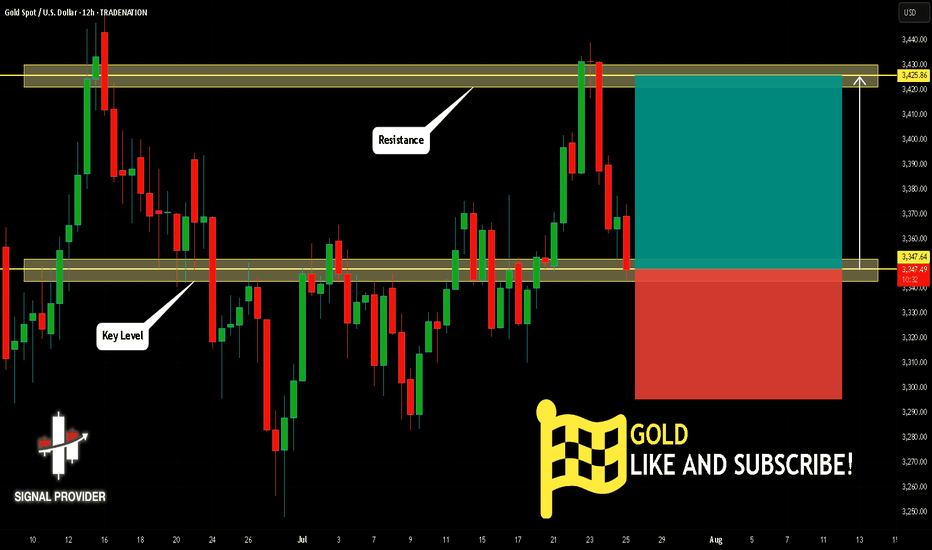

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Trading

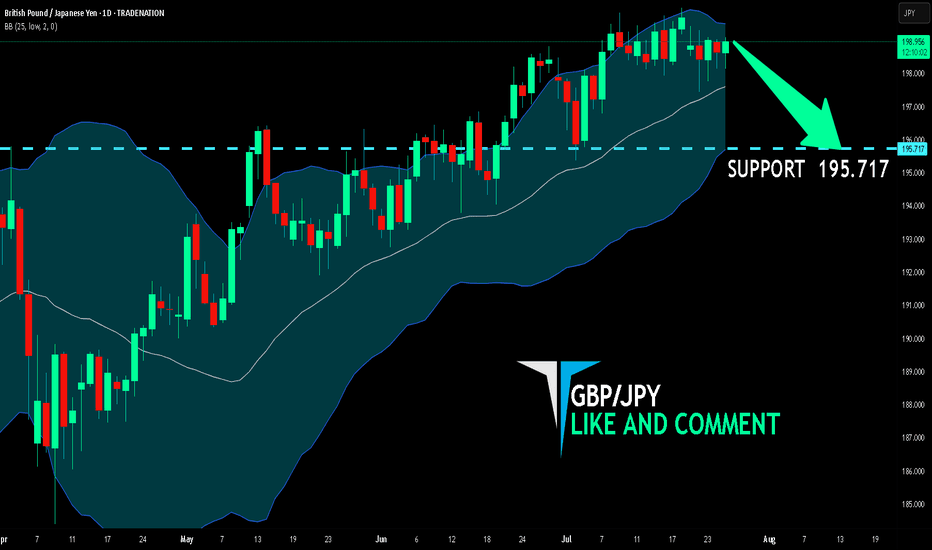

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 195.717 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

