confluence zone of 3373, as this is a signal confirming the strong bullish momentum continues.

📍 Important price zones:

Support: 3343 – 3322

Resistance: 3373 – 3400

🚀 Buy Trigger:

Price rejects 3343 zone with clear bullish signal

Strong bounce from 3322 zone

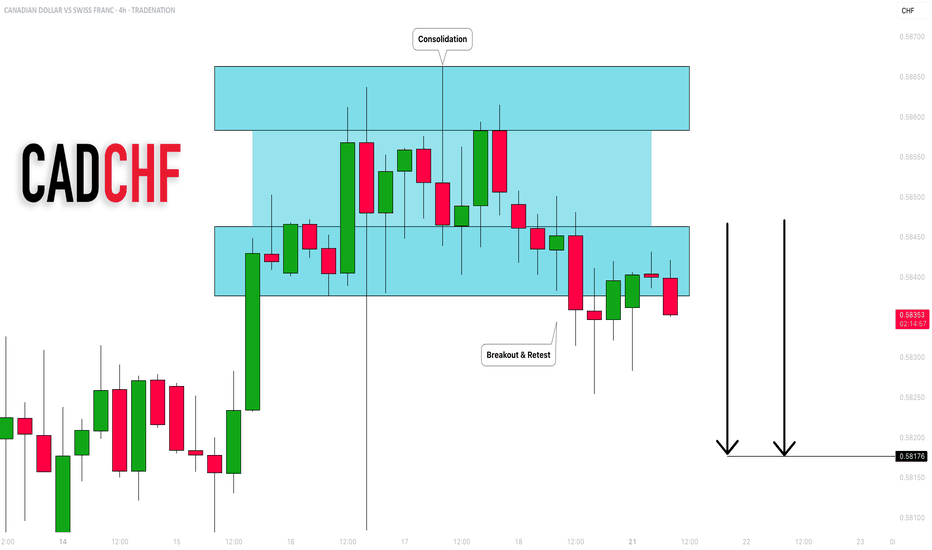

CADCHF: Bearish Outlook Explained 🇨🇦🇨🇭

CADCHF completed an intraday consolidation within a horizontal

parallel channel.

Its support was broken on Friday and we see a positive bearish

reaction to that after its retest.

With a high probability, the price will drop to 0.582 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

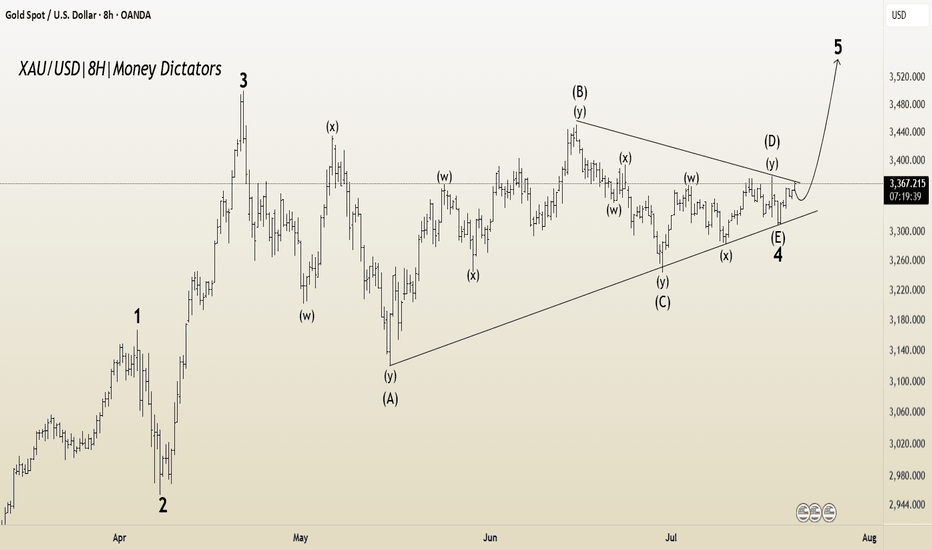

XAU/USD Elliott Wave Setup : Triangle Ends, Impulse BeginsThe 8-hour XAU/USD chart presents an Elliott Wave structure, currently in the final stages of Wave 4 within a larger impulsive cycle. The complex correction in Wave 4 has unfolded as a WXYXZ (triple-three pattern), forming a contracting triangle (ABCDE) — a classic consolidation phase that typically precedes a sharp impulsive breakout.

