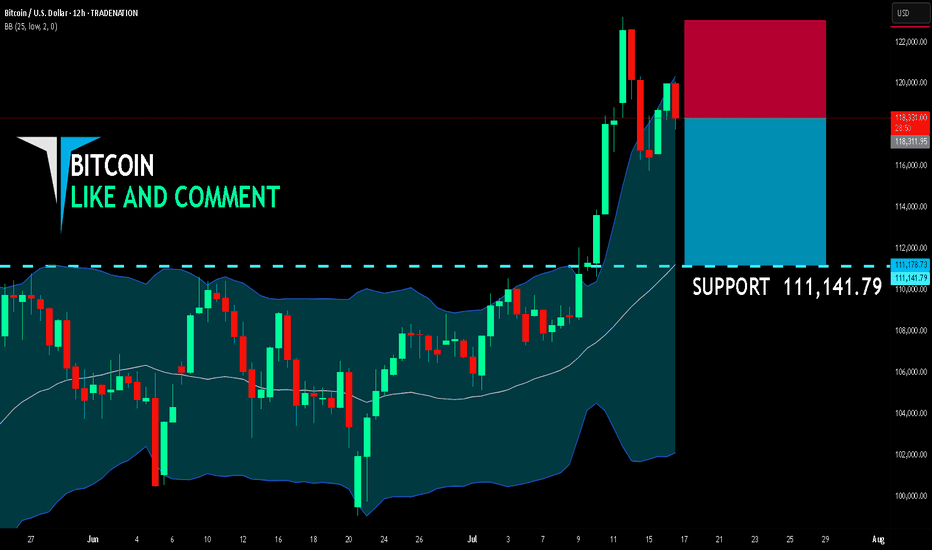

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 118,311.95

Target Level: 111,141.79

Stop Loss: 123,054.98

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trading

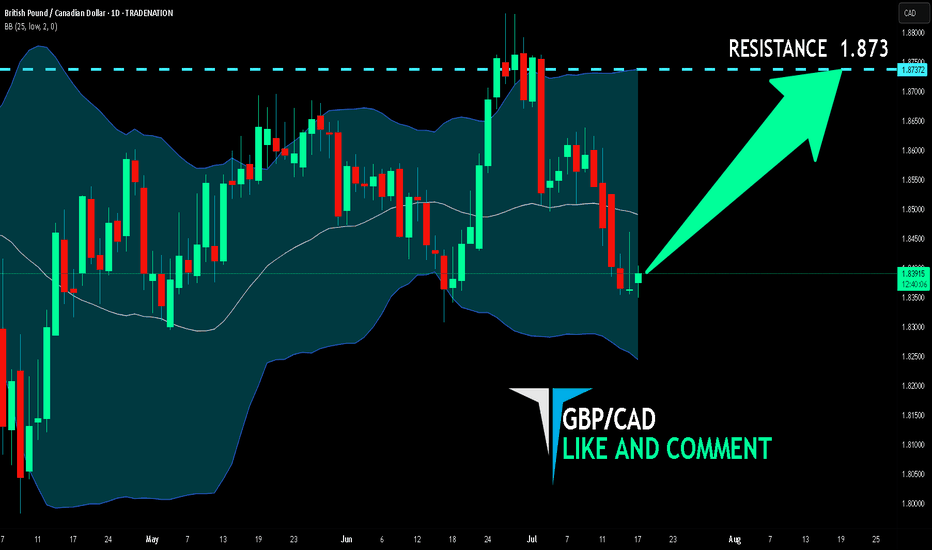

GBP/CAD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

We are now examining the GBP/CAD pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 1.873 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

#009: EUR/AUD Long Investment Opportunity

We placed a buy limit order at 1,776, waiting for a bearish spike that would allow us to enter alongside the institutions, not against them.

Why this entry?

🔻 We're waiting for a false breakout at 1,776, a key level where big players are accumulating liquidity with technical stop hunts.

🔐 The SL is below the levels where banking systems have protective orders for the future.