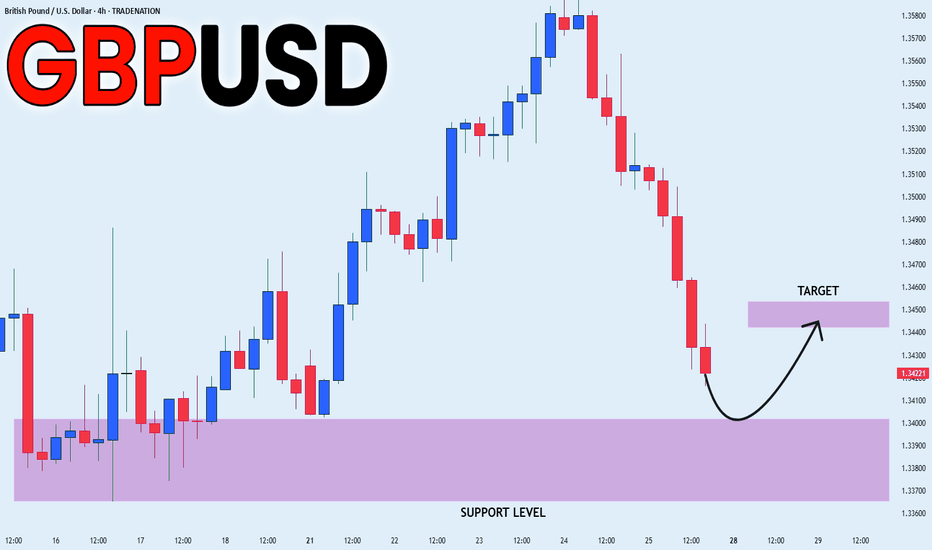

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

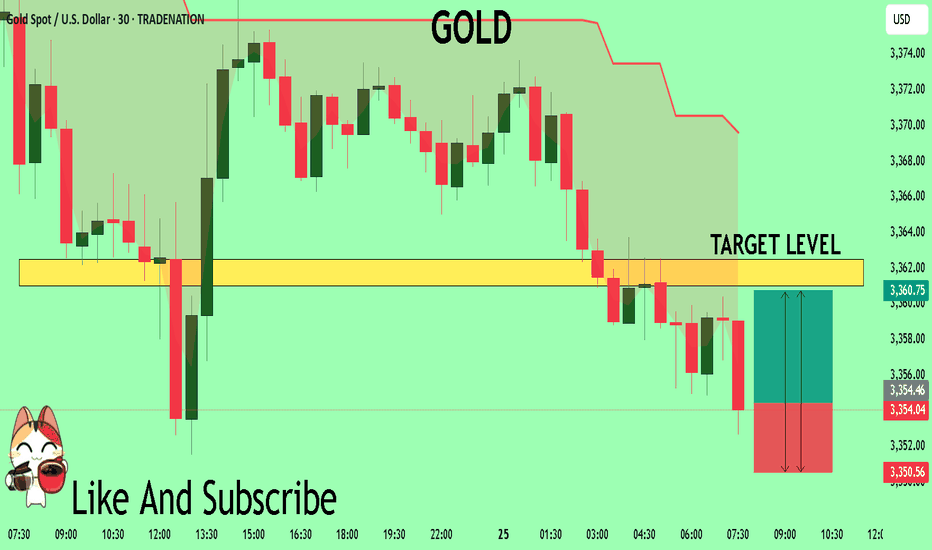

GOLD The Target Is UP! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3354.1 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3361.01

Safe Stop Loss - 3350.5

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

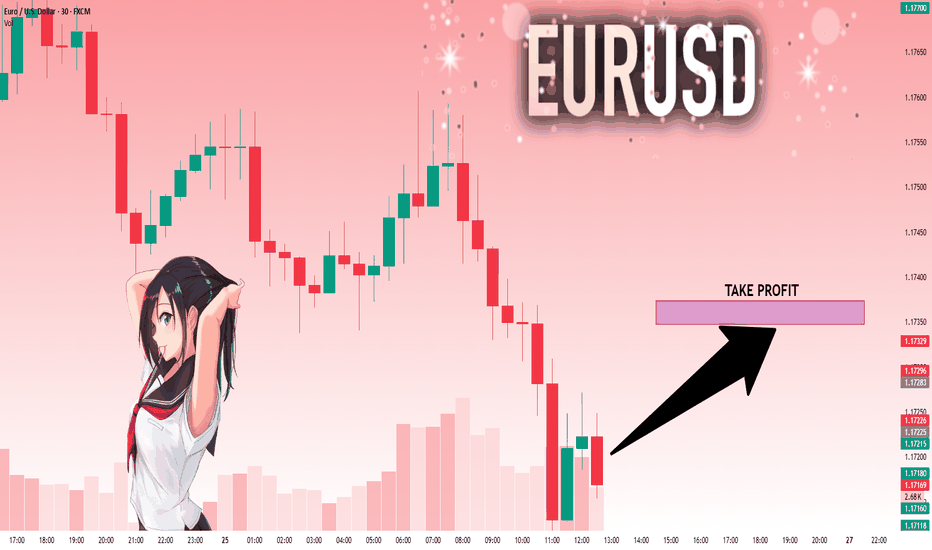

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17201 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.17348.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD | Time For A Pullback?The week kicked off with strong impulsive moves to the upside, leaving no room for deeper correction. Then slowly from Wednesday, we started to see a decline in strength in the bullish run.

Now, with price edging toward the next swing low for a possible bearish change of character, is this a good way to ride the stream to the downside?

Keep your A-game on as we watch price unfold, and trade reactively to price movement.

Do not forget to guard your capitals with risk management.

Good luck traders. 👍

Follow me for more and more of these analyses.

