End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prior day’s high and value area, showing strength into the close.

Russell 2000: This market was quite choppy and balanced for a good part of the session, but eventually pushed up to close near the prior value area high.

Gold: It stayed range-bound, moving between the CVA high and the prior day’s value area without breaking out.

Crude Oil: We saw a significant drop right from the start, with prices falling about 1.5 points and ending the day lower, though still within the prior day’s range.

Euro Dollar: It tested the CVA low, dipped below the prior day’s low, and then bounced back to close around that level.

Yen Dollar: It started near the prior value area low, accepted below it by midday, and remained balanced in that lower range.

Aussie Dollar: Initially, it held above the CVA area and tested a higher level before sharply dropping below the prior day’s low and then balancing in that lower area.

In total, I took eight trades today. Two of them were in the Yen, both valid setups that didn’t work out and ended in stop-outs. I also took some long trades in the Aussie Dollar that I probably could have avoided since the market was choppy.

On the positive side, I managed risk well and ended up with two winning trades that put me in the green by about $1,200. Overall, I’d rate today as an A- day. Moving forward, I’ll focus on staying out of choppy markets, paying attention to the developing value area, and possibly using Heikin Ashi bars for better clarity.

Trading

GBP-CAD Support Ahead! Buy!

Hello,Traders!

GBP-CAD keeps falling down

But a strong horizontal support

Level of 1.8322 is ahead so after

The retest we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

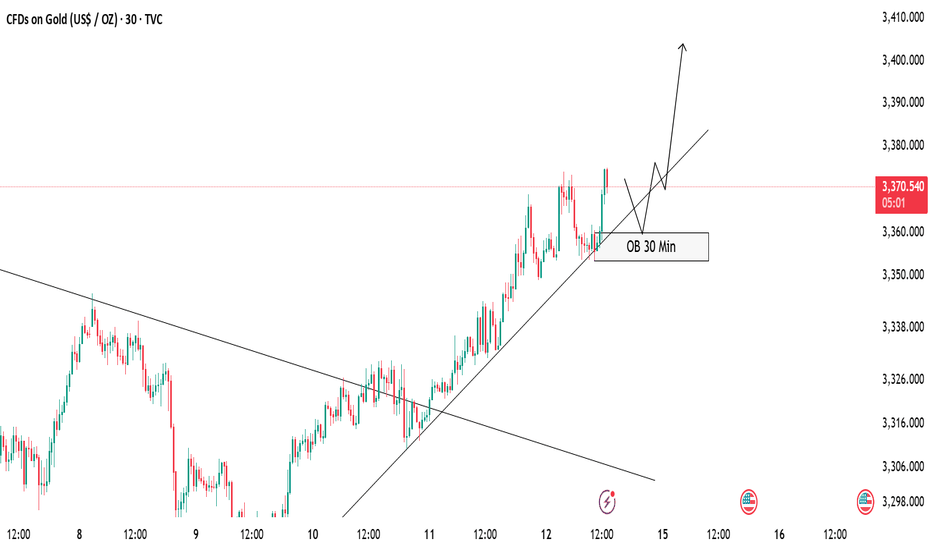

GOLD Buy Setup – OB Zone in FocusCurrently, gold is respecting the ascending trendline and maintaining a bullish structure 🟢. Price hasn’t tapped into the 30 Min Order Block (OB) yet, but we are expecting a potential pullback into this OB zone 📍.

✅ Our Plan:

We will wait patiently for price to mitigate the OB.

After the tap, we will look for bullish confirmation (rejection wick, bullish engulfing, or break of minor structure) before entering a buy position 🚀.

As long as the trendline holds, we remain bullish on gold.

📝 Invalidation:

If price breaks and closes below the trendline and OB zone, we will stay out or re-evaluate the setup ❌.

Stay disciplined and follow the plan! 💪

Nightly $SPY / $SPX Scenarios for July 15, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 15, 2025 🔮

🌍 Market-Moving News 🌍

📦 Dow Futures Dip on New Tariff Announcements

President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as markets assess inflation risk ahead of key CPI data this week

📈 Tech & AI Stocks Lead Despite Tariffs

Stocks like Circle (+9.3%), CoreWeave (+5.2%), Palantir (+5%), Roblox (+5.8%), and Shopify (+4.1%) surged, showcasing sector resilience amid broader tariff fears

⚠️ Deutsche Bank Warns of Summer Volatility

With thin market liquidity and rising geopolitical tension (tariff deadline Aug 1), Deutsche Bank flags summer as a period prone to sudden corrections

📊 Key Data Releases & Events 📊

📅 Tuesday, July 15:

8:30 AM ET – CPI (June)

Core CPI is projected at +0.3% MoM (2.7% YoY) and headline CPI +0.3% MoM—signs tariff effects may be feeding into prices

8:30 AM ET – Core CPI (June)

Expected to come in around 3.0% YoY.

8:30 AM ET – Empire State Manufacturing Survey (July)

Forecast: –7.8 (less negative than June’s –16.0) — a modest sign of stabilizing factory conditions

Fed Speakers Throughout the Day

Watch for commentary from Fed officials (Michael Barr, Barkin, Collins, Logan) for fresh insights on inflation and monetary policy

⚠️ Market Interpretation:

Inflation Watch: A hotter-than-expected CPI could delay anticipated rate cuts and lift yields. A pick-up in core CPI above 3% would be a red flag.

Growth Signals: A less-negative Empire State reading may suggest improving industrial momentum but still signals contraction.

Political Risk: Tariff escalation could shift investor appetite, even if markets right now are focusing on broader macro narratives.

Volatility Setup: The combination of thin liquidity, tariff uncertainty, and critical data makes for a potentially choppy week.

