10 POWERFUL INVESTING & TRADING QUOTES OF ALL TIME

Here are powerful quotes of professional traders, investors and experts in financial markets.

Let their words inspire you and help you in your trading journey.

"To succeed in the market, you must learn to think like everyone else and do the opposite." - Sir John Templeton 📈💭💡

"The four most dangerous words in investing are: 'This time it's different.'" - Sir John Templeton ⏳📉🛑

"The more you learn, the more you earn." - Warren Buffett 📚💰📈

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money." - Victor Sperandeo. 💪💰🚫🧠

"Investing is not about making predictions, it's about having a plan and sticking to it." - Tony Robbins 📊🔄📌

"The best time to buy a stock is when the blood is running in the streets." - Baron Rothschild 💀🔪💰

"The best investment you can make is in yourself." - Warren Buffett 💼💡💰

"The stock market is not a casino; it's a crooked casino." - Charlie Munger 🎰🎲🏛️

"Losses are part of the game. You can't win every trade." - Martin Schwartz. 📉😔💔

"The fundamental law of investing is the uncertainty of the future." - Peter Bernstein. ⚖️❓🔮

The More I trade, the more I realize how precise and meaningful are these phrases. Take them seriously, and they will help you achieve the financial success.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Tradingbasics

Learn 2 Essential Elements of Forex Gold Trading

In the today's post, we will discuss how Forex Gold trading is structured, and I will share with you its 2 key milestones.

Trading with its nuances and complexities can be explained as the interconnections of two processes: trading rules creation and trading rules following.

1️⃣ With the trading rules, you define what you will trade and how exactly, classifying your entry and exist conditions, risk and trade management rules. Such a set of consistent trading rules compose a trading strategy.

For example, you can have a following trading plan:

you trade only gold, you analyze the market with technical analysis,

you buy from a key support and sell from a key resistance on a daily, your entry confirmation is a formation of a reversal candlestick pattern.

You set stop loss above the high/low of the pattern, and your target is the closest support/resistance level.

Here is how the trading setup would look like.

In the charts above, all the conditions for the trade are met, and the market nicely reached the take profit.

2️⃣ Trading strategy development is a very simple process. You can find hundreds of different ones on the internet and start using one immediately.

The main obstacle comes, however, with Following Trading Rules.

Following the rules is our second key milestone. It defines your ability to stay disciplined and to stick to your trading plan.

It implies the control of emotions, patience and avoidance of rationalization.

Once you open a trade, following your rules, challenges are just beginning. Imagine how happy you would feel yourself, seeing how nicely gold is moving to your target after position opening.

And how your mood would change, once the price quickly returns to your entry.

Watching how your profits evaporate and how the initially winning position turns into a losing one, emotions will constantly intervene.

In such situations, many traders break their rules , they start adjusting tp or stop loss or just close the trading, not being able to keep holding.

The ability to follow your system is a very hard skill to acquire. It requires many years of practicing. So if you believe that a good trading strategy is what you need to make money, please, realize the fact that even the best trading strategy in the world will lose without consistency and discipline.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the 3 TYPES of MARKET ANALYSIS in Gold Forex Trading

In the today's post, we will discuss 3 types of analysis of a financial market.

🛠1 - Technical Analysis

Technical analysis focuses on p rice action, key levels, technical indicators and technical tools for the assessment of a market sentiment.

Pure technician thoroughly believes that the price chart reflects all the news, all the actions of big and small players. With a proper application of technical strategies, technical analysts make predictions and identify trading opportunities.

In the example above, the trader applies price action patterns, candlestick analysis, key levels and 2 technical indicators to make a prediction that the market will drop to a key horizontal support from a solid horizontal resistance.

📰2 - Fundamental Analysis

Fundamental analysts assess the key factors and related data that drive the value of an asset.

These factors are diverse: it can be geopolitical events, macro and micro economic news, financial statements, etc.

Fundamental traders usually make trading decision and forecasts, relying on fundamental data alone and completely neglecting a chart analysis.

Price action on Gold on a daily time frame could be easily predicted, applying a fundamental analysis.

A bearish trend was driven by FED Interest Rates tightening program,

while a strong bullish rally initiated after escalation of Israeli-Palestinian conflict.

📊🔬 3 - Combination of Technical and Fundamental Analysis

Such traders combine the principles of both Technical and Fundamental approaches.

When they are looking for trading opportunities, they analyze the price chart and make predictions accordingly.

Then, they analyze the current related fundamentals and compare the technical and fundamental biases.

If the outlooks match , one opens a trading position.

In the example above, Gold reached a solid horizontal daily support.

Testing the underlined structure, the price formed a falling wedge pattern and a double bottom, breaking both a horizontal neckline and a resistance of the wedge.

These were 2 significant bullish technical confirmation.

At the same time, the escalation of Israeli-Palestinian conflict left a very bullish fundamental confirmation.

It is an endless debate which method is better.

Each has its own pros and cons.

I strongly believe that one can make money mastering any of those.

Just choose the method that you prefer, study it, practice and one day you will make it.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What is Dynamic Support and Resistance Levels & Zones in Forex

Dynamic supports and resistances play a crucial role in technical analysis.

Unlike classic supports and resistances, these zones change and adapt to a market price action in real time.

Learn what is dynamic support and resistance in Forex, Gold trading and how to find it easily.

Discover its main types and real market examples.

Let's start with the basics.

There are 2 major types of supports and resistances in technical analysis.

The first type is called static .

Such supports and resistances are fixed and don't change with time.

It should be strictly horizontal key levels or the zones.

Market price action and momentum beyond them do not affect these supports and resistances.

In the example above, you can find static supports and resistances on Gold. The market may return to one of those levels or the zones today, tomorrow or in a month, but it will not move.

In comparison to static supports and resistances, the dynamic ones shift with time. They constantly change and adjust as the time flies.