See you on the next one. 🫡

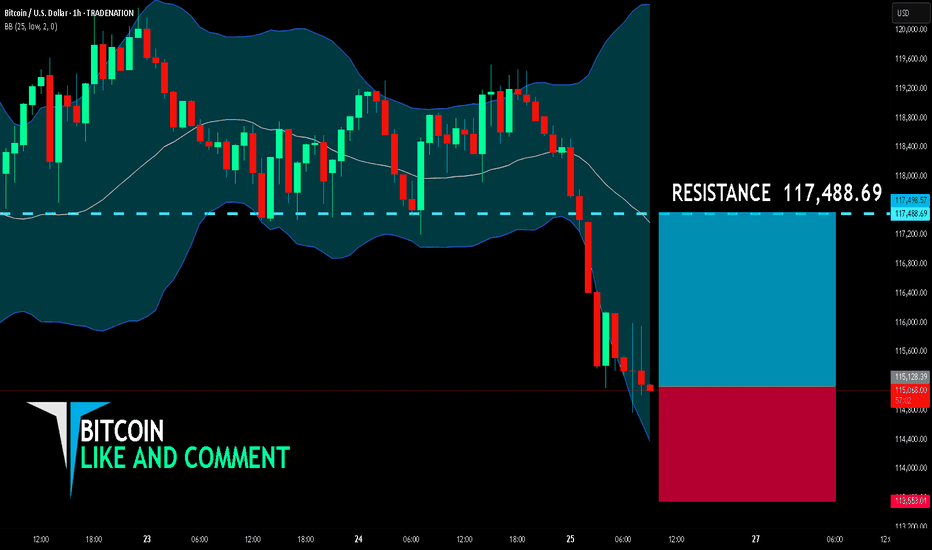

BITCOIN BULLS ARE GAINING STRENGTH|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 115,128.39

Target Level: 117,488.69

Stop Loss: 113,553.01

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

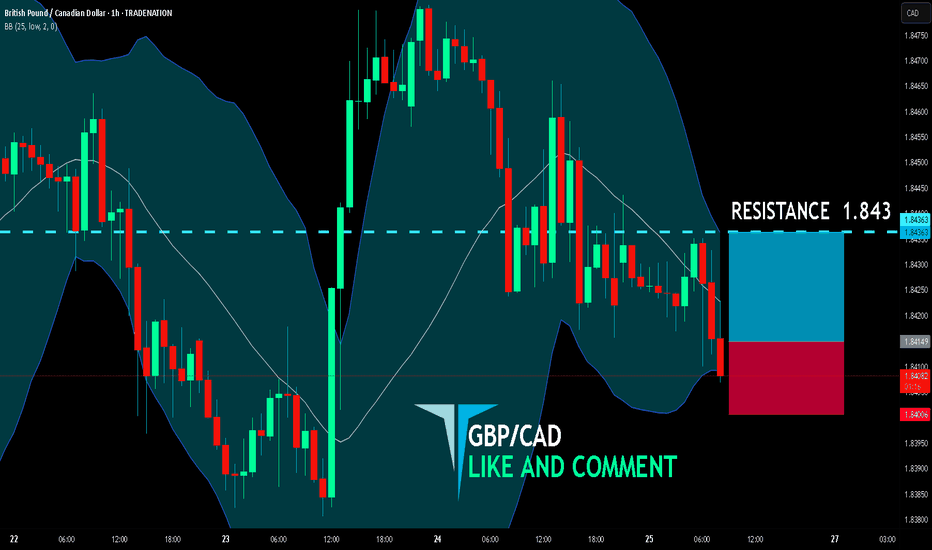

GBP/CAD BUYERS WILL DOMINATE THE MARKET|LONG

GBP/CAD SIGNAL

Trade Direction: long

Entry Level: 1.841

Target Level: 1.843

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SPK Market Update – Key Levels Ahead 🚨 SPK Market Update – Key Levels Ahead 🔄📉📈

SPK previously formed a bearish Head and Shoulders pattern, which was confirmed by a breakdown. So, what’s next?

🔹 Option 1:

Price could move down to the two blue support levels — these zones may offer potential long entries, as buyers were active here before. Watch for confirmation! 👀

🔺 Option 2:

We also have a red resistance zone, located around the right shoulder of the H&S.

If INDEX:SPK breaks above this zone, it may signal the return of buyers and a potential bullish reversal.

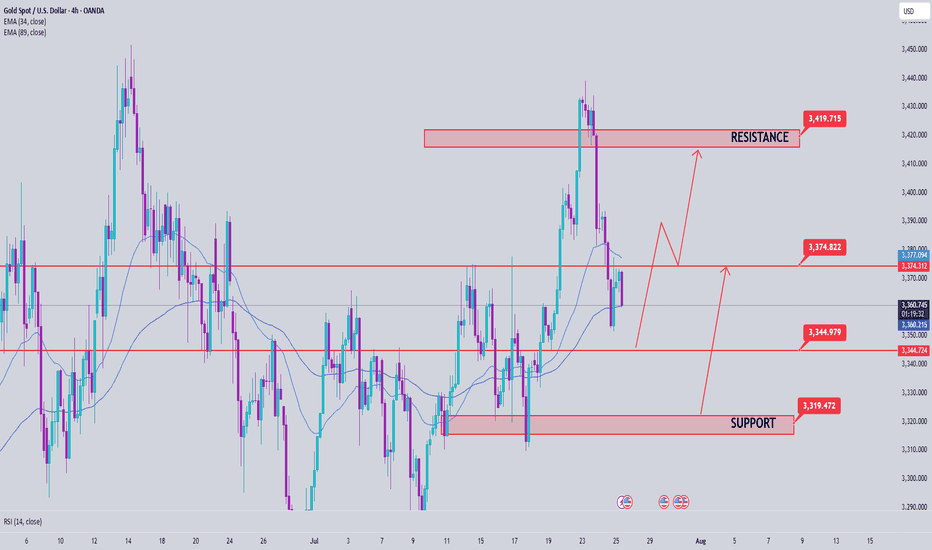

Gold price analysis July 25Gold Analysis – D1 Uptrend Still Maintains, But Needs New Momentum

Yesterday’s trading session recorded a D1 candle closing above the Breakout 3363 zone, indicating that buying power in the US session is still dominant. This implies that the uptrend is still being maintained, although the market may need a short-term technical correction.

