Trading

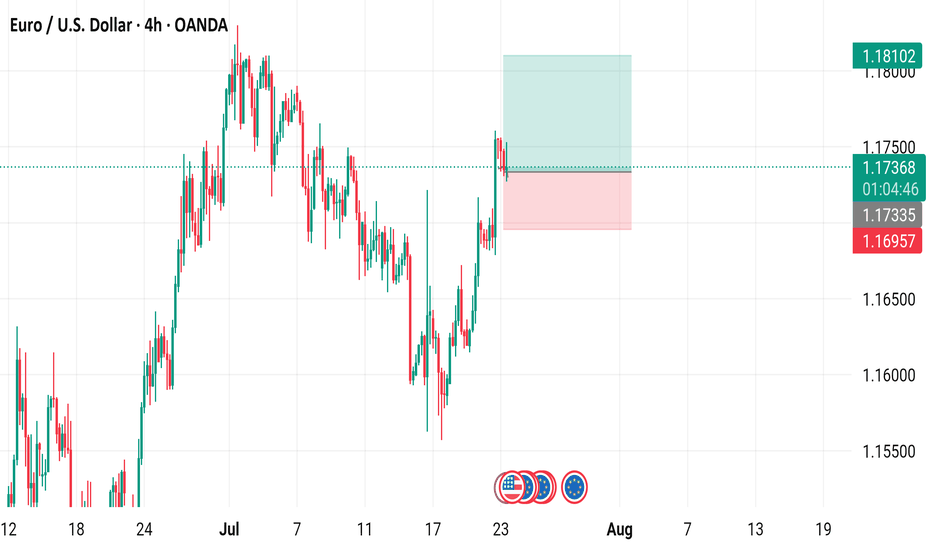

EUR/USD 4-Hour Candlestick Chart (OANDA)4-hour candlestick pattern for the Euro/US Dollar (EUR/USD) currency pair on the OANDA platform, covering the period from mid-July to mid-August 2025. The current price is 1.17358, reflecting a 0.16% decrease (-0.00186). Key levels include a sell signal at 1.17350 and a buy signal at 1.17366, with a highlighted resistance zone around 1.18102 and support near 1.16957. The chart includes technical indicators and price movements over the specified timeframe.

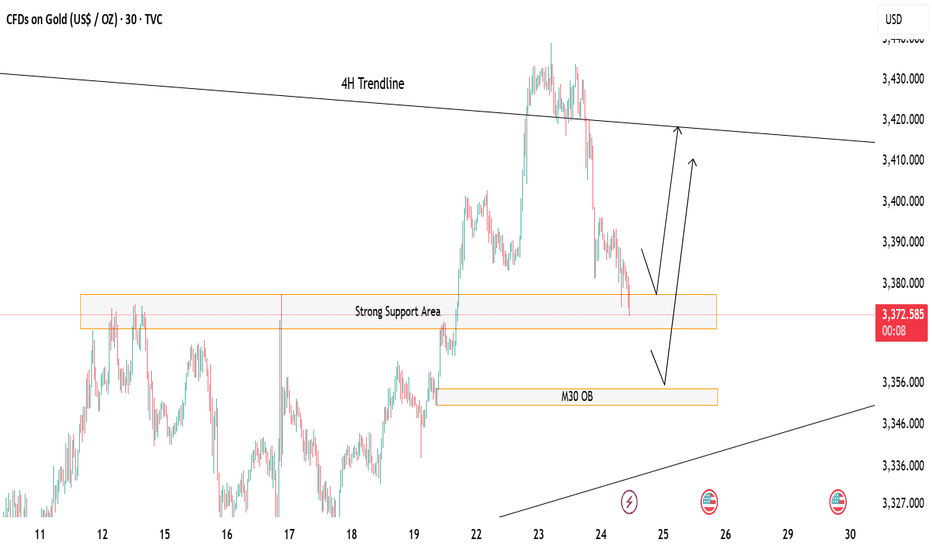

Gold at Key Decision Zone – Bounce or Break?Price is currently hovering above a strong support zone, showing potential for a short-term bounce. 🔁

If this zone holds, we could see a bullish reaction toward the 4H trendline resistance above. 📈

However, a break below may lead price to drop and tap into the M30 Order Block (OB) for a deeper mitigation before any move up. ⚠️

If this happen we could look for potential sell till the OB test otherwise the buying opportunity should focused more

🎯 Watch these key zones carefully – market is at a decision point!

Both buy and sell setups possible depending on how price reacts at these levels.