Wave E has recently completed near the lower boundary of the triangle, supported by the ascending trendline drawn from the April low. This suggests the correction is mature and Wave 5 is ready to ignite.

Target 1 (T1) : 3434.845

Target 2 (T2) : 3500.535

Stop Loss (SL) : 3309.729

The triangle (Wave 4) breakout structure suggests bullish continuation.

Multiple internal WXY corrective waves have completed, signaling exhaustion.

Volume and candle structure support the possibility of impulsive buying in Wave 5.

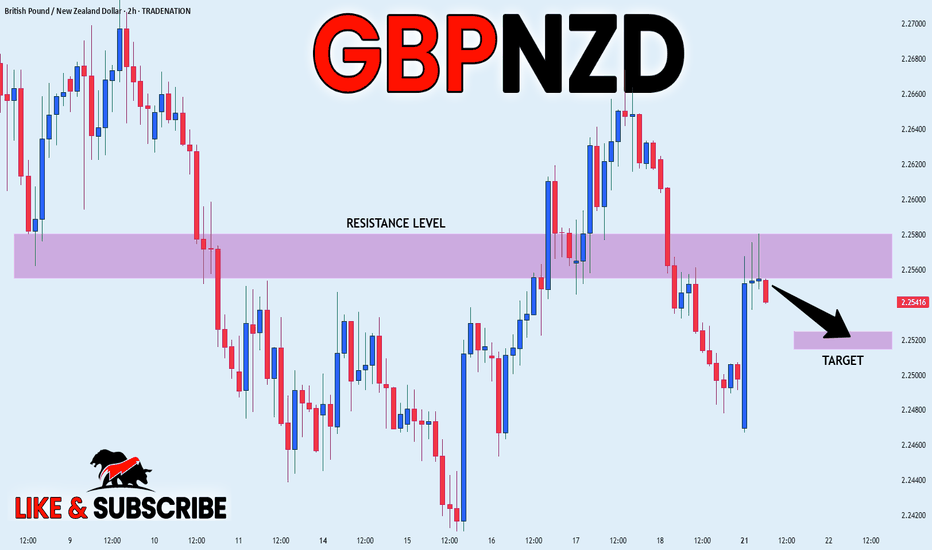

GBP_NZD LOCAL SHORT|

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

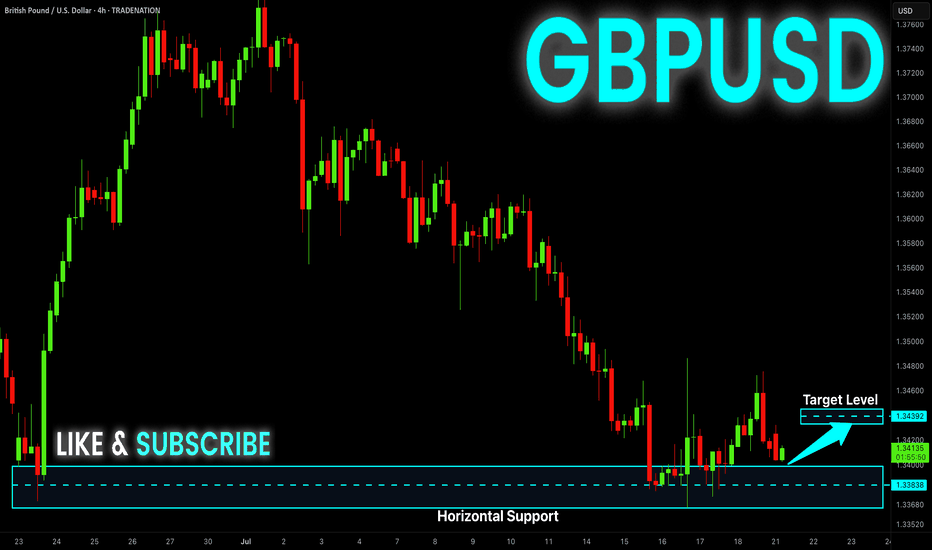

GBP-USD Local Long! Buy!

Hello,Traders!