In today’s Tokyo and London sessions, there is a possibility of liquidity sweeps to the support zone below before Gold recovers and increases again in the New York session.

Important to note:

The uptrend will only be broken if Gold closes below the 3345 zone on the D1 chart.

In this case, the 3320 level will be the next support zone to observe the price reaction and consider buying points.

For the bullish wave to continue expanding towards the historical peak (ATH) at 3500, the market needs stronger supporting factors, which can come from economic data or geopolitical developments.

📌 Support zone: 3345 – 3320

📌 Resistance zone: 3373 – 3418

🎯 Potential buy zone:

3345 (prioritize price reaction in this zone)

3320 (in case of breaking through 3345)

🎯 Target: 3417

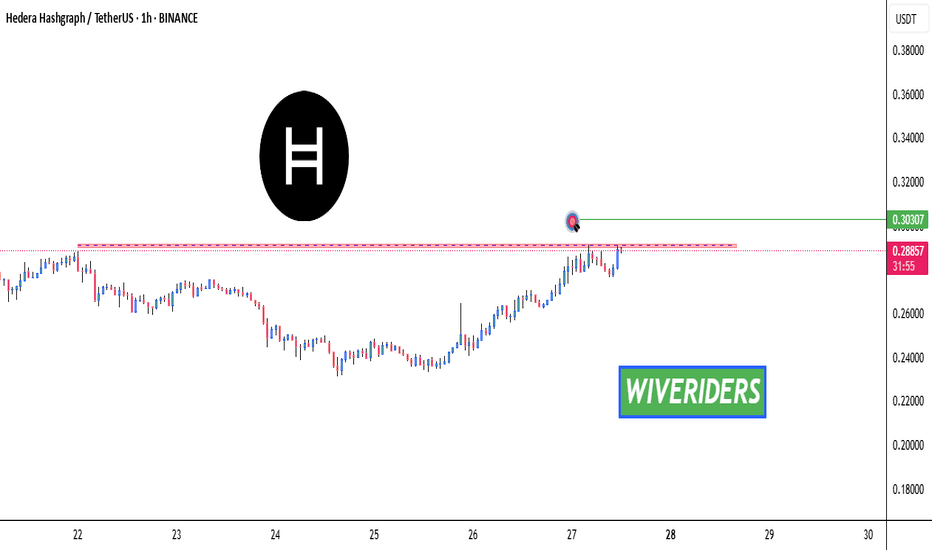

HBAR Breakout Watch – Red Resistance Being Tested! HBAR Breakout Watch – Red Resistance Being Tested! 🔴⏳

HBAR is testing the red resistance zone.

📊 If breakout confirms, next move could target:

🎯 First Target → Green line level

A breakout here could spark bullish momentum and open the door for continuation.

👉 Stay updated with real-time trade ideas and analysis:

t.me/+BMywp4GN12UyZjY9

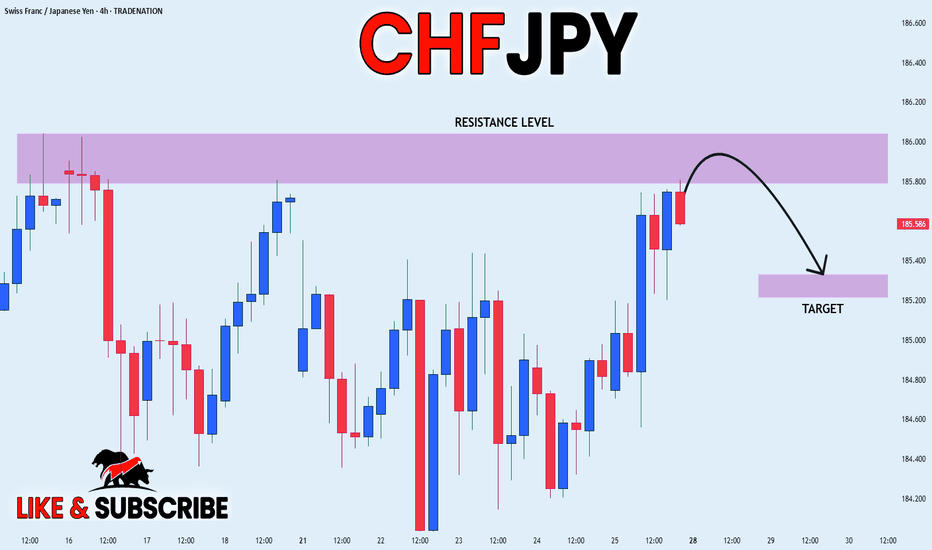

CHF_JPY RISKY SHORT|

✅CHF_JPY is going up now

But a strong resistance level is ahead at 186.036

Thus I am expecting a pullback

And a move down towards the target of 185.329

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

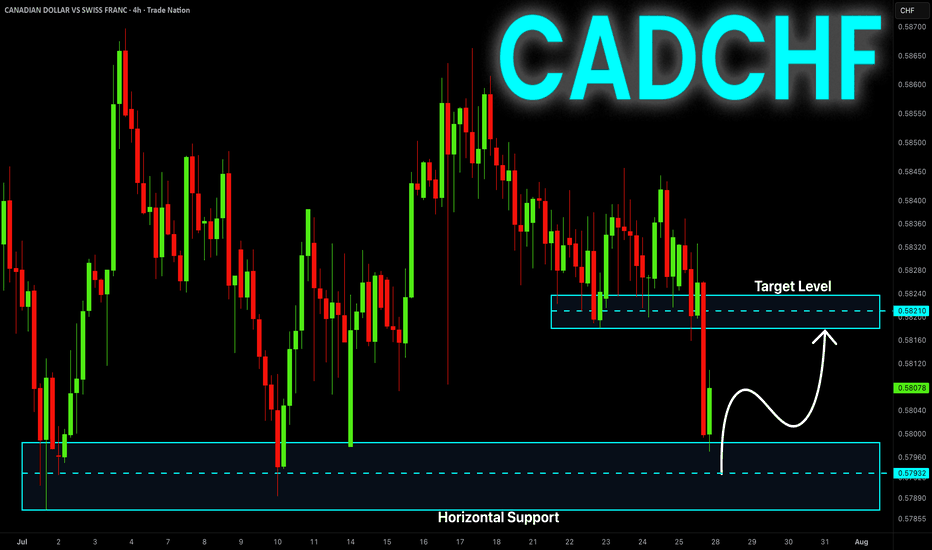

CAD-CHF Local Rebound Ahead! Buy!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal support

At 0.5797 from where we

Are already seeing a bullish

Reaction so we will be

Expecting a further local

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

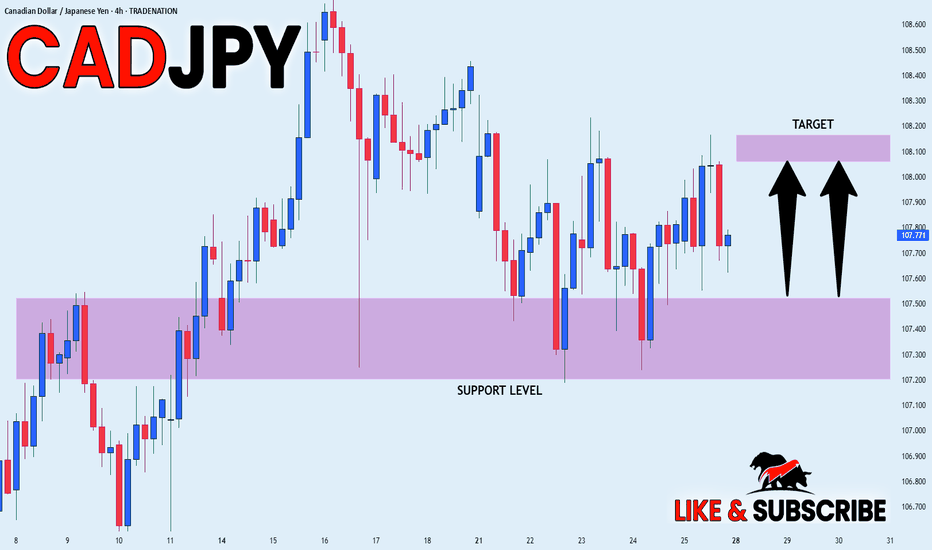

CAD_JPY WILL GO UP|LONG|

✅CAD_JPY will soon retest a key support level of 107.500

So I think that the pair will make a rebound

And go up to retest the supply level above at 108.100

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

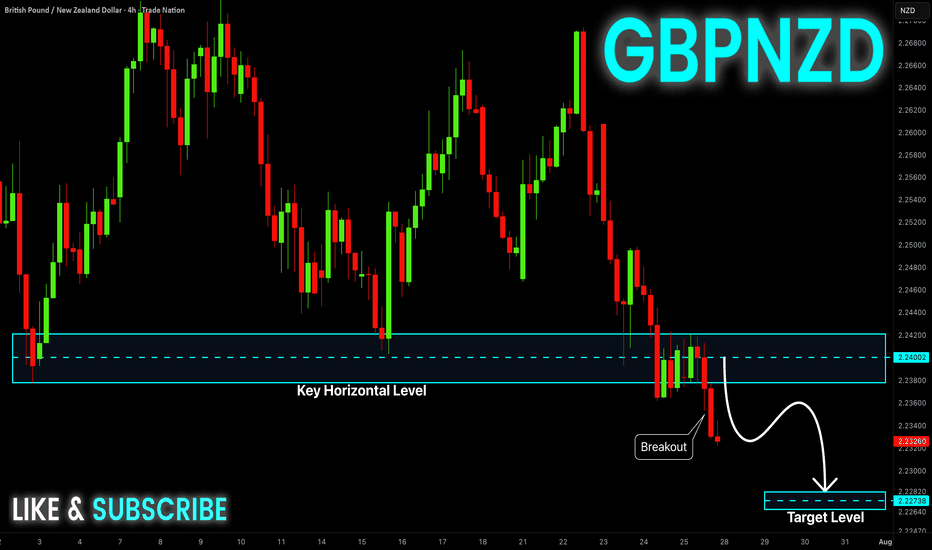

GBP-NZD Will Keep Falling! Sell!