📊 Retailers are still heavily short and aren't exiting, confirming that the upside movement hasn't started yet.

📈 Open interest shows anticipation of an imminent breakout, with progressive loading by large players.

⏳ We're staying out now to avoid being victims of the retracement, but ready to enter on the institutional bearish spike.

A violent expansion toward 1.79, with a directional candlestick that will start as soon as the retail cleanup below 1.776 is completed.

The trade has all the hallmarks of a perfect institutional entry: early positioning, patience, and a defensive stop.

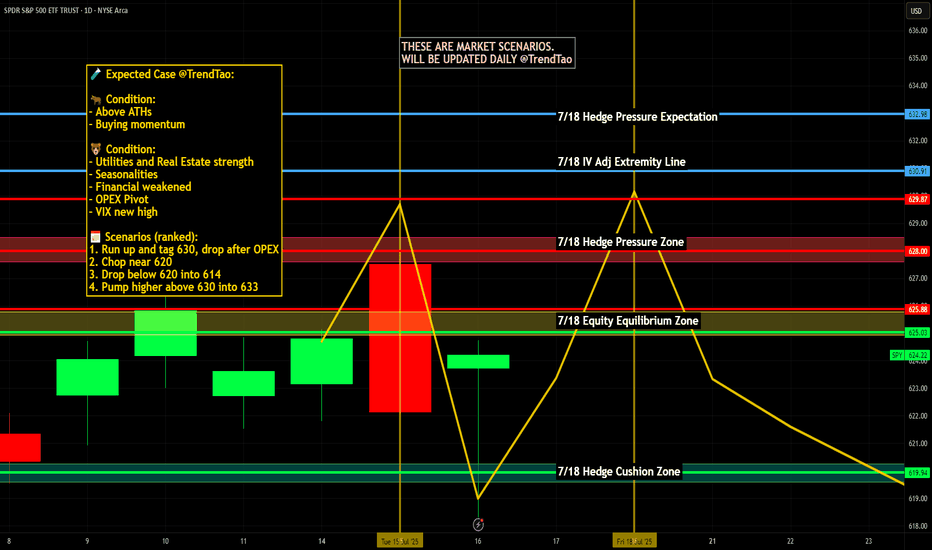

Nightly $SPY / $SPX Scenarios for July 17, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 17, 2025 🔮

🌍 Market-Moving News 🌍

🇮🇳 India–U.S. Inflation Divergence Dampens Dollar

India’s June retail inflation tumbled to a six-year low, while U.S. CPI hit its fastest pace since February—driven by tariff effects. This divergence is weakening the U.S. dollar against the rupee, pushing down dollar‑rupee forward premiums

📜 Treasury to Ramp Up T-Bill Issuance

Following the recent debt-ceiling increase, the U.S. Treasury plans to issue over $1 trillion in T-bills over the next 18 months. Money-market funds, flush with cash, are expected to absorb the supply, which could influence short-dated yields

💱 Dollar Eases Amid Fed-Related Volatility

Headline news that President Trump “highly unlikely” to fire Fed Chair Powell, coupled with stable PPI data, calmed markets. The dollar dipped slightly after earlier turmoil, while gold and bonds saw modest gains

📊 Key Data Releases & Events 📊

📅 Thursday, July 17:

(No major U.S. economic releases)

Markets will track T-bill issuance plans, dollar forward dynamics, and statements from the Treasury and Fed regarding debt and rate strategy.