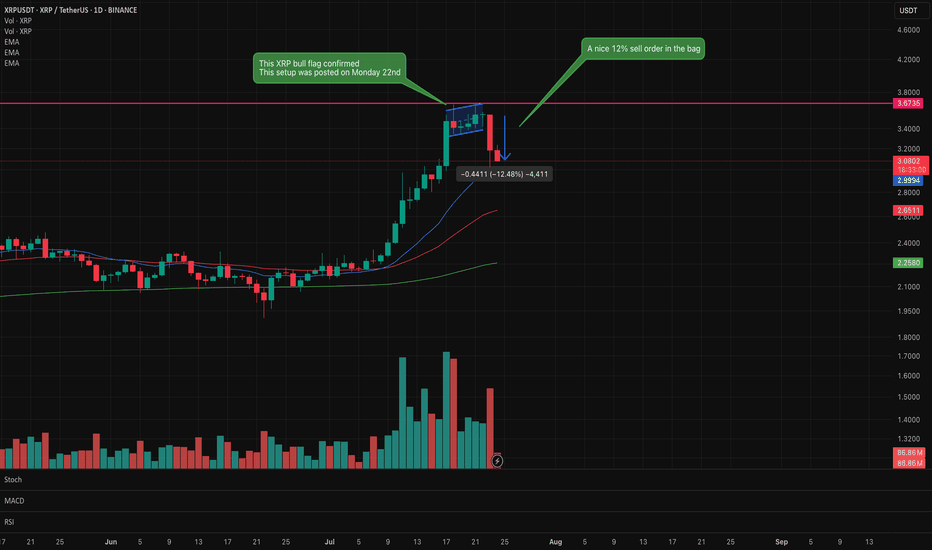

XRP Bear flag confirmed. Looking for support in the decline.XRP bear flag identified on Monday 22nd has now confirmed with a nice 12% short sell.

This signals do not always confirm but when they do it is satisfying that the analysis and patience has paid off.

Trading is all about controlling emotions and being patient. Wait for the confirmation before executing.

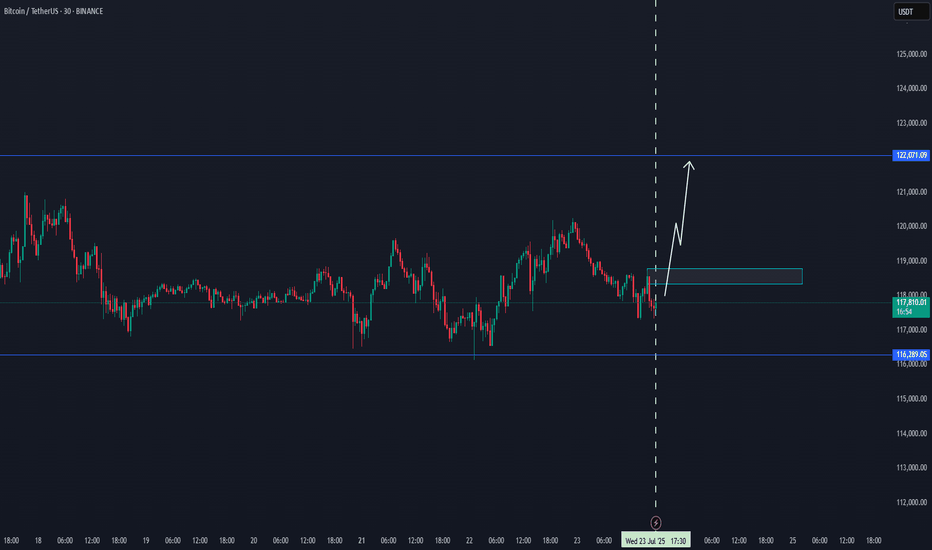

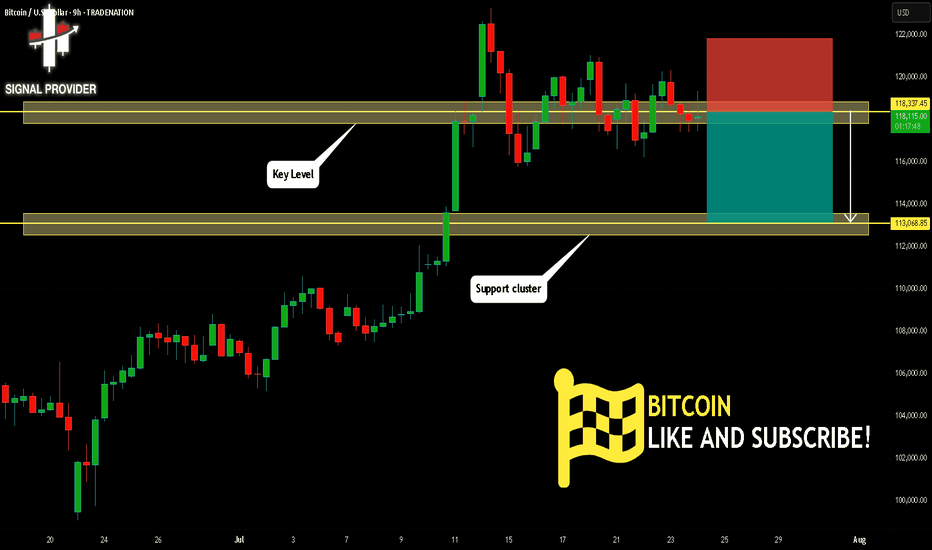

BITCOIN Will Fall! Short!