Hello,Traders!

GBP-NZD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 2.2400

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

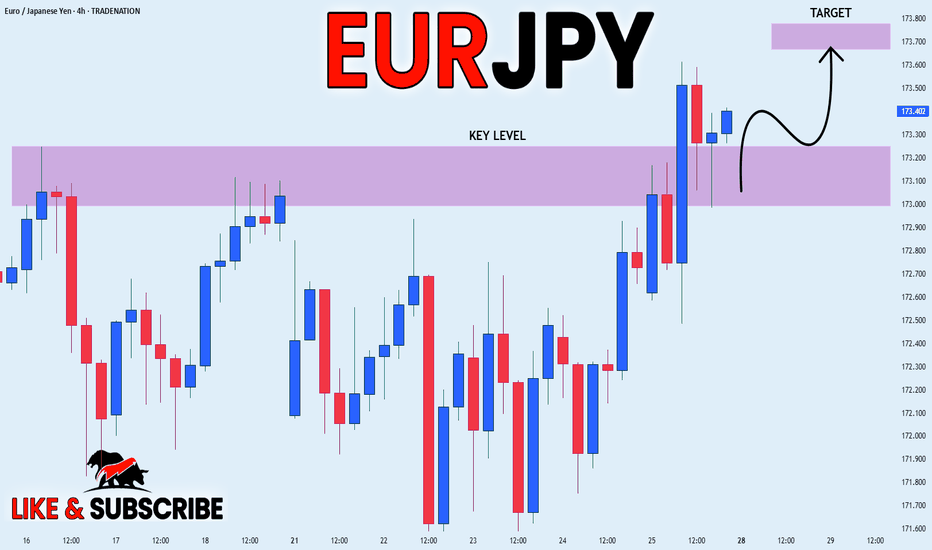

EUR_JPY WILL GROW|LONG|

✅EUR_JPY will keep growing

Because the pair is in the uptrend

And recently broke the key level of 173.200

So we will be expecting

Bullish continuation

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

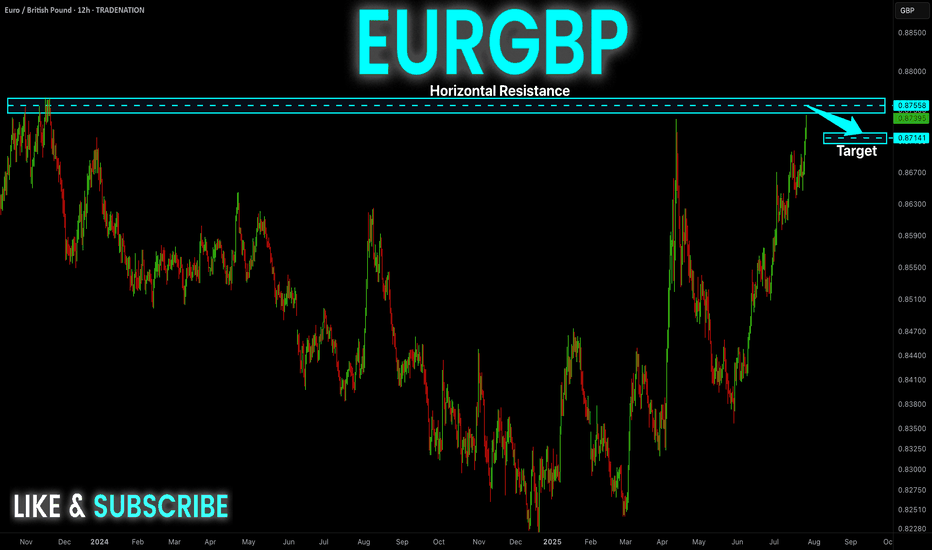

EUR-GBP Swing Short! Sell!

Hello,Traders!