One of the obvious types of dynamic supports and resistances is a trend line.

Above is the example of a dynamic rising support based on trend line.

As the time goes, a support shifts and becomes higher and higher.

I found a great example of a dynamic resistance on Dollar Index.

Depending on the moment when the price tests that, the resistance will be on different levels.

The later the price tests the trend line, the lower is the resistance.

When newbie traders learn dynamic supports and resistances, they usually stop on trend lines.

But it is just a beginning.

Really significant dynamic supports are resistances will be the zones .

The areas based on static horizontal supports and resistances and trend lines.

Examine a price action on GBPCHF forex pair.

We have a static horizontal support area and a dynamic rising trend line.

Two supports intersect, composing a contracting dynamic support zone.

With time, it will become narrower, accumulating buy orders within.

On NZDCAD forex pair, I underlined a contracting dynamic resistance zone that is based on an intersection of a static horizontal resistance area and a falling trend line.

Selling orders will be distributed within.

The 2 dynamic support and resistance zones that we discussed are narrowing , but that is not always the case.

A dynamic support zone that I found on GBPNZD is expanding and broaden with time.

It is based on a dynamic falling trend line and a static horizontal support.

With time its boundaries will be wider and a bullish reaction may initiate from any level within that.

A dynamic resistance area that I spotted on EURCAD forex pair is a great example of an expanding resistance.

It is based on a static horizontal resistance and a rising trend line.

We can easily recognize how it grows with time.

Of course, another types of dynamic supports and resistances exist. But they are more nuanced and rare.

As soon as you learn to recognize the clusters that we discussed in this article, you will be able to recognize the less obvious ones as well.

Next time, when you execute a support and resistance analysis, try to find a dynamic zone. You can find it on any time frame, and forex pair and gold, and it will completely change your perspective on the market.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

9 Essential TIPS For Newbie Traders (Learn from my Mistakes!)

In the today's article, I will reveal trading secrets I wish I knew when I started trading.

1️⃣ Forget about becoming a pro quickly

Most of the traders believe, that you can learn how to trade easily and that it takes a very short period of time in order to master a profitable trading strategy.

The truth is, however, that trading is a long journey.

I spent more than 3 years, trying different strategies and looking for a profitable technique to trade. Once I found that, it took more than a year to polish a trading strategy and to learn how to apply that properly.

Be prepared to spend YEARS before you find a way to trade profitably.

2️⃣ Focus on One Strategy

While you are learning how to trade you will try different techniques, tools and strategies. And the thing is that newbies are trying multiple things simultaneously. The more strategies you try at once, the more setups you have on your chart. The more setups you have on your chart, the more complex and difficult is your trading.

Remember that in this game, your attention is the key.

You should meticulously study each and every trading setup.

For that reason, I highly recommend you to focus on one strategy, one approach, one technique. Test it, try it and look for a new one only when you realize that it doesn't work.

Here is the example how the same price chart can provide absolutely different trading opportunities depending on a trading strategy.

Price action pattern trader would recognize a lot of a patterns, while indicator based trader could spot absolutely different bullish and bearish signals.

Now, try to imagine how hard it would be to follow both strategies simultaneously.

3️⃣ Start with small capital that you can afford to lose

You will lose your first trading deposit and, probably, the second one and potentially the third one as well.

Losses are the only way to learn real trading. While you are on a demo account, you feel like a king, but once you start risking your savings, the perspective completely changes .

For that reason, make sure that you trade with an account that you can afford to lose. The fact of blowing such an account should be unpleasant, but that should not affect your daily life.

4️⃣ Use stop loss

I am doing trading coaching for more than 4 years.

What pisses me off is that the main reason of the substantial losses of my mentees is the absence of stop loss. Why can it be if naturally everyone: from your broker to Instagram trading gurus repeat that day after day.

Set stop loss, know in advance how much you risk per trade, and know the exact level on a price chart where you become wrong.

Imagine what could be your loss, if you shorted USDJPY and hold the trade while the market kept going against you.

5️⃣ Forget about getting rich quick

That is the iconic fallacy. I believe that around 90% of people who come in this game want to get rich quick , want easy money.

And no surprise, when I share a trading setup in my free telegram channel, and it loses I receive dozens of messages that I am a scammer.

People truly believe that professional trading implies 100% win rate and quick and easy money.

The truth is, traders, that trading is a very tough game. And with a good trading strategy, you have just a little statistical edge that will give you the profits that would slightly overcome your losses.

6️⃣ Train your eyes

Professional trading implies pattern recognition: it can be some technical indicators pattern, the price action or candlestick formation, etc.

Your main goal as a trader is to learn to identify these patterns.

Pattern recognition is a hard skill to acquire.

You should spend dozens of hours in front of the screen in order to train your eyes to identify certain patterns.

Here is how many patterns you would spot on GBPUSD chart, paying close attention.

7️⃣ Track and analyze your trades

Study all the trades that you take, especially the losing ones.

Look for mistakes, look for the reasons why a certain setup played out and why a certain one didn't. Journal your trades and make notes.

8️⃣ Don't use technical indicators

Newbies believe that technical indicators should do the work for them.

They are constantly looking for one or a bunch that will accurately show where the market will go.

However, I always say to my mentees that technical indicators make the chart messy and distract.

If you just started trading, focus on a naked chart, learn to analyze the market trend, key levels, classic price action patterns.

Learn to make accurate predictions relying on a price chart alone.

Only then add some technical indicators on your chart.

They won't do the work for you, but will help you to slightly increase the accuracy of a certain setup.

Above is the classic chart of a newbie trader.

A lot of indicators and a complete mess

The same chart would look much better without technical indicators.

9️⃣ Find a Mentor

There are hundreds of trading mentors on Instagram, YouTube, TradingView. Find the one with a trading style that you like.