Take a look at our analysis for BITCOIN.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 118,337.45.

Considering the today's price action, probabilities will be high to see a movement to 113,068.85.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

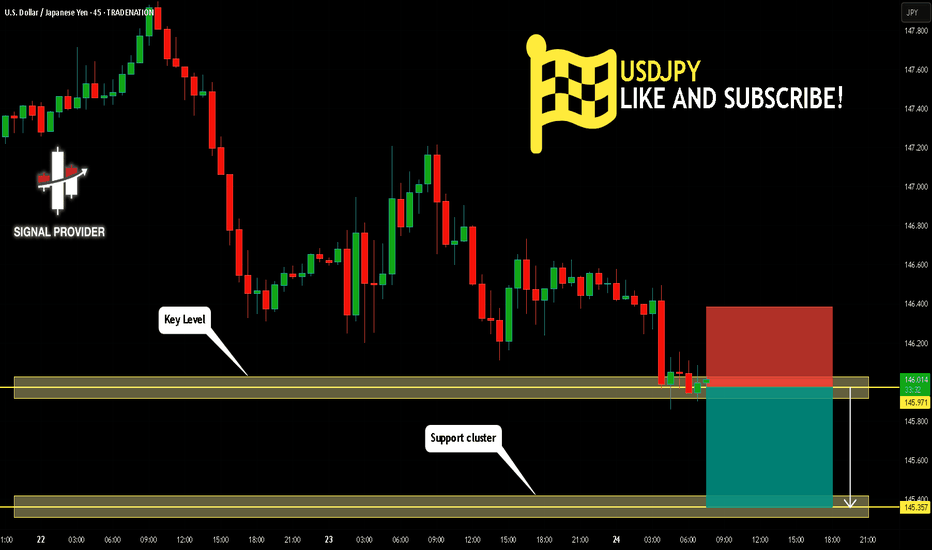

USDJPY Will Go Lower From Resistance! Sell!

Please, check our technical outlook for USDJPY.

Time Frame: 45m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 145.971.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 145.357 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

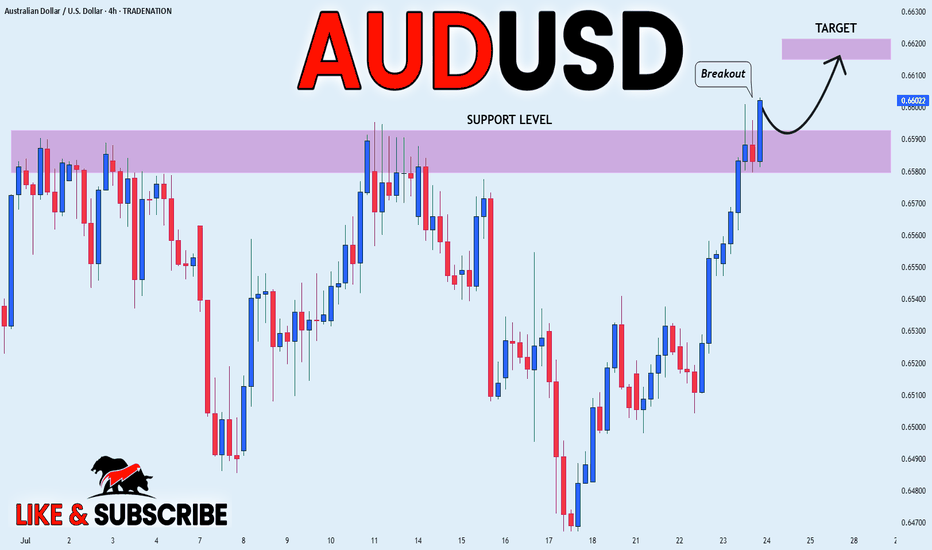

AUDUSD Will Go Up From Support! Long!

Here is our detailed technical review for AUDUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.661.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.665 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPUSD Will Go Lower! Short!

Take a look at our analysis for GBPUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.358.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.353 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