⚠️ Disclaimer:

This is for educational purposes only—not financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #dollar #tbills #inflation #Fed #technicalanalysis

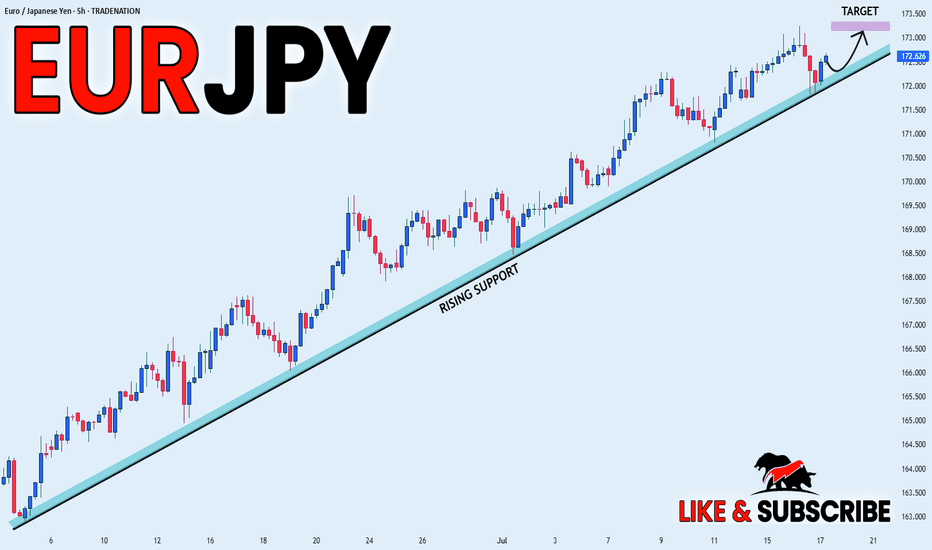

EUR_JPY WILL GO UP|LONG|

✅EUR_JPY is trading along the rising support line

And as the pair is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 173.166

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

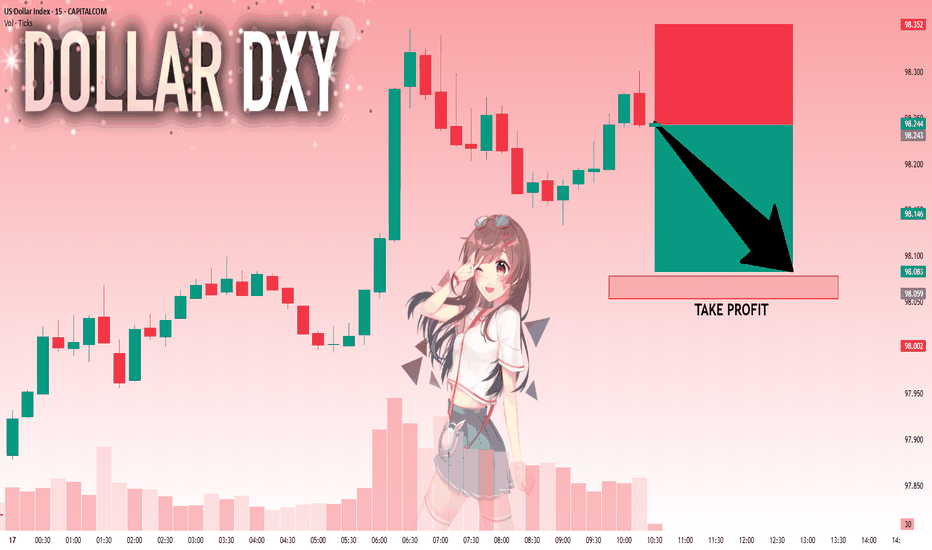

DXY: Next Move Is Down! Short!

My dear friends,

Today we will analyse DXY together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 98.243 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 98.078..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