Follow him, learn from his trading experience, listen to his trading recommendations.

11 years ago I found a guy on YouTube, his name was Jason.

I really liked his free teachings, and they were meaningful to me.

I decided to purchase his premium coaching program.

It was 200$ monthly - a huge amount of money for me at that time.

However, with his knowledge I saved a lot, I learned a lot of profitable techniques and tricks that helped me to become a professional forex trader.

Of course, this list could be much bigger.

The more I think about different subjects in trading, the more important tips come to my mind. However, I believe that the tips above are essential and I truly wish I knew all that before I started.

I hope that info will help you in your trading journey!

Good luck to you.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SMC Trading Basics. Change of Character - CHoCH (GOLD FOREX)

In the today's post, we will discuss one of the most crucial concepts in SMC - Change of Character.

Change of Character relates to market trend analysis.

In order to understand its meaning properly, first, we will discuss how Smart Money traders execute trend analysis.

🔘Smart Money Traders apply price action for the identification of the direction of the market.

They believe that the trend is bullish ,

if the price forms at least 2 bullish impulse with 2 consequent higher highs and a higher low between them.

The market trend is considered to be bearish ,

if the market forms at least 2 bearish impulses with 2 consequent lower lows and a lower high between them.

Here is how the trend analysis looks in practice.

One perceives the price action as the set of impulse and retracement legs.

According to the rules described above, USDCAD is trading in a bullish trend because the pair set 2 higher lows and 2 higher highs.

🔘Of course, trends do not last forever.

A skill of the identification of the market reversal is a key to substantial profits in trading.

Change of Character will help you quite accurately identify a bullish and bearish trend violation.

📉In a bearish trend, the main focus is the level of the last lower high.

While the market is trading below or on that, the trend remains bearish .

However, its bullish violation is a very important bullish signal,

it is called a Change of Character, and it signifies a confirmed violation of a bearish trend.

In a bearish trend, CHoCH is a very powerful bullish pattern.

Take a look, how accurate CHoCH indicated the trend reversal on Gold.

After a massive selloff, a bullish breakout of the level of the last lower high confirmed the initiation of a strong bullish wave.

📈In a bullish trend, the main point of interest is the level of the last higher low. While the price is trading above that or on that, the trend remains bullish.

A bearish violation of the last higher low level signifies the violation of a current bullish trend. It is called a Change of Character, and it is a very accurate bearish pattern.

Take a look at the example on Dollar Index below.

In a bullish trend, bearish violation of the last higher low level

quite accurately predicted a coming bearish reversal.

Change of Character is one of the simplest , yet accurate SMC patterns that you should know.

First, learn to properly execute the price action analysis and identify HH, HL, LL, LH and then CHoCH will be your main tool for the identification of the trend reversal.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn The Difference Between Beginner and Expert in Trading

In the today's post, we will discuss the evolution of a mindset of a trader as he matures in trading.

✔️Beginner

For some unknown reasons, beginners assume that a couple of educational videos and books about trading is more than enough to start trading successfully.

They believe that they got a comprehensive knowledge and that very few things remain to learn.

They start trading, but quickly realize that their knowledge is not enough to make even small gains.

✔️COMPETENT

After practicing a couple of years, traders come to the conclusion

that they know everything in that field. That they learned, tested and tried all concepts and techniques that are available.

They consider themselves to be the experts in the field BUT

for some unknown reasons, these traders still are not able to trade profitably.

✔️EXPERT

After many years of learning, training and practicing, eyes finally open.

Traders realize how limited is their knowledge and how much more there is to learn .

While they already have the skills to trade in profits, they understand now that even the entire life is not enough to learn all the subtleties of trading.

And here is a little lifehack for you:

if you are a beginner, embrace a mindset of an expert.

Start from realizing how little you actually know and how much more there is to know, that will help you a lot in your trading journey.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD: Pullback From Resistance Confirmed 🇦🇺🇨🇦

AUDCAD is going to retrace from a key intraday horizontal resistance.

A local bearish CHoCH and an imbalance on an hourly time frame

provide a strong bearish confirmation.

Goal - 0.88445

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn 6 Common Beginner Trading Mistakes (FOREX, GOLD)

In the today's post, we will discuss very common beginner's mistakes in trading that you should avoid.

1. No trading plan 📝

That is certainly the TOP 1 mistake. I don't know why it happens but 99% of newbies assume that they don't need a trading plan.

It is more than enough for them to watch a couple of educational videos, read some books about trading and Voilà when a good setup appears they can easily recognize and trade it without a plan.

Guys, I guarantee you that you will blow your trading account in maximum 2 months if you keep thinking like that. Trading plan is the essential part of every trading approach, so build one and follow that strictly.

2. Overtrading 💱

That mistake comes from a common newbies' misconception: they think that in order to make money in trading, they should trade a lot. The more they trade, the higher are the potential gains.

The same reasoning appears when they choose a signal service: the more trades a signal provider shares, the better his signals are supposed to be.

However, the truth is that good trades are very rare and your goal as a trader is to recognize and trade only the best setups. While the majority of the trading opportunities are risky and not profitable.

3. Emotional trading 😤

There are 2 ways to make a trading decision: to make it objectively following the rules of your trading plan or to follow the emotions.

The second option is the main pick of the newbies.

The intuition, fear, desire are their main drivers. And such an approach is of course doomed to a failure.

And we will discuss the emotional trading in details in the next 2 sections.

4. Having no patience ⏳

Patience always pays. That is the trader's anthem.

However, in practice, it is extremely hard to keep holding the trade that refuses to reach the target, that comes closer and closer to a stop loss level, that stuck around the entry level.

Once we are in a trade, we want the price to go directly to our goal without any delay. And the more we wait, the harder it is to keep waiting. The impatience makes traders close their trades preliminary, missing good profits .

5. Greed 🤑

Greed is your main and worst enemy in this game.