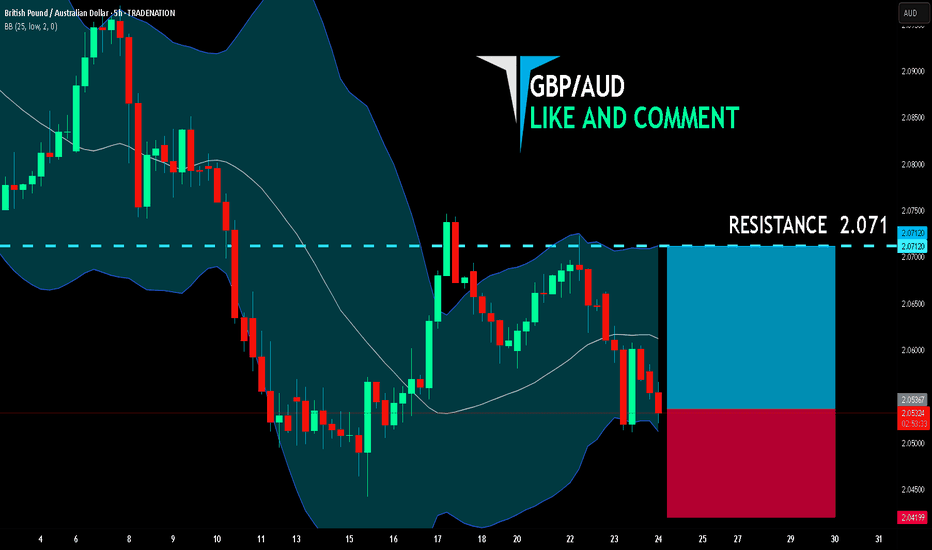

GBP/AUD LONG FROM SUPPORT

GBP/AUD SIGNAL

Trade Direction: long

Entry Level: 2.053

Target Level: 2.071

Stop Loss: 2.041

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 5h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

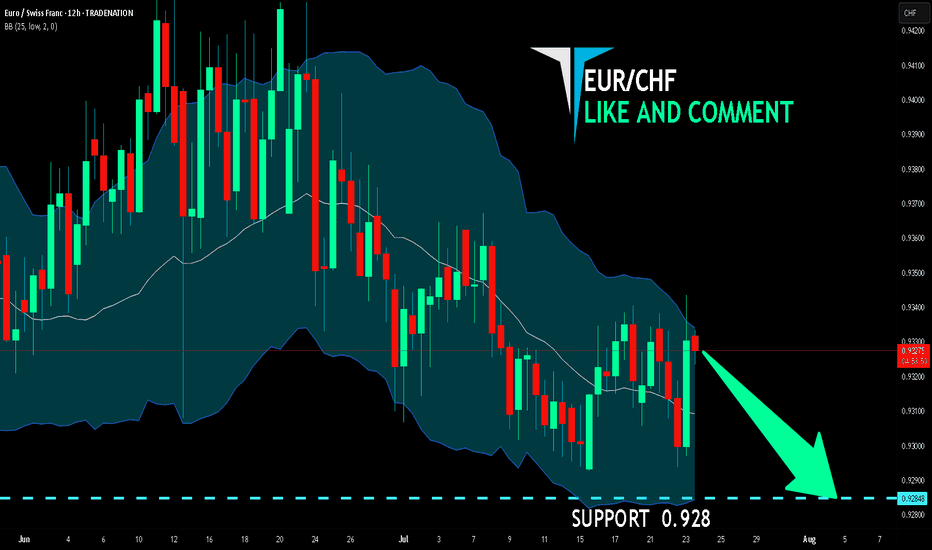

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/CHF is making a bullish rebound on the 12H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.928 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

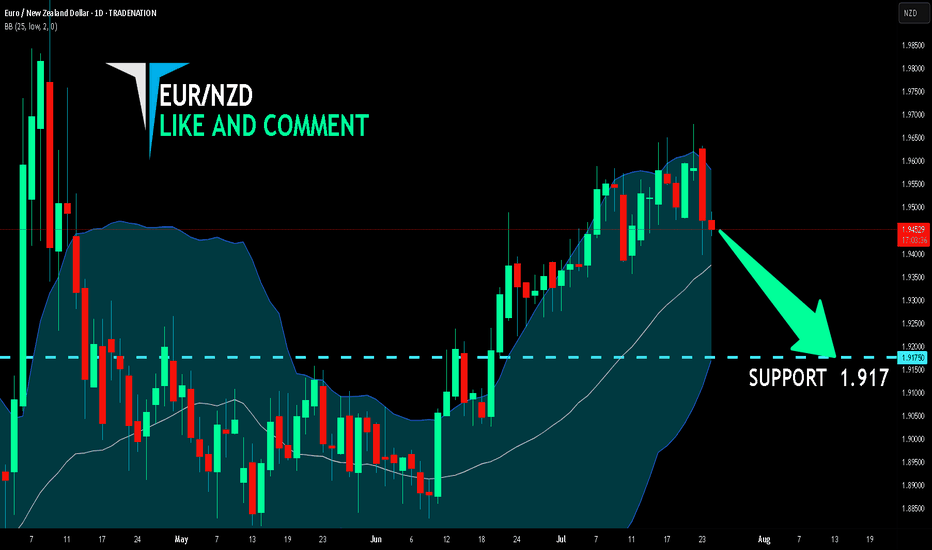

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so EUR-NZD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.917.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