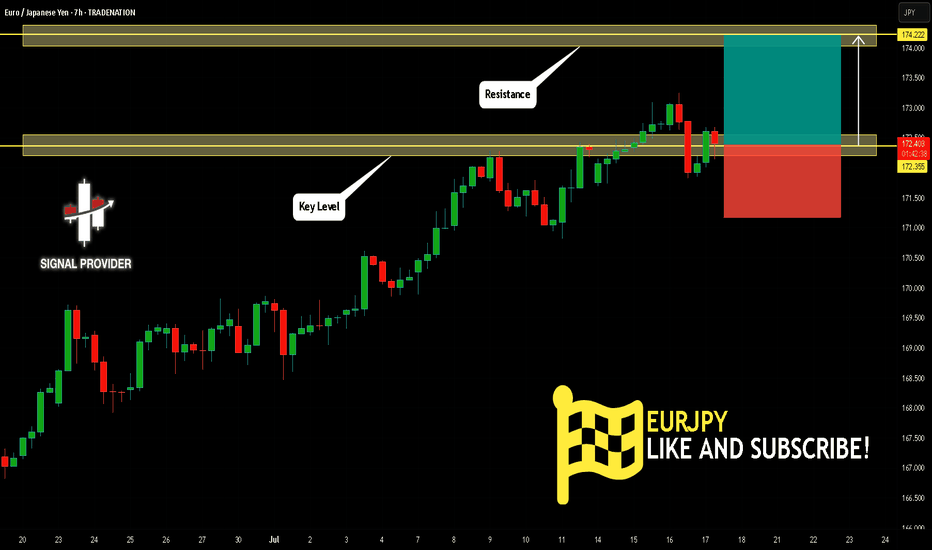

EURJPY Is Going Up! Long!

Here is our detailed technical review for EURJPY.

Time Frame: 7h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 172.355.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 174.222 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

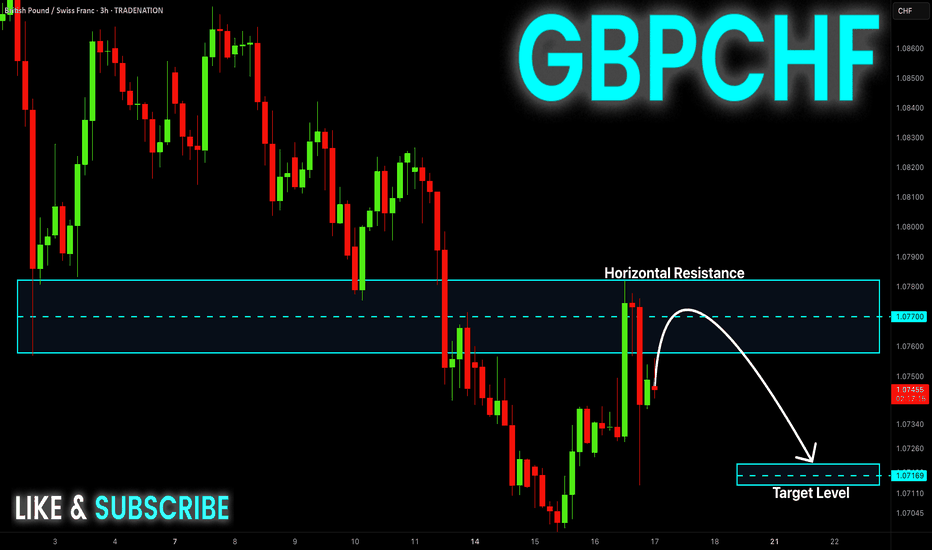

GBP-CHF Local Short! Sell!

Hello,Traders!

GBP-CHF made a retest of

The wide horizontal resistance

Of 1.0780 and we are already

Seeing a bearish pullback

So as the pair is trading in a

Downtrend we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_JPY BULLISH BIAS|LONG|

✅CAD_JPY is trading along

The rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels

Above at 108.708

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Strong Uptrend! Buy!

Hello, Traders!