It will pursue you no matter how experienced you are.

The desire to get maximum from every move, to not miss any pip of profit, will be your permanent obstacle.

Greed will also pursue you after you close the profitable trades. No matter how much you win, how many good winning trades you catch in a row, you always want more. And that sense main lead you to making irrational, bad trading decision.

6. Big Risks 🛑

Why to calculate lot size for the trade?

Why even bother about risk management?

These are the typical thoughts of the newbies.

Newbie traders completely underestimate the risks involved in trading and for that reason they are risking big.

I heard so many times these stories, when a trading deposit of a trader is wiped out with a one single bad trade.

Never ever risk big, especially if you just started.

Start with a very conservative approach and risk a tiny little portion of your trading account per trade.

Of course there are a lot more mistakes to discuss.

However, the ones that I listed above at the most common

and I am kindly recommending you to fix them before you start trading with a substantial amount of money.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn What is TRAILING STOP LOSS | Risk Management Basics

In the today's article, we will discuss a trailing stop loss. I will explain to you its concept in simple words and share real market examples.

🛑Trailing stop loss is a risk management tool that allows to protect unrealized profits of an active trading position as long as the price moves in the desired direction.

Traditionally, traders trade with fixed stop loss and take profit. Following such an approach, one knows exactly the level where the trade will be closed in a profit and the level where it will be closed in a loss.

Take a look at a long trade on USDCAD above.

The trade has fixed TP Level - 1.354 and fixed SL Level - 1.341.

Once one of these levels is reached, the trade will be closed.

Even though the majority of the traders stick to fixed sl and tp, there is one important disadvantage of such an approach – substantial gains could be easily missed .

After the market reached TP in USDCAD trade, the price temporarily dropped, then a strong bullish rally initiated and the price went way above the Take Profit level. Potential gains with that long position could be much bigger.

Trailing stop solves that issue.

With a trailing stop loss, the trader usually opens the trade with Stop Loss and WITHOUT Take Profit.

Take a look at a long trade on USDCHF.

Trader expects growth, he opens a long position and sets stop loss – 0.8924, while take profit level is not determined.

With a trailing stop loss, the trader usually opens the trade with Stop Loss and WITHOUT Take Profit.

As the market starts growing, one decides not to close the trade in profit, but modify stop loss – trail it to the level above the entry.

As the market keeps rallying, one TRAILS a stop loss in the direction of the market, protecting the unrealized gains.

When the market finally starts falling, the price hits stop loss and a trader closes the trade in a substantial profit.

The main obstacle with the application of a trailing stop is to keep it at a distance from current price levels that is not too narrow nor too wide.

With a wide stop loss distance, substantial unrealized gains might be washed out with the market reversal.

Imagine you predicted a nice bullish rally on Bitcoin.

The market bounced nicely after you opened a long position.

Trailing stop loss too far from current price levels, all the gains could be easily wiped out.

While with a narrow trailing stop distance, one can be stop hunted before the move in the desired direction continues.

A trader opens a long trade on EURJPY and the price bounces perfectly as predicted.

One immediately trails the stop loss.

However, the distance between current prices was too narrow and the position was closed after a pullback.

And then market went much higher.

In conclusion, I want to note that fixed SL & TP approach is not bad , it is different and for some trading strategies it will be more appropriate. However, because of its limitations, occasionally big moves will be missed.

Try trailing stop by your own, combine it with your strategy and I hope that you will make a lot of money with that!

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

When and How to Use Weekly Time Frame in Gold Forex Trading

Ignoring weekly time frame chart analysis could cost you big losses in Forex, Gold trading!

Discover 3 specific cases when weekly time frame beats daily time frame analysis.

Learn the situations when weekly timeframe exposes what daily charts can’t, how to analyze it properly and when to check it.

1. Long-term historic levels

When the market trades in a strong bullish or bearish trend and goes beyond recent historic levels, quite often the daily time frame will not be sufficient for the identification of significant supports and resistances.

The proven way to identify the next meaningful levels will be to analyze a weekly time frame.

Examine a price action on EURAUD forex pair on a daily time frame chart. The market is trading in a strong bullish trend and just updated the high.

Checking the historic price action, we don't see any historic resistance on the left.

Switching to a weekly time frame chart, we can easily recognize a historic resistance that the price respected 5 years ago.

That's a perfect example when weekly t.f revealed a historic price action that a daily didn't.

2. Trend-lines

Weekly time frame analysis is important not only for a search of historic levels. It can help you find significant vertical structures - the trend lines.

We can easily find several meaningful historic resistances on EURUSD pair on a daily time frame.

Though, there are a lot of historic structures there, let's check if there are some hidden structures on a weekly.

Weekly time frame reveals 2 important trend lines, one being a vertical support and another being a vertical resistance.

With a daily time frame analysis, these trend lines would be missed .

3. More accurate breakout confirmations

Some false support and resistance breakouts that you see on a daily could be easily avoided with a weekly time frame analysis.

Quite regularly, a daily time frame support or resistance is in fact a weekly structure. And for its breakout, a weekly candle close will provide more accurate confirmation.

From a daily time frame perspective, we see a confirmed breakout - a daily candle close above a solid resistance zone.

It provides a strong bullish signal on AUDUSD forex pair.

However, the violation turned out to be false and dropped.

Such a false breakout , could be easily avoided, checking a weekly time frame chart.

The underlined resistance is in fact a weekly structure.

The price did not manage to close above, and perfectly respected that, starting to fall after its test.

Such a deeper analysis would completely change our bias from strong bullish (based solely on a daily) to strongly bearish (based on a daily AND weekly)

Remember This

Do not ignore and always check a weekly time frame.

It shows a unique perspective on the market and reveals a lot of hidden elements that you would not notice.