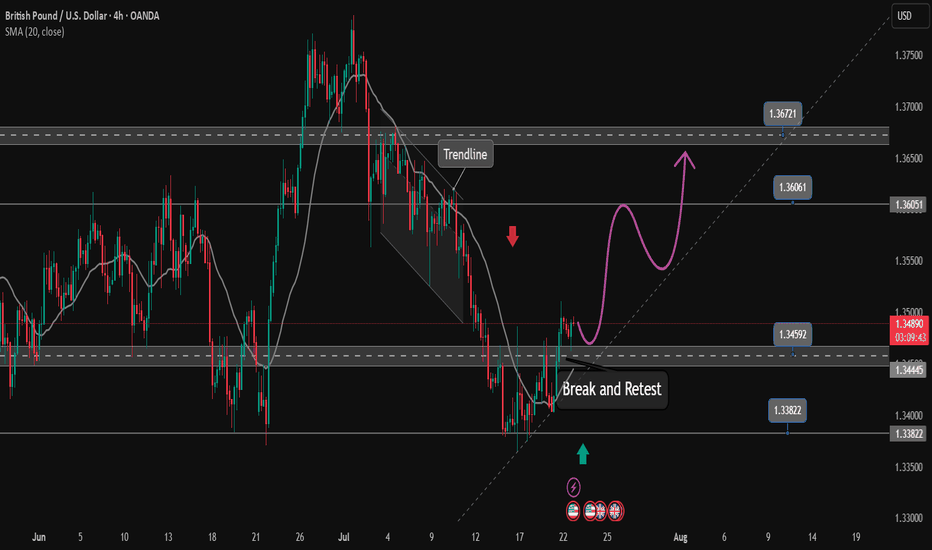

The bearish wave recovery ends and a new bullish wave begins✏️ OANDA:GBPUSD After a long downtrend that touched the important support zone of 1.138 GBPUSD has recovered to the upside. The h4 candle has just closed above the accumulation zone of 1.345 to continue the upward momentum towards the peak of 1.367. The price line also created a trendline supporting the main uptrend of the pair, and the price line can follow the uptrend to the Target.

📉 Key Levels

Support: 1.345 - 1.338

Resistance: 1.360-1.367

Buy Trigger: Rejects above 1.345

Buy zone: 1.348-1.345

Target 1.367

Leave your comments on the idea. I am happy to read your views.

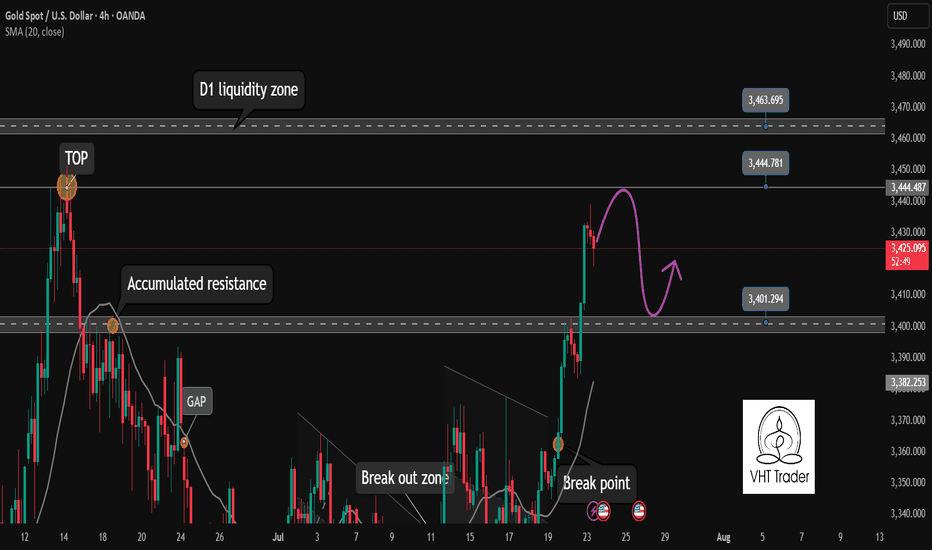

Gold will pause its rally today. Be cautious✏️ OANDA:XAUUSD continues to hit new highs this week. As the daily candle closes above the 3430 area, gold is creating a wide trading range of about 50 prices today. The uptrend may face a slight slowdown due to profit-taking psychology of some investors.

📉 Key Levels

Sell trigger: Rejection from 3445

Sell zone: 3463

Target: 3405

BUY trigger: 3402 (Price retests breakout zone and buyers react)

Leave your comments on the idea. I am happy to read your views.