EUR-AUD is trading along

The rising support line in a

Strong uptrend so we we are

Bullish biased and as the pair

Is going down to retest the

Support we will be expecting

A rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

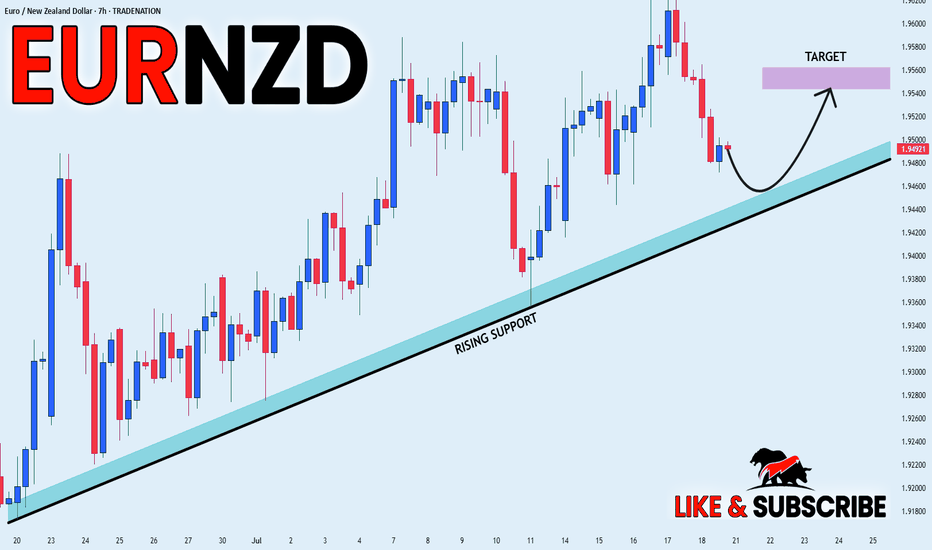

EUR_NZD LONG FROM RISING SUPPORT|

✅EUR_NZD is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 1.9544

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Will Keep Growing! Buy!

Hello,Traders!

USD-JPY is trading in an

Uptrend along the rising

Support line and the pair

Already made a bullish

Rebound and is consolidating

In a local range so as we

Are bullish biased we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

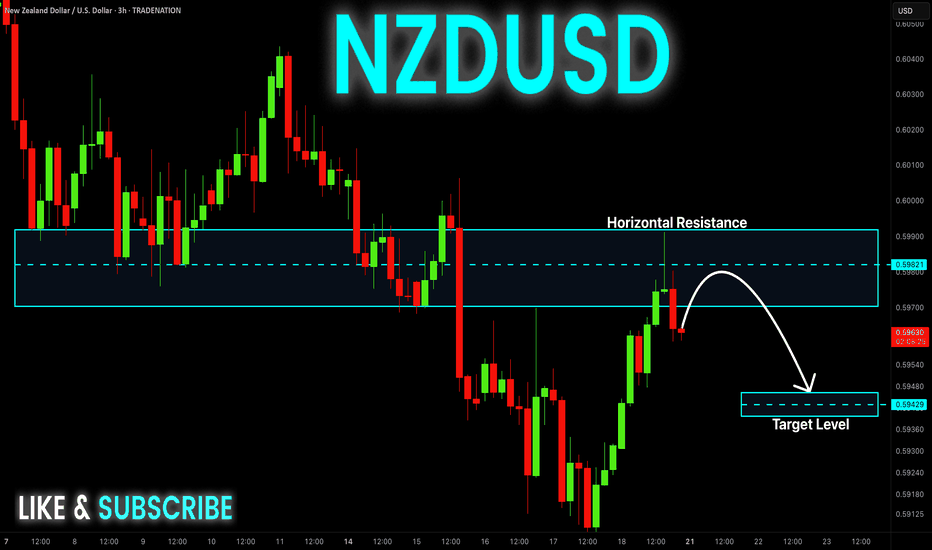

NZD-USD Will Go Down! Sell!

Hello,Traders!