No matter whether you are a scalper, day trader or swing trader,

remember that weekly time frame structures are very impactful and accumulate large trading volumes.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn What Time Frame to Trade. Gold Forex Trading Basics

If you just started trading, you are probably wondering how to choose a trading time frame.

In the today's post, I will go through the common time frames, and explain when to apply them.

1m; 5m, 15m Time Frames

These 4 t.f's are very rapid and are primarily applied by scalpers .

If your goal is to catch quick ebbs and flows within a trading session, that is a perfect selection for you.

30m, 1H Time Frame

These 2 are perfectly suited for day traders.

Executing the analysis and opening the trades on these time frames,

you will be able to catch the moves within a trading day.

4h, Daily Time Frames

These time frames are relatively slow .

They are mostly applied by swing traders, who aim to trade the moves that last from several days to several weeks.

Weekly, Monthly Time Frames

These time frames reveal long-term historical perspective and are mostly used by investors and position traders.

If your goal is to look for buy & hold assets, these time frames will help you to make a reasonable decision.

📝When you are choosing a time frame to trade, consider the following factors :

1️⃣ - Time Availability

How much time daily/weekly are you able to sacrifice on trading?

Remember a simple rule: lower is the time frame, more time it requires for management.

2️⃣ - Risk Tolerance

Smaller time frames usually involve higher risk,

while longer-term time frames are considered to be more conservative and stable.

3️⃣ - Your Trading Goals

If you are planning to benefit from short term price fluctuations you should concentrate your attention on lower time frames,

while investing and long-term capital accumulation suite for higher time frames.

Time frame selection is nuanced and a complex topic. However, I believe that these simple rules and factors will help you to correctly choose the one for you.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How Forex Brokers Manipulate Your Trading. Real Examples

Your Forex broker could be manipulating your trades right now - and you would not even know it.

They can rig your charts, trap you in losing trades and steal your money.

In this article, I will expose how they do it, I will show you a real example how broker's manipulations can lead to bad trading decisions and significant losses.

What I’m about to show you will change the way you trade forever, and you’ll never look at your trading charts the same way again.

The story started with a trading live stream in my academy with my students.

We spotted a nice setup to trade.

We found a strong 4H support on Silver with a confirmed liquidity grab after its test.

As a confirmation, we identified a cup & handle pattern on an hourly time frame and a breakout of its neckline with a bullish imbalance.

When I got my entry signal, I opened my trading terminal to execute the trade.

And the way I trade is very specific: I use TradingView for chart analysis BUT I have a separate trading terminal for trade execution.

When I opened the same setup in my trading terminal, I saw a completely different picture and a strong bearish signal.

The broker that I use for technical chart analysis is OANDA , while my trading terminal uses ICMarkets quotes.

On the right is the price chart of SILVER with IC.

There we can see a valid breakout and a candle close below the support with its consequent retest.

From a price action perspective, it is a strong signal to sell .

I got a strong feeling that some kind of manipulation is going on here, so I decided to check Silver charts of other brokers.

Only the broker that I used for market analysis on TradingView provided a bullish signal, while other brokers had very bearish charts on Silver.

It looked very suspicious and felt like OANDA broker was inducing me to buy, knowing that the price is going to drop. So I made a decision not to take a trade.

Look what happened then.

After a retest of a broken support, Silver dropped sharply.

Checking the same trading setup on different brokers' charts can help you to avoid the manipulation.

My simple decision to examine more charts helped to avoid a losing trade.

I strictly recommend you doing the same thing before you place a trade.

IF you see a strong deviation of your charts from other brokers, stay alert and vigilant. Probably it is not a good idea to open the trade.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the 4 Best Strategies to Maximize Your Profits in Trading

In the today's article, we will discuss 4 classic yet profitable forex and gold trading strategies.

1️⃣Pullback Trading

Pullback trading is a trend-following strategy where you open the positions after pullbacks.

If the market is trading in a bullish trend, your goal as a pullback trader is to wait for a completion of a bullish impulse and then let the market correct itself. Your entry should be the assumed completion point of a correctional movement. You expect a trend-following movement from there.

In a bearish trend, you wait for a completion of the bearish impulse, let the market retrace, and you look for short-entry after a completion of the retracement leg.

Here is the example of pullback trading.

On the left chart, we see the market that is trading in a bearish trend.

A pullback trader would short the market upon completion of the correctional moves.

On the right chart, I underlined the buy entry points of a pullback trader.

That strategy is considered to be one of the simplest and profitable and appropriate for newbie traders.

2️⃣Breakout Trading

Breakout trading implies buying or selling the breakout of a horizontal structure or a trend line.

If the price breaks a key support, it signifies a strong bearish pressure.

Such a violation will trigger a bearish continuation with a high probability.

Alternatively, a bullish breakout of a key resistance is a sign of strength of the buyers and indicates a highly probable bullish continuation.

Take a look, how the price broke a key daily resistance on a daily time frame. After a breakout, the market retested the broken structure that turned into a support. A strong bullish rally initiated from that.

With the breakout trading, the best entries are always on a retest of a broken structure.

3️⃣Range Trading

Range trading signifies trading the market that is consolidating .

Most of the time, the market consolidates within the horizontal ranges.

The boundaries of the range may provide safe points to buy and sell the market from.

The upper boundary of the range is usually a strong resistance and one may look for shorting opportunities from there,

while the lower boundary of the range is a safe place to buy the market from.

EURCAD pair is trading within a horizontal range on a daily.

The support of the range is a safe zone to buy the market from.

A bullish movement is anticipated to the resistance of the range from there.

Taking into considerations, that the financial instruments may consolidate for days, weeks and even months, range trading may provide substantial gains.

4️⃣Counter Trend Trading

Counter trend trading signifies trading against the trend.

No matter how strong is the trend, the markets always trade in zig-zags. After impulses follow the corrections , and after the corrections follow the impulses.