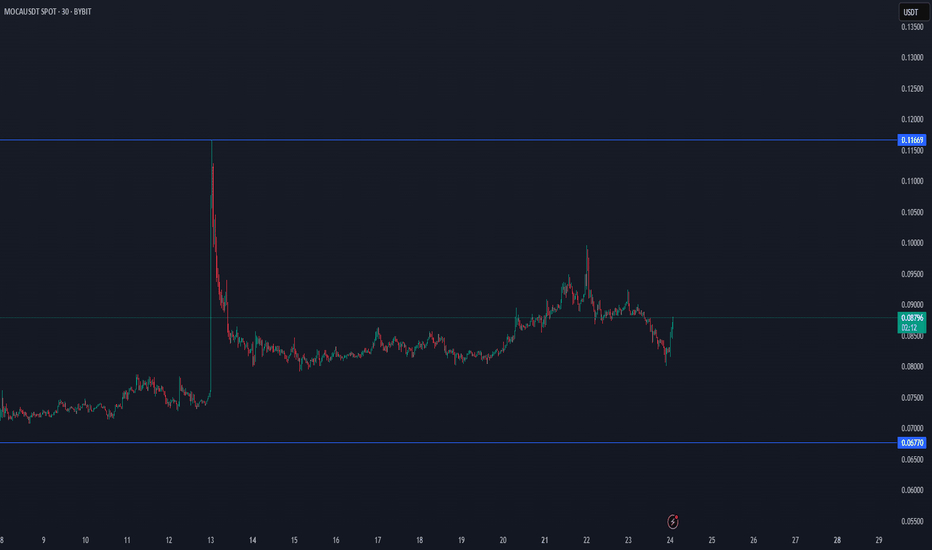

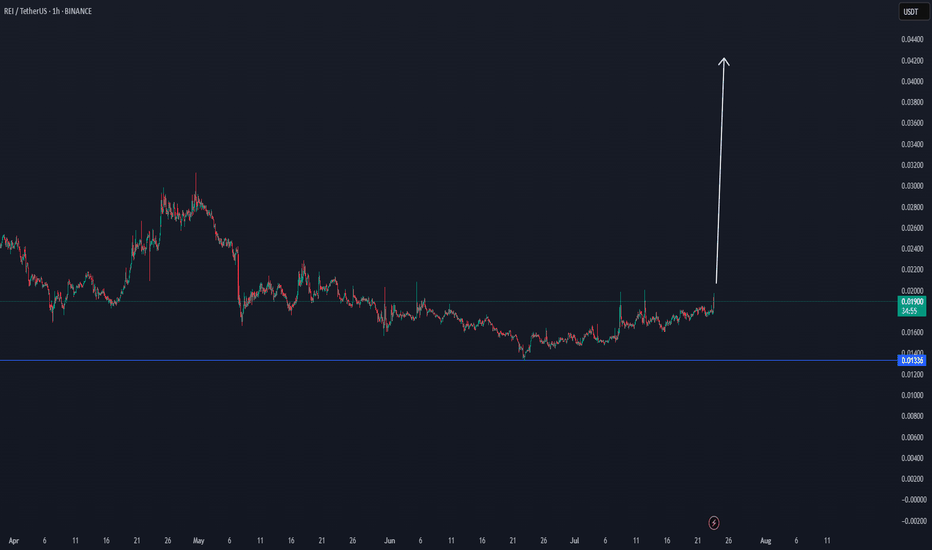

REI/USDT THE NEXT WHALE INCREASE COIN $0,04 TargetREI/USDT THE NEXT WHALE INCREASE COIN

This coin seems to have a powerful DCA effect, which can be confirmed in the coming time frames with a break.

When there is interest, and new confirmations, here below the update.