GBP-USD is about to retest

The horizontal support

Level below at 1.3383

And as this is a strong

Support level we will be

Expecting a local bullish

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

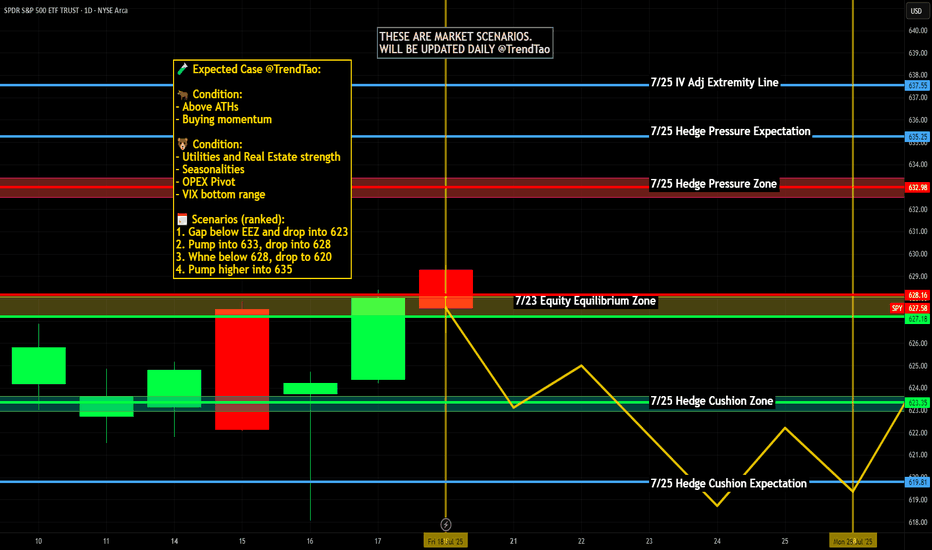

Weekly $SPY / $SPX Scenarios for July 21–25, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 21–25, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Chair Powell Speaks — Markets Key Into Tone

Federal Reserve Chair Jay Powell’s Jackson Hole speech is the week’s centerpiece. Markets will be closely listening for clues on inflation strategy, rate-cut timing, and sensitivity to geopolitical inflation drivers like tariffs.

📦 Tariff Deadlines Gain Spotlight

Multiple tariff deadlines are set this week for targeted trade partners including the EU, Mexico, Canada, Japan, South Korea, and Thailand. Any new announcements or extensions could trigger volatility in trade-exposed sectors.

🛢️ Oil Market Mixed Signals

Brent crude prices have stabilized near mid-$70s, but OPEC+ discussions regarding supply extensions and global growth concerns continue to inject uncertainty into energy-linked equities.

📈 Big Tech Earnings Kick Off

The “Magnificent Seven” tech giants begin reporting: Nvidia leads on Tuesday, followed by Microsoft, Amazon, Alphabet, and Meta later in the week. Expect significant sentiment swings based on forward commentary.

📊 Key Data Releases & Events 📊

📅 Monday, July 21

Quiet session ahead of a packed week of speeches and data.

📅 Tuesday, July 22

8:30 AM ET – Existing Home Sales (June):

Measures signed contracts on previously owned homes—a key housing indicator.

After Market Close – Nvidia Q2 Earnings:

Market will watch guidance and China commentary.

📅 Wednesday, July 23

8:30 AM ET – Leading Economic Indicators (June):

An early gauge of U.S. economic momentum.

📅 Thursday, July 24

8:30 AM ET – Initial & Continuing Jobless Claims:

Labor-market health indicator.

📅 Friday, July 25

8:30 AM ET – Durable Goods Orders (June):

Signals demand for long-lasting goods, often driven by business spending.

8:30 AM ET – New Home Sales (June):

Follows existing home data for housing sector insight.

4:00 PM ET – Fed Chair Powell Speech at Jackson Hole:

Expect commentary on inflation, growth, and rate-path clarity.