Counter trend traders looks for a completion of the bullish impulses in a bullish trend to short the market, and for a completion of bearish impulses in a downtrend to buy it.

Here is the example of a counter trend trade.

EURJPY is trading in a bullish trend. However, the last 3 bearish moves initiated from a rising trend line. For a trader, shorting the trend line was a perfect entry to catch a bearish move.

Such trading strategy is considered to be one of the most complicated , because one goes against the crowd and overall sentiment.

With the experience, traders may combine these strategies.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MarketBreakdown | AUDUSD, EURAUD, US100, CHFJPY

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #AUDUSD daily time frame 🇦🇺🇺🇸

The pair has completed a bullish accumulation and violated

a resistance line of a horizontal range on a daily.

A new higher high higher close confirms a strong bullish sentiment

and a highly probably continuation of an uptrend.

2️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

The price has recently violated a significant daily support cluster.

After a breakout, the price dropped but did not manage

to reach any important demand zone so far.

The closest one is based on 1.742 level.

It will most likely be the next goal for the sellers.

3️⃣ #US100 daily time frame

The market is currently retesting a recently broken

massive daily demand cluster.

I believe that the growth will resume soon

and the price will reach 20300.

4️⃣ #CHFJPY daily time frame 🇨🇭🇯🇵

The pair is currently testing a critical contracting demand

zone based on a rising trend line and a horizontal support.

I will expect a strong bullish reaction to that.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn KEY PRINCIPLES of Technical Analysis in Gold Forex Trading

In the today's article, we will discuss the absolute basics of trading - 3 key principles of technical analysis in Forex & Gold Trading.

1️⃣History Repeats

History tends to repeat itself in the Forex market.

Certain trends are cyclical and may reemerge in a predictable manner, certain key levels are respected again and again over time.

Take a look at the example:

Silver perfectly respected a historical horizontal resistance in 2011 that was respected in 1980 already. Moreover, the price action before and after the tests of the underlined zone were absolutely identical.

2️⃣Priced In

All relevant information about a currency pair: economical and political events, rumors, and facts; is already reflected in a price.

When the FED increased the rate 26th of July by 25 bp, EURUSD bounced instead of falling. Before the rate hike, the market was going down on EXPECTATIONS of a rate hike. The release of the news was already price in.

3️⃣Pattern DO Work

Some specific price models can be applied for predicting the future price movements.

Technicians strongly believe that certain formations - being applied and interpreted properly, can give the edge on the market.

Depending on the trading style, different categories of patterns exist: harmonic patterns, price action patterns, wave patterns, candlestick patterns...

Above, I have listed various price action patterns that are applied by many traders and investors as the main tool for analyzing the financial markets.

If you believe in these 3 principles, you are an inborn technician!

Study technical analysis and learn to apply these principles to make money in trading.

b]❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Your ULTIMATE Guide For Time Frames in Gold, Forex Trading

If you just started trading, you are probably wondering what time frames to trade. In the today's post, I will reveal the difference between mainstream time frames like daily, 4h, 1h, 15m.

Firstly, you should know that the selection of a time frame primarily depends on your goals in trading. If you are interested in swing trading strategies, of course, you should concentrate on higher time frames analysis while for scalping the main focus should be on lower time frames.

Daily time frame shows a bigger picture.

It can be applied for the analysis of a price action for the last weeks, months, and even years.

It reveals the historical key levels that can be relevant for swing traders, day traders and scalpers.

The patterns that are formed on a daily time frame may predict long-term movements.

In the picture above, you can see how the daily time frame can show the price action for the last years, months and weeks.

In contrast, hourly time frame reflects intra week & intraday perspectives.

The patterns and key levels that are spotted there, will be important for day traders and scalpers.

The setups that are spotted on an hourly time frame, will be useful for predicting the intraday moves and occasionally the moves within a trading week.

Take a look at the 2 charts above, the hourly time frame perfectly shows the market moves within a week and within a single day.

4H time frame is somewhere in between. For both swing trader and day trader, it may provide some useful confirmations.

4H t.f shows intra week and week to week perspectives.

Above, you can see how nicely 4H time frame shows the price action on EURUSD within a week and for the last several weeks.

15 minutes time frame is a scalping time frame.

The setups and levels that are spotted there can be used to predict the market moves within hours or within a trading session.

Check the charts above: 15 minutes time frame shows both the price action within a London session and the price action for the last couple of hours.

It is also critical to mention, that lower is the time frame, lower is the accuracy of the patterns and lower is the strength of key levels that are identified there. It makes higher time frame analysis more simple and reliable.

The thing is that higher is the time frame, more important it is for the market participants.

While lower time frames can help to predict short term moves, higher time frames are aimed for predicting long-term trends.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn the Harsh Truth About Success & Failure in Trading

The picture above completely represents the real nature of trading:

We all came here because we all wanted easy money.

Being attracted by catchy ads, portraying the guys on lambos, wearing guccies and living fancy lives, we jump into the game with high hopes of doubling our tiny initial trading accounts.

However, the reality quickly kicks in and losing trades become the norm.

The first trading account will most likely be blown .

In just one single month, 40% of traders will be discouraged and abandon this game forever.

The rest will realize the fact that the things are not that simple as they seemed to be and decide to start learning.

The primary obstacle with trading education though is the fact that there are so much data out there, so many different materials, so many strategies and techniques to try, so the one feels completely lost .

And on that stage, one plays the roulette: in the pile of dirt, he must find the approach that works .

80% of the traders, who stay after the first month, will leave in the next 2 years. Unfortunately, the majority won't be able to find a valid strategy and will quit believing that the entire system is the scam.

After 5 years, the strongest will remain. The ones that are motivated and strong enough to face the failures.

With such an experience, the majority of the traders already realize how the things work. They usually stuck around breakeven and winning trades start covering the losing ones.