entering this coin only when there are more confirmations

The first confirmation is to get first out of this box

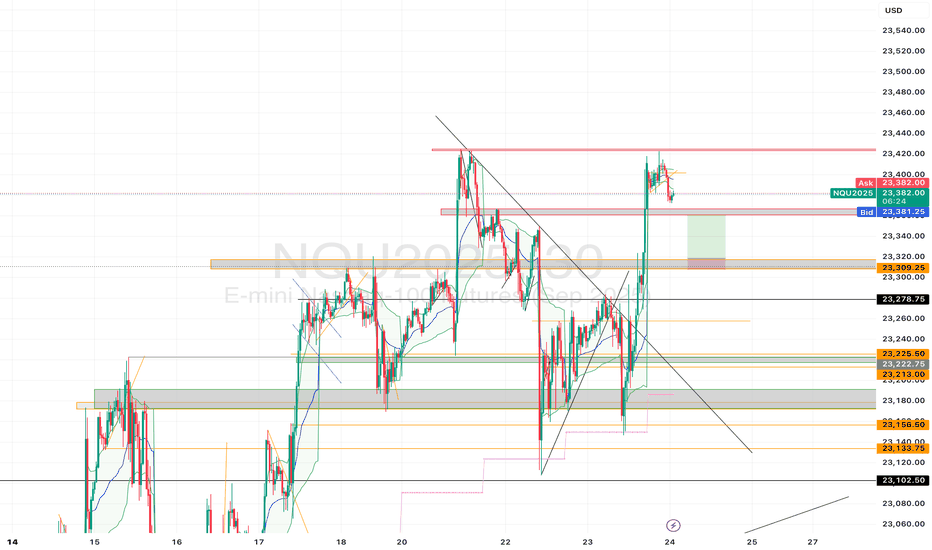

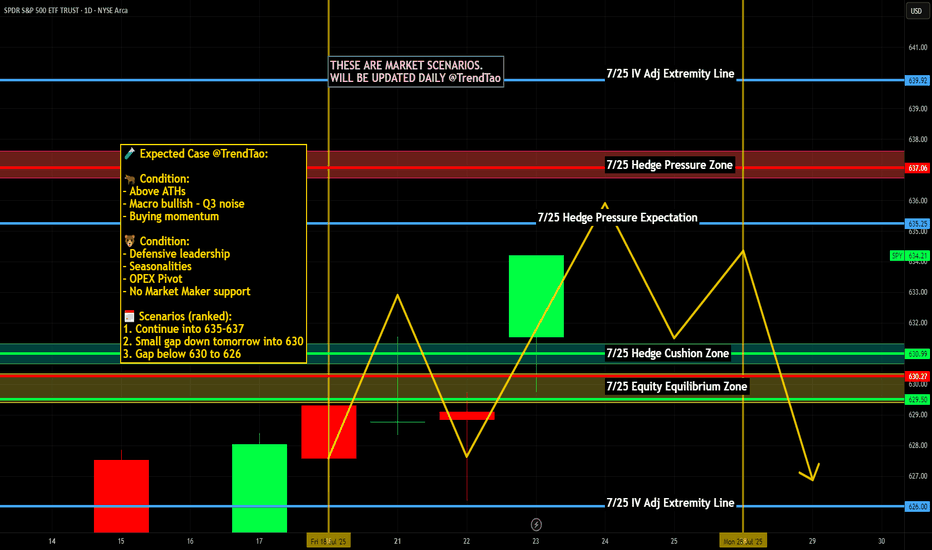

Nightly $SPY / $SPX Scenarios for July 24, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 24, 2025 🔮

🌍 Market-Moving News 🌍

🤝 U.S.–EU & U.S.–Japan Trade Optimism Lifts Sentiment

The S&P 500 and Nasdaq hit record-high closes on July 23, fueled by optimism over a potential U.S.–EU trade deal mirroring the U.S.–Japan framework, with the EU-set tariff on autos potentially halved to 15%

💵 Dollar Retreats, Yields Climb

As markets shifted toward risk assets, U.S. Treasury yields increased and gold softened, while the dollar eased—highlighting growing confidence in trade-driven growth news

🏦 Fed Independence Under Pressure—But No July Cut Expected

A Reuters poll shows economists see heightened political pressure on the Fed jeopardizing its independence, though the consensus remains that rates will stay unchanged this month

📊 Key Data Releases & Events 📊

📅 Thursday, July 24:

8:30 AM ET – Initial Jobless Claims

Weekly tally of new unemployment benefit applications—key indicator of labor-market conditions.

10:00 AM ET – New Residential Sales (June)

Tracks signed contracts for new homes, offering insight into housing demand under tightening mortgage rates.

All Day – Trade Headlines & Fed Watch

Continued focus on U.S.–EU trade developments and any follow-up to Fed independence concerns from policy circles.

⚠️ Disclaimer:

This information is for educational and informational purposes only—not financial advice. Please consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #trade #economy #Fed #housing #jobs #technicalanalysis

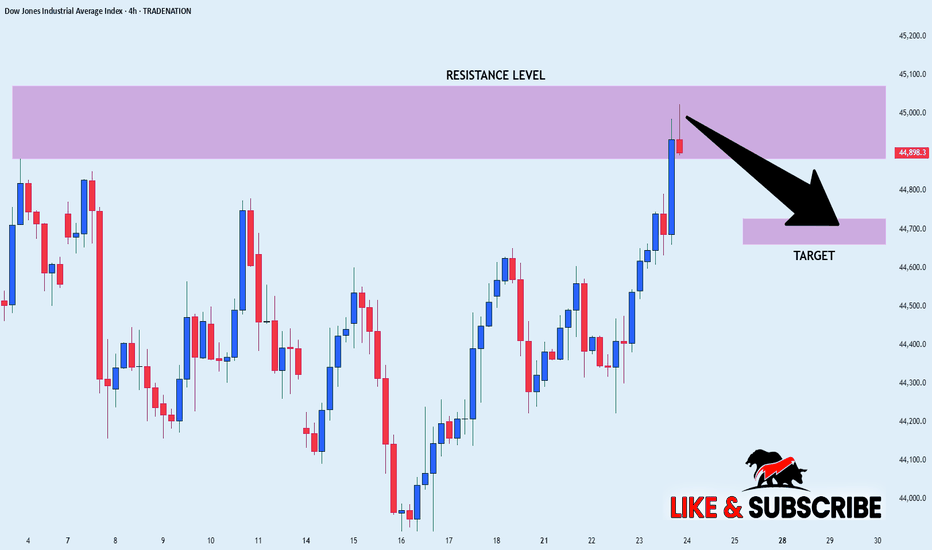

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 0.6590 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