EUR-GBP keeps growing in

A strong uptrend but the pair

Is locally overbought so after

The price hits a horizontal

Resistance level of 0.8764

We will be expecting a

Local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

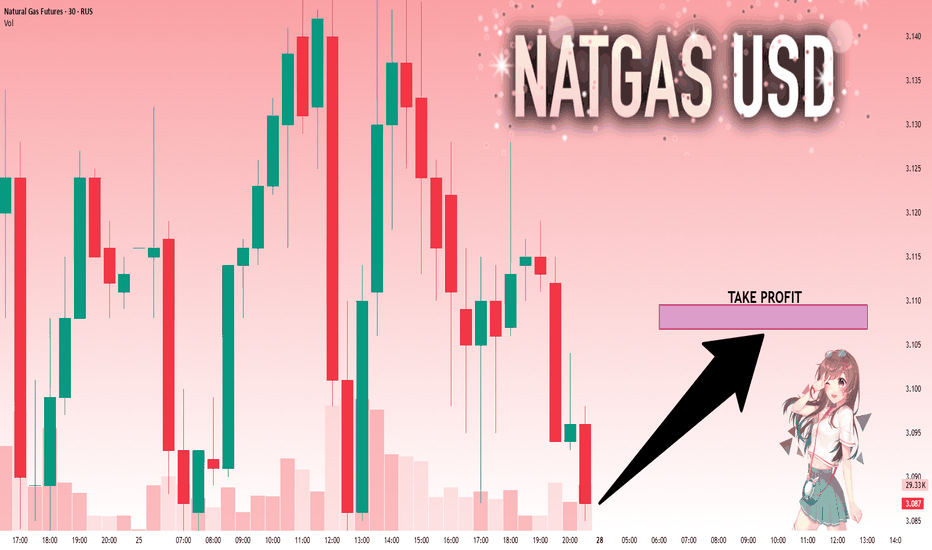

NG1!: Target Is Up! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.087 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3.107.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

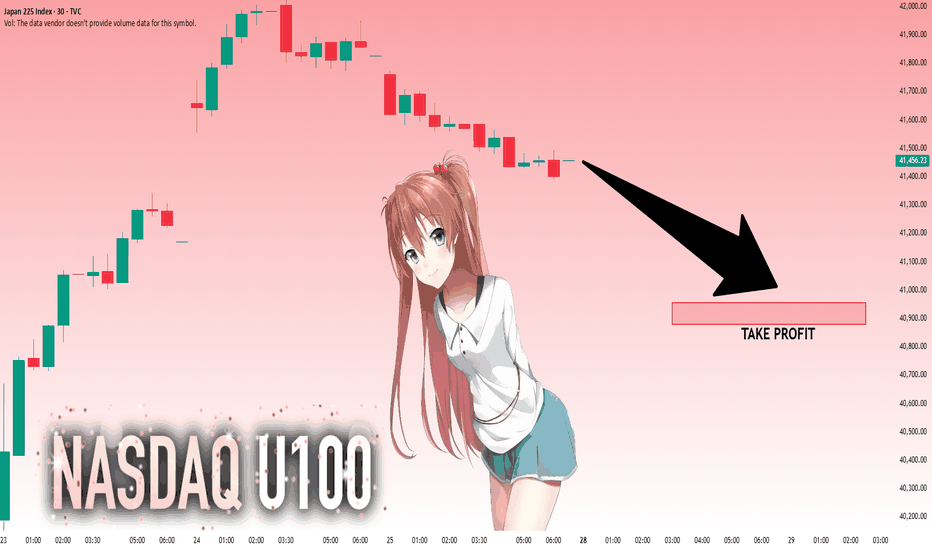

NI225: Move Down Expected! Short!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 41,456.23 will confirm the new direction downwards with the target being the next key level of 40,954.70 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Gold Approaching 3365 Breakout: Bullish Continuation Above TrendDaily Analysis:

Price is respecting the long-term trendline support and still holding firmly above the 3300 region. Bulls are defending structure with a clean series of higher lows. No major change in trend as long as price remains above 3246.

4H Analysis:

Price is consolidating above the trendline and building structure around 3350. A clean break and close above 3365 could ignite a push toward the 3450 supply zone.

1H Analysis:

Descending trendline break confirmed with bullish closure. Retest holding well above 3350. If structure remains intact, next short-term target is 3375–3390.

Confirmation & Entry:

Break and close above 3365 with strong bullish candle = confirmation. Optional entry on 3350–3355 retest. Targets: 3390, 3450.