However, some minor, tiny component is still missing in their system. They should find something that prevents them from becoming consistently profitable.

Only 1% of those who came in this game will finally discover the way to make money. These individuals will build a solid strategy, an approach that will work and that will let them become independent .

That path is hard and long. And unfortunately, most of the people are not disciplined and motivated enough to keep going. Only the strongest ones will stay. I wish you to be the one with the iron discipline, titanic patience and nerves of steel.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DON'T Make This MISTAKE in MULTIPLE TIME FRAME Analysis

Most of the traders apply multiple time frame analysis incorrectly . In the today's article, we will discuss how to properly use it and how to build the correct thinking process with that trading approach.

The problem is that many traders start their analysis with lower time frames first . They build the opinion and the directional bias analyzing hourly or even lower time frames and look for bullish / bearish signals there.

Once some solid setup is spotted, they start looking for confirmations , analyzing higher time frames. They are trying to find the clues that support their observations.

However, the pro traders do the opposite .

The fact is that higher is the time frame, more significant it is for the analysis. The key structures and the patterns that are spotted on an hourly time frame most of the time will be completely irrelevant on a daily time frame.

In the picture above, I underlined the key levels on USDJPY on an hourly time frame on the left.

On the right, I opened a daily time frame. You can see that on a higher time frame, the structures went completely lost.

BUT the structures that are identified on a daily, will be extremely important on any lower time frame.

In the example above, I have underlined key levels on a daily.

On an hourly time frame, we simply see in detail how important are these structures and how the market reacts to them.

The correct way to apply the top-down approach is to start with the higher time frame first: daily or weekly. Identify the market trend there, spot the important key levels. Make prediction on these time frames and let the analysis on lower time frames be your confirmation.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HOW FOREX BROKERS MANIPULATE YOU TRADING? Real Example

Last month, I spotted a nice trading position on NZDCAD forex pair.

I shared that with my TradingView subscribers immediately after I placed the trade.

Though, the price moved exactly as it was predicted, the half of the members did not make any penny from this signal, while another half made a nice profit.

It happened because of one rare thing that I absolutely hate in trading.

Learn about a major frustration and market manipulation in trading, that no one will tell you about.

Here is the trading position that I spotted.

It was a classic price action trading setup based on a double top pattern.

Trade was taken on a retest of a broken neckline aiming at the closest strong support and stop loss lying about the tops.

Though, initially, the market started to fall rapidly. But it reversed, not being able to reach the target.

Watching that bullish rally resumes, I send the signal to my students to close the trade on entry, and I also did that personally.

I felt myself quite sad that I did not mange cash out from that trade.

Later on in the evening, surprisingly, I started to receive multiple thank you messages from my members that they made a good profit with that signal.

How could it be?

I decided to anonymously ask the members, how did they close the trade.

More than half of the members replied that the trade reached take profit.

Can it be possible? My TP was not reached and it was still quite far from the lowest low.

Now, examine the trading setup on NZDCAD on charts of different popular forex brokers.

On these 6 charts, you can see NZDCAD pair on OANDA, CAPITALCOM, IC MARKETS, ICE, FXCM, FOREX.COM brokers.

While in half of the instances TP was not reached, in other half, TP was reached and the price went even lower.

Why it happened?

There are the rare situations in Forex trading, when the price action on one broker can be very different from another.

It happens because different brokers have different liquidity providers, spreads, order execution methods and so on.

That is why the selection of a good broker is so vital in trading.

If you use TradingView for chart analysis, make sure that you watch all the instruments of one broker.

Moreover, once you start trading your strategy, always check how the price acted with different broker quotes.

If you will see a lot of instances that your tp is not hit, while on another broker it would, it will be a signal for you to change the broker.

When I started learning trading, no one told be that important nuance of Forex trading.

But knowing that is a very significant step in your trading journey.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

3 Best Trading Opportunities to Maximize Profit Potential

Hey traders,

In the today's article, we will discuss 3 types of incredibly accurate setups that you can apply for trading financial markets.

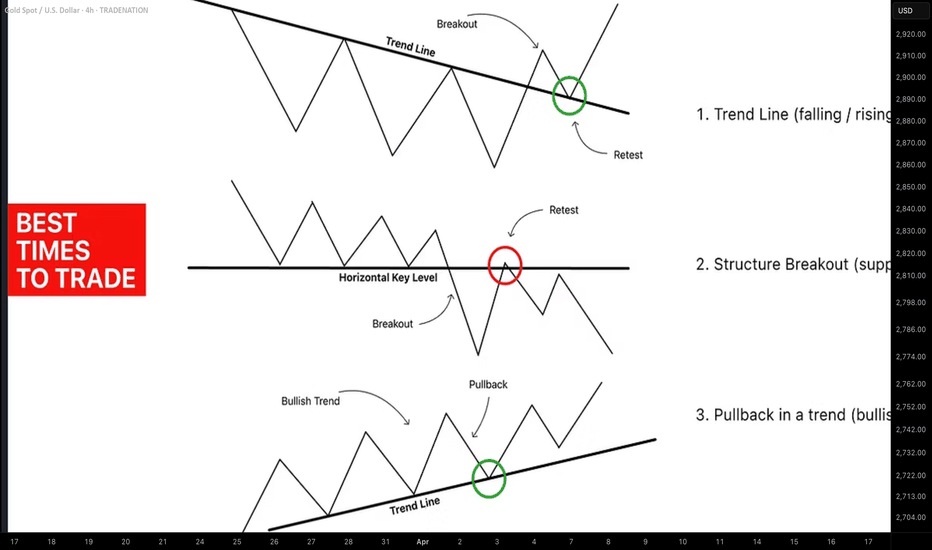

1. Trend Line Breakout and Retest

The first setup is a classic trend line breakout.

Please, note that such a setup will be accurate if the trend line is based on at least 3 consequent bullish or bearish moves.