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be construed as financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #housing #durablegoods #JacksonHole #technicalanalysis

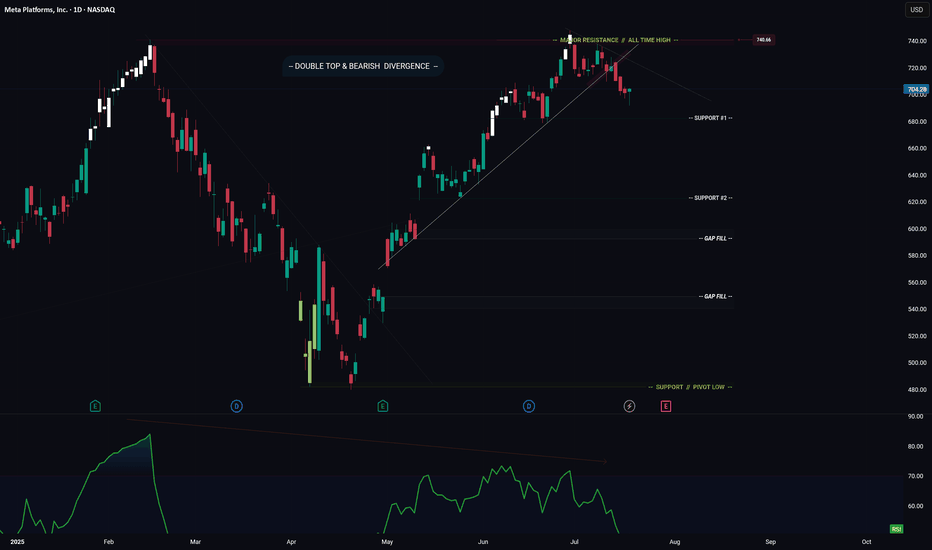

META -- Breakdown? Or Move Higher? Levels To Watch ForHello Traders!

Meta has broken down from its ascending trendline. This is bearish.

In addition price has formed a major Double Top pattern with Bearish Divergence.

Bearish Factors

1) Breakdown of ascending trendline

2) Double top

3) Bearish divergence

Two things need to happen if META is going to make a move higher...

1) Price needs to stay above "Support #1"

2) Price needs to break above the descending trendline (connecting the range highs)

IF price does breaks lower... where do we start looking for long positions?

- Support #2 is a great starting point, however if price makes it to support #2, then I could also see price trading down to fill the gap just below.

- This is where you could enter again to average down your position.

Thanks everyone and best of luck on your trading journey!

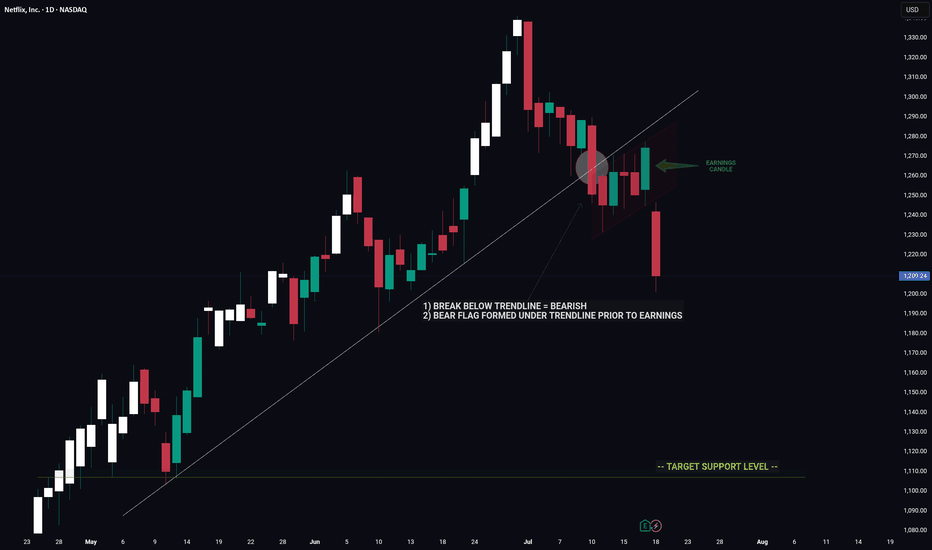

NETFLIX -- Price Signaled A Move Lower Prior To EarningsHello Traders!

The chart of NFLX is a great example of using clues to decipher a future move.

Prior to earnings we had major bearish indicators on the chart that hinted towards a move down on earnings.

1) Break below major trendline

2) Bear flag

These two signals by themselves are very bearish however the fact that these signals appeared coming into earnings was an even strong indicator of a potential for negative move.

Now that the upward trend is broken NFLX has a long way to fall before reaching the next key support level.

Thanks everyone and best of luck on your trading journey!