📌 #trading #stockmarket #economy #inflation #tariffs #Fed #CPI #manufacturing #technicalanalysis

NZDJPY Buyers In Panic! SELL!

My dear followers,

This is my opinion on the NZDJPY next move:

The asset is approaching an important pivot point 88.573

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 88.065

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPNZD What Next? BUY!

My dear friends,

My technical analysis for GBPNZDis below:

The market is trading on 2.2457 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2547

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

APPLE Set To Fall! SELL!

My dear friends,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 211.08 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 206.69

Recommended Stop Loss - 213.91

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

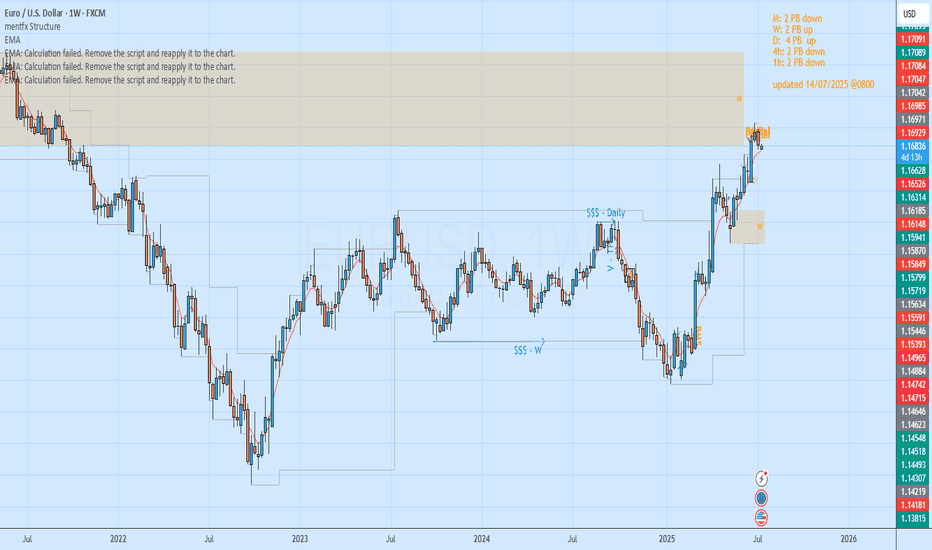

EURUSD Sellers In Panic! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1684

Bias - Bullish

Safe Stop Loss - 1.1633

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1776

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Good opportunity to wait for recovery and buy GoldOANDA:XAUUSD Confirmation of breaking Key level 3330 on Friday has formed an Uptrend in Gold. Reaction at GAP 3368 is obvious in an uptrend. Gold trend is favoring buying to 3388 and 3400 next week.

Support: 3345-3331

Resistance: 3387-3400

BUY Trigger: Retest and Reject support 3345

BUY Trigger: 3331 ( Strong support zone)

Target: 3400

SELL Trigger: rejection 3387 with bearish confirmation

Leave your comments on the idea. I am happy to read your views.

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for a reaction and looking for an entry point.

The post will be adjusted based on changes.

Don't forget to click on the Rocket! =)

GBPCAD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The instrument tests an important psychological level 1.8447

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.8505

Recommended Stop Loss - 1.8418

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD: Local Bearish Bias! Short!

My dear friends,

Today we will analyse GOLD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3,349.76 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 3,341.88..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Will Go Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 1.16802 will confirm the new direction downwards with the target being the next key level of 1.16684.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

AUDCHF Expected Growth! BUY!

My dear friends,

AUDCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5224 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.5232

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

DXY: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 97.463 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SILVER: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 38.768 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 38.937.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Gold breaks trendline towards 3390, Uptrend resumes✏️ OANDA:XAUUSD The price increase will continue today and will be even stronger. After breaking the trendline, gold has strong support. SELL strategies are only considered to find short-term reaction points waiting for the next trends.

Gold has confirmed the uptrend is back, heading to 3390 today.

📉 Key Levels

Support 3330-3314

Resistance 3345-3362-3388

Sell trigger: rejection from 3345 with bearish confirmation

Sell zone: 3362–3387 (Strong resistance)

BUY trigger: 3330-3314 support with bounce confirmation

Leave your comments on the idea. I am happy to read your views.

SILVER Will Go Up From Support! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 17h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,903.0.

Considering the today's price action, probabilities will be high to see a movement to 4,102.1.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPUSD Will Go Up! Long!

Take a look at our analysis for GBPUSD.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 1.347.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 1.358 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD Will Move Higher! Buy!

Please, check our technical outlook for GBPAUD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 2.052.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 2.082 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD Will Go Down From Resistance! Short!

Here is our detailed technical review for EURUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.177.

The above observations make me that the market will inevitably achieve 1.172 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Which Way to GoHello students and traders, let us jump into a quick top down analysis of the EURUSD.

On the Monthly, we see that price is in a down swing. We have seen price recently go bullish, all the way into the Monthly zone, from where it has begun to reverse bearish. We expect price to hold bearish and continue to melt towards our Monthly liquidity target.

Weekly & Daily:

On the weekly and daily Time frames, we have a bullish setup. This bullish setup is what has helped in driving prices all the way up and into the Monthly refined reversal zone. The weekly timeframe is curently seeing a bearish reversal. With the price hitting the monthly zone, there is a low likelihood of price continuing bullish. The bearishness might just continue for a while.

4 hour and 1 Hour

On the smaler timeframes of the 1 and 4 hour timeframe, market is in a bearish swing. We see prices making lower highs and lower lows, a clear sign of a downtrend. We expect this bearishness to hold. Where that happens, we will see market in the longrun and on the lower time frames experience bearish reversals, with price untimately targetting the Monthly liquidity target.