If the market bounces from a trend line, it is a vertical support.

If the market drops from a trend line, it is a vertical resistance.

The breakout of the trend line - vertical support is a candle close below that. After a breakout, it turns into a safe point to sell the market from.

The breakout of the trend line - vertical resistance is a candle close above that. After a breakout, it turns into a safe point to buy the market from.

Take a look at the example. On GBPJPY, the market was growing steadily, respecting a rising trend line that was a vertical support.

A candle close below that confirmed its bearish violation.

It turned into a vertical resistance .

Its retest was a perfect point to sell the market from.

2. Horizontal Structure Breakout and Retest

The second setup is a breakout of a horizontal key level.

The breakout of a horizontal support and a candle close below that is a strong bearish signal. After a breakout, a support turns into a resistance.

Its retest is a safe point to sell the market from.

The breakout of a horizontal resistance and a candle close above that is a strong bullish signal. After a breakout, a resistance turns into a support.

Its retest if a safe point to buy the market from.

Here is the example. WTI Crude Oil broke a key daily structure resistance. A candle close above confirmed the violation.

After a breakout, the broken resistance turned into a support.

Its test was a perfect point to buy the market from.

3. Buying / Selling the Market After Pullbacks

The third option is to trade the market after pullbacks.

However, remember that the market should be strictly in a trend .

In a bullish trend, the market corrects itself after it sets new higher highs. The higher lows usually respect the rising trend lines.

Buying the market from such a trend line, you open a safe trend-following trade.

In a bearish trend, after the price sets lower lows, the correctional movements initiate. The lower highs quite often respect the falling trend lines.

Selling the market from such a trend line, you open a safe trend-following trade.

On the chart above, we can see EURAUD pair trading in a bullish trend.

After the price sets new highs, it retraces to a rising trend line.

Once the trend line is reached, trend-following movements initiate.

What I like about these 3 setups is the fact that they work on every market and on every time frame. So no matter what you trade and what is your trading style, you can apply them for making nice profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Exploring the Main Components of a Powerful Trading Journal

In one of the previous posts, we discussed the significance of a trading journal. In the today's article, I will share with you the key elements of a trading journal of a professional trader.

And first, a quick reminder that a trading journal is essential for your trading success. No matter on which level you are at the moment, you should always keep track of your results.

Let's go through the list of the things that you should include in your journal.

1 - Trading Instrument

The symbol where the order is executed.

You need that in order to analyze the performance of trading a particular instrument.

2 - Date

The date of the opening of the position. Some traders also include the exact time of the execution.

3 - Risk

Percentage of the account balance at risk.

Even though some traders track the lot of sizes instead, I do believe that the percentage data is more important and may give more insights.

4 - Entry Reason

The set of conditions that were met to open the trade.

In that section, I recommend to note as much data as possible.

It will be applied in future for the identification of the weaknesses of your strategy.

5 - Risk Reward Ratio

The expected returns in relation to potential risks.

6 - Results

Gain or loss in percentage.

And again, some traders track the pip value of the gain, however,

in my view, the percentage points are more relevant for studying the statistics.

Here is the example of the trade on Gold:

Here is how exactly you should journal the following trade:

Instrumet: Gold (XAUUSD)

Date: 03.07.2023

Risk: 1%

Entry Reason: H&S Pattern Formation,

Neckline Breakout & Retest

R/R Ratio: 1.77

Results: +1.77%

Of course, depending on your trading strategy and your personal goals, some other elements can be added. However, the list that I propose is the absolute minimum that you should track.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HIGH Volatility Alert! Everything You Need to Know

Have you ever wondered why the certain trading instruments are very rapid while some our extremely slow and boring?

In this educational article, we will discuss the market volatility , how is it measured and how can it be applied for making smart trading and investing decisions.

📚 First, let's start with the definition. Market volatility is a degree of a fluctuation of the price of a financial instrument over a certain period of time.

High volatility reflects quick and significant rises and falls on the market, while low volatility implies that the price moves slowly and steadily.

High volatility makes it harder for the traders and investors to predict the future direction of the market, but also may bring substantial gains.

On the other hand, a low volatility market is much easier to predict, but the potential returns are more modest.

The chart on the left is the perfect example of a volatile market.

While the chart on the right is a low volatility market.

📰 The main causes of volatility are economic and geopolitical events.

Political and economic instability, wars and natural disasters can affect the behavior of the market participants, causing the chaotic, irrational market movements.

On the other hand, the absence of the news and the relative stability are the main sources of a low volatility.

Here is the example, how the Covid pandemic affected GBPUSD pair.

The market was falling in a very rapid face in untypical manner, being driven by the panic and fear.

But how the newbie trader can measure the volatility of the market?

The main stream way is to apply ATR indicator , but, working with hundreds of struggling traders from different parts of the globe, I realized that for them such a method is complicated.

📏 The simplest way to assess the volatility of the market is to analyze the price action and candlesticks.

The main element of the volatile market is occasional appearance of large candlestick bars - the ones that have at least 4 times bigger range than the average candles.

Sudden price moves up and down are one more indicator of high volatility. They signify important shifts in the supply and demand of a particular asset.

Take a look at a price action and candlesticks on Bitcoin.

The market moves in zigzags, forming high momentum bullish and bearish candles. These are the indicators of high volatility.

🛑 For traders who just started their trading journey, high volatility is the red flag.

Acting rapidly, such instruments require constant monitoring and attention. Moreover, such markets require a high level of experience in stop loss placement because one single high momentum candle can easily hit the stop loss and then return to entry level.

Alternatively, trading a low volatility market can be extremely boring because most of the time it barely moves.

The best solution is to look for the market where the volatility is average , where the market moves but on a reasonable scale.

Volatility assessment plays a critical role in your success in trading. Know in advance, the degree of a volatility that you can tolerate and the one that you should avoid.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.