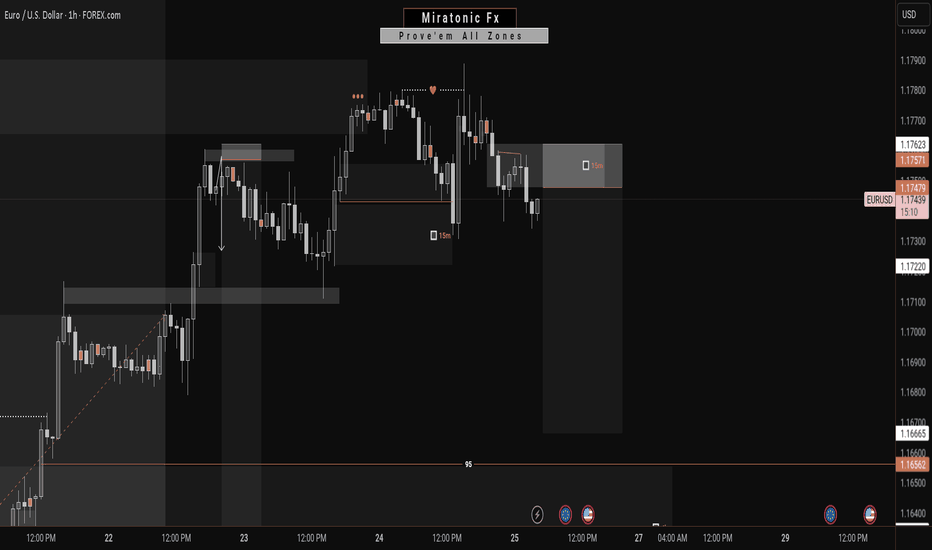

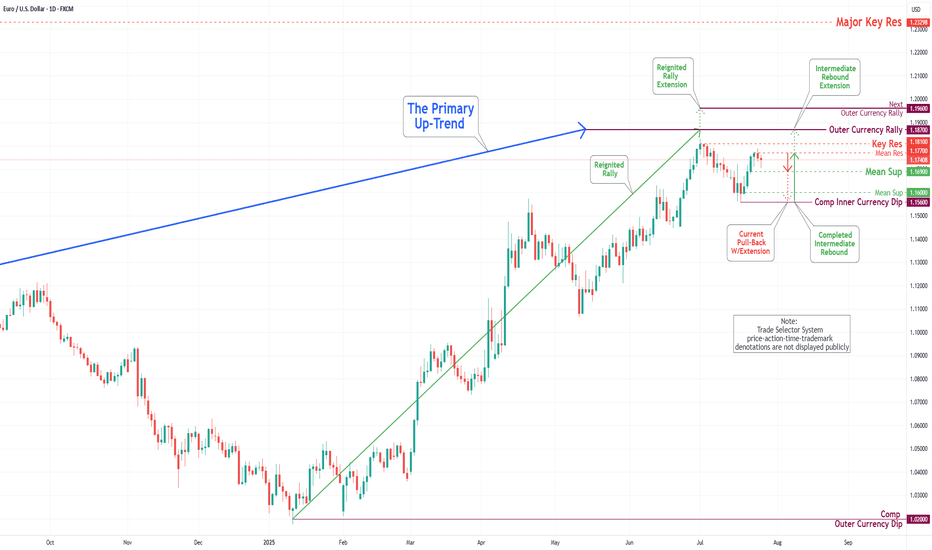

EUR/USD Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

During the previous week's trading session, the Euro experienced an increase following the completion of the Inner Currency Dip at the 1.156 level. It subsequently surpassed two significant Mean Resistance levels, namely 1.167 and 1.172; however, it reversed direction by the conclusion of the trading week. Recent analyses indicate that the Euro is likely to undergo a sustained downward trend, with a projected target set at the Mean Support level of 1.169 and a potential further decline to retest the previously completed Currency Dip at 1.156. Nonetheless, it remains essential to consider the possibility of renewed upward momentum towards the Mean Resistance level of 1.177, which could initiate a preeminent rebound and facilitate the completion of the critical Outer Currency Rally at 1.187.

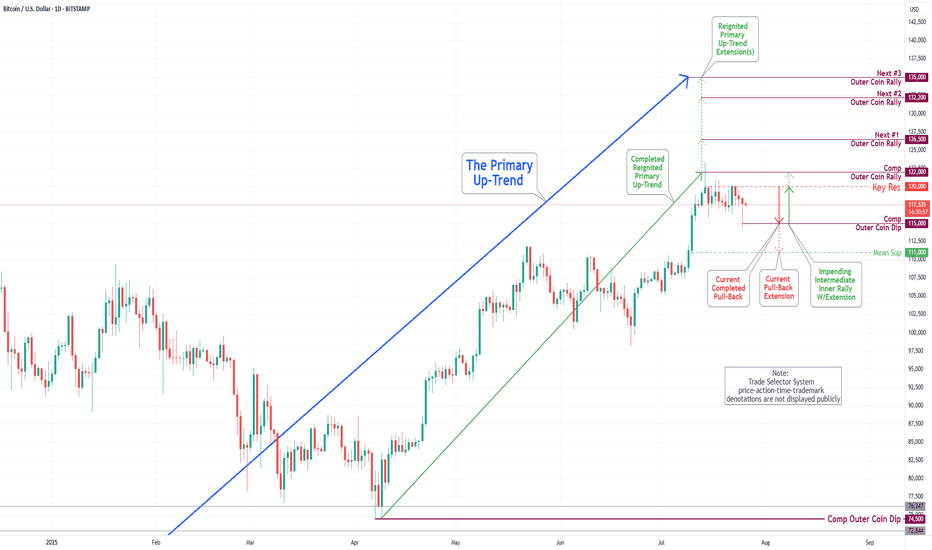

Bitcoin(BTC/USD) Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

In the trading session of the previous week, the Bitcoin market exhibited considerable volatility as it retested the Key Resistance level at 120000. On the lower end of the spectrum, the market engaged with the Mean Support levels at 117500 and 115900, culminating in the completion of the Outer Coin Dip at 115000. Currently, the coin is poised to retest the Key Resistance at 120000 once again. This anticipated rebound will necessitate a retest of the completed Outer Coin Rally at 122000. The additional target levels for the renewed Primary Up-Trend are 126500, 132200, and 135000.