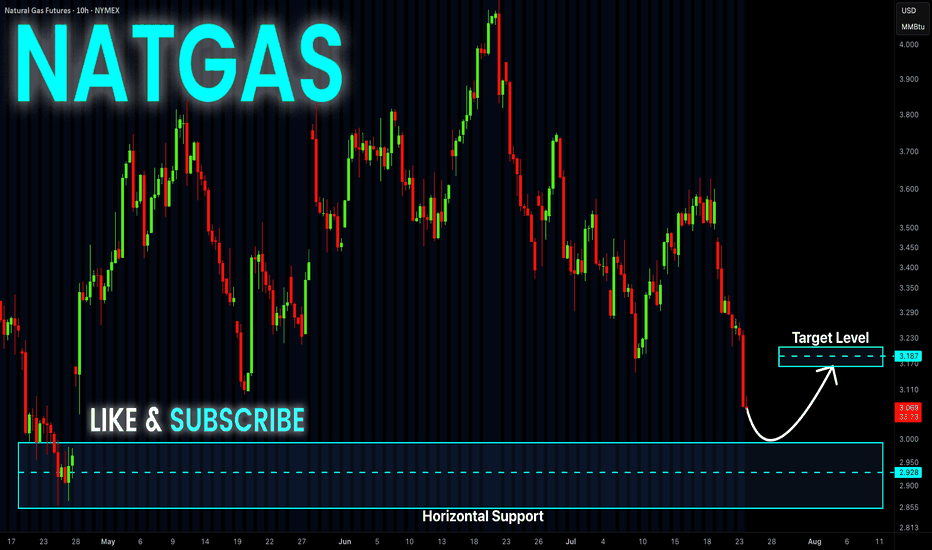

NATGAS Support Ahead! Buy!

Hello,Traders!

NATGAS keeps falling but

A strong horizontal support

Level is ahead at 3.00$ so

After Gas retests the support

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

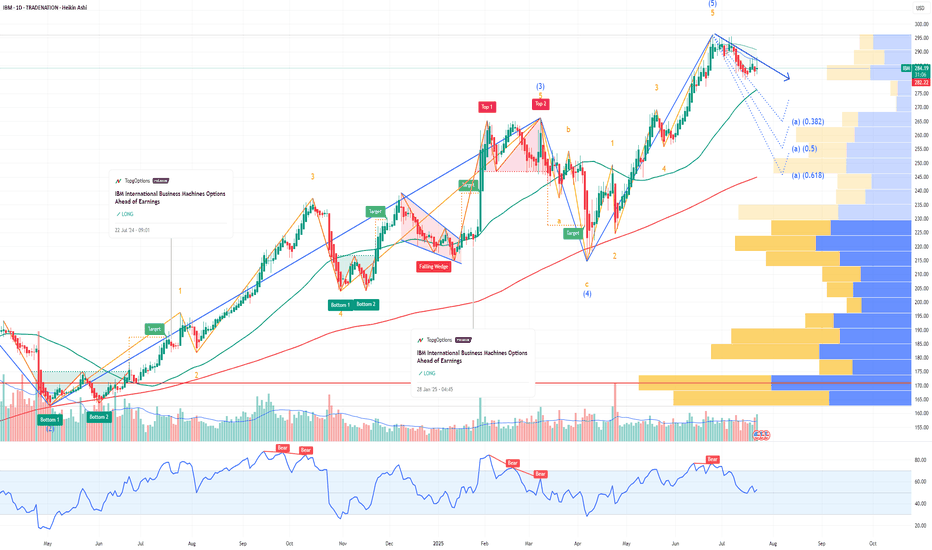

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

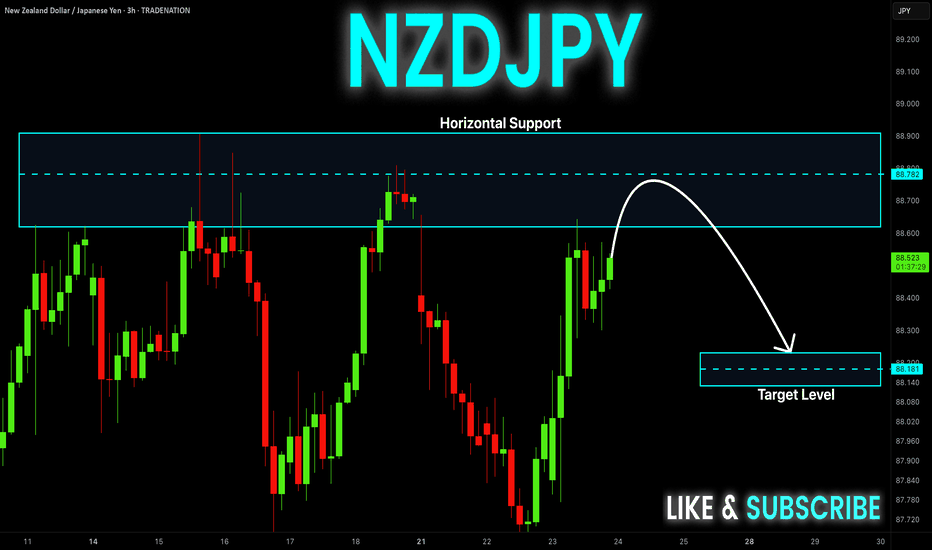

NZD-JPY Resistance Ahead! Sell!

Hello,Traders!

NZD-JPY is trading in an

Uptrend but the pair is locally

Overbought so after the pair

Hits the horizontal resistance

Level of 88.900 we will be

Expecting a local bearish

Move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.