NZD-USD already made a retest

Of the horizontal resistance

Of 0.5992 from where we

Are seeing a bearish reaction

And we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

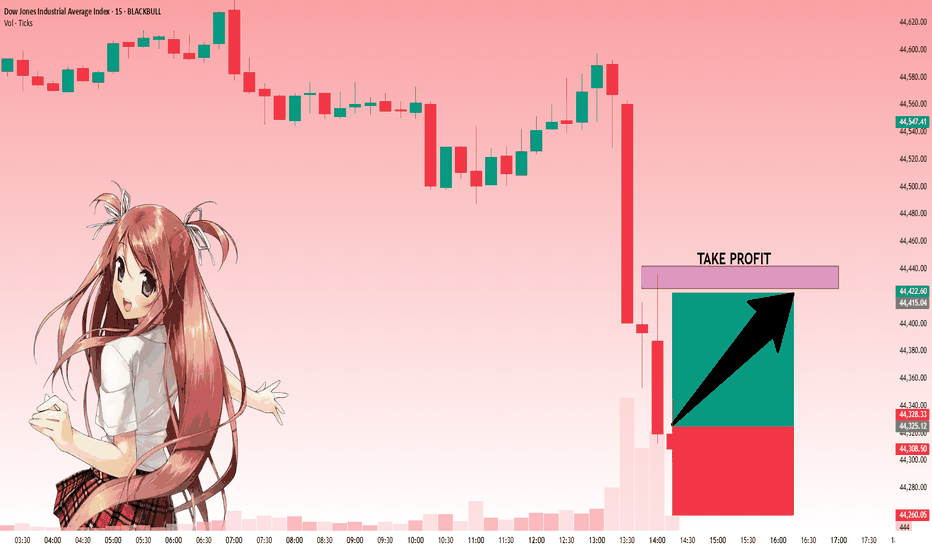

US30: Move Up Expected! Long!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 44,325.14 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 44,425.56.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16557 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.16419..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

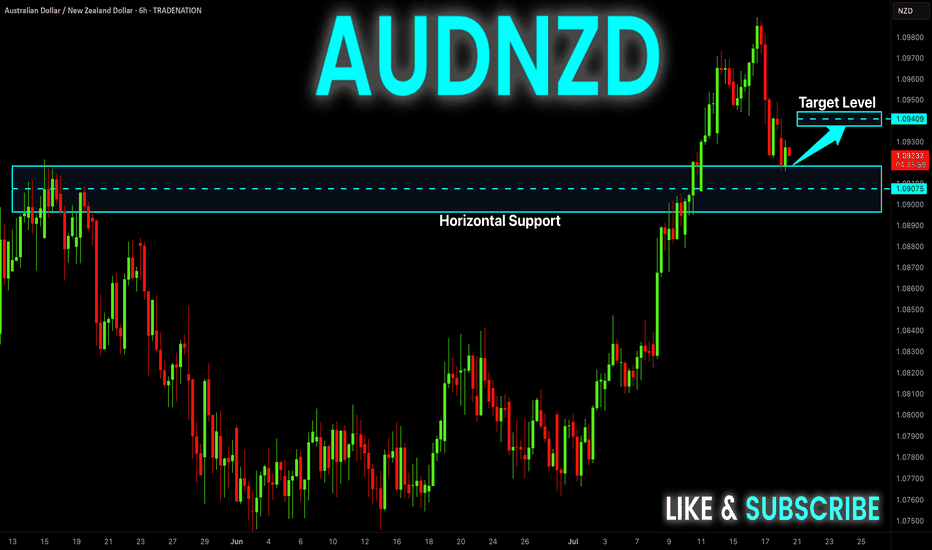

AUD-NZD Rebound Expected! Buy!

Hello,Traders!

AUD-NZD is making a retest

Of the horizontal support

Level of 1.0909 and as the

Pair is trading in an uptrend

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD POTENTIAL SHORT|

✅NZD_USD is going up to retest

A horizontal resistance of 0.5990

Which makes me locally bearish biased

And I think that we will see a pullback

And a move down from the level

Towards the target below at 0.5947

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

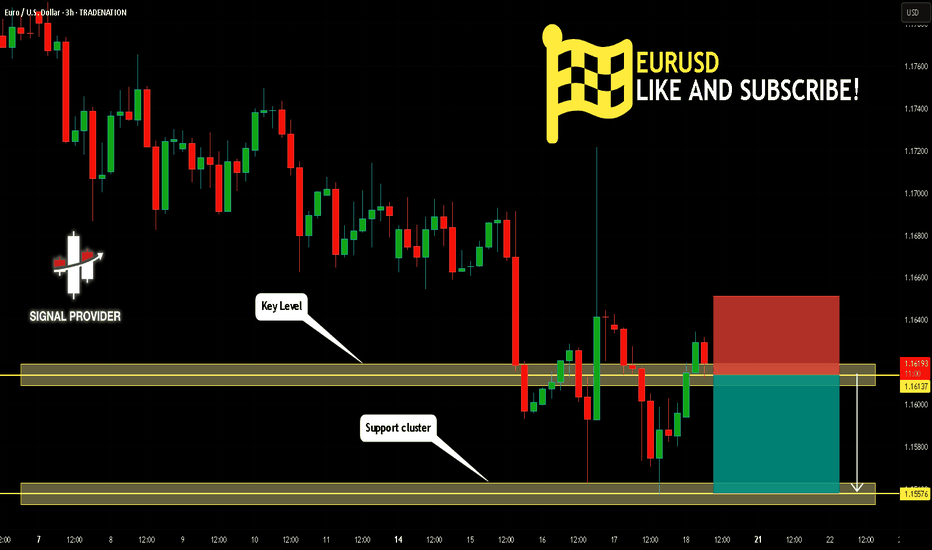

EURUSD Will Go Down! Short!

Please, check our technical outlook for EURUSD.

Time Frame: 3h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.161.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.155 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

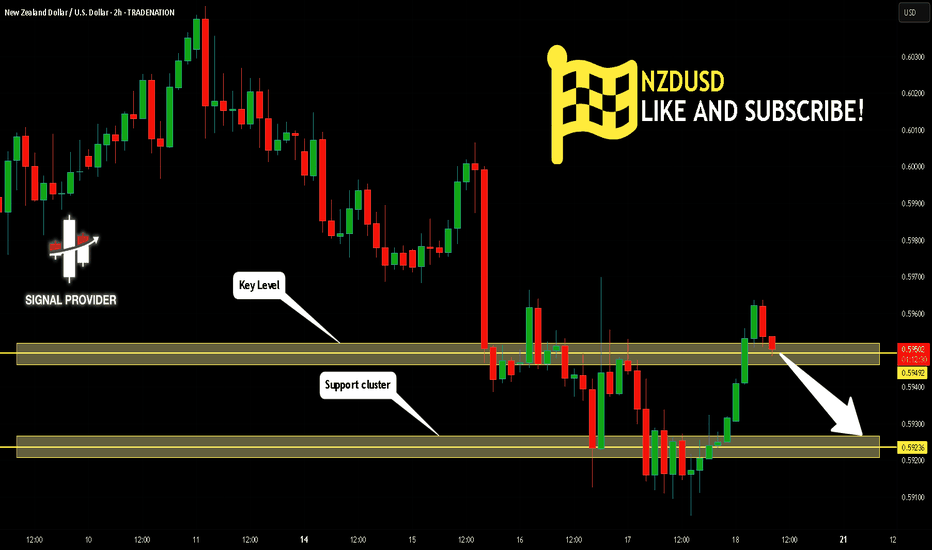

NZDUSD Will Move Lower! Sell!

Here is our detailed technical review for NZDUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.594.

The above observations make me that the market will inevitably achieve 0.592 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/CAD BEARISH BIAS RIGHT NOW| SHORT

AUD/CAD SIGNAL

Trade Direction: short

Entry Level: 0.893

Target Level: 0.890

Stop Loss: 0.894

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR-GBP Long From Rising Support! Buy!

Hello,Traders!

EUR-GBP is trading in an

Uptrend along the rising

Support line and the pair

Is going down now so after

The retest we will be

Expecting a bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CAD LOCAL SHORT|

✅USD_CAD is going up now

But a strong resistance level is ahead at 1.3800

Thus I am expecting a pullback

And a move down towards the target of 1.